Global Primary Immunodeficiency Market

Market Size in USD Billion

CAGR :

%

USD

8.84 Billion

USD

14.64 Billion

2024

2032

USD

8.84 Billion

USD

14.64 Billion

2024

2032

| 2025 –2032 | |

| USD 8.84 Billion | |

| USD 14.64 Billion | |

|

|

|

|

Primary Immunodeficiency Market Size

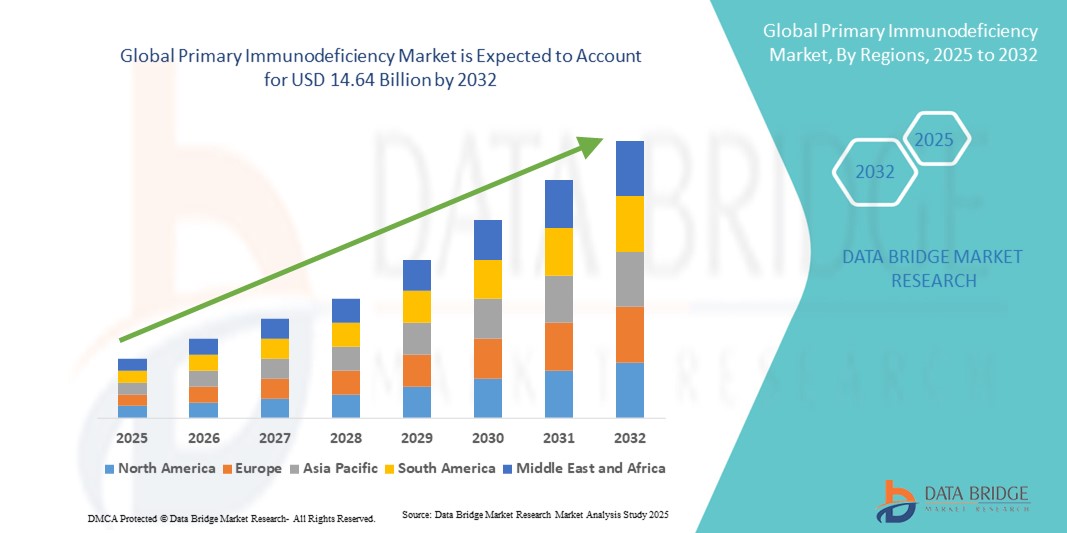

- The global primary immunodeficiency market size was valued at USD 8.84 billion in 2024 and is expected to reach USD 14.64 billion by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely driven by increasing awareness and diagnosis of primary immunodeficiency disorders, along with advancements in biologics, immunoglobulin therapies, and gene-based treatments, which are improving patient outcomes

- Furthermore, rising healthcare expenditure, growing patient population, and the expanding adoption of novel and targeted therapies are positioning primary immunodeficiency treatments as essential in managing immune system disorders. These converging factors are accelerating the uptake of advanced therapeutic solutions, thereby significantly boosting the industry's growth

Primary Immunodeficiency Market Analysis

- Primary immunodeficiency (PID) disorders, caused by defects in the immune system, are increasingly recognized as critical areas of focus in healthcare due to their potential for severe infections and long-term complications, driving demand for advanced diagnostics and therapies in both pediatric and adult populations

- The rising demand for effective PID management is primarily fueled by growing awareness among physicians and patients, improved diagnostic capabilities, and the increasing availability of immunoglobulin replacement therapies and gene-based treatments

- North America dominated the PID market with the largest revenue share of 39.3% in 2024, driven by well-established healthcare infrastructure, early adoption of novel therapies, and significant investments in research and development, with the U.S. witnessing strong uptake of biologics and precision therapies for rare immunodeficiencies

- Asia-Pacific is expected to be the fastest-growing region in the PID market during the forecast period due to increasing healthcare access, rising awareness, and expanding healthcare expenditure across emerging economies

- Immunoglobulin Replacement Therapy segment dominated the PID market with a market share of 46.1% in 2024, driven by its proven efficacy in reducing infection rates and improving quality of life among PID patients

Report Scope and Primary Immunodeficiency Market Segmentation

|

Attributes |

Primary Immunodeficiency Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Primary Immunodeficiency Market Trends

“Expansion of Advanced Therapies and Personalized Treatment Approaches”

- A significant trend in the global PID market is the growing adoption of advanced therapies, including immunoglobulin replacement, biologics, and emerging gene and cell-based treatments, which are transforming disease management and improving patient outcomes

- For instance, recent developments in gene therapy allow targeted correction of specific immune deficiencies, while long-acting immunoglobulin formulations reduce dosing frequency and enhance patient convenience. Companies such as Shire (Takeda) and CSL Behring are increasingly offering personalized PID treatment plans tailored to individual patient profiles

- Personalized treatment approaches, leveraging diagnostic advancements and genetic profiling, enable clinicians to optimize therapy selection and dosing schedules, minimizing adverse effects while maximizing efficacy. Some therapies now incorporate predictive biomarkers to monitor immune function and guide treatment adjustments

- Integration of telemedicine platforms and digital health tools with PID care facilitates remote monitoring of patient health, therapy adherence, and infection tracking, enhancing continuity of care. This digital integration also allows for centralized management of patient data across healthcare providers

- This trend toward more personalized, precise, and patient-centric therapy solutions is reshaping expectations in PID care, prompting pharmaceutical companies to innovate with targeted therapies, home-administered treatment options, and supportive digital tools

- The demand for advanced, patient-friendly, and tailored PID therapies is growing rapidly worldwide, as healthcare providers and patients increasingly prioritize improved outcomes, convenience, and long-term disease management

Primary Immunodeficiency Market Dynamics

Driver

“Increasing Awareness, Early Diagnosis, and Rising Adoption of Biologics”

- The growing awareness of PID disorders among healthcare professionals and patients, coupled with improved diagnostic capabilities, is a major driver of market growth. Early diagnosis enables timely intervention, reducing infection-related complications and healthcare costs

- For instance, in March 2024, CSL Behring expanded its immunoglobulin therapy portfolio to include new formulations designed for easier administration, improving patient compliance and outcomes. Such strategic innovations are expected to boost the adoption of PID therapies during the forecast period

- The rising use of biologics and immunoglobulin replacement therapies, alongside increasing government support for rare disease treatments, is further fueling market expansion. Personalized therapies, home-based infusion options, and digital monitoring tools enhance patient adherence and quality of life

- The combination of growing patient awareness, advanced treatment options, and supportive healthcare policies is positioning PID management as an increasingly accessible and effective healthcare segment globally

Restraint/Challenge

“High Treatment Costs and Limited Access in Emerging Regions”

- The high cost of advanced PID therapies, particularly gene and biologic treatments, poses a significant challenge to broader market adoption, especially in price-sensitive or resource-limited regions. This limits access for patients who require lifelong therapy

- For instance, gene therapies for certain severe PID forms can cost hundreds of thousands of dollars per patient, restricting availability to developed markets with insurance coverage or government support

- Limited healthcare infrastructure, shortage of trained specialists, and inconsistent availability of immunoglobulin products in emerging regions further hinder treatment access. While global programs and patient assistance initiatives exist, disparities in treatment adoption persist

- Addressing these challenges through cost-reduction strategies, expansion of distribution channels, and patient support programs will be crucial to achieving broader market penetration and sustained growth

- Increasing awareness, education, and collaboration between stakeholders including governments, healthcare providers, and pharmaceutical companies will be key to overcoming accessibility and affordability barriers in the global PID market

Primary Immunodeficiency Market Scope

The market is segmented on the basis of type, treatment type, and end-user.

- By Type

On the basis of type, the primary immunodeficiency market is segmented into antibody deficiency, cellular deficiency, and innate immune deficiency. The Antibody Deficiency segment dominated the market with the largest revenue share of 48% in 2024, driven by the high prevalence of B-cell related immunodeficiencies such as X-linked agammaglobulinemia and common variable immunodeficiency. These conditions often require long-term immunoglobulin replacement therapy, which has become the standard of care globally. The wide adoption of diagnostic tests for antibody deficiencies and strong clinical guidelines further reinforce the dominance of this segment. Major pharmaceutical companies continue to invest in antibody therapies to improve efficacy and patient adherence, supporting consistent revenue growth. Additionally, antibody deficiency disorders are more frequently diagnosed across pediatric and adult populations, increasing the overall patient pool.

The Cellular Deficiency segment is anticipated to witness the fastest growth rate of 19.2% from 2025 to 2032, fueled by advancements in stem cell and gene therapy for T-cell and combined immunodeficiencies. This segment is gaining traction as newer, curative treatment options emerge, especially for severe combined immunodeficiency (SCID) and other T-cell disorders. Rising awareness among clinicians and increased investment in research are accelerating adoption. The growing availability of clinical trials and specialized treatment centers also contributes to the segment’s rapid growth. Cellular therapies offer potential long-term correction of immune defects, making them highly attractive for the expanding patient population in developed and emerging markets.

- By Treatment Type

On the basis of treatment type, the primary immunodeficiency market is segmented into immunoglobulin replacement therapy, antibiotic therapy, stem cell & gene therapy, and others. Immunoglobulin Replacement Therapy dominated the market with the largest revenue share of 46.1% in 2024 due to its established efficacy in preventing recurrent infections and improving patient quality of life. This therapy is recommended across most antibody deficiency disorders and is available in both intravenous and subcutaneous formulations. Innovations in long-acting and home-administered immunoglobulin products are further enhancing patient adherence and convenience. Major pharmaceutical companies, including CSL and Takeda, continue to expand their immunoglobulin portfolios, strengthening the dominance of this segment. The therapy’s safety profile, clinical acceptance, and wide patient base make it the backbone of PID management globally.

The Stem Cell & Gene Therapy segment is expected to witness the fastest CAGR of 21.5% from 2025 to 2032, driven by the emergence of curative approaches for severe immunodeficiencies such as SCID and Wiskott-Aldrich syndrome. Technological advancements in gene editing, particularly CRISPR-Cas9, and autologous hematopoietic stem cell transplantation, are expanding treatment possibilities. Increasing clinical trial activity, regulatory approvals in developed markets, and rising patient awareness contribute to rapid growth. These therapies offer the potential for permanent correction of immune defects, making them highly attractive for patients and healthcare providers alike.

- By End-User

On the basis of end-user, the primary immunodeficiency market is segmented into hospitals, clinics, and others. The Hospitals segment dominated the market with the largest revenue share of 53% in 2024, driven by the availability of advanced diagnostic facilities, infusion centers, and specialized immunology departments. Hospitals provide comprehensive care for PID patients, including intravenous immunoglobulin administration, monitoring for adverse events, and access to clinical trials. The presence of multidisciplinary care teams and high patient throughput reinforces hospital dominance in both developed and emerging markets. Partnerships with pharmaceutical companies for patient assistance programs also contribute to revenue growth in this segment.

The Clinics segment is expected to witness the fastest growth rate of 18.9% from 2025 to 2032, fueled by the increasing number of outpatient immunology clinics offering subcutaneous immunoglobulin therapy and home-based care. Clinics provide convenient, accessible care, particularly in urban and semi-urban regions, reducing the need for hospital visits. Telemedicine integration, rising awareness, and improved diagnostic capabilities are accelerating adoption. Specialized clinics are also collaborating with biopharma companies to expand patient access to innovative therapies, contributing to faster market expansion in this end-user segment.

Primary Immunodeficiency Market Regional Analysis

- North America dominated the primary immunodeficiency market with the largest revenue share of 39.3% in 2024, driven by well-established healthcare infrastructure, early adoption of novel therapies, and significant investments in research and development, with the U.S. witnessing strong uptake of biologics and precision therapies for rare immunodeficiencies

- Healthcare providers and patients in the region highly value access to specialized care, state-of-the-art diagnostic facilities, and innovative therapies that improve patient outcomes and quality of life

- The widespread adoption of PID treatments is further supported by well-established healthcare infrastructure, high healthcare expenditure, strong government support for rare diseases, and the presence of leading pharmaceutical companies focusing on immunodeficiency therapies. This combination positions North America as the largest and most mature market for PID management

U.S. Primary Immunodeficiency Market Insight

The U.S. primary immunodeficiency market captured the largest revenue share of 82% in 2024 within North America, fueled by high diagnosis rates, strong healthcare infrastructure, and the swift uptake of advanced therapies such as immunoglobulin replacement and gene-based treatments. Patients and healthcare providers are increasingly prioritizing early detection and effective management strategies to reduce infection-related complications. The growing preference for home-based immunoglobulin infusions, combined with robust demand for biologics and precision therapies, further propels the U.S. PID market. Moreover, government support for rare disease treatments and ongoing clinical trials are significantly contributing to the market’s expansion.

Europe Primary Immunodeficiency Market Insight

The Europe primary immunodeficiency market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising awareness of rare immune disorders, improved access to diagnostic tools, and supportive healthcare policies. The increase in urbanization and the demand for advanced biologics are fostering the adoption of PID therapies. European patients are also drawn to the availability of home-based subcutaneous immunoglobulin options that enhance treatment flexibility and quality of life. The region is experiencing significant growth across hospitals, clinics, and specialty centers, with therapies being integrated into both established healthcare systems and emerging rare-disease care frameworks.

U.K. Primary Immunodeficiency Market Insight

The U.K. primary immunodeficiency market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-backed awareness programs, clinical research initiatives, and access to advanced biologic treatments. Concerns regarding undiagnosed or misdiagnosed immune deficiencies are encouraging healthcare providers to adopt advanced genetic and biomarker-based diagnostics. The U.K.’s robust National Health Service (NHS) infrastructure, alongside its rare disease strategy, is expected to continue stimulating market growth by improving patient access to both standard immunoglobulin therapy and innovative gene therapies.

Germany Primary Immunodeficiency Market Insight

The Germany primary immunodeficiency market is expected to expand at a considerable CAGR during the forecast period, fueled by strong investment in biotechnology, advanced diagnostic capabilities, and patient-focused care models. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and precision medicine, promotes the adoption of novel PID therapies, particularly gene editing and personalized biologics. The integration of PID care into advanced healthcare networks is becoming increasingly prevalent, with a strong preference for safety, efficacy, and sustainability aligning with local healthcare priorities.

Asia-Pacific Primary Immunodeficiency Market Insight

The Asia-Pacific primary immunodeficiency market is poised to grow at the fastest CAGR of 23% during the forecast period of 2025 to 2032, driven by rising healthcare awareness, improving access to diagnostics, and growing healthcare expenditure in countries such as China, Japan, and India. The region’s increasing focus on rare disease care, supported by government initiatives promoting digital health and advanced therapies, is driving the adoption of PID treatments. Furthermore, as APAC strengthens its biopharma manufacturing capabilities, the affordability and accessibility of immunoglobulin therapies and novel biologics are expanding to a wider patient base.

Japan Primary Immunodeficiency Market Insight

The Japan primary immunodeficiency market is gaining momentum due to the country’s high-tech healthcare system, early adoption of advanced biologics, and growing focus on rare diseases. The Japanese market places significant emphasis on genetic testing and precision diagnostics, driving better identification of PID patients. The integration of immunoglobulin therapy with digital monitoring systems is fueling growth, while Japan’s aging population is expected to further spur demand for easier-to-administer, long-term immune support therapies in both hospital and home-care settings.

India Primary Immunodeficiency Market Insight

The India primary immunodeficiency market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding healthcare infrastructure, rapid urbanization, and improving diagnosis rates. India stands as one of the fastest-growing markets for rare disease therapies, with PID gaining attention in both pediatric and adult populations. The push towards universal healthcare, combined with the availability of affordable immunoglobulin therapies and the presence of domestic biopharma manufacturers, are key factors propelling the market in India. In addition, government-backed rare disease policies are expected to further strengthen patient access and market growth.

Primary Immunodeficiency Market Share

The primary immunodeficiency industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- CSL (Australia)

- Octapharma AG (Switzerland)

- Biotest AG (Germany)

- Kedrion (U.S.)

- Bio Products Laboratory Limited (U.K.)

- LFB. (France)

- Grifols, S.A. (Spain)

- Lupin. (India)

- ADMA Biologics, Inc. (U.S.)

- medac GmbH (Germany)

- Novartis AG (Switzerland)

- Pharming (Netherlands)

- Horizon Therapeutics plc (Ireland)

- Amgen Inc. (U.S.)

- UCB S.A. (Belgium)

- Gilead Sciences, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

What are the Recent Developments in Global Primary Immunodeficiency Market?

- In June 2025, Takeda announced that the U.S. Food and Drug Administration (FDA) approved Gammagard Liquid ERC, a low-IgA immunoglobulin therapy for patients aged two years and older with primary immunodeficiency. This ready-to-use therapy offers flexibility with both intravenous and subcutaneous administration options, providing a new treatment avenue for those with low IgA levels

- In May 2025, an international clinical trial co-led by University College London (UCL) demonstrated that an investigational gene therapy successfully restored immune function in all nine children treated for severe leukocyte adhesion deficiency-I (LAD-I), a rare and life-threatening immune disorder. This breakthrough offers hope for children who previously had limited treatment options

- In October 2024, Prime Medicine initiated a Phase I/II clinical trial focusing on adults with stable chronic granulomatous disease (CGD), a primary immunodeficiency. Preclinical studies showed that PM359 corrected the genetic variant causing CGD in over 75% of patient hematopoietic stem cells. The trial aims to evaluate the safety and efficacy of this gene therapy in humans, with data expected in 2025

- In June 2024, Grifols’ subsidiary Biotest received FDA approval for Yimmugo, an intravenous immunoglobulin (IVIG) therapy for primary immunodeficiencies. Originally introduced in Europe in late 2022, Yimmugo is now set to be launched commercially in the United States by late 2024, with production in a newly FDA-certified facility in Dreieich, Germany.

- This launch expands Grifols’ PID product portfolio, improving patient access to IVIG therapy in North America

- In April 2024, X4 Pharmaceuticals received FDA approval for Xolremdi (mavorixafor), the first therapy specifically indicated for WHIM syndrome a rare primary immunodeficiency disorder. This oral medication targets the CXCR4 gene to increase the number of mature neutrophils and lymphocytes in circulation, addressing the underlying immune deficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.