Global Probiotics In Animal Feed Market

Market Size in USD Billion

CAGR :

%

USD

5.59 Billion

USD

10.31 Billion

2024

2032

USD

5.59 Billion

USD

10.31 Billion

2024

2032

| 2025 –2032 | |

| USD 5.59 Billion | |

| USD 10.31 Billion | |

|

|

|

|

Probiotics in Animal Feed Market Size

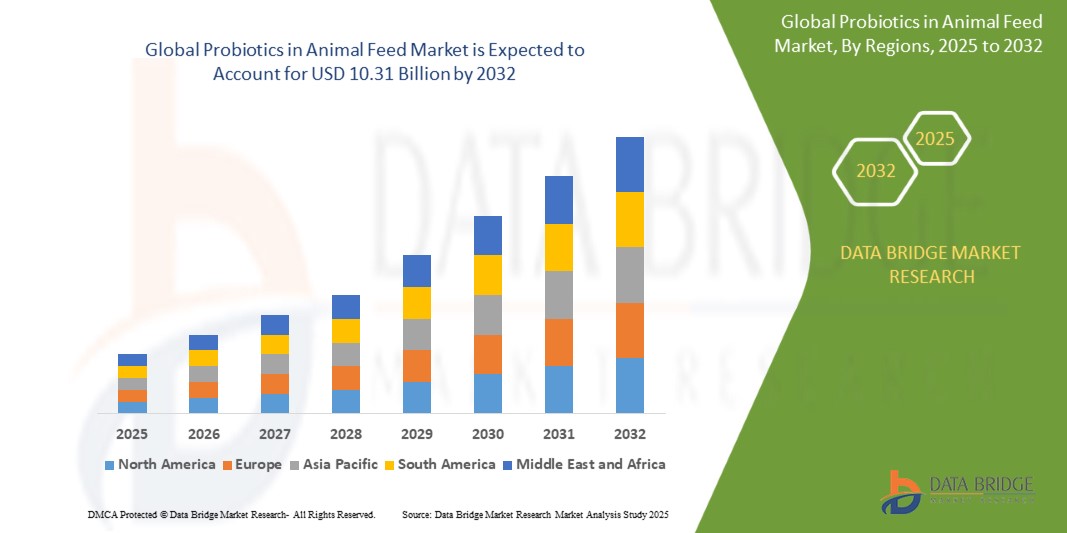

- The global probiotics in animal feed market was valued at USD 5.59 billion in 2024 and is expected to reach USD 10.31 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.95% primarily driven by the increasing demand for high-quality animal nutrition and sustainable farming practices

- This growth is driven by factors such as the rising awareness about the benefits of probiotics in enhancing livestock health and productivity

Probiotics in Animal Feed Market Analysis

- Probiotics in animal feed are live microorganisms, typically bacteria or yeast, added to livestock feed to promote gut health, improve digestion, enhance immune function, and support overall animal health and productivity

- The probiotics in animal feed market is growing due to the increasing demand for natural additives that enhance animal health and productivity, with probiotics helping improve digestive health and nutrient absorption in livestock

- For instance, the use of probiotics in poultry feed to reduce gut inflammation and improve overall health

- Probiotics are gaining popularity as natural alternatives to antibiotics, as they promote a healthy gut microbiota, which is essential for animal growth and performance, reducing reliance on chemical treatments

- For instance, probiotics have been used in dairy cattle to improve milk production and reduce infections

- Farmers and feed manufacturers are increasingly adopting probiotics to improve feed efficiency, leading to healthier animals and better productivity

- For instance, in the aquaculture industry, probiotics help reduce disease outbreaks and improve fish growth

- Consumer awareness regarding animal welfare and food quality is pushing the market, as more consumers demand ethically sourced animal products, prompting farmers to use healthier, natural feed ingredients

- For instance, probiotics are widely used in organic farming to maintain sustainable animal husbandry practices

- Probiotics are being incorporated into various animal feeds, including for poultry, cattle, and aquaculture, with companies such as Chr. Hansen and DuPont providing advanced probiotic solutions to meet the growing demand in the animal feed industry

Report Scope and Probiotics in Animal Feed Market Segmentation

|

Attributes |

Probiotics in Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Probiotics in Animal Feed Market Trends

“Increasing Adoption of Probiotics Across Various Animal Types”

- The adoption of probiotics in poultry feed is increasing to improve gut health and reduce digestive issues, leading to better growth rates and egg production

- For instance, probiotics are used in broiler chickens to enhance feed efficiency and immune response, with companies such as Kemin Industries offering probiotic solutions to boost poultry health

- In cattle farming, probiotics are being used to improve milk production and reduce digestive diseases

- For instance, probiotics in dairy cows help to enhance digestion, increase milk yield, and reduce the risk of infections such as mastitis, as seen with products such as Lactobacillus in dairy herds to improve milk quality and animal health

- Probiotics are becoming a key part of aquaculture feed to improve fish health and growth rates

- For instance, probiotics are used in tilapia farming to control pathogens and improve water quality, ensuring better fish health and productivity, with companies such as Probiotics International offering solutions to boost the immune system of farmed fish

- The use of probiotics in swine feed is also growing, with benefits such as improved gut health and better nutrient absorption

- For instance, probiotics are used in pigs to enhance growth and reduce the incidence of gastrointestinal diseases, with probiotics such as Enterococcus faecium being added to pig feed to improve growth rates and reduce diarrhea outbreaks

- The increasing preference for natural alternatives to antibiotics is driving the growth of probiotics in animal feed, with many farmers opting for probiotics to boost immunity and improve overall animal health without relying on antibiotics, as seen with the rise of probiotic feed solutions in organic farming to maintain sustainable animal husbandry practices

Probiotics in Animal Feed Market Dynamics

Driver

“Rising Consumer Demand for Natural and Sustainable Animal Products”

- Rising consumer demand for natural and sustainable animal products is driving the growth of probiotics in animal feed, as health-conscious consumers prefer products without harmful antibiotics or synthetic additives

- For instance, companies such as Nestlé have started offering dairy products from antibiotic-free cows to meet consumer preferences

- Probiotics are increasingly used in poultry feed to prevent gut-related issues and improve feed conversion rates, leading to healthier birds and higher production rates

- For instance, probiotics such as Lactobacillus are used in broiler chickens to enhance immune response and promote better growth

- In dairy farming, probiotics are added to cattle feed to improve milk yield and quality

- For instance, the incorporation of probiotics such as Bifidobacterium in dairy cows has been shown to improve milk production and overall herd health

- The growing trend of "clean-label" and organic products has fueled the adoption of probiotics, with consumers seeking safe, chemical-free animal products, such as organic eggs produced with the help of probiotics to ensure gut health in poultry

- Stricter government regulations on antibiotic use in livestock farming are encouraging the adoption of probiotics as a natural alternative, as seen in the European Union, where regulations on antibiotic use in animal farming are pushing for more sustainable solutions such as probiotics to enhance animal health

Opportunity

“Increasing Demand for Sustainable and Organic Farming Practices”

- The increasing demand for sustainable and organic farming practices presents a major opportunity for probiotics in animal feed, as farmers seek effective and environmentally friendly alternatives

- For instance, the rise in organic livestock farming in Europe and North America is fueling demand for probiotics

- Probiotics are a natural solution that fits within the growing push for sustainable agriculture, helping improve animal health without harming the environment, as seen in the growing use of probiotics in organic poultry and dairy farming to enhance productivity naturally

- Consumer preference for organic products and a focus on animal welfare are opening new markets for probiotics, with consumers increasingly demanding products from organically raised animals

- For instance, the use of probiotics in organic eggs to maintain the health of laying hens

- The adoption of probiotics in aquaculture is expanding due to the growing demand for sustainable fish and seafood products, probiotics improve fish gut health, enhance growth rates, and reduce disease outbreaks, with companies such as Probiotics International offering tailored probiotic solutions for aquaculture

- Companies are capitalizing on the demand for probiotics by developing specialized formulations tailored to different animal types, which broadens the market

- For instance, specific probiotics are being formulated for different species, such as pigs, cattle, and poultry, to address their unique health needs

Restraint/Challenge

“High Cost of Production”

- One of the significant challenges in the probiotics in animal feed market is the high cost of production, as producing effective probiotics requires stringent quality control measures, specialized formulations, and advanced manufacturing techniques, which can drive up production expenses

- Developing probiotic solutions that are tailored to specific animal species, such as poultry, cattle, or fish, requires considerable research and development, which further increases costs,

- For instance, creating a custom probiotic mix for aquaculture requires thorough testing to ensure the correct strains are effective for different fish species

- The need for maintaining a high level of consistency and potency in probiotic products adds to the cost, as probiotics must be carefully preserved and transported under controlled conditions to maintain their effectiveness, which requires additional investment in infrastructure

- In addition, the formulation of probiotics often involves using specific microorganisms, which can be expensive to cultivate, making the end product costly for farmers, especially in comparison to traditional feed additives

- These high production costs may limit the adoption of probiotics in developing regions or among smaller-scale farmers who have more limited budgets, thereby slowing the widespread use of probiotics in animal feed across various markets

Probiotics in Animal Feed Market Scope

The market is segmented on the basis of source, livestock, form, and function

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Livestock |

|

|

By Form |

|

|

By Function |

|

Probiotics in Animal Feed Market Regional Analysis

“North America is the Dominant Region in the Probiotics in Animal Feed Market”

- North America leads the probiotics in animal feed market due to its advanced livestock industry and a strong regulatory framework that promotes the use of natural feed additives

- Farmers in the region are increasingly adopting probiotics as a replacement for antibiotics, driven by growing consumer demand for clean-label and organic meat and dairy products

- The U.S. is witnessing widespread use of probiotics across both conventional and organic farming systems, especially in poultry and dairy farming

- Companies based in North America are investing heavily in research and development to create species-specific probiotic solutions tailored for cattle, poultry, swine, and aquaculture

- A combination of innovation, consumer awareness, and strong agricultural infrastructure continues to position North America as the dominant force in the global probiotics in animal feed market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest growing region in the probiotics in animal feed market, driven by rapid growth in livestock production and a shift toward sustainable farming practices

- Countries such as China and India are experiencing rising demand for natural alternatives to antibiotics, supported by increasing awareness of animal health and food safety

- Governments in the region are promoting the use of probiotics through agricultural modernization efforts and quality improvement initiatives in livestock farming

- In India, the expansion of aquaculture and poultry farming has significantly boosted the adoption of probiotics to enhance feed efficiency and animal welfare

- The combination of advanced farming techniques and increasing consumer demand for high-quality animal products makes Asia-Pacific a rapidly expanding and highly dynamic market for probiotics in animal feed

Probiotics in Animal Feed Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Chr. Hansen A/S, part of Novonesis (Denmark)

- dsm-firmenich (Switzerland)

- DuPont (U.S.)

- Land O'Lakes, Inc. (U.S.)

- Kerry Group plc. (Ireland)

- Novus International, Inc. (U.S.)

- Novozymes A/S (Denmark)

- Lesaffre (France)

- Lallemand Inc. (Canada)

- Alltech (U.S.)

- Adisseo (France)

- ASAHI GROUP HOLDINGS, LTD (Japan)

- Suguna Foods Private Limited (India)

- Provita Animal Health (U.K.)

Latest Developments in Global Probiotics in Animal Feed Market

- In January 2023, Chr. Hansen, a global bioscience company, launched BOVAMINE DEFEND Plus, an advanced probiotic solution for feedlot cattle. This product combines four synergistic bacterial strains to enhance digestive and immune functions in cattle. By supporting gut health and feed efficiency, it aims to improve overall cattle productivity and reduce stress-related issues. The introduction of BOVAMINE DEFEND Plus strengthens Chr. Hansen's position in the North American probiotics market, offering a comprehensive solution for modern livestock management

- In February 2023, Evonik Industries introduced PhytriCare IM, its first plant-based premix designed to enhance animal health. Developed in collaboration with Dr. Eckel Animal Nutrition, this product combines selected plant extracts rich in flavonoids known for their anti-inflammatory properties. PhytriCare IM aims to alleviate inflammation in sows, laying hens, and dairy cows, thereby improving animal welfare and productivity. Its launch expands Evonik's Gut Health Solutions portfolio, offering farmers a natural alternative to antibiotics

- In September 2022, BASF and Evonik entered into a strategic partnership to enhance sustainability in the feed and animal protein industries. Through this collaboration, Evonik integrated BASF's digital sustainability platform, Opteinics, into its global feed consultancy services. Opteinics enables the measurement, analysis, and reduction of the environmental footprint in animal feed production, focusing on areas such as greenhouse gas emissions and resource use. This partnership aims to provide the livestock industry with data-driven insights to promote more sustainable farming practices. By combining BASF's digital expertise with Evonik's industry knowledge, the initiative supports the transition towards more environmentally responsible animal protein production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROBIOTICS IN ANIMAL FEED MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROBIOTICS IN ANIMAL FEED MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 RUSSIA-UKRAINE WAR IMPACT

11 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY STRAIN

11.1 OVERVIEW

11.2 BACTERIA

11.2.1 LACTOBACILLUS

11.2.1.1. LACTOBACILLUS ACIDOPHILUS

11.2.1.2. LACTOBACILLUS RHAMNOSUS

11.2.1.3. LACTOBACILLUS CASEI

11.2.1.4. LACTOBACILLUS REUTERI

11.2.1.5. LACTOBACILLUS FERMENTUM

11.2.1.6. LACTOBACILLUS GASSERI

11.2.1.7. LACTOBACILLUS JOHNSONII

11.2.1.8. LACTOBACILLUS PARACASEI

11.2.1.9. LACTOBACILLUS PLANTARUM

11.2.1.10. LACTOBACILLUS SALIVARIUS

11.2.1.11. LACTOBACILLUS THERMOPHILUS

11.2.1.12. LACTOBACILLUS BULGARICUS

11.2.1.13. OTHERS

11.2.2 BIFIDOBACTERIUM

11.2.2.1. BIFIDOBACTERIUM ADOLESCENTIS

11.2.2.2. BIFIDOBACTERIUM ANIMALIS

11.2.2.3. BIFIDOBACTERIUM BIFIDUM

11.2.2.4. BIFIDOBACTERIUM BREVE

11.2.2.5. BIFIDOBACTERIUM LONGUM

11.2.2.6. BIFIDOBACTERUM BIFIDUS

11.2.2.7. BIFIDOBACTERIUM THERMOPHILUS

11.2.2.8. OTHERS

11.2.3 STREPTOCOCCUS THERMOPHILUS

11.2.4 BACILLUS

11.2.4.1. AMYLOLIQUEFACIENS

11.2.4.2. TOYONENSIS

11.2.4.3. LICHENIFORMIS

11.2.4.4. SUBTILIS

11.2.4.5. OTHERS

11.2.5 ENTEROCOCCUS

11.2.6 PEDIOCOCCUS

11.2.6.1. ACIDILACTICI

11.2.6.2. PARVULUS

11.2.7 PROPIONIBACTERIUM

11.2.8 CLOSTRIDIUM

11.2.9 ASPERGILLUS

11.2.10 OTHER BACTERIAL

11.3 YEAST AND FUNGI

11.3.1 SACCHAROMYCES BOULARDII

11.3.2 SACCHAROMYCES CEREVISIAE

11.3.3 ASPERGILLUS ORYZAE

11.3.4 CANDIDA PINTOLOPESII

11.3.5 OTHER YEAST AND FUNGI

12 GLOAL PROBIOTICS IN ANIMAL FEED MARKET, BY TYPE

12.1 OVERVIEW

12.2 SINGLE STRAIN PROBIOTICS

12.3 MULTI-STRAIN PROBIOTICS

13 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 GMO

13.3 NON-GMO

14 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY FORM

14.1 OVERVIEW

14.2 DRY

14.3 LIQUD

15 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY FUNCTION

15.1 OVERVIEW

15.2 NUTRITION

15.3 GUT HEALTH

15.4 YIELD

15.5 IMMUNITY

15.6 PRODUCTIVITY

15.7 SKIN HEALTH

15.8 OTHERS

16 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY LIFECYCLE

16.1 OVERVIEW

16.2 GROWER FEED

16.3 FINISHER FEED

16.4 STARTER FEED

16.5 BROODER FEED

17 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY LIVESTOCK

17.1 OVERVIEW

17.2 RUMINANTS

17.2.1 CALVES

17.2.2 DAIRY CATLE

17.2.3 BEEF CATLE

17.2.4 DAIRY CATTLE

17.2.5 OTHERS

17.2.6 RUMINANTS, BY PRODUCT TYPE

17.2.6.1. BACTERIA

17.2.6.2. YEAST AND FUNGI

17.3 SWINE

17.3.1 STARTER

17.3.2 GROWER

17.3.3 SOW

17.3.4 SWINE, BY PRODUCT TYPE

17.3.4.1. BACTERIA

17.3.4.2. YEAST AND FUNGI

17.4 POULTRY

17.4.1 CHICKEN

17.4.1.1. BROILERS

17.4.1.2. LAYERS

17.4.1.3. BREEDERS

17.4.2 TURKEY

17.4.3 GEESE

17.4.4 DUCKS

17.4.5 GUINEA FOWL

17.4.6 QUAIL

17.4.7 OTHERS

17.4.8 POULTRY, BY PRODUCT TYPE

17.4.8.1. BACTERIA

17.4.8.2. YEAST AND FUNGI

17.4.8.3.

17.5 AQUACULTURE

17.5.1 FISH

17.5.1.1. TILAPIA

17.5.1.2. SALMON

17.5.1.3. CARP

17.5.1.4. TROUT

17.5.1.5. OTHERS

17.5.2 CRUSTACEANS

17.5.2.1. SHRIMP

17.5.2.2. CRABS

17.5.2.3. KRILL

17.5.2.4. OTHERS

17.5.3 MOLLUSKS

17.5.3.1. OYSTERS

17.5.3.2. MUSSELS

17.5.3.3. OTHERS

17.5.4 AQUACULTURE, BY PRODUCT TYPE

17.5.4.1. BACTERIA

17.5.4.2. YEAST AND FUNGI

17.6 PETS

17.6.1 CATS

17.6.2 DOGS

17.6.3 RABBITS

17.6.4 OTHERS

17.6.5 PETS, BY PRODUCT TYPE

17.6.5.1. BACTERIA

17.6.5.2. YEAST AND FUNGI

17.7 EQUINE

17.7.1 EQUINE, BY PRODUCT TYPE

17.7.1.1. BACTERIA

17.7.1.2. YEAST AND FUNGI

17.8 BIRDS

17.8.1 BIRDS, BY PRODUCT TYPE

17.8.1.1. BACTERIA

17.8.1.2. YEAST AND FUNGI

17.8.1.3.

17.9 OTHERS

18 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY END USER

18.1 OVERVIEW

18.2 FEED MANUFACTURERS

18.3 CONTRACT MANUFACTURERS

18.4 LIVESTOCK PRODUCERS

19 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, BY COUNTRY

GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 SWITZERLAND

19.2.7 NETHERLANDS

19.2.8 BELGIUM

19.2.9 RUSSIA

19.2.10 DENMARK

19.2.11 SWEDEN

19.2.12 POLAND

19.2.13 TURKEY

19.2.14 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 AUSTRALIA

19.3.6 SINGAPORE

19.3.7 THAILAND

19.3.8 INDONESIA

19.3.9 MALAYSIA

19.3.10 PHILIPPINES

19.3.11 NEW ZEALAND

19.3.12 VIETNAM

19.3.13 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 UAE

19.5.3 SAUDI ARABIA

19.5.4 OMAN

19.5.5 QATAR

19.5.6 KUWAIT

19.5.7 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

20.6 MERGERS & ACQUISITIONS

20.7 NEW PRODUCT DEVELOPMENT & APPROVALS

20.8 EXPANSIONS & PARTNERSHIP

20.9 REGULATORY CHANGES

21 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, SWOT & DBMR ANALYSIS

22 GLOBAL PROBIOTICS IN ANIMAL FEED MARKET, COMPANY PROFILE

22.1 CHR. HANSEN

22.1.1 COMPANY OVERVIEW

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENTS

22.2 KONINKLIJKE DSM N.V.

22.2.1 COMPANY OVERVIEW

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT DEVELOPMENTS

22.3 DUPONT

22.3.1 COMPANY OVERVIEW

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 EVONIK INDUSTRIES

22.4.1 COMPANY OVERVIEW

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 LAND O'LAKES

22.5.1 COMPANY OVERVIEW

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT DEVELOPMENTS

22.6 OHLY

22.6.1 COMPANY OVERVIEW

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT DEVELOPMENTS

22.7 LESAFFRE

22.7.1 COMPANY OVERVIEW

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT DEVELOPMENTS

22.8 ALLTECH

22.8.1 COMPANY OVERVIEW

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT DEVELOPMENTS

22.9 UNIQUE BIOTECH

22.9.1 COMPANY OVERVIEW

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT DEVELOPMENTS

22.1 PURE CULTURES

22.10.1 COMPANY OVERVIEW

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT DEVELOPMENTS

22.11 PROVITA EUROTECH

22.11.1 COMPANY OVERVIEW

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHIC PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT DEVELOPMENTS

22.12 DR. BATA ZRT.

22.12.1 COMPANY OVERVIEW

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHIC PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT DEVELOPMENTS

22.13 PRINOVA GROUP

22.13.1 COMPANY OVERVIEW

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHIC PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT DEVELOPMENTS

22.14 ORFFA

22.14.1 COMPANY OVERVIEW

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHIC PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT DEVELOPMENTS

22.15 LALLEMAND INC.

22.15.1 COMPANY OVERVIEW

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHIC PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT DEVELOPMENTS

22.16 ADISSEO

22.16.1 COMPANY OVERVIEW

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHIC PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT DEVELOPMENTS

22.17 VIT-E-MEN COMPANY

22.17.1 COMPANY OVERVIEW

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHIC PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT DEVELOPMENTS

22.18 INDOGULF COMPANY

22.18.1 COMPANY OVERVIEW

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHIC PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT DEVELOPMENTS

22.19 CARGILL INCORPORATED

22.19.1 COMPANY OVERVIEW

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHIC PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT DEVELOPMENTS

22.2 VETANCO

22.20.1 COMPANY OVERVIEW

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHIC PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT DEVELOPMENTS

22.21 MYSTICAL BIOTECH PVT LTD.

22.21.1 COMPANY OVERVIEW

22.21.2 REVENUE ANALYSIS

22.21.3 GEOGRAPHIC PRESENCE

22.21.4 PRODUCT PORTFOLIO

22.21.5 RECENT DEVELOPMENTS

22.22 VERONA HEALTH SOLUTIONS INC.

22.22.1 COMPANY OVERVIEW

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHIC PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT DEVELOPMENTS

22.23 CHEMBOND CHEMICALS LIMITED

22.23.1 COMPANY OVERVIEW

22.23.2 REVENUE ANALYSIS

22.23.3 GEOGRAPHIC PRESENCE

22.23.4 PRODUCT PORTFOLIO

22.23.5 RECENT DEVELOPMENTS

22.24 PROBYN INTERNATIONAL INC.

22.24.1 COMPANY OVERVIEW

22.24.2 REVENUE ANALYSIS

22.24.3 GEOGRAPHIC PRESENCE

22.24.4 PRODUCT PORTFOLIO

22.24.5 RECENT DEVELOPMENTS

22.25 PANDO NUTRITION INC

22.25.1 COMPANY OVERVIEW

22.25.2 REVENUE ANALYSIS

22.25.3 GEOGRAPHIC PRESENCE

22.25.4 PRODUCT PORTFOLIO

22.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 QUESTIONNAIRE

25 ABOUT DATA BRIDGE MARKET RESEARCH

Global Probiotics In Animal Feed Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Probiotics In Animal Feed Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Probiotics In Animal Feed Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.