Global Processed Mushrooms Market

Market Size in USD Billion

CAGR :

%

USD

18.85 Billion

USD

26.00 Billion

2024

2032

USD

18.85 Billion

USD

26.00 Billion

2024

2032

| 2025 –2032 | |

| USD 18.85 Billion | |

| USD 26.00 Billion | |

|

|

|

|

Processed Mushrooms Market Size

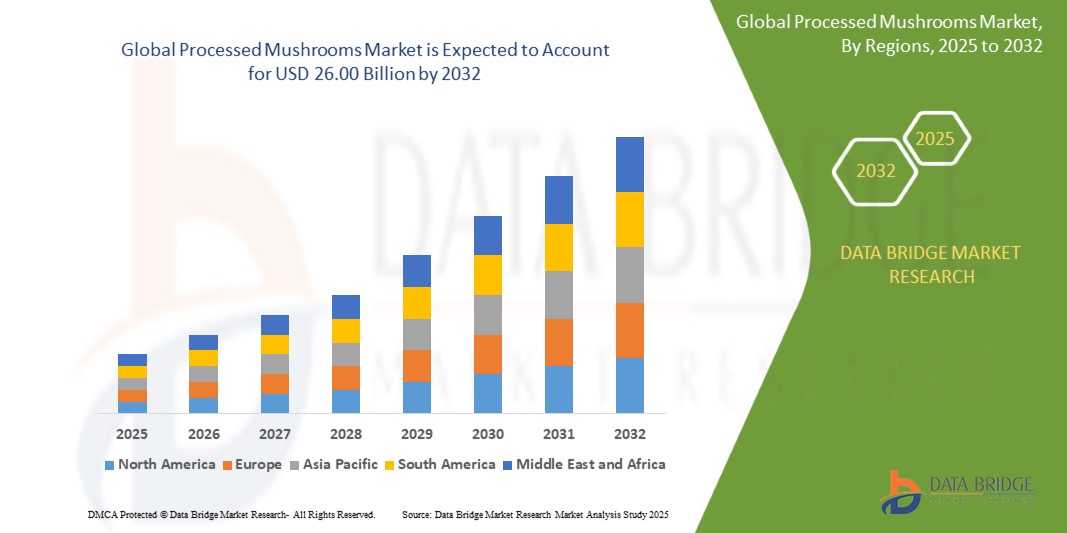

- The global processed mushrooms market was valued at USD 18.85 billion in 2024 and is expected to reach USD 26.00 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.10% primarily driven by the increasing demand for healthy and plant-based food options

- This growth is driven by factors such as the rising consumer preference for convenient, ready-to-eat food products

Processed Mushrooms Market Analysis

- The processed mushrooms market is expanding as consumer interest in plant-based diets rises, with mushrooms becoming a popular meat alternative in vegetarian and vegan dishes

- For instance, Impossible Burger’s mushroom-based patties or plant-based pizza toppings at major pizzerias such as Domino's

- Health-conscious eating habits are fuelling the demand for mushrooms, as they are rich in essential nutrients such as vitamins, antioxidants, and fiber, making them a preferred ingredient in wellness-focused recipes such as mushroom-based soups and fresh salads

- Advanced processing techniques, such as improved drying and canning methods, ensure that processed mushrooms maintain their quality and flavour, allowing products to have longer shelf lives and be available throughout the year

- For instance, dried shiitake mushrooms used in gourmet foods by brands such as Whole Foods Market

- The growth of online retail platforms, such as Amazon and specialty food stores such as Thrive Market, has made processed mushrooms more accessible to a global audience, offering consumers a wide variety of options, including mushroom powders, canned mushrooms, and ready-to-eat mushroom snacks

- The food service industry, including restaurants, hotels, and catering services, increasingly uses processed mushrooms in dishes such as mushroom soups, sauces, and vegetarian entres, further driving the demand for processed mushroom products

Report Scope and Processed Mushrooms Market Segmentation

|

Attributes |

Processed Mushrooms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Processed Mushrooms Market Trends

“Increasing Consumer Shift Towards Plant-Based Diets”

- The shift towards plant-based diets is driven by growing health concerns, environmental awareness, and ethical considerations, with more people opting for sustainable food choices

- Mushrooms are emerging as a popular plant-based protein alternative, recognized for their nutritional value, low calorie content, and versatility in various dishes

- For instance, the growing popularity of mushroom-based burgers from brands such as Nestlé and Tyson

- Processed mushrooms, including mushroom-based burgers, snacks, and even jerky, are gaining traction as convenient, nutritious, and sustainable options for plant-based consumers

- For instance, in 2023 launch of Four Sigmatic’s Mushroom-Botanical-Vitamin Capsule Blends, targeting consumers seeking wellness benefits such as improved memory and cognition

- The environmental appeal of mushrooms, with their low resource requirements compared to traditional protein sources, positions them as a key part of the growing plant-based food market

Processed Mushrooms Market Dynamics

Driver

“Increased Demand for Plant-Based Products”

- The increased demand for plant-based products is one of the key drivers of the processed mushrooms market, with consumers focusing more on health, sustainability, and ethical food production

- For instance, the rise of plant-based food companies such as Beyond Meat and Impossible Foods, which have made plant-based alternatives widely available, has opened the door for more mushroom-based products to enter the market

- Mushrooms are gaining popularity due to their nutritional profile, offering plant-based protein, fiber, vitamins, and minerals, making them ideal for those on vegan, vegetarian, or flexitarian diets

- For instance, brands such as Nestlé have incorporated mushrooms into their plant-based burgers, and Tyson Foods has launched its "Raised & Rooted" brand, which features mushroom-based products as meat alternatives

- Processed mushrooms are being used in a wide range of products, from mushroom-based burgers to sausages and plant-based meat substitutes, catering to health-conscious and environmentally aware consumers

- For instance, Meati Foods uses mushrooms to create its plant-based “meat,” mimicking the taste and texture of animal-based protein while remaining sustainable

- Mushrooms require fewer resources to cultivate compared to traditional animal-based proteins, making them an eco-friendly option

- For instance, mushroom farming uses significantly less water and land than livestock farming. This environmental efficiency has drawn attention from environmentally conscious brands and consumers who want to reduce their carbon footprint

- As plant-based diets continue to grow globally, the processed mushrooms market is expected to expand, fueled by innovations in processing techniques that make mushrooms more accessible, convenient, and appealing

- For instance, brands such as Treeline Dairy are making dairy-free cheese from mushrooms, and companies such as Wildbrine are offering mushroom-based fermented products to cater to diverse consumer preferences

Opportunity

“Growing Interest in Functional Foods”

- The growing interest in functional foods presents a significant opportunity in the processed mushrooms market, as consumers seek foods that provide health benefits beyond basic nutrition

- For instance, functional mushrooms such as lion’s mane, reishi, and chaga are increasingly being incorporated into products such as capsules, teas, and powders to enhance wellness

- Functional mushrooms are known for their medicinal properties, including boosting immune health, reducing inflammation, and improving cognitive function. Companies such as Four Sigmatic have capitalized on this trend by launching Mushroom-Botanical-Vitamin Capsule Blends, designed to improve memory, focus, and overall cognitive health

- The demand for wellness-focused products is also driving the popularity of mushroom-infused beverages, such as mushroom coffee

- For instance, brands such as Four Sigmatic and RYZE have gained attention by blending functional mushrooms such as lion’s mane and reishi with coffee, offering consumers a health-conscious alternative to traditional caffeinated drinks

- The growing recognition of the health benefits of functional mushrooms is prompting companies to expand their offerings, creating products that support a variety of wellness goals, including stress reduction and enhanced immunity, with instance such as host defense mushroom supplements gaining traction in the market

- As consumers become more health-conscious and seek functional foods, the processed mushrooms market is poised for growth, with brands increasingly focusing on products that combine the convenience of ready-to-use formats with the wellness benefits of mushrooms, tapping into the rising trend of preventative health and self-care

Restraint/Challenge

“Limited Consumer Awareness”

- Despite the growing popularity of plant-based and functional foods, one of the major challenges in the processed mushrooms market is the limited consumer awareness of the health benefits and versatility of mushrooms

- For instance, many consumers are unfamiliar with varieties such as reishi, shiitake, and lion’s mane when used in supplements, powders, and beverages

- The lack of awareness has resulted in slower adoption of processed mushroom products among mainstream consumers, especially in regions where mushrooms are not a traditional part of the diet or where plant-based protein alternatives such as soy or pea protein are more familiar

- For instance, in some Western markets where mushrooms are primarily seen as a culinary ingredient rather than a functional food

- Certain consumer segments, such as those already following plant-based diets or those with an interest in health and wellness, are more likely to embrace mushrooms for their nutritional benefits, but the broader consumer base remains hesitant to explore mushroom-based alternatives

- To overcome this challenge, manufacturers need to invest in consumer education and marketing campaigns to showcase the diverse benefits of mushrooms, such as improved immunity or cognitive function. Companies such as Four Sigmatic are already emphasizing the health benefits of functional mushrooms, but more widespread efforts are needed to reach the mainstream market

- In addition, creating products that appeal to a wider range of tastes and preferences, such as mushroom-based snacks, ready-to-eat meals, or easy-to-use meal kits, could help drive consumer interest and awareness. Until there is more widespread understanding of the health benefits and uses of mushrooms, the market may face slower growth in regions unfamiliar with these benefits

Processed Mushrooms Market Scope

The market is segmented on the basis of type, product, form, and application

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Product |

|

|

By Form |

|

|

By Application |

|

Processed Mushrooms Market Regional Analysis

“Europe is the Dominant Region in the Processed Mushrooms Market”

- Europe dominates the global processed mushrooms market, due to strong culinary tradition where mushrooms are a staple ingredient in many dishes, making them a key part of European diets

- Countries such as Poland, the Netherlands, and Ireland are major contributors due to their high levels of mushroom production and export capabilities

- Europe's well-established distribution networks ensure processed mushrooms are readily available both locally and internationally, facilitating market growth

- The increasing interest in plant-based diets and health-conscious food choices is driving the demand for mushrooms as a nutritious and sustainable alternative to traditional proteins in Europe

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is the fastest-growing market for processed mushrooms, fuelled by advancements in food processing technologies and a growing health-conscious population

- China plays a central role in the region’s mushroom production and export, benefiting from favourable climatic conditions and cost-effective production methods

- The rising vegetarian population in countries such as India and China is increasing the demand for plant-based alternatives, including processed mushrooms, as more consumers seek sustainable and nutritious food options

- Manufacturers in the region are diversifying their product offerings, with mushroom-based supplements, powders, and beverages catering to various consumer preferences

- Competitive labour costs and efficient production systems further strengthen the region’s position, making Asia-Pacific an attractive hub for both local and international mushroom production

Processed Mushrooms Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The Mushroom Company (India)

- OKECHAMP SA (Poland)

- BONDUELLE (France)

- Modernmush (U.S.)

- WEIKFIELD FOODS PVT. LTD. (India)

- Scelta Mushrooms BV (Netherlands)

- Monaghan Group (Ireland)

- Monterey Mushrooms, Inc. (U.S.)

- Costa Group – (Australia)

- Basciani Foods. (U.S.)

- To-Jo Mushrooms (U.S.)

- VALLEY MUSHROOMS. (Canada)

- ANN MILLER'S SPECIALITY MUSHROOMS LIMITED (U.K.)

- White Prince Mushrooms (Netherlands)

- Agro Dutch (Netherlands)

- Drinkwater Mushrooms (U.K.)

- Sa Mushrooms Pty Ltd (Australia)

Latest Developments in Global Processed Mushrooms Market

- In June 2023, MyForest Foods, a subsidiary of Ecovative, received USD 15 million in Series A-2 funding and appointed Greg Shewchuk as CEO. This investment aims to expand the distribution of their flagship product, MyBacon, a mycelium-based meatless bacon, across the East Coast, including New York City. The funding will also support retail growth and foodservice presence, enhancing MyBacon's availability in over 100 retail locations. This expansion is expected to increase market competition in the plant-based meat sector and meet the rising consumer demand for sustainable, plant-based protein alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PROCESSED MUSHROOMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROCESSED MUSHROOMS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PROCESSED MUSHROOMS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 THREAT OF SUBSTITUTE PRODUCTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.5 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.6 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.7 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 REGULATORY FRAMEWORK AND GUIDELINES

7 GLOBAL PROCESSED MUSHROOMS MARKET, BY MUSHROOM TYPE, 2022-2031, USD MILLION, KILO TONS

7.1 OVERVIEW

7.2 BUTTON MUSHROOM

7.3 SHIITAKE MUSHROOM

7.4 OYSTER MUSHROOM

7.5 MAITAKE MUSHROOM

7.6 ENOKI MUSHROOM

7.7 PORCINO MUSHROOM

7.8 REISHI MUSHROOM

7.9 OTHERS (IF ANY)

8 GLOBAL PROCESSED MUSHROOMS MARKET, BY PRODUCT TYPE, 2022-2031, USD MILLION

8.1 OVERVIEW

8.2 DRIED MUSHROOM

8.3 FROZEN MUSHROOM

8.4 CANNED MUSHROOM

8.5 OTHERS

9 GLOBAL PROCESSED MUSHROOMS MARKET, BY FORM, 2022-2031, USD MILLION

9.1 OVERVIEW

9.2 WHOLE

9.3 SLICED

9.4 DICED

9.5 OTHERS

10 GLOBAL PROCESSED MUSHROOMS MARKET, BY CATEGORY, 2022-2031, USD MILLION

10.1 OVERVIEW

10.2 ORGANIC

10.3 CONVENTIONAL

11 GLOBAL PROCESSED MUSHROOMS MARKET, BY END-USER, 2022-2031, USD MILLION

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL

11.3 FOOD PROCESSING SECTOR

11.4 FOOD SERVICE SECTOR

11.4.1 FOODSERVICE SECTOR, BY TYPE

11.4.1.1. RESTAURANTS

11.4.1.2. CAFÉ & BARS

11.4.1.3. HOTELS

11.4.1.4. CANTEEN/CAFETERIA

11.4.1.5. CLOUD KITCHENS

11.4.1.6. OTHERS

12 GLOBAL PROCESSED MUSHROOMS MARKET, BY PACKAGING TYPE, 2022-2031, USD MILLION

12.1 OVERVIEW

12.2 CAN/ JARS

12.3 BAGS

12.4 BOXES

12.5 TRAY

12.5.1 TRAY, BY TYPE

12.5.1.1. WOODEN TRAY

12.5.1.2. CARDBOARD TRAY

12.5.1.3. TOPSEAL TRAY

12.6 BOTTLE

12.6.1 BOTTLE, BY TYPE

12.6.1.1. GLASS

12.6.1.2. PLASTIC

12.7 OTHERS

13 GLOBAL PROCESSED MUSHROOMS MARKET, BY PACKAGING SIZE, 2022-2031, USD MILLION

13.1 OVERVIEW

13.2 100 GRAMS TO 500 GRAMS

13.3 501 GRAMS TO 1000 GRAMS

13.4 1001 GRAMS TO 2000 GRAMS

13.5 MORE THAN 2000 GRAMS

14 GLOBAL PROCESSED MUSHROOMS MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, USD MILLION

14.1 OVERVIEW

14.2 B2B

14.2.1 B2B, BY TYPE

14.2.1.1. WHOLESELLERS

14.2.1.2. ONLINE RETAILERS

14.3 B2C

14.3.1 B2C, BY TYPE

14.3.1.1. DEPARTMENTAL STORES

14.3.1.2. SUPERMARKET

14.3.1.3. HYPERMARKET

14.3.1.4. SPECIALTY STORES

14.3.1.5. ONLINE RETAILERS

14.3.1.6. OTHERS (IF ANY)

15 GLOBAL PROCESSED MUSHROOMS MARKET, BY GEOGRAPHY, (2022-2031) (USD MILLION) (KILO TONS)

15.1 GLOBAL PROCESSED MUSHROOMS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 SWITZERLAND

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 LUXEMBOURG

15.3.12 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 PHILLIPPINES

15.4.9 MALAYSIA

15.4.10 AUSTRALIA

15.4.11 NEW ZEALAND

15.4.12 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 COLUMBIA

15.5.3 CHILE

15.5.4 PERU

15.5.5 ARGENTINA

15.5.6 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 NIGERIA

15.6.4 SAUDI ARABIA

15.6.5 IRAN

15.6.6 UNITED ARAB EMIRATES

15.6.7 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL PROCESSED MUSHROOMS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT & APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

17 GLOBAL PROCESSED MUSHROOMS MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL PROCESSED MUSHROOMS MARKET, COMPANY PROFILES

18.1 BANKEN CHAMPIGNONS

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 BONDUELLE SA

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 OYSTER ISLAND MUSHROOM LLC

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 MODERN MUSHROOM FARMS INC

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MONTEREY MUSHROOMS INC

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 BREWER’S MUSHROOMS

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 ROCKY BOTTOM MUSHROOMS LLC

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 WHITE MOUNTAIN MUSHROOMS LLC

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 HIRANO MUSHROOM LLC

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 HIGHVELD MUSHROOMS

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 RAIN FOREST MUSHROOMS

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 THE MUSHROOM COMPANY

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHICAL PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 LAMBERT SPAWN

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHICAL PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 GREENYARD

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHICAL PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 BLUFF CITY FUNGI

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHICAL PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 SMITHY MUSHROOMS

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHICAL PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MYCOTERRAFARM

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHICAL PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 FUJISHUKIN CO.,LTD

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHICAL PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 OKECHAMP SA

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHICAL PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 MYCOTRITION GMBH

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHICAL PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

Note: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Processed Mushrooms Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Processed Mushrooms Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Processed Mushrooms Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.