Global Protein Powder Market

Market Size in USD Billion

CAGR :

%

USD

24.24 Billion

USD

39.23 Billion

2024

2032

USD

24.24 Billion

USD

39.23 Billion

2024

2032

| 2025 –2032 | |

| USD 24.24 Billion | |

| USD 39.23 Billion | |

|

|

|

|

What is the Global Protein Powder Market Size and Growth Rate?

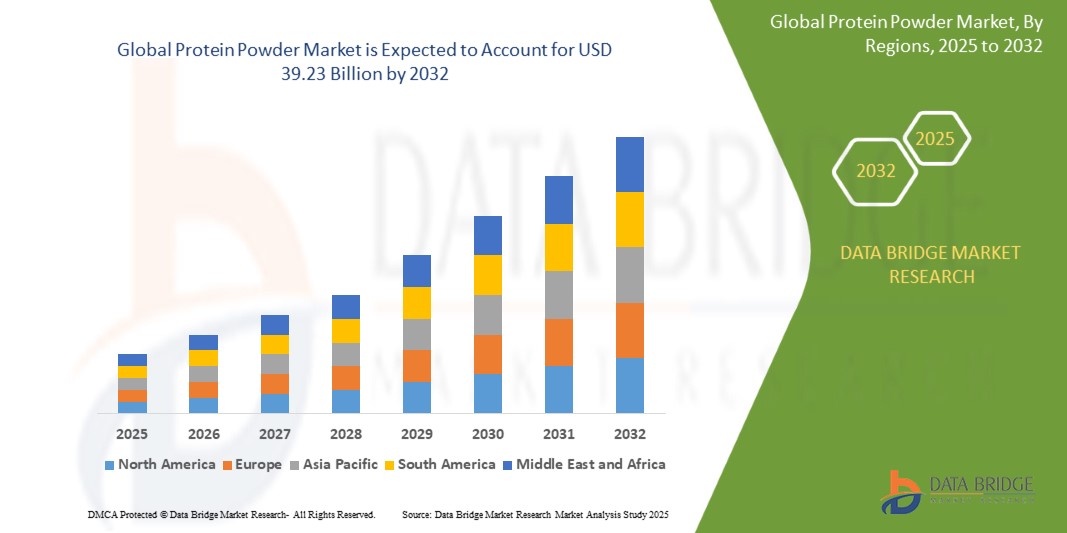

- The global protein powder market size was valued at USD 24.24 billion in 2024 and is expected to reach USD 39.23 billion by 2032, at a CAGR of 6.20% during the forecast period

- In the realm of sports nutrition, protein powder is a fundamental component for athletes and fitness enthusiasts asuch as. It serves as a convenient and efficient way to supplement protein intake, essential for muscle repair, growth, and recovery post-exercise

- Athletes often rely on protein powder to meet their increased protein requirements, aiding in the maintenance of lean muscle mass and supporting overall athletic performance. Protein powders come in various forms, including whey, casein, soy, and plant-based options, offering versatility to cater to different dietary preferences and goals

- In 2021, a study in Malaysia revealed that a significant majority of gym-goers, around 73.7%, favored protein shakes as their preferred supplement, with 68.3% specifically opting for whey protein. This data underscores the widespread popularity of protein powders, particularly among individuals engaged in fitness activities, reaffirming their crucial role in sports nutrition for muscle support and recovery

What are the Major Takeaways of Protein Powder Market?

- As people become more conscious about their nutrition and overall well-being, they are increasingly turning to protein supplements to support their active lifestyles and fitness goals. Protein powders are seen as a convenient and efficient way to supplement protein intake, especially for those engaged in fitness activities. Protein powders are seen as a way to support muscle recovery, growth, and overall performance, making them popular among athletes and fitness enthusiasts

- For instance, Nestlé's acquisition of Orgain underscores the surging demand for premium protein supplements, particularly plant-based options, reflecting consumers' increasing focus on nutrition and wellness. This move aligns with the diverse offerings in the protein powder market, where brands such as Optimum Nutrition, Quest Nutrition, and MusclePharm cater to various consumer preferences, displaying the industry's growth and potential

- North America dominated the protein powder market with the largest revenue share of 33.47% in 2024, driven by rising health consciousness, increasing gym memberships, and strong demand for sports and dietary supplements

- Asia-Pacific protein powder market is set to grow at the fastest CAGR of 11.12% from 2025 to 2032, driven by rising disposable incomes, urbanization, and growing interest in fitness and preventive health in countries such as China, Japan, and India

- The Whey Protein segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its high bioavailability, complete amino acid profile, and widespread use in sports nutrition and weight management

Report Scope and Protein Powder Market Segmentation

|

Attributes |

Protein Powder Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Protein Powder Market?

Personalized Nutrition and Clean-Label Innovations Driving Market Growth

- A significant trend in the global Protein Powder market is the rising demand for personalized nutrition solutions and clean-label formulations. Consumers are increasingly seeking protein products tailored to their fitness goals, dietary preferences, and health conditions, driving innovation in formulations and delivery methods

- For instance, in March 2024, Nestlé Health Science launched a customizable protein blend platform, allowing users to select protein types (whey, plant-based, collagen) and functional ingredients (probiotics, vitamins) based on individual needs

- Advancements in AI-driven nutrition platforms and DNA-based dietary recommendations are enabling brands to deliver targeted protein powders, while clean-label attributes such as non-GMO, organic, and free-from additives are becoming critical purchasing factors

- The emergence of sustainable plant-based proteins—including pea, hemp, and rice—is reshaping consumer preferences, aligning with vegan and environmentally conscious lifestyles

- Companies such as Optimum Nutrition and Vega are investing in innovative formulations featuring bioavailable protein blends, adaptogens, and digestive enzymes to enhance performance and wellness benefits

- This trend is transforming protein powders from a gym-focused product to a mainstream functional food, expanding adoption across athletes, lifestyle users, and aging populations

What are the Key Drivers of Protein Powder Market?

- Increasing awareness about health, fitness, and preventive nutrition is a primary driver, as consumers prioritize protein intake for muscle development, weight management, and immune support

- For instance, in February 2024, Abbott expanded its Ensure High Protein line to target seniors seeking enhanced muscle strength and recovery solutions

- The surge in plant-based diets and veganism is fueling demand for alternative protein sources, encouraging brands to develop dairy-free and allergen-friendly protein powders

- Expanding e-commerce platforms and direct-to-consumer models are making protein powders more accessible, supported by influencer marketing and fitness-centric social media campaigns

- Technological innovations, such as microencapsulation for better taste and texture and fortification with functional ingredients (collagen, probiotics), are driving product differentiation

- In addition, rising disposable incomes and increasing participation in sports and fitness activities worldwide are propelling market growth across both developed and emerging economies

Which Factor is challenging the Growth of the Protein Powder Market?

- One of the major challenges in the Protein Powder market is quality inconsistencies and regulatory hurdles across global markets. Mislabeling, adulteration, and varying standards for protein content create consumer distrust and hinder market credibility

- For instance, in 2023, several brands faced recalls in the U.S. due to heavy metal contamination in plant-based protein powders, raising concerns over product safety

- High prices of premium formulations including organic, grass-fed, and multi-functional protein powders remain a barrier for cost-sensitive consumers, particularly in developing regions

- Digestive discomfort and allergen issues linked to certain protein sources (such as whey or soy) further limit adoption among sensitive populations

- In addition, the market faces intense competition from ready-to-drink (RTD) protein beverages and whole-food alternatives, pressuring manufacturers to innovate

- Addressing these challenges will require stricter quality control, transparent labeling, and affordable clean-label innovations to establish protein powders as a reliable and accessible nutritional solution

How is the Protein Powder Market Segmented?

The market is segmented on the basis of protein type, nature, source, flavor, utility, and distribution channel.

• By Protein Type

On the basis of protein type, the Protein Powder market is segmented into Whey Protein, Casein Protein, Soy Protein, Pea Protein, Rice Protein, Hemp Protein, Egg White Protein, Pumpkin Seed Protein, Mixed Plant-Based Protein Blends, and Others. The Whey Protein segment dominated the market with the largest revenue share of 38.6% in 2024, driven by its high bioavailability, complete amino acid profile, and widespread use in sports nutrition and weight management. Whey Protein remains the preferred choice among athletes and fitness enthusiasts for muscle recovery and performance enhancement.

The Pea Protein segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for allergen-free, vegan, and sustainably sourced plant-based alternatives.

• By Nature

On the basis of nature, the market is segmented into Pure and Blend. The Blend segment accounted for the largest revenue share of 55.4% in 2024, supported by increasing demand for formulations combining multiple protein sources to enhance nutritional value, taste, and functionality.

The Pure segment is expected to grow steadily as consumers seeking targeted nutritional benefits prefer single-source proteins such as Whey Isolate or Soy Protein.

• By Source

On the basis of source, the market is segmented into Plant Protein and Animal Protein. The Animal Protein segment held the dominant revenue share of 61.2% in 2024, driven by strong consumption of Whey and Casein proteins, particularly in developed regions where sports nutrition products are well established.

The Plant Protein segment is projected to record the highest CAGR from 2025 to 2032, propelled by growing veganism, lactose intolerance, and sustainability concerns.

• By Flavor

On the basis of flavor, the market is segmented into Plain and Flavored. The Flavored segment dominated with 68.9% of the market share in 2024, owing to consumer preference for palatable options such as chocolate, vanilla, and fruit blends that enhance the taste experience.

The Plain segment caters to consumers seeking versatile protein powders for cooking or customized flavoring, with steady demand growth expected.

• By Utility

On the basis of utility, the market is segmented into Medical Use, Sports Protein, and Others. The Sports Protein segment accounted for the largest revenue share of 59.7% in 2024, driven by increasing participation in fitness activities, bodybuilding, and endurance sports globally.

The Medical Use segment is anticipated to witness rapid growth, supported by rising applications in clinical nutrition, elderly care, and recovery diets.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Offline and Online. The Offline segment dominated with 62.3% of the market share in 2024, supported by the strong presence of specialty stores, gyms, and pharmacies where consumers prefer physical product verification and expert recommendations.

The Online segment is projected to expand at the fastest CAGR from 2025 to 2032, driven by the convenience of e-commerce, wider product availability, and rising digital marketing campaigns by leading brands.

Which Region Holds the Largest Share of the Protein Powder Market?

- North America dominated the protein powder market with the largest revenue share of 33.47% in 2024, driven by rising health consciousness, increasing gym memberships, and strong demand for sports and dietary supplements

- Consumers in the region highly value high-quality formulations, clean-label ingredients, and personalized nutrition, with protein powders becoming a mainstream dietary component beyond athletic circles

- This growth is further supported by high disposable incomes, an extensive network of fitness centers and retail outlets, and strong brand penetration, positioning Protein Powder as a leading functional nutrition category across both sports and lifestyle users

U.S. Protein Powder Market Insight

The U.S. protein powder market dominated North America’s revenue share in 2024, driven by growing adoption of plant-based proteins, fortified blends, and innovative product formats such as ready-to-mix sachets. Consumers are increasingly prioritizing muscle recovery, weight management, and preventive health, fueling the demand for whey, casein, and vegan protein powders. Expanding e-commerce channels, coupled with aggressive marketing by leading brands such as Optimum Nutrition and Abbott, further accelerates market growth.

Europe Protein Powder Market Insight

The Europe protein powder market is projected to grow at a substantial CAGR throughout the forecast period, supported by clean-label trends, sustainable sourcing, and rising interest in plant-based nutrition. Urbanization and a cultural shift toward active lifestyles are driving demand across sports, medical, and lifestyle applications. Protein powders are increasingly incorporated into functional foods and meal replacements, with adoption surging in residential consumers, fitness facilities, and healthcare sectors.

U.K. Protein Powder Market Insight

The U.K. protein powder market is expected to grow at a noteworthy CAGR, fueled by rising veganism, flexitarian diets, and the growing popularity of performance supplements among recreational athletes. Consumers are gravitating toward organic and allergen-free formulations, supported by a robust retail and e-commerce infrastructure that ensures accessibility to global and domestic brands.

Germany Protein Powder Market Insight

The Germany protein powder market is projected to expand at a considerable CAGR, driven by demand for high-protein functional foods and eco-conscious products. With its emphasis on quality certification and scientifically validated nutrition, Germany is witnessing strong growth in plant-based proteins and premium whey isolates. Integration of protein powders into bakery, dairy, and beverage applications is also gaining traction, reflecting a preference for multi-functional nutritional solutions.

Which Region is the Fastest Growing Region in the Protein Powder Market?

Asia-Pacific protein powder market is set to grow at the fastest CAGR of 11.12% from 2025 to 2032, driven by rising disposable incomes, urbanization, and growing interest in fitness and preventive health in countries such as China, Japan, and India. Government initiatives promoting nutrition awareness and the emergence of local brands offering affordable, high-quality products are broadening market access across diverse demographics.

Japan Protein Powder Market Insight

The Japan protein powder market is expanding steadily, supported by the country’s tech-savvy consumer base, aging population, and focus on healthy aging. Demand is increasing for collagen-infused proteins, plant-based formulations, and ready-to-consume products catering to convenience-driven lifestyles. Partnerships between nutrition companies and healthcare providers are further boosting adoption.

China Protein Powder Market Insight

The China protein powder market accounted for the largest share in Asia-Pacific in 2024, driven by a booming middle class, rapid urbanization, and rising awareness of muscle health and weight management. Domestic brands and global players are leveraging online marketplaces and social media influencers to target younger consumers, while government support for sports development and nutrition standards continues to strengthen market growth.

Which are the Top Companies in Protein Powder Market?

The protein powder industry is primarily led by well-established companies, including:

- Optimum Nutrition (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- BELLRING BRANDS, INC. (BRBR) (U.S.)

- Nestlé (Switzerland)

- Vega (Canada)

- Isopure (U.S.)

- QuestNutrition & WorldPantry LLC (U.S.)

- EVLUTION NUTRITION (U.S.)

- Bright Life Care Private Limited (India)

- MusclePharm (U.S.)

- Jarrow Formulas, Inc (U.S.)

- NOW Foods (U.S.)

- Nutrabio (U.S.)

- Jym Supplement Science (U.S.)

- Rule One Proteins (U.S.)

- MRM Nutrition (U.S.)

- Universal Nutrition (U.S.)

- Abbott (U.S.)

What are the Recent Developments in Global Protein Powder Market?

- In December 2023, Centrum introduced Multivitamin & Protein Powders in the Indian market, offering both powder and gummy formats to cater to diverse consumer preferences. This launch enhances Centrum’s product portfolio and strengthens its position in the Indian health and wellness segment

- In May 2023, Arla Foods Ingredients unveiled a solution to increase protein content in juice-style oral nutrition supplements (ONS) to 7% without affecting taste or mouthfeel, specifically targeting medical nutrition applications. This innovation broadens the company’s offerings in clinical nutrition and supports its focus on functional health solutions

- In April 2023, Genetic Nutrition, a premium U.K.-based sports supplement brand, launched its high-quality health and wellness range in India, including protein powders, amino acids, and vitamins formulated with best-in-class ingredients. This entry strengthens the brand’s global presence and expands access to advanced sports nutrition for Indian consumers

- In October 2022, Tata Consumer Products (TCP), a Tata Group subsidiary, entered the health supplements category with its Tata GoFit range, designed for women seeking fitness solutions. The plant-protein powder features dry probiotics for gastrointestinal health and is free from lactose, soy, and sugars, marking TCP’s strategic move into functional nutrition

- In March 2022, MusclePharm Corporation announced the upcoming launch of whey protein RTD drinks in the U.S. market for summer 2022, offering over 20g of protein per serving in multiple flavors. This product expansion positions MusclePharm to capture greater share in the rapidly growing ready-to-drink protein beverage category

- In April 2021, THG plc acquired Brighter Foods Limited, a subsidiary of Real Good Food plc and a manufacturer of nutritional products such as snacks and bars. This acquisition strengthens THG’s expertise in developing healthy products and enhances its capabilities in the functional foods market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protein Powder Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protein Powder Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protein Powder Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.