Global Rapid Influenza Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.72 Billion

2025

2033

USD

1.50 Billion

USD

2.72 Billion

2025

2033

| 2026 –2033 | |

| USD 1.50 Billion | |

| USD 2.72 Billion | |

|

|

|

|

Rapid Influenza Diagnostics Market Size

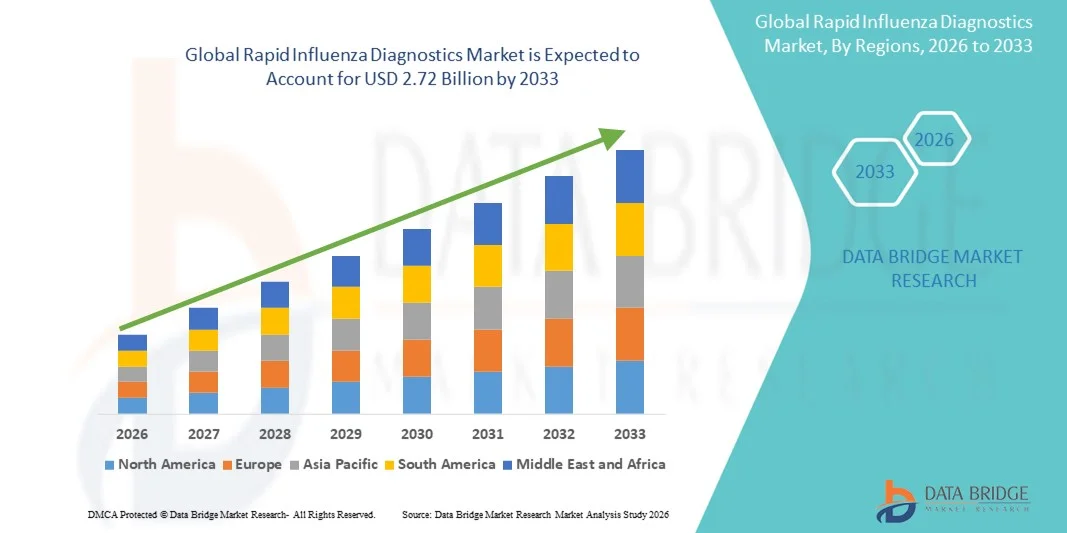

- The global rapid influenza diagnostics market size was valued at USD 1.50 billion in 2025 and is expected to reach USD 2.72 billion by 2033, at a CAGR of 7.75% during the forecast period

- The market growth is largely fueled by the increasing prevalence of influenza infections worldwide, coupled with rising demand for rapid and accurate diagnostic solutions to enable timely treatment and reduce disease spread

- Furthermore, advancements in point-of-care testing technologies, along with rising awareness among healthcare providers and patients about early influenza detection, are driving the adoption of Rapid Influenza Diagnostics solutions, thereby significantly boosting the industry’s growth

Rapid Influenza Diagnostics Market Analysis

- Rapid Influenza Diagnostics, offering point-of-care and laboratory-based testing for influenza viruses, are increasingly vital in both clinical and community healthcare settings due to their speed, accuracy, and ability to guide timely treatment decisions

- The escalating demand for rapid influenza diagnostics is primarily fueled by the rising prevalence of influenza infections, growing awareness among healthcare providers, and the increasing need for early detection to reduce complications and transmission

- North America dominated the rapid influenza diagnostics market with the largest revenue share of 41.5% in 2025, supported by advanced healthcare infrastructure, widespread use of rapid testing in hospitals and clinics, strong government programs for infectious disease control, and the presence of key diagnostic companies. The U.S. experienced substantial growth due to the integration of rapid influenza testing in emergency departments, outpatient clinics, and pandemic preparedness initiatives

- Asia-Pacific is expected to be the fastest-growing region in the rapid influenza diagnostics market during the forecast period, registering a CAGR driven by increasing healthcare expenditure, expanding laboratory networks, rising influenza awareness, and government initiatives promoting early detection in countries such as China, India, and Japan

- The Influenza A segment dominated the largest market revenue share of 57.3% in 2025, driven by its higher prevalence, seasonal outbreaks, and greater clinical severity compared to Influenza B

Report Scope and Rapid Influenza Diagnostics Market Segmentation

|

Attributes |

Rapid Influenza Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Abbott (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Rapid Influenza Diagnostics Market Trends

Growing Need Due to Rising Incidence of Influenza and Demand for Rapid Testing

- The increasing prevalence of influenza outbreaks globally, coupled with heightened awareness about early detection, is a significant driver for the demand for rapid influenza diagnostics

- For instance, in October 2024, Quidel Corporation expanded its Sofia Influenza FIA test distribution in the U.S. to meet rising testing needs in hospitals and clinics. Such initiatives by key companies are expected to drive market growth in the forecast period

- Rapid and accurate testing allows healthcare providers to initiate timely antiviral treatments, reducing complications and improving patient outcomes, thus making rapid diagnostics an essential tool in influenza management

- Furthermore, the growing focus on preventive healthcare and influenza surveillance programs is propelling adoption across both public and private healthcare sectors

- The convenience of point-of-care testing, quick turnaround times (often within 15–30 minutes), and the ability to conduct tests outside conventional laboratories are key factors driving demand

- In addition, government initiatives promoting seasonal flu vaccination and testing programs, especially during peak flu seasons, are further fueling market expansion

Rapid Influenza Diagnostics Market Dynamics

Driver

Increasing Adoption of Multiplex and Point-of-Care Testing

- A major trend in the global rapid influenza diagnostics market is the integration of multiplex testing platforms that can detect multiple respiratory pathogens simultaneously, improving efficiency and diagnostic accuracy

- Companies are increasingly investing in the development of portable, point-of-care rapid tests suitable for clinics, emergency rooms, and community health centers, addressing the need for fast, on-site diagnostics

- For instance, in July 2023, Roche launched its cobas® Liat® SARS-CoV-2 & Influenza A/B test in Europe and the U.S., combining influenza and COVID-19 detection in a single rapid test platform

- The trend toward easy-to-use, compact, and automated rapid testing devices is helping healthcare facilities reduce patient wait times and enhance workflow efficiency

- Adoption of digital reporting and connectivity features in newer rapid testing kits also facilitates real-time data collection for epidemiological monitoring

- These innovations are expected to reshape diagnostic practices, making rapid influenza diagnostics more accessible and widely utilized across varied healthcare settings

Restraint/Challenge

Concerns Regarding Accuracy, Cost, and Regulatory Hurdles

- Concerns regarding the sensitivity and specificity of some rapid influenza diagnostic tests can limit their adoption, especially in settings requiring confirmatory testing for clinical decisions

- For instance, studies reported in the Journal of Clinical Virology in 2022 highlighted variability in accuracy among different rapid test kits, making healthcare providers cautious about exclusive reliance on rapid tests

- In addition, the relatively higher cost of some advanced rapid diagnostic kits compared to traditional laboratory-based methods may pose a barrier in price-sensitive regions

- Strict regulatory requirements for approval and quality control in different countries can also delay product launches and limit market expansion in certain geographies.

- While newer rapid tests are becoming more affordable and accurate, perceptions of cost and reliability can still hinder widespread adoption in resource-limited settings

- Addressing these challenges through robust clinical validation, cost-effective solutions, and alignment with regulatory standards will be crucial for sustained market growth

Rapid Influenza Diagnostics Market Scope

The market is segmented on the basis of type of disease, test type, end user, and distribution channel.

- By Type of Disease

On the basis of type of disease, the Rapid Influenza Diagnostics market is segmented into Influenza A and Influenza B. The Influenza A segment dominated the largest market revenue share of 57.3% in 2025, driven by its higher prevalence, seasonal outbreaks, and greater clinical severity compared to Influenza B. Hospitals and clinics prioritize Influenza A testing due to its rapid transmission potential and association with serious complications such as pneumonia and hospitalization. The segment benefits from government-led influenza surveillance programs and awareness campaigns emphasizing early detection. Rapid Influenza A diagnostics are often used in emergency and outpatient settings to reduce patient load and improve treatment outcomes. Multiplex testing platforms detecting Influenza A alongside other pathogens further strengthen demand. Standardized and validated rapid diagnostic kits enhance clinical confidence and workflow efficiency. The segment is reinforced by continuous product launches and global initiatives for influenza preparedness. Rising adoption in both developed and emerging markets supports steady growth. High reliability, ease of use, and regulatory approvals add to the segment’s dominance.

The Influenza B segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, fueled by the rising incidence of co-infections and increased awareness of Influenza B-related complications. Influenza B infections are becoming more common in school-aged children and working adults, boosting the demand for rapid detection. Multiplex assays detecting both Influenza A and B are driving growth. Adoption is further supported by preventive healthcare initiatives, vaccination programs, and early diagnostic needs. Rising investments in public health infrastructure and home-based testing are also contributing factors. Rapid test kits tailored for community clinics and smaller hospitals improve accessibility. Educational campaigns on influenza prevention increase the demand for accurate and timely diagnostics. Seasonal peaks in Influenza B cases create recurring market opportunities. Technological advancements in sensitivity and specificity of kits enhance adoption rates. The segment is particularly growing in emerging regions with expanding healthcare access. Partnerships between test manufacturers and public health authorities accelerate deployment. Growing focus on reducing flu-related absenteeism in schools and workplaces further propels segment expansion.

- By Test Type

On the basis of test type, the Rapid Influenza Diagnostics market is segmented into STANDARD F Influenza A/B Fluorescence Immunoassay (STANDARD F), Sofia Influenza A + B Fluorescence Immunoassay (Sofia), Immunochromatographic Assay, Real-Time Polymerase Chain Reaction (RT-PCR), and Others. The Sofia Influenza A+B Fluorescence Immunoassay dominated the market with a revenue share of 45.8% in 2025, driven by its high sensitivity, rapid turnaround time of 15–20 minutes, and broad adoption in hospitals and emergency care settings. The test is widely preferred for point-of-care use, enabling clinicians to make immediate treatment decisions and reduce complications. Integration with automated readers and digital reporting improves workflow efficiency and epidemiological tracking. Its minimal training requirements, strong clinical reliability, and ease of use contribute to dominance. Continuous product improvements and widespread distribution networks reinforce leadership. Endorsements in clinical guidelines for influenza management strengthen its adoption. The test’s compatibility with multiple clinical workflows ensures consistent utilization. Multiplexing capabilities detecting other respiratory pathogens alongside influenza enhance market relevance. Governments and public health agencies frequently recommend Sofia tests for influenza surveillance. The segment is further supported by increasing hospital investments in rapid diagnostics. Strategic collaborations with diagnostic centers and distributors expand reach globally.

The RT-PCR segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by its high accuracy, ability to detect multiple pathogens, and use in confirmatory testing. RT-PCR is increasingly adopted in reference laboratories and during influenza peaks or outbreaks. Technological advancements in faster PCR assays and portable PCR devices support decentralized testing. Growing demand for high-precision diagnostics in hospitals and research labs fuels expansion. Government-funded influenza testing programs and outbreak monitoring also drive growth. Multiplex RT-PCR assays allow simultaneous detection of Influenza A, B, and other respiratory viruses, increasing clinical adoption. Rising awareness of influenza co-infections boosts utilization. Laboratory automation and high-throughput PCR platforms improve efficiency. Regulatory approvals and validated protocols enhance clinician confidence. Increasing investments in diagnostic infrastructure in developing regions accelerate growth. Partnerships between PCR kit manufacturers and hospital networks facilitate distribution. Rising patient demand for accurate influenza detection supports rapid adoption.

- By End User

On the basis of end user, the Rapid Influenza Diagnostics market is segmented into Hospitals & Clinics, Laboratories, and Other. The Hospitals & Clinics segment accounted for the largest market revenue share of 61.2% in 2025, driven by the need for rapid point-of-care influenza testing to manage patient flow, initiate antiviral therapy, and prevent hospital-acquired infections. Hospitals prefer rapid tests to reduce turnaround times and ensure timely treatment. High adoption is supported by emergency departments and outpatient clinics. Government influenza surveillance programs often rely on hospital data, boosting the segment. Standardized rapid test kits improve clinical efficiency and reduce misdiagnosis. Rising awareness of seasonal influenza and vaccination campaigns further supports hospital adoption. Hospitals require validated tests with consistent sensitivity and specificity. Integration with hospital information systems enhances data management. Emergency preparedness plans during flu season increase demand. Multiplex testing for co-infections drives additional adoption. Hospitals in both developed and emerging markets are increasing investments in rapid diagnostics. Clinical guidelines recommending rapid testing reinforce segment dominance.

The Laboratories segment is anticipated to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by the rising need for confirmatory testing and high-precision diagnostics. Laboratories are adopting multiplex assays for simultaneous detection of influenza and other respiratory pathogens. Investment in automated high-throughput testing platforms is increasing. Reference laboratories support public health surveillance and research, boosting demand. Expansion of laboratory networks in developing regions accelerates growth. RT-PCR and other molecular testing methods are particularly driving laboratory adoption. Laboratories also benefit from collaborations with hospitals and academic institutions. Technological advances improving assay sensitivity further promote segment growth. Rising focus on influenza outbreak management in urban centers supports laboratory demand. Government and private funding for influenza research contributes to expansion.

- By Distribution Channel

On the basis of distribution channel, the Rapid Influenza Diagnostics market is segmented into Direct and Retail. The Direct segment dominated the market with a share of 53.5% in 2025, driven by hospitals, clinics, and laboratories procuring influenza rapid test kits directly from manufacturers for bulk orders, timely supply, and quality assurance. Direct procurement ensures authenticity and faster delivery. Healthcare institutions prefer direct channels to maintain inventory and reduce dependency on intermediaries. Strong manufacturer relationships with hospital networks reinforce dominance. Bulk ordering for seasonal flu peaks strengthens direct channel adoption. Strategic partnerships and supply contracts with public health programs increase segment growth. Regulatory compliance and validated product lines favor direct procurement. Timely delivery of kits during outbreak situations enhances market relevance. Direct sales provide manufacturers with insights into market demand trends. Hospitals rely on direct channels to ensure uninterrupted test availability. Increasing demand for standardized rapid tests globally supports this segment. Manufacturers also provide training and support directly to healthcare facilities.

The Retail segment is expected to witness the fastest CAGR of 7.8% from 2026 to 2033, supported by the increasing availability of influenza rapid test kits through pharmacies, drugstores, and online platforms. Retail channels expand access for home-based testing and community healthcare settings. E-commerce growth contributes to faster distribution and adoption. Retail availability improves convenience for patients seeking early diagnosis. Public awareness campaigns and at-home testing trends drive segment growth. Partnerships between manufacturers and retail chains enhance accessibility. Point-of-care self-testing kits further boost retail adoption. Regulatory approvals for over-the-counter test kits support growth. Retail access facilitates testing in underserved regions. Online pharmacies provide convenient delivery and tracking. Consumer awareness and willingness to self-test increase adoption. Retail expansion into emerging markets accelerates market penetration.

Rapid Influenza Diagnostics Market Regional Analysis

- North America dominated the rapid influenza diagnostics market with the largest revenue share of 41.5% in 2025

- Supported by advanced healthcare infrastructure, widespread use of rapid testing in hospitals and clinics, strong government programs for infectious disease control, and the presence of key diagnostic companies

- The market experienced substantial growth due to the integration of rapid influenza testing in emergency departments, outpatient clinics, and pandemic preparedness initiatives

U.S. Rapid Influenza Diagnostics Market Insight

The U.S. rapid influenza diagnostics market captured the majority share in North America in 2025, driven by extensive adoption of point-of-care testing and incorporation of rapid influenza diagnostics in hospitals, outpatient clinics, and public health programs. Rising influenza awareness, increasing vaccination campaigns, and integration of diagnostics with electronic health records (EHRs) further fueled market growth.

Europe Rapid Influenza Diagnostics Market Insight

The Europe rapid influenza diagnostics market is projected to expand steadily during the forecast period, driven by increasing demand for timely influenza detection in hospitals and clinics, government-supported vaccination and monitoring programs, and growing awareness of seasonal influenza outbreaks. Countries such as Germany, France, and the U.K. are witnessing notable adoption of rapid testing solutions in both clinical and laboratory settings.

U.K. Rapid Influenza Diagnostics Market Insight

The U.K. rapid influenza diagnostics market is expected to grow at a healthy CAGR, supported by national influenza vaccination programs, increasing healthcare expenditure, and rising awareness of rapid diagnostic tools among healthcare providers. The expansion of outpatient and emergency care facilities with integrated rapid testing capabilities is a key growth driver.

Germany Rapid Influenza Diagnostics Market Insight

Germany rapid influenza diagnostics market is anticipated to witness substantial market growth due to strong healthcare infrastructure, government initiatives for infectious disease control, and increasing use of rapid diagnostic solutions in hospitals and diagnostic laboratories. Rising demand for accurate, quick influenza detection in both urban and rural healthcare settings further contributes to market expansion.

Asia-Pacific Rapid Influenza Diagnostics Market Insight

The Asia-Pacific rapid influenza diagnostics market is expected to be the fastest-growing region, registering a high CAGR during the forecast period, driven by increasing healthcare expenditure, expanding laboratory networks, rising influenza awareness, and government initiatives promoting early detection. Countries such as China, India, and Japan are experiencing rapid adoption of point-of-care and hospital-based rapid influenza testing solutions.

Japan Rapid Influenza Diagnostics Market Insight

Japan’s rapid influenza diagnostics market growth is fueled by the country’s well-developed healthcare system, aging population, and rising demand for early and accurate influenza detection. The adoption of rapid diagnostics in clinics, hospitals, and public health programs, along with integration with digital health platforms, is propelling market expansion.

China Rapid Influenza Diagnostics Market Insight

China rapid influenza diagnostics market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, increasing healthcare awareness, government initiatives for infectious disease control, and a growing number of hospitals and diagnostic centers adopting rapid influenza testing. Expansion of local manufacturers and affordable testing solutions further support market growth.

Rapid Influenza Diagnostics Market Share

The Rapid Influenza Diagnostics industry is primarily led by well-established companies, including:

• Abbott (U.S.)

• BD (U.S.)

• Cepheid (U.S.)

• F. Hoffmann-La Roche Ltd. (Switzerland)

• Sophia Genetics (Switzerland)

• Samsung Bioepis (South Korea)

• Quidel Corporation (U.S.)

• Siemens Healthineers (Germany)

• Alere Inc. (U.S.)

• Trinity Biotech (Ireland)

• Ortho Clinical Diagnostics (U.S.)

• Meridian Bioscience (U.S.)

• Micronics, Inc. (U.S.)

• GenMark Diagnostics (U.S.)

• Healgen Scientific (U.S.)

• Fujirebio Diagnostics, Inc. (Japan)

• BD Veritor (U.S.)

• ICON Diagnostics (U.S.)

• Altona Diagnostics (Germany)

• QuantuMDx Group (U.K.)

Latest Developments in Global Rapid Influenza Diagnostics Market

- In December 2021, Roche announced plans to launch a combined SARS‑CoV-2 & Flu A/B Rapid Antigen Test (for professional use in CE‑mark markets), capable of differentiating between COVID‑19 and influenza in less than 30 minutes — supporting point‑of-care and resource‑limited settings

- In October 2024, Healgen Scientific received official marketing authorization from U.S. Food and Drug Administration (FDA) for its OTC rapid antigen test — Healgen Rapid Check COVID-19/Flu A&B Antigen Test — enabling individuals to self‑test at home for both COVID‑19 and influenza A/B with results in about 15 minutes

- In February 2025, Biolabs International LLC launched its SpeedySwab Rapid COVID-19 + Flu A&B Antigen Self-Test — an at‑home diagnostic kit for simultaneous detection of influenza A/B and COVID‑19. The launch was timed amid heightened flu‑season demand in the U.S., reflecting increasing consumer demand for accessible, rapid respiratory diagnostics

- In September 2024, Microbix Biosystems Inc. announced a new line of quality‑assessment products and reference materials (QAPs and QUANTDx) for H3N2 influenza A — enabling better validation and reliability for both antigen‑ and molecular-based flu assays, crucial given antigenic drift and emerging seasonal flu variants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.