Global Remote Surgery Market

Market Size in USD Billion

CAGR :

%

USD

7.17 Billion

USD

17.63 Billion

2024

2032

USD

7.17 Billion

USD

17.63 Billion

2024

2032

| 2025 –2032 | |

| USD 7.17 Billion | |

| USD 17.63 Billion | |

|

|

|

|

Remote Surgery Market Size

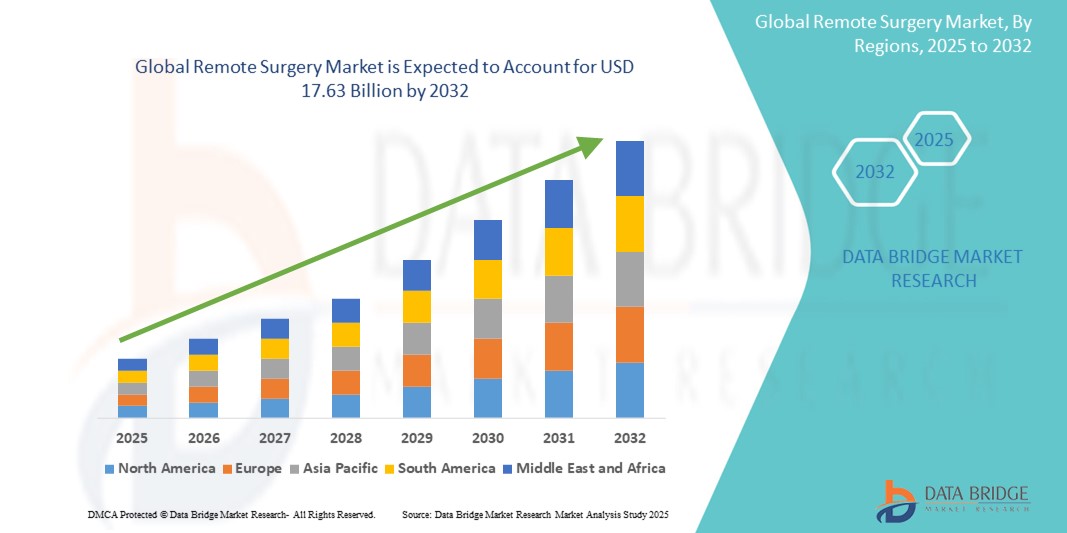

- The global remote surgery market size was valued at USD 7.17 billion in 2024 and is expected to reach USD 17.63 billion by 2032, at a CAGR of 11.90% during the forecast period

- The market growth is largely fueled by rapid advancements in telecommunication technologies, such as 5G and high-speed internet, alongside the increasing integration of robotics and AI in surgical systems, enabling real-time, precise remote procedures across geographic boundaries

- Furthermore, rising demand for specialist surgical care in underserved and remote areas, coupled with growing investments in digital health infrastructure and robotic platforms, is positioning remote surgery as a transformative solution in modern healthcare delivery. These converging factors are accelerating the adoption of remote surgical systems, thereby significantly boosting the industry’s growth

Remote Surgery Market Analysis

- Remote surgery, enabling surgeons to perform operations from distant locations using robotic systems and high-speed connectivity, is emerging as a transformative solution in surgical care, particularly in critical or underserved areas where specialist access is limited

- The accelerating demand for remote surgery is primarily fueled by the advancement of telecommunication networks such as 5G, increased adoption of robotic-assisted surgical systems, and the global shift toward digital and minimally invasive healthcare solutions

- North America dominated the remote surgery market with the largest revenue share of 42.1% in 2024, driven by strong healthcare infrastructure, high investment in surgical robotics, and early adoption of telemedicine technologies, especially in the U.S., where institutions are increasingly integrating remote surgery into clinical workflows

- Asia-Pacific is expected to be the fastest growing region in the remote surgery market during the forecast period due to increasing healthcare investments, improving internet penetration, and rising awareness of advanced surgical technologies across emerging economies

- Systems segment dominated the remote surgery market with a market share of 58.9% in 2024, attributed to its critical role in enabling precise, real-time, and efficient surgical interventions across distances using robotic and AI-integrated platforms

Report Scope and Remote Surgery Market Segmentation

|

Attributes |

Remote Surgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Remote Surgery Market Trends

“Robotic Precision and 5G-Driven Surgical Connectivity”

- A defining and accelerating trend in the global remote surgery market is the convergence of surgical robotics and ultra-fast, low-latency communication technologies such as 5G. This combination is enabling highly precise, real-time remote surgical procedures, revolutionizing access to specialist care across distances

- For instance, in early 2024, China successfully performed a complex spinal surgery remotely over a 5G network using the Tinavi orthopedic robot, showcasing the transformative potential of remote surgery powered by high-speed networks

- The use of robotic surgical systems such as those developed by Intuitive Surgical (da Vinci) and Medtronic is increasingly paired with real-time data transmission and augmented reality (AR) interfaces, allowing surgeons to operate from remote locations with minimal latency. These systems provide haptic feedback, high-definition imaging, and multi-arm control to mirror in-person capabilities

- The trend also includes AI-powered surgical planning and intraoperative assistance, which enhances the surgeon’s decision-making accuracy and helps in real-time adjustment during complex procedures. AI platforms can analyze patient data and suggest optimal procedural paths, making surgeries more efficient

- Furthermore, the integration of cloud-based platforms allows for real-time collaboration between multiple specialists across geographies, enabling second opinions and training during live procedures. This creates a broader ecosystem of telepresence in surgical environments

- This trend is fundamentally reshaping the global surgical landscape by overcoming geographical barriers, reducing patient travel, and enabling specialist care in underserved regions. Consequently, companies such as CMR Surgical and Stryker are investing in cloud-linked and AI-integrated surgical robotics to expand the potential of remote surgery globally

- The growing demand for connected, intelligent, and minimally invasive surgical technologies is accelerating adoption across both developed and emerging healthcare systems, driving the global market for remote surgery forward

Remote Surgery Market Dynamics

Driver

“Surge in Demand for Minimally Invasive Surgeries and Specialist Accessibility”

- The global healthcare sector is experiencing rising demand for minimally invasive surgeries (MIS) due to reduced patient recovery time, shorter hospital stays, and lower complication risks making remote surgery a natural progression in surgical evolution

- For instance, the da Vinci robotic surgical system, used in over 10 million procedures globally, continues to expand in remote and telerobotic capabilities, offering real-time operative control across long distances

- The ability to deliver specialist surgical services to remote or underserved areas, especially in rural settings or during disaster responses, is a significant driver of remote surgery adoption

- Increasing investments by governments and private health organizations in digital health infrastructure especially robotic-assisted surgery platforms, surgical navigation systems, and telepresence tools are contributing to rapid market expansion

- In addition, medical training institutions are using remote surgery systems for skill development and simulation-based learning, further strengthening demand in both academic and clinical environments

Restraint/Challenge

“Connectivity, Regulatory, and Ethical Hurdles”

- The performance of remote surgery is heavily dependent on reliable, high-speed, low-latency internet connections. Inadequate connectivity, especially in low-resource settings, poses a significant challenge to real-time surgical precision and safety

- Moreover, concerns related to data security, patient privacy, and ethical liability in case of surgical failure due to technical glitches or transmission delays remain key barriers to full-scale deployment

- The complex regulatory frameworks governing telemedicine and cross-border healthcare services vary widely across countries, creating compliance challenges for the implementation of remote surgical platforms

- For instance, the FDA and EMA continue to evaluate the integration of AI and remote systems into surgical procedures, often requiring extensive clinical validation before granting approvals

- Further, the high capital investment required for robotic systems, training, and maintenance such as those offered by companies such as Stryker, Medtronic, and Zimmer Biomet can limit adoption in smaller hospitals and developing regions

- Overcoming these challenges through standardized regulatory pathways, improved broadband access, and cost-reduction strategies will be crucial for the continued advancement and global accessibility of remote surgery technologies

Remote Surgery Market Scope

The market is segmented on the basis of component, application, and end users.

- By Component

On the basis of component, the remote surgery market is segmented into systems and accessories. The systems segment dominated the market with the largest revenue share of 58.9% in 2024, driven by the increasing demand for advanced robotic-assisted surgical platforms that serve as the core infrastructure for performing remote procedures. These systems enable precise, minimally invasive surgeries and offer features such as real-time video transmission, AI-powered surgical planning, and haptic feedback, making them indispensable in modern remote operating environments.

The accessories segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the continuous need for complementary tools such as robotic arms, endoscopic instruments, sensors, and connectivity modules. As hospitals adopt remote surgery systems, the recurring demand for high-quality accessories and upgrades to enhance surgical precision and safety is expected to drive this segment forward.

- By Application

On the basis of application, the remote surgery market is segmented into gynaecology, thoracic surgery, cardiac surgery, urology surgery, neurosurgery, orthopaedic surgery, general surgery, and others. The general surgery segment accounted for the largest revenue share of 24.6% in 2024, driven by the high volume and diversity of procedures falling under this category. Remote robotic systems are increasingly being deployed in general surgeries due to their wide applicability, including laparoscopic operations, appendectomies, and hernia repairs. Their relatively lower complexity compared to other surgical types makes them ideal for early adoption of remote capabilities.

The neurosurgery segment is anticipated to experience the fastest growth from 2025 to 2032, owing to the increasing reliance on precision-guided, minimally invasive technologies in brain and spine surgeries. Remote robotic systems provide high-definition visualization and precise micro-movements essential for neurosurgical interventions, particularly in areas with limited neurology specialists.

- By End Users

On the basis of end users, the remote surgery market is segmented into hospitals and clinics. The hospitals segment held the dominant market share of 69.8% in 2024, primarily due to their larger budgets, better access to skilled personnel, and readiness to adopt cutting-edge medical technologies. Hospitals often serve as the central hub for complex and high-risk surgeries, making them ideal settings for implementing and scaling remote surgical solutions.

The clinics segment is expected to grow at the fastest pace from 2025 to 2032, supported by the miniaturization of surgical systems and increasing demand for outpatient procedures. As affordability and accessibility of robotic-assisted technologies improve, more clinics are expected to adopt remote surgery tools for targeted use cases such as urology, dermatology, and minor orthopedic surgeries.

Remote Surgery Market Regional Analysis

- North America dominated the remote surgery market with the largest revenue share of 42.1% in 2024, driven by strong healthcare infrastructure, high investment in surgical robotics, and early adoption of telemedicine technologies

- Healthcare institutions in the region highly value the precision, real-time control, and specialist accessibility offered by remote surgery systems, particularly in rural or underserved areas where traditional surgical resources may be limited

- This widespread adoption is further supported by significant R&D investments, favorable regulatory frameworks, and a growing emphasis on minimally invasive procedures, positioning remote surgery as a critical advancement in both hospital-based and remote healthcare delivery

U.S. Remote Surgery Market Insight

The U.S. remote surgery market captured the largest revenue share of 78.5% in 2024 within North America, driven by robust healthcare infrastructure, early adoption of robotic-assisted surgery, and significant investments in 5G and telehealth platforms. Surgeons and hospitals increasingly leverage these technologies to improve access to specialized procedures, especially in rural and underserved areas. The integration of AI, cloud-based surgical collaboration tools, and regulatory support for digital health initiatives is further accelerating adoption across academic medical centers and leading healthcare providers.

Europe Remote Surgery Market Insight

The Europe remote surgery market is projected to grow at a strong CAGR during the forecast period, supported by cross-border healthcare initiatives and growing acceptance of teleoperated surgery. Rising demand for minimally invasive procedures, coupled with advancements in surgical robotics and digital health integration, is fostering growth across the region. European Union funding for health innovation and a focus on reducing patient wait times are driving hospitals and research institutions to adopt remote surgery platforms, particularly in countries such as France, Germany, and the Netherlands.

U.K. Remote Surgery Market Insight

The U.K. remote surgery market is expected to expand at a noteworthy CAGR during the forecast period, spurred by rising NHS investments in surgical innovation and digital transformation. A focus on improving surgical accessibility, especially in remote or rural areas, is encouraging the adoption of telerobotic systems. The country's growing use of AI in clinical decision-making, along with initiatives supporting virtual consultations and digital operating rooms, positions the U.K. as a key contributor to the regional remote surgery landscape.

Germany Remote Surgery Market Insight

The Germany remote surgery market is anticipated to grow steadily during the forecast period, driven by the country’s advanced healthcare infrastructure and strong emphasis on medical robotics and precision technologies. Germany’s robust investment in R&D, coupled with an innovation-friendly regulatory environment, supports rapid deployment of remote surgical platforms. Hospitals and surgical centers are increasingly adopting these systems for complex procedures such as neurosurgery and urology, with patient data privacy and interoperability standards aligning with national digital health priorities.

Asia-Pacific Remote Surgery Market Insight

The Asia-Pacific remote surgery market is forecasted to grow at the fastest CAGR of 23.6% from 2025 to 2032, fueled by expanding healthcare access, rapid digitalization, and government-backed investments in smart hospitals and 5G infrastructure. Countries such as China, Japan, South Korea, and India are leading adoption through a combination of strong manufacturing capabilities, large patient populations, and demand for remote specialist care. Increased participation in global health tech collaborations is further driving remote surgery implementation across the region.

Japan Remote Surgery Market Insight

The Japan remote surgery market is gaining traction due to the nation’s high-tech infrastructure, advanced robotics sector, and focus on improving healthcare for its aging population. Japanese hospitals are at the forefront of integrating AI-guided surgical platforms and teleoperated systems, enabling complex procedures across distance with high precision. Public-private partnerships and strong government support for digital health innovation are accelerating market penetration, particularly in neurology and gastrointestinal surgery applications.

India Remote Surgery Market Insight

The India remote surgery market accounted for the largest revenue share within Asia Pacific in 2024, driven by rapid healthcare infrastructure development, increased adoption of smart medical technologies, and the government’s push for digital healthcare transformation. India’s focus on expanding access to specialist care in rural areas, combined with growing investments in telemedicine and robotic surgery startups, is fueling demand for remote surgery systems. Local manufacturing capabilities and cost-effective solutions are further making remote surgical technologies accessible across public and private sectors.

Remote Surgery Market Share

The remote surgery industry is primarily led by well-established companies, including:

- Intuitive Surgical, Inc. (U.S.)

- Medtronic (Ireland)

- Stryker (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- CMR Surgical Ltd (U.K.)

- Asensus Surgical, Inc. (U.S.)

- Corindus, Inc. (U.S.)

- Renishaw plc (U.K.)

- Avatera Medical GmbH (Germany)

- THINK Surgical, Inc. (U.S.)

- Titan Medical Inc. (Canada)

- Medicaroid Corporation (Japan)

- TMiRob (Shanghai TMiRob Technology Co., Ltd.) (China)

- Meerecompany Inc. (South Korea)

- Virtual Incision Corporation (U.S.)

- XACT Robotics Ltd. (Israel)

- Apollo Hospitals Enterprise Ltd. (India)

What are the Recent Developments in Global Remote Surgery Market?

- In April 2023, Medtronic plc announced the expansion of its Hugo robotic-assisted surgery (RAS) system to multiple hospitals in Latin America and Southeast Asia, advancing access to minimally invasive procedures in underserved regions. The initiative demonstrates Medtronic’s commitment to scaling robotic surgery globally and supporting healthcare systems through technological innovation and remote surgical capabilities. By combining real-time connectivity and precision robotics, Medtronic is driving broader adoption of digital surgery platforms worldwide

- In March 2023, Johnson & Johnson MedTech revealed enhancements to its Ottava surgical robotic system, focusing on improved modularity, imaging integration, and remote operation features. The upgrades aim to facilitate better adaptability across surgical specialties and enable remote collaboration between surgeons and clinical teams. This development highlights Johnson & Johnson’s strategic push into intelligent, scalable surgical platforms optimized for both in-hospital and remote procedure settings

- In March 2023, CMR Surgical partnered with major Indian hospitals to deploy its Versius robotic surgical system, with a focus on expanding access to high-quality minimally invasive surgery in rural and tier-2 cities. The collaboration supports India’s broader digital health mission and reflects the growing role of remote-compatible robotics in addressing surgical workforce shortages. It also underscores CMR’s efforts to make advanced surgical care more accessible and cost-effective in emerging markets

- In February 2023, Intuitive Surgical, the maker of the da Vinci surgical system, announced the successful completion of several pilot telesurgery procedures across Europe using 5G-enabled connections. These trials, conducted in collaboration with telecom and hospital partners, demonstrated the feasibility of real-time remote robotic surgery. The initiative reinforces Intuitive’s leadership in the field and paves the way for regulatory and clinical advancements in cross-border surgical care

- In January 2023, Apollo Hospitals Group (India) launched a remote surgery training and simulation center in partnership with U.S.-based tech firms, aiming to upskill surgeons using VR and robotic-assisted surgery platforms. The facility offers real-time collaboration with global experts, providing practical exposure to remote techniques. This initiative reflects the growing demand for tele-mentoring and simulation-based training in the adoption of remote surgical systems across developing countries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.