Global Renal Artery Stenosis Treatment Market

Market Size in USD Million

CAGR :

%

USD

500.50 Million

USD

717.22 Million

2025

2033

USD

500.50 Million

USD

717.22 Million

2025

2033

| 2026 –2033 | |

| USD 500.50 Million | |

| USD 717.22 Million | |

|

|

|

|

Renal Artery Stenosis Treatment Market Size

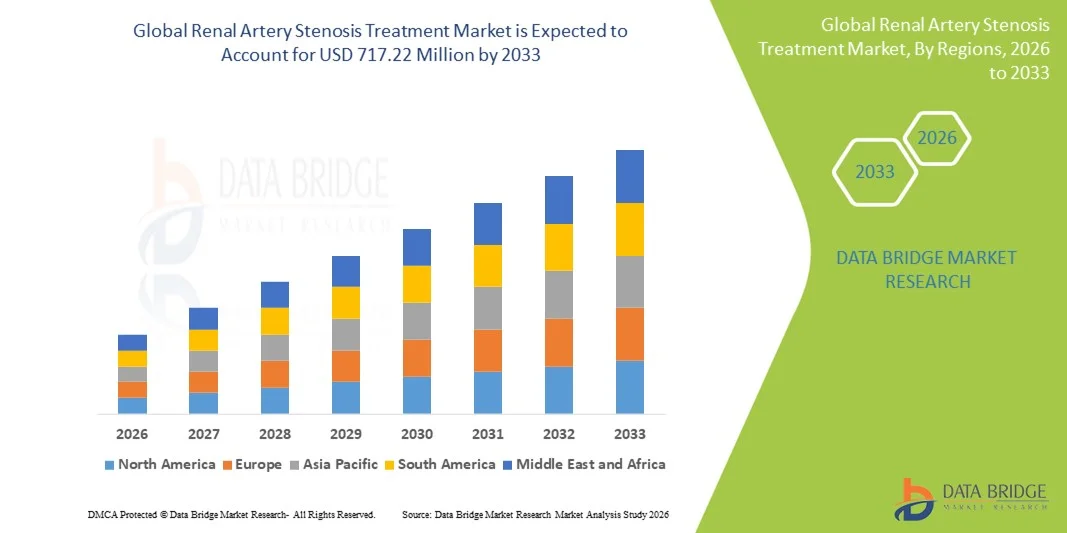

- The global renal artery stenosis treatment market size was valued at USD 500.50 million in 2025 and is expected to reach USD 717.22 million by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the rising prevalence of renal artery stenosis, increasing chronic kidney disease cases, and growing adoption of minimally invasive stenting procedures

- Furthermore, advancements in stent technology, such as drug‑eluting and bioresorbable stents, along with rising patient awareness and preference for less invasive interventions, are driving the adoption of renal artery stenosis treatments, thereby significantly boosting the industry's growth

Renal Artery Stenosis Treatment Market Analysis

- Renal artery stenosis treatments, including medication, angioplasty, bypass surgery, and renal artery endarterectomy, are increasingly critical for managing renal artery narrowing and preventing associated complications such as hypertension and chronic kidney disease, driven by their efficacy, minimally invasive nature, and integration with advanced diagnostic and interventional technologies

- The rising prevalence of atherosclerosis, fibromuscular dysplasia, hypertension, diabetes, and an aging population are primary factors fueling demand for renal artery stenosis interventions, alongside growing awareness among patients and healthcare providers regarding early diagnosis and treatment

- North America dominated the renal artery stenosis treatment market with the largest revenue share of 39.7% in 2025, supported by advanced healthcare infrastructure, high adoption of minimally invasive procedures, and strong presence of leading device and pharmaceutical manufacturers, with the U.S. experiencing significant growth due to increasing diagnostic screenings, procedural innovations, and early intervention strategies

- Asia-Pacific is expected to be the fastest growing region in the renal artery stenosis treatment market during the forecast period, owing to rising healthcare expenditure, increasing prevalence of risk factors such as diabetes and hypertension, and expanding access to advanced diagnostic tools such as CT scans, Doppler ultrasound, and magnetic resonance angiography (MRA)

- Medication segment dominated the renal artery stenosis treatment market with a market share of 53.8% in 2025, driven by widespread use of ACE inhibitors, angiotensin II receptor blockers, beta-blockers, and other drugs for effective management of hypertension, edema, and other related symptoms, alongside ease of administration through oral and intravenous routes

Report Scope and Renal Artery Stenosis Treatment Market Segmentation

|

Attributes |

Renal Artery Stenosis Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Renal Artery Stenosis Treatment Market Trends

Advancements in Minimally Invasive and Imaging-Guided Procedures

- A significant and accelerating trend in the global renal artery stenosis treatment market is the increasing adoption of minimally invasive procedures such as angioplasty and stenting combined with advanced imaging guidance, enhancing treatment precision and patient outcomes

- For instance, the Resolute Onyx Zotarolimus-Eluting Stent utilizes intravascular imaging to optimize stent placement, reducing procedural complications and improving long-term vessel patency

- Imaging-guided interventions, including CT angiography and Doppler ultrasound integration, allow physicians to better assess lesion severity and plan targeted interventions, reducing procedure time and recovery periods

- The combination of minimally invasive techniques with real-time imaging supports safer, faster, and more effective renal artery interventions, enabling outpatient procedures and shorter hospital stays

- This trend toward image-assisted, patient-specific interventions is reshaping treatment protocols and expectations, with companies such as Medtronic and Boston Scientific advancing next-generation stent systems optimized for precision placement and reduced restenosis rates

- The demand for integrated, minimally invasive, and image-guided renal artery stenosis treatments is growing rapidly across both hospital and specialty clinic settings, driven by patient preference for safer procedures and faster recovery times

- Growing focus on personalized treatment plans using patient-specific imaging data is enabling more precise intervention selection, improving success rates and reducing complications

- Technological convergence of robotics and catheter-based systems with imaging guidance is emerging, enhancing procedural accuracy and operational efficiency in renal artery interventions

Renal Artery Stenosis Treatment Market Dynamics

Driver

Increasing Prevalence of Hypertension, Atherosclerosis, and Chronic Kidney Disease

- The rising incidence of hypertension, atherosclerosis, and chronic kidney disease is a significant driver for the heightened demand for renal artery stenosis treatments

- For instance, in March 2025, Medtronic announced expanded use of its renal artery stent portfolio for patients with resistant hypertension, highlighting the growing need for interventional solutions

- As clinicians focus on preventing kidney damage and cardiovascular complications, renal artery stenosis treatments provide effective management options, improving long-term patient outcomes

- In addition, growing awareness among healthcare providers and patients regarding early diagnosis and intervention is increasing procedural adoption across both public and private healthcare facilities

- The integration of advanced stents and drug therapies, along with minimally invasive procedural techniques, continues to enhance treatment efficacy and broaden applicability across diverse patient populations

- Rising investments in R&D by key medical device companies for next-generation stents and imaging technologies are accelerating innovation, boosting market growth

- Expansion of government and private insurance coverage for interventional procedures is facilitating greater accessibility, encouraging higher adoption of renal artery stenosis treatments

Restraint/Challenge

Procedure Risks, High Cost, and Regulatory Hurdles

- Concerns surrounding procedural risks, such as restenosis, thrombosis, and contrast-induced nephropathy, pose significant challenges to broader market penetration

- For instance, reports of stent restenosis in certain high-risk patients have made some clinicians cautious about intervention selection, especially in elderly or comorbid populations

- Addressing these concerns through advanced stent designs, drug-eluting technologies, and optimized peri-procedural protocols is crucial for improving adoption and patient safety

- In addition, the relatively high cost of interventional procedures and stent devices compared to conservative medical management can be a barrier for budget-constrained hospitals or regions with limited healthcare coverage

- Navigating complex regulatory requirements for device approval and clinical trial validation, particularly for next-generation stents and drug-eluting systems, remains a key challenge for manufacturers aiming for global market expansion

- Limited availability of trained interventional cardiologists and radiologists in emerging markets restricts procedural accessibility, slowing market growth

- Variability in patient response and long-term efficacy of certain stents poses clinical uncertainty, potentially affecting physician confidence and adoption rates

Renal Artery Stenosis Treatment Market Scope

The market is segmented on the basis of drug type, treatment, diagnosis, dosage, route of administration, indication, symptoms, end-users, and distribution channel.

- By Drug Type

On the basis of drug type, the market is segmented into non-steroidal anti-inflammatory drugs (NSAIDS), diuretics, beta-blockers, angiotensin ii receptor blockers, blood thinners, angiotensin converting enzyme (ACE) inhibitors, calcium channel blockers, and hmg-coa reductase inhibitors. The ACE inhibitors segment dominated the market with the largest revenue share of 31.5% in 2025, owing to their proven efficacy in controlling hypertension and providing renal protection. ACE inhibitors are widely prescribed for long-term management of renal artery stenosis patients due to their dual benefit of lowering blood pressure and protecting kidney function. Their well-established safety profile and compatibility with combination therapies drive their widespread clinical adoption. Physicians prefer ACE inhibitors as a first-line therapy, particularly in patients with comorbidities such as diabetes or cardiovascular disease. Oral formulations of ACE inhibitors also enhance patient adherence, further supporting market dominance. Continuous research and clinical guidelines recommending ACE inhibitors reinforce their leading position in the market.

The Angiotensin II Receptor Blockers (ARBs) segment is anticipated to witness the fastest growth rate of 9.8% from 2026 to 2033, fueled by rising adoption among patients intolerant to ACE inhibitors. ARBs offer comparable efficacy in blood pressure management and renal protection while minimizing side effects such as persistent cough. Growing awareness of ARBs’ benefits among healthcare providers and patients is accelerating their clinical adoption. The availability of multiple oral formulations adds to patient convenience and compliance. Increasing prevalence of renal artery stenosis in emerging markets also contributes to higher ARB demand.

- By Treatment

On the basis of treatment, the market is segmented into medication, renal artery endarterectomy, bypass surgery, angioplasty, and others. The medication segment dominated the market with a 52.8% revenue share in 2025, driven by its convenience, cost-effectiveness, and lower risk compared to invasive procedures. Medication is often the first-line therapy in early-stage renal artery stenosis and is widely adopted in outpatient settings. Its dominance is supported by the broad availability of antihypertensive and lipid-lowering drugs, which manage associated risk factors such as hypertension and atherosclerosis. Medications provide sustained therapy and improve long-term patient outcomes, enhancing their market share. Physicians rely on medication management for chronic care, further driving adoption. Awareness campaigns and clinical guidelines recommending pharmacological interventions also support market dominance.

The angioplasty segment is expected to witness the fastest CAGR of 7.2% from 2026 to 2033, driven by the increasing preference for minimally invasive procedures that restore renal blood flow while reducing hospital stay. Technological advancements such as drug-eluting and bioresorbable stents are supporting higher adoption rates. Hospitals and specialty clinics are increasingly using angioplasty for high-risk atherosclerotic stenosis cases. Growing physician confidence and improved procedural success rates contribute to rapid growth. Favorable reimbursement policies in developed markets further facilitate angioplasty adoption. Patient preference for minimally invasive treatments is a key factor accelerating market expansion.

- By Diagnosis

On the basis of diagnosis, the market is segmented into CT scan, Magnetic Resonance Angiography (MRA), Doppler Ultrasound, Renal Arteriography, and others. Renal arteriography dominated the market with the largest share of 45.1% in 2025, as it is considered the gold standard for evaluating stenosis severity. This invasive diagnostic method provides real-time visualization for treatment planning and procedural guidance. It is extensively used in hospitals and specialized vascular centers. Renal arteriography ensures accurate lesion assessment, improving treatment success. Its adoption is also supported by skilled interventional specialists and advanced imaging infrastructure. Growing awareness of its diagnostic precision continues to maintain its market dominance.

The Doppler Ultrasound segment is anticipated to witness the fastest growth rate of 11.4% from 2026 to 2033, driven by its non-invasive nature, cost-effectiveness, and increasing adoption in routine screenings. Doppler imaging is ideal for early detection, patient monitoring, and follow-up assessments. Clinics and outpatient facilities increasingly prefer Doppler due to its ease of use. Rising awareness among healthcare providers and patients contributes to higher adoption. Technological improvements in ultrasound devices are enhancing diagnostic accuracy, boosting growth.

- By Dosage

On the basis of dosage, the market is segmented into tablet, injection, and others. Tablet formulations dominated the market with a 61.8% revenue share in 2025, owing to their convenience, patient adherence, and suitability for long-term management of hypertension and renal protection. Tablets are commonly prescribed for outpatient care, ensuring sustained therapy and improved outcomes. Their availability across multiple drug classes increases their utility. Physicians favor oral tablets for patient compliance and cost-effectiveness. The ease of administration at home also contributes to widespread adoption. Continuous patient education and guideline recommendations support the dominance of tablets in therapy.

The injection segment is expected to witness the fastest CAGR of 8.6% from 2026 to 2033, primarily due to hospital and clinic-based interventions requiring rapid onset of drug action. Injectable medications are used for acute hypertensive crises, peri-procedural anticoagulation, or renal protection during interventions. Hospitals increasingly rely on IV formulations for optimized procedural support. Growing interventional procedures in emerging markets contribute to rising demand. Development of novel injectable formulations further accelerates growth.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and others. Oral administration dominated the market with 65.3% revenue share in 2025 due to ease of use, patient adherence, and broad clinical applicability for chronic disease management. Oral drugs are preferred in outpatient settings, supporting long-term therapy. Physicians frequently prescribe oral formulations for hypertension and renal protection. Widespread availability of oral medications enhances patient compliance. Oral administration reduces the need for hospital visits, increasing adoption. Clinical guidelines favor oral therapy for first-line management, reinforcing its dominance.

The intravenous segment is expected to witness the fastest growth rate of 7.9% from 2026 to 2033, driven by hospital use for acute care, rapid blood pressure control, and peri-procedural interventions. Hospitals prefer IV formulations for precise dosing and rapid onset. Growing interventional procedures such as angioplasty and stenting support adoption. Technological advances in IV drug delivery improve safety and efficacy. Increasing availability in emerging markets also contributes to growth.

- By Indication

On the basis of indication, the market is segmented into fibromuscular dysplasia and atherosclerosis. Atherosclerosis dominated the market with 78.2% revenue share in 2025 due to its high prevalence in aging populations and patients with cardiovascular comorbidities. Treatments for atherosclerotic stenosis include medication, stenting, and surgical interventions, driving market demand. Hospitals and specialty centers treat the majority of these cases, supporting revenue dominance. Early detection and preventive strategies increase treatment adoption. Clinical guidelines emphasize intervention for atherosclerotic renal artery stenosis, sustaining market share. Ongoing research in stent technologies further reinforces dominance.

Fibromuscular dysplasia is expected to witness the fastest CAGR of 10.1% from 2026 to 2033, due to rising diagnosis rates, increased awareness, and minimally invasive treatment options suitable for younger populations. Improved imaging techniques enable early detection and intervention. Growing patient awareness and access to care in developed regions support growth. Hospitals and specialized clinics are increasingly adopting treatment protocols. Clinical studies demonstrating efficacy of angioplasty in FMD patients accelerate adoption.

- By Symptoms

On the basis of symptoms, the market is segmented into hypertension, edema, fluid retention, fatigue, nausea, vomiting, decreased kidney function, and others. Hypertension dominated the market with a 62.5% share in 2025, as it is the most common clinical manifestation driving treatment initiation. Effective blood pressure management is central to all treatment approaches. Physicians prioritize controlling hypertension to prevent renal and cardiovascular complications. Medication and interventional treatments target hypertension as a primary endpoint. Hospital and clinic-based care ensures monitoring and treatment adherence. Rising prevalence of hypertension globally supports sustained demand.

Edema and fluid retention are expected to witness the fastest CAGR of 8.9% from 2026 to 2033, driven by increased awareness of renal complications and the need for targeted management. Early intervention improves outcomes and reduces long-term complications. Outpatient and hospital-based therapies support growth. Emerging markets show increased screening for renal-related edema. Advances in pharmacological treatments enhance symptom management. Patient education programs further contribute to adoption.

- By End-Users

On the basis of end-users, the market is segmented into clinic, hospital, and others. Hospitals dominated the market with 70.4% revenue share in 2025, due to advanced interventional facilities, skilled specialists, and availability of both diagnostic and treatment services under one roof. Hospitals are preferred for complex procedures such as angioplasty, stenting, and bypass surgery. Integrated care and procedural capabilities support high adoption. Specialist-led interventions increase efficacy and patient trust. Hospitals also ensure availability of advanced medications. Rising hospital infrastructure in developed regions reinforces dominance.

Clinics are expected to witness the fastest CAGR of 9.3% from 2026 to 2033, fueled by adoption of non-invasive diagnostics, outpatient medication management, and follow-up care. Clinics provide accessible care for early-stage patients. Growing awareness and screening programs increase clinic-based adoption. Integration with telemedicine supports patient monitoring. Clinics in emerging markets expand market reach. Preventive and maintenance care drives growth in this segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital pharmacy dominated the market with 55.6% revenue share in 2025, due to immediate availability of prescription medications and procedural drugs for inpatients and interventions. Hospital pharmacies ensure timely administration during procedures. Hospitals’ centralized procurement supports consistent supply. Integration with treatment protocols drives adoption. Pharmacist expertise ensures correct dispensing. Established relationships with device and drug manufacturers maintain inventory efficiency.

Online pharmacy is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, driven by increasing patient preference for home delivery, telemedicine integration, and convenient refills of chronic medications. Patients benefit from timely access to antihypertensives and lipid-lowering agents. Online platforms improve medication adherence. Digital healthcare adoption accelerates convenience. Emerging markets increasingly rely on online pharmacies. Promotions and subscription models further boost online sales growth.

Renal Artery Stenosis Treatment Market Regional Analysis

- North America dominated the renal artery stenosis treatment market with the largest revenue share of 39.7% in 2025, supported by advanced healthcare infrastructure, high adoption of minimally invasive procedures, and strong presence of leading device and pharmaceutical manufacturers

- Patients and healthcare providers in the region highly value minimally invasive treatments, precise diagnostics, and effective management of renal complications, contributing to the strong adoption of medication, stenting, and angioplasty procedures

- This widespread adoption is further supported by high healthcare expenditure, well-established reimbursement policies, a technologically advanced medical ecosystem, and the presence of leading medical device and pharmaceutical companies, establishing North America as the key market for renal artery stenosis treatments in both hospital and clinic settings

U.S. Renal Artery Stenosis Treatment Market Insight

The U.S. renal artery stenosis treatment market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of hypertension, atherosclerosis, and chronic kidney disease. Patients and healthcare providers are increasingly prioritizing minimally invasive interventions, including angioplasty and stenting, alongside effective pharmacological management. The growing focus on early diagnosis through advanced imaging technologies, combined with well-established healthcare infrastructure and reimbursement policies, further propels market growth. Moreover, the presence of leading medical device and pharmaceutical companies, along with widespread clinical adoption of evidence-based treatment protocols, is significantly contributing to the market’s expansion.

Europe Renal Artery Stenosis Treatment Market Insight

The Europe renal artery stenosis treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of cardiovascular and renal disorders, along with rising awareness of early diagnosis and intervention. Growing urbanization, an aging population, and government initiatives for improved healthcare delivery are fostering the adoption of both interventional procedures and pharmacological treatments. European healthcare providers emphasize minimally invasive techniques, and the availability of advanced imaging tools supports high procedural success rates. The region is experiencing significant growth across hospital and clinic settings, with treatments being integrated into both routine care and specialized vascular programs.

U.K. Renal Artery Stenosis Treatment Market Insight

The U.K. renal artery stenosis treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising incidence of hypertension and chronic kidney disease, alongside increasing awareness of early intervention benefits. Concerns regarding cardiovascular complications are encouraging healthcare providers to adopt minimally invasive stenting and angioplasty procedures. The U.K.’s advanced healthcare infrastructure, coupled with a robust outpatient care system and widespread access to diagnostic technologies, is expected to continue stimulating market growth. In addition, growing patient preference for hospital-based interventions ensures steady adoption of evidence-based treatments.

Germany Renal Artery Stenosis Treatment Market Insight

The Germany renal artery stenosis treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by high prevalence of renal and cardiovascular disorders and the demand for technologically advanced treatment options. Germany’s well-developed healthcare system, emphasis on medical innovation, and widespread adoption of minimally invasive interventions promote market growth. Hospitals and specialty clinics increasingly utilize angioplasty, stenting, and imaging-guided procedures, supported by advanced diagnostic infrastructure. The integration of treatment protocols with patient monitoring systems ensures higher efficacy and safety, aligning with local healthcare standards and patient expectations.

Asia-Pacific Renal Artery Stenosis Treatment Market Insight

The Asia-Pacific renal artery stenosis treatment market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2026 to 2033, driven by increasing prevalence of hypertension, atherosclerosis, and chronic kidney disease in countries such as China, Japan, and India. Rising healthcare expenditure, urbanization, and growing access to advanced diagnostic and interventional facilities are driving adoption. Government initiatives promoting early diagnosis and chronic disease management support wider procedural uptake. Furthermore, increasing awareness among patients and healthcare providers about minimally invasive treatments is expanding the market to both hospital and clinic settings across the region.

Japan Renal Artery Stenosis Treatment Market Insight

The Japan renal artery stenosis treatment market is gaining momentum due to the country’s high prevalence of hypertension and chronic kidney disease, rapid urbanization, and aging population. Japanese healthcare providers emphasize early detection and minimally invasive interventions such as stenting and angioplasty. Integration of advanced imaging technologies with interventional procedures ensures high precision and patient safety. Moreover, rising patient awareness regarding renal protection and cardiovascular risk reduction is driving the adoption of both pharmacological and procedural treatments. Hospitals and specialty clinics remain the primary treatment centers, supporting market expansion.

India Renal Artery Stenosis Treatment Market Insight

The India renal artery stenosis treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to increasing prevalence of hypertension, atherosclerosis, and kidney-related complications. The country’s expanding healthcare infrastructure, rising patient awareness, and growing adoption of minimally invasive interventions are major growth drivers. India also benefits from an increasing number of specialized hospitals and clinics equipped with advanced diagnostic tools such as CT angiography, Doppler ultrasound, and MRA. Furthermore, affordability of treatments and availability of domestic and international stent systems are facilitating wider access. Government initiatives promoting early screening and chronic disease management are key factors propelling the market.

Renal Artery Stenosis Treatment Market Share

The Renal Artery Stenosis Treatment industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Cook (U.S.)

- Terumo Corporation (Japan)

- B. Braun SE (Germany)

- Biotronik SE & Co. KG (Germany)

- MicroPort Scientific Corporation (China)

- W. L. Gore & Associates, Inc. (U.S.)

- Endologix, Inc. (U.S.)

- Cardinal Health (U.S.)

- Cordis Corporation (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- AngioDynamics, Inc. (U.S.)

- iVascular SLU (Spain)

- Medinol Ltd. (Israel)

- STENTYS SA (France)

- InspireMD, Inc. (U.S.)

- Elixir Medical Corporation (U.S.)

- Acotec Scientific Holdings Ltd (China)

What are the Recent Developments in Global Renal Artery Stenosis Treatment Market?

- In October 2025, Medtronic shared long‑term data from the three‑year follow-up of the SPYRAL HTN-ON MED Trial showing that patients treated with Symplicity Spyral had sustained and significant reductions in blood pressure over sham-treated patients and importantly, no new cases of severe renal artery stenosis (> 70%) were observed in the RDN group over three years

- In September 2025, Medtronic announced that its Symplicity Spyral RDN System (renal denervation device) received regulatory approval in Japan making Japan the 77th country cleared to use this system for treating resistant hypertension associated with renal‑artery related issues

- In March 2025, Boston Scientific announced a definitive agreement to acquire SoniVie Ltd. the privately held company behind the TIVUS Intravascular Ultrasound System in a deal valued up to USD540 million. This acquisition marks a strategic expansion for Boston Scientific into the renal denervation (RDN) space: the TIVUS system uses catheter-based ultrasound to ablate nerves surrounding renal arteries (rather than relying on stents), offering a minimally invasive, nerve‑targeted therapy for resistant hypertension — a major risk factor for renal complications

- In April 2024, Getinge received the EU MDR certification for its Advanta V12 covered stent system, confirming its approved use for patients with renal artery stenosis and/or aortoiliac occlusive disease (AIOD), including lesions at the aortic bifurcation. This regulatory milestone effectively (re‑)validates a long‑standing device (on the market for decades) under modern EU medical‑device regulations helping ensure regulatory compliance, safety standards, and continued clinical acceptance

- In April 2024, alongside regulatory approvals, Getinge entered into a commercial distribution agreement with Cook Medical for the U.S. market granting Cook exclusive sales and distribution rights for the U.S. version of Advanta V12. This collaboration enhances global availability and accessibility of a proven covered stent system for renal artery stenosis, potentially improving patient access in the U.S. and ensuring streamlined supply and support

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.