Global Restaurant Management Software Market

Market Size in USD Billion

CAGR :

%

USD

5.95 Billion

USD

20.75 Billion

2024

2032

USD

5.95 Billion

USD

20.75 Billion

2024

2032

| 2025 –2032 | |

| USD 5.95 Billion | |

| USD 20.75 Billion | |

|

|

|

|

Restaurant Management Software Market Size

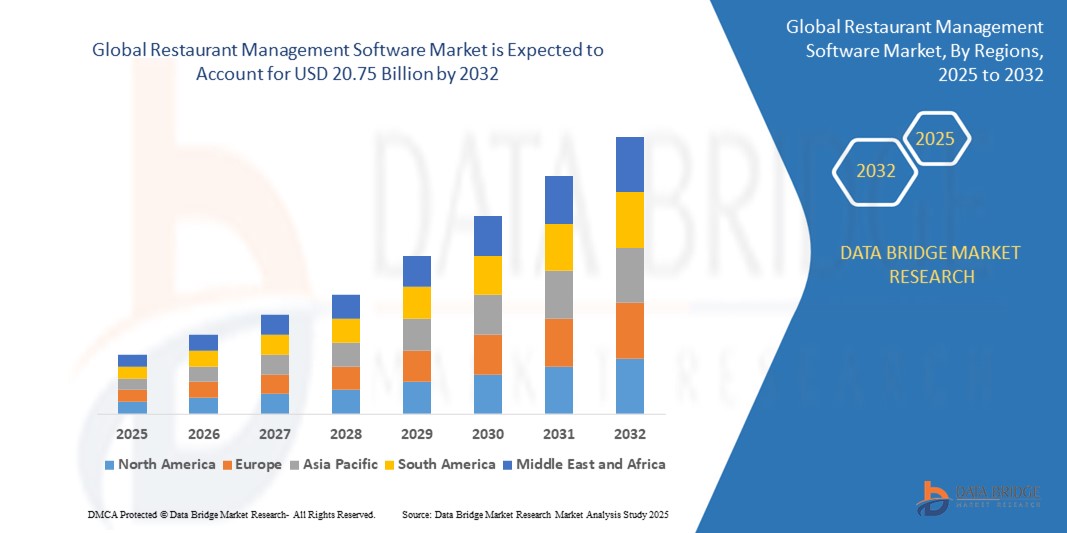

- The global restaurant management software market was valued at USD 5.95 billion in 2024 and is expected to reach USD 20.75 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 16.90%, primarily driven by expansion of restaurant chains

- This growth is driven by factors such as centralized management, operational standardization and workforce automation

Restaurant Management Software Market Analysis

- Restaurant management software refers to digital solutions that streamline restaurant operations, including order processing, inventory management, and customer relationship management. These solutions enhance efficiency, automation, and overall restaurant performance

- The market is expanding rapidly due to the growing need for operational automation, real-time data insights, and enhanced customer service. Restaurants are increasingly adopting these solutions to improve order accuracy, optimize supply chain management, and integrate multiple service channels such as dine-in, takeaway, and online food delivery

- The restaurant management software market is evolving with a strong focus on cloud-based platforms, artificial intelligence-driven analytics, and integrated point-of-sale systems. As concerns over data security, regulatory compliance, and operational efficiency increase, businesses are investing in scalable and secure restaurant management software solutions

- For instance, leading providers such as Toast, Square, and Oracle are continuously innovating by offering cloud-based point-of-sale systems, artificial intelligence powered inventory management, and customer engagement tools to address the evolving needs of the restaurant industry

- The restaurant management software market is expected to experience substantial growth, driven by the rising adoption of digital solutions in quick-service restaurants, full-service restaurants, and cloud kitchens. With continuous advancements in automation, artificial intelligence integration, and mobile ordering systems, the market is projected to witness sustained expansion in the coming years

Report Scope and Restaurant Management Software Market Segmentation

|

Attributes |

Restaurant Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Restaurant Management Software Market Trends

“Increasing Adoption of Cloud-Based Solutions”

- One prominent trend in the global restaurant management software market is the increasing adoption of cloud-based solutions

- This trend is driven by the growing demand for real-time data access, operational flexibility, and cost-efficient restaurant management, with businesses leveraging cloud technology to streamline operations, integrate multiple service channels, and enhance overall efficiency

- For instance, companies such as Toast, Square, and Oracle are offering cloud-based point-of-sale systems and restaurant management platforms that enable businesses to manage orders, track inventory, and monitor customer interactions remotely

- The transition toward cloud-based restaurant management software is expected to accelerate, with restaurants investing in scalable, secure, and AI-powered cloud platforms to optimize workflows, reduce hardware dependencies, and improve customer service

- As competition in the market intensifies, software providers will continue to enhance cloud infrastructure, data security, and artificial intelligence-driven analytics. The rising adoption of cloud-based restaurant management solutions, combined with innovations in automation, digital payments, and third-party integrations, will further drive market growth, making cloud computing a fundamental component of next-generation restaurant operations

Restaurant Management Software Market Dynamics

Driver

“Rising Demand for Streamlined Operations”

- The rising demand for streamlined operations is a key driver of growth in the restaurant management software market. As restaurants seek to improve efficiency, reduce operational costs, and optimize workflows, digital solutions are becoming essential tools for managing everything from order processing and inventory tracking to customer engagement and staff scheduling

- This impact is particularly evident in sectors such as quick-service restaurants, full-service dining, and cloud kitchens, where restaurant management software enhances productivity, minimizes human errors, and ensures smooth multi-channel operations

- With businesses prioritizing speed, accuracy, and seamless customer service, the adoption of automation-driven restaurant management software for order management, real-time inventory tracking, and predictive analytics has accelerated

- Features such as cloud-based point-of-sale systems, automated workforce scheduling, and AI-powered menu optimization are reshaping how restaurants operate, enabling them to scale efficiently while maintaining consistent service quality and cost control

- Companies are increasingly investing in intelligent restaurant management solutions to improve operational agility, enhance customer experiences, and strengthen supply chain management

For instance,

- Enterprises such as TouchBistro, Upserve, and Zenput offer smart restaurant management solutions that streamline table reservations, automate food safety compliance, and enhance staff productivity

- Revel Systems, Fourth, and 7shifts offer workforce management solutions that automate scheduling, payroll processing, and labor compliance tracking

- With ongoing innovations in automation, increasing use of artificial intelligence in restaurant management systems, and widespread adoption of digital technologies in the hospitality sector, the market is set for sustained expansion, reinforcing its role as a cornerstone of modern restaurant operations

Opportunity

“Expansion of Cloud Kitchens and Virtual Restaurants”

- The expansion of cloud kitchens and virtual restaurants presents a significant opportunity for market growth. As the food service industry shifts toward delivery-focused operations, the demand for restaurant management software that supports cloud kitchen infrastructure and virtual brand management is increasing

- Cloud kitchens, which operate without traditional dine-in spaces, require advanced software to handle high-volume online orders, inventory tracking, and real-time analytics. Virtual restaurants, which exist solely on digital platforms, rely on technology-driven solutions to manage multiple brands, optimize menus, and track customer preferences efficiently

- The ability of restaurant management software to provide centralized control, automate food preparation processes, and integrate seamlessly with third-party delivery services is driving widespread adoption, as businesses recognize its potential to improve profitability and operational efficiency

For instance,

- Fourth, 7shifts, and Zenput offer workforce management solutions that help virtual restaurants optimize staffing and scheduling for peak delivery hours

- OpenTable, Quandoo, and Clover provide reservation and order management integrations that enhance customer experience and streamline food preparation times

- As the cloud kitchen and virtual restaurant model continues to grow, investments in restaurant management software tailored for these digital-first businesses will accelerate. Collaborations between technology providers, food delivery platforms, and restaurant operators will drive further adoption, positioning cloud-based restaurant management software as a key enabler of the future food service industry

Restraint/Challenge

“Data Security and Privacy Concerns”

- Data security and privacy concerns pose a significant challenge for the restaurant management software market. As restaurants increasingly rely on cloud-based solutions and digital payment systems, the risk of cyber threats, data breaches, and unauthorized access to sensitive customer information is growing

- Restaurant management software processes vast amounts of customer data, including payment details, order history, and personal preferences. A lack of robust security measures can expose businesses to cyberattacks, leading to financial losses, reputational damage, and legal penalties

- Compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, adds complexity for restaurant software providers. Businesses must implement encryption, multi-factor authentication, and regular security audits to mitigate risks

For instance,

- Toast, Square, and Clover have strengthened their platforms with end-to-end encryption and secure payment gateways to protect customer transactions

- As digital transformation accelerates in the food service industry, concerns over data security and privacy will continue to grow, impacting the adoption and trust in restaurant management software solutions

Restaurant Management Software Market Scope

The market is segmented on the basis of deployment, restaurant type, enterprise size, functionality, pricing model, and end-use.

|

Segmentation |

Sub-Segmentation |

|

By Deployment |

|

|

By Restaurant Type |

|

|

By Enterprise Size |

|

|

By Functionality

|

|

|

By Pricing Model |

|

|

By End-Use |

|

Restaurant Management Software Market Regional Analysis

“North America is the Dominant Region in the Restaurant Management Software Market”

- North America dominates the restaurant management software market, driven by the high digital adoption, strong technology infrastructure, and increasing demand for automation in the food service industry. The region benefits from significant investments in cloud-based solutions, AI-driven analytics, and integrated payment systems, enabling restaurants to optimize operations and enhance customer experiences

- The U.S. holds a significant share due to presence of major restaurant management software providers such as Toast, Square, Oracle, and Micros Systems. These companies are driving innovation through cloud-based point-of-sale (POS) solutions, AI-powered customer engagement tools, and automated inventory management systems

- The rise of third-party delivery platforms such as Uber Eats, DoorDash, and Grubhub has further accelerated the demand for restaurant management software that seamlessly integrates order management, kitchen automation, and delivery tracking

- With continuous advancements in AI, machine learning, and IoT-based restaurant management systems, North America is expected to maintain its dominance in the market, driven by increasing digitalization and innovation in the food service industry

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the restaurant management software market, driven by rapid urbanization, the rise of online food delivery services, and increasing investment in digital transformation across the restaurant sector

- China leads the region's market growth, supported by government initiatives in digitalization and smart city development. Companies such as Alibaba, Tencent, and Meituan-Dianping are investing in AI-powered restaurant automation, robotics, and predictive analytics to enhance customer service and optimize supply chains

- Southeast Asia is also witnessing significant growth, with restaurants embracing cloud-based solutions to manage multi-location operations, automate order processing, and improve customer loyalty programs. The demand for cost-effective, mobile-friendly restaurant management software is rising, particularly among small and medium-sized food service businesses

- With rising investments in AI, IoT, and digital payment systems, Asia-Pacific is poised for substantial market expansion, attracting both local and global technology providers aiming to capitalize on the region’s growing food service industry

Restaurant Management Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Clover Network, LLC (U.S.)

- Oracle (U.S.)

- Fourth Enterprises LLC., Inc. (U.S.)

- OpenTable, Inc. (U.S.)

- 7shifts (Canada)

- Toast, Inc. (U.S.)

- ADP (U.S.)

- Quandoo GmbH (Germany)

- Zenput (U.S.)

- TouchBistro (Canada)

Latest Developments in Global Restaurant Management Software Market

- In September 2024, TouchBistro launched its Inventory Management and Labor Management solutions after acquiring Peachworks, strengthening its position in the restaurant management software market. This expansion enhances its competitive edge by offering streamlined operations and cost efficiency, driving greater adoption amid rising demand for integrated, data-driven restaurant management solutions

- In April 2024, Toast launched its Restaurant Management Suite, leveraging insights from over 100,000 restaurant locations, including major brands such as Caribou Coffee, Papa Gino’s & D’Angelo, Bar Louie, and Nothing Bundt Cakes. This expansion strengthens Toast’s position in the restaurant management software market by offering enterprise brands enhanced data-driven insights, operational control, and seamless integrations. By addressing the complex needs of multi-unit restaurants, this launch is expected to accelerate adoption and reinforce Toast’s leadership in enterprise restaurant solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.