Global Rheumatology Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

36.17 Billion

USD

43.05 Billion

2024

2032

USD

36.17 Billion

USD

43.05 Billion

2024

2032

| 2025 –2032 | |

| USD 36.17 Billion | |

| USD 43.05 Billion | |

|

|

|

|

Rheumatology Therapeutics Market Size

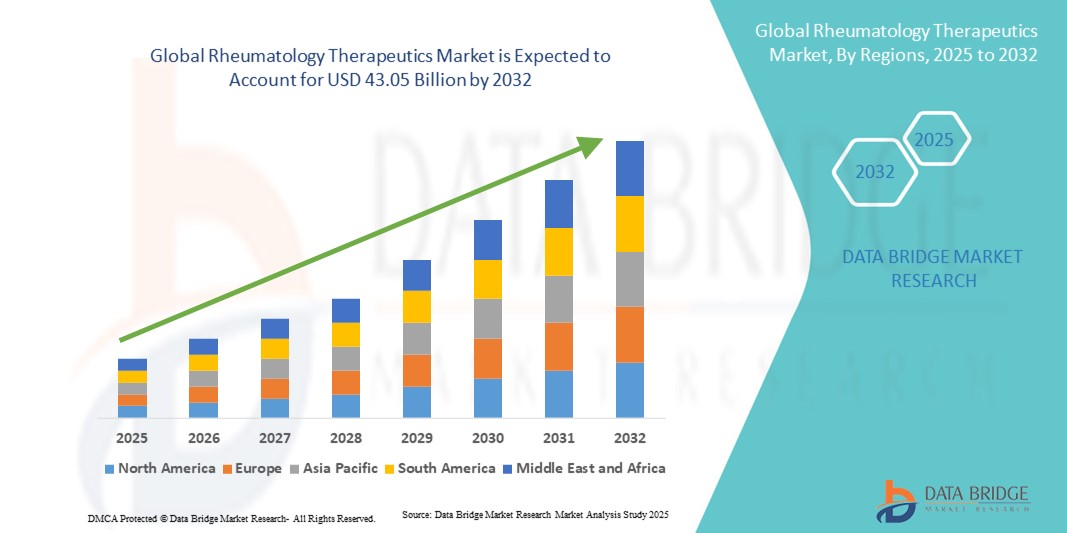

- The global rheumatology therapeutics market size was valued at USD 36.17 billion in 2024 and is expected to reach USD 43.05 billion by 2032, at a CAGR of 2.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of autoimmune and inflammatory diseases, advancements in biologic therapies, and rising healthcare access, particularly in emerging economies

- Furthermore, growing demand for targeted, personalized, and cost-effective treatments for conditions such as rheumatoid arthritis, lupus, and other rheumatic disorders is establishing advanced therapeutics as the preferred treatment option. These converging factors are accelerating the uptake of rheumatology therapies, thereby significantly boosting the industry's growth

Rheumatology Therapeutics Market Analysis

- Rheumatology therapeutics, including Disease-Modifying Anti-Rheumatic Drugs (DMARDs), Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), corticosteroids, and uric acid-lowering drugs, are increasingly vital components of modern healthcare for managing autoimmune and inflammatory diseases such as rheumatoid arthritis, osteoarthritis, gout, psoriatic arthritis, and ankylosing spondylitis due to their efficacy, safety, and ability to control disease progression

- The escalating demand for rheumatology therapeutics is primarily fueled by the rising prevalence of autoimmune and inflammatory disorders, growing patient awareness, and ongoing advancements in treatment options, particularly targeted therapies and improved formulations that enhance patient adherence and outcomes

- North America dominated the rheumatology therapeutics market with the largest revenue share of 39% in 2024, driven by high healthcare expenditure, advanced medical infrastructure, early adoption of biologic and targeted therapies, and a strong presence of key industry players such as AbbVie, Pfizer, and Johnson & Johnson. The U.S. witnessed substantial growth in treatment uptake supported by innovative therapies and patient support programs

- Asia-Pacific is expected to be the fastest growing region in the rheumatology therapeutics market during the forecast period due to increasing healthcare access, rising patient awareness, and expanding medical infrastructure in emerging economies

- Disease Modifying Anti-Rheumatic Drugs (DMARD’s) segment dominated the rheumatology therapeutics market with a market share of 45.1% in 2024, driven by their effectiveness in controlling disease activity, reducing joint damage, and long-term adoption among patients with moderate-to-severe rheumatoid arthritis and other autoimmune disorders

Report Scope and Rheumatology Therapeutics Market Segmentation

|

Attributes |

Rheumatology Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rheumatology Therapeutics Market Trends

Advancements in Targeted and Personalized Therapies

- A significant and accelerating trend in the global rheumatology therapeutics market is the development and adoption of targeted therapies and personalized medicine approaches, including JAK inhibitors, biologic DMARDs, and precision dosing strategies. This trend is improving patient outcomes and reducing adverse effects

- For instance, the use of IL-6 inhibitors in patients with rheumatoid arthritis allows for more precise modulation of the immune response, tailoring treatment to individual disease activity and response

- Targeted therapies are enabling earlier intervention and better disease control, minimizing joint damage and improving quality of life for patients with autoimmune conditions

- Personalized treatment plans, guided by biomarkers and genetic profiling, facilitate optimized therapy selection and improved adherence. This approach is reshaping treatment protocols across major rheumatology centers

- The integration of digital tools and patient monitoring platforms alongside targeted therapies supports data-driven decision-making and long-term disease management

- The demand for innovative, precise, and patient-centric therapeutics is growing rapidly, as patients and healthcare providers increasingly prioritize efficacy, safety, and individualized treatment strategies

Rheumatology Therapeutics Market Dynamics

Driver

Rising Prevalence of Autoimmune and Inflammatory Disorders

- The increasing incidence of autoimmune and inflammatory diseases globally, including rheumatoid arthritis, psoriatic arthritis, and ankylosing spondylitis, is a significant driver for market growth

- For instance, in 2024, rising rheumatoid arthritis cases in North America and Europe prompted higher adoption of biologic DMARDs and targeted therapies

- As patients and healthcare providers seek better disease management options, advanced therapeutics with improved efficacy and safety profiles are preferred over conventional treatments

- The growing awareness among patients and clinicians about early intervention benefits is further propelling demand for modern rheumatology drugs

- Expanding healthcare access, insurance coverage, and patient assistance programs are enabling broader uptake of advanced therapies

- The push for improved long-term disease management, reduced joint damage, and enhanced patient quality of life continues to drive global market demand

- The trend toward long-term disease control and reduced healthcare burden is making rheumatology therapeutics a key component of treatment strategies worldwide

Restraint/Challenge

High Treatment Costs and Regulatory Hurdles

- The high cost of biologics, targeted therapies, and combination treatment regimens poses a significant challenge to market growth, limiting access in price-sensitive regions

- For instance, the annual cost of biologic DMARDs can reach tens of thousands of dollars, restricting affordability for many patients in developing economies

- Regulatory approval processes for novel therapies are lengthy and complex, delaying market entry and increasing development costs

- Variations in reimbursement policies and healthcare infrastructure across regions also create disparities in patient access to advanced therapeutics

- Side effects, such as increased infection risk with immunosuppressive therapies, may reduce patient adherence and limit prescription uptake

- Differences in reimbursement policies and healthcare infrastructure across regions create disparities in access to advanced therapeutics.

- Overcoming these challenges through cost-effective biosimilars, streamlined regulatory pathways, and patient support initiatives will be crucial for sustaining market growth

Rheumatology Therapeutics Market Scope

The market is segmented on the basis of drug class, disease indication, and distribution channel.

- By Drug Class

On the basis of drug class, the rheumatology therapeutics market is segmented into disease-modifying anti-rheumatic drugs (DMARDs), nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroids, and uric acid drugs. The DMARDs segment dominated the rheumatology therapeutics market with the largest market revenue share of 45.1% in 2024. This dominance is attributed to their high efficacy in controlling disease progression in autoimmune conditions such as rheumatoid arthritis and psoriatic arthritis. Biologic DMARDs, including TNF inhibitors and IL-6 inhibitors, are particularly popular due to their ability to target specific pathways in the immune system, reducing inflammation and joint damage. Patients and healthcare providers prefer DMARDs for long-term disease management, as they can slow structural damage and improve quality of life. The segment also benefits from strong adoption in North America and Europe, where healthcare infrastructure supports advanced therapies. In addition, the availability of combination therapies and ongoing innovations in targeted DMARDs continue to enhance treatment outcomes and maintain the segment’s leadership.

The NSAIDs segment is anticipated to witness the fastest growth from 2025 to 2032, driven by their widespread use in managing pain and inflammation associated with osteoarthritis, gout, and ankylosing spondylitis. NSAIDs are often the first line of treatment for mild to moderate symptoms, making them highly accessible and widely prescribed. Increasing awareness of pain management and the convenience of oral formulations contribute to their growing adoption. The segment is also benefiting from the development of safer NSAID formulations with reduced gastrointestinal and cardiovascular risks. Emerging markets with rising prevalence of musculoskeletal disorders are fueling demand. Integration with combination therapies alongside DMARDs further strengthens its market growth potential.

- By Disease Indication

On the basis of disease indication, the rheumatology therapeutics market is segmented into rheumatoid arthritis, osteoarthritis, gout, psoriatic arthritis, and ankylosing spondylitis. The rheumatoid arthritis segment dominated the market in 2024 due to the high global prevalence of the disease and its chronic, progressive nature. RA requires long-term management, driving consistent demand for DMARDs, biologics, and targeted synthetic drugs. Healthcare providers prioritize RA treatment for early intervention to prevent joint damage and disability. Patients benefit from comprehensive care programs and patient support initiatives offered by key pharmaceutical companies, which enhance treatment adherence. North America and Europe are major markets for RA therapeutics, owing to advanced healthcare systems and high awareness levels. Ongoing clinical research and development of new biologics continue to expand the treatment options for RA patients, reinforcing the segment’s market leadership.

Osteoarthritis is expected to witness the fastest growth during the forecast period, driven by the increasing aging population globally and rising prevalence of lifestyle-related joint disorders. Symptom management with NSAIDs, corticosteroids, and combination therapies is contributing to rapid market expansion. Patients are increasingly seeking treatments that improve mobility and quality of life without the need for invasive procedures. The growth is supported by healthcare initiatives aimed at early diagnosis and intervention. Emerging economies with increasing healthcare access and affordability are significant growth contributors. The rise of minimally invasive therapies and long-acting formulations is also accelerating adoption in both developed and developing regions.

- By Distribution Channel

On the basis of distribution channel, the rheumatology therapeutics market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2024 due to centralized access to specialized treatments and complex biologic therapies that require professional administration and monitoring. Hospitals often provide integrated care programs for rheumatology patients, ensuring adherence to treatment protocols and proper management of adverse effects. The availability of advanced DMARDs and targeted therapies in hospital pharmacies strengthens the segment’s market share. North America and Europe are the leading regions where hospital pharmacies serve as primary distribution channels. In addition, patient support initiatives, insurance coverage, and access to clinical consultations encourage treatment uptake in hospitals. The segment also benefits from ongoing collaborations between pharmaceutical companies and hospitals for clinical trials and therapy awareness programs.

The online pharmacy segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing internet penetration, e-pharmacy platforms, and patient preference for home delivery of chronic medications. Online pharmacies provide convenience, privacy, and competitive pricing for both branded and generic rheumatology drugs. Patients in remote or underserved regions are increasingly adopting online platforms to access treatments that may not be available locally. Integration with telemedicine services further enhances patient adherence and continuous disease management. Regulatory support for online pharmaceutical sales in several countries is encouraging rapid expansion. The growing trend of digital health adoption and e-commerce convenience is significantly accelerating the segment’s growth.

Rheumatology Therapeutics Market Regional Analysis

- North America dominated the rheumatology therapeutics market with the largest revenue share of 39% in 2024, driven by high healthcare expenditure, advanced medical infrastructure, early adoption of biologic and targeted therapies, and a strong presence of key industry players such as AbbVie, Pfizer, and Johnson & Johnson

- Patients and healthcare providers in the region prioritize effective disease management and long-term treatment outcomes, leading to strong adoption of DMARDs, biologics, and targeted synthetic drugs for conditions such as rheumatoid arthritis and psoriatic arthritis

- This widespread adoption is further supported by well-established healthcare systems, comprehensive insurance coverage, strong patient support programs, and significant investments in research and development by leading pharmaceutical companies, establishing North America as a key hub for rheumatology therapeutics

U.S. Rheumatology Therapeutics Market Insight

The U.S. rheumatology therapeutics market captured the largest revenue share of 82% in 2024 within North America, driven by the high prevalence of autoimmune and inflammatory disorders such as rheumatoid arthritis and psoriatic arthritis. Patients increasingly prioritize advanced treatments such as DMARDs, biologics, and targeted synthetic drugs for effective long-term disease management. The growing awareness of early intervention benefits, combined with strong insurance coverage and patient support programs, further propels market growth. Moreover, continuous R&D and the introduction of innovative therapies enhance treatment outcomes and adoption rates.

Europe Rheumatology Therapeutics Market Insight

The Europe rheumatology therapeutics market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing disease awareness, aging population, and government initiatives promoting access to advanced therapies. The demand for effective management of chronic autoimmune disorders is fostering the adoption of DMARDs and biologics. European healthcare infrastructure, coupled with reimbursement policies, encourages patient access to innovative treatments. The market is witnessing significant growth across hospital and specialty pharmacy channels, with both new therapies and reformulated drugs being incorporated into treatment protocols.

U.K. Rheumatology Therapeutics Market Insight

The U.K. rheumatology therapeutics market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising prevalence of rheumatoid arthritis and related autoimmune disorders. Patients and healthcare providers increasingly prefer advanced treatment options for better disease control and improved quality of life. National healthcare coverage and growing awareness about early intervention are supporting adoption. In addition, the country’s strong pharmaceutical and research infrastructure continues to stimulate market growth through the introduction of novel therapies and combination treatments.

Germany Rheumatology Therapeutics Market Insight

The Germany rheumatology therapeutics market is expected to expand at a considerable CAGR during the forecast period, driven by rising awareness of autoimmune diseases and growing demand for effective, safe, and targeted therapies. Germany’s well-developed healthcare system, strong R&D capabilities, and emphasis on clinical innovation promote the adoption of DMARDs and biologics. Hospitals and specialty clinics are increasingly incorporating advanced treatment protocols. The integration of digital health tools for patient monitoring and adherence further supports the market. Consumer focus on safety and treatment efficacy aligns with local expectations and accelerates adoption.

Asia-Pacific Rheumatology Therapeutics Market Insight

The Asia-Pacific rheumatology therapeutics market is poised to grow at the fastest CAGR of 25% during 2025 to 2032, driven by rising prevalence of autoimmune disorders, growing healthcare access, and increasing patient awareness in countries such as China, India, and Japan. Expansion of healthcare infrastructure and government initiatives supporting early diagnosis and treatment are fostering market growth. The adoption of biologics and DMARDs is increasing due to improved affordability and accessibility. The region’s growing focus on chronic disease management and patient support programs is further accelerating market expansion.

Japan Rheumatology Therapeutics Market Insight

The Japan rheumatology therapeutics market is gaining momentum due to the country’s aging population, high healthcare standards, and strong adoption of advanced therapies. Patients increasingly demand effective treatments such as DMARDs and biologics for chronic autoimmune conditions. Integration of healthcare technology and telemedicine enhances treatment adherence and monitoring. In addition, government support and healthcare reimbursement policies contribute to increasing therapy accessibility. The combination of innovation, patient awareness, and focus on disease management is driving growth in both residential and clinical settings.

India Rheumatology Therapeutics Market Insight

The India rheumatology therapeutics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rising prevalence of autoimmune disorders, expanding healthcare access, and increasing awareness about chronic disease management. Patients are adopting advanced therapies such as DMARDs and biologics due to affordability improvements and growing availability in hospital and retail pharmacies. Government initiatives promoting early diagnosis and the development of specialized treatment centers further boost market growth. The expanding middle class, urbanization, and a focus on long-term treatment adherence are key factors propelling the market in India.

Rheumatology Therapeutics Market Share

The rheumatology therapeutics industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- Bristol Myers Squibb Company (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Lilly USA, LLC (U.S.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- Abbott (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- UCB S.A. (Belgium)

- F. Hoffmann-La Roche Ltd (Switzerland)

What are the Recent Developments in Global Rheumatology Therapeutics Market?

- In July 2025, SetPoint Medical announced that the U.S. Food and Drug Administration (FDA) approved its SetPoint System, a first-of-its-kind neuroimmune modulation device for the treatment of adults with moderate-to-severe rheumatoid arthritis (RA) who are not adequately managed by or cannot tolerate existing advanced RA therapies. This approval represents a transformative milestone in the management of autoimmune diseases

- In July 2025, Swiss drugmaker Novartis entered a collaboration agreement with U.S.-based biotech company Matchpoint Therapeutics, committing up to USD 1 billion to develop oral drugs targeting inflammatory diseases. Matchpoint will utilize its technology to develop drugs that block the activity of a specific protein, helping to lower the production of inflammation-causing signals

- In April 2025, AbbVie announced that the U.S. Food and Drug Administration (FDA) approved Rinvoq (upadacitinib), an oral Janus kinase (JAK) inhibitor, for the treatment of adults with giant cell arteritis (GCA). This approval marks a significant advancement in the management of GCA, a rare and serious inflammatory condition affecting the arteries

- In March 2025, Celltrion received FDA approval for its denosumab biosimilars, expanding treatment options for patients with conditions such as osteoporosis and rheumatoid arthritis. This approval is expected to increase accessibility to these therapies

- In January 2022, Bristol Myers Squibb announced that the U.S. Food and Drug Administration (FDA) approved a new indication for Orencia (abatacept), a selective T-cell co-stimulation modulator, for the prevention of acute graft-versus-host disease (aGVHD) in combination with a calcineurin inhibitor and methotrexate. This approval provides a new therapeutic option for patients undergoing hematopoietic stem cell transplantation, addressing a critical unmet need in the management of aGVHD

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.