Global Rhinoplasty Injectable Fillers Market

Market Size in USD Million

CAGR :

%

USD

719.85 Million

USD

1,530.77 Million

2025

2033

USD

719.85 Million

USD

1,530.77 Million

2025

2033

| 2026 –2033 | |

| USD 719.85 Million | |

| USD 1,530.77 Million | |

|

|

|

|

Rhinoplasty Injectable Fillers Market Size

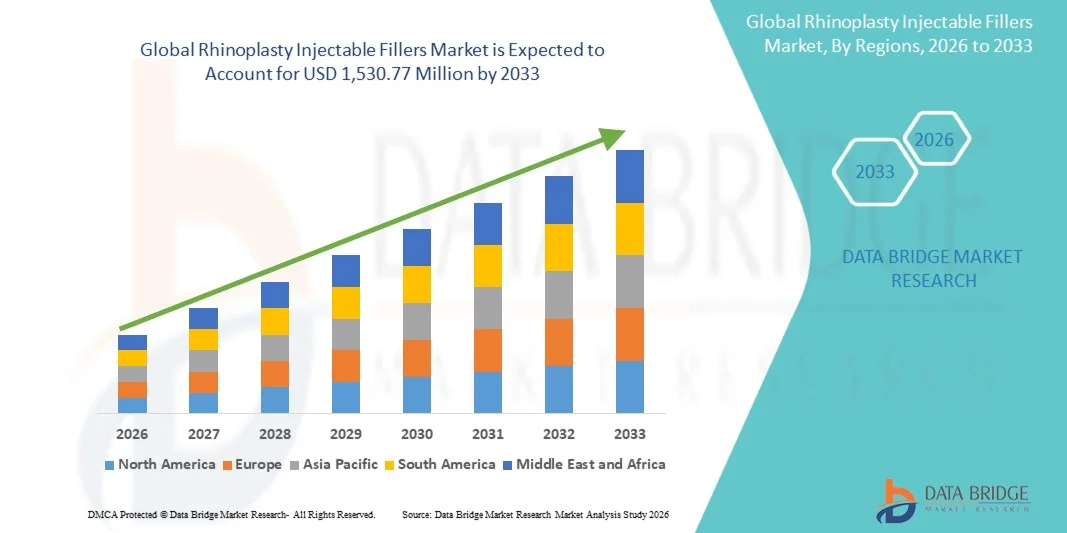

- The global rhinoplasty injectable fillers market size was valued at USD 719.85 million in 2025 and is expected to reach USD 1,530.77 million by 2033, at a CAGR of 9.89% during the forecast period

- The market growth is primarily driven by the rising preference for non-surgical aesthetic procedures, as patients seek minimally invasive alternatives to traditional rhinoplasty with reduced downtime and lower risk

- In addition, ongoing advancements in dermal filler formulations, improved safety profiles, and growing awareness of facial aesthetics are fueling the adoption of injectable fillers for nasal reshaping. These combined factors are accelerating the global uptake of rhinoplasty injectable fillers, substantially enhancing the industry’s expansion trajectory

Rhinoplasty Injectable Fillers Market Analysis

- Rhinoplasty injectable fillers, offering non-surgical nasal contouring and reshaping solutions, are becoming increasingly important within the aesthetic medicine industry due to their minimally invasive nature, reduced recovery time, and ability to achieve natural-looking results compared to traditional surgical rhinoplasty procedures

- The rising demand for injectable fillers is primarily driven by growing consumer preference for non-surgical aesthetic enhancements, advancements in filler materials such as hyaluronic acid and calcium hydroxylapatite, and the expanding influence of social media beauty standards encouraging facial harmonization treatments

- North America dominated the rhinoplasty injectable fillers market with the largest revenue share of 38.9% in 2025, supported by a high concentration of aesthetic clinics, strong spending power, and the early adoption of innovative filler products, particularly in the U.S., where demand is surging among both millennial and middle-aged demographics seeking minimally invasive procedures

- The Asia-Pacific region is expected to witness the fastest growth during the forecast period, driven by rising beauty consciousness, rapid urbanization, increasing disposable incomes, and the popularity of quick cosmetic treatments in countries such as South Korea, Japan, and China

- The hyaluronic acid segment dominated the global market with a market share of 45.6% in 2025, attributed to its biocompatibility, reversibility, and widespread clinical use for nasal contour correction and refinement procedures

Report Scope and Rhinoplasty Injectable Fillers Market Segmentation

|

Attributes |

Rhinoplasty Injectable Fillers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Rhinoplasty Injectable Fillers Market Trends

“Growing Shift Toward Non-Surgical and Minimally Invasive Aesthetic Procedures”

- A significant and accelerating trend in the global rhinoplasty injectable fillers market is the rising preference for non-surgical nasal reshaping, driven by increasing demand for minimally invasive procedures that deliver natural-looking results with minimal downtime

- For instance, the growing use of hyaluronic acid-based fillers such as Juvederm and Restylane for nasal contouring has transformed aesthetic practices, offering patients safer, reversible, and more affordable alternatives to traditional rhinoplasty

- Advancements in filler materials now allow enhanced lift, projection, and longevity, enabling practitioners to perform precision contouring and achieve results tailored to individual patient anatomy

- For instance, novel cross-linked HA fillers are being developed to improve structural support and durability for nasal correction

- The integration of advanced imaging technologies, such as 3D facial mapping and digital simulation tools, is helping clinicians plan treatments with higher accuracy and predictability, further boosting patient confidence in non-surgical rhinoplasty

- This trend toward customized, natural-looking, and reversible outcomes is redefining patient expectations in aesthetic medicine. Consequently, companies such as Allergan Aesthetics and Galderma are expanding their injectable filler portfolios to meet the rising demand for nasal applications

- The demand for non-surgical rhinoplasty is rapidly increasing across both developed and emerging economies, as consumers prioritize convenience, safety, and personalized treatment outcomes in their aesthetic enhancement choices

Rhinoplasty Injectable Fillers Market Dynamics

Driver

“Rising Demand for Aesthetic Enhancements with Minimal Downtime”

- The growing global focus on appearance enhancement and self-confidence, coupled with increasing awareness of non-invasive cosmetic options, is a major driver of the rhinoplasty injectable fillers market

- For instance, in March 2025, Revance Therapeutics expanded its RHA Collection filler line for advanced contouring applications, emphasizing natural movement and flexibility in nasal reshaping procedures

- As more consumers seek subtle improvements without surgery, injectable fillers offer quick, office-based procedures that produce immediate results and require minimal recovery time

- Furthermore, the rising influence of social media and beauty standards has increased the popularity of non-surgical rhinoplasty, encouraging individuals to pursue aesthetic correction with reduced risks

- The combination of growing practitioner expertise, wider availability of premium filler options, and increasing affordability of non-surgical procedures continues to drive the global market forward. The trend toward patient-specific, outcome-oriented treatments further enhances market potential

- Increasing product innovation and R&D investment by leading aesthetic manufacturers is creating a strong pipeline of advanced filler technologies designed specifically for nasal applications. The rising number of certified aesthetic practitioners and training programs worldwide is expanding procedural accessibility, supporting higher patient safety and confidence in injectable rhinoplasty outcomes

Restraint/Challenge

“Skin Reaction Risks and Regulatory Approval Barriers”

- Concerns regarding potential adverse reactions, including bruising, swelling, or vascular complications, remain significant challenges to the broader adoption of rhinoplasty injectable fillers

- For instance, reports of filler-induced complications in nasal procedures have prompted regulatory authorities to tighten approval requirements and clinical usage guidelines to ensure patient safety

- Addressing these safety issues through improved injection techniques, advanced training programs, and enhanced filler formulations is essential for sustaining patient trust and procedural growth. Companies such as Allergan Aesthetics and Teoxane focus on clinician education to minimize complication risks

- In addition, varying regulatory frameworks across different countries often delay product approvals and limit the commercial rollout of innovative filler technologies for nasal use

- While continuous R&D efforts are improving filler safety profiles, the combination of stringent regulations and limited product-specific approvals continues to pose a challenge to global market expansion

- Overcoming these challenges through standardized safety protocols, comprehensive clinical validation, and harmonized regulatory pathways will be critical for ensuring sustainable market growth and wider adoption

- The limited insurance coverage and high out-of-pocket costs for aesthetic procedures act as barriers for price-sensitive consumers, particularly in developing regions

- Persistent misinformation and lack of awareness regarding the safety and reversibility of injectable rhinoplasty procedures continue to discourage potential patients, highlighting the need for broader education and transparent communication in the market

Rhinoplasty Injectable Fillers Market Scope

The market is segmented on the basis of product type, procedure type, end user, and distribution channel

- By Product Type

On the basis of product type, the global rhinoplasty injectable fillers market is segmented into hyaluronic acid (HA), calcium hydroxylapatite (CAHA), poly-l-lactic acid (PLLA), polymethyl methacrylate (PMMA), collagen-based fillers, and other fillers. The Hyaluronic Acid (HA) segment dominated the market with the largest market revenue share of 45.6% in 2025, driven by its superior safety profile, reversibility with hyaluronidase, and versatility across dorsal, tip, and columella applications. HA fillers are available in multiple viscosities and cross-linking formulations that let practitioners fine-tune lift and projection while minimizing downtime, making them the go-to choice in both clinics and medical spas. Patient confidence in dissolvable fillers and extensive clinician familiarity with HA injection techniques further reinforce HA’s market leadership. The wide brand presence and established distribution channels also support steady demand and rapid adoption globally.

The Poly-L-lactic Acid (PLLA) segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by growing interest in biostimulatory fillers that induce collagen remodeling and provide longer-lasting volumization. PLLA’s appeal for patients seeking durable, natural-looking improvements without permanent implants is increasing among aesthetic practitioners. Improvements in formulation, refined dilution and injection protocols, and rising clinician training in biostimulatory techniques are expanding PLLA’s nasal applications. In addition, patient preference for longer intervals between treatments and premium positioning of bio-stimulatory products contribute to PLLA’s accelerated uptake.

- By Procedure Type

On the basis of procedure type, the market is segmented into dorsal augmentation, tip projection, alar contouring, columella support, and post-surgical correction. The Dorsal Augmentation segment dominated the market in 2025, because addressing bridge height and smoothing irregularities are among the most common patient goals areas where fillers deliver immediate, visible change. Injectable fillers enable controlled augmentation of the dorsum with minimal invasiveness, appealing to patients who want predictable improvements without implant surgery. The prominence of dorsal correction in regions emphasizing bridge enhancement (notably parts of Asia) further boosts revenue for this subsegment. Clinician preference for HA and CaHA products for dorsal work, plus well-established treatment protocols, contribute to steady market dominance.

The Tip Projection segment is expected to be the fastest growing during the forecast period, driven by improved filler rheology and microcannula techniques that allow safer, more durable tip refinement. Patients increasingly desire subtle tip elevation and definition while preserving nasal mobility and natural appearance, which modern fillers and delivery methods can achieve. The rise of younger demographics seeking minimally invasive profile refinement and the acceptance of combined treatments (tip + dorsum contouring) also propel growth. Ongoing skills training for tip-specific injections and the introduction of fillers optimized for structural support are expanding this subsegment.

- By End User

On the basis of end user, the market is segmented into hospitals, plastic surgery clinics, dermatology clinics, ambulatory surgical centers, and medical spas. Plastic Surgery Clinics held the dominant market share in 2025, as these clinics combine surgical expertise with non-surgical offerings, attracting patients who seek high-trust environments for facial aesthetics and individualized treatment planning. The presence of board-certified surgeons and structured pre/post-procedure care makes plastic surgery clinics a preferred choice for complex or high-value nasal corrections. These clinics typically carry a wide range of filler brands, provide comprehensive consultations, and integrate imaging tools that increase conversion rates and average treatment value.

The Medical Spas segment is projected to register the fastest growth from 2026 to 2033, supported by rising consumer demand for accessible, outpatient aesthetic services and competitive pricing. Medical spas are expanding their clinical capabilities by hiring trained injectors and partnering with recognized filler brands, enabling safe delivery of rhinoplasty filler procedures outside traditional hospital settings. The convenience, marketing visibility on social media, and appeal to younger first-time aesthetic patients help medical spas scale volumes quickly. Increased regulation, credentialing, and clinical oversight in many markets are also professionalizing this channel and encouraging patient adoption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct sales, distributors, online sales, and retail pharmacies. The Direct Sales channel dominated the market in 2025, primarily because direct manufacturer–clinic relationships enable product training, authorized supply, and focused clinical support that are critical for safe nasal applications. Major filler manufacturers rely on direct engagement to provide injector education, launch new variants, and maintain quality assurance factors that build physician trust and drive repeat purchases. Direct channels also support controlled rollouts and post-market surveillance activities needed for medical aesthetic products.

The Online Sales segment is expected to witness the fastest growth from 2026 to 2033, as digital procurement platforms and verified e-distributors make it easier for smaller clinics and international practitioners to source authentic products. The convenience of online ordering, comparative pricing, and digital access to product information accelerates adoption among emerging clinics and mobile aesthetic providers. In addition, e-commerce platforms that incorporate compliance checks, batch verification, and supplier accreditation reduce counterfeit risk and increase confidence in online procurement supporting rapid expansion of this channel.

Rhinoplasty Injectable Fillers Market Regional Analysis

- North America dominated the rhinoplasty injectable fillers market with the largest revenue share of 38.9% in 2025, supported by a high concentration of aesthetic clinics, strong spending power, and the early adoption of innovative filler products

- Consumers in the region increasingly favor minimally invasive treatments that offer quick results with minimal downtime, making injectable fillers an attractive alternative to surgical rhinoplasty

- The region’s dominance is also reinforced by advanced practitioner training programs, the presence of leading filler manufacturers, and extensive marketing of FDA-approved injectable products. In addition, growing cultural acceptance of aesthetic treatments among both men and women, combined with the influence of social media and celebrity trends, continues to fuel demand.

U.S. Rhinoplasty Injectable Fillers Market Insight

The U.S. rhinoplasty injectable fillers market captured the largest revenue share of 82% in 2025 within North America, driven by a rising preference for non-surgical nasal reshaping and the availability of FDA-approved filler products. Consumers are increasingly opting for minimally invasive treatments that deliver instant, natural-looking results without the downtime associated with surgery. The growing influence of social media aesthetics, combined with the presence of leading players such as Allergan Aesthetics and Revance Therapeutics, further propels market expansion. Moreover, advanced practitioner training, high disposable incomes, and the increasing popularity of combination facial treatments are reinforcing market growth across aesthetic clinics.

Europe Rhinoplasty Injectable Fillers Market Insight

The Europe rhinoplasty injectable fillers market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing demand for non-surgical aesthetic procedures and increased focus on facial symmetry and natural enhancements. Rising consumer awareness about filler safety and the widespread acceptance of hyaluronic acid-based fillers are supporting regional growth. In addition, the presence of strong regulatory frameworks ensures high product quality and patient safety, boosting trust among consumers. Europe is witnessing growing adoption across dermatology and cosmetic clinics, particularly in countries such as the U.K., France, and Germany, where aesthetic innovation and cultural acceptance of cosmetic enhancements are strong.

U.K. Rhinoplasty Injectable Fillers Market Insight

The U.K. rhinoplasty injectable fillers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising demand for minimally invasive facial procedures and growing awareness of aesthetic advancements. Increasing acceptance of injectable fillers among both men and women, along with strong influence from social media and celebrity trends, is driving adoption. The expansion of medical spas and aesthetic clinics, supported by skilled practitioners and innovative filler brands, is further supporting growth. In addition, the country’s robust private healthcare infrastructure and regulatory clarity for injectable treatments continue to attract consumers seeking safe and effective nasal reshaping options.

Germany Rhinoplasty Injectable Fillers Market Insight

The Germany rhinoplasty injectable fillers market is expected to expand at a considerable CAGR during the forecast period, fueled by high demand for technologically advanced filler formulations and precision-driven aesthetic treatments. German consumers place a strong emphasis on natural-looking, balanced facial outcomes, driving interest in non-surgical nasal contouring. The country’s established network of certified dermatologists and plastic surgeons further supports market penetration. Moreover, increased R&D efforts by European filler manufacturers, alongside strict safety standards and patient education programs, are enhancing consumer confidence. The integration of digital imaging and 3D visualization tools is also advancing procedural accuracy and satisfaction rates.

Asia-Pacific Rhinoplasty Injectable Fillers Market Insight

The Asia-Pacific rhinoplasty injectable fillers market is poised to grow at the fastest CAGR of 25.4% during the forecast period of 2026 to 2033, driven by growing beauty consciousness, rising disposable incomes, and cultural preference for facial refinement in countries such as China, Japan, and South Korea. Increasing awareness of non-surgical rhinoplasty as a safer, cost-effective option is significantly influencing consumer choices. The expanding aesthetic clinic network and availability of affordable filler options are contributing to rapid market adoption. Furthermore, the region’s leadership in aesthetic innovation and the popularity of “lunchtime procedures” are expected to fuel continuous market expansion.

Japan Rhinoplasty Injectable Fillers Market Insight

The Japan rhinoplasty injectable fillers market is gaining momentum due to the country’s advanced aesthetic standards, emphasis on precision, and growing demand for subtle nasal enhancements. Japanese consumers increasingly prefer non-surgical procedures that offer immediate, reversible results with minimal discomfort. The integration of injectable fillers with advanced imaging and skin analysis tools is elevating procedural accuracy and patient confidence. In addition, Japan’s highly regulated healthcare environment ensures product quality and safety, supporting market growth. The combination of cultural emphasis on natural aesthetics and technological innovation is expected to sustain steady demand across both male and female demographics.

India Rhinoplasty Injectable Fillers Market Insight

The India rhinoplasty injectable fillers market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, growing disposable incomes, and rising beauty awareness among younger demographics. The increasing availability of affordable filler options and skilled aesthetic practitioners is accelerating market adoption. The expanding network of dermatology clinics, coupled with the growing popularity of non-surgical procedures among social media–influenced consumers, is driving the market forward. In addition, India’s developing medical tourism sector and the introduction of international filler brands are boosting market penetration. As aesthetic awareness continues to grow, India is positioned as a key emerging market for rhinoplasty injectable fillers.

Rhinoplasty Injectable Fillers Market Share

The Rhinoplasty Injectable Fillers industry is primarily led by well-established companies, including:

- AbbVie (U.S.)

- GALDERMA (Switzerland)

- Merz Therapeutics (Germany)

- REVANCE. (U.S.)

- TEOXANE (Switzerland)

- Sinclair Pharma (U.K.)

- Croma-Pharma GmbH (Austria)

- Prollenium Medical Technologies Inc. (Canada)

- Suneva Medical, Inc. (U.S.)

- Hugel, Inc. (South Korea)

- Medytox Inc. (South Korea)

- Beijing Huaxi Haiyu Technology Co., Ltd. (China)

- LG Chem Ltd. (South Korea)

- Anika Therapeutics, Inc. (U.S.)

- Filorga Laboratories (France)

- Luminera (Israel)

- Regenyal Laboratories (Italy)

- Laboratoires VIVACY (France)

What are the Recent Developments in Global Rhinoplasty Injectable Fillers Market?

- In April 2025, a major consumer publication reported that do-it-yourself (DIY) use of injectable fillers was rising, with serious complications resulting from unregulated self-injection underscoring regulatory and safety concerns in the market

- In February 2025, EVOLYSSE™ FORM and SMOOTH injectable hyaluronic acid gels received approval from the U.S. Food & Drug Administration (FDA) marking what the manufacturer described as the “first major technological breakthrough in HA dermal fillers in a decade”. The products use a novel “COLD-X™” technology for improved HA structure and will launch in the U.S. in Q2 2025

- In July 2024, an article highlighted the increasing popularity of “liquid rhinoplasty” and noted that the effects typically last from six months to two years depending on filler type and volume illustrating growing patient and clinician acceptance of these procedures

- In March 2024, the FDA approved an expanded indication for Juvéderm Voluma XC hyaluronic acid filler for injection in the temple region to improve moderate to severe temple hollowing in adults over 21. This signals broader anatomical use of fillers beyond typical facial zones

- In September 2023, a clinical study published in the Journal of Cosmetic Dermatology demonstrated the safety and efficacy of nonsurgical rhinoplasty using the hyaluronic acid filler VYC-25L in routine practice, with predictable outcomes and high patient satisfaction validating the technique’s maturation in clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.