Global Rtd Alcoholic Beverages Market

Market Size in USD Billion

CAGR :

%

USD

32.84 Billion

USD

58.57 Billion

2024

2032

USD

32.84 Billion

USD

58.57 Billion

2024

2032

| 2025 –2032 | |

| USD 32.84 Billion | |

| USD 58.57 Billion | |

|

|

|

|

Ready to Drink (RTD) Alcoholic Beverages Market Size

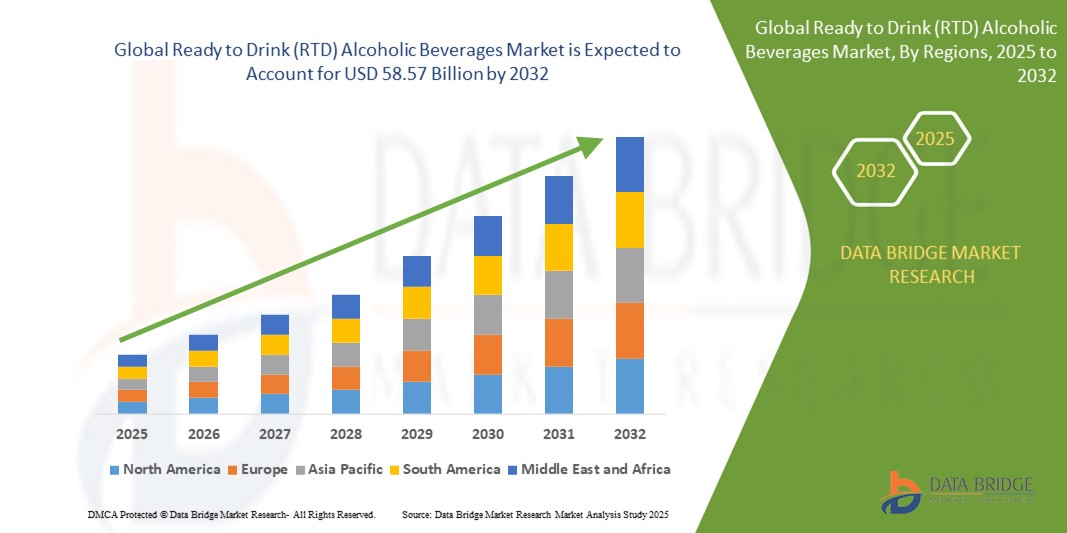

- The global ready to drink (RTD) alcoholic beverages market was valued at USD 32.84 billion in 2024 and is expected to reach USD 58.57 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.50 % primarily driven by the increasing consumer demand for convenient and low-alcohol beverage options

- This growth is driven by factors such as the rising popularity of flavoured alcoholic drinks, shifting consumer preferences toward healthier lifestyle choices, and the expansion of distribution channels both online and offline

Ready to Drink (RTD) Alcoholic Beverages Market Analysis

- Ready-to-drink (RTD) alcoholic beverages are pre-mixed drinks that combine alcohol with other ingredients, such as fruit juices, soda, or flavourings, and are ready for immediate consumption without any preparation

- The market is seeing continuous innovation in flavours and ingredients, with brands launching drinks such as vodka-based lemonades and gin with botanicals, as seen with Absolut’s pre-mixed cocktails and Tanqueray’s gin and tonic cans becoming popular in retail stores and at festivals

- Health-driven preferences are shaping new product launches, such as low-calorie hard seltzers and zero-sugar cocktails

- For instances, White Claw and Truly have expanded their lines with lighter versions to meet the demand from fitness-aware consumers

- Packaging plays a major role in consumer appeal, where recyclable cans and resealable bottles are trending, such as the use of slim cans by High Noon and Bacardi to enhance portability and eco-conscious branding

- Premiumization continues across the market, where consumers are drawn to drinks with artisanal spirits and craft-inspired labels, similar to how Cutwater Spirits markets its bar-quality canned cocktails using real tequila and whiskey

- Online sales channels are thriving, especially through platforms such as Drizzly and Minibar Delivery, where consumers can browse a wide range of Ready to Drink options, often discovering limited-edition releases or new flavours not found in-store

Report Scope and Ready to Drink (RTD) Alcoholic Beverages Market Segmentation

|

Attributes |

Ready to Drink (RTD) Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink (RTD) Alcoholic Beverages Market Trends

“Rising Demand for Health-Conscious Options”

- Consumers are increasingly choosing light and clean-label drinks, which has led to the popularity of products such as hard seltzers made with natural fruit flavours and no added sugar, such as White Claw and Truly, which have introduced versions with fewer than 100 calories per can to cater to health-conscious drinkers

- Many Ready to Drink brands are reformulating classic cocktails into healthier alternatives

- For instance, Skinnygirl's low-calorie margaritas offer a flavourful yet lighter option for those looking to enjoy a cocktail without the extra calories, while brands such as Cutwater Spirits now offer lower-calorie versions of their canned cocktails, providing a healthier choice

- Beverage makers are introducing drinks with functional ingredients such as vitamin C, antioxidants, and adaptogens to meet wellness trends, such as Pulp Culture’s hard-pressed juices, which include live probiotics for gut health, targeting fitness-focused consumers who are interested in beverages with added benefits

- Organic and gluten-free options are becoming more widely available, with brands such as JuneShine offering kombucha-based alcoholic beverages that combine the health benefits of probiotics with the enjoyment of an alcoholic drink, appealing to health-conscious consumers who want a cleaner, natural option

- Labels and marketing are now highlighting health-related features more prominently, with phrases such as “low sugar,” “zero carbs,” and “natural flavours” becoming common on products such as Spindrift sparkling water, making it easier for consumers to find healthier options both in-store and through online platforms such as Drizzly

Ready to Drink (RTD) Alcoholic Beverages Market Dynamics

Driver

“Increasing consumer demand for convenience”

- Busy lifestyles are pushing consumers towards RTD beverages, with products such as White Claw and Truly’s hard seltzers becoming popular at beach outings and outdoor events

- For instances, White Claw’s growth surged during summer gatherings, making it a go-to drink at barbecues and pool parties across the U.S.

- Millennials and young professionals are increasingly opting for on-the-go drinks such as Cutwater Spirits’ canned margaritas, often spotted at events such as Coachella and tailgates, where the convenience of a pre-mixed drink is essential

- For instances, At Coachella, Cutwater’s pre-mixed canned cocktails became a fan favorite due to their portability and refreshing taste

- The trend toward smaller home-based social events has led to a rise in demand for products such as High Noon’s canned vodka cocktails, which have gained popularity on online platforms such as Drizly. These drinks are now a popular choice for at-home gatherings, especially during the pandemic when socializing shifted to smaller, private settings

- RTD beverages are designed for convenience, with products such as Jack Daniel’s ready-to-drink whiskey cocktails being especially favored at music festivals such as Lollapalooza. At these events, Jack Daniel’s RTDs offer festival-goers a hassle-free way to enjoy whiskey cocktails without needing a bartender or mixers

- Eco-conscious consumers are driving the demand for sustainable options, with Bon & Viv’s recyclable cans gaining popularity among environmentally-minded shoppers at grocery stores and on platforms such as Amazon. Their emphasis on eco-friendly packaging appeals to consumers who seek to reduce their environmental footprint while enjoying their favorite beverages

Opportunity

“Functional RTD Beverages”

- Modern consumers, especially Millennials and Gen Z, are seeking RTD beverages that support wellness goals such as stress relief, energy boosts, or mood enhancement rather than just traditional intoxication

- For instance, Kin Euphorics, co-founded by Bella Hadid, blends adaptogens and nootropics to promote calm and focus

- Ingredient innovation aligned with health trends: Brands are incorporating adaptogens (such as, ashwagandha), nootropics (such as, L-theanine), and botanicals (such as, chamomile, ginger) into their formulas to appeal to a more mindful drinking culture

- For instance, Recess Mood is a sparkling RTD brand that blends magnesium and botanicals for stress relief, blurring the line between wellness and alcohol

- Shifting positioning from recreational to lifestyle-enhancing: Functional RTDs are marketed for specific moods or use cases such as “post-work wind down” or “social energy,” offering an experience tailored to modern lifestyles

- For instance, Hiyo sells its beverages as "feel-good social tonics" meant to elevate mood without alcohol

- Social drinking without compromise: These beverages cater to occasions where people want to enjoy the ritual of drinking without negative side effects such as hangovers, the popularity of low- and no-alcohol RTDs such as De Soi, created by Katy Perry, reflects this shift

- A clear path for brand differentiation and loyalty: In an increasingly saturated RTD space, functionality offers unique value, allowing brands to stand out while building deeper emotional connections with consumers who prioritize both health and indulgence

Restraint/Challenge

“Limited Regulatory Landscape”

- The regulatory landscape poses a significant challenge for the Ready to Drink alcoholic beverages market, with different regions imposing varying rules on production, labeling, and distribution

- For instance, in countries such as Australia, high taxes on alcohol can increase the cost of products such as hard seltzers, impacting their affordability and market penetration

- Some countries have restrictions on alcohol content in ready-to-drink beverages, which can limit product formulations and affect overall marketability

- For instance, in the European Union, there are strict regulations on alcohol percentages in canned cocktails, which forces brands to modify their recipes to meet specific local standards

- Stringent marketing and labelling guidelines require clear disclosures on ingredients, alcohol content, and health warnings. In the U.S., the Alcohol and Tobacco Tax and Trade Bureau (TTB) enforces these regulations, increasing the operational complexity and cost for brands such as White Claw, which must ensure full transparency in their product labelling

- The demand from health-conscious consumers forces brands to ensure higher standards for ingredients and quality control

- For instance, brands such as Bon & Viv focus on offering gluten-free and low-sugar options, but this comes with increased costs and more stringent production processes to meet market expectations

- Cultural preferences for traditional alcoholic beverages, such as beer and wine, also limit the growth of the Ready to Drink market in some regions. In countries such as Germany and Italy, where beer and wine dominate the alcohol market, the acceptance of RTD drinks remains slow, hindering the growth potential of brands trying to enter these established markets

Ready to Drink (RTD) Alcoholic Beverages Market Scope

The market is segmented on the basis of product, packaging type, type, end user, nature, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Packaging Type |

|

|

By Type |

|

|

By End User |

|

|

By Nature |

|

|

By Distribution Channel |

|

Ready to Drink (RTD) Alcoholic Beverages Market Regional Analysis

“Europe is the Dominant Region in the Ready to Drink (RTD) Alcoholic Beverages Market”

- Europe dominates the Ready-to-Drink alcoholic beverages market, supported by its deep-rooted social drinking culture and consistently high alcohol consumption rates

- A strong tradition of socializing, especially in countries such as the UK, Germany, and Spain, drives the popularity of convenient, ready-to-serve alcoholic drinks among European consumers

- The preference for minimal preparation and ease of use has led to a surge in RTD demand, with consumers incorporating these beverages into both casual home settings and public gatherings

- European brands continue to innovate with unique flavour’s, premium ingredients, and stylish packaging to meet diverse consumer preferences and enhance the overall drinking experience

- The blend of cultural habits and evolving convenience-driven trends keeps Europe at the forefront of the global RTD alcoholic beverages market, encouraging steady demand and product

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia Pacific is fastest-growing region in the Ready-to-Drink (RTD) alcoholic beverages market due to its large and diverse population

- The growing demand for convenience, especially among millennials and young professionals, is one of the key drivers for the region's RTD market expansion

- Consumers in countries such as China and Japan are increasingly opting for ready-to-drink cocktails, hard seltzers, and flavored alcoholic beverages as a quick and convenient alternative to traditional drinks

- The trend of smaller, home-based social gatherings, accelerated by recent global events, has further boosted the demand for RTD products as they offer easy-to-consume, pre-mixed options

- Manufacturers are responding by diversifying their product offerings, tailoring them to local tastes, and creating innovative flavours to match the evolving preferences in Asia Pacific, driving rapid market growth

Ready to Drink (RTD) Alcoholic Beverages Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Davide Campari-Milano N.V. (Netherlands)

- Diageo (U.K.)

- Halewood Sales (U.K.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Accolade Wines (Australia)

- Bacardi & Company Limited (Bermuda)

- Mike's Hard Lemonade Co. (U.S.)

- Castel Group (France)

- SUNTORY HOLDINGS LIMITED. (Japan)

- Anheuser-Busch Companies LLC (U.S.)

- Brown Forman (U.S.)

- United Brands LLC (U.S.)

- Pernod Ricard (France)

- Miller Brewing Co. (U.S.)

Latest Developments in Global Ready to Drink (RTD) Alcoholic Beverages Market

- In September 2024, The Coca-Cola Company and Bacardi Limited announced a strategic partnership to launch a ready-to-drink (RTD) cocktail combining BACARDÍ rum and Coca-Cola. This collaboration marks Coca-Cola's continued expansion into the alcoholic beverage sector, aiming to offer consumers a convenient, high-quality pre-mixed cocktail. The initial launch is planned for select European markets and Mexico in 2025, with a benchmark alcohol by volume (ABV) of 5%, varying by market. This move is expected to enhance Coca-Cola's portfolio, tapping into the growing demand for RTD beverages and reinforcing Bacardi's presence in the global spirit’s market

- In September 2024, Diageo and PepsiCo announced a strategic partnership to launch a ready-to-drink (RTD) cocktail combining Captain Morgan Original Spiced Gold rum with Pepsi Max. This collaboration marks PepsiCo's entry into the alcoholic beverage market in Great Britain. The 5% ABV product is available in 330ml and 250ml cans at major U.K. retailers, including Tesco, Sainsbury's, Morrisons, and Asda, with a recommended retail price of GBP 2.59 (USD 3.46) for the 330ml format. This launch is expected to expand the RTD category by offering a premium, convenient option that aligns with evolving consumer preferences for quality and convenience in alcoholic beverages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 PRIVATE LABEL VS BRAND ANALYSIS

5.3 PROMOTIONAL ACTIVITIES

5.4 NEW PRODUCT LAUNCH STRATEGY

5.4.1 NUMBER OF NEW PRODUCT LAUNCH

5.4.1.1. LINE EXTENSTION

5.4.1.2. NEW PACKAGING

5.4.1.3. RE-LAUNCHED

5.4.1.4. NEW FORMULATION

5.4.2 DIFFERNTIAL PRODUCT OFFERING

5.4.3 MEETING CONSUMER REQUIREMENT

5.4.4 PACKAGE DESIGNING

5.4.5 PRICING ANALYSIS

5.5 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.6 MARKET GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.7 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 TAXATION AND DUTY LEVIES

12 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY TYPE, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 BEER

12.2.1 BEER, BY TYPE

12.2.1.1. ALE BEER

12.2.1.1.1. ALE, BY TYPE

12.2.1.1.1.1 BLOND ALE

12.2.1.1.1.2 BROWN ALE

12.2.1.1.1.3 PALE ALE

12.2.1.1.1.4 SOUR ALE

12.2.1.2. LAGER BEER

12.2.1.3. STOUT BEER

12.2.1.4. PORTER BEER

12.2.1.5. WHEAT BEER

12.2.1.6. PILSNER

12.2.1.7. OTHERS

12.3 WINE

12.3.1 WINE, BY TYPE

12.3.1.1. RED WINE

12.3.1.1.1. RED WINE, BY TYPE

12.3.1.1.1.1 FULL-BODIED RED WINES

12.3.1.1.1.2 MEDIUM-BODIED RED WINES

12.3.1.1.1.3 LIGHT-BODIED RED WINES

12.3.1.2. WHITE WINE

12.3.1.3. ROSE WINE

12.3.2 WINE, BY CATEGORY

12.3.2.1. STILL WINE

12.3.2.2. SPARKLING WINE

12.4 WHISKEY

12.4.1.1. WHISKEY, BY TYPE

12.4.1.1.1. RYE MALT WHISKEY

12.4.1.1.2. CORN WHISKEY

12.4.1.1.3. BOURBON WHISKEY

12.4.1.1.4. TENNESSEE WHISKEY

12.4.1.1.5. IRISH WHISKEY

12.4.1.1.6. RYE WHISKEY

12.4.1.1.7. CANADIAN WHISKY

12.4.1.1.8. SCOTCH WHISKY

12.4.1.1.9. JAPANESE WHISKY

12.4.1.1.10. WHITE WHISKEY

12.4.1.1.11. WHEAT WHISKEY

12.4.1.1.12. MALT WHISKEY

12.4.1.1.13. BLENDED WHISKEY

12.4.1.1.14. OTHERS

12.4.1.2. WHISKEY, BY DISTILLATION PROCESS

12.4.1.2.1. SINGLE DISTILLED

12.4.1.2.2. DOUBLE DISTILLED

12.4.1.2.3. TRIPLE DISTILLED

12.5 RUM

12.5.1 RUM, BY TYPE

12.5.1.1. WHITE RUM

12.5.1.2. LIGHT RUM

12.5.1.3. GOLD RUM

12.5.1.4. DARK RUM

12.5.1.5. OVER-PROOF RUM

12.5.1.6. SPICED RUM

12.5.1.7. CACHACA

12.5.1.8. FLAVORED RUM

12.5.1.9. OTHERS (IF ANY)

12.6 VODKA

12.7 TEQUILA

12.7.1 TEQUILA, BY TYPE

12.7.1.1. BLANCO

12.7.1.2. REPOSADO

12.7.1.3. ANEJO

12.7.1.4. EXTRA-ANEJO

12.7.1.5. OTHERS (IF ANY)

12.8 GIN

12.8.1 GIN, BY STYLE

12.8.1.1. LONDON DRY GIN

12.8.1.2. PLYMOUTH GIN

12.8.1.3. OLD TOM GIN

12.8.1.4. GENEVER

12.8.1.5. NEW AMERICAN

12.9 BRANDY

12.9.1 BRANDY, BY TYPE

12.9.1.1. COGNAC

12.9.1.2. ARMAGNAC

12.9.1.3. SPANISH BRANDY

12.9.1.4. AMERICAN BRANDY

12.9.1.5. GRAPPA

12.9.1.6. EAU-DE-VIE

12.9.1.7. FLAVORED BRANDY

12.9.1.8. OTHERS (IF ANY)

12.1 RTD COCKTAILS

12.10.1 RTD COCKTAILS, BY PRODUCT

12.10.1.1. MALT BASED RTD COCKTAILS

12.10.1.2. SPIRIT BASED RTD COCKTAILS

12.10.1.3. WINE BASED RTD COCKTAILS

12.10.2 RTD COCKTAILS, BY ALCOHOL BY VOLUME % (ABV %)

12.10.2.1. 3% ABV

12.10.2.2. 5% ABV

12.10.2.3. 6% BV

12.10.2.4. 7% ABV

12.10.2.5. 8% ABV

12.10.2.6. OTHERS

12.11 OTHERS (IF ANY)

13 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY FLAVOR, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 REGULAR / PLAIN

13.3 FLAVORED

13.3.1 FLAVORED, BY TYPE

13.3.1.1. HONEY

13.3.1.2. MAPLE

13.3.1.3. CARAMEL

13.3.1.4. PINA COLADA

13.3.1.5. CHOICOLATE

13.3.1.6. VANILLA

13.3.1.7. FRUIT

13.3.1.7.1. GGREEN APPLE

13.3.1.7.2. FFIG

13.3.1.7.3. LYCHEE

13.3.1.7.4. MINT

13.3.1.7.5. PEACH

13.3.1.7.6. PPEAR

13.3.1.7.7. LLEMON

13.3.1.7.8. PECAN

13.3.1.7.9. MANGO

13.3.1.7.10. BLACK CHERRY

13.3.1.7.11. RASPBERRY

13.3.1.7.12. STRAWBERRY

13.3.1.7.13. BLUEBERRY

13.3.1.7.14. CRANBERRY

13.3.1.7.15. ORANGE

13.3.1.7.16. MELON

13.3.1.7.17. OTHERS

13.3.1.8. SPICES

13.3.1.8.1. CINNAMON

13.3.1.8.2. GINGER

13.3.1.8.3. PEPPER

13.3.1.8.4. CLOVE

13.3.1.8.5. NUTMEG

13.3.1.8.6. OTHERS

13.3.1.9. NUTS

13.3.1.9.1. ALMOND

13.3.1.9.2. WALNUT

13.3.1.9.3. HAZELNUT

13.3.1.9.4. MACADAMIA NUTS

13.3.1.9.5. OTHERS

13.3.1.10. OTHERS

14 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY ALCOHOLIC CONTENT, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 LOW

14.3 MEDIUM

14.4 HIGH

15 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY CATEGORY, 2022-2031, (USD MILLION)

15.1 OVERVIEW

15.2 ORGANIC

15.2.1 ORGANIC, BY RTD ALCOHOLIC BEVERAGE TYPE

15.2.1.1. BEER

15.2.1.2. WINE

15.2.1.3. WHISKEY

15.2.1.4. RUM

15.2.1.5. VODKA

15.2.1.6. TEQUILA

15.2.1.7. GIN

15.2.1.8. BRANDY

15.2.1.9. RTD COCKTAILS

15.2.1.10. OTHERS )IF ANY)

15.3 CONVENTIONAL

15.3.1 CONVENTIONAL, BY RTD ALCOHOLIC BEVERAGE TYPE

15.3.1.1. BEER

15.3.1.2. WINE

15.3.1.3. WHISKEY

15.3.1.4. RUM

15.3.1.5. VODKA

15.3.1.6. TEQUILA

15.3.1.7. GIN

15.3.1.8. BRANDY

15.3.1.9. RTD COCKTAILS

15.3.1.10. OTHERS )IF ANY)

16 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY PRICE CATEGORY, 2022-2031, (USD MILLION)

16.1 OVERVIEW

16.2 ECONOMY

16.2.1 ECONOMY, BY RTD ALCOHOLIC BEVERAGE TYPE

16.2.1.1. BEER

16.2.1.2. WINE

16.2.1.3. WHISKEY

16.2.1.4. RUM

16.2.1.5. VODKA

16.2.1.6. TEQUILA

16.2.1.7. GIN

16.2.1.8. BRANDY

16.2.1.9. RTD COCKTAILS

16.2.1.10. OTHERS )IF ANY)

16.3 STANDARD

16.3.1 STANDARD, BY RTD ALCOHOLIC BEVERAGE TYPE

16.3.1.1. BEER

16.3.1.2. WINE

16.3.1.3. WHISKEY

16.3.1.4. RUM

16.3.1.5. VODKA

16.3.1.6. TEQUILA

16.3.1.7. GIN

16.3.1.8. BRANDY

16.3.1.9. RTD COCKTAILS

16.3.1.10. OTHERS )IF ANY)

16.4 PREMIUM

16.4.1 PREMIUM, BY RTD ALCOHOLIC BEVERAGE TYPE

16.4.1.1. BEER

16.4.1.2. WINE

16.4.1.3. WHISKEY

16.4.1.4. RUM

16.4.1.5. VODKA

16.4.1.6. TEQUILA

16.4.1.7. GIN

16.4.1.8. BRANDY

16.4.1.9. RTD COCKTAILS

16.4.1.10. OTHERS )IF ANY)

17 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY BRAND CATEGORY, 2022-2031, (USD MILLION)

17.1 OVERVIEW

17.2 BRANDED

17.3 PRIVATE LABEL

18 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY AGE GROUP, 2022-2031, (USD MILLION)

18.1 OVERVIEW

18.2 18-24 YEARS

18.3 25-44 YEARS

18.4 45-64 YEARS

18.5 65+ YEARS

19 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY PACKAGING TYPE, 2022-2031, (USD MILLION)

19.1 OVERVIEW

19.2 BOTTLES

19.2.1 PLASTIC

19.2.2 GLASS

19.3 CANS

19.4 OTHERS

20 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY PACKAGING SIZE, 2022-2031, (USD MILLION)

20.1 OVERVIEW

20.2 LESS THAN 250 ML

20.3 251-500 ML

20.4 501-750 ML

20.5 751-1000 ML

20.6 MORE THAN 1000 ML

21 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY END USE, 2022-2031, (USD MILLION)

21.1 OVERVIEW

21.2 HOUSEHOLD / RETAIL

21.2.1 HOUSEHOLD / RETAIL, BY RTD ALCOHOLIC BEVERAGE TYPE

21.2.1.1. BEER

21.2.1.2. WINE

21.2.1.3. WHISKEY

21.2.1.4. RUM

21.2.1.5. VODKA

21.2.1.6. TEQUILA

21.2.1.7. GIN

21.2.1.8. BRANDY

21.2.1.9. RTD COCKTAILS

21.2.1.10. OTHERS )IF ANY)

21.3 COMMERCIAL

21.3.1 COMMERCIAL, BY CATEGORY

21.3.1.1. HOTELS

21.3.1.2. RESTAURANTS

21.3.1.3. BARS / CLUBS

21.3.1.4. CAFÉ

21.3.1.5. PARTIES / BANQUETS

21.3.1.6. OTHERS

21.3.2 COMMERCIAL, BY RTD ALCOHOLIC BEVERAGE TYPE

21.3.2.1. BEER

21.3.2.2. WINE

21.3.2.3. WHISKEY

21.3.2.4. RUM

21.3.2.5. VODKA

21.3.2.6. TEQUILA

21.3.2.7. GIN

21.3.2.8. BRANDY

21.3.2.9. RTD COCKTAILS

21.3.2.10. OTHERS )IF ANY)

22 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

22.1 OVERVIEW

22.2 STORE-BASED

22.2.1 SUPERMARKETS & HYPERMARKETS

22.2.2 GROCERY STORES

22.2.3 CONVENIENCE STORES

22.2.4 SPECIALTY STORES

22.2.5 BARS / RESTAURANTS / CAFES / CLUBS

22.2.6 LIQUIR STORES

22.2.7 OTHERS

22.3 NON-STORE-BASED

22.3.1 ONLINE

22.3.1.1. E-COMMERCE WEBSITES

22.3.1.2. COMPANY OWNED WEBSITES

22.3.2 VENDING

23 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

23.1 NORTH AMERICA

23.1.1 U.S.

23.1.2 CANADA

23.1.3 MEXICO

23.2 EUROPE

23.2.1 GERMANY

23.2.2 U.K.

23.2.3 ITALY

23.2.4 FRANCE

23.2.5 SPAIN

23.2.6 SWITZERLAND

23.2.7 NETHERLANDS

23.2.8 BELGIUM

23.2.9 RUSSIA

23.2.10 TURKEY

23.2.11 REST OF EUROPE

23.3 ASIA-PACIFIC

23.3.1 JAPAN

23.3.2 CHINA

23.3.3 SOUTH KOREA

23.3.4 INDIA

23.3.5 AUSTRALIA

23.3.6 SINGAPORE

23.3.7 THAILAND

23.3.8 INDONESIA

23.3.9 MALAYSIA

23.3.10 PHILIPPINES

23.3.11 REST OF ASIA-PACIFIC

23.4 SOUTH AMERICA

23.4.1 BRAZIL

23.4.2 ARGENTINA

23.4.3 REST OF SOUTH AMERICA

23.5 MIDDLE EAST AND AFRICA

23.5.1 SOUTH AFRICA

23.5.2 UAE

23.5.3 SAUDI ARABIA

23.5.4 KUWAIT

23.5.5 REST OF MIDDLE EAST AND AFRICA

24 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, COMPANY LANDSCAPE

24.1 COMPANY SHARE ANALYSIS: GLOBAL

24.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

24.3 COMPANY SHARE ANALYSIS: EUROPE

24.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

24.5 MERGERS & ACQUISITIONS

24.6 NEW PRODUCT DEVELOPMENT & APPROVALS

24.7 EXPANSIONS & PARTNERSHIP

24.8 REGULATORY CHANGES

25 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, SWOT & DBMR ANALYSIS

26 GLOBAL READY TO DRINK (RTD) ALCOHOLIC BEVERAGES MARKET, COMPANY PROFILE

26.1 ASAHI GROUP HOLDINGS LTD

26.1.1 COMPANY OVERVIEW

26.1.2 REVENUE ANALYSIS

26.1.3 PRODUCT PORTFOLIO

26.1.4 GEOGRAPHIC PRESENCE

26.1.5 RECENT DEVELOPMENTS

26.2 ANHEUSER-BUSCH INBEV SA/NV

26.2.1 COMPANY OVERVIEW

26.2.2 REVENUE ANALYSIS

26.2.3 PRODUCT PORTFOLIO

26.2.4 GEOGRAPHIC PRESENCE

26.2.5 RECENT DEVELOPMENTS

26.3 BACARDI LTD

26.3.1 COMPANY OVERVIEW

26.3.2 REVENUE ANALYSIS

26.3.3 PRODUCT PORTFOLIO

26.3.4 GEOGRAPHIC PRESENCE

26.3.5 RECENT DEVELOPMENTS

26.4 BROWN-FORMAN CORPORATION

26.4.1 COMPANY OVERVIEW

26.4.2 REVENUE ANALYSIS

26.4.3 PRODUCT PORTFOLIO

26.4.4 GEOGRAPHIC PRESENCE

26.4.5 RECENT DEVELOPMENTS

26.5 CARLSBERG A/S

26.5.1 COMPANY OVERVIEW

26.5.2 REVENUE ANALYSIS

26.5.3 PRODUCT PORTFOLIO

26.5.4 GEOGRAPHIC PRESENCE

26.5.5 RECENT DEVELOPMENTS

26.6 DIAGEO PLC

26.6.1 COMPANY OVERVIEW

26.6.2 REVENUE ANALYSIS

26.6.3 PRODUCT PORTFOLIO

26.6.4 GEOGRAPHIC PRESENCE

26.6.5 RECENT DEVELOPMENTS

26.7 SUNTORY HOLDINGS LTD.

26.7.1 COMPANY OVERVIEW

26.7.2 REVENUE ANALYSIS

26.7.3 PRODUCT PORTFOLIO

26.7.4 GEOGRAPHIC PRESENCE

26.7.5 RECENT DEVELOPMENTS

26.8 PERNOD RICARD

26.8.1 COMPANY OVERVIEW

26.8.2 REVENUE ANALYSIS

26.8.3 PRODUCT PORTFOLIO

26.8.4 GEOGRAPHIC PRESENCE

26.8.5 RECENT DEVELOPMENTS

26.9 HEINEKEN HOLDING

26.9.1 COMPANY OVERVIEW

26.9.2 REVENUE ANALYSIS

26.9.3 PRODUCT PORTFOLIO

26.9.4 GEOGRAPHIC PRESENCE

26.9.5 RECENT DEVELOPMENTS

26.1 WILLIAM GRANT & SONS

26.10.1 COMPANY OVERVIEW

26.10.2 REVENUE ANALYSIS

26.10.3 PRODUCT PORTFOLIO

26.10.4 GEOGRAPHIC PRESENCE

26.10.5 RECENT DEVELOPMENTS

26.11 SAPPORO BREWERIES LTD

26.11.1 COMPANY OVERVIEW

26.11.2 REVENUE ANALYSIS

26.11.3 PRODUCT PORTFOLIO

26.11.4 GEOGRAPHIC PRESENCE

26.11.5 RECENT DEVELOPMENTS

26.12 SABECO

26.12.1 COMPANY OVERVIEW

26.12.2 REVENUE ANALYSIS

26.12.3 PRODUCT PORTFOLIO

26.12.4 GEOGRAPHIC PRESENCE

26.12.5 RECENT DEVELOPMENTS

26.13 VIVINO

26.13.1 COMPANY OVERVIEW

26.13.2 REVENUE ANALYSIS

26.13.3 PRODUCT PORTFOLIO

26.13.4 GEOGRAPHIC PRESENCE

26.13.5 RECENT DEVELOPMENTS

26.14 CARLYLE GROUP INC (ACQUIRED ACCOLADE WINES)

26.14.1 COMPANY OVERVIEW

26.14.2 REVENUE ANALYSIS

26.14.3 PRODUCT PORTFOLIO

26.14.4 GEOGRAPHIC PRESENCE

26.14.5 RECENT DEVELOPMENTS

26.15 BUNDABERG BREWED DRINKS

26.15.1 COMPANY OVERVIEW

26.15.2 REVENUE ANALYSIS

26.15.3 PRODUCT PORTFOLIO

26.15.4 GEOGRAPHIC PRESENCE

26.15.5 RECENT DEVELOPMENTS

26.16 HALEWOOD INTERNATIONAL

26.16.1 COMPANY OVERVIEW

26.16.2 REVENUE ANALYSIS

26.16.3 PRODUCT PORTFOLIO

26.16.4 GEOGRAPHIC PRESENCE

26.16.5 RECENT DEVELOPMENTS

26.17 MOLSON COORS

26.17.1 COMPANY OVERVIEW

26.17.2 REVENUE ANALYSIS

26.17.3 PRODUCT PORTFOLIO

26.17.4 GEOGRAPHIC PRESENCE

26.17.5 RECENT DEVELOPMENTS

26.18 MARK ANTHONY BREWING (MIKE'S HARD)

26.18.1 COMPANY OVERVIEW

26.18.2 REVENUE ANALYSIS

26.18.3 PRODUCT PORTFOLIO

26.18.4 GEOGRAPHIC PRESENCE

26.18.5 RECENT DEVELOPMENTS

26.19 LA MARTINIQUAISE

26.19.1 COMPANY OVERVIEW

26.19.2 REVENUE ANALYSIS

26.19.3 PRODUCT PORTFOLIO

26.19.4 GEOGRAPHIC PRESENCE

26.19.5 RECENT DEVELOPMENTS

26.2 MARIE BRIZARD WINE & SPIRITS (MBWS)

26.20.1 COMPANY OVERVIEW

26.20.2 REVENUE ANALYSIS

26.20.3 PRODUCT PORTFOLIO

26.20.4 GEOGRAPHIC PRESENCE

26.20.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Global Rtd Alcoholic Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rtd Alcoholic Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rtd Alcoholic Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.