Global Rtd Beverages Market

Market Size in USD Billion

CAGR :

%

USD

106.00 Billion

USD

168.94 Billion

2024

2032

USD

106.00 Billion

USD

168.94 Billion

2024

2032

| 2025 –2032 | |

| USD 106.00 Billion | |

| USD 168.94 Billion | |

|

|

|

|

Ready to Drink Beverages Market Size

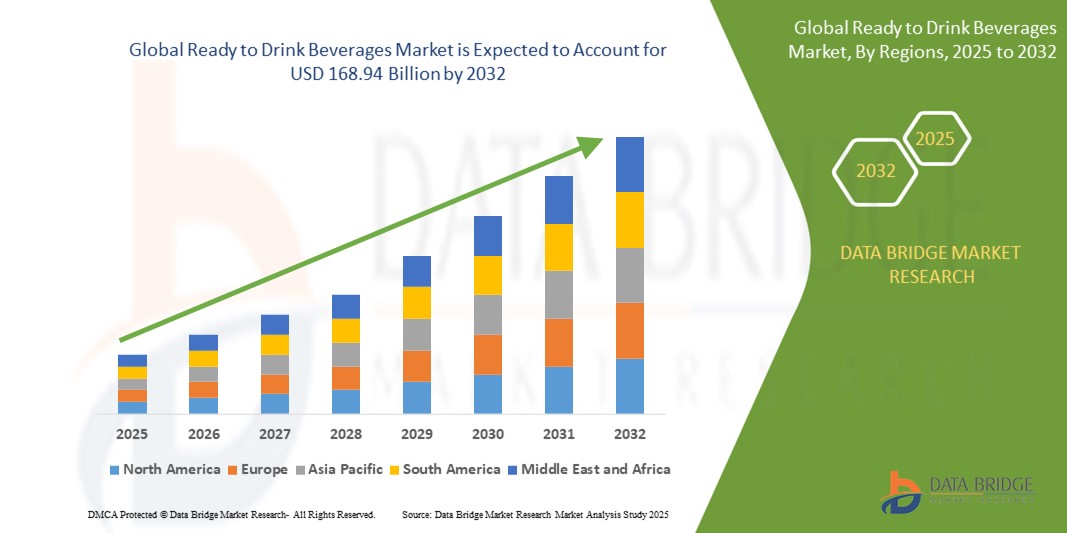

- The global ready to drink beverages market was valued at USD 106 billion in 2024 and is expected to reach USD 168.94 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.00 % primarily driven by the increasing consumer demand for convenient and health-conscious beverage options

- This growth is driven by factors such as the rising popularity of functional drinks and the growing preference for on-the-go consumption

Ready to Drink Beverages Market Analysis

- Ready-to-drink (RTD) beverages are pre-packaged drinks that are fully prepared and ready for immediate consumption without any need for mixing or further preparation

- The ready to drink beverages market is growing steadily as consumers increasingly prioritize convenience and health, with brands such as Nestlé and PepsiCo expanding their ready to drink product lines to include low-sugar and plant-based options

- Functional beverages such as vitamin-infused waters and protein-enriched shakes are gaining popularity, with products such as Vitamin water by Coca-Cola and Ensure by Abbott Nutrition catering to the demand for added wellness benefits

- For instance, Starbucks continues to launch seasonal ready to drink coffee blends such as Pumpkin Spice Latte and Caramel Macchiato in chilled bottle formats to attract both regular and new consumers

- Sustainable and portable packaging is influencing purchase behaviour

- For instance, Liquid Death has seen rapid success by using aluminium cans for mountain water, appealing to environmentally conscious consumers looking for alternatives to plastic bottles

- E-commerce and direct-to-consumer platforms are transforming access to ready to drink beverages, for instance, brands such as Huel offer online subscriptions for their complete nutrition drinks, providing consumers with convenience and consistent delivery of their preferred products

Report Scope and Ready to Drink Beverages Market Segmentation

|

Attributes |

Ready to Drink Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ready to Drink Beverages Market Trends

“Rising Demand for Health-Focused Beverages”

- The rising demand for health-focused beverages is transforming the ready to drink market as consumers increasingly seek options that support their wellness goals without compromising on taste

- For instance, drinks infused with probiotics, antioxidants, or electrolytes such as Kombucha, Vitamin water, and cold-pressed juices are gaining popularity among those prioritizing gut health, immunity, and hydration

- Many brands are reformulating their beverages with clean labels, reducing added sugars, and eliminating artificial ingredients to appeal to a more health-conscious audience

- Plant-based and functional drinks made from ingredients such as green tea, coconut water, or apoptogenic herbs are seeing greater shelf space, reflecting a shift toward beverages that offer both refreshment and nutritional value

- This trend is particularly evident in product launches such as PepsiCo’s Lifewtr or Nestlé’s Essentia Water, which highlight hydration, pH balance, and added minerals, signalling strong consumer interest in drinks that do more than just quench thirst

Ready to Drink Beverages Market Dynamics

Driver

“Growing Consumer Shift Toward Convenience”

- Convenience is becoming a top priority for consumers, especially among busy Millennials and Gen Z, who prefer ready-to-drink options that save time without compromising on flavor or quality

- For instance, Seedlip, a non-alcoholic spirit brand, has gained popularity for its ease of use, offering a premium product that can be enjoyed without preparation

- RTD beverages eliminate the need for mixing, measuring, or preparation, offering a quick, hassle-free solution for social events, outdoor activities, and at-home consumption

- For instance, brands such as Pip's Original offer pre-made mocktails in ready-to-serve cans, making it easier for consumers to enjoy a crafted, alcohol-free drink on the go

- The increasing demand for convenience aligns with broader lifestyle trends such as remote work, smaller gatherings, and outdoor experiences, where consumers value quick and portable beverage options

- For instance, La Colombe cold brew coffee RTDs provide a caffeine fix in a can, catering to busy professionals on the move

- The rise of online grocery shopping and alcohol delivery services has accelerated the appeal of RTD drinks, as consumers can conveniently stock up on their favorite beverages without leaving home

- Consumers are opting for RTD mocktails and cocktails as they offer high-quality flavors and convenience, without the need for specialized tools or ingredients, with brands such as Caleño tapping into the mocktail trend by offering vibrant, tropical, and alcohol-free options that can be enjoyed immediately

Opportunity

“Expansion Through E-commerce and Direct-to-Consumer Channels”

- The growth of digital shopping and direct-to-consumer strategies presents a major opportunity for ready to drink beverage brands

- For instance, Coca-Cola and PepsiCo have leveraged e-commerce to offer customized bundles and exclusive offers directly to consumers, enhancing their reach and engagement

- Online platforms allow brands to interact with customers directly, build loyalty through subscription models, and gather valuable consumer insights

- For instance, Bai offers direct-to-consumer sales through its website, where consumers can subscribe to regular deliveries of their preferred drinks

- The convenience of online shopping is especially appealing to consumers in urban areas, where time constraints drive the preference for home delivery. Amazon Fresh has become a popular option for purchasing beverages, offering fast delivery and a variety of ready to drink products

- Smaller or emerging brands have a level playing field on e-commerce platforms, allowing them to compete with larger players by offering niche products, exclusive flavors, or health-focused formulas

- For instance, Pop & Bottle offers organic, plant-based coffee beverages through its online store, catering to a growing market of health-conscious consumers

- Digital marketing and social media play a key role in educating consumers about product benefits and sustainability practices, helping build trust. Many brands, such as Health-Ade Kombucha, use Instagram and other platforms to highlight their natural ingredients and eco-friendly practices, driving consumer loyalty

Restraint/Challenge

“High Competition and Product Saturation”

- One of the major challenges in the ready to drink beverages market is the intense competition and increasing product saturation

- For instance, the influx of brands such as Coca-Cola, PepsiCo, and emerging start-ups such as Suja Juice makes it difficult for smaller players to stand out in the crowded market

- The large number of similar products available often leads to minimal differentiation, resulting in diluted brand loyalty and price sensitivity. Consumers now have access to an overwhelming variety of options, from kombuchas to health-focused drinks, which complicates decision-making

- Companies are being forced to invest heavily in marketing, innovation, and distribution to maintain visibility in a crowded market

- For instance, Nestlé has launched multiple new flavours and revamped its beverage packaging to differentiate itself from competitors

- In addition, there is intense competition for shelf space in physical retail stores, where established brands such as PepsiCo and Coca-Cola often have an advantage, making it difficult for newer or smaller brands to gain prominent placements

- As the market continues to grow, consolidation may occur, with only a few dominant players emerging while smaller, niche brands struggle to survive. This presents a major challenge for companies trying to carve out their share in a competitive and saturated market

Ready to Drink Beverages Market Scope

The market is segmented on the basis of product type, nature, packaging, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Nature |

|

|

By Packaging |

|

|

By Distribution Channel |

|

Ready to Drink Beverages Market Regional Analysis

“North America is the Dominant Region in the Ready to Drink Beverages Market”

- North America dominates the global ready-to-drink beverages market due to the rising popularity of coffee, especially ready-to-drink coffee products

- The ongoing trend of urbanization in North America has increased the demand for convenient, on-the-go refreshments, contributing to market growth

- Consumers in the region are increasingly opting for quick and convenient beverages to fit their busy lifestyles, which further boosts the demand for ready-to-drink beverages

- Major players in the market are continually innovating and expanding their product offerings to meet the growing demand for convenient beverages

- With this continuous innovation and a large consumer base, North America remains a leader in the ready-to-drink beverage market

“Europe is Projected to Register the Highest Growth Rate”

- Europe is expected to experience significant growth in the ready-to-drink beverages market due to a shift in consumer lifestyles toward convenience, health-consciousness, and on-the-go products

- European consumers are increasingly seeking beverages that align with their fast-paced lifestyles, driving demand for ready-to-drink beverages

- The market is being propelled by innovation as companies focus on developing diverse RTD options that cater to evolving preferences for healthier, functional drinks

- The demand for convenience is a major factor in fuelling the growth of the RTD beverage market in Europe, as consumers seek easy-to-consume, nutritious options

- This changing consumer behaviour is expected to lead to sustained market growth and continued expansion of the RTD beverage sector across Europe

Ready to Drink Beverages Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bacardi (Bermuda)

- Del Monte Foods, Inc. (U.S.)

- Diageo PLC. (U.K.)

- Keurig Dr. Pepper, Inc. (U.S.)

- Molson Coors Brewing Company (U.S.)

- Nestle S.A. (Switzerland)

- Pernod Ricard (France)

- Rauch Fruchtsafte GmbH & Co OG (Austria)

- SUNTORY HOLDINGS LIMITED (Japan)

- The Coca-Cola Company (U.S.)

- Yakult Honsha Co. Ltd. (Japan)

- Brown-Forman (U.S.)

- ASAHI GROUP HOLDINGS, LTD. (Japan)

- Halewood Sales (U.K.)

- SHANGHAI BACCHUS LIQUOR CO., LTD. (China)

- Manchester Drinks. (U.K.)

Latest Developments in Global Ready to Drink Beverages Market

- In January 2024, SYSTM Foods, a functional beverage brand platform, acquired HUMM Kombucha, a leader in the low-sugar, gut-health-focused kombucha category. This acquisition strengthens SYSTM Foods' portfolio, which includes brands such as REBBL and Chameleon Organic Coffee. By integrating HUMM Kombucha, SYSTM aims to enhance its position in the growing refrigerated ready-to-drink market, responding to the rising demand for healthier, functional beverages. This move is expected to drive synergies, expand market reach, and support the growth of both brands in the health-conscious beverage sector

- In September 2023, BODYARMOR Sports Drink announced its first international expansion into Canada, set to begin in January 2024. This marks a significant milestone in the brand’s growth as it enters new markets, offering products such as the original sports drink and BODYARMOR LYTE. The expansion is facilitated through a partnership with The Coca-Cola Company and Coke Canada Bottling, aiming to cater to the growing demand for healthier hydration options. This move is expected to boost BODYARMOR’s presence and drive its growth in the global sports drink market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL READY TO DRINK BEVERAGES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL READY TO DRINK BEVERAGES MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL READY TO DRINK BEVERAGES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 PRIVATE LABEL VS BRAND ANALYSIS

5.3 SHOPPING BEHAVIOUR AND DYNAMICS

5.3.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.3.2 RESEARCH

5.3.3 IMPULSIVE

5.3.4 ADVERTISEMENT

5.4 PROMOTIONAL ACTIVITIES

5.5 NEW PRODUCT LAUNCH STRATEGY

5.5.1 NUMBER OF NEW PRODUCT LAUNCH

5.5.1.1. LINE EXTENSTION

5.5.1.2. NEW PACKAGING

5.5.1.3. RE-LAUNCHED

5.5.1.4. NEW FORMULATION

5.5.2 DIFFERNTIAL PRODUCT OFFERING

5.5.3 MEETING CONSUMER REQUIREMENT

5.5.4 PACKAGE DESIGNING

5.5.5 PRICING ANALYSIS

5.5.6 PRODUCT POSITIONING

5.6 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.7 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.8 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 BRAND OUTLOOK

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW

10 GLOBAL READY TO DRINK BEVERAGES MARKET, BY TYPE, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 ALCOHOLIC BEVERAGES

10.2.1 ALCOHOLIC BEVERGES, BY TYPE

10.2.1.1. BEER

10.2.1.1.1. BEER, BY TYPE

10.2.1.1.1.1 ALE BEER

10.2.1.1.1.1.1. ALE, BY TYPE

A. BLOND ALE

B. BROWN ALE

C. PALE ALE

D. SOUR ALE

10.2.1.1.1.2 LAGER BEER

10.2.1.1.1.3 STOUT BEER

10.2.1.1.1.4 PORTER BEER

10.2.1.1.1.5 WHEAT BEER

10.2.1.1.1.6 PILSNER

10.2.1.1.1.7 OTHERS

10.2.1.2. WINE

10.2.1.2.1. WINE, BY TYPE

10.2.1.2.1.1 RED WINE

10.2.1.2.1.1.1. RED WINE, BY TYPE

A. FULL-BODIED RED WINES

B. MEDIUM-BODIED RED WINES

C. LIGHT-BODIED RED WINES

10.2.1.2.1.2 WHITE WINE

10.2.1.2.1.3 DESSERT WINE

10.2.1.2.1.3.1. LIGHTLY SWEET DESSERT WIN

10.2.1.2.1.3.2. RICHLY SWEET DESSERT WINE

10.2.1.2.1.3.3. WINE

10.2.1.2.1.4 ROSE WINE

10.2.1.2.1.5 OTHERS

10.2.1.2.2. WINE, BY CATEGORY

10.2.1.2.2.1 STILL WINE

10.2.1.2.2.2 SPARKLING WINE

10.2.1.3. WHISKEY

10.2.1.3.1. WHISKEY, BY TYPE

10.2.1.3.1.1 RYE WHISKEY

10.2.1.3.1.2 RYE MALT WHISKEY

10.2.1.3.1.3 MALT WHISKEY

10.2.1.3.1.4 WHEAT WHISLEY

10.2.1.3.1.5 CORN WHISKEY

10.2.1.3.1.6 OTHERS

10.2.1.4. RUM

10.2.1.4.1. RUM, BY TYPE

10.2.1.4.1.1 WHITE RUM

10.2.1.4.1.2 DARK RUM

10.2.1.5. VODKA

10.2.1.6. TEQUILA

10.2.1.6.1. TEQUILA, BY TYPE

10.2.1.6.1.1 TEQUILA BLANCO

10.2.1.6.1.2 TEQUILA JOVEN

10.2.1.6.1.3 TEQUILA REPOSADO

10.2.1.6.1.4 OTHERS

10.2.1.7. GIN

10.2.1.8. BOTTLED COCKTAIL

10.2.1.8.1. BOTTLED COCKTAIL, BY ALCOHOL BY VOLUME % (ABV %)

10.2.1.8.1.1 3% ABV

10.2.1.8.1.2 5% ABV

10.2.1.8.1.3 6% BV

10.2.1.8.1.4 7% ABV

10.2.1.8.1.5 8% ABV

10.2.1.8.1.6 OTHERS

10.2.1.9. MALT-BASED DRINKS

10.2.1.10. OTHERS (IF ANY)

10.3 NON-ALCOHOLIC BEVERAGES

10.3.1 NON-ALCOHOLIC BEVERGES, BY TYPE

10.3.1.1. RTD TEA

10.3.1.1.1. RTD TEA, BY TYPE

10.3.1.1.1.1 GREEN TEA

10.3.1.1.1.2 BLACK TEA

10.3.1.1.1.3 MATCHA

10.3.1.1.1.4 HERBAL TEA

10.3.1.1.1.5 FERMENTED TEA

10.3.1.1.1.6 OTHERS

10.3.1.2. RTD COFFEE

10.3.1.3. JUICE BASED BEVERAGES

10.3.1.4. CARBONATED BEVERAGES

10.3.1.4.1. DIET DRINKS

10.3.1.4.2. FRUIT FLAVORED CARBONATES

10.3.1.4.3. OTHERS

10.3.1.5. SPORTS & ENERGY BEVERAGE

10.3.1.5.1. SPORTS BEVERAGE, BY TYPE

10.3.1.5.1.1 ISOTONIC

10.3.1.5.1.2 HYPERTONIC

10.3.1.5.1.3 HYPOTONIC

10.3.1.5.2. ENERGY BEVERAGE, BY TYPE

10.3.1.5.2.1 ENERGY DRIN BEVERAGE K, BY TYPE

10.3.1.5.2.1.1. STILL

10.3.1.5.2.1.2. CARBONATED

10.3.1.6. CBD INFUSED RTD BEVERGES

10.3.1.7. PLANT-BASED MILK BEVERAGES

10.3.1.7.1. PLANT-BASED MILK, BY TYPE

10.3.1.7.1.1 SOY

10.3.1.7.1.2 ALMOND

10.3.1.7.1.3 CASHEW

10.3.1.7.1.4 COCONUT

10.3.1.7.1.5 PEA

10.3.1.7.1.6 OATS

10.3.1.7.1.7 OTHERS

10.3.1.8. WHEY PROTEIN BEVERAGES

10.3.1.9. PROTEIN SHAKES

10.3.1.10. OTHERS

11 GLOBAL READY TO DRINK BEVERAGES MARKET , BY FLAVOR, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 PLAIN / UNFLAVORED

11.3 HONEY

11.4 MAPLE

11.5 CARAMEL

11.6 PINA COLADA

11.7 CHOCOLATE

11.8 VANILLA

11.9 FRUIT FLAVORS

11.9.1 FRUIT FLAVORS, BY TYPE

11.9.1.1. GREEN APPLE

11.9.1.2. FIG

11.9.1.3. LYCHEE

11.9.1.4. MINT

11.9.1.5. PEACH

11.9.1.6. PEAR

11.9.1.7. LEMON

11.9.1.8. PECAN

11.9.1.9. MANGO

11.9.1.10. BLACK CHERRY

11.9.1.11. RASPBERRY

11.9.1.12. STRAWBERRY

11.9.1.13. BLUEBERRY

11.9.1.14. CRANBERRY

11.9.1.15. ORANGE

11.9.1.16. MELON

11.9.1.17. OTHERS

11.1 SPICE FLAVOR

11.10.1 SPICE FLAVOR, BY TYPE

11.10.1.1. CINNAMON

11.10.1.2. GINGER

11.10.1.3. PEPPER

11.10.1.4. CLOVE

11.10.1.5. NUTMEG

11.10.1.6. OTHERS

11.11 NUTS FLAVOR

11.11.1 NUTS FLAVOR, BY TYPE

11.11.1.1. ALMOND

11.11.1.2. WALNUT

11.11.1.3. HAZELNUT

11.11.1.4. MACADAMIA NUTS

11.11.1.5. OTHERS

11.12 OTHERS

12 GLOBAL READY TO DRINK BEVERAGES MARKET , BY PACKAGING TYPE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 BOTTLES

12.3 CANS

12.4 CARTONS

12.5 STAND-UP POUCHES

12.6 TETRAPACKS

12.7 OTHERS

13 GLOBAL READY TO DRINK BEVERAGES MARKET , BY CATEGORY, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 ORGANIC

13.3 CONVENTIONAL

14 GLOBAL READY TO DRINK BEVERAGES MARKET , BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 STORE-BASED

14.2.1 SUPERMARKETS & HYPERMARKETS

14.2.2 GROCERY STORES

14.2.3 SPECIALTY STORES

14.2.4 CONVENIENCE STORES

14.2.5 OTHERS

14.3 NON-STORE-BASED

14.3.1 ONLINE

14.3.2 E-COMMERCE WEBSITES

14.3.3 VENDING MACHINES

15 GLOBAL READY TO DRINK BEVERAGES MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16 GLOBAL READY TO DRINK BEVERAGES MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 NETHERLANDS

16.2.8 BELGIUM

16.2.9 RUSSIA

16.2.10 TURKEY

16.2.11 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 AUSTRALIA

16.3.6 SINGAPORE

16.3.7 THAILAND

16.3.8 INDONESIA

16.3.9 MALAYSIA

16.3.10 PHILIPPINES

16.3.11 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 UAE

16.5.3 SAUDI ARABIA

16.5.4 KUWAIT

16.5.5 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL READY TO DRINK BEVERAGES MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL READY TO DRINK BEVERAGES MARKET, COMPANY PROFILE

18.1 THE COCA-COLA COMPANY

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 GEOGRAPHIC PRESENCE

18.1.5 RECENT DEVELOPMENTS

18.2 STARBUCKS COFFEE COMPANY

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 GEOGRAPHIC PRESENCE

18.2.5 RECENT DEVELOPMENTS

18.3 NESTLÉ

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 GEOGRAPHIC PRESENCE

18.3.5 RECENT DEVELOPMENTS

18.4 TATA SONS PRIVATE LIMITED

18.4.1 COMPANY OVERVIEW

18.4.2 PRODUCT PORTFOLIO

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 RECENT DEVELOPMENTS

18.5 BRITVIC PLC

18.5.1 COMPANY OVERVIEW

18.5.2 PRODUCT PORTFOLIO

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 RECENT DEVELOPMENTS

18.6 PEPSICO, INC.

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 GEOGRAPHIC PRESENCE

18.6.5 RECENT DEVELOPMENTS

18.7 SUNTORY GROUP

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 GEOGRAPHIC PRESENCE

18.7.5 RECENT DEVELOPMENTS

18.8 THE BROWN-FORMAN CORPORATION

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 GEOGRAPHIC PRESENCE

18.8.5 RECENT DEVELOPMENTS

18.9 ASAHI GROUP HOLDINGS

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 GEOGRAPHIC PRESENCE

18.9.5 RECENT DEVELOPMENTS

18.1 BICKFORD'S AUSTRALIA

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 GEOGRAPHIC PRESENCE

18.10.5 RECENT DEVELOPMENTS

18.11 TRU BLU BEVERAGES

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 GEOGRAPHIC PRESENCE

18.11.5 RECENT DEVELOPMENTS

18.12 F&N FOODS PTE LTD

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 GEOGRAPHIC PRESENCE

18.12.5 RECENT DEVELOPMENTS

18.13 HANGZHOU WAHAHA GROUP CO.,LTD.

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 GEOGRAPHIC PRESENCE

18.13.5 RECENT DEVELOPMENTS

18.14 PARLE AGRO PVT. LTD.,

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 GEOGRAPHIC PRESENCE

18.14.5 RECENT DEVELOPMENTS

18.15 BERTS SOFT DRINKS

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 GEOGRAPHIC PRESENCE

18.15.5 RECENT DEVELOPMENTS

18.16 DELUXE RICH SDN BHD

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 GEOGRAPHIC PRESENCE

18.16.5 RECENT DEVELOPMENTS

18.17 WESTS NZ LTD.

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 GEOGRAPHIC PRESENCE

18.17.5 RECENT DEVELOPMENTS

18.18 TOMBOW BEVERAGE CO. LTD.

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 GEOGRAPHIC PRESENCE

18.18.5 RECENT DEVELOPMENTS

18.19 KIMINO

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 GEOGRAPHIC PRESENCE

18.19.5 RECENT DEVELOPMENTS

18.2 MIKE'S HARD LEMONADE

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHICAL PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 JACK DANIEL’S COUNTRY COCKTAIL

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHICAL PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 SHS GROUP

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHICAL PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 COMPANHIA MÜLLER DE BEBIDAS CNPJ

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHICAL PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 PERNOD RICARD

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHICAL PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 CAMPARI SODA

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHICAL PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 ANHEUSER-BUSCH INBEV

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHICAL PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 ACCOLADE WINES

18.27.1 COMPANY OVERVIEW

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHICAL PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 ASAHI GROUP HOLDINGS, LTD

18.28.1 COMPANY OVERVIEW

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHICAL PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

18.29 RIO FIZZY WINE

18.29.1 COMPANY OVERVIEW

18.29.2 REVENUE ANALYSIS

18.29.3 GEOGRAPHICAL PRESENCE

18.29.4 PRODUCT PORTFOLIO

18.29.5 RECENT DEVELOPMENTS

18.3 BACARDI BREEZER

18.30.1 COMPANY OVERVIEW

18.30.2 REVENUE ANALYSIS

18.30.3 GEOGRAPHICAL PRESENCE

18.30.4 PRODUCT PORTFOLIO

18.30.5 RECENT DEVELOPMENTS

18.31 JOOSE

18.31.1 COMPANY OVERVIEW

18.31.2 REVENUE ANALYSIS

18.31.3 GEOGRAPHICAL PRESENCE

18.31.4 PRODUCT PORTFOLIO

18.31.5 RECENT DEVELOPMENTS

18.32 SMIRNOFF ICE

18.32.1 COMPANY OVERVIEW

18.32.2 REVENUE ANALYSIS

18.32.3 GEOGRAPHICAL PRESENCE

18.32.4 PRODUCT PORTFOLIO

18.32.5 RECENT DEVELOPMENTS

18.33 TREASURY WINE ESTATE

18.33.1 COMPANY OVERVIEW

18.33.2 REVENUE ANALYSIS

18.33.3 GEOGRAPHICAL PRESENCE

18.33.4 PRODUCT PORTFOLIO

18.33.5 RECENT DEVELOPMENTS

18.34 BREWERY INTERNATIONAL

18.34.1 COMPANY OVERVIEW

18.34.2 REVENUE ANALYSIS

18.34.3 GEOGRAPHICAL PRESENCE

18.34.4 PRODUCT PORTFOLIO

18.34.5 RECENT DEVELOPMENTS

18.35 RED SQUARE

18.35.1 COMPANY OVERVIEW

18.35.2 REVENUE ANALYSIS

18.35.3 GEOGRAPHICAL PRESENCE

18.35.4 PRODUCT PORTFOLIO

18.35.5 RECENT DEVELOPMENTS

18.36 BUNDABERG

18.36.1 COMPANY OVERVIEW

18.36.2 REVENUE ANALYSIS

18.36.3 GEOGRAPHICAL PRESENCE

18.36.4 PRODUCT PORTFOLIO

18.36.5 RECENT DEVELOPMENTS

18.37 DIAGEO

18.37.1 COMPANY OVERVIEW

18.37.2 REVENUE ANALYSIS

18.37.3 GEOGRAPHICAL PRESENCE

18.37.4 PRODUCT PORTFOLIO

18.37.5 RECENT DEVELOPMENTS

18.38 BORIE-MANOUX

18.38.1 COMPANY OVERVIEW

18.38.2 REVENUE ANALYSIS

18.38.3 GEOGRAPHICAL PRESENCE

18.38.4 PRODUCT PORTFOLIO

18.38.5 RECENT DEVELOPMENTS

18.39 MILLER BREWING COMPANY

18.39.1 COMPANY OVERVIEW

18.39.2 REVENUE ANALYSIS

18.39.3 GEOGRAPHICAL PRESENCE

18.39.4 PRODUCT PORTFOLIO

18.39.5 RECENT DEVELOPMENTS

18.4 BEAM SUNTORY

18.40.1 COMPANY OVERVIEW

18.40.2 REVENUE ANALYSIS

18.40.3 GEOGRAPHICAL PRESENCE

18.40.4 PRODUCT PORTFOLIO

18.40.5 RECENT DEVELOPMENTS

18.41 CANOPY GROWTH CORPORATION

18.41.1 COMPANY OVERVIEW

18.41.2 REVENUE ANALYSIS

18.41.3 PRODUCT PORTFOLIO

18.41.4 GEOGRAPHIC PRESENCE

18.41.5 RECENT DEVELOPMENTS

18.42 APHRIA INC.

18.42.1 COMPANY OVERVIEW

18.42.2 REVENUE ANALYSIS

18.42.3 PRODUCT PORTFOLIO

18.42.4 GEOGRAPHIC PRESENCE

18.42.5 RECENT DEVELOPMENTS

18.43 DAYTRIP BEVERAGES

18.43.1 COMPANY OVERVIEW

18.43.2 REVENUE ANALYSIS

18.43.3 PRODUCT PORTFOLIO

18.43.4 GEOGRAPHIC PRESENCE

18.43.5 RECENT DEVELOPMENTS

18.44 KOIOS BEVERAGE CORP.

18.44.1 COMPANY OVERVIEW

18.44.2 REVENUE ANALYSIS

18.44.3 PRODUCT PORTFOLIO

18.44.4 GEOGRAPHIC PRESENCE

18.44.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Global Rtd Beverages Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rtd Beverages Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rtd Beverages Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.