Global Saffron Market

Market Size in USD Million

CAGR :

%

USD

839.00 Million

USD

1,367.81 Million

2024

2032

USD

839.00 Million

USD

1,367.81 Million

2024

2032

| 2025 –2032 | |

| USD 839.00 Million | |

| USD 1,367.81 Million | |

|

|

|

|

Saffron Market Size

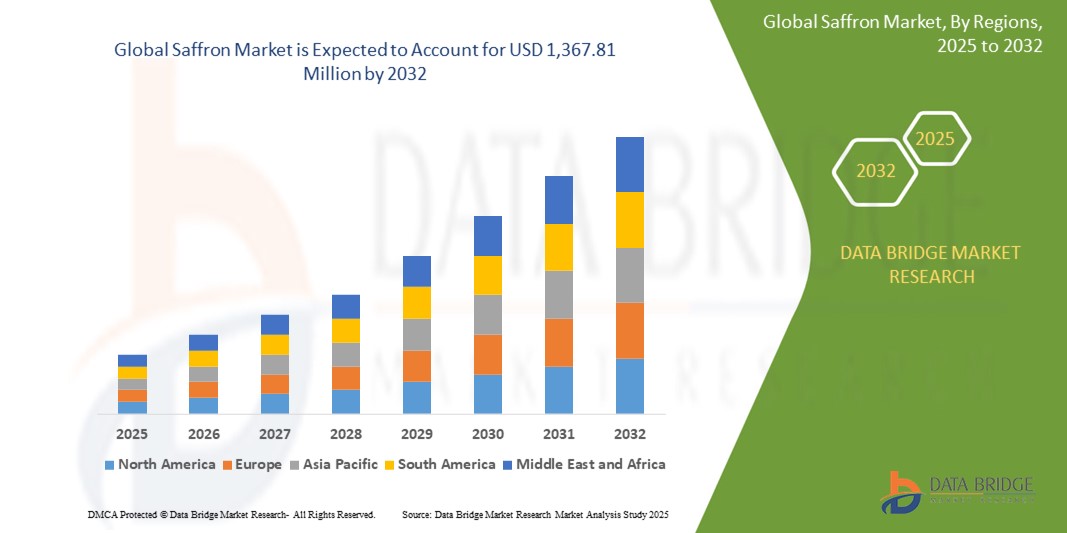

- The global saffron market size was valued at USD 839 million in 2024 and is expected to reach USD 1,367.81 million by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of saffron’s medicinal, nutritional, and cosmetic benefits, driving its adoption across food, pharmaceutical, and personal care industries

- Furthermore, rising demand for natural, organic, and functional ingredients, coupled with government support for saffron cultivation and expanding e-commerce distribution channels, is strengthening market accessibility and visibility. These converging factors are accelerating saffron consumption across regions, thereby significantly boosting the industry's growth

Saffron Market Analysis

- Saffron, a premium spice derived from the dried stigmas of the Crocus sativus flower, is increasingly valued across culinary, pharmaceutical, and cosmetic applications due to its unique flavor, aroma, antioxidant properties, and perceived health benefits

- The escalating demand for saffron is primarily fueled by rising consumer preference for natural and organic ingredients, growing use in traditional and alternative medicine, and expanding applications in functional foods, beauty, and wellness products across global markets

- Middle East and Africa dominated the saffron market with a share of 51.7% in 2024, due to historical and cultural importance of saffron in traditional dishes, herbal medicine, and religious practices across countries such as Iran, Morocco, and the U.A.E.

- Asia-Pacific is expected to be the fastest growing region in the saffron market during the forecast period due to widespread use of saffron in traditional medicine, culinary applications, and religious rituals across countries such as India, China, and Japan

- Grade I segment dominated the market with a market share of 60.5% due to its superior chemical composition, including high levels of crocin (coloring), picrocrocin (taste), and safranal (aroma), making it suitable for high-value uses in health supplements, herbal medicine, and functional foods. This grade is often preferred by pharmaceutical manufacturers and luxury brands looking for consistent potency and certified quality

Report Scope and Saffron Market Segmentation

|

Attributes |

Saffron Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Saffron Market Trends

“Increasing Demand for Saffron in Wellness and Cosmetics”

- A significant and accelerating trend in the global saffron market is its growing adoption in the wellness and cosmetics sectors due to its antioxidant, anti-inflammatory, and skin-brightening properties. This shift is expanding saffron’s role beyond culinary uses into premium skincare, personal care, and health supplements

- For instance, companies such as Kausar Saffron, Gohar Saffron, and Baby Bright have launched saffron-infused products ranging from face serums to dietary capsules, capitalizing on the spice’s rejuvenating and anti-aging benefits

- Saffron’s use in wellness products supports claims related to improved mood, reduced stress, and hormonal balance, making it a key ingredient in functional health supplements. For instance, Ayurveda Experience markets saffron-based beauty oils targeting holistic skincare solutions rooted in traditional remedies

- In cosmetics, saffron is increasingly used in formulations for brightening creams, under-eye serums, and facial oils due to its ability to promote an even skin tone and reduce pigmentation. Brands such as Forest Essentials and Biotique are integrating saffron into luxury Ayurvedic skincare ranges to meet growing consumer demand

- This trend reflects a broader consumer shift toward clean-label and naturally-derived ingredients, with saffron gaining recognition for its multipurpose therapeutic properties

- The demand for saffron-based wellness and cosmetic products is rapidly growing across Asia-Pacific and Europe, driven by rising health consciousness and preference for herbal and organic skincare options

Saffron Market Dynamics

Driver

“Growing Demand for Saffron in Food and Beverages Industry”

- The increasing use of saffron as a premium ingredient in culinary applications, combined with the rising consumer preference for natural flavoring and coloring agents, is a significant driver for the heightened demand for saffron

- For instance, in March 2024, Gohar Saffron expanded its product line to include gourmet-grade saffron strands and powder specifically tailored for the foodservice and packaged food sectors. Such strategic initiatives by major players are expected to fuel market growth during the forecast period

- As consumers become more health-conscious and gravitate toward clean-label and functional ingredients, saffron’s antioxidant and digestive properties are making it a favored choice in health beverages, dairy, confectionery, and ready-to-eat meals

- Furthermore, the growing popularity of ethnic cuisines, premium gourmet products, and traditional recipes across global markets is increasing the incorporation of saffron in a wide variety of food products, including biryanis, desserts, and flavored drinks

- The expanding global food and beverage sector, especially in Asia-Pacific and the Middle East, combined with growing exports of saffron-infused items, is expected to continue driving market growth across both developed and emerging economies

Restraint/Challenge

“High Production Costs”

- The labor-intensive harvesting process and limited geographic suitability for saffron cultivation pose a significant challenge to broader market scalability. Saffron production requires meticulous manual labor, with around 150,000 flowers needed to yield just one kilogram of saffron, leading to elevated costs

- For instance, Mehr Saffron and Rowhani Saffron Co. have highlighted the burden of rising labor wages and climate-related disruptions in major producing regions such as Iran and India, which further escalate production expenses and impact overall profitability

- Addressing these challenges through mechanization, improved harvesting techniques, and agricultural innovation is crucial for sustaining long-term supply. Companies are exploring precision farming and cooperative cultivation models to reduce per-unit costs while maintaining quality standards

- In addition to harvesting expenses, saffron requires delicate post-harvest handling and strict quality control to meet export-grade standards, increasing costs across the supply chain. The premium pricing associated with authentic saffron also limits its accessibility in price-sensitive markets

- Overcoming these limitations will require investment in research, farmer training programs, and policy support to scale saffron farming sustainably while preserving its traditional cultivation integrity

Saffron Market Scope

The market is segmented on the basis of type, grade, category, form, origin, drying method, application, and distribution channel.

• By Type

On the basis of type, the saffron market is segmented into Sargol Saffron, Pushal/Poshal Saffron, Negin Saffron, Super Negin Saffron, and Bunch or Dasteh Saffron. The Negin Saffron segment dominated the market revenue share in 2024, attributed to its high stigma volume, vibrant red color, strong aroma, and high crocin and safranal content, which make it ideal for premium culinary, medicinal, and cosmetic applications. Its high yield per stigma and clean appearance without yellow or orange threads appeal to luxury buyers and high-end retailers, especially in the Gulf and European markets.

The Super Negin Saffron segment is projected to witness the fastest growth from 2025 to 2032, as demand rises for ultra-premium, chemically pure saffron that offers maximum coloring power and extended shelf life. It is increasingly preferred by pharmaceutical companies, gourmet food producers, and nutraceutical brands, particularly in Japan, Germany, and South Korea, where quality certifications and high standards drive sourcing decisions.

• By Grade

On the basis of grade, the saffron market is segmented into Grade I, Grade II, Grade III, and Grade IV. The Grade I segment accounted for the largest share of 60.5% in 2024, due to its superior chemical composition, including high levels of crocin (coloring), picrocrocin (taste), and safranal (aroma), making it suitable for high-value uses in health supplements, herbal medicine, and functional foods. This grade is often preferred by pharmaceutical manufacturers and luxury brands looking for consistent potency and certified quality.

Grade II saffron is expected to register the fastest CAGR from 2025 to 2032, driven by increasing use in mainstream packaged food and regional cuisine products where affordability and reasonable quality are more critical than premium standards. It is widely adopted in South Asian, Middle Eastern, and North African regions for both household and commercial consumption.

• By Category

On the basis of category, the saffron market is segmented into Conventional Products and Organic Products. The Conventional Products segment led the market in 2024, primarily due to widespread farming practices without organic certification, making it more accessible and cost-effective. Major producers such as Iran and Morocco continue to rely on conventional farming due to established supply chains, larger output volumes, and lower production costs.

The Organic Products segment is anticipated to grow at the highest CAGR from 2025 to 2032, spurred by heightened consumer awareness about chemical-free, pesticide-free food products, particularly in developed markets such as the U.S., Germany, and France. Certified organic saffron is increasingly used in baby food, natural cosmetics, and premium dietary supplements, where demand for traceability and sustainability continues to grow.

• By Form

On the basis of form, the saffron market is segmented into Powder, Liquid, Stigma, and Petals. The Stigma form held the highest revenue share in 2024, driven by its authenticity, minimal processing, and consumer preference for whole saffron threads as a mark of purity and quality. It is commonly purchased by gourmet chefs, herbal medicine practitioners, and premium retail consumers who value full-spectrum potency.

The Powder form is expected to experience the fastest growth from 2025 to 2032, as food manufacturers, bakeries, and beverage brands increasingly use it for uniform blending, accurate dosing, and scalable production. The powdered form also supports innovation in ready-to-drink saffron beverages, saffron-infused spice blends, and supplement capsules.

• By Origin

On the basis of origin, the saffron market is segmented into India, Iran, Spain, Greece, Morocco, and Others. Iran held the largest market share in 2024, accounting for the majority of global saffron production due to its favorable soil and climate, traditional harvesting practices, and government support for export infrastructure. The country’s ability to supply in bulk and at competitive prices makes it the dominant player in both raw material and processed forms.

India is projected to be the fastest-growing region from 2025 to 2032, especially due to the rising recognition of Kashmiri saffron’s GI tag, expansion of cultivation through government schemes such as the National Saffron Mission, and increasing demand from the Indian wellness and Ayurveda sectors. Exports to Gulf countries and North America are also gaining traction.

• By Drying Method

On the basis of drying method, the market is segmented into Sun Drying Method, Electric Oven Drying Method, Vacuum Oven Drying Method, Microwave Drying Method, and Others. The Sun Drying Method led the market in 2024 due to its traditional usage, low cost, and energy-free processing, especially among small-scale farmers in Iran, India, and Morocco. This method preserves natural aroma but can lead to inconsistencies in quality if not closely monitored.

The Vacuum Oven Drying Method is expected to grow at the fastest rate from 2025 to 2032, driven by its ability to preserve sensitive bioactives such as crocin and safranal while offering standardized drying conditions. Pharmaceutical and premium cosmetic companies increasingly prefer this method for ensuring batch-to-batch consistency, hygiene, and compliance with global safety standards.

• By Application

On the basis of application, the saffron market is segmented into Food and Beverages, Food Supplements, Dietary Supplements, Pharmaceutical, Personal Care, Cosmetic, and Others. The Food and Beverages segment accounted for the largest market share in 2024, supported by saffron’s longstanding role as a coloring and flavoring agent in traditional cuisines, confectionery, dairy products, teas, and alcoholic beverages across Asia, Europe, and the Middle East.

The Pharmaceutical segment is projected to witness the fastest CAGR from 2025 to 2032, as clinical research continues to highlight saffron’s antidepressant, antioxidant, and neuroprotective properties. Its growing use in herbal drugs, mental wellness supplements, and chronic disease therapeutics is increasing, particularly in Japan, China, and Western Europe.

• By Distribution Channel

On the basis of distribution channel, the saffron market is segmented into B2B and B2C. The B2B segment dominated the market in 2024 due to high-volume purchases by industries including packaged food, beverages, pharmaceutical companies, and cosmetic brands requiring bulk saffron for processing and formulation. Long-term contracts and direct sourcing from farms or cooperatives also support B2B dominance.

The B2C segment is expected to grow at the highest CAGR from 2025 to 2032, driven by the expansion of e-commerce platforms, rising disposable incomes, and growing consumer interest in using saffron for home cooking, skincare routines, and wellness practices. Premium packaging, GI certification, and brand storytelling are key strategies used by online brands to attract retail buyers.

Saffron Market Regional Analysis

- Middle East and Africa dominates the saffron market with the largest revenue share of 51.7% in 2024, driven by historical and cultural importance of saffron in traditional dishes, herbal medicine, and religious practices across countries such as Iran, Morocco, and the U.A.E.

- Consumers in the region place high value on saffron’s purity, color strength, and aroma, supporting steady demand from both domestic households and regional export hubs

- This growth is reinforced by government-backed cultivation initiatives, improvements in agricultural practices, and increasing global demand for high-grade saffron, which positions MEA as a key supplier to international markets

Iran Saffron Market Insight

The Iran saffron market accounted for the largest revenue share in 2024 within the Middle East and Africa, solidifying its status as the world’s largest saffron producer and exporter. Iranian saffron is globally renowned for its deep red threads, intense fragrance, and high crocin content. Government efforts to support farmers through subsidies, technical training, and export incentives have enhanced both production and global competitiveness. Despite facing export restrictions in certain markets, Iran continues to lead the global saffron trade, supplying to Europe, Asia, and North America.

North America Saffron Market Insight

North America saffron market is anticipated to grow at the significant CAGR from 2025 to 2032, fueled by increasing demand for wellness-focused, plant-derived ingredients and the rising popularity of ethnic cuisine. Consumers in the region are showing growing interest in saffron for its mood-enhancing, antioxidant, and anti-inflammatory properties, driving its application in supplements, teas, and skincare products. This growth is further supported by high health awareness, growing immigrant populations from saffron-using regions, and the availability of premium, traceable saffron products through retail and e-commerce channels.

U.S. Saffron Market Insight

The U.S. saffron market captured the largest revenue share in 2024 within North America, driven by its use in gourmet foods, dietary supplements, and high-end skincare formulations. Increasing research-backed promotion of saffron’s mental health benefits is fueling demand in the nutraceutical space. Consumers are also seeking out clean-label and ethically sourced products, leading to partnerships with certified farms in Spain, Iran, and India. Growing availability of saffron through specialty retailers, online platforms, and health food chains is expanding market reach.

Asia-Pacific Saffron Market Insight

Asia-Pacific is anticipated to grow at the fastest CAGR of 7.8% from 2025 to 2032, driven by the widespread use of saffron in traditional medicine, culinary applications, and religious rituals across countries such as India, China, and Japan. Consumers in the region highly value the natural, medicinal, and aromatic qualities of saffron, with strong demand from both end users and the pharmaceutical, personal care, and food sectors. This market dominance is further supported by regional government support for saffron farming, increasing disposable incomes, and the expanding presence of online and offline distribution channels that promote local and international trade

India Saffron Market Insight

The India saffron market captured the largest revenue share in 2024 within Asia-Pacific, driven by the rising popularity of Ayurvedic and natural wellness products. Kashmiri saffron, known for its deep red hue and high crocin content, is widely consumed domestically and exported. Government initiatives such as the National Saffron Mission and GI-tag protection are enhancing production, quality control, and market value. Strong domestic demand for saffron in food, health supplements, and cosmetics continues to propel growth.

China Saffron Market Insight

China saffron market is expanding steadily due to its increasing incorporation in Traditional Chinese Medicine, skincare products, and functional foods. The country’s growing middle class and wellness-driven population are driving imports and controlled domestic cultivation. Rising demand for premium herbal products, combined with improved access to international saffron brands via cross-border e-commerce, is further fueling market momentum. China’s investments in modern cultivation techniques also aim to reduce dependence on imports and improve local output.

Saffron Market Share

The saffron industry is primarily led by well-established companies, including:

- Baby Brand Saffron (Iran)

- Esfedan Saffron Co. (Iran)

- Rowhani Saffron Co. (Iran)

- Kashmir Kesar Leader (India)

- The Cheshire Saffron Company (U.K.)

- Novin Saffron Company (Iran)

- Norfolk Saffron (U.K.)

- Retaj Agro Farms (India)

- GREEN LEAVES INTERNATIONAL (Iran)

- Tarvand Saffron Co (Iran)

- MVT Foods (India)

- Società Agricola Baghini Buonacara Srls (Italy)

- SAFRANTE SPECIALTY FOODS S.A. (Greece)

- Cornish Saffron (U.K.)

- Saharkhiz International Group Inc. (Iran)

- English Saffron (U.K.)

- ORGANIC KASHMIR (India)

- Zamindar Kesar (India)

- Roskorwell Farm (U.K.)

- Mane KANCOR (India)

- Saffron Business (Iran)

- Red Ruby Norway (Norway)

- Eyjann Saffron (Iceland)

- Mancha Farms (U.S.)

Latest Developments in Global Saffron Market

- In August 2023, Tata Consumer Products (TCP) expanded its product line by launching a premium range of Kashmiri saffron under its Himalayan brand. This strategic move aims to tap into the growing demand for high-quality saffron, emphasizing its rich flavor and potential health benefits. The new product line underscores TCP’s commitment to quality and innovation in the food and beverage sector, catering to discerning consumers

- In June 2022, Natac Group strengthened its market presence in the saffron extracts sector by acquiring French biotech firm Inoreal. This acquisition facilitates easier access for customers to high-quality bioactive components, enhancing the product offerings. With a focus on providing branded ingredients backed by clinical data, Natac aims to meet the growing demand for saffron-based products, ensuring consumer trust and satisfaction

- In November 2022, Veggitech inaugurated a cutting-edge saffron farm in Sharjah, U.A.E., aligning with the National Food Security Strategy for 2051. Utilizing smart built-in systems for efficient farming management, the facility exemplifies innovation in agriculture. This initiative aims to boost local saffron production, ensuring sustainability and high quality. By leveraging advanced technology, Veggitech contributes to the UAE’s goal of achieving long-term food security and self-sufficiency

- In February 2022, Mumbai-based ENTOD Pharmaceutical launched “Macusaff,” a saffron-based eye care supplement in India. This product is formulated entirely from natural saffron, containing 5 percent crocin, which is believed to aid in treating conditions such as retinitis pigmentosa and glaucoma. ENTOD’s focus on using natural ingredients highlights a growing trend in the pharmaceutical sector toward holistic and effective solutions for eye health, catering to an increasing consumer demand

- In June 2022, SoulTree, a brand specializing in Ayurvedic beauty and wellness, introduced its Advanced Kumkumadi line of products. This new range is crafted from 100% pure, certified organic Mogra Saffron, adhering to the principles of Ayurvedic traditions. By emphasizing organic and natural ingredients, SoulTree aims to cater to the rising consumer preference for holistic beauty solutions, blending traditional knowledge with modern skincare needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Saffron Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Saffron Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Saffron Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.