Global Saliva Test Devices Market

Market Size in USD Billion

CAGR :

%

USD

818.18 Billion

USD

1.17 Billion

2024

2032

USD

818.18 Billion

USD

1.17 Billion

2024

2032

| 2025 –2032 | |

| USD 818.18 Billion | |

| USD 1.17 Billion | |

|

|

|

|

Saliva Test Device Market Size

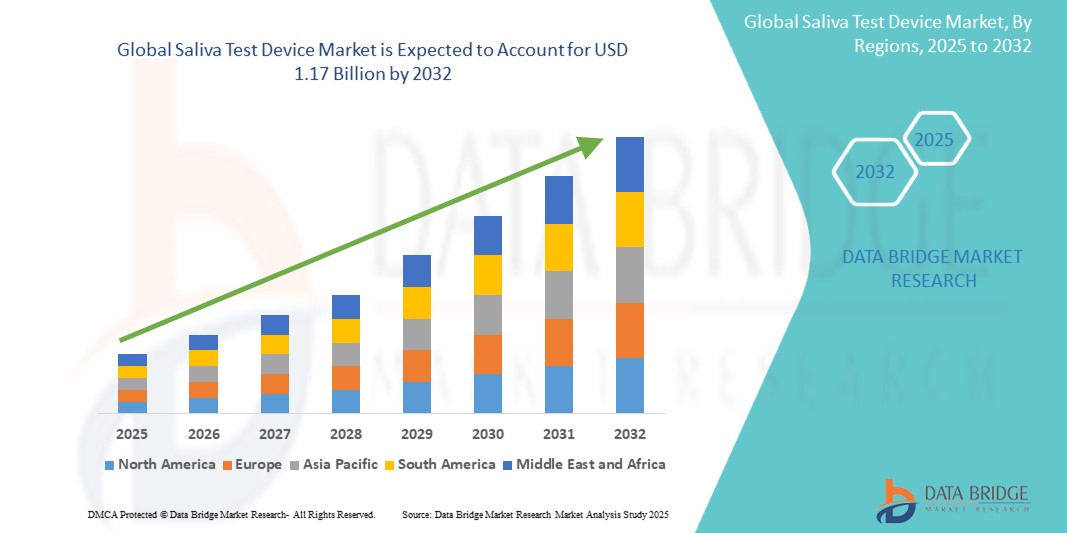

- The global saliva test device market size was valued at USD 818.18 million in 2024 and is expected to reach USD 1.17 billion by 2032, at a CAGR of 4.6% during the forecast period

- This growth is driven by factors such as the non-invasive testing method, growing awareness and acceptance.

Saliva Test Device Market Analysis

- Saliva test devices are non-invasive diagnostic tools used for detecting a variety of conditions, including infectious diseases, hormonal imbalances, drug use, and even certain cancers. They offer rapid results and are increasingly being adopted in clinical, workplace, and home settings

- The demand for saliva test devices is significantly driven by the growing preference for non-invasive testing methods, rising awareness of preventive healthcare, and the need for rapid, accurate diagnostics, particularly during infectious disease outbreaks such as COVID-19

- North America is expected to dominate the saliva test device market due to its well-established diagnostic infrastructure, higher adoption of advanced healthcare technologies, and strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the saliva test device market during the forecast period due to increasing healthcare investments, growing public health awareness, and expanding access to diagnostic services in emerging economies

- 5-Panel Saliva Test Kits segment is expected to dominate the market with a market share of 56.25% due to its cost effectiveness. These kits are widely used in both workplace and roadside testing due to their quick results and compliance with regulatory standards

Report Scope and Saliva Test Device Market Segmentation

|

Attributes |

Saliva Test Device Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Saliva Test Device Market Trends

“Technological Advancements and Digital Integration in Saliva-Based Diagnostics”

- One prominent trend in the development of saliva test devices is the growing integration of advanced biosensors and digital health technologies, aimed at enhancing the speed, accuracy, and accessibility of diagnostics

- These innovations support rapid, non-invasive testing for a wide range of conditions—from infectious diseases and hormonal imbalances to substance use—making them highly suitable for point-of-care, home-based, and remote health applications

- For instance, next-generation saliva test kits are now being developed with smartphone connectivity and AI-powered analysis, allowing users and healthcare providers to receive real-time results and track health trends over time. This is particularly impactful for chronic disease monitoring and large-scale public health screening

- These advancements are revolutionizing how diagnostics are conducted, shifting the focus toward patient-centric, preventive healthcare, and fueling demand for more versatile and intelligent saliva-based diagnostic solutions

Saliva Test Device Market Dynamics

Driver

“Rising Demand for Non-Invasive and Rapid Diagnostic Solutions”

- The growing need for non-invasive, user-friendly, and rapid diagnostic methods is a major driver of the saliva test device market. Saliva-based diagnostics offer a painless alternative to traditional blood tests, increasing patient compliance and enabling more frequent health monitoring

- The demand is particularly high for applications such as infectious disease detection, drug testing, and hormone level monitoring, where saliva provides accurate biomarkers

- As healthcare systems shift toward preventive care and early diagnosis, the adoption of easy-to-use saliva tests in clinical and at-home settings is on the rise

For instance,

- In August 2023, a study published in Nature Biomedical Engineering highlighted the increasing accuracy of saliva-based COVID-19 tests, which demonstrated comparable performance to nasal swabs, while offering a more comfortable experience for patients

- The growing preference for convenient and rapid diagnostics, especially in public health emergencies and remote testing environments, is propelling the market forward

Opportunity

“Digital Health Integration and Personalized Testing Solutions”

- The integration of digital health platforms and AI-powered analytics with saliva testing devices presents a major opportunity for market expansion. This includes smartphone-compatible readers, cloud-based result tracking, and AI-driven interpretation of results.

- These technologies can improve real-time monitoring, early disease detection, and remote patient management, particularly for chronic diseases, hormonal imbalances, and stress-related conditions

- In addition, the rise of personalized medicine is pushing the development of saliva tests tailored to individual genetic, metabolic, and hormonal profiles

For instance,

- In October 2024, according to The Lancet Digital Health, researchers developed a portable AI-integrated saliva test system for early-stage oral cancer detection, capable of delivering results within 15 minutes using smartphone-based imaging and data analytics

- This fusion of diagnostics and digital tech is expected to drive greater adoption among consumers and healthcare providers, opening new avenues in both clinical and consumer health markets

Restraint/Challenge

“Variability in Sensitivity and Regulatory Hurdles”

- One of the primary challenges in the saliva test device market is the variability in test sensitivity and specificity, especially for low-concentration biomarkers. Unlike blood, saliva may contain lower levels of certain analytes, potentially affecting test accuracy

- In addition, regulatory hurdles and lack of standardized validation protocols can delay product approvals and limit market entry, particularly in high-regulation regions such as the U.S. and Europe

- Ensuring consistent performance across different populations, devices, and test conditions remains a technical and regulatory barrier to widespread adoption

For instance,

- In December 2023, the U.S. FDA highlighted concerns regarding several over-the-counter saliva test kits that lacked sufficient clinical validation, delaying their market clearance and raising questions about diagnostic reliability

- These challenges must be addressed through technological innovation, improved biomarker detection methods, and global regulatory harmonization, to ensure greater trust and reliability in saliva-based diagnostics

Saliva Test Device Market Scope

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

In 2025, the 5-panel saliva test kits is projected to dominate the market with a largest share in type segment

The 5-panel saliva test kits is expected to dominate the saliva test device market with the largest share of 56.25% in 2025 due to its cost effectiveness. These kits are widely used in both workplace and roadside testing due to their quick results and compliance with regulatory standards.

The workplace testing segment is expected to account for the largest share during the forecast period in the application market

In 2025, the workplace testing segment is anticipated to hold the largest market share of 48.63%, fueled by growing employer focus on maintaining drug-free environments and ensuring employee safety. With rising substance use concerns and strict regulatory policies in sectors such as transportation, construction, and manufacturing, organizations are increasingly adopting saliva-based drug screening for its non-invasive nature, real-time results, and ease of administration. This widespread demand solidifies workplace testing as the leading application in the saliva test device market.

Saliva Test Device Market Regional Analysis

“North America Holds the Largest Share in the Saliva Test Device Market”

- North America dominates the saliva test device market, fueled by a well-developed healthcare infrastructure, early adoption of innovative diagnostic technologies, and the presence of major market players involved in rapid test development and distribution

- U.S. accounts for the largest share within the region, driven by the widespread use of saliva tests in workplace drug testing, disease diagnostics, and law enforcement. Regulatory support for non-invasive testing, along with a growing preference for point-of-care and home-based diagnostics, boosts market demand

- In addition, robust reimbursement frameworks, government initiatives for preventive health screening, and significant investment in research and development contribute to the region's leadership position

- The increasing adoption of telehealth and remote testing solutions, particularly since the COVID-19 pandemic, further strengthens North America’s dominance in the saliva testing market

“Asia-Pacific is Projected to Register the Highest CAGR in the Saliva Test Device Market”

- Asia-Pacific is expected to witness the highest CAGR in the saliva test device market, driven by growing public health awareness, expansion of diagnostic infrastructure, and a surge in demand for non-invasive and affordable testing methods

- Countries such as China, India, and Japan are emerging as major markets due to their large populations, increasing incidence of infectious diseases, and rising concern over substance abuse and chronic conditions

- In Japan, technological advancements in diagnostic devices and a strong focus on early disease detection are driving the demand for saliva-based testing, especially in elderly care and wellness monitoring

- In India and China, government-led initiatives to expand healthcare access, combined with investments from global and local diagnostic companies, are accelerating market growth. The push for affordable, rapid diagnostic tools in rural and urban healthcare settings presents a significant opportunity for saliva test device manufacturers

Saliva Test Device Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- Wondfo (China)

- OraSure Technologies, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Neogen Corporation (U.S.)

- Oranoxis Inc. (U.S.)

- Premier Biotech, Inc. (U.S.)

- Securetec (Germany)

- AccuBioTech Co., Ltd. (China)

- MEDACX Ltd. (U.K.)

- Oasis Diagnostics Corporation (U.S.)

- Porex (U.S.)

- Salimetrics, LLC. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Salignostics (Israel)

- Magnasense (Sweden)

- Abionic SA (Switzerland)

Latest Developments in Global Saliva Test Device Market

- In January 2025, Eli Health, a Canadian health-tech company, announced the launch of the Hormometer, an at-home saliva-based hormone testing device, at CES 2025. The Hormometer uses a smartphone camera and saliva samples to analyze hormones such as cortisol and progesterone, helping users monitor stress, sleep, and fertility. Priced at approximately USD 8 per test, the system is currently in beta rollout across the U.S. and Canada, emphasizing accessibility and convenience in personal health monitoring

- In January 2025, Nagpur-based startup ErlySign developed a 15-minute saliva test for early detection of oral precancerous conditions, showcasing 98.04% sensitivity and 100% specificity. The innovation received Rs 16 crore in pre-Series A funding and is currently undergoing regulatory approval, with full-scale commercialization expected by Q2 2026. The test aims to provide early, affordable screening in both clinical and rural settings, addressing oral cancer’s rising incidence in India

- In March 2024, Spectrum Solutions released the SimplyPERIO Saliva Test, powered by SimplyTest®, a new saliva diagnostic innovation that tests for periodontal bacteria, caries, fungal, and viral targets from a single sample. The test provides real-time clinical data on oral health, offering patients and providers a pain-free, easy-to-use method to detect gum disease and its link to systemic health issues. SimplyPERIO features a proprietary molecular technology and a patented blue buffer solution, ensuring room temperature stability without special storage or shipping requirements

- In January 2021, Vatic launched the KnowNow COVID-19 saliva test, a rapid 15-minute lateral flow test designed to identify current COVID-19 infections and determine who is infectious. Unlike other tests, it uses saliva collected from inside the cheek and under the tongue, detecting the spike protein on the virus’s surface by mimicking human cell properties. Paired with an app, the test provides documented proof of the result and infectiousness status. The test is CE Marked and aims to be deployed for workplace, travel, and event screenings, with potential for future self-testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.