Global Seed Market

Market Size in USD Billion

CAGR :

%

USD

61.68 Billion

USD

112.49 Billion

2024

2032

USD

61.68 Billion

USD

112.49 Billion

2024

2032

| 2025 –2032 | |

| USD 61.68 Billion | |

| USD 112.49 Billion | |

|

|

|

|

What is the Global Seed Market Size and Growth Rate?

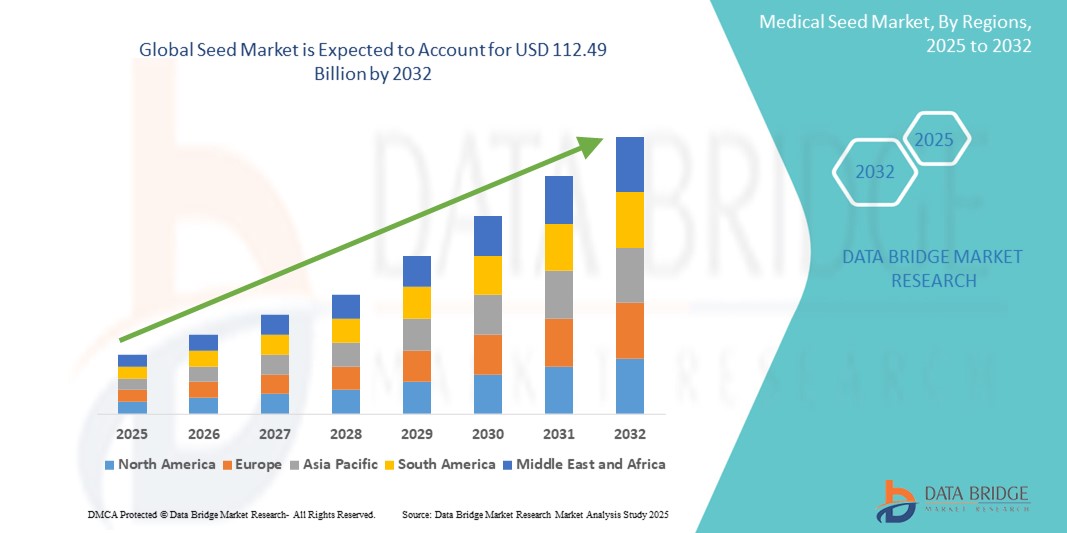

- The global seed market size was valued at USD 61.68 billion in 2024 and is expected to reach USD 112.49 billion by 2032, at a CAGR of 7.80% during the forecast period

- The seed market is witnessing significant growth, driven by advancements in biotechnology, precision agriculture, and digital tools

- Innovative techniques such as CRISPR gene editing enable the development of genetically modified seeds that are more resistant to pests, diseases, and environmental stressors. These seeds improve crop yields and reduce the need for chemical inputs, promoting sustainable farming practices

What are the Major Takeaways of Seed Market?

- Precision agriculture technologies, including satellite imaging and drones, facilitate better seed placement and monitoring, optimizing planting strategies. This data-driven approach enhances decision-making for farmers, leading to increased efficiency and productivity

- The use of digital platforms for seed distribution and information sharing is also on the rise, allowing farmers to access a wider variety of seeds and tailored recommendations based on local conditions

- North America dominated the Seed market with the largest revenue share of 33.6% in 2024, driven by the region's advanced agricultural practices, strong focus on high-yield crops, and growing emphasis on sustainable farming solution

- Asia-Pacific Seed market is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, driven by the region’s expanding agricultural activities, rising population, and increasing need for food security

- The Transgenic Hybrids segment dominated the Seed market with the largest revenue share of 49.2% in 2024, driven by the increasing demand for high-yield, pest-resistant, and drought-tolerant seed varieties

Report Scope and Seed Market Segmentation

|

Attributes |

Seed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Seed Market?

“Biotechnology-Enabled High-Yield and Climate-Resilient Seed Development”

- A prominent and rapidly advancing trend in the global Seed market is the increasing adoption of biotechnology and genetic innovation to develop seeds with higher yields, enhanced disease resistance, and improved climate resilience

- For instance, leading companies are leveraging CRISPR gene editing, hybrid breeding, and trait stacking technologies to create seed varieties that withstand drought, pests, and changing environmental conditions while maximizing productivity

- Biotechnology integration enables the development of herbicide-tolerant, insect-resistant, and stress-adapted seeds, supporting farmers in overcoming yield volatility and production risks amid climate change

- The trend also includes growing use of biofortified seeds, which enhance nutritional content in staple crops, contributing to food security and public health goals in developing regions

- Key market players such as Corteva and KWS SAAT SE & Co. KGaA are investing heavily in R&D to introduce innovative seed technologies that support sustainable agriculture and reduce dependence on synthetic inputs

- As the agriculture sector faces mounting pressure to produce more with fewer resources, demand for biotech-driven, high-performance seeds is accelerating, reshaping global farming practices and promoting long-term agricultural sustainability

What are the Key Drivers of Seed Market?

- The growing global population, coupled with the urgent need to enhance food production and reduce agricultural land degradation, is significantly driving demand for high-quality, genetically advanced seeds

- For instance, in February 2024, Limagrain introduced new hybrid cereal seeds designed to deliver higher yields and improved drought tolerance, reflecting the industry's focus on resilience and productivity

- The rising adoption of precision agriculture, supported by satellite monitoring, AI, and IoT technologies, is increasing the demand for seeds tailored to specific environmental and soil conditions, optimizing resource use and yield outputs

- In addition, government initiatives, such as subsidies for improved seed varieties and programs promoting climate-resilient agriculture, are fueling market expansion, particularly in emerging economies

- Growing farmer awareness regarding the benefits of using certified, disease-resistant, and high-yield seeds is also contributing to market growth, addressing productivity gaps in developing regions and supporting global food security goals

Which Factor is challenging the Growth of the Seed Market?

- The Seed market faces significant challenges from regulatory complexities, intellectual property restrictions, and public concerns over genetically modified (GM) crops and biodiversity impact

- For instance, regions such as the European Union maintain strict policies limiting the cultivation of certain GM seeds, affecting product availability and market penetration for biotech-focused companies

- In addition, rising demand for organic and non-GMO produce, especially in developed markets, restricts the adoption of genetically engineered seeds in some consumer segments

- High R&D costs, prolonged approval processes for new seed varieties, and limited access to advanced seed technologies for smallholder farmers further constrain market growth, particularly in low-income regions

- Overcoming these challenges will require enhanced investment in transparent, sustainable seed innovation, alongside regulatory harmonization and greater accessibility of advanced seeds for farmers worldwide

How is the Seed Market Segmented?

The market is segmented on the basis of product, crop, availability, and type.

- By Product

On the basis of product, the Seed market is segmented into Transgenic Hybrids, Non-Transgenic Hybrids, and Open-Pollinated Varieties. The Transgenic Hybrids segment dominated the Seed market with the largest revenue share of 49.2% in 2024, driven by the increasing demand for high-yield, pest-resistant, and drought-tolerant seed varieties. Transgenic hybrids offer superior performance in challenging environments, making them highly preferred among farmers aiming to maximize productivity and profitability. Rising adoption of biotech crops in both developed and emerging markets continues to fuel the growth of this segment.

The Open-Pollinated Varieties segment is projected to witness the fastest growth rate from 2025 to 2032, supported by their affordability, seed-saving potential, and suitability for smallholder farmers, particularly in developing regions where access to advanced hybrid seeds remains limited.

- By Crop

On the basis of crop, the Seed market is segmented into Grains and Cereals, Pulses and Oilseeds, Cotton, Fruits and Vegetables, and Other Crops. The Grains and Cereals segment accounted for the largest revenue share of 46.5% in 2024, owing to the significant global dependence on staple crops such as rice, wheat, and maize for food security and economic stability. Continuous efforts to improve yields, pest resistance, and climate adaptability in cereals drive the demand for advanced seeds in this category.

The Fruits and Vegetables segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising health awareness, growing consumer demand for nutritious produce, and the need for disease-resistant, high-yield seeds to support commercial horticulture.

- By Availability

On the basis of availability, the Seed market is segmented into Commercial Seeds and Saved Seeds. The Commercial Seeds segment dominated the market with the largest revenue share of 63.7% in 2024, driven by the increasing reliance on certified, high-quality seeds that ensure consistent yields, improved disease resistance, and better crop uniformity. Growing awareness among farmers about the benefits of using commercial seeds, supported by government programs and private sector innovations, continues to boost segment growth.

The Saved Seeds segment is anticipated to witness steady growth, particularly in developing regions where traditional farming practices and cost constraints encourage farmers to reuse seeds from previous harvests.

- By Type

On the basis of type, the Seed market is segmented into Conventional Seeds and Genetically Modified (GM) Seeds. The Conventional Seeds segment held the largest revenue share of 54.1% in 2024, due to their wide acceptance across diverse markets, lower regulatory hurdles, and suitability for organic and traditional farming practices. Many farmers, especially in regions with restrictions on GM crops, continue to prefer conventional seeds for staple and cash crop cultivation.

The Genetically Modified Seeds segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by advancements in biotech innovation, increasing adoption of pest- and herbicide-resistant varieties, and the need to enhance crop resilience against climate change and resource limitations.

Which Region Holds the Largest Share of the Seed Market?

- North America dominated the Seed market with the largest revenue share of 33.6% in 2024, driven by the region's advanced agricultural practices, strong focus on high-yield crops, and growing emphasis on sustainable farming solutions

- U.S. and Canada are witnessing increased demand for Seed due to rising food security concerns, the need to maximize crop productivity, and technological advancements in precision farming, fertilizers, and crop protection products

- Favorable government policies, substantial investments in R&D, and a well-established commercial agriculture sector have positioned North America as the leading market for Seed, with major emphasis on genetically modified seeds, pest-resistant varieties, and environmentally friendly agrochemicals

U.S. Seed Market Insight

The U.S. Seed market accounted for the largest revenue share within North America in 2024, fueled by the country's leadership in agricultural innovation, growing demand for residue-free, high-quality produce, and the widespread adoption of precision farming technologies. The increasing focus on sustainable agriculture, bio-based crop protection, and soil health management continues to drive market expansion, particularly across key crops such as corn, soybeans, and wheat.

Canada Seed Market Insight

The Canada Seed market is experiencing steady growth, supported by large-scale grain, oilseed, and vegetable production, as well as rising awareness regarding climate-resilient and eco-friendly agricultural practices. Canadian farmers are increasingly adopting advanced Seed solutions to enhance yields, improve soil fertility, and address pest challenges, aligning with national sustainability goals and export market requirements.

Which Region is the Fastest Growing Region in the Seed Market?

Asia-Pacific Seed market is projected to grow at the fastest CAGR of 11.2% from 2025 to 2032, driven by the region’s expanding agricultural activities, rising population, and increasing need for food security. Countries such as China, India, and Southeast Asian nations are witnessing strong adoption of advanced Seed solutions, supported by government subsidies, expanding farmland, and growing demand for high-yield, pest-resistant crop varieties Technological advancements in crop protection, increased awareness of sustainable farming, and investments in modern agricultural inputs are accelerating Seed market growth across the Asia-Pacific region.

China Seed Market Insight

The China Seed market captured the largest revenue share within Asia-Pacific in 2024, supported by the country's significant agricultural sector, rising domestic food demand, and government initiatives promoting modern farming practices. Increasing adoption of fertilizers, pesticides, and genetically enhanced seeds to improve crop productivity and address soil degradation is driving market growth, particularly across cereals, fruits, and vegetables.

India Seed Market Insight

The India Seed market is experiencing rapid growth, fueled by rising demand for high-quality food production, government-led fertilizer subsidy programs, and growing awareness of crop protection. India's expanding farmland, coupled with efforts to improve yields and promote sustainable agriculture, is encouraging the widespread use of advanced Seed solutions across the country’s cereals, pulses, and horticulture sectors.

Which are the Top Companies in Seed Market?

The Seed industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Syngenta Crop Protection AG (Switzerland)

- Corteva (U.S.)

- Limagrain (France)

- KWS SAAT SE & Co. KGaA (Germany)

- East-West Seed (Netherlands)

- Land O'Lakes, Inc. (U.S.)

- Enza Zaden Global (Netherlands)

What are the Recent Developments in Global Seed Market?

- In August 2023, Bayer AG launched its herbicide-tolerant biotech corn variety, Dekalb DK95R, in Banggo village, located in the Manggalewa district of Dompu Regency, West Nusa Tenggara, Indonesia. This innovative corn variety is designed to enhance agricultural productivity by offering resistance to specific herbicides, allowing farmers to manage weeds more effectively and maximize yields in challenging growing conditions, contributing significantly to local farming communities

- In July 2023, Syngenta unveiled a new hybrid winter barley that exhibits tolerance to the barley yellowing virus (BYDV) and promises higher yields. This advancement aims to support farmers in achieving better crop performance despite the presence of this damaging virus, ensuring sustainable agricultural practices. The introduction of this hybrid is expected to enhance food security and provide economic benefits to barley producers by improving overall crop quality and productivity

- In July 2023, BASF expanded its Xitavo soybean seed portfolio by adding 11 new high-yielding varieties featuring the advanced Enlist E3 technology, specifically designed to combat difficult weeds for the 2024 growing season. This expansion allows farmers to select from a broader range of resilient soybean varieties, enhancing their ability to adapt to various environmental challenges, optimize yields, and contribute to sustainable agricultural practices in competitive markets

- In July 2022, Corteva Agriscience, BASF, and MS Technologies signed a significant agreement to develop next-generation Enlist E3 soybeans with a nematode-resistant soybean (NRS) trait, targeted at farmers in the United States and Canada. This collaboration aims to create improved soybean varieties that are resistant to nematodes and capable of enhancing crop yields, thereby addressing critical challenges in soybean farming and supporting farmer profitability in these regions

- In June 2022, a new range of tropicalized lettuce varieties, branded as Arunas RZ, was introduced to the market. This innovative product line is expected to significantly boost the company's market share by catering to the growing demand for versatile and climate-resilient vegetables. By offering varieties that thrive in tropical climates, the company aims to enhance consumer choice while supporting local agriculture and increasing food production capabilities

- In May 2022, Syngenta Canada launched the innovative Pelta seed pelleting technology designed specifically for canola seeds. This technology optimizes seed size and uniformity, enhancing planter performance during the sowing process. By improving singulation, Pelta technology aims to increase planting efficiency and crop establishment rates, ultimately leading to higher yields and better overall productivity for canola farmers, contributing to a more sustainable and profitable agricultural landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.