Global Serine Amino Acids Market

Market Size in USD Million

CAGR :

%

USD

164.83 Million

USD

258.78 Million

2024

2032

USD

164.83 Million

USD

258.78 Million

2024

2032

| 2025 –2032 | |

| USD 164.83 Million | |

| USD 258.78 Million | |

|

|

|

|

Serine Amino Acids Market Size

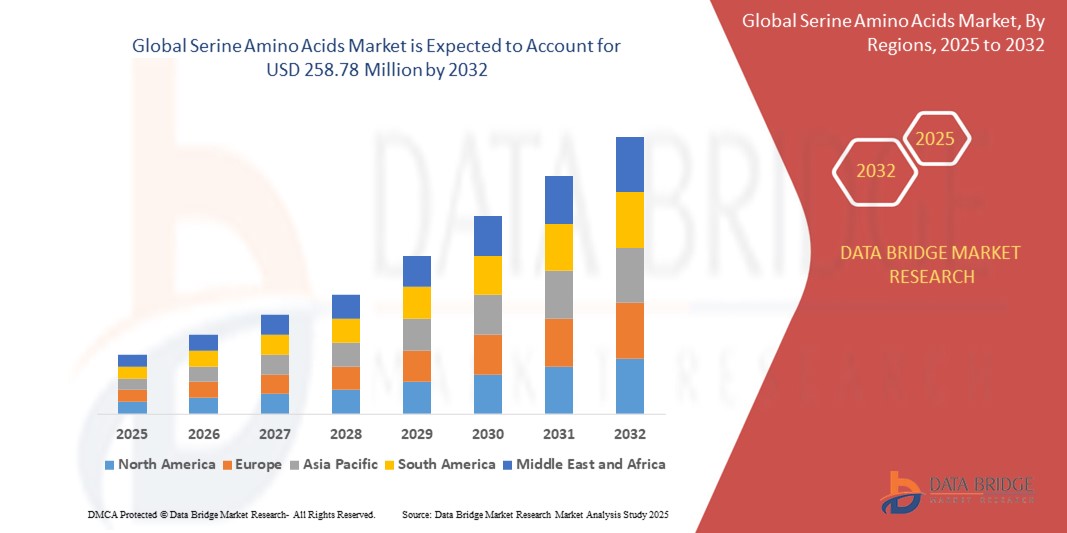

- The global serine amino acids market size was valued at USD 164.83 million in 2024 and is expected to reach USD 258.78 million by 2032, at a CAGR of 5.80 % during the forecast period

- This growth is driven by factors such as the rising demand for serine in pharmaceutical formulations, increasing applications in dietary supplements, and expanding use in cosmetic and personal care products

Serine Amino Acids Market Analysis

- The serine amino acids market is seeing consistent growth as it becomes increasingly vital in various sectors such as pharmaceuticals, nutrition, and cosmetics. The demand for high-quality amino acids has driven innovations in production methods, improving overall market dynamics

- Companies are expanding their research and development efforts to enhance the applications of serine amino acids in diverse products, contributing to a more competitive market landscape. These advancements are expected to sustain the positive momentum in the market over time

- North America is expected to dominate the serine amino acids market due to advanced pharmaceutical and nutraceutical industries, high demand for health and wellness products, and the presence of major market players.

- Asia-Pacific is expected to be the fastest growing region in the serine amino acids market during the forecast period due to increasing health consciousness, expanding demand for dietary supplements, and growing applications in the pharmaceutical and cosmetic industries

- L-Serine segment is expected to dominate the market with a market share of 41.5% due to its widespread use in pharmaceuticals, dietary supplements, and its essential role in protein synthesis and neurological health

Report Scope and Serine Amino Acids Market Segmentation

|

Attributes |

Serine Amino Acids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Serine Amino Acids Market Trends

“Increasing Incorporation of Serine into Functional Foods and Dietary Supplements”

- Serine is increasingly incorporated into functional foods and dietary supplements, aligning with the growing consumer demand for products that support cognitive health, muscle growth, and immune function

- For instance, recent dietary supplements with serine are gaining popularity in the market as more people turn to these products to enhance mental clarity and support overall wellness

- The rise in health-conscious consumers has led to a surge in demand for serine-enriched products, including protein bars, beverages, and capsules, catering to those seeking natural and functional ingredients

- For instance, a number of leading health supplement brands have started offering serine-based formulations aimed at improving muscle recovery post-exercise

- Athletes and fitness enthusiasts are turning to serine-based supplements for post-exercise recovery and muscle-building, further driving the market's expansion

- The increasing preference for plant-based diets has led to a higher demand for plant-derived amino acids such as serine, as consumers seek sustainable and health-conscious alternatives to animal-based proteins

Serine Amino Acids Market Dynamics

Driver

“Increasing Healthcare Spending and Research and Development Investments”

- The expanding pharmaceutical industry, driven by increasing healthcare spending and research and development investments, fuels the demand for serine amino acids in drug development and formulation

- For instance, the development of treatments for Alzheimer’s disease has seen a rise in serine-based drug formulations as they play a role in the production of important neurotransmitters

- Growing consumer awareness regarding the importance of nutrition and wellness boosts demand for serine-based nutritional supplements and functional foods. This trend is evident in the increasing number of serine-enriched products available in the market

- The thriving cosmetics industry, driven by changing consumer preferences and rising disposable incomes, creates opportunities for serine amino acids in skincare and haircare products. Serine's inclusion in anti-aging formulations is a testament to this trend

- Advances in biotechnology and genetic engineering techniques increase the demand for serine amino acids in cell culture media and biopharmaceutical production. These advancements have led to more efficient and cost-effective production processes

Opportunity

“Increasing Adoption of Biologics, Gene Therapies, and Personalized Medicine”

- The increasing adoption of biologics, gene therapies, and personalized medicine presents opportunities for serine amino acids in novel drug formulations and therapeutic interventions

- For instance, serine is being explored in personalized treatments for neurological conditions such as Parkinson’s and dementia as part of targeted therapies

- The growing trend towards functional foods and dietary supplements with added health benefits creates opportunities for incorporating serine amino acids into innovative food and beverage formulations.

- For instance, Vital Proteins and Garden of Life have developed functional food products with amino acids such as serine, catering to consumers looking for brain-boosting benefits

- For instance, major supplement brands such as NOW Foods and Swanson Health Products have introduced serine-enriched capsules aimed at cognitive health and energy support

- The development of eco-friendly and sustainable manufacturing processes for serine amino acids using biotechnology or enzymatic synthesis opens up new opportunities for market growth. Companies investing in green synthesis technologies are likely to gain a competitive edge

- The expansion of the pharmaceutical and cosmetics industries in emerging markets offers untapped opportunities for serine amino acid manufacturers to expand their geographical presence. The rising disposable income and health awareness in these regions are driving the demand for serine-based products

Restraint/Challenge

“Stringent regulatory requirements and quality standards”

- Stringent regulatory requirements and quality standards in the pharmaceutical and cosmetics industries pose challenges for market players in terms of compliance and product certification

- For instance, the Food and Drug Administration (FDA) enforces strict guidelines for the approval of new amino acid-based supplements, requiring extensive clinical trials before approval

- Fluctuations in raw material prices, particularly in the production of serine amino acids through fermentation or chemical synthesis, can impact production costs and profit margins for manufacturers

- For instance, the rising cost of raw materials such as corn and soybeans can drive up the cost of fermentation processes used in amino acid production

- Competition from alternative amino acids or synthetic substitutes in pharmaceutical formulations and personal care products limits market growth potential for serine amino acids. Synthetic serine, produced more cost-effectively through chemical methods, poses a competitive challenge to natural serine sources used in high-end supplements and cosmetics.

- Disruptions in the global supply chain, such as trade barriers, logistics challenges, and raw material shortages, can affect the availability and pricing of serine amino acids

Serine Amino Acids Market Scope

The market is segmented on the basis type, application, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By Distribution Channel |

|

In 2025, the dietary supplements are projected to dominate the market with a largest share in application segment

The dietary supplements segment is expected to dominate the serine amino acids market with the largest share of 38.5% in 2025 due to its increasing consumer awareness of health and wellness, leading to a higher demand for amino acid-based supplements.

The L-Serine is expected to account for the largest share during the forecast period in type market

In 2025, the L-Serine segment is expected to dominate the market with the largest market share of 41.5% due to its critical role in biological processes, including neurotransmitter production, and its widespread use in pharmaceuticals, dietary supplements, and cosmetics.

Serine Amino Acids Market Regional Analysis

“North America Holds the Largest Share in the Serine Amino Acids Market”

- North America is the dominating region in the serine amino acids market due to its established pharmaceutical and nutraceutical industries and high consumer awareness

- The region benefits from strong healthcare infrastructure and early adoption of amino acid-based therapies across dietary supplements and medical treatments

- High demand from food and beverage manufacturers for clean-label, functional ingredients has driven consistent market expansion

- Strong presence of leading players and consistent research and development investments continue to reinforce North America's leading market position

“Asia-Pacific is Projected to Register the Highest CAGR in the Serine Amino Acids Market”

- Asia-Pacific is the fastest growing region in the serine amino acids market due to rising healthcare spending and expanding middle-class population

- The growth in dietary supplement consumption, especially in countries such as India, China, and South Korea, is rapidly accelerating market demand

- Increased use of serine in cosmetics and functional foods aligns with the regional trend toward health-conscious and beauty-focused lifestyles

- Government support for biotech production and domestic manufacturing is fuelling local capacity and reducing reliance on imports, further boosting growth

Serine Amino Acids Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ajinomoto Co., Inc. (Japan)

- CJ CheilJedang Corporation (South Korea)

- Evonik Industries AG (Germany)

- Kyowa Hakko Bio Co., Ltd. (Japan)

- Sumitomo Chemical Company, Limited (Japan)

- Meihua Holdings Group Co., Ltd. (China)

- Shine Star (Hubei) Biological Engineering Co., Ltd. (China)

- Cargill, Incorporated (U.S.)

- Royal DSM N.V. (Netherlands)

Latest Developments in Global Serine Amino Acids Market

- In April 2023, EverGrain, AB InBev’s sustainable ingredient business, launched FȲTA, a sports nutrition powder line made from upcycled barley protein. Developed over nearly a decade, FȲTA utilizes EverPro, a barley protein with high solubility and low viscosity, enhancing taste and absorption. Each serving offers 30g of protein, 3g of fiber, and 1g of added sugar, without artificial ingredients. Initially available online in chocolate, vanilla, and café latte flavours, FȲTA aims to upcycle over 6,000 metric tons of barley annually, promoting sustainability and meeting growing consumer demand for plant-based performance products

- In September 2021, Element Nutritional Sciences, now known as Promino Nutritional Sciences, announced the launch of JAKTRX Pro Amino, a plant-based sports nutrition product under its JAKTRX brand. This innovative formulation aims to enhance muscle protein synthesis by 76%, surpassing the 35% increase associated with traditional whey protein. The product is designed to support muscle health and recovery, catering to athletes seeking effective and sustainable nutrition solutions. By offering a plant-based alternative, JAKTRX Pro Amino aligns with the growing consumer preference for clean-label and environmentally friendly products. The introduction of this product is expected to impact the sports nutrition market by providing a high-performance, plant-based option that meets the needs of health-conscious consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Serine Amino Acids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Serine Amino Acids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Serine Amino Acids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.