Global Sleeve Labels Market

Market Size in USD Billion

CAGR :

%

USD

15.88 Billion

USD

24.19 Billion

2024

2032

USD

15.88 Billion

USD

24.19 Billion

2024

2032

| 2025 –2032 | |

| USD 15.88 Billion | |

| USD 24.19 Billion | |

|

|

|

|

Sleeve Labels Market Size

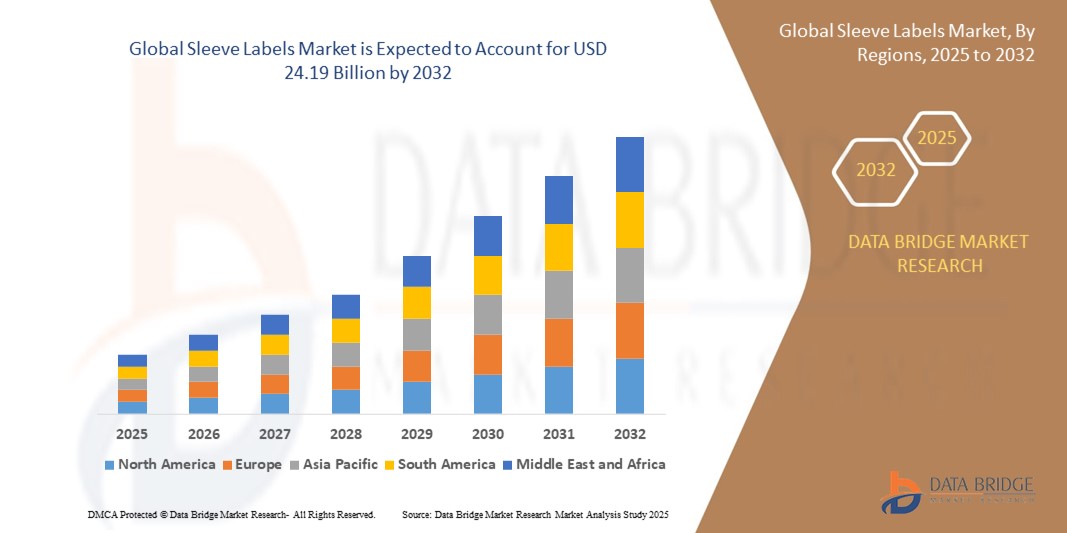

- The global sleeve labels market size was valued at USD 15.88 billion in 2024 and is expected to reach USD 24.19 billion by 2032, at a CAGR of 5.40% during the forecast period

- Market growth is primarily driven by the increasing demand for visually appealing and durable product packaging, particularly in the food & beverage, personal care, and household products industries, where sleeve labels offer 360-degree branding and tamper-evident features

- In addition, the rising adoption of shrink and stretch sleeve technologies—owing to their versatility in labeling complex container shapes—is accelerating the global uptake of sleeve labels, especially among FMCG manufacturers and beverage brands aiming for product differentiation and shelf appeal

Sleeve Labels Market Analysis

- Sleeve labels continue to gain momentum across key industries—including food & beverages, personal care, pharmaceuticals, and household products—due to their ability to offer 360-degree branding, tamper resistance, and compatibility with a wide range of container shapes. In 2025, sleeve labels are estimated to account for approximately 18.2% of the global labeling market

- The widespread adoption of shrink sleeve labels, which held a market share of 65.3% within the sleeve label segment in 2025, is driven by their superior conformity, high-resolution print quality, and suitability for complex packaging designs. Meanwhile, stretch sleeve labels are gaining moderate traction due to their recyclability and cost-efficiency, holding the remaining 34.7% of the sleeve labels segment

- Asia-Pacific dominates the global sleeve labels market with a market share of 43.6% in 2025, led by China, India, and Southeast Asia, where rising consumer product demand and rapid urbanization are boosting packaging volumes. Regional manufacturers are scaling up production capabilities and incorporating eco-friendly substrates to meet both domestic and international standards

- North America is projected to be the fastest-growing regional market, expected to grow at a CAGR above 6%, and holding a 21.4% market share in 2025. Growth is supported by innovations in digital printing, an increasing shift toward recyclable label materials, and strong demand from craft beverage, health & wellness, and organic food sectors

- The food and beverage industry remains the largest end-user segment, accounting for over 49.8% of the global sleeve labels market in 2025, owing to the need for tamper-evident, high-impact, and moisture-resistant labeling. The personal care & cosmetics sector follows, driven by premium product presentation and brand differentiation strategies

Report Scope and Sleeve Labels Market Segmentation

|

Attributes |

Sleeve Labes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Sleeve Labels Market Trends

“Innovation, Sustainability, and Market Diversification Drive Growth”

- One of the most prominent trends in the global sleeve labels market is the integration of hybrid printing technologies, combining flexographic, gravure, and digital systems to enable short-run variability, high-resolution graphics, and multi-material compatibility. These innovations are particularly beneficial for product categories like personal care and craft beverages, where unique, limited-edition packaging is a key selling point

- For instance, in August 2024, HP Indigo partnered with Constantia Flexibles to develop a new generation of digitally printed shrink sleeves using sustainable inks and recyclable substrates—offering converters the flexibility to meet varying regional compliance and branding needs

- Brand owners and packaging converters are increasingly investing in smart sleeve labels, incorporating QR codes, RFID tags, and NFC technology for product authentication, consumer engagement, and traceability. In June 2024, Unilever began using interactive smart sleeves on its personal care lines in Southeast Asia, allowing consumers to scan packaging for product details, promotions, and recycling instructions

- Geographic diversification and nearshoring are emerging trends as companies seek to reduce logistics costs and mitigate supply chain disruptions. For instance, Bonset America Corporation expanded its shrink film manufacturing operations in Mexico in late 2023, improving delivery capabilities for North American clients while reducing carbon emissions linked to long-haul transport

- The market is also witnessing a shift toward mono-material sleeve labels, which simplify recycling processes by eliminating multi-layer barriers. In 2024, Nestlé adopted a mono-material shrink sleeve design for several of its bottled water brands in Europe, aligning with EU packaging directives and reducing packaging complexity

- Collaborative innovation between CPG brands and label converters is fostering the development of sleeve labels that support circular economy goals. In early 2025, PepsiCo and Berry Global co-developed a sleeve label made from 30% post-consumer recycled (PCR) PETG film, targeting a closed-loop packaging model for ready-to-drink beverages in North America

- These trends point to a future where material science, supply chain agility, and connected packaging converge to reshape the competitive landscape. Stakeholders that align with these shifts—through sustainability, digital integration, and customer-focused innovation—are best positioned to thrive in the evolving sleeve labels market.

Sleeve Labels Market Dynamics

Driver

“Rising Demand from FMCG, Personal Care, and Sustainable Packaging Sectors”

- The expanding global consumption of packaged goods across food & beverage, personal care, pharmaceuticals, and household products is a primary driver boosting the demand for sleeve labels. Sleeve labels offer full-body, high-impact branding and tamper-evident packaging, making them preferred choices for premium and mid-tier product segments

- For instances, in February 2024, Procter & Gamble announced increased adoption of shrink sleeve labels across its personal care portfolio to enhance shelf visibility and consumer engagement in emerging markets like India and Latin America

- The global push towards sustainable and recyclable packaging is propelling demand for sleeve labels made from mono-material films and eco-friendly adhesives, which align with brand owners’ sustainability commitments and comply with tightening packaging regulations worldwide

- Growth in e-commerce and direct-to-consumer product shipments is further accelerating sleeve label adoption due to their durability, tamper resistance, and high-quality graphics, which improve unboxing experiences and reduce product returns

- Technological advancements such as digital printing and automated inspection systems are enabling cost-effective short runs and mass customization, expanding sleeve labels’ appeal to niche product lines and seasonal promotions

- The rising popularity of premium beverages, craft drinks, and health & wellness products in regions like North America and Asia-Pacific is increasing the demand for innovative sleeve labeling solutions that offer differentiation and brand storytelling.

Restraint/Challenge

“High Production Costs, Material Complexity, and Recycling Challenges”

- A significant challenge in the sleeve labels market is the higher production cost relative to traditional pressure-sensitive or wrap-around labels, especially when using specialty films and high-quality adhesives. This limits adoption among cost-sensitive product categories and small manufacturer

- For instances, fluctuating prices of PETG, PVC, and biodegradable films—key substrates for sleeve labels—create pricing volatility and margin pressure on converters and brand owners, particularly amid raw material supply chain disruptions in 2022–2024

- The complexity of recycling multi-layer sleeve labels—which often combine different polymers, inks, and adhesives—presents a major sustainability challenge. Many recycling facilities lack the capability to process these materials efficiently, leading to increased environmental concerns and regulatory scrutiny

- Regulatory frameworks like the European Union’s Packaging and Packaging Waste Directive are enforcing stricter compliance, mandating recyclability and eco-design, which requires substantial R&D investments for sleeve label producers to innovate sustainable solutions

- The capital-intensive nature of advanced sleeve label production equipment, including digital presses and automated inspection lines, poses barriers to entry for smaller converters and restricts capacity expansion in emerging markets

- In addition, consumer awareness and demand for sustainable packaging are still evolving, and some regions exhibit slower adoption rates due to cost sensitivity and lack of recycling infrastructure, restraining global market penetration

Sleeve Labels Market Scope

The market is segmented on the basis of type, material type, printing technology, ink, application, and end use.

By Type

On the basis of type, the Sleeve Labels market is segmented into stretch sleeves and shrink sleeves. The Shrink Sleeves segment dominates the largest market revenue share in 2025, driven by its superior conformability to various container shapes, excellent tamper-evident properties, and high-impact visual appeal. Shrink sleeves are widely used in the food and beverage industries for their 360-degree branding capabilities and durability during transportation and handling

The Stretch Sleeves segment is anticipated to witness steady growth due to its cost-effectiveness and increasing adoption in specialty packaging applications requiring flexibility and ease of application

• By Material Type

On the basis of material type, the Sleeve Labels market is segmented into polythene terephthalate glycol (PETG), polyvinyl chloride (PVC), oriented polystyrene (OPS), polypropylene (PP), polyethylene (PE), and others. The PETG segment holds the largest market revenue share in 2025, owing to its excellent clarity, shrink performance, and recyclability, making it a preferred choice in premium beverage and personal care packaging

The Polyvinyl Chloride (PVC) segment is expected to witness significant demand due to its cost-effectiveness and versatility in labeling applications across food and household products

• By Printing Technology

On the basis of printing technology, the Sleeve Labels market is segmented into gravure, flexographic, offset, digital, and letterpress. The Gravure printing segment led the market revenue share in 2025, favored for its ability to produce high-quality, consistent prints at high volumes, especially for large-scale beverage and consumer goods packaging

The Digital printing segment is expected to experience the fastest CAGR from 2025 to 2032, driven by growing demand for short runs, customization, and rapid turnaround times in specialty and limited-edition product packaging

• By Ink

On the basis of ink, the sleeve labels market is segmented into water-based, solvent-based, and UV. The Water-based ink segment dominated the market in 2025 due to its environmental benefits, lower VOC emissions, and compatibility with recyclable sleeve materials, aligning with global sustainability initiatives

The UV ink segment is forecasted to witness robust growth, attributed to its superior print durability, fast curing times, and enhanced resistance to abrasion and chemicals in industrial and personal care applications

• By Application

On the basis of application, the Sleeve Labels market is segmented into pressure sensitive, heat transfer, in-mould, heat-shrink and stretch, and glue-applied. The Heat-Shrink and Stretch segment held the largest market revenue share in 2025, driven by its ability to provide full-body coverage, tamper evidence, and design versatility

The Pressure Sensitive segment is expected to register the fastest growth rate, favored for its ease of application and growing use in retail and pharmaceutical sectors

• By End Use

On the basis of end use, the Sleeve Labels market is segmented into food, beverages, pharmaceuticals, personal care and home care, chemicals, and others. The Beverages segment accounted for the largest market revenue share in 2025, owing to the widespread use of sleeve labels on bottles and cans to enhance brand visibility and consumer appeal

The Personal Care and Home Care segment is anticipated to witness the fastest growth, driven by increasing demand for innovative, sustainable packaging solutions in cosmetics, toiletries, and cleaning products

Sleeve Labels Market Regional Analysis

- Asia-Pacific dominates the global Sleeve Labels market, accounting for the largest revenue share of 43.6% in 2025, driven by rapid industrialization, urbanization, and rising consumer demand in countries such as China, India, Japan, and Southeast Asian nations. The region benefits from a strong manufacturing base in packaging, beverages, personal care, and pharmaceuticals, supported by cost-effective production and expanding retail sectors

- In addition, significant investments in advanced printing technologies, sustainable materials, and label application equipment are accelerating market growth. Major regional players, including Avery Dennison and Berry Global, are expanding their footprint through capacity enhancements and strategic partnerships to serve growing domestic and export markets. The increasing adoption of innovative sleeve labeling solutions for branding, product differentiation, and anti-counterfeiting in fast-growing sectors such as FMCG and e-commerce further fuels demand

- The regional market is also supported by favorable government policies encouraging packaging industry modernization, environmental sustainability, and digital transformation. Enhanced recycling infrastructure and rising consumer awareness around eco-friendly packaging, especially in countries like Japan and South Korea, are propelling demand for recyclable and biodegradable sleeve labels, aligning with global circular economy initiatives

Japan Sleeve Labels Market Insight

The Japan Sleeve Labels market is driven by the country’s advanced manufacturing capabilities, high consumer demand for premium packaging, and a strong presence of electronics, automotive, and pharmaceuticals industries. Japanese companies are focusing on innovative sleeve label materials and printing technologies to meet niche application requirements such as tamper-evident and smart labels. In addition, Japan’s increasing commitment to sustainability and circular economy initiatives is fostering the adoption of eco-friendly, recyclable sleeve materials with improved performance and environmental compatibility

China Sleeve Labels Market Insight

The China Sleeve Labels market is expected to dominate the Asia-Pacific region, propelled by the country’s expansive packaging sector, large-scale production facilities, and rapid urbanization driving demand for consumer goods. China’s investment in automated printing technologies and capacity expansion for high-quality sleeve label materials, including PETG and PVC, supports growing domestic and export markets. Leading manufacturers are upgrading production lines to supply innovative, sustainable sleeve labels that meet evolving regulatory standards and consumer preferences across food, beverage, and personal care industries

North America Sleeve Labels Market Insight

The North America Sleeve Labels market is witnessing robust growth, fueled by strong demand from the food and beverage, pharmaceutical, and personal care sectors. Increasing use of stretch and shrink sleeve labels for brand differentiation and tamper evidence is a key driver. Technological advancements in digital printing and water-based inks are enhancing product customization and environmental compliance. The presence of major players investing in R&D and sustainable packaging solutions is further expanding product portfolios to meet consumer expectations and regulatory requirements

U.S. Sleeve Labels Market Insight

The U.S. Sleeve Labels market holds the largest share in North America in 2025, supported by mature packaging industries, advanced manufacturing infrastructure, and rising adoption of innovative printing technologies like digital and flexographic printing. Growing consumer preference for visually appealing and sustainable packaging is increasing demand for eco-friendly inks and recyclable substrates. Continuous investments in supply chain optimization and sustainability initiatives are strengthening domestic production capabilities and export potential

Europe Sleeve Labels Market Insight

The Europe Sleeve Labels market is projected to grow steadily, driven by stringent regulations on packaging sustainability and increasing demand for recyclable and lightweight sleeve labels. Countries such as Germany, France, and the Netherlands are leading in the adoption of innovative materials like PETG and polypropylene and sustainable inks. Strategic partnerships between packaging manufacturers and brand owners are fostering new product developments tailored to food, beverage, and personal care industries. The focus on reducing environmental impact and enhancing product aesthetics is fueling regional market expansion

U.K. Sleeve Labels Market Insight

The U.K. Sleeve Labels market is gaining momentum due to rising demand from food and beverage, pharmaceutical, and personal care sectors. Manufacturers are increasingly adopting sustainable sleeve label materials and water-based inks to comply with green packaging mandates. The growth of e-commerce and premiumization of consumer goods is also driving demand for tamper-evident and decorative sleeve labels. Industry initiatives promoting circular economy principles and low-emission printing technologies are further propelling market development

Germany Sleeve Labels Market Insight

The Germany Sleeve Labels market is expanding significantly, driven by the country’s robust automotive, food and beverage, and pharmaceuticals industries, which utilize sleeve labels for branding, product safety, and information disclosure. German companies emphasize high-quality materials, precision printing, and innovative label application technologies to meet strict EU regulations and consumer demands. Growing investments in sustainable packaging and circular economy practices are enhancing market opportunities for eco-friendly sleeve solutions and advanced printing inks

Sleeve Labels Market Share

The sleeve labels industry is primarily led by well-established companies, including:

- Bemis Manufacturing Company (U.S.)

- Avery Dennison Corporation (U.S.)

- Berry Global Inc. (U.S.)

- Cenveo Worldwide Limited (U.S.)

- Constantia Flexibles (Austria)

- Intertape Polymer Group (Canada)

- Eastman Chemical Company (U.S.)

- Walmart (U.S.)

- Unilever (U.K.)

- Nestlé (Switzerland)

- Procter & Gamble (U.S.)

- PepsiCo (U.S.)

- The Coca-Cola Company (U.S.)

- Danone S.A. (France)

- Barry-Wehmiller Companies (U.S.)

- Taghleef Industries Group (U.A.E.)

- Bonset America Corporation (U.S.)

- Esko-Graphics BV (Belgium)

- CCL Industries (Canada)

- Flint Group (Luxembourg)

Latest Developments in Global Sleeve Labels Market

- In August 2024, Siegwerk, Multi-Plastics, and Tripack collaborated to launch APR-approved fully recyclable shrink sleeves for PET water bottles. This breakthrough packaging solution, presented at Label Expo Americas 2024, integrates Multi-Plastics' Envirocycle PET shrink sleeve film, Siegwerk's CIRKIT de-inking primer and SICURA Orbis ink technology, and Tripack's expertise in application. The innovation enhances recyclability while preserving packaging quality

- In April 2024, Nestlé USA announced a major sustainability initiative by transitioning its Nesquik ready-to-drink bottles to recyclable shrink sleeve labels. These labels incorporate light-blocking print technology, ensuring compatibility with the U.S. recycling stream while maintaining product quality. The move supports consumer demand for eco-friendly packaging and aims to make 4,500 metric tons of PET plastic easier to recycle annually

- In February 2024, CCL Industries introduced EcoFloat WHITE, a low-density polyolefin shrink sleeve designed to enhance recyclability. This innovation supports the shift from HDPE to PET packaging, particularly in the food and beverage industry, by offering functional product decoration for light-sensitive products. The sleeve material enables float separation during recycling, increasing the yield of high-quality, food-grade PET flakes

- In October 2023, Cymmetrik Group expanded its sleeve labels division by establishing a new plant in Zhejiang. This facility utilizes inline flexographic printing technology, replacing traditional gravure printing to enhance efficiency and sustainability. The Zhejiang plant focuses on high-end sleeve label production, including shrink sleeves and wraparound labels, supporting the company’s diversification strategy

- In September 2021, Huhtamaki Oyj completed the acquisition of Elif Holding A.Ş., a major player in sustainable flexible packaging. This strategic move strengthens Huhtamaki’s flexible packaging business, particularly in emerging markets, and reinforces its position as a leading provider of innovative and sustainable packaging solutions for global FMCG brands. The acquisition includes Elif’s operations in Turkey and Egypt, expanding Huhtamaki’s market reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sleeve Labels Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sleeve Labels Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sleeve Labels Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.