Global Smart Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

26.17 Billion

2024

2032

USD

8.50 Billion

USD

26.17 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 26.17 Billion | |

|

|

|

|

Smart Diabetes Management Market Size

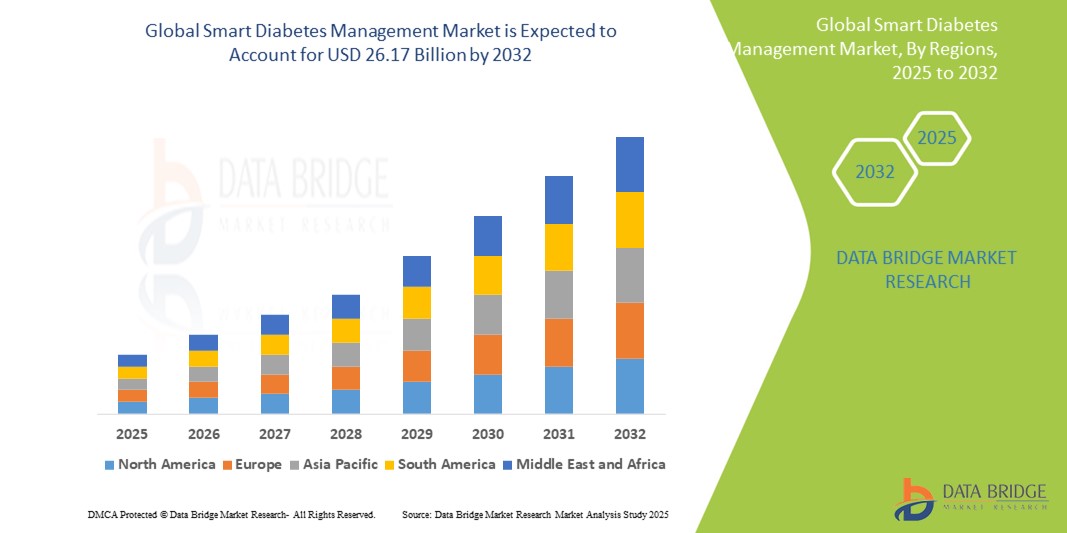

- The global smart diabetes management market size was valued at USD 8.55 billion in 2024 and is expected to reach USD 26.17 billion by 2032, at a CAGR of 15.00% during the forecast period

- The market growth is largely fuelled by the growing adoption and technological progress within continuous glucose monitoring (CGM) devices, insulin pumps, and digital health platforms, leading to increased digitalization in both personal diabetes management and clinical care settings

- Furthermore, rising consumer (patient) and healthcare provider demand for secure, user-friendly, and integrated solutions for real-time glucose tracking, automated insulin delivery, and data-driven insights is establishing smart diabetes management solutions as the modern standard of care. These converging factors are accelerating the uptake of Smart diabetes management solutions, thereby significantly boosting the industry's growth

Smart Diabetes Management Market Analysis

- Smart Diabetes Management solutions, encompassing advanced devices such as continuous glucose monitors (CGMs), smart insulin pens, insulin pumps, and digital health applications, are increasingly vital components of modern diabetes care due to their enhanced real-time data tracking, personalized insights, remote monitoring capabilities, and seamless integration with healthcare ecosystems

- The escalating demand for smart diabetes management solutions is primarily fueled by the rising global prevalence of diabetes, growing awareness of its complications, and a rising preference for technology-driven, convenient, and proactive approaches to disease management

- North America dominated the smart diabetes management market with the largest revenue share of 37.7% in 2024. This is characterized by the high prevalence of diabetes, significant healthcare spending, favorable reimbursement policies for smart devices, and a strong presence of key industry players and innovators

- Asia-Pacific is expected to be the fastest-growing region in the smart diabetes management market during the forecast period, driven by increasing urbanization, a rapidly rising diabetic population, growing disposable incomes, and increasing government initiatives promoting digital health and access to advanced diabetes care technologies

- Continuous glucose monitoring systems segment dominated the smart diabetes management market, with a market share of 42.6% in 2024. This dominance is driven by the critical need for real-time, continuous monitoring of glucose levels, which provides individuals with diabetes and their healthcare providers with essential data to manage their condition more effectively, reduce hypoglycemic events, and improve overall glycemic control

Report Scope and Smart Diabetes Management Market Segmentation

|

Attributes |

Smart Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Diabetes Management Market Trends

“Enhanced Convenience in Smart Diabetes Management”

- A significant and accelerating trend in the global smart diabetes management market is the deepening integration with advanced Artificial Intelligence (AI) and intuitive voice-controlled interfaces. This fusion of technologies is profoundly enhancing convenience and ease of use for individuals managing diabetes and their healthcare providers

- For instance, digital health platforms and smart glucose meters are increasingly incorporating voice commands, allowing users to log meals, exercise, or insulin doses simply by speaking. Similarly, AI-powered virtual assistants within diabetes apps can offer personalized insights, answer common queries about glucose trends, or provide medication reminders through verbal interactions, offering a discreet and hands-free solution

- AI integration in smart diabetes management enables features such as learning individual glucose patterns to proactively suggest insulin adjustments or meal timing, and providing more intelligent alerts based on real-time data. For instance, some advanced systems utilize AI to improve the accuracy of glucose prediction algorithms over time and can send intelligent alerts if unusual or concerning glucose trends are detected, allowing for timely intervention. Furthermore, voice control capabilities offer users the ease of hands-free operation, allowing them to record vital information or receive guidance using simple verbal commands, which is especially beneficial when dealing with blood glucose readings or insulin delivery

- ·The seamless integration of smart diabetes devices with digital health assistants and broader healthcare platforms facilitates centralized control over various aspects of diabetes self-management. Through a single interface, users can manage their glucose data, insulin delivery, medication schedules, and even share insights with their care teams, creating a unified and automated health management experience

- This trend towards more intelligent, intuitive, and interconnected diabetes management systems is fundamentally reshaping user expectations for chronic disease care. Consequently, companies are developing AI-enabled smart diabetes solutions with features such as automated insulin delivery adjustments based on predictive analytics and comprehensive voice interaction compatibility for enhanced user experience

- The demand for smart diabetes management solutions that offer seamless AI and voice control capabilities is growing rapidly across patient populations and healthcare systems, as users increasingly prioritize convenience, personalized insights, and comprehensive disease management functionality

Smart Diabetes Management Market Dynamics

Driver

“Growing Need Due to Rising Diabetes Prevalence and Technological Advancements”

- The increasing global prevalence of diabetes (both Type 1 and Type 2), coupled with the accelerating pace of technological advancements in continuous glucose monitoring (CGM) systems, insulin delivery devices (smart pens and pumps), and digital health platforms, is a significant driver for the heightened demand for Smart Diabetes Management solutions

- For instance, as of early 2025, major diabetes technology companies are continuously innovating, integrating AI-powered analytics and enhanced connectivity into their devices. Such strategies by key companies are expected to drive the Smart Diabetes Management industry growth in the forecast period, by offering more precise, personalized, and proactive care

- As individuals with diabetes and healthcare providers become more aware of the benefits of real-time data, predictive insights, and automated functionalities, smart diabetes solutions offer advanced features such as continuous glucose monitoring, automated insulin delivery, personalized dose recommendations, and remote data sharing, providing a compelling upgrade over traditional, manual diabetes management methods

- Furthermore, the growing popularity of value-based care models and the desire for improved patient outcomes and reduced healthcare costs are making smart diabetes management solutions an integral component of comprehensive diabetes care, offering seamless integration with electronic health records (EHRs) and telehealth platforms

- The convenience of continuous, less invasive monitoring, simplified insulin dosing, remote support from healthcare professionals, and the ability to manage the condition through integrated smartphone applications are key factors propelling the adoption of smart diabetes management tools in both developed and developing regions. The trend towards personalized medicine and the increasing availability of user-friendly Smart Diabetes Management options further contributes to market growth

Restraint/Challenge

“Concerns Regarding Data Security, High Initial Costs, and Interoperability”

- Concerns surrounding data security vulnerabilities in smart diabetes management platforms pose a significant restraint to wider market adoption. As these systems often rely on cloud-based storage, mobile applications, and data sharing across platforms, they are susceptible to cybersecurity risks such as hacking, unauthorized access, and breaches of sensitive health information

- High-profile incidents involving data leaks and growing scrutiny over compliance with HIPAA, GDPR, and other data protection regulations have made patients and healthcare providers more cautious about adopting smart diabetes tools, especially those lacking end-to-end encryption, secure authentication, or transparent privacy policies

- Furthermore, the high initial cost of advanced diabetes management devices, such as continuous glucose monitors (CGMs), smart insulin pumps, and closed-loop systems, can act as a barrier—particularly in price-sensitive markets or regions with limited insurance coverage. In addition to device costs, there may be ongoing expenses for app subscriptions, software updates, and data syncing services

- While companies are increasingly offering bundled or value-based pricing, the cost-to-benefit perception can still deter adoption among users who are either newly diagnosed or managing diabetes through traditional methods such as manual glucose logs or basic meters

- Interoperability challenges further complicate adoption, as not all smart diabetes devices and apps integrate seamlessly with electronic health records (EHRs), telemedicine platforms, or each other. Patients and providers often face difficulties syncing data across different brands or systems, resulting in fragmented insights and reduced effectiveness of holistic diabetes management

Smart Diabetes Management Market Scope

The market is segmented on the basis of devices, device type, application, diabetes type, and end use.

- By Devices

On the basis of devices, the smart diabetes management market is segmented into smart glucose meters, continuous glucose monitoring systems (CGM), smart insulin pens, smart insulin pumps, and closed loop systems. The continuous glucose monitoring systems (CGM) segment dominated the largest market revenue share of 42.6% in 2024, driven by its unparalleled ability to provide real-time, continuous glucose data, significantly improving glycemic control and reducing the burden of finger-prick testing. The increasing adoption of CGM, particularly in Type 1 and intensifying Type 2 diabetes management, is a primary driver.

The closed loop systems segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for automated insulin delivery systems that integrate CGM and insulin pump data, offering near-complete automation of diabetes management and vastly improving quality of life for users.

- By Device Type

On the basis of device type, the smart diabetes management market is segmented into handheld devices and wearable devices. The wearable devices segment held the largest market revenue share in 2024 and is also expected to witness the fastest CAGR from 2025 to 2032. This dominance is driven by the widespread adoption of continuous glucose monitors (CGMs) and wearable insulin pumps, which offer convenience, continuous data, and seamless integration with digital health platforms. Wearable solutions enhance patient adherence and provide real-time insights without constant user intervention.

- By Application

On the basis of application, the smart diabetes management market is segmented into diabetes and blood glucose tracking apps, and obesity and diet management apps. The diabetes and blood glucose tracking apps segment held the largest market revenue share in 2024, driven by the ubiquitous use of smartphones and the convenience of managing diabetes data through dedicated mobile applications. These apps offer features such as glucose logging, insulin tracking, carbohydrate counting, activity monitoring, and data visualization, making them highly versatile and user-friendly for daily diabetes management.

The obesity and diet management apps segment is expected to witness the fastest CAGR of 17.4% from 2025 to 2032, supported by the rising global prevalence of obesity, increasing awareness of lifestyle-related chronic conditions, and a growing shift toward preventive health through diet-focused digital tools.

- By Diabetes

On the basis of diabetes type, the smart diabetes management market is segmented into type 1 diabetes and type 2 diabetes. The type 2 diabetes segment accounted for the largest market revenue share in 2024, driven by the significantly higher global prevalence of Type 2 diabetes. The increasing focus on managing the growing population with Type 2 diabetes through digital health interventions, lifestyle modifications, and medication adherence support propels the demand for smart management solutions tailored to this group.

The type 1 diabetes segment is projected to register the fastest CAGR of 15.9% from 2025 to 2032, driven by technological advancements in closed-loop insulin delivery systems, CGMs, and growing demand for personalized, data-driven diabetes care among younger patients and pediatric populations.

- By End Use

On the basis of end use, the smart diabetes management market is segmented into home healthcare, hospitals, and specialty diabetes clinics. The home healthcare segment accounted for the largest market revenue share in 2024, driven by the increasing shift towards patient self-management and remote monitoring. Smart diabetes devices and apps empower individuals to manage their condition effectively from home, reducing the need for frequent clinic visits and improving convenience. The expansion of telehealth services further supports this segment's growth.

The specialty diabetes clinics segment is expected to witness a significant CAGR from 2025 to 2032, driven by the increasing need for specialized care, data-driven insights for clinical decision-making, and the integration of smart device data into professional care workflows within dedicated diabetes centers.

Smart Diabetes Management Market Regional Analysis

- North America dominated the smart diabetes management market, holding a revenue share of 37.7% in 2024. This leadership position is primarily driven by a high prevalence of diabetes, significant healthcare expenditure, advanced healthcare infrastructure, and a robust ecosystem for medical technology innovation and adoption

- Consumers and healthcare providers in the region highly value the enhanced convenience, real-time data insights, and seamless integration offered by smart diabetes devices such as continuous glucose monitors (CGMs), smart insulin pumps, and digital health applications. These solutions are crucial for effective disease management, improving patient outcomes, and enabling personalized care

- This widespread adoption is further supported by favorable reimbursement policies, high disposable incomes, a strong emphasis on preventive care and remote patient monitoring, and a technologically advanced patient base, establishing smart diabetes management solutions as a favored approach for both individual self-management and integrated clinical care

U.S. Smart Diabetes Management Market Insight

The U.S. smart diabetes management market held the largest revenue share within North America in 2024. This market is fueled by the high prevalence of diabetes, robust healthcare expenditure, strong demand for advanced diabetes management technologies, and favorable reimbursement policies for devices such as Continuous Glucose Monitors (CGMs) and insulin pumps. Consumers and healthcare providers are increasingly prioritizing proactive disease management and personalized care enabled by connected devices and digital platforms. The market also benefits from a strong presence of key technology developers and ongoing innovation in automated insulin delivery systems.

Europe Smart Diabetes Management Market Insight

The Europe smart diabetes management market is projected to expand at a substantial CAGR from 2025 to 2032. This growth is primarily driven by the increasing burden of diabetes, stringent healthcare regulations promoting digital health, and the escalating need for efficient chronic disease management across the continent. The rise in digitalization within European healthcare systems, coupled with growing awareness and acceptance of advanced diabetes technologies, is fostering the adoption of smart insulin delivery systems, CGMs, and integrated digital platforms. European consumers are also drawn to the improved convenience and better health outcomes these devices offer.

U.K. Smart Diabetes Management Market Insight

The U.K. smart diabetes management market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on improving diabetes care outcomes within the National Health Service (NHS) and a desire for enhanced patient self-management and convenience. In addition, concerns regarding the long-term complications of diabetes are encouraging both patients and healthcare providers to adopt advanced glucose monitoring and insulin management solutions. The UK’s embrace of digital health technologies, alongside its efforts to integrate health data, is expected to continue to stimulate market growth.

Germany Smart Diabetes Management Market Insight

The Germany smart diabetes management market is expected to expand at a considerable CAGR from 2025 to 2032. This growth is fueled by increasing awareness of the benefits of digital health in diabetes management and a strong demand for technologically advanced, patient-centric solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on innovation and high quality of care, promotes the adoption of smart diabetes devices, particularly in managing chronic conditions and enabling personalized treatment plans. The integration of these devices with digital health platforms is also becoming increasingly prevalent, aligning with local consumer and regulatory expectations for secure and privacy-focused healthcare.

Asia-Pacific Smart Diabetes Management Market Insight

The Asia-Pacific smart diabetes management market is poised to grow at the fastest CAGR of 15.07% from 2025 to 2032 driven by increasing urbanization, a rapidly expanding diabetic population, rising disposable incomes, and significant technological advancements in countries such as China, Japan, and India. The region's growing inclination towards digital health solutions, supported by government initiatives promoting healthcare digitalization and access to advanced medical technologies, is driving the adoption of smart diabetes management tools. Furthermore, as APAC emerges as a crucial manufacturing hub for medical devices, the affordability and accessibility of smart diabetes management solutions are expanding to a wider consumer base.

Japan Smart Diabetes Management Market Insight

The Japan smart diabetes management market is gaining momentum due to the country’s aging population, a significant burden of diabetes, and a demand for high-tech, convenient healthcare solutions. The Japanese market places a significant emphasis on precise disease management and improving patient quality of life, and the adoption of smart diabetes technologies is driven by the increasing integration of continuous glucose monitoring and automated insulin delivery into clinical practice. The integration of smart diabetes devices with other IoT-enabled health devices and electronic health records is fueling growth. Moreover, Japan's robust technological infrastructure is expected to spur demand for highly advanced, analytical smart diabetes solutions in both individual self-care and professional healthcare sectors.

China Smart Diabetes Management Market Insight

The China smart diabetes management market is a major contributor to the Asia-Pacific region, attributed to the country's vast population, expanding middle class, rapid urbanization, and high rates of technological adoption in healthcare. China stands as one of the largest markets for digital health solutions, and smart diabetes management platforms are becoming increasingly popular in addressing the healthcare needs of its massive diabetic population. The push towards digital health initiatives and the availability of increasingly sophisticated and affordable smart diabetes management options from strong domestic manufacturers are key factors propelling the market in China.

Smart Diabetes Management Market Share

The smart diabetes management industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- PHC Holdings Corporation (Japan)

- Welldoc, Inc. (U.S.)

- Sanofi (France)

- Dexcom, Inc. (U.S.)

- DarioHealth Corp. (U.S.)

- Medtronic (Ireland)

- B. Braun SE (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Insulet Corporation (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Tandem Diabetes Care, Inc. (U.S.)

- LifeScan IP Holdings, LLC (U.S.)

- AgaMatrix (U.S.)

- Glooko, Inc. (U.S.)

Latest Developments in Global Smart Diabetes Management Market

- In April 2023, Glooko, Inc. entered into a global partnership with Hedia, a developer of insulin-dosing algorithms, aiming to create an interoperable solution combining remote patient monitoring, connected care, and digital therapeutics for people with Type 1 and Type 2 diabetes

- In May 2023, Medtronic plc announced definitive agreements to acquire EOFlow Co. Ltd., known for their wearable insulin patches. This acquisition is designed to enhance Medtronic’s automated insulin delivery (AID) capabilities, simplifying therapeutic regimens for diabetes patients

- In April 2024, the Dexcom G7 15‑Day Continuous Glucose Monitoring System, with extended sensor wear and enhanced accuracy, received FDA approval. This builds on Dexcom’s momentum in fully interoperable CGMs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.