Global Smoked Salmon Market

Market Size in USD Billion

CAGR :

%

USD

9.66 Billion

USD

13.33 Billion

2024

2032

USD

9.66 Billion

USD

13.33 Billion

2024

2032

| 2025 –2032 | |

| USD 9.66 Billion | |

| USD 13.33 Billion | |

|

|

|

|

Smoked Salmon Market Size

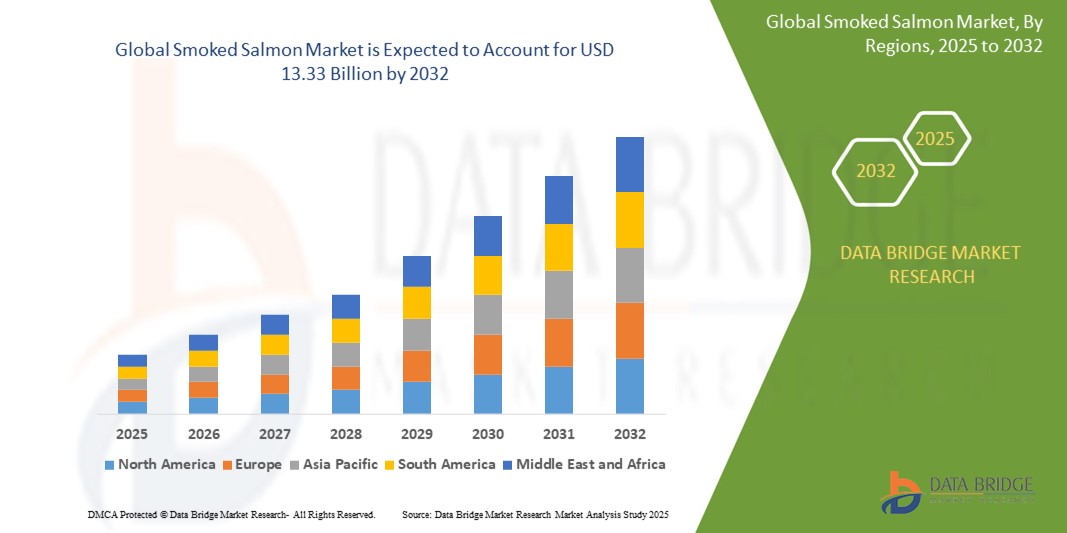

- The global smoked salmon market size was valued at USD 9.66 billion in 2024 and is expected to reach USD 13.33 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is primarily driven by increasing consumer demand for healthy, sustainable, and high-quality seafood, coupled with rising awareness of the nutritional benefits of smoked salmon, such as its high omega-3 fatty acid content

- The growing preference for convenient, ready-to-eat food products, along with the expansion of e-commerce and sustainable packaging innovations, is significantly boosting the adoption of smoked salmon across various consumer segments

Smoked Salmon Market Analysis

- Smoked salmon, a premium seafood product prepared by curing and smoking salmon fillets, is increasingly popular in both food service and retail sectors due to its rich flavor, nutritional benefits, and versatility in culinary applications

- The demand for smoked salmon is fueled by rising health consciousness, the growing popularity of gourmet and premium food products, and the increasing incorporation of seafood in global cuisines, such as sushi, salads, and appetizer

- Europe dominated the smoked salmon market with the largest revenue share of 46.3% in 2024, driven by its strong culinary tradition of smoked seafood, particularly in countries like Norway, Scotland, and the UK, where smoked salmon is a staple in both traditional and modern cuisines

- Asia-Pacific is expected to be the fastest-growing region in the smoked salmon market during the forecast period, propelled by increasing urbanization, rising disposable incomes, and growing consumer interest in Western cuisines and premium seafood products in countries like Japan, China, and South Korea

- The cold-smoked salmon segment dominated the largest market revenue share of 62.5% in 2024, driven by its delicate texture and raw-like taste, which are highly preferred by gourmet consumers for applications in sandwiches, salads, and sushi

Report Scope and Smoked Salmon Market Segmentation

|

Attributes |

Smoked Salmon Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smoked Salmon Market Trends

“Increasing Adoption of Sustainable Sourcing and Clean-Label Products”

- The global smoked salmon market is experiencing a notable trend toward sustainable sourcing and clean-label products

- Consumers are increasingly demanding transparency in production processes, driving companies to adopt eco-friendly fishing practices and traceable supply chains

- Advanced technologies, such as blockchain, are being integrated to provide consumers with detailed information about the salmon’s origin, processing, and certifications

- For instance, several brands are leveraging sustainability certifications such as MSC (Marine Stewardship Council) to appeal to environmentally conscious consumer

- This trend is enhancing the market’s appeal, particularly in Europe, the dominating region, where regulatory frameworks and consumer preferences prioritize sustainability

- Clean-label smoked salmon, free from artificial preservatives and additives, is gaining traction as health-conscious consumers seek minimally processed foods.

Smoked Salmon Market Dynamics

Driver

“Growing Consumer Preference for Healthy and Premium Food Products”

- Rising health awareness and the demand for nutrient-rich foods are key drivers for the global smoked salmon market

- Smoked salmon is valued for its high omega-3 fatty acids, protein content, and low-calorie profile, making it a popular choice among health-conscious consumer

- The increasing popularity of premium and gourmet food products, particularly in Europe, is boosting demand for high-quality smoked salmon varieties

- The expansion of e-commerce platforms and global trade is facilitating access to smoked salmon, enabling brands to reach new markets, especially in the Asia-Pacific, the fastest-growing region

- Foodservice industries, including restaurants and hotels, are incorporating smoked salmon into diverse cuisines, further driving market growth

- Retailers are also offering innovative packaging, such as vacuum-sealed and ready-to-eat portions, to cater to convenience-driven consumers

Restraint/Challenge

“High Production Costs and Regulatory Compliance Issues”

- The high cost of sustainable salmon farming, smoking processes, and compliance with stringent environmental regulations poses a significant barrier to market growth

- Maintaining consistent quality and adhering to certifications such as MSC or ASC increases production expenses, particularly for small-scale producers

- Data privacy concerns related to supply chain transparency tools, such as blockchain, and compliance with varying regional regulations create operational challenges

- The fragmented regulatory landscape across countries, especially in emerging markets such as Asia-Pacific, complicates standardization for global producers and exporters

- These factors can deter market entry for new players and limit expansion in cost-sensitive regions, where price competitiveness is critical

- In addition, concerns about overfishing and environmental impact may influence consumer perceptions, particularly in regions with high environmental awareness such as Europe

Smoked Salmon market Scope

The market is segmented on the basis of type, species, application, and distribution channel.

- By Type

On the basis of type, the global smoked salmon market is segmented into cold-smoked salmon and hot-smoked salmon. The cold-smoked salmon segment dominated the largest market revenue share of 62.5% in 2024, driven by its delicate texture and raw-such as taste, which are highly preferred by gourmet consumers for applications in sandwiches, salads, and sushi. The smoking process at low temperatures preserves the fish's natural flavor, enhancing its appeal in premium dining and retail settings.

The hot-smoked salmon segment is expected to witness the fastest growth rate of 6.2% from 2025 to 2032, fueled by increasing consumer interest in diverse flavor profiles and culinary experimentation. Hot-smoked salmon, with its flakier texture and pronounced smoky taste, is gaining popularity in dishes such as pasta and salads, supported by innovations in smoking techniques.

- By Species

On the basis of species, the global smoked salmon market is segmented into Atlantic salmon, Pacific salmon, and others. The Atlantic salmon segment dominated with a market revenue share of 68.5% in 2024, owing to its widespread use in aquaculture, tender texture, and rich flavor, making it ideal for cold-smoking processes. Its high-fat content and consistent availability through farming drive its prominence in North America and Europe.

The pacific salmon segment is anticipated to experience the fastest growth rate of 7.8% from 2025 to 2032, driven by rising demand for wild-caught varieties such as sockeye and chinook, which offer distinct flavors and firmer textures suitable for both hot and cold smoking. Growing consumer preference for sustainable and premium seafood in Asia-Pacific fuels this segment’s expansion.

- By Application

On the basis of application, the global smoked salmon market is segmented into food service sector, retail sector, and others. The retail sector accounted for the largest market revenue share of 58.5% in 2024, driven by widespread availability in supermarkets, hypermarkets, and specialty stores, catering to consumers seeking convenient, ready-to-eat seafood for home consumption. The variety of packaging and flavor options enhances its appeal.

The food service sector is expected to witness robust growth of 6.8% from 2025 to 2032, propelled by increasing incorporation of smoked salmon in restaurant menus, hotels, and catering services. Its versatility in gourmet dishes, from appetizers to main courses, aligns with the rising trend of health-conscious dining and premium culinary experiences.

- By Distribution Channel

On the basis of distribution channel, the global smoked salmon market is segmented into supermarkets/hypermarkets, specialty stores, online retail, and others. The supermarkets/hypermarkets segment held the largest market revenue share of 55.5% in 2024, attributed to their extensive reach, refrigeration infrastructure, and ability to offer a wide range of smoked salmon products under one roof, catering to a diverse consumer base.

The online retail segment is anticipated to witness the fastest growth rate of 8.5% from 2025 to 2032, driven by the convenience of home delivery, expanding e-commerce platforms, and increasing consumer preference for premium and organic smoked salmon. Subscription models and promotional offers further boost online sales, particularly in urban areas of Asia-Pacific.

Smoked Salmon Market Regional Analysis

- Europe dominated the smoked salmon market with the largest revenue share of 46.3% in 2024, driven by its strong culinary tradition of smoked seafood, particularly in countries such as Norway, Scotland, and the UK, where smoked salmon is a staple in both traditional and modern cuisines

- Consumers prioritize smoked salmon for its rich flavor, nutritional benefits, and versatility in gourmet dishes, particularly in regions with established seafood consumption habits

- Growth is supported by innovations in processing techniques, such as cold and hot smoking methods, alongside increasing demand in both retail and foodservice sectors

U.S. Smoked Salmon Market Insight

The U.S. is expected to witness rapid growth in the smoked salmon market fueled by strong retail demand and growing consumer interest in healthy and gourmet food options. The trend towards premiumization and increasing regulations promoting sustainable sourcing standards further boost market expansion. Major producers’ focus on eco-friendly packaging and organic products complements retail sales, creating a diverse product ecosystem.

Europe Smoked Salmon Market Insight

The Europe dominated the global smoked salmon market with the highest revenue share of 69.8% in 2024, fueled by robust demand in retail and hospitality sectors and growing consumer awareness of the health benefits of omega-3-rich seafood. The trend towards sustainable and organic products further boosts market expansion. Major producers in countries such as Norway and Scotland complement retail sales with premium exports, creating a diverse market ecosystem.

U.K. Smoked Salmon Market Insight

The U.K. market for smoked salmon is expected to witness significant growth, driven by demand for high-quality seafood in urban and suburban settings. Increased interest in healthy eating and rising awareness of smoked salmon’s nutritional benefits encourage adoption. Evolving food safety and sustainability regulations influence consumer choices, balancing quality with environmental compliance.

Germany Smoked Salmon Market Insight

Germany is expected to witness rapid growth in the smoked salmon market, attributed to its advanced food processing sector and high consumer focus on health-conscious and premium food products. German consumers prefer sustainably sourced smoked salmon that aligns with environmental standards. The integration of these products in retail chains and foodservice supports sustained market growth.

Asia-Pacific Smoked Salmon Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising disposable incomes and expanding seafood consumption in countries such as China, Japan, and India. Increasing awareness of smoked salmon’s health benefits and culinary versatility is boosting demand. Government initiatives promoting healthy diets and food safety further encourage the adoption of premium smoked salmon products.

Japan Smoked Salmon Market Insight

Japan’s smoked salmon market is expected to witness the fastest growth rate due to strong consumer preference for high-quality, artisanal seafood products that enhance culinary experiences. The presence of major importers and growing integration of smoked salmon in sushi restaurants accelerates market penetration. Rising interest in Western-style dining and retail products also contributes to growth.

China Smoked Salmon Market Insight

The China holds the largest share of the Asia-Pacific smoked salmon market, propelled by rapid urbanization, rising seafood consumption, and increasing demand for premium food products. The country’s growing middle class and focus on healthy lifestyles support the adoption of smoked salmon. Strong domestic distribution networks and competitive pricing enhance market accessibility.

Smoked Salmon Market Share

The smoked salmon industry is primarily led by well-established companies, including:

- Mowi (Norway)

- Leroy(Norway)

- Trident Seafoods (U.S.)

- Multiexport Foods (Chile)

- Norwegian Seafood Federation (Norway)

- Acme Smoked Fish (U.S.)

- JCS Fish Ltd. (U.K.)

- Bleiker’s Smokehouse (U.K.)

- Delpeyrat (France)

- UBAGO GROUP MARE, S.L. (Spain)

- Labeyrie (France)

- Suempol (Poland)

- Norvelita (Lithuania)

- Cooke Aquaculture (Canada)

- Grieg Seafood (Norway)

What are the Recent Developments in Global Smoked Salmon Market?

- In May 2025, Loch Duart, a renowned Scottish salmon farmer, introduced its Signature Smoke and Double Smoked salmon products, crafted for high-end retailers and restaurants. These premium offerings are made using only two natural ingredients—Scottish salmon and pure sea salt—and are smoked by Scottish master smokers to enhance their rich, savory taste. The Signature Smoke delivers a delicate oak-smoked flavor, while the Double Smoked variety undergoes an additional whisky cask smoking process, creating a bold, full-bodied smokiness

- In April 2025, SimpliiGood (AlgaeCore Technologies) launched the commercial production of its 100% plant-based smoked salmon analog, crafted entirely from spirulina microalgae. This breakthrough aims to combat overfishing while meeting the growing demand for sustainable alternative proteins. The product, developed using Simplii Texture technology, replicates the appearance, texture, and taste of traditional smoked salmon without requiring complex processing equipment. With pilot programs underway in Europe and Israel, the company is scaling up production to hundreds of tons annually

- In February 2025, Salmon Evolution partnered with Lofotprodukt AS to introduce smoked salmon made from land-based salmon under the premium brand Lofoten in Norwegian retail. This marks the first-ever consumer-packaged smoked salmon from a land-based facility to be launched in Norway, reinforcing sustainable aquaculture. The product will be available in Meny and selected Spar stores, supported by NorgesGruppen’s distribution network. Salmon Evolution’s hybrid flow-through system (HFS) ensures optimal water quality, reducing environmental impact while maintaining exceptional taste and texture

- In January 2025, Captain Fresh, an Indian tech-led seafood supply chain company, acquired Koral, a Polish smoked salmon processor, marking its entry into the European salmon market. This strategic move enhances Captain Fresh’s international processing capacity, adding Koral’s 26 production lines and daily processing of 120 tons of fish to its operations. The acquisition strengthens Captain Fresh’s value-added product (VAP) portfolio, complementing its earlier purchase of France-based Senecrus. With Boguslaw Kowalski and Justyna Frankowska leading the global salmon strategy, Captain Fresh aims to expand its presence in premium seafood markets

- In July 2024, Acme Smoked Fish acquired Banner Smoked Fish, bringing together two family-owned Brooklyn-based businesses with a shared legacy in smoked seafood. This strategic merger aims to expand Acme’s customer base, particularly within the New York City deli scene, while maintaining high-quality smoked fish offerings. Banner’s operations will transition to Acme’s Greenpoint production facility, ensuring seamless integration and continued excellence in smoked salmon, whitefish, sable, and other specialties

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Smoked Salmon Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Smoked Salmon Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Smoked Salmon Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.