Global Soft Drink Concentrates Market

Market Size in USD Billion

CAGR :

%

USD

43.97 Billion

USD

96.61 Billion

2024

2032

USD

43.97 Billion

USD

96.61 Billion

2024

2032

| 2025 –2032 | |

| USD 43.97 Billion | |

| USD 96.61 Billion | |

|

|

|

|

What is the Global Soft Drink Concentrates Market Size and Growth Rate?

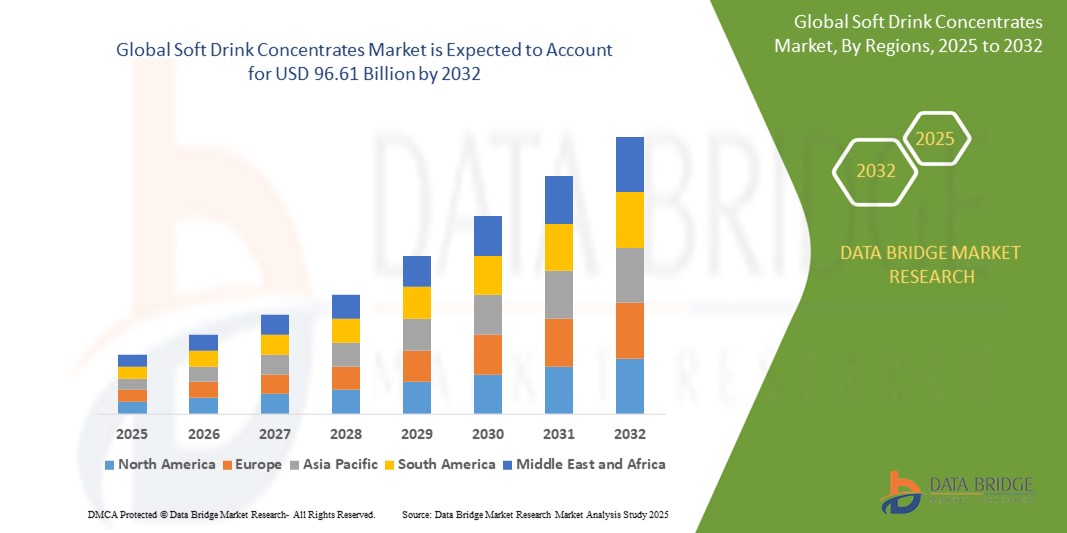

- The global soft drink concentrates market size was valued at USD 43.97 billion in 2024 and is expected to reach USD 96.61 billion by 2032, at a CAGR of 10.34% during the forecast period

- Soft drinks refer to beverages that possess sweetening agents, distilled water, and flavoring agents. Sugar, high-fructose corn syrup, and sweeteners, among others, are some of the sweetening agents used to enhance the substance

- Soft drinks are known to contain caffeine, preservatives, coloring agents, and other additives depending on the type the manufacturing industry

What are the Major Takeaways of Soft Drink Concentrates Market?

- Soft drink concentrates offer the industry an avenue to capitalize on this shift by providing a versatile platform for the development of healthier beverage alternatives

- Manufacturers can formulate concentrates with natural sweeteners, reduced sugar content, and innovative functional ingredients, meeting the preferences of health-conscious consumers

- North America dominated the soft drink concentrates market with the largest revenue share of 42.36% in 2024, driven by high demand for low-calorie, sugar-free, and functional beverages

- Asia-Pacific market is poised to grow at the fastest CAGR of 15.36% from 2025 to 2032, fueled by rising disposable incomes, rapid urbanization, and the expanding middle class

- The carbonated segment dominated the market with the largest revenue share of 57.8% in 2024, driven by strong consumer preference for fizzy beverages across both developed and emerging markets

Report Scope and Soft Drink Concentrates Market Segmentation

|

Attributes |

Soft Drink Concentrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Soft Drink Concentrates Market?

“Personalized Flavors and Health-Oriented Formulations”

- A significant and accelerating trend in the global soft drink concentrates market is the rising demand for customized flavor experiences and health-conscious formulations. Manufacturers are increasingly leveraging data-driven insights to develop concentrates that cater to specific dietary preferences, such as low sugar, organic, or fortified with vitamins

- For instance, Coca-Cola has introduced flavor capsules under its Freestyle system, allowing consumers to create custom soft drinks by selecting combinations of flavors and sweetness levels. PepsiCo’s SodaStream platform also empowers users to mix their own beverages, supporting a shift toward at-home personalization

- Consumers are seeking beverages that taste good and align with their health goals. Soft drink concentrates enriched with functional ingredients such as antioxidants, probiotics, or electrolytes are gaining traction among health-aware demographics. In addition, the trend towards natural sweeteners such as stevia and monk fruit is reshaping formulations

- The market is also benefiting from innovations in smart beverage dispensers, which allow consumers to scan QR codes or use apps to select preferred concentrates and track nutritional intake. These systems enhance consumer engagement and promote repeat purchases

- Companies such as Kraft Heinz and Nestlé are investing in AI-based flavor prediction tools to speed up R&D cycles and align with shifting consumer preferences more rapidly. This is fueling a wave of hyper-personalized soft drink offerings

- This trend toward flavor customization and wellness-driven beverages is boosting consumer loyalty and expanding the use of soft drink concentrates in foodservice, hospitality, and home-use markets

What are the Key Drivers of Soft Drink Concentrates Market?

- Rising demand for convenient and cost-effective beverage options is a key factor fueling the adoption of soft drink concentrates. These products allow users to prepare multiple servings from a single container, offering both affordability and portability

- For instance, in January 2024, Keurig Dr Pepper expanded its concentrate offerings for commercial dispensers in the U.S. market, aiming to meet rising demand in quick-service restaurants and cafeterias

- The growth of e-commerce platforms and DTC (Direct-to-Consumer) channels is making soft drink concentrates more accessible to a global audience. Subscription-based delivery models are also becoming popular, encouraging regular usage

- Growing urbanization and busy lifestyles are increasing the appeal of on-the-go and DIY beverage preparation, where concentrates offer faster and easier solutions compared to bottled soft drinks

- Increasing awareness about environmental sustainability is pushing consumers toward concentrates, which reduce plastic waste and carbon footprints. This eco-friendly positioning is helping brands differentiate and build loyalty

Which Factor is challenging the Growth of the Soft Drink Concentrates Market?

- A major challenge is the perception of artificiality and high sugar content associated with soft drink concentrates. Health-conscious consumers may avoid these products due to concerns about additives, preservatives, and synthetic ingredients

- For instance, a 2023 survey by the International Food Information Council revealed that 48% of consumers were wary of soft drink concentrates due to unclear labeling and perceived lack of transparency in ingredient sourcing

- Addressing these concerns requires brands to adopt clean label practices, enhance product transparency, and shift towards natural ingredients and sweeteners. Reformulating products without compromising taste remains a significant hurdle

- In addition, market penetration in low-income and rural regions is hindered by limited awareness and lack of access to dispensing equipment or clean water, which are necessary for concentrate use

- Finally, competition from ready-to-drink (RTD) functional beverages and infused waters presents a threat, especially among younger consumers who prefer grab-and-go options without preparation step

- Overcoming these barriers through consumer education, improved health positioning, and innovations in concentrate packaging and portability will be crucial for sustaining long-term growth in this market

How is the Soft Drink Concentrates Market Segmented?

The market is segmented on the basis of type, flavours, distribution channel, and end-user.

• By Type

On the basis of type, the soft drink concentrates market is segmented into Non-Carbonated and Carbonated. The Carbonated segment dominated the market with the largest revenue share of 57.8% in 2024, driven by strong consumer preference for fizzy beverages across both developed and emerging markets. The popularity of carbonated soft drinks in fast food outlets, vending machines, and home soda makers continues to boost segment growth. Leading brands such as Coca-Cola and PepsiCo maintain robust portfolios in this category, ensuring high visibility and wide availability across distribution channels.

The Non-Carbonated segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising health consciousness and demand for functional beverages. This includes concentrates enriched with vitamins, electrolytes, and natural ingredients, appealing to fitness-oriented and younger consumers seeking low-sugar or caffeine-free alternatives.

• By Flavours

On the basis of flavour, the soft drink concentrates market is categorized into Cola, Non-Cola, Orange, Mixed, Pineapple, Kiwi, Litchi, Apple, Grape, Grapefruit, Peach, and Mango. The Cola segment led the market in 2024 with the highest revenue share of 34.5%, attributed to its long-standing consumer base, global brand recognition, and consistent demand in both retail and foodservice environments.

Meanwhile, the Mixed flavor segment is projected to experience the fastest growth rate from 2025 to 2032, supported by consumer interest in innovative and exotic flavor blends. Brands are increasingly experimenting with fusion options, such as berry-citrus or tropical mixes, to attract younger consumers and diversify their product lines.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and Others. The Supermarkets/Hypermarkets segment accounted for the largest revenue share of 42.1% in 2024, owing to their extensive reach, promotional pricing strategies, and the availability of a wide range of concentrate brands. These retail formats provide high-volume sales and visibility for both premium and budget concentrate offerings.

The Online Retail Stores segment is expected to register the fastest CAGR from 2025 to 2032, driven by changing consumer shopping behavior, convenience, and the growing popularity of e-commerce platforms. Subscription-based models, digital promotions, and direct-to-consumer options are fueling sales via this channel.

• By End-User

On the basis of end-user, the market is segmented into Drinking Places, Mass Merchandise, The Fountain Machine, Private Clubs, and Food Service. The Fountain Machine segment dominated the market with the highest revenue share of 38.9% in 2024, due to its widespread use in QSRs (quick-service restaurants), movie theaters, and entertainment venues. These machines offer cost-efficiency, consistency, and customization of flavors at point-of-sale, making them highly attractive for high-traffic environments.

The Food Service segment is anticipated to exhibit the fastest growth rate from 2025 to 2032, spurred by rising adoption in cafes, hotels, and catering services seeking customizable beverage solutions that reduce waste and storage needs. Growth in organized food chains and catering businesses is further supporting segment expansion.

Which Region Holds the Largest Share of the Soft Drink Concentrates Market?

- North America dominated the soft drink concentrates market with the largest revenue share of 42.36% in 2024, driven by high demand for low-calorie, sugar-free, and functional beverages

- Consumers in the region prefer convenient drink options that allow flavor customization and align with health-conscious lifestyles, boosting concentrate usage in both households and foodservice sectors

- This demand is further supported by strong retail distribution, rising adoption of natural and organic ingredients, and widespread marketing campaigns by global beverage brands

U.S. Soft Drink Concentrates Market Insight

U.S. soft drink concentrates market dominated the revenue share within North America in 2024, driven by evolving consumer preferences for reduced-sugar and zero-calorie alternatives. With the increasing focus on personal wellness and functional drinks enriched with vitamins or energy-boosting ingredients, the market is experiencing strong momentum. In addition, growing popularity of DIY beverages and mix-at-home solutions is fueling sales, especially through online grocery platforms and retail club stores.

Europe Soft Drink Concentrates Market Insight

Europe soft drink concentrates market is projected to grow at a notable CAGR over the forecast period, supported by the rising trend of healthy beverage consumption and sustainability. European consumers are increasingly opting for concentrates with natural flavors and plant-based ingredients, reflecting a shift from traditional sugary sodas. The regional market is expanding across both household and HoReCa channels, with brands offering sugar-tax-compliant formulations and recyclable packaging to meet regulatory and consumer expectations.

U.K. Soft Drink Concentrates Market Insight

U.K. market is expected to witness strong growth, driven by heightened demand for low-sugar beverages amid health campaigns targeting obesity and diabetes. Consumers are leaning towards fruit-based and functional concentrates with added vitamins, aligning with wellness goals. Growth is also supported by the rising popularity of concentrate pods and dispensers compatible with smart kitchens, making at-home drink preparation more convenient and customizable.

Germany Soft Drink Concentrates Market Insight

Germany market is growing steadily due to the increasing demand for eco-friendly and health-conscious beverage solutions. German consumers value organic certification, clean labels, and sustainability, leading to a rise in the adoption of plant-extract-based concentrates. The country’s emphasis on recyclable materials and minimal processing is encouraging producers to innovate in flavor and formulation, supporting the premium segment of the soft drink concentrates market.

Which Region is the Fastest Growing Region in the Soft Drink Concentrates Market?

Asia-Pacific market is poised to grow at the fastest CAGR of 15.36% from 2025 to 2032, fueled by rising disposable incomes, rapid urbanization, and the expanding middle class. Increased demand for affordable, shelf-stable beverages and growing awareness of healthier drink alternatives are key drivers. Moreover, the surge in e-commerce and convenience store penetration is making soft drink concentrates more accessible to consumers across emerging economies.

Japan Soft Drink Concentrates Market Insight

Japan’s market is expanding due to the nation’s strong demand for compact, functional products aligned with fast-paced urban lifestyles. Japanese consumers are showing interest in wellness-oriented beverages, especially those fortified with vitamins or collagen. The trend of personalized nutrition is also gaining traction, with companies launching customizable concentrate mixes that cater to aging and health-conscious demographics.

China Soft Drink Concentrates Market Insight

China captured the largest revenue share in Asia-Pacific in 2024, driven by the country’s massive population, rising health awareness, and strong beverage consumption culture. The growing popularity of sugar-free and fruit-based drinks, especially among millennials and Gen Z, is stimulating demand. Local brands are innovating with traditional herbal flavors, while international brands focus on premiumization and functional ingredient additions, solidifying China's position as a key growth engine in the global market.

Which are the Top Companies in Soft Drink Concentrates Market?

The soft drink concentrates industry is primarily led by well-established companies, including:

- GRANA Beteiligungs-AG (Germany)

- Döhler GmbH (Germany)

- Ingredion Incorporated (U.S.)

- Kerry Inc. (Ireland)

- Nestlé (Switzerland)

- ADM (U.S.)

- SunOpta (Canada)

- Tree Top, Inc. Corporate Office (U.S.)

- China Haisheng Fresh Fruit Juice Co., Ltd (China)

- The Coca-Cola Company (U.S.)

- Capricorn Food Products India Ltd. (India)

What are the Recent Developments in Global Soft Drink Concentrates Market?

- In May 2023, Bisleri International expanded its carbonated beverage portfolio to meet the surging demand during India’s rising summer temperatures, introducing new variants under the Rev, Pop, and Spyci Jeera sub-brands. The range now includes fizzy cola, orange, and jeera flavors, with the company actively leveraging digital and social media marketing, including sampling campaigns at IPL matches as a hydration partner. This move reflects Bisleri’s strategic effort to strengthen its presence in India’s growing carbonated drink segment

- In March 2022, PepsiCo’s SodaStream unit introduced Pepsi syrup mixes in California, designed for use with its at-home soda-making appliances. These syrup options included Pepsi Zero Sugar, Diet Pepsi, Sierra Mist Zero Sugar, and Sierra Mist, catering to health-conscious consumers seeking DIY beverage solutions. This launch emphasized PepsiCo’s focus on personalization and convenience within the carbonated drink market

- In September 2021, PepsiCo rolled out four SodaStream syrup flavors — Pepsi, Pepsi Max, 7UP, and 7UP Free, each in a 440ml bottle capable of producing nine liters of soft drink. The release was aimed at reducing packaging waste by offering consumers an eco-friendly alternative to traditional canned and bottled beverages. This step showcased PepsiCo’s commitment to sustainability and innovation in the soft drink concentrates space

- In September 2021, Rasna, a well-known soft drink concentrate brand, entered the soft drink category with the launch of ‘Indie Cola’, a fruit cola product initially targeted at middle-class families in small towns, with later plans to cater to upmarket metro audiences. This marked Rasna’s diversification strategy and its attempt to tap into broader consumer segments across India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soft Drink Concentrates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soft Drink Concentrates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soft Drink Concentrates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.