Global Sophorolipids Market

Market Size in USD Million

CAGR :

%

USD

645.74 Million

USD

998.55 Million

2024

2032

USD

645.74 Million

USD

998.55 Million

2024

2032

| 2025 –2032 | |

| USD 645.74 Million | |

| USD 998.55 Million | |

|

|

|

|

Sophorolipids Market Size

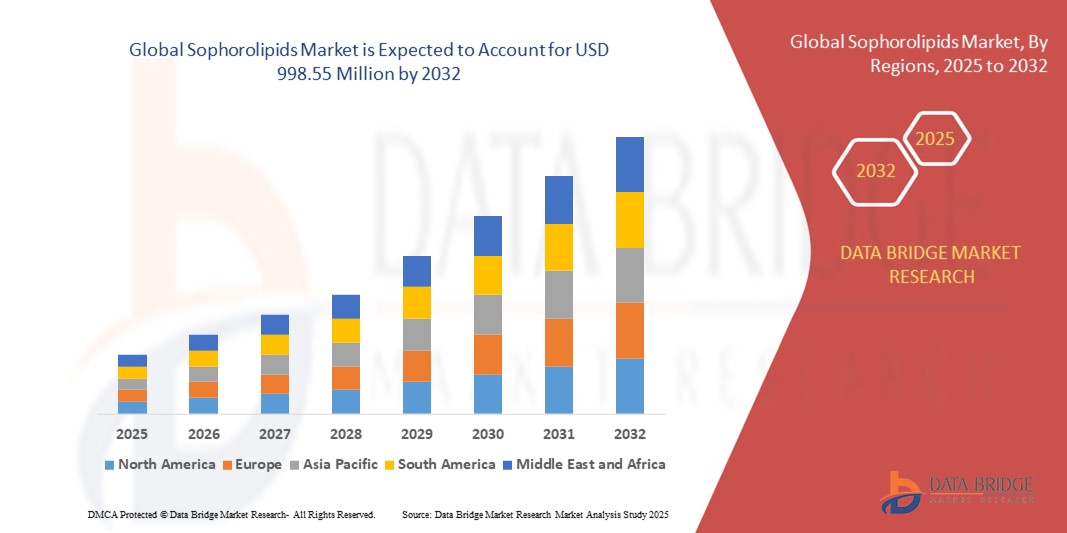

- The global sophorolipids market was valued at USD 645.74 Million in 2024 and is projected to reach USD 998.55 Million by 2032, growing at a CAGR of 5.60% from 2025 to 2032

- Market growth is primarily driven by increasing demand for eco-friendly, biodegradable, and sustainable surfactants across industries such as personal care, household cleaning, and agriculture

- In addition, the rising consumer awareness of environmental issues and growing regulations against synthetic chemicals are accelerating the adoption of sophorolipids as a natural alternative. These combined factors are propelling industry expansion and positioning sophorolipids as a key player in the green chemistry revolution

Sophorolipids Market Analysis

- Sophorolipids, biosurfactants derived from the fermentation of Candida bombicola, are gaining momentum as natural, biodegradable alternatives to synthetic surfactants across industries such as personal care, food, and household cleaning, thanks to their low toxicity, high biodegradability, and antimicrobial properties

- The market’s expansion is driven by rising global demand for eco-friendly products, increasing consumer awareness of sustainability, and regulatory pressure to replace petroleum-based ingredients with safer, bio-based solutions

- Europe dominated the sophorolipids market with the largest revenue share of 38.7% in 2024, supported by stringent environmental regulations, strong consumer preference for green products, and the presence of major biotechnology firms investing in biosurfactant RandD

- Asia-Pacific sophorolipids market is projected to grow at the fastest CAGR of 12.6% during the forecast period of 2025 to 2032, supported by rapid industrialization, increasing environmental concerns, and growing investments in biotechnology

- The acidic sophorolipids segment dominated the market with the largest revenue share of 47.5% in 2024, driven by their superior water solubility and versatility across applications such as detergents, cosmetics, and agriculture

Report Scope and Sophorolipids Market Segmentation

|

Attributes |

Global Sophorolipids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sophorolipids Market Trends

Shift Toward Sustainable and Bio-Based Surfactants

- A key and accelerating trend in the global sophorolipids market is the growing shift from synthetic surfactants to sustainable, bio-based alternatives driven by rising environmental awareness, consumer preference for green products, and stricter regulations on chemical use in personal care, cleaning, and industrial applications

- Sophorolipids, being biodegradable and non-toxic, are increasingly being used in formulations for cosmetics, detergents, and agriculture. For instance, major cosmetic brands are incorporating sophorolipids into natural skincare lines due to their gentle cleansing and antimicrobial properties, offering an eco-friendly alternative to sulfates

- The increasing demand for “clean label” ingredients has led companies such as Evonik and Allied Carbon Solutions to ramp up production capacities and RandD investments focused on optimizing fermentation processes and developing tailor-made sophorolipid variants with enhanced properties

- In the household cleaning sector, sophorolipids are replacing synthetic surfactants in green cleaning products, providing effective performance with lower ecological impact. Startups and established players asuch as are launching eco-certified products with biosurfactants as a core component

- This trend is further supported by advancements in microbial fermentation and biotechnology, which have improved production efficiency and scalability. In addition, public and private initiatives promoting the bioeconomy are encouraging partnerships between research institutions and manufacturers to accelerate sophorolipid commercialization

- As sustainability becomes a central value proposition for both consumers and industries, the adoption of sophorolipids is expected to expand across sectors, with innovation focused on expanding applications beyond personal care and cleaning into pharmaceuticals, textiles, and oilfield chemicals

Sophorolipids Market Dynamics

Driver

Growing Demand for Eco-Friendly Alternatives

- The rising global demand for sustainable and environmentally safe ingredients is a major driver fueling sophorolipid market growth. Industries are under increasing pressure to reduce their environmental footprint, driven by consumer expectations and tightening regulations related to chemical safety and emissions

- For instance, the European Chemicals Agency (ECHA) continues to push for the reduction of harmful surfactants in cosmetics and cleaning products, making biosurfactants such as sophorolipids a viable and preferred alternative

- Sophorolipids offer multiple functional benefits—such as emulsification, mild cleansing, and antimicrobial properties—making them suitable for replacing traditional petrochemical-based surfactants in a wide array of applications

- The market is also benefiting from growing consumer demand for organic and vegan-certified products, especially in the personal care and home care sectors. This is prompting global brands to reformulate products using biodegradable surfactants

- In addition, ongoing advancements in microbial fermentation and cost-effective production techniques are making large-scale sophorolipid manufacturing more feasible, driving industrial adoption across both developed and emerging markets

Restraint/Challenge

High Production Costs and Limited Commercial Scalability

- Despite their advantages, high production costs and challenges in large-scale commercial manufacturing remain key barriers to widespread sophorolipid adoption. The fermentation-based production process is more complex and costly than that of synthetic surfactants, impacting pricing competitiveness

- For instance, while companies such as Saraya Co., Ltd. and Evonik have developed pilot-scale production facilities, scalability remains a challenge due to the need for specialized fermentation infrastructure and consistent yields

- In addition, limited awareness about sophorolipids in several end-user industries and a lack of standardization in product quality can hinder market penetration, particularly in price-sensitive sectors

- Compared to mature synthetic surfactant markets, the sophorolipids supply chain is still developing, leading to inconsistencies in availability and cost-effectiveness. This can deter smaller manufacturers from integrating biosurfactants into their formulations

- Overcoming these challenges will require continued investment in RandD to optimize production efficiency, public-private partnerships to scale up manufacturing, and educational initiatives to raise awareness of the benefits of sophorolipids across industries. Collaborative efforts to reduce cost barriers and enhance supply chain resilience will be essential for long-term market expansion

Sophorolipids Market Scope

The market is segmented on the basis of type, form, application, and end-use industry.

- By Type

On the basis of type, the sophorolipids market is segmented into acidic sophorolipids, lactonic sophorolipids, and others. The acidic sophorolipids segment dominated the market with the largest revenue share of 47.5% in 2024, driven by their superior water solubility and versatility across applications such as detergents, cosmetics, and agriculture. Their compatibility with aqueous formulations and effectiveness as emulsifying and foaming agents make them a preferred choice in eco-friendly product development. Rising demand for biodegradable and non-toxic ingredients in home and personal care sectors continues to support the segment’s dominance.

The lactonic sophorolipids segment is anticipated to witness the fastest growth rate of 22.3% from 2025 to 2032, fueled by their strong antimicrobial, antifungal, and surface-active properties, which are highly valued in pharmaceuticals, wound care, and food preservation. Their lower water solubility and higher surface activity make them suitable for specialized, high-performance applications. Increasing RandD investments to expand the functional scope of lactonic sophorolipids further contribute to their projected rapid market growth.

- By Form

On the basis of form, the market is segmented into liquid and dry. The liquid form dominated the market with the largest revenue share in 2024 due to its ease of formulation, compatibility with various aqueous systems, and ready-to-use nature in cosmetic and cleaning applications. Liquid sophorolipids are often preferred for their superior spreadability and fast integration into existing product lines.

The dry form is anticipated to register the fastest CAGR from 2025 to 2032, driven by its extended shelf life, ease of transport, and better storage stability. Dry sophorolipids are gaining traction in sectors such as agriculture and industrial cleaning, where powder formulations offer better handling and dosage control.

- By Application

On the basis of application, the sophorolipids market is segmented into detergents, cosmetics and personal care, food processing, agriculture, and others. The cosmetics and personal care segment held the largest market revenue share in 2024, supported by the increasing consumer preference for natural, non-toxic ingredients in skincare and haircare products. Sophorolipids are widely used as mild surfactants and emulsifiers in natural formulations.

The agriculture segment is projected to witness the fastest growth from 2025 to 2032, driven by rising demand for bio-based pest control and soil treatment products. Sophorolipids’ biodegradability and low toxicity make them ideal candidates for eco-friendly agricultural inputs, particularly in organic farming practices.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into personal care, home care, food and beverage, agriculture, pharmaceuticals, and others. The personal care industry led the market in 2024, driven by the surge in clean beauty trends, consumer awareness of ingredient safety, and increasing product launches incorporating biosurfactants. Major beauty brands are adopting sophorolipids as alternatives to sulfates and harsh synthetic surfactants.

The pharmaceutical segment is expected to grow at the fastest CAGR from 2025 to 2032 due to ongoing research into sophorolipids’ antimicrobial, anti-inflammatory, and drug delivery properties. Increased investment in biopharmaceutical RandD and interest in green chemistry-based formulations are accelerating their use in topical and oral drug products.

Sophorolipids Market Regional Analysis

- Europe dominated the sophorolipids market with the largest revenue share of 38.5% in 2024, driven by stringent environmental regulations, a well-established biotechnology sector, and strong demand for sustainable ingredients across personal care, cleaning, and industrial applications.

- Consumers in the region are increasingly favoring eco-friendly and biodegradable products, leading manufacturers to adopt biosurfactants such as sophorolipids in formulations.

- The European Union’s regulatory focus on reducing the use of synthetic and petroleum-based surfactants supports market expansion. In addition, collaborative efforts between research institutes and bio-based startups are accelerating product innovation and commercial adoption.

Germany Sophorolipids Market Insight

The Germany sophorolipids market held the largest revenue share in Europe in 2024, fueled by the country’s strong emphasis on environmental sustainability and advanced biotechnology infrastructure. Germany’s chemical and personal care industries are actively integrating sophorolipids into green product lines. Supportive regulatory frameworks, such as the EU Green Deal, along with growing consumer awareness, are prompting leading brands to shift toward bio-based surfactants in skincare, detergents, and agrochemical applications.

France Sophorolipids Market Insight

The France sophorolipids market is expected to grow at a notable CAGR during the forecast period, driven by increasing demand for clean beauty products and natural ingredients. French cosmetic brands are at the forefront of green innovation, embracing biosurfactants such as sophorolipids for their mild, skin-friendly properties. The country’s strong focus on organic certification and sustainable sourcing is further propelling the adoption of bio-based ingredients in both personal care and home care sectors.

Asia-Pacific Sophorolipids Market Insight

Asia-Pacific sophorolipids market is projected to grow at the fastest CAGR of 12.6% during the forecast period of 2025 to 2032, supported by rapid industrialization, increasing environmental concerns, and growing investments in biotechnology. Countries such as China, India, South Korea, and Japan are seeing rising demand for sustainable solutions in agriculture, personal care, and cleaning products. Government initiatives promoting green chemistry and rising disposable incomes are further driving market expansion across the region

China Sophorolipids Market Insight

The China sophorolipids market accounted for the largest revenue share in Asia-Pacific in 2024, driven by strong domestic manufacturing capacity, environmental policy shifts, and the rapid expansion of the natural personal care and home cleaning sectors. As part of China’s push toward eco-friendly production under its “Green Development” strategy, local companies are increasingly investing in fermentation-based biosurfactant production. Support from academic institutions and biotech incubators is also boosting innovation in sophorolipid applications.

India Sophorolipids Market Insight

The India sophorolipids market is expected to grow at a substantial CAGR during the forecast period, propelled by increased awareness of sustainable agriculture, expanding organic farming practices, and rising demand for natural personal care products. Government support for green technologies and growing interest in replacing chemical surfactants with biodegradable alternatives are encouraging the use of sophorolipids in both urban and rural markets. The country’s vast agricultural base also presents strong potential for biosurfactant-based crop protection products.

North America Sophorolipids Market Insight

The North America sophorolipids market is projected to expand steadily, driven by the rise in consumer preference for natural and organic products, especially in the U.S. and Canada. The region is seeing increased investment in green chemistry and biotech RandD, which is fostering innovations in fermentation processes and downstream applications. Regulations favoring sustainable ingredients and corporate commitments to environmental goals are pushing manufacturers to explore sophorolipids as viable surfactant alternatives.

U.S. Sophorolipids Market Insight

The U.S. sophorolipids market captured the largest share in North America in 2024, supported by growing demand in personal care, cleaning, and food processing industries. The clean label movement, along with mounting consumer pressure for environmentally safe ingredients, is driving the transition toward biosurfactants. Key U.S.-based companies and research institutions are heavily investing in pilot-scale production and application development, strengthening the market’s commercial outlook.

Global Sophorolipids Market Share

Global Sophorolipids Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Agarwal Group. (India)

- Mitsubishi Chemical Corporation (Japan)

- SABIC (Saudi Arabia)

- Sustainable Solutions Corporation (U.S.)

- Hawkins. Inc. (U.S.)

- Kraton Corporation (U.S.)

- Ecover (Belgium)

Latest Developments Global Sophorolipids Market:

- In June 2023, Evonik Industries AG, a key player in the biosurfactants market, announced the expansion of its sophorolipid production capacity at its Slovenská Ľupča site in Slovakia. This move is part of Evonik’s broader strategy to meet the growing global demand for sustainable and biodegradable surfactants used in personal care and home cleaning products. The expansion aims to support customers seeking high-performance, eco-friendly alternatives to conventional surfactants and reinforces Evonik’s leadership in green chemistry innovation.

- In May 2023, Allied Carbon Solutions Co., Ltd. (ACS), a Japanese biotech company, entered into a strategic collaboration with a European cosmetics brand to supply premium-grade sophorolipids for use in natural skincare formulations. This partnership marks a significant step in cross-regional collaboration for biosurfactant commercialization and reflects rising consumer interest in clean-label personal care products across global markets. ACS aims to strengthen its presence in Europe through localized partnerships and advanced product customization.

- In April 2023, Holiferm, a UK-based biosurfactant startup, secured additional funding from Clean Growth Fund and other investors to scale up its commercial sophorolipid production at its new manufacturing facility in the North West of England. The funding will enable Holiferm to expand output capacity to meet rising demand from multinational brands in the home and personal care sectors. This development underscores investor confidence in sustainable biotechnology and the accelerating industrial transition to bio-based ingredients.

- In March 2023, researchers at Ghent University in Belgium published findings on a novel fermentation process that significantly improves sophorolipid yield and reduces production time. This breakthrough, achieved through metabolic engineering and bioprocess optimization, has the potential to lower production costs and make sophorolipids more accessible for large-scale industrial applications. The research has sparked interest among commercial producers aiming to enhance cost-efficiency and scalability.

- In February 2023, Soliance (a subsidiary of Givaudan) launched a new biosurfactant formulation based on sophorolipids for use in high-end cosmetic applications. Marketed under a clean beauty label, the product offers mild cleansing and moisturizing properties while aligning with eco-certification standards. Givaudan’s move reflects increasing demand for multifunctional, sustainable cosmetic ingredients and reinforces the role of sophorolipids in driving innovation within the natural beauty segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sophorolipids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sophorolipids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sophorolipids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.