Global Soy Sauce Market

Market Size in USD Billion

CAGR :

%

USD

56.10 Billion

USD

100.50 Billion

2024

2032

USD

56.10 Billion

USD

100.50 Billion

2024

2032

| 2025 –2032 | |

| USD 56.10 Billion | |

| USD 100.50 Billion | |

|

|

|

|

Soy Sauce Market Analysis

The soy sauce market is experiencing significant growth, driven by increasing consumer preference for Asian cuisine and the rising demand for umami-rich condiments. Soy sauce, a staple in households and the food service industry, is widely used for seasoning, marinating, and enhancing flavors. The market is segmented based on product type, including blended and brewed soy sauce, packaging types such as glass jars and flexible packs, and distribution channels such as supermarkets, convenience stores, and online platforms. Growing health-consciousness has also led to innovations in low-sodium and organic variants. Recent developments include strategic acquisitions, product innovations, and expanding production capacities by key players to meet global demand. For instance, leading manufacturers are focusing on sustainable production methods and clean-label formulations to cater to evolving consumer preferences. As the global appetite for diverse flavors continues to rise, the soy sauce market is expected to witness steady growth in the coming years.

Soy Sauce Market Size

The global soy sauce market size was valued at USD 56.10 billion in 2024 and is projected to reach USD 100.50 billion by 2032, with a CAGR of 7.56% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Soy Sauce Market Trends

“Innovation in Flavors and Ingredients”

Manufacturers are continuously innovating to meet changing consumer preferences by introducing new varieties of soy sauces infused with unique flavors. Flavored soy sauces, including those infused with garlic, mushroom, truffle, and other aromatic ingredients, are gaining popularity among consumers who seek enhanced taste profiles. These innovative formulations cater to diverse culinary applications, from marinades and stir-fries to dipping sauces and gourmet recipes. The growing interest in premium and artisanal bakery products is further fueling the demand for specialty soy sauces with rich, bold flavors. As consumers become more adventurous with their food choices, companies are focusing on expanding their product portfolios with unique, high-quality soy sauce variants to stay competitive in the market.

Report Scope and Soy Sauce Market Segmentation

|

Attributes |

Soy Sauce Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

OTAFUKU SAUCE Co., Ltd. (Japan), YAMASA CORPORATION USA (U.S.), Lee Kum Kee (Hong Kong), Bourbon Barrel Foods (U.S.), Masan Group (Vietnam), Kikkoman Corporation (Japan), Foshan Haitian Flavouring & Food Co., Ltd. (China), Sing Cheung Co. (Hong Kong), Aloha Shoyu Company (U.S.), Higeta Soy Sauce Co., Ltd. (Japan), SAN-J (U.S.), Eden Foods (U.S.), Kodanmal Group (India), SHODA SHOYU CO., LTD. (Japan), Dream Foods (Italy), MONGGO FOODS INC (South Korea), Cargill, Incorporated (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Soy Sauce Market Definition

Soy sauce is a liquid condiment traditionally made from fermented soybeans, wheat, salt, and water. It is widely used in Asian cuisine as a seasoning, marinade, and dipping sauce, adding umami-rich flavor to various dishes. The fermentation process, which involves the action of mold, yeast, and bacteria, enhances its deep, savory taste and aroma. Soy sauce comes in different varieties, including light, dark, sweet, and low-sodium options, catering to diverse culinary preferences. With its widespread global appeal, soy sauce is also incorporated into Western and fusion cuisines, making it a versatile and essential ingredient in kitchens worldwide.

Soy Sauce Market Dynamics

Drivers

- Rising Global Demand for Asian Cuisine

The growing global appreciation for Asian cuisine has significantly driven the demand for soy sauce, making it a staple ingredient in both traditional and fusion dishes. As consumers explore diverse flavors, the incorporation of soy sauce in international recipes has expanded beyond Asian restaurants to mainstream dining and home cooking. The rising trend of experimenting with global cuisines, along with the increasing availability of Asian food products in supermarkets and online stores, has further strengthened market growth. As a result, manufacturers are introducing new variations, including low-sodium and organic options, to cater to health-conscious consumers, making this a key market driver.

- Rise of the Foodservice Industry

The expansion of restaurants, fast-food chains, and ready-to-eat meal options has significantly boosted the demand for soy sauce in commercial kitchens and packaged food products. As consumers seek convenient and flavorful meal solutions, food service providers are incorporating soy sauce into a wide range of dishes, from marinades and stir-fries to dressings and dipping sauces. In addition, the growing popularity of takeout, meal kits, and frozen foods has further driven its use in processed food manufacturing. This increasing reliance on soy sauce as a key ingredient in the food service and packaged food sectors highlights its role as a major market driver.

Opportunities

- E-commerce and Online Retail Growth

The rise of online grocery shopping and direct-to-consumer sales channels is significantly expanding the accessibility of soy sauce to global consumers. E-commerce platforms, subscription-based food services, and direct brand websites are enabling consumers to explore a wide variety of soy sauce options, including organic, gluten-free, and flavored variants. This shift is particularly beneficial for specialty and international brands, allowing them to reach new markets without relying solely on traditional retail distribution. As digital shopping continues to grow, the increasing availability and convenience of purchasing soy sauce online present a lucrative market opportunity for manufacturers and suppliers worldwide.

- Product Innovation and Premium Offerings

Manufacturers are increasingly launching flavored, aged, and artisanal soy sauces to cater to evolving consumer tastes and preferences. Variants infused with ingredients such as garlic, truffle, mushroom, and chili are gaining popularity among home cooks and professional chefs seeking unique flavors. In addition, aged soy sauces with richer umami profiles and small-batch artisanal products appeal to premium and gourmet food markets. As consumers become more experimental with international cuisines, this diversification in product offerings presents a significant market opportunity, enabling brands to differentiate themselves and attract a broader customer base across retail, e-commerce, and food service channels.

Restraints/Challenges

- Rising Competition from Alternative Seasonings

The increasing consumer preference for healthier and allergen-free food options has intensified competition in the soy sauce market. With rising awareness of gluten intolerance and the demand for organic and plant-based alternatives, products such as coconut aminos and liquid aminos are gaining popularity as substitutes for traditional soy sauce. These alternatives offer lower sodium content and cater to consumers following specialized diets, including gluten-free, keto, and paleo lifestyles. As a result, soy sauce manufacturers face the challenge of adapting to evolving market preferences while maintaining their traditional consumer base. This shift poses a competitive challenge for established brands in the industry.

- Fluctuating Raw Material Costs

The soy sauce market faces challenges due to the fluctuating prices of essential raw materials such as soybeans and wheat. These price variations are influenced by factors such as adverse weather conditions, trade regulations, supply chain disruptions, and geopolitical tensions. Unpredictable shifts in agricultural yields can lead to increased costs for manufacturers, impacting profit margins and pricing strategies. In addition, rising transportation and labor costs further contribute to production expenses. As a result, companies must navigate these uncertainties while ensuring competitive pricing and maintaining product quality. These market restraints create financial pressures, particularly for smaller producers with limited resources.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Soy Sauce Market Scope

The market is segmented on the basis of product type, packaging type, distribution channel, and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Blended Soy Sauce

- Brewed Soy Sauce

Packaging Type

- Glass Jars

- Flexible Packs

- Plastic Jars

- Others

Distribution Channel

- Direct Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Application

- Household

- Food Processing

- Food Service Industry

Soy Sauce Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, packaging type, distribution channel, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

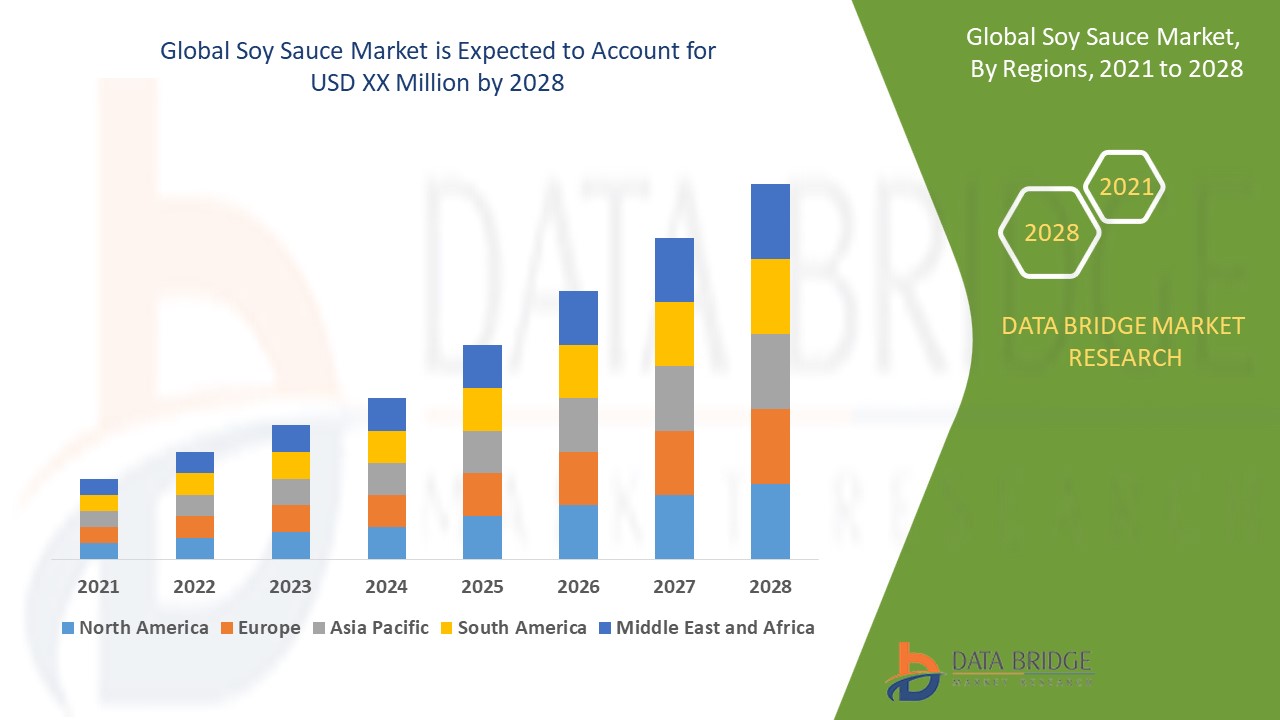

North America is the fastest-growing region in the soy sauce market, driven by the increasing popularity of Asian cuisine in everyday meals. The region’s consumers are actively seeking healthier condiment options, positioning soy sauce as a preferred alternative to high-sodium seasonings. In addition, the growing demand for organic, gluten-free, and low-sodium soy sauces further fuels market expansion.

The Asia-Pacific region dominates the soy sauce market and is expected to maintain its dominance throughout the forecast period. This growth is driven by a large and continuously expanding population base, which sustains high demand for soy sauce as a staple ingredient in various cuisines. In addition, the region's rich culinary heritage and increasing urbanization contribute to the market's steady expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Soy Sauce Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Soy Sauce Market Leaders Operating in the Market Are:

- OTAFUKU SAUCE Co., Ltd. (Japan)

- YAMASA CORPORATION USA (U.S.)

- Lee Kum Kee (Hong Kong)

- Bourbon Barrel Foods. (U.S.)

- Masan Group (Vietnam)

- Kikkoman Corporation (Japan)

- Foshan Haitian Flavouring & Food Co., Ltd. (Haitian) (China)

- Sing Cheung Co (Hong Kong)

- Aloha Shoyu Company (U.S.)

- Higeta Soy Sauce Co., Ltd (Japan)

- SAN-J (U.S.)

- Eden Foods (U.S.)

- Kodanmal Group (India)

- SHODA SHOYU CO., LTD. (Japan)

- Dream Foods (Italy)

- MONGGO FOODS INC (South Korea)

- Cargill, Incorporated (U.S.)

Latest Developments in Soy Sauce Market

- In April 2024, Lee Kum Kee introduced a brand campaign to promote its newly launched Supreme Soy Sauce, emphasizing its premium quality and versatility. The campaign aimed to inspire home cooks by showcasing how the product enhances flavors in everyday meals. Through digital and offline marketing efforts, the company sought to strengthen its brand presence among culinary enthusiasts. This initiative reflects Lee Kum Kee’s commitment to elevating home cooking experiences with superior soy sauce offerings

- In May 2021, Kraft Heinz Company unveiled a reduced-salt version of its Master Weijixian soy sauce, catering to health-conscious consumers. The new formulation contains 28% less salt while maintaining a rich umami taste, achieved through the inclusion of high-quality dried scallops. By launching this product, Kraft Heinz aimed to provide a healthier alternative without compromising on flavor. This move aligns with the growing demand for low-sodium condiments in the market

- In September 2020, Kraft Heinz made a strategic investment of USD 100 million in constructing a state-of-the-art soy sauce factory in Guangdong, China. This facility, one of the company's largest investments, is projected to produce 200,000 tons of soy sauce annually. The factory is expected to enhance Kraft Heinz’s production capabilities and cater to rising demand in the Asian market. This expansion reinforces the company’s long-term commitment to strengthening its presence in China

- In May 2020, Lee Kum Kee introduced a new range of soy sauce products in China, expanding its portfolio to meet evolving consumer preferences. The launch included a Hoisin Sauce variant blended with lime water, offering a unique twist to traditional flavors. By introducing this innovation, the company aimed to appeal to local taste preferences and enhance culinary creativity. This product expansion aligns with Lee Kum Kee’s strategy of continuously evolving to meet market demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Soy Sauce Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Soy Sauce Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Soy Sauce Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.