Global Speciality Starches Market

Market Size in USD Billion

CAGR :

%

USD

12.35 Billion

USD

19.24 Billion

2024

2032

USD

12.35 Billion

USD

19.24 Billion

2024

2032

| 2025 –2032 | |

| USD 12.35 Billion | |

| USD 19.24 Billion | |

|

|

|

|

Speciality Starches Market Size

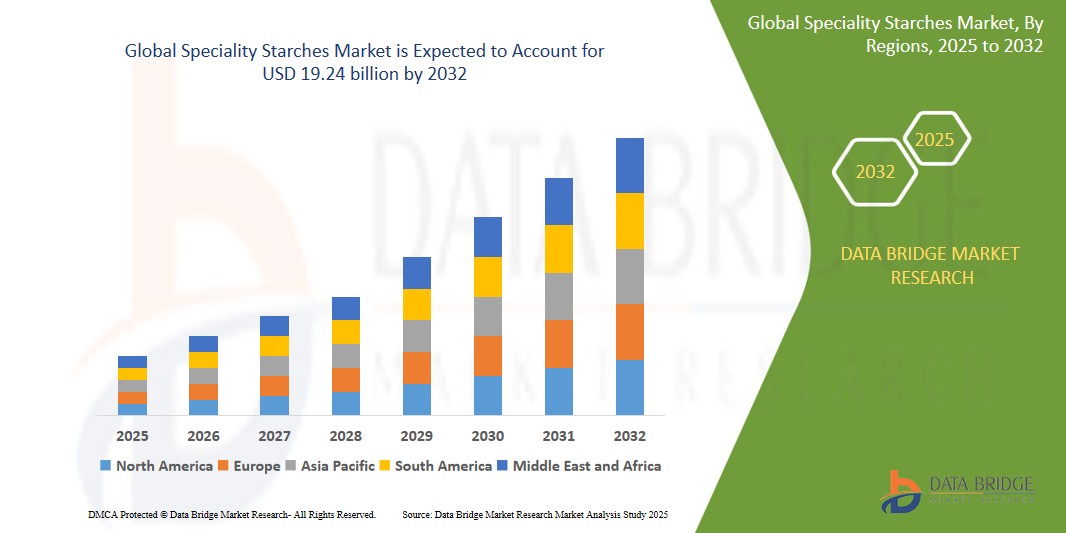

- The global speciality starches market size was valued at USD 12.35 billion in 2024 and is expected to reach USD 19.24 billion by 2032, at a CAGR of 5.70% during the forecast period

- This growth is driven by factors such as rising demand for processed foods, clean-label trends, growing use in pharma and cosmetics, expanding industrial applications, and rapid growth in emerging markets

Speciality Starches Market Analysis

- Specialty starches are modified starches designed for specific functional purposes across food, pharmaceutical, and industrial applications. They enhance texture, stability, and shelf life in processed foods, while also serving key roles in drug delivery systems and personal care products

- The market is experiencing steady growth, driven by increasing demand for convenience foods, rising adoption of clean-label ingredients, expanding industrial applications, and growing usage in pharmaceuticals and cosmetics

- North America is expected to dominate the speciality starches market due to rising awareness of health and wellness, particularly the benefits of low-fat and clean-label foods, as well as strong consumer demand for processed and convenience foods

- Asia-Pacific is expected to be the fastest growing region in the speciality starches market during the forecast period due to rapid urbanization, increasing disposable income, and growing demand for processed and convenience foods

- Corn segment is expected to dominate the market with a market share of 57.5% due to its abundant availability, cost-effectiveness, and versatility across industries such as food & beverages, pharmaceuticals, and textiles. In addition, its functional properties such as thickening and stabilizing, along with growing consumer demand for clean-label and non-GMO products, further boost its market share

Report Scope and Speciality Starches Market Segmentation

|

Attributes |

Speciality Starches Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Speciality Starches Market Trends

“Increasing Demand for Clean Label Starches”

- One prominent trend in the global speciality starches market is the increasing demand for clean label starches

- This trend is driven by the rising consumer preference for natural, minimally processed ingredients and growing awareness of health and wellness

- For instance, food manufacturers in the U.S. and Europe are increasingly replacing chemically modified starches with clean label alternatives derived from corn, potato, and tapioca

- The shift toward clean label formulations is also promoting innovation in processing techniques to maintain functionality without synthetic additives

- As food and beverage companies aim to meet clean label standards and regulatory expectations, the demand for clean label specialty starches is expected to play a key role in market expansion

Speciality Starches Market Dynamics

Driver

“Rise in Demand for Processed and Convenience Food”

- The rise in demand for processed and convenience food is a significant driver for growth in the specialty starches market, as these products rely heavily on starches for texture, stability, and shelf-life enhancement

- This shift is especially evident in ready-to-eat meals, snacks, and bakery products, which require functional ingredients that can withstand various processing conditions while maintaining product quality

- With increasing urbanization, busy lifestyles, and dual-income households, consumers are turning to convenient food options that are quick to prepare without compromising on taste or nutrition

- Specialty starch manufacturers are responding by developing starches tailored for specific functions such as freeze-thaw stability, moisture retention, and clean-label appeal

- As the global demand for convenience food continues to rise, the role of specialty starches in delivering product consistency and performance will drive their increased adoption

For instance,

- Companies such as Ingredion and Cargill are offering pregelatinized and resistant starches that enhance the texture and shelf life of processed foods without the need for chemical modification

- In Asia-Pacific, the surge in frozen food consumption is creating significant opportunities for modified starches that provide stability during long storage and reheating

- The ongoing shift in dietary habits and reliance on processed foods is expected to remain a key driver for specialty starch market growth in the coming years

Opportunity

“Developments in Food Processing Techniques”

- Developments in food processing techniques present a significant opportunity for the specialty starches market, driven by the need for ingredients that perform consistently under varied processing conditions

- The food industry is investing in advanced processing methods such as high-pressure processing, extrusion, and freeze-drying, which require starches with enhanced functional properties such as heat stability, emulsification, and gelling

- This opportunity aligns with the broader trend toward premium, functional, and clean-label food products that maintain quality throughout production, packaging, and storage

For instance,

- Ingredion has introduced specialty starches optimized for high-shear and high-temperature processing, enabling better texture and shelf stability in soups, sauces, and ready meals

- Tate & Lyle is developing starches tailored for use in extrusion-cooked snacks and cereals, maintaining crispness and expansion during processing

- As food manufacturers continue to adopt innovative technologies to meet consumer demands, the need for versatile and performance-driven specialty starches is expected to drive significant market growth

Restraint/Challenge

“Limited Sources and High Cost of Natural Additives”

- Limited sources and high cost of natural additives present a significant challenge for the specialty starches market, particularly as demand for clean label and plant-based ingredients continues to rise

- The reliance on specific crops such as organic corn, potato, and tapioca for clean label starch production can lead to supply constraints and price volatility, especially in regions with limited agricultural capacity

- This challenge becomes more pronounced as food and beverage manufacturers aim to replace synthetic additives with natural alternatives, while also maintaining cost-effectiveness and product performance

For instance,

- Companies sourcing non-GMO or organic starches often face higher input costs and supply chain limitations, impacting overall production scalability and pricing competitiveness

- The high cost and inconsistent availability of natural additives may hinder broader adoption of specialty starches in price-sensitive markets, posing a constraint on market growth despite rising consumer interest in clean label products

Speciality Starches Market Scope

The market is segmented on the basis of product, function, type, source, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Function |

|

|

By Type |

|

|

By Source

|

|

|

By End User |

|

|

By Distribution Channel |

|

In 2025, the corn is projected to dominate the market with a largest share in source segment

The corn segment is expected to dominate the speciality starches market with the largest share of 57.5% in 2025 due to its abundant availability, cost-effectiveness, and versatility across industries such as food & beverages, pharmaceuticals, and textiles. In addition, its functional properties such as thickening and stabilizing, along with growing consumer demand for clean-label and non-GMO products, further boost its market share.

The resistant is expected to account for the largest share during the forecast period in product market

In 2025, the resistant segment is expected to dominate the market due to its health benefits, including improved digestive health and blood sugar control. The rising demand for fiber-enriched and functional foods, along with its growing use in low-carb diets and clean-label products, is driving its popularity in the food and pharmaceutical industries.

Speciality Starches Market Regional Analysis

“North America Holds the Largest Share in the Speciality starches Market”

- North America dominates the speciality starches market, driven by the rising awareness of health and wellness, particularly the benefits of low-fat and clean-label foods, as well as strong consumer demand for processed and convenience foods

- U.S. holds a significant share of 19.4% due to large-scale corn production, advanced food processing capabilities, and favorable government policies in agriculture and food trade that encourage innovation in starch-based ingredients

- The region also benefits from a well-developed food and beverage industry, strong R&D infrastructure, and the presence of leading starch manufacturers such as Cargill and Ingredion

- As North America continues to lead in the development and adoption of functional and natural starch solutions, the region is expected to maintain its dominant market position throughout the forecast period of 2025 to 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Speciality starches Market”

- Asia-Pacific is expected to witness the highest growth rate in the speciality starches market, driven by rapid urbanization, increasing disposable income, and growing demand for processed and convenience foods

- China and India are key contributors, with expanding food manufacturing sectors, rising health awareness, and a shift toward westernized diets boosting the use of specialty starches in packaged and functional foods

- The region is also witnessing improvements in food processing infrastructure and increased investment in clean-label and plant-based food production, creating a favorable environment for specialty starch adoption

- With government support for agriculture, growing middle-class populations, and increasing industrial applications of specialty starches, Asia-Pacific is poised to be the fastest-growing region from 2025 to 2032

Speciality Starches Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Archer Daniels Midland Company (U.S.)

- Koninklijke DSM N.V. (Netherlands)

- Tate & Lyle (U.K.)

- Cargill, Incorporated (U.S.)

- Givaudan (Switzerland)

- DuPont (U.S.)

- Sensient Technologies Corporation (U.S.)

- Ingredion Incorporated (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Kerry Inc. (Ireland)

- Roquette Frères (France)

- AGRANA Beteiligungs-AG (Austria)

Latest Developments in Global Speciality Starches Market

- In August 2024, Roquette expanded its texturizing solutions with four new tapioca-based cook-up starches: CLEARAM TR 2010, CLEARAM TR 2510, CLEARAM® TR 3010, and CLEARAM® TR 4010. These starches are designed to meet the texture needs of food manufacturers, improving viscosity, consistency, and elasticity in applications such as sauces, dairy desserts, yogurt, and bakery fillings. This addition strengthens Roquette’s market position by offering innovative solutions that enhance sensory experiences and address the evolving demands of the food industry

- In February 2024, Ingredion Incorporated, a global leader in specialty ingredient solutions and clean label ingredients, introduced NOVATION Indulge 2940 starch. This new addition expands their clean label texturizer range with the first non-GMO functional native corn starch, offering a unique texture for gelling and co-texturizing in popular dairy, alternative dairy products, and desserts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Speciality Starches Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Speciality Starches Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Speciality Starches Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.