Global Spices And Seasonings In Meat And Poultry Market

Market Size in USD Billion

CAGR :

%

USD

16.56 Billion

USD

28.45 Billion

2024

2032

USD

16.56 Billion

USD

28.45 Billion

2024

2032

| 2025 –2032 | |

| USD 16.56 Billion | |

| USD 28.45 Billion | |

|

|

|

|

Spices and Seasonings in Meat and Poultry Market Size

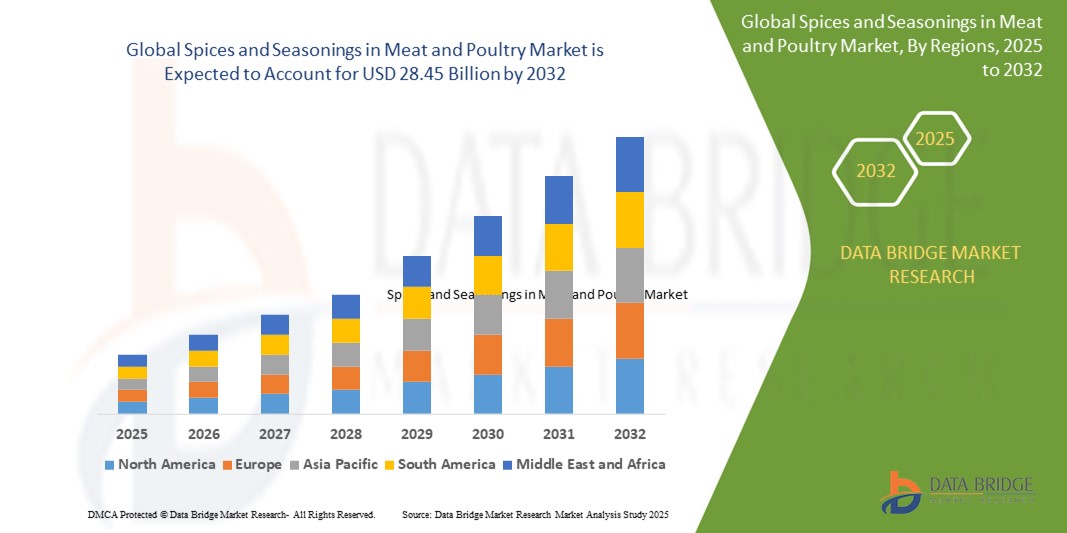

- The global spices and seasonings in meat and poultry market size was valued at USD 16.56 billion in 2024 and is expected to reach USD 28.45 billion by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fuelled by the rising global consumption of processed and ready-to-cook meat products, increasing preference for ethnic and flavorful cuisines, and growing awareness regarding clean-label and natural seasoning alternatives

- The expansion of the foodservice sector, including quick service restaurants and ready-meal providers, is further accelerating the demand for customized spice blends and marinades in meat and poultry preparations

Spices and Seasonings in Meat and Poultry Market Analysis

- Growing demand for customized flavor profiles in processed meats and poultry, especially in the quick service restaurant (QSR) and foodservice segments, is driving market expansion

- Increasing use of regional and ethnic spice blends such as harissa, peri-peri, chipotle, and garam masala is gaining traction among consumers seeking diverse taste experiences

- Asia-Pacific dominated the spices and seasonings in meat and poultry market with the largest revenue share of 38.7% in 2024, driven by the widespread use of spices in traditional cuisines and the growing demand for processed and ready-to-cook meat products

- North America region is expected to witness the highest growth rate in the global spices and seasonings in meat and poultry market, driven by increasing demand for ethnic flavors, rising consumption of processed and ready-to-cook meats, and a growing preference for clean-label seasoning products

- The spices segment dominated the market with the largest revenue share of 49.6% in 2024, driven by their widespread use in enhancing the flavor, aroma, and color of meat and poultry dishes. Spices such as black pepper, paprika, chili, cumin, and coriander are key ingredients in marinades, rubs, and seasoning mixes, widely adopted across both household and commercial applications. Their versatility and ability to cater to diverse culinary traditions make them indispensable in the global meat processing industry

Report Scope and Spices and Seasonings in Meat and Poultry Market Segmentation

|

Attributes |

Spices and Seasonings in Meat and Poultry Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Demand for Clean-Label and Organic Spice Blends in Meat and Poultry Applications • Growing Penetration of Ethnic and Fusion Flavors in Convenience-Based Meat Products |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Spices and Seasonings in Meat and Poultry Market Trends

“Surge in Demand for Ethnic and Regional Spice Blends”

- Consumers are seeking authentic and bold flavors influenced by global cuisines

- Indian, Middle Eastern, and Latin American spice blends are gaining popularity in marinated and processed meat products

- Manufacturers are launching ethnic-inspired seasoning kits for both retail and foodservice sectors

- For instance, chipotle and ancho chili seasonings are trending in smoked chicken offerings in U.S. QSRs

- In the Middle East, shawarma and za’atar seasoning blends are being incorporated into packaged poultry meals to meet growing demand for local flavor profiles

Spices and Seasonings in Meat and Poultry Market Dynamics

Driver

“Growth in Ready-to-Cook and Convenience-Based Meat Products”

- Rising urbanization and busy lifestyles are increasing demand for easy-to-prepare meat options

- Pre-seasoned and marinated meat products reduce preparation time and ensure flavor consistency

- Clean-label, natural spice blends are preferred by health-conscious consumers

- Manufacturers are developing proprietary spice mixes to strengthen brand identity and customer loyalty

- For instance, major U.S. retailers have introduced Cajun-style and garlic-marinated poultry cuts to cater to time-sensitive buyers

Restraint/Challenge

“Volatility in Raw Spice Prices and Supply Chain Disruptions”

- Spices depend on seasonal harvests in limited regions, making them vulnerable to price fluctuations

- Weather events, geopolitical tensions, and trade policies can impact spice availability and cost

- Supply chain issues such as port delays and increased freight charges affect timely ingredient sourcing

- Manufacturers, especially SMEs, face cost pressures and inventory management challenges

- For instance, during the COVID-19 pandemic, delayed spice imports from Asia disrupted seasoning supplies for meat processors in North America and Europe

Spices and Seasonings in Meat and Poultry Market Scope

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the spices and seasonings in meat and poultry market is segmented into herbs, salt and salt substitutes, and spices. The spices segment dominated the market with the largest revenue share of 49.6% in 2024, driven by their widespread use in enhancing the flavor, aroma, and color of meat and poultry dishes. Spices such as black pepper, paprika, chili, cumin, and coriander are key ingredients in marinades, rubs, and seasoning mixes, widely adopted across both household and commercial applications. Their versatility and ability to cater to diverse culinary traditions make them indispensable in the global meat processing industry.

The salt and salt substitutes segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing health awareness and the rising demand for low-sodium and heart-healthy meat products. Food processors are actively reformulating seasoning blends using potassium-based and natural salt alternatives to meet regulatory guidelines and consumer preferences. This segment is gaining momentum as manufacturers strive to balance flavor enhancement with nutritional considerations, particularly in developed markets where salt reduction is a key focus area.

• By Application

On the basis of application, the spices and seasonings in meat and poultry market is segmented into bakery and confectionery products, frozen food, soups, sauces, dressings, beverages, and others. The frozen food segment held the largest market revenue share in 2024, driven by the growing demand for ready-to-cook and ready-to-eat meat products. Consumers’ increasing preference for convenience-based meals has led to higher incorporation of spice blends in frozen meat and poultry formats to enhance flavor and extend shelf life. This trend is especially prominent in urban households and foodservice establishments relying on frozen inventories.

The sauces, dressings, and marinades segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing consumption of seasoned meat products and the expanding popularity of international cuisines. Spice-infused sauces and marinades play a crucial role in flavor delivery, especially in quick-service restaurants and premium dining outlets. The rising demand for exotic flavor combinations and customizable heat levels is further propelling growth in this segment as consumers seek diverse taste experiences in their meat and poultry preparations.

Spices and Seasonings in Meat and Poultry Market Regional Analysis

• Asia-Pacific dominated the spices and seasonings in meat and poultry market with the largest revenue share of 38.7% in 2024, driven by the widespread use of spices in traditional cuisines and the growing demand for processed and ready-to-cook meat products

• Countries such as India, China, and Indonesia are witnessing a surge in consumption of spice blends, marinades, and seasoning mixes, fueled by rising disposable incomes, urbanization, and changing dietary habits

• The region’s flourishing meat processing industry, coupled with increasing awareness of clean-label and natural ingredients, is further supporting the adoption of diverse spices and herbs in poultry and meat applications across both domestic and commercial segments

China Spices and Seasonings in Meat and Poultry Market Insight

The China spices and seasonings in meat and poultry market held the largest revenue share in Asia-Pacific in 2024, driven by the high consumption of pork and poultry, as well as the growing popularity of ready-to-eat meat dishes. Local and international manufacturers are launching region-specific seasoning blends that cater to diverse taste preferences across provinces. The strong presence of spice producers and meat processing facilities, along with growing demand for flavor innovation in convenience foods, continues to boost market growth

Japan Spices and Seasonings in Meat and Poultry Market Insight

The Japan spices and seasonings in meat and poultry market is growing steadily, supported by the country’s preference for subtle yet distinct flavors in meat dishes. Consumers are increasingly choosing spice-infused poultry products, especially in pre-cooked and convenience categories. The integration of spices in functional meat items such as low-sodium or high-protein variants is also gaining traction. Japan’s aging population and demand for nutrient-rich, flavorful foods are driving innovation in spice-based meat offerings

North America Spices and Seasonings in Meat and Poultry Market Insight

The North America is expected to be the fastest growing region in the spices and seasonings in meat and poultry market during the forecast period of 2025 to 2032, driven by rising consumer interest in bold, global flavors and a growing shift toward clean-label, premium meat products. The popularity of ethnic cuisines such as Mexican, Cajun, and Asian is fueling demand for exotic spice blends in processed meat and poultry. The region is witnessing increased innovation in pre-seasoned and marinated meats that appeal to convenience-seeking consumers looking for restaurant-style experiences at home

U.S. Spices and Seasonings in Meat and Poultry Market Insight

The U.S. spices and seasonings in meat and poultry market captured the largest revenue share in North America in 2024, driven by the growing consumption of processed meats, rapid expansion of retail-ready marinated poultry, and high demand for barbecue and smoked flavors. The U.S. market continues to witness strong growth in natural, organic, and low-sodium seasoning options. Leading players are introducing regionally inspired blends and functional spice formulations to meet evolving consumer preferences

Europe Spices and Seasonings in Meat and Poultry Market Insight

The Europe spices and seasonings in meat and poultry market is projected to register a significant CAGR during the forecast period, supported by a strong meat consumption base and increasing focus on flavor enhancement through herbs and spices. The trend toward health-conscious eating and the reduction of artificial additives is encouraging the use of clean-label, organic seasonings. Countries across the region are seeing rising demand for spice-infused processed meats in both retail and foodservice sectors

U.K. Spices and Seasonings in Meat and Poultry Market Insight

The U.K. spices and seasonings in meat and poultry market is poised for steady growth, supported by a growing preference for global cuisines and the rise of premium, ready-to-cook meat products. Consumers are showing increasing interest in Mediterranean, Indian, and Middle Eastern flavor profiles. Retailers and manufacturers are launching new marinated meat products using spice blends that offer a fusion of taste and convenience, aligning with the U.K.’s evolving food culture

Germany Spices and Seasonings in Meat and Poultry Market Insight

The Germany spices and seasonings in meat and poultry market is expected to expand at a healthy CAGR, fueled by the rising demand for organic and plant-based meat seasonings, along with a strong tradition of processed meat consumption. German consumers are actively seeking healthier, additive-free spice options. The market is also experiencing a shift toward culinary experimentation, with spice combinations tailored for grilling, roasting, and slow-cooked meat dishes gaining strong traction in both urban and rural areas.

Spices and Seasonings in Meat and Poultry Market Share

The Spices and Seasonings in Meat and Poultry industry is primarily led by well-established companies, including:

- McCormick & Company, Inc. (U.S.)

- Olam Group (Singapore)

- Ajinomoto Co. Inc. (Japan)

- Associated British Foods plc (U.K.)

- Kerry Group plc (Ireland)

- Sensient Technologies Corporation (U.S.)

- Döhler GmbH (Germany)

- SHS Group (U.K.)

- F.Z. Organic Food (Netherlands)

- Rhythm Superfoods, LLC. (U.S.)

- Luke’s Organic (U.S.)

- Late July Snacks LLC (U.S.)

- General Mills Inc. (U.S.)

Latest Developments in Global Spices and Seasonings in Meat and Poultry Market

- In February 2021, Olam Food Ingredients, a newly formed operating group under Olam International Limited, expanded its spice portfolio by acquiring Mizkan America Inc. Olam Americas Inc, a subsidiary of Olam International, invested USD 108.5 million in this U.S. based chile pepper business, known for high-quality New Mexico green chilies and specialty peppers

- In February 2021, The Kerry Group finalized its acquisition of Jining Nature Group, a prominent Chinese manufacturer specializing in flavors, seasonings, and prepared food products. This strategic move bolstered Kerry’s presence in China’s food industry, enhancing its portfolio and market reach in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Spices And Seasonings In Meat And Poultry Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Spices And Seasonings In Meat And Poultry Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Spices And Seasonings In Meat And Poultry Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.