Global Sweet Spread Market

Market Size in USD Billion

CAGR :

%

USD

11.00 Billion

USD

14.16 Billion

2024

2032

USD

11.00 Billion

USD

14.16 Billion

2024

2032

| 2025 –2032 | |

| USD 11.00 Billion | |

| USD 14.16 Billion | |

|

|

|

|

Sweet Spread Market Size

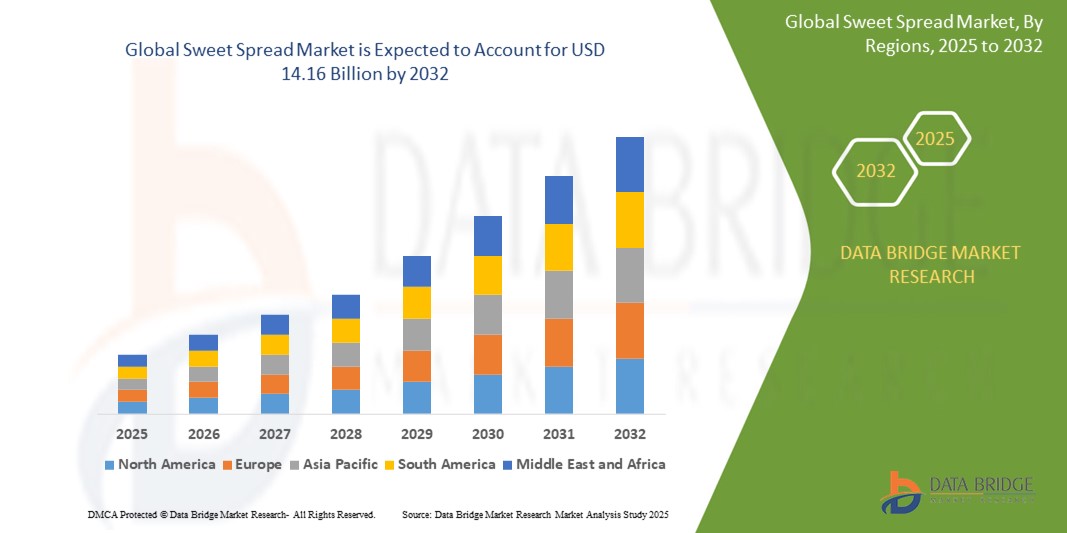

- The global sweet spread market was valued at USD 11.00 billion in 2024 and is expected to reach USD 14.16 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.20 % primarily driven by the rising demand for healthier and more diverse sweet spread options

- This growth is driven by factors such as the increasing consumer preference for organic, low-sugar, and plant-based sweet spreads

Sweet Spread Market Analysis

- Sweet spread is a sweet, spreadable food product, typically made from ingredients such as fruit, sugar, or chocolate, used on bread, crackers, or other foods

- The sweet spread market is expanding as consumers seek more variety in their food choices, with products such as jams, chocolate spreads, and nut butters becoming household staples, catering to a wide range of preferences

- For instance, brands such as Nutella and Jif are leading the chocolate and peanut butter spread categories

- There is a notable shift towards premium and artisanal sweet spreads, as consumers demand higher quality ingredients and unique flavors, such as organic almond butter by Justin’s and small-batch fruit preserves such as Bonne Maman, which offer a more gourmet experience

- Health-conscious consumers are driving the popularity of low-sugar, organic, and plant-based spreads, with instances such as sugar-free peanut butter from PB2 and dairy-free hazelnut spreads from Nocciolata gaining traction in the market

- The rise of e-commerce and online retail platforms is increasing accessibility to a variety of sweet spreads, allowing consumers to explore new and international brands from the comfort of their homes, with platforms such as Amazon and specialty stores such as Thrive Market offering a wide selection of global options

- Sustainability is becoming a key factor in the market, with brands focusing on eco-friendly packaging and ethically sourced ingredients, such as fair-trade certified honey by HoneyTree and organic cocoa used in sweet spreads such as those from Alter Eco

Report Scope and Sweet Spread Market Segmentation

|

Attributes |

Sweet Spread Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sweet Spread Market Trends

“Increasing Demand for Healthier Options”

- The demand for healthier options in the sweet spread market is growing as consumers increasingly focus on wellness and clean eating, leading to the rise of low-sugar, organic, and plant-based spreads

- For instance, brands such as Smucker’s and Jif have introduced sugar-free peanut butters to cater to this growing demand

- Brands such as Justin's have responded by offering organic peanut butter and almond butter, catering to consumers looking for natural, clean-label products without added sugars or preservatives, Justin’s also offers a variety of nut butters made with only a few ingredients, appealing to health-conscious consumers

- The popularity of plant-based diets has driven the demand for dairy-free spreads, with instances such as Nocciolata Organic Dairy-Free Hazelnut Spread offering a vegan alternative to traditional chocolate spreads, providing a rich, creamy texture without any dairy

- The trend towards organic ingredients is evident in products such as the honey-based spreads from HoneyTree, which are marketed as organic and free from artificial additives

- For instance, HoneyTree’s organic honey options cater to consumers who prefer sustainably sourced and pure ingredients

- Health-conscious consumers are opting for sugar-free options, with spreads such as Smucker’s Natural Peanut Butter offering no added sugar, making it an attractive choice for those following low-sugar or ketogenic diets, showing a shift towards more mindful, healthier indulgences

Sweet Spread Market Dynamics

Driver

“Rising Popularity of Plant-Based and Vegan Diets”

- The shift toward plant-based and vegan diets is significantly influencing consumer preferences in the sweet spread market, as more people reduce animal products for health, environmental, and ethical reasons, driving demand for dairy-free and vegan-friendly spreads

- For instance, a 2024 Nielsen report found that nearly 39% of global consumers now identify as flexitarian, contributing to this growing demand

- Nocciolata Organic Dairy-Free Hazelnut Spread has gained strong shelf presence across major retailers

- For instance, it’s available in Whole Foods and Sprouts and offers a creamy, chocolatey flavor without dairy, making it a preferred choice for vegan consumers looking for indulgent but ethical alternatives to traditional chocolate spreads

- Brands are responding with innovative plant-based options

- Minimal ingredient lists and clean sourcing are also key; for instance, Justin’s almond and peanut butters are made with just two or three ingredients and are USDA Organic and Non-GMO Project Verified, making them highly appealing to vegan and health-conscious buyers

- Fruit-based spreads are being chosen as plant-based alternatives to honey or dairy-based options

- For instance, St. Dalfour offers 100% fruit spreads with no added sugars or gelatin, now found in stores such as Walmart and Costco, appealing to those seeking natural, vegan-friendly sweetness

Opportunity

“Rise in Premium and Artisanal Products”

- The growing demand for premium and artisanal sweet spreads presents a significant opportunity in the market

- For instance, brands such as Bonne Maman and Stonewall Kitchen offer small-batch, handcrafted jams with unique flavors such as wild blueberry and strawberry rhubarb, catering to consumers seeking high-quality, distinctive spreads

- Consumers are increasingly prioritizing innovative flavors and premium ingredients in their sweet spread choices

- For instance, Justin’s and Barney Butter focus on using organic and non-GMO nuts in their nut butters, appealing to those looking for healthier, premium options

- The willingness to pay more for high-quality products is driving the demand for premium sweet spreads

- For instance, fair-trade honey and single-origin chocolate spreads are gaining popularity among consumers who value sustainability and ethical sourcing

- As consumers become more adventurous with their food choices, they are gravitating toward artisanal options that offer a more personalized and high-quality experience

- For instance, small-batch jam brands are becoming increasingly popular among those who seek unique flavors beyond traditional spreads

- The premium sweet spread market is expanding, with brands seizing the opportunity to innovate and create products that meet the evolving needs of health-conscious and discerning consumers looking for exclusive and high-end flavor experiences

Restraint/Challenge

“Price Sensitivity and Competition from Private Labels”

- Price sensitivity is a key challenge in the sweet spread market, especially in emerging markets where many consumers opt for budget-friendly options over premium products

- For instance, private label brands are increasingly offering low-cost alternatives that compete with established brands, making it difficult for premium products to capture market share

- Private label sweet spreads are gaining traction, as retailers offer store-brand alternatives that mimic the quality of well-known brands at a fraction of the cost

- For instance, supermarket chains are expanding their own-brand product lines to include sweet spreads, which puts pressure on premium brands to compete with the lower-priced options

- The competition from low-priced products forces manufacturers to balance quality and affordability, which can challenge profitability

- For instance, some premium brands have responded by introducing more affordable versions of their spreads, though it remains difficult to retain high margins while appealing to price-sensitive consumers

- Sweet spread brands are under pressure to innovate and differentiate themselves to maintain relevance in the market

- For instance, some companies are focusing on unique flavours, healthier ingredients, and sustainable practices to create added value that justifies the higher price point

- As the price-sensitive market continues to grow, brands in the premium segment must find new ways to remain competitive by offering exclusive products that justify the price difference, while still ensuring their products resonate with cost-conscious buyers

Sweet Spread Market Scope

The market is segmented on the basis of product type, ingredient type, packaging type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type: |

|

|

By Ingredient Type |

|

|

By Packaging Type |

|

|

By Distribution Channel |

|

Sweet Spread Market Regional Analysis

“North America is the Dominant Region in the Sweet Spread Market”

- North America dominates the sweet spread market, driven by strong consumer demand in the U.S. and Canada

- High preference for popular sweet spreads such as mayonnaise, garlic butter, and avocado spreads contributes to market strength

- Widespread consumption of fast-food items, such as sandwiches and burgers, further fuels demand for sweet spreads

- The growing market for low-fat and low-sugar sweet spreads caters to the increasing number of health-conscious consumers

- A well-established retail infrastructure positions North America as a leader in the market, with a significant market share and influence on global trends

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing region in the sweet spread market, driven by the increasing adoption of Western food culture in countries such as China, India, and Japan

- Chocolate-based spreads are gaining popularity, appealing to consumers' taste preferences and boosting demand

- The rise of fast-food chains such as McDonald's and the growth of online food delivery apps contribute to the region's expanding sweet spread market

- A young, tech-savvy population, along with widespread use of mobile food apps, accelerates the consumption of sweet spreads

- The Asia-Pacific market is expected to continue growing rapidly as consumers embrace the convenience of sweet spreads and adapt to changing dietary habits and food preferences

Sweet Spread Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- The Kraft Heinz Company (U.S.)

- Unilever (U.K.)

- The J.M. Smucker Company (U.S.)

- Ferrero (Italy)

- Conagra Brands, Inc. (U.S.)

- F. Duerr & Sons Ltd (U.K.)

- Pioneer Food Group (South Africa)

- Mondelez International (U.S.)

- Hormel Foods Corporation (U.S.)

- Andros Foods (France)

- The Hershey Company (U.S.)

- Dabur India Limited (India)

- Glanbia PLC (Ireland)

- Dr. August Oetker Nahrungsmittel KG (Germany)

- Premium Vegetable Oils Sdn Bhd (Malaysia)

Latest Developments in Global Sweet Spread Market

- In March 2023, Bonne Maman launched its Hazelnut Chocolate Spread in the U.S. market. This development marks the brand's expansion beyond its traditional fruit preserves into the chocolate spread category. The spread is crafted with high-quality, natural ingredients, including 20% hazelnuts, and is free from palm oil, catering to health-conscious consumers. Available in 8.8 oz and 12.7 oz glass jars, it is priced between USD 6.49 and USD 8.99. The product is positioned as a versatile option for snacking, spreading, or incorporating into recipes. Its introduction provides a premium alternative to existing chocolate spreads, potentially impacting market dynamics by appealing to consumers seeking cleaner, indulgent options

- In April 2022, Marico Limited expanded its Saffola brand by introducing Saffola Mayonnaise and Saffola Peanut Butter, marking its entry into the healthy spreads category. Saffola Mayonnaise is an eggless variant made with milk cream and enriched with vitamins A, D, and E, offering a healthier option for consumers. Saffola Peanut Butter replaces refined sugar with jaggery and provides 31% of the recommended daily allowance for protein, catering to health-conscious individuals. These products are available in both 'Crunchy' and 'Creamy' variants and are currently accessible on major e-commerce platforms, with plans for phased expansion across other channels. This launch strengthens Marico's position in the healthy foods and ready-to-eat segment, aligning with the growing consumer demand for nutritious and convenient snacking options

- In March 2022, Hershey India launched its 'Crunchy Cookie' Chocolate Spread, expanding its breakfast offerings. This product combines creamy cocoa with crunchy cookie pieces, targeting Millennials and Gen Z consumers seeking indulgent, multi-sensory breakfast options. The launch aims to enhance the breakfast experience, making it more enjoyable and appealing to younger audiences. By introducing this unique variant, Hershey India strengthens its presence in the chocolate spreads category and aligns with evolving consumer preferences for innovative and flavourful spreads

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SWEET SPREAD MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL SWEET SPREAD MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 CONSUMPTION TREND OF END PRODUCTS

2.2.9 TOP TO BOTTOM ANALYSIS

2.2.10 STANDARDS OF MEASUREMENT

2.2.11 VENDOR SHARE ANALYSIS

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL SWEET SPREAD MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 FACTORS INFLUENCING PURCHASING DECISION

5.3 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5.4 SHOPPING BEHAVIOUR AND DYNAMICS

5.4.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.4.2 RESEARCH

5.4.3 IMPULSIVE

5.4.4 ADVERTISEMENT

5.4.4.1. TTELEVISION ADVERTISEMENT

5.4.4.2. OONLINE ADVERTISEMENT

5.4.4.3. IIN-STORE ADVERTISEMENT

5.4.4.4. OOUTDOOR ADVERTISEMENT

5.5 PRIVATE LABEL VS BRAND ANALYSIS

5.6 PROMOTIONAL ACTIVITIES

5.7 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.8 NEW PRODUCT LAUNCH STRATEGY

5.8.1 NUMBER OF NEW PRODUCT LAUNCHES

5.8.1.1. LLINE EXTENSION

5.8.1.2. NNEW PACKAGING

5.8.1.3. RRE-LAUNCHED

5.8.1.4. NNEW FORMULATION

5.9 CONSUMER LEVEL TRENDS

5.10 MEETING CONSUMER REQUIREMENTS

5.11 BRAND COMPARATIVE ANALYSIS

6. REGULATORY FRAMEWORK AND GOVERNMENT INITIATIVES

7. GLOBAL SWEET SPREAD MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CHOCOLATE SPREAD

7.2.1 CHOCOLATE SPREAD, BY TYPE

7.2.1.1. DARK CHOCOLATE SPREAD

7.2.1.2. WHITE CHOCOLATE SPREAD

7.2.1.3. MILK CHOCOLATE SPREAD

7.2.2 CHOCOLATE SPREAD, BY COCOA CONTENT

7.2.2.1. LESS THAN 50%

7.2.2.2. 50%-60%

7.2.2.3. 61%-70%

7.2.2.4. 71%-80%

7.2.2.5. 81%-90%

7.2.2.6. 91%-100%

7.3 NUT BASED SPREAD

7.3.1 NUT BASED SPREAD, BY TYPE

7.3.1.1. PEASWEET SPREADS

7.3.1.2. ALMOND BASED SPREADS

7.3.1.3. WALSWEET SPREADS

7.3.1.4. CASHEW BASED SPREADS

7.3.1.5. HAZELSWEET SPREADS

7.3.1.6. OTHERS (IF ANY)

7.4 JAMS, JELLY & PRESERVE

7.5 OTHERS

8. GLOBAL SWEET SPREAD MARKET, BY CALORIE

8.1 OVERVIEW

8.2 HIGH CALORIE

8.3 LOW CALORIE

8.4 NO CALORIE

9. GLOBAL SWEET SPREAD MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10. GLOBAL SWEET SPREAD MARKET, BY FLAVORS

10.1 OVERVIEW

10.2 REGULAR

10.3 FLAVORED

10.3.1 FLAVORED, BY TYPE

10.3.1.1. DARK CHOCOLATE

10.3.1.2. WHITE CHOCOLATE

10.3.1.3. MAPLE

10.3.1.4. CINNAMON

10.3.1.5. HONEY

10.3.1.6. CARAMEL

10.3.1.7. HAZELNUT

10.3.1.8. TURMERIC

10.3.1.9. MATCHA GREEN TEA

10.3.1.10. BUTTERSCOTCH

10.3.1.11. PEPPERMINT

10.3.1.12. IRISH CREAM

10.3.1.13. VANILLA

10.3.1.14. MOCHA

10.3.1.15. OTHERS (IF ANY)

11. GLOBAL SWEET SPREAD MARKET, BY SWEETNESS CATEGORY

11.1 OVERVIEW

11.2 SWEETENED

11.3 UNSWEETENED

12. GLOBAL SWEET SPREAD MARKET, BY CLAIM

12.1 OVERVIEW

12.2 GLUTEN-FREE

12.3 VEGAN

12.4 NON-GMO

12.5 PRESERVATIVES FREE

12.6 ALL OF THE ABOVE-MENTIONED CLAIMS

12.7 REGULAR/NO CLAIM

13. GLOBAL SWEET SPREAD MARKET, BY BRAND

13.1 OVERVIEW

13.2 PRIVATE LABEL

13.3 BRANDED

14. GLOBAL SWEET SPREAD MARKET, BY PACKAGING TYPE

14.1 OVERVIEW

14.2 BOTTLES

14.3 JARS

14.4 CANS

14.5 POUCHES & SACHETS

14.6 OTHERS (IF ANY)

15. GLOBAL SWEET SPREAD MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 STORE-BASED RETAILING

15.2.1 CONVENIENCE STORES

15.2.2 SUPERMARKETS/HYPERMARKETS

15.2.3 SPECIALTY STORES

15.2.4 GROCERY STORES

15.2.5 WHOLESALERS

15.2.6 OTHERS

15.3 NON-STORE RETAILING

15.3.1 ONLINE RETAILERS

15.3.2 COMPANY WEBSITE

16. GLOBAL SWEET SPREAD MARKET, BY GEOGRAPHY

16.1 GLOBAL SWEET SPREAD MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.2 NORTH AMERICA

16.2.1 U.S.

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 U.K.

16.3.3 ITALY

16.3.4 FRANCE

16.3.5 SPAIN

16.3.6 SWITZERLAND

16.3.7 NETHERLANDS

16.3.8 BELGIUM

16.3.9 RUSSIA

16.3.10 SWEDEN

16.3.11 TURKEY

16.3.12 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 JAPAN

16.4.2 CHINA

16.4.3 SOUTH KOREA

16.4.4 INDIA

16.4.5 AUSTRALIA

16.4.6 SINGAPORE

16.4.7 THAILAND

16.4.8 INDONESIA

16.4.9 MALAYSIA

16.4.10 PHILIPPINES

16.4.11 NEW ZEALAND

16.4.12 VIETNAM

16.4.13 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SOUTH AFRICA

16.6.2 UAE

16.6.3 SAUDI ARABIA

16.6.4 OMAN

16.6.5 QATAR

16.6.6 KUWAIT

16.6.7 REST OF MIDDLE EAST AND AFRICA

17. GLOBAL SWEET SPREAD MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS & PARTNERSHIP

17.8 REGULATORY CHANGES

18. GLOBAL SWEET SPREAD MARKET, COMPANY PROFILE

18.1 THE J.M. SMUCKER COMPANY

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 GEOGRAPHIC PRESENCE

18.1.5 RECENT DEVELOPMENTS

18.2 THE HERSHEY COMPANY

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 GEOGRAPHIC PRESENCE

18.2.5 RECENT DEVELOPMENTS

18.3 HORMEL FOODS CORPORATION

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 GEOGRAPHIC PRESENCE

18.3.5 RECENT DEVELOPMENTS

18.4 FERRERO

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 GEOGRAPHIC PRESENCE

18.4.5 RECENT DEVELOPMENTS

18.5 KRAFT FOODS GROUP

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 GEOGRAPHIC PRESENCE

18.5.5 RECENT DEVELOPMENTS

18.6 NUFLOWER FOODS AND NUTRITION

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 GEOGRAPHIC PRESENCE

18.6.5 RECENT DEVELOPMENTS

18.7 SHEDD'S COUNTRY CROCK

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 GEOGRAPHIC PRESENCE

18.7.5 RECENT DEVELOPMENTS

18.8 SOCIAL NATURE

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 GEOGRAPHIC PRESENCE

18.8.5 RECENT DEVELOPMENTS

18.9 NATURE'S EATS

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 GEOGRAPHIC PRESENCE

18.9.5 RECENT DEVELOPMENTS

18.10 GREENNATURE AGROTECH LLP

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 GEOGRAPHIC PRESENCE

18.10.5 RECENT DEVELOPMENTS

18.11 PRANA

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 GEOGRAPHIC PRESENCE

18.11.5 RECENT DEVELOPMENTS

18.12 AMUL

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 GEOGRAPHIC PRESENCE

18.12.5 RECENT DEVELOPMENTS

18.13 MOTHER NUTRI FOODS

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 GEOGRAPHIC PRESENCE

18.13.5 RECENT DEVELOPMENTS

18.14 PEANUT BUTTER & CO

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 GEOGRAPHIC PRESENCE

18.14.5 RECENT DEVELOPMENTS

18.15 ALGOOD FOOD CO

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 GEOGRAPHIC PRESENCE

18.15.5 RECENT DEVELOPMENTS

18.16 CONAGRA BRANDS, INC.

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 GEOGRAPHIC PRESENCE

18.16.5 RECENT DEVELOPMENTS

18.17 THE LEAVITT CORPORATION

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 GEOGRAPHIC PRESENCE

18.17.5 RECENT DEVELOPMENTS

18.18 DISANO

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 GEOGRAPHIC PRESENCE

18.18.5 RECENT DEVELOPMENTS

18.19 ALPINO

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 GEOGRAPHIC PRESENCE

18.19.5 RECENT DEVELOPMENTS

18.20 PINTOLA

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 GEOGRAPHIC PRESENCE

18.21 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 GEOGRAPHIC PRESENCE

18.21.5 RECENT DEVELOPMENTS

18.22 MONDELEZ INTERNATIONAL

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 GEOGRAPHIC PRESENCE

18.22.5 RECENT DEVELOPMENTS

18.23 NESTLÉ

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 GEOGRAPHIC PRESENCE

18.23.5 RECENT DEVELOPMENTS

18.24 NUTKAO S.R.L

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 GEOGRAPHIC PRESENCE

18.24.5 RECENT DEVELOPMENTS

18.25 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 PRODUCT PORTFOLIO

18.25.4 GEOGRAPHIC PRESENCE

18.25.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19. CONCLUSION

20. QUESTIONNAIRE

21. RELATED REPORTS

22. ABOUT DATA BRIDGE MARKET RESEARCH

Global Sweet Spread Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sweet Spread Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sweet Spread Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.