Global System Integration Market

Market Size in USD Million

CAGR :

%

USD

444.19 Million

USD

999.55 Million

2024

2032

USD

444.19 Million

USD

999.55 Million

2024

2032

| 2025 –2032 | |

| USD 444.19 Million | |

| USD 999.55 Million | |

|

|

|

|

System Integration Market Analysis

The system integration market is experiencing significant growth, driven by the increasing need for businesses to streamline their operations and improve efficiency. System integration involves the process of linking different computing systems, software applications, and hardware devices to work together seamlessly. This enables businesses to optimize their IT infrastructure and automate various processes, improving productivity and reducing costs. Recent developments in cloud computing, the Internet of Things (IoT), and artificial intelligence (AI) are further accelerating the demand for advanced system integration solutions. Industries such as healthcare, manufacturing, retail, and finance are increasingly adopting these solutions to enhance customer experiences and gain a competitive edge. With the rise in digital transformation, companies are investing in system integration to ensure smooth communication and interoperability across various platforms. This trend is expected to continue as businesses seek to stay agile, improve decision-making, and support data-driven initiatives.

System Integration Market Size

The global system integration market size was valued at USD 444.19 million in 2024 and is projected to reach USD 999.55 million by 2032, with a CAGR of 10.67% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

System Integration Market Trends

“Adoption of Cloud-Based System”

The system integration market is evolving rapidly as businesses seek to enhance operational efficiency and digital transformation. Innovations in cloud computing, artificial intelligence (AI), and automation are driving demand for more sophisticated integration solutions. A key trend is the growing adoption of cloud-based system integration, allowing businesses to seamlessly connect on-premise and cloud applications. This trend is helping companies reduce infrastructure costs and improve scalability while enhancing data accessibility. As industries such as healthcare, finance, and retail continue to digitize, the demand for seamless integration across diverse platforms is increasing. With advancements in technology, system integration is becoming more flexible, scalable, and essential for businesses striving to stay competitive in a digital-first world.

Report Scope and System Integration Market Segmentation

|

Attributes |

System Integration Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Capgemini (France), Accenture (Ireland), IBM (U.S.), Infosys Limited (India), Jitterbit (U.S.), Magic Software Enterprises (Israel), HCL Technologies Limited (India), Wipro (India), Johnson Controls Inc. (Ireland), Cognizant (U.S.), Tata Consultancy Services Limited (India), John Wood Group PLC (U.K.), ATS Corporation (Canada), Avanceon (UAE), Tesco Controls (U.S.), Burrow Global LLC (U.S.), Prime Controls LP (U.S.), Rockwell Automation (U.S.), and BW Design Group (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

System Integration Market Definition

System integration refers to the process of connecting different computing systems, hardware, software, and applications within an organization to work together as a unified system. The goal is to streamline operations, improve efficiency, and ensure seamless communication between various technological components. This integration allows for the automation of workflows, data sharing across platforms, and enhanced functionality. By integrating disparate systems, businesses can optimize their IT infrastructure, improve decision-making, and reduce operational costs.

System Integration Market Dynamics

Drivers

- Rising Demand for Automation

The increasing adoption of automated systems across industries is a significant driver of the system integration market. Automation enhances efficiency by streamlining processes, reducing human errors, and accelerating operational workflows. Industries such as manufacturing, healthcare, and retail are implementing advanced automation technologies to optimize resource utilization and lower operational costs. Automated systems often require seamless integration with existing IT infrastructure and other technologies, driving the demand for robust system integration solutions. This trend is further fueled by the rising focus on Industry 4.0, smart factories, and digital transformation initiatives, positioning automation as a key catalyst for market growth.

- Rapid Proliferation of Internet of Things (IoT) Devices

The rapid proliferation of Internet of Things (IoT) devices across various industries is driving the need for effective system integration solutions. With the growing number of connected devices, sensors, and data sources, organizations face the challenge of ensuring seamless communication and management across diverse platforms. System integration enables businesses to connect IoT devices, consolidate data, and automate processes, resulting in improved efficiency, real-time insights, and enhanced decision-making. As industries such as manufacturing, healthcare, and logistics increasingly adopt IoT technologies, the demand for integration solutions continues to rise, making IoT integration a key driver for the system integration market.

Opportunities

- Industry-Specific Solutions

The growing demand for industry-specific system integration solutions presents significant opportunities for specialized service providers. In sectors such as healthcare, the integration of electronic health records (EHR) systems and patient data management solutions is becoming increasingly critical to improve efficiency, data accessibility, and compliance. Similarly, the finance industry requires robust integration solutions to ensure smooth transaction processing, regulatory compliance, and data security. These industry-specific needs create a niche market for system integrators with expertise in areas such as healthcare IT and financial services, offering tailored solutions that address the unique challenges and requirements of each sector. This trend is driving growth in the system integration market.

- Integration of Artificial Intelligence

The integration of artificial intelligence (AI) and automation technologies is creating significant opportunities for system integrators to enhance business operations. AI-powered predictive analytics and machine learning models enable businesses to make data-driven decisions and improve forecasting accuracy. In addition, robotic process automation (RPA) helps automate repetitive tasks, increasing efficiency and reducing human error. However, these advanced technologies require complex integration solutions to ensure seamless functioning across different platforms and systems. As more companies adopt AI and automation to stay competitive, the demand for sophisticated system integration services will grow, offering a key market opportunity for providers to deliver tailored, cutting-edge solution.

Restraints/Challenges

- Complexity of Integration

Integrating diverse systems, technologies, and platforms, particularly when modern solutions must be combined with legacy systems, poses significant challenges in the system integration market. This process is often complex and time-consuming due to the need to reconcile different data formats, communication protocols, and system architectures. It requires specialized expertise to ensure compatibility and seamless operation across the various systems. In addition, businesses must invest substantial resources in terms of both financial costs and skilled labor to effectively manage these integration projects. As a result, this complexity can lead to longer implementation times, increased costs, and the potential for disruption, highlighting it as a major challenge in the market.

- High Initial Investment

The cost of implementing system integration solutions can be a significant restraint, particularly for smaller businesses with limited budgets. The process involves substantial investments in software, hardware, and specialized skilled labor, which can create financial barriers for many organizations. Small and medium-sized enterprises (SMEs) may struggle to allocate the necessary resources for complex system integration projects, especially when they need to integrate legacy systems with modern technologies. This financial burden can limit the adoption of system integration solutions in certain markets, especially in emerging economies, where businesses may prioritize other operational needs over costly technological upgrades.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

System Integration Market Scope

The market is segmented on the basis of service, application, consulting, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service

- Building Management System (BMS)

- Cloud Integration

- Integrated Communication

- Data Center Infrastructure Management (DCIM)

- Network Integration

- Others

Application

- Application Integration

- Data Integration

- Unified Communication

- Integrated Market Security Software

- Integrated Social Software

- Others

Consulting

- Application Lifecycle Management (ALM)

- Business Transformation

- Business Process Integration

- Others

Vertical

- Government

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Goods and Retail

- Healthcare

- Manufacturing

- Oil, Gas, and Energy

- Telecommunication and IT

- Transportation and Logistics

- Others

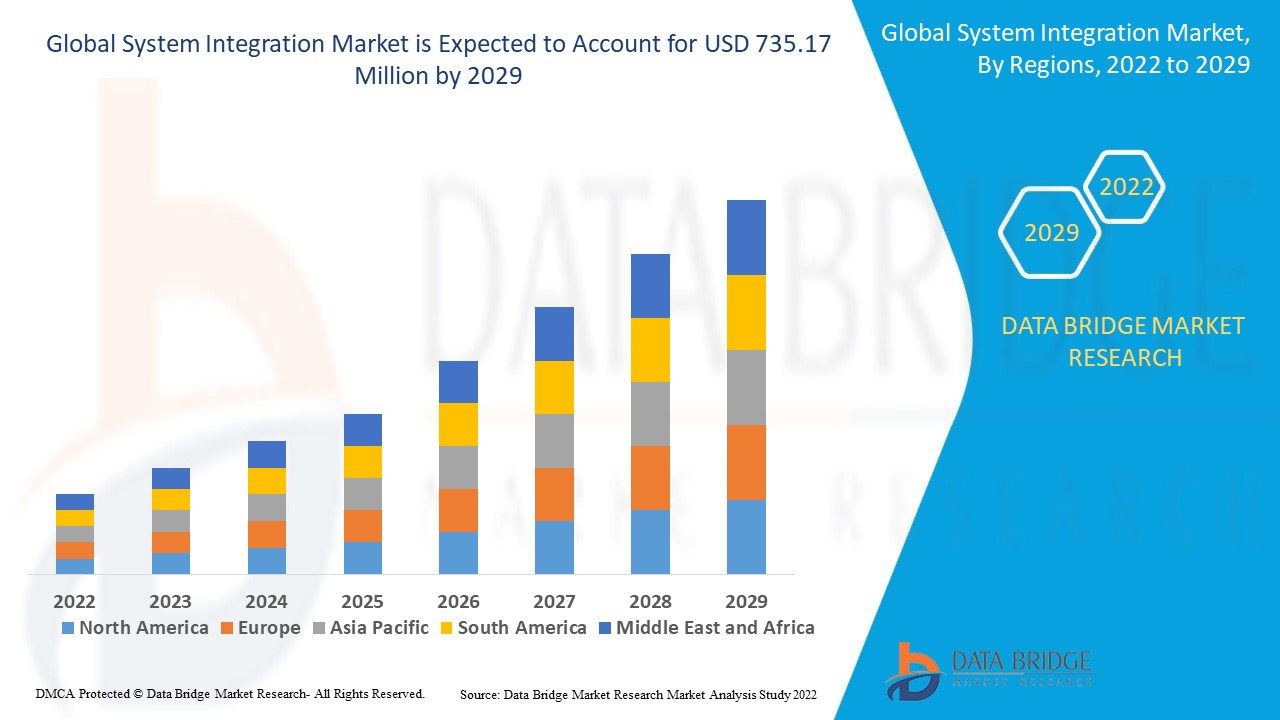

System Integration Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, service, application, consulting, and vertical as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America is expected to lead the system integration market in terms of share and revenue during the forecast period. This growth is driven by significant government investments aimed at adopting innovative solutions across various sectors, the rising use of the Internet of Things (IoT) in industrial automation, and a growing emphasis on energy-efficient production processes. In addition, the demand for cost-effective solutions further contributes to the region's dominance in the market.

Asia-Pacific is projected to be the fastest-growing region from 2025 to 2032, driven by rapid advancements in the automation sector. The region is seeing significant investments in distributed information technology systems, as well as a growing adoption of the Internet of Things (IoT) in industrial automation. These factors are contributing to the region's strong market growth during the forecast period.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

System Integration Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

System Integration Market Leaders Operating in the Market Are:

- Capgemini (France)

- Accenture (Ireland)

- IBM (U.S.)

- Infosys Limited (India)

- Jitterbit U.S.)

- Magic Software Enterprises (Israel)

- HCL Technologies Limited (India)

- Wipro (India)

- Johnson Controls Inc. (Ireland)

- Cognizant (U.S.)

- Tata Consultancy Services Limited (India)

- John Wood Group PLC (U.K.)

- ATS Corporation (Canada)

- Avanceon (UAE)

- TESCO CONTROLS (U.S.)

- Burrow Global LLC (U.S.)

- Prime Controls LP (U.S.)

- Rockwell Automation (U.S.)

- BW Design Group (U.S.)

Latest Developments in System Integration Market

- In February 2023, Schneider Electric, Capgemini, and Qualcomm Technologies, Inc. unveiled an innovative 5G-enabled automated hoisting solution. This groundbreaking project replaced traditional wired connections with a state-of-the-art wireless 5G private network, facilitating the large-scale deployment of digital technologies across industrial sites. The collaboration streamlines and optimizes the integration of advanced digital technologies, marking a significant step forward in system integration within industrial environments

- In June 2023, Cisco introduced its new Security Service Edge (SSE) solution, designed to provide seamless and secure access across all locations, devices, and applications. This service tackles challenges such as inconsistent access experiences by intelligently routing traffic to both private and public destinations. By eliminating the need for end-user intervention, it streamlines access management and boosts productivity, enhancing overall operational efficiency

- In January 2022, Proud Automation, a subsidiary of RG Group, expanded its offerings by adding Mobile Industrial Robots (MiR) certified system integrations to its portfolio in North America. Proud Automation, a prominent manufacturer of MiR and autonomous mobile robots, now provides advanced integration solutions to enhance automation capabilities. This addition strengthens their position in the growing mobile robotics market

- In January 2022, Wood received funding from the Canadian province of Newfoundland and Labrador to support the recovery of its offshore oil and gas industry while boosting local employment. The project focuses on providing maintenance services and establishing a regional autonomous robotic inspection system. This initiative aims to enhance operational efficiency and safety in the region’s energy sector through innovative technologies

- In June 2021, ATS Automation Tooling Systems Inc., a leading supplier of automation solutions, acquired Control and Information Management Ltd. (CIM), an industrial automation system integrator based in Ireland. This acquisition enhances ATS’s automation and service capabilities, particularly in the pharmaceutical, biopharma, and manufacturing sectors. It also bolsters the company's digitization strategy, expanding its expertise in providing advanced automation solutions across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global System Integration Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global System Integration Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global System Integration Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.