Global Thoracic Surgery Devices Market

Market Size in USD Billion

CAGR :

%

USD

9.56 Billion

USD

16.71 Billion

2025

2033

USD

9.56 Billion

USD

16.71 Billion

2025

2033

| 2026 –2033 | |

| USD 9.56 Billion | |

| USD 16.71 Billion | |

|

|

|

|

Thoracic Surgery Devices Market Size

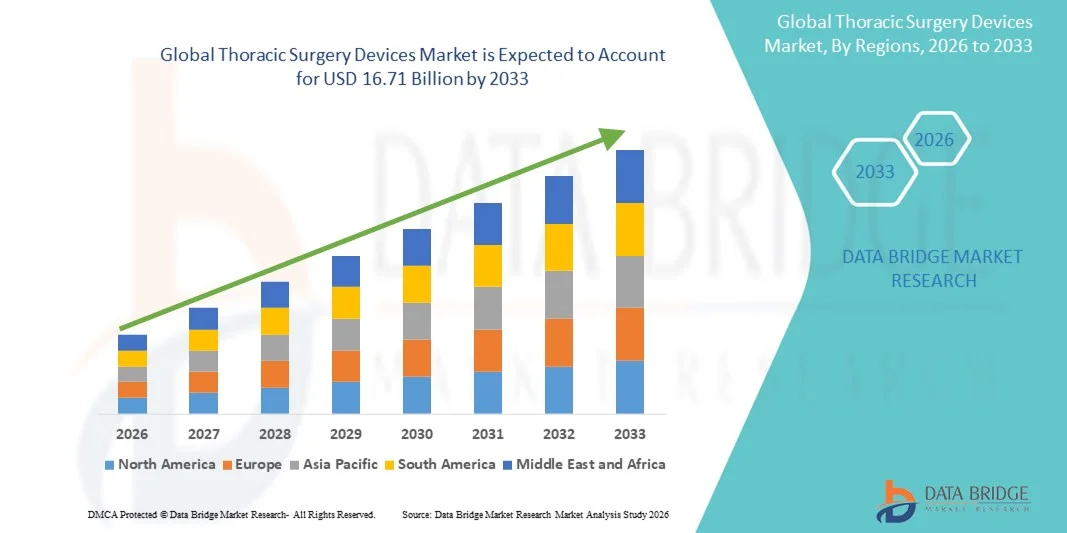

- The global thoracic surgery devices market size was valued at USD 9.56 billion in 2025 and is expected to reach USD 16.71 billion by 2033, at a CAGR of 7.23% during the forecast period

- The market growth is largely fueled by the rising prevalence of thoracic conditions such as lung cancer, COPD, and other chest‑related diseases, along with the increasing adoption of minimally invasive and robotic‑assisted surgical procedures, driving higher demand for advanced surgical devices and instrumentation

- Furthermore, growing investments in healthcare infrastructure, expanding surgical volumes, and technological progress in thoracic surgical systems and tools are expanding the use of thoracic surgery devices in hospitals and surgical centers globally. These converging factors are accelerating the uptake of innovative solutions, thereby significantly boosting the industry’s growth

Thoracic Surgery Devices Market Analysis

- Thoracic surgery devices, encompassing a range of specialty surgical instruments used in procedures such as lobectomy, wedge resection, and pneumonectomy, are increasingly critical within modern surgical care due to their role in treating thoracic conditions such as lung cancer, COPD, and other chest diseases, with advancements in minimally invasive and robotic‑assisted techniques improving precision and patient outcomes

- The escalating demand for thoracic surgery devices is primarily fueled by the rising prevalence of thoracic diseases worldwide, the aging global population more susceptible to such conditions, and continuous innovations in surgical instrumentation and techniques that enable shorter hospital stays and enhanced procedural efficiency

- North America dominated the thoracic surgery devices market in 2025 with the largest revenue share of 40.01%, characterized by well‑developed healthcare infrastructure, high procedural volumes, advanced reimbursement environments, and strong presence of leading device manufacturers, with the U.S. exhibiting substantial adoption of minimally invasive and robotic‑assisted thoracic surgeries

- Asia‑Pacific is expected to be the fastest growing region in the thoracic surgery devices market during the forecast period, due to rising healthcare expenditure, expanding surgical capacity, increasing access to advanced technologies, and growing awareness and diagnosis rates of thoracic diseases in emerging economies

- The Cardiopulmonary Devices segment dominated the thoracic surgery devices market in 2025 with a share of 35.9%, driven by its essential role in supporting heart and lung function during complex thoracic procedures

Report Scope and Thoracic Surgery Devices Market Segmentation

|

Attributes |

Thoracic Surgery Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Thoracic Surgery Devices Market Trends

Advancements in Minimally Invasive and Robotic-Assisted Procedure

- A significant and accelerating trend in the global thoracic surgery devices market is the increasing adoption of minimally invasive and robotic-assisted surgical techniques, which are enhancing precision, reducing patient recovery time, and improving procedural outcomes

- For instance, the da Vinci Surgical System allows surgeons to perform complex thoracic procedures through small incisions with enhanced dexterity and 3D visualization, improving patient safety and post-operative recovery

- Integration of advanced imaging and navigation systems into thoracic surgery devices enables real-time guidance during surgery, reduces intraoperative errors, and improves overall procedural efficiency. For instance, some Intuitive Surgical robotic platforms provide image-guided assistance for accurate resection of lung tumors

- The seamless combination of robotic systems, advanced imaging, and thoracic instruments facilitates more complex surgeries with fewer complications, reduced hospital stays, and faster patient recovery

- This trend towards technologically advanced, precise, and less invasive thoracic surgical solutions is reshaping surgeon expectations and patient demand. Consequently, companies such as Medtronic are developing robotic-assisted thoracic surgery systems with integrated navigation and imaging capabilities

- The adoption of these advanced surgical devices is growing rapidly across hospitals and specialized surgical centers, as healthcare providers prioritize better patient outcomes, reduced complications, and efficiency in thoracic procedures

- Rising collaboration between device manufacturers and healthcare providers to develop procedure-specific instruments is enhancing customization and surgical efficiency, offering opportunities for market differentiation

- Increasing integration of AI and machine learning in thoracic surgical planning is enabling predictive analytics for patient outcomes and personalized surgical approaches, further driving adoption of advanced devices

Thoracic Surgery Devices Market Dynamics

Driver

Rising Prevalence of Thoracic Diseases and Aging Population

- The increasing prevalence of thoracic diseases such as lung cancer, COPD, and congenital heart defects, along with the aging global population, is a significant driver for the growing demand for thoracic surgery devices

- For instance, in April 2025, Medtronic announced the launch of an advanced cardiopulmonary device designed for minimally invasive thoracic procedures, highlighting technological innovation to meet rising clinical demand

- As more patients are diagnosed with thoracic conditions, demand for advanced surgical interventions is increasing, making thoracic surgery devices a critical component of modern healthcare

- Furthermore, the growing number of specialized hospitals and surgical centers equipped to perform complex thoracic procedures is fueling device adoption, enabling better access to minimally invasive and robotic-assisted surgeries

- The integration of thoracic surgery devices with modern imaging and monitoring systems, as well as the expansion of skilled surgical workforce, is further enhancing procedural efficiency and supporting market growth

- Increasing healthcare expenditure and insurance coverage in developed and emerging markets is enabling broader adoption of advanced thoracic surgery devices, particularly in high-volume surgical centers

- Government initiatives and funding to improve cardiac and thoracic healthcare infrastructure in emerging economies are supporting the deployment of modern thoracic surgical technologies

Restraint/Challenge

High Cost of Devices and Regulatory Compliance Requirement

- The relatively high cost of advanced thoracic surgery devices, especially robotic-assisted systems, poses a significant challenge to market expansion, particularly in developing regions and smaller healthcare facilities

- For instance, high acquisition and maintenance costs of robotic surgery platforms can limit adoption by hospitals with budget constraints, slowing market penetration

- In addition, stringent regulatory requirements for thoracic surgery devices, including approvals from agencies such as the FDA and CE marking in Europe, can delay product launches and increase compliance-related expenses

- While innovative devices provide improved patient outcomes, the need for specialized training for surgeons and support staff can also be a barrier, adding to the overall operational cost of adoption

- Overcoming these challenges through cost-effective device solutions, enhanced surgeon training programs, and streamlined regulatory approvals will be crucial for sustained market growth and wider adoption of thoracic surgery devices

- Limited reimbursement coverage for high-end thoracic surgery procedures in certain regions can restrict adoption of costly devices, especially in outpatient or smaller hospital settings

- Potential technical failures or complications during complex procedures may create hesitancy among healthcare providers, emphasizing the need for robust post-market support and device reliability assurance

Thoracic Surgery Devices Market Scope

The market is segmented on the basis of product and end-user

- By Product

On the basis of product, the thoracic surgery devices market is segmented into cardiac rhythm management (CRM) and cardiac assist, heart valve repair and replacement, heart defect closure, cardiopulmonary devices, and others. Cardiopulmonary Devices segment dominated the market with the largest revenue share of 35.9% in 2025, driven by their essential role in supporting heart and lung function during complex thoracic surgeries. These devices are critical in procedures such as cardiopulmonary bypass, ECMO, and minimally invasive thoracic operations, ensuring patient safety and procedural success. Hospitals and high-volume surgical centers prioritize cardiopulmonary devices due to their reliability, compatibility with advanced surgical systems, and life-saving capabilities. The segment also benefits from continuous technological advancements, such as improved perfusion systems and portable cardiopulmonary units, which enhance procedure efficiency. In addition, training programs and clinical familiarity with these devices make them the preferred choice for thoracic surgeons globally. The growing prevalence of thoracic conditions requiring prolonged cardiopulmonary support further reinforces their dominant market position.

Heart Valve Repair and Replacement segment is anticipated to witness the fastest growth rate of 22% CAGR from 2026 to 2033, fueled by rising cases of valvular heart diseases, aging populations, and the adoption of minimally invasive and transcatheter procedures. Heart valve devices allow surgeons to perform complex repairs or replacements with reduced recovery times and improved patient outcomes. Increasing awareness among patients and healthcare providers about early intervention and advanced device availability is also driving demand. Technological innovations, such as 3D-printed valves and customizable implant options, are expanding procedural possibilities. The segment’s growth is further supported by favorable reimbursement policies in developed markets and rising investments in cardiac surgery infrastructure in emerging economies. Hospitals and specialized cardiac centers are increasingly investing in these devices to meet the rising procedural demand.

- By End-User

On the basis of end-user, the thoracic surgery devices market is segmented into hospitals, clinics, ambulatory surgery centers, and others. Hospitals dominated the market with the largest share of 65% in 2025, driven by high procedural volumes, availability of advanced surgical infrastructure, and the presence of skilled thoracic surgeons. Hospitals are equipped to perform complex procedures requiring robotic-assisted systems, cardiopulmonary devices, and advanced imaging, making them the primary consumers of thoracic surgery devices. The large patient base, combined with comprehensive post-operative care facilities, further consolidates hospitals’ leading position. In addition, hospitals often invest in device standardization and staff training programs, ensuring optimal utilization of advanced thoracic instruments. Partnerships with device manufacturers for research and clinical trials also enhance adoption rates. Hospitals in North America and Europe, in particular, continue to drive demand due to well-established healthcare systems and high procedure frequency.

Ambulatory Surgery Centers (ASCs) are expected to witness the fastest growth rate of 20% CAGR from 2026 to 2033, fueled by the increasing preference for outpatient minimally invasive thoracic procedures. ASCs offer cost-effective, efficient surgical options with shorter recovery periods, attracting both patients and healthcare providers. The expansion of ASCs in emerging regions and adoption of portable, user-friendly thoracic devices allow high-quality procedures outside traditional hospital settings. Growing investments in outpatient surgical infrastructure, combined with reimbursement support, are accelerating device adoption. The convenience for patients, reduced hospital burden, and enhanced efficiency make ASCs an attractive growth segment for thoracic surgery devices. Rising collaboration between device manufacturers and ASCs for specialized device training and workflow integration also contributes to the rapid growth of this segment.

Thoracic Surgery Devices Market Regional Analysis

- North America dominated the thoracic surgery devices market in 2025 with the largest revenue share of 40.01%, characterized by well‑developed healthcare infrastructure, high procedural volumes, advanced reimbursement environments, and strong presence of leading device manufacturers, with the U.S. exhibiting substantial adoption of minimally invasive and robotic‑assisted thoracic surgeries

- Healthcare providers in the region prioritize advanced surgical technologies and cardiopulmonary devices to improve patient outcomes, reduce complications, and enhance operational efficiency in complex thoracic procedures

- This widespread adoption is further supported by high healthcare expenditure, favorable reimbursement policies, a skilled surgical workforce, and strong presence of key device manufacturers, establishing North America as a leading market for thoracic surgery devices in both hospital and specialized surgical center settings

U.S. Thoracic Surgery Devices Market Insight

The U.S. thoracic surgery devices market captured the largest revenue share of 81% in 2025 within North America, fueled by the rapid adoption of minimally invasive and robotic-assisted procedures and the growing prevalence of thoracic diseases such as lung cancer and COPD. Hospitals and specialized surgical centers are increasingly prioritizing advanced surgical technologies to improve patient outcomes and reduce complications. The demand for cardiopulmonary devices, heart valve repair systems, and cardiac rhythm management devices is further propelling the market. Moreover, integration with advanced imaging, monitoring, and navigation systems is significantly contributing to the market's expansion.

Europe Thoracic Surgery Devices Market Insight

The Europe thoracic surgery devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising thoracic disease prevalence, aging populations, and increasing adoption of minimally invasive and robotic-assisted surgeries. Stringent healthcare standards and reimbursement policies are fostering the use of advanced thoracic surgical devices. European hospitals and specialized centers are incorporating these devices into both routine and complex surgeries, supported by skilled surgeons and technologically advanced surgical infrastructure. Growing investments in healthcare infrastructure and increasing awareness of advanced thoracic procedures are further fueling market growth.

U.K. Thoracic Surgery Devices Market Insight

The U.K. thoracic surgery devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing demand for advanced surgical procedures and heightened focus on patient outcomes. Hospitals and cardiac centers are investing in robotic-assisted and minimally invasive thoracic devices for enhanced precision and safety. In addition, the prevalence of thoracic conditions and the country’s strong healthcare infrastructure are encouraging wider adoption of complex cardiopulmonary and valve repair devices. The integration of imaging and monitoring technologies in surgical workflows is further supporting market expansion.

Germany Thoracic Surgery Devices Market Insight

The Germany thoracic surgery devices market is expected to expand at a considerable CAGR during the forecast period, fueled by rising awareness of advanced thoracic surgical procedures and increasing hospital investments in minimally invasive and robotic-assisted systems. Germany’s emphasis on innovation, healthcare quality, and technologically advanced solutions promotes adoption of cardiopulmonary, heart valve repair, and cardiac rhythm management devices. Hospitals and specialized surgical centers are increasingly integrating these devices with advanced imaging and monitoring systems to improve surgical precision and patient outcomes. The demand for efficient, high-quality thoracic procedures aligns with local healthcare standards and patient expectations.

Asia-Pacific Thoracic Surgery Devices Market Insight

The Asia-Pacific thoracic surgery devices market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by increasing prevalence of thoracic diseases, rapid expansion of healthcare infrastructure, and adoption of minimally invasive and robotic-assisted surgeries in countries such as China, Japan, and India. Growing investment in specialized hospitals and surgical centers, combined with rising awareness of advanced thoracic procedures, is driving device adoption. Moreover, government initiatives promoting modern healthcare technologies and training of skilled surgeons are significantly contributing to market expansion.

Japan Thoracic Surgery Devices Market Insight

The Japan thoracic surgery devices market is gaining momentum due to high-tech healthcare infrastructure, increasing adoption of robotic-assisted and minimally invasive procedures, and the growing prevalence of thoracic diseases. Hospitals and cardiac centers are emphasizing patient safety, precision, and efficiency, fueling demand for cardiopulmonary devices and heart valve repair systems. The integration of advanced imaging, navigation, and monitoring technologies in surgical workflows is further enhancing market growth. Japan’s aging population is also driving demand for safer, minimally invasive thoracic procedures in both residential and clinical settings.

India Thoracic Surgery Devices Market Insight

The India thoracic surgery devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of thoracic diseases, rapid expansion of specialized hospitals, and increasing adoption of minimally invasive procedures. India is emerging as a key market for cardiopulmonary devices, heart valve repair systems, and cardiac rhythm management devices. Government initiatives promoting healthcare infrastructure, growing awareness of advanced surgical procedures, and availability of cost-effective devices are key factors propelling market growth. In addition, training of skilled surgeons and expansion of modern surgical centers further support adoption across the country

Thoracic Surgery Devices Market Share

The Thoracic Surgery Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Intuitive Surgical Operations, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Edwards Lifesciences Corporation (U.S.)

- Teleflex Incorporated (U.S.)

- Getinge AB (Sweden)

- LivaNova PLC (U.K.)

- B. Braun SE (Germany)

- Olympus Corporation (Japan)

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Cook (U.S.)

- Cardinal Health (U.S.)

- Richard Wolf GmbH (Germany)

- Scanlan International (U.S.)

- KLS Martin Group (Germany)

- Sklar Surgical Instruments (U.S.)

- ATMOS MedizinTechnik GmbH & Co. KG (Germany)

- Medela Healthcare (Switzerland)

- Biolitec AG (Germany)

What are the Recent Developments in Global Thoracic Surgery Devices Market?

- In December 2025, USA Health launched a robotic thoracic surgery program using the da Vinci Xi system, expanding access to minimally invasive lung and chest surgeries including cancerous tissue removal. The program emphasizes reduced trauma, quicker patient recovery, and the nuanced benefits of robotics for thoracic care, reflecting growing institutional adoption of advanced robotic platforms in the U.S. market

- In October 2025, Johns Hopkins Aramco Healthcare (JHAH) performed the first‑of‑its‑kind robot‑assisted thoracic procedures in Saudi Arabia, including a robot‑assisted diaphragm plication, lobectomy, and bullectomy with pleurectomy. These milestones represent the launch of advanced robotic thoracic surgery capabilities at the region’s tertiary care center, offering patients faster recovery and reduced complications through precision minimally invasive techniques

- In June 2025, W.L. Gore & Associates announced that the GORE® TAG® Thoracic Branch Endoprosthesis (TBE) received expanded U.S. FDA approval for use in Zones 0 and 1 of the aortic arch, broadening its indications beyond Zone 2 for minimally invasive endovascular repair of complex aortic arch and descending thoracic aorta lesions. This expansion enables surgeons to treat a wider range of high‑risk thoracic vascular pathologies with an off‑the‑shelf branched solution, improving access to less invasive care

- In April 2025, Intuitive Surgical received U.S. FDA 510(k) clearance for its fully wristed SP SureForm 45 stapler designed for use with the da Vinci SP surgical system in thoracic, colorectal, and urologic procedures, enhancing surgeon control and precision in minimally invasive robotic thoracic surgeries. This stapler’s SmartFire technology continuously monitors tissue compression to improve staple line integrity and reduce tissue damage, marking a significant step in expanding single‑port robotic surgical capabilities

- In August 2024, DePuy Synthes (Johnson & Johnson) introduced the MatrixSTERNUM chest wall fixation system, a plate and screw solution designed to stabilize the chest after open‑heart and chest surgeries. This innovative system offers superior locking strength, faster fixation, and low‑profile plates, improving patient outcomes by reducing procedure time and enhancing recovery after major thoracic operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.