Global Tissue And Hygiene Market

Market Size in USD Billion

CAGR :

%

USD

302.00 Billion

USD

512.00 Billion

2024

2032

USD

302.00 Billion

USD

512.00 Billion

2024

2032

| 2025 –2032 | |

| USD 302.00 Billion | |

| USD 512.00 Billion | |

|

|

|

|

Tissue and Hygiene Market Size

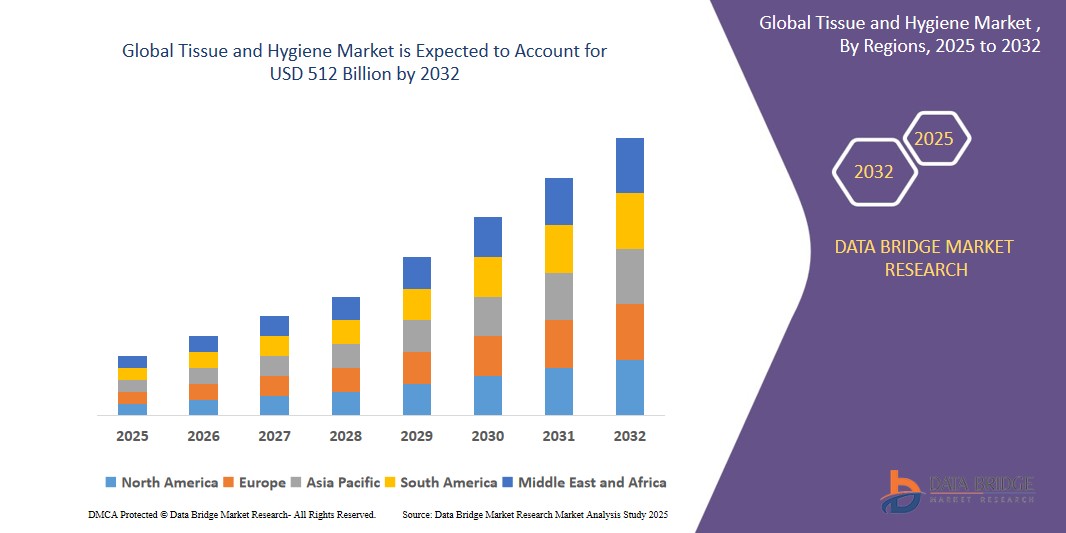

- The global Tissue and Hygiene market size was valued at USD 302 billion in 2024 and is expected to reach USD 512 billion by 2032, at a CAGR of 7.5% during the forecast period

- The market growth is largely fueled by Increasing consumer preference for convenient, safe, and disposable hygiene solutions in both residential and commercial sectors is boosting demand

- Furthermore, The expanding use of automated and touchless hygiene systems in public and workplace environments—such as sensor-based dispensers and IoT-enabled monitoring for refills. These converging factors are accelerating the uptake of Tissue and Hygiene solutions, thereby significantly boosting the industry's growth

Tissue and Hygiene Market Analysis

- Tissue and hygiene products, encompassing items such as toilet paper, facial tissues, sanitary products, diapers, and paper towels, are essential components of personal and household care routines due to their role in promoting cleanliness, comfort, and public health.

- The growing demand for tissue and hygiene products is driven by increasing awareness around personal hygiene, expanding global population, rising disposable incomes, and heightened health concerns post-COVID-19, along with a shift towards sustainable and biodegradable product alternatives.

- North America dominates the Tissue and Hygiene market with the largest revenue share of approximately 37.81% in 2025, underpinned by high consumer awareness, strong retail infrastructure, and demand for premium hygiene solutions; the U.S. leads the regional market owing to continuous product innovations, brand loyalty, and preference for environmentally friendly options.

- Asia-Pacific is expected to be the fastest growing region in the Tissue and Hygiene market during the forecast period, driven by rapid urbanization, improving living standards, population growth, and increased availability of international brands in emerging economies such as China, India, and Southeast Asian countries.

- The tissue product segment is expected to dominate the Tissue and Hygiene market with a market share of 31.20% in 2025, propelled by its extensive use across households, commercial spaces, and institutions, coupled with product innovations such as ultra-soft, antibacterial, and recycled tissue varieties

Report Scope and Tissue and Hygiene Market Segmentation

|

Attributes |

Tissue and Hygiene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Tissue and Hygiene Market Trends

“Sustainable Product Development and Eco-Friendly Innovation”

- A significant and accelerating trend in the global Tissue and Hygiene market is the pivot toward sustainable, biodegradable, and plastic-free products, driven by rising environmental concerns and tightening global regulations on single-use plastics. Consumers are demanding hygiene solutions that not only provide comfort and cleanliness but also align with their eco-conscious lifestyles.

- For instance, major players like Sofidel and Kimberly-Clark have introduced tissue products made from recycled fibers and bamboo pulp, along with packaging that is either compostable or made from renewable materials. Sofidel’s "Natura" product line uses eco-friendly wrapping, while Kimberly-Clark is investing in reducing its carbon footprint through innovations in raw material sourcing.

- Innovation in this space includes the development of chlorine-free bleaching processes, zero-plastic sanitary products, and flushable wet wipes that comply with water treatment standards. Companies are also employing certifications like FSC, PEFC, and EU Ecolabel to validate their sustainability claims and build consumer trust.

- Manufacturers are integrating closed-loop production systems and partnering with environmental NGOs to improve supply chain transparency. For example, Unicharm has pledged to increase its use of recycled content and reduce water usage in its production processes by 2030.

- This shift toward sustainability is not only reshaping product design but also influencing marketing, packaging, and procurement practices across the tissue and hygiene value chain. Sustainability is becoming a key differentiator in a highly competitive market.

- The demand for eco-friendly tissue and hygiene products is growing rapidly across both developed and emerging markets, as consumers, retailers, and governments push for greener solutions. This trend is expected to accelerate further, driving innovation, brand repositioning, and new product development in the coming decade.

Tissue and Hygiene Market Dynamics

Driver

“Increasing Hygiene Awareness and Public Health Concerns Post-Pandemic”

- The heightened global emphasis on personal and environmental hygiene—amplified by the COVID-19 pandemic—continues to drive strong demand for tissue and hygiene products across residential, commercial, and institutional sectors.

- For instance, in 2024, Procter & Gamble and Unicharm Corporation launched campaigns focused on hand hygiene and surface sanitation in public areas, schools, and workplaces, encouraging routine use of tissues, wipes, and other hygiene essentials. These initiatives are expected to bolster market growth during the forecast period.

- As consumers remain increasingly aware of the importance of preventing infections and maintaining cleanliness, the usage of products such as toilet paper, facial tissues, wet wipes, feminine hygiene products, and adult incontinence items is expanding significantly.

- Additionally, regulatory support and public health campaigns from global organizations like the World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC) have reinforced the need for maintaining proper hygiene, especially in healthcare and food service environments.

- The integration of hygiene products into daily routines, travel kits, workspaces, and public settings is becoming more normalized, with rising demand for convenient, single-use, and portable solutions.

- This increased hygiene consciousness is not only fueling product consumption but also encouraging innovation in antibacterial, dermatologically tested, and skin-sensitive formulations, driving sustained market growth globally.

Restraint/Challenge

“Environmental Concerns and Raw Material Dependency”

- Environmental concerns related to deforestation, excessive water usage, and non-biodegradable waste pose a significant challenge to the global tissue and hygiene market. Many products in this segment, such as paper towels, toilet paper, and baby diapers, are derived from virgin pulp and are often packaged in plastic, raising sustainability issues.

- For instance, environmental advocacy groups and NGOs have criticized major brands for contributing to deforestation, particularly in regions like the Amazon and Southeast Asia, where pulpwood harvesting has had negative ecological impacts. This criticism can influence consumer preferences and regulatory actions.

- Additionally, the industry is heavily dependent on the availability and price of raw materials like pulp, super absorbent polymers (SAP), and nonwoven fabrics. Price volatility in the global pulp market, often driven by geopolitical events, climate conditions, or trade restrictions, can significantly increase production costs and erode profit margins.

- Regulatory pressure is also mounting in regions like the European Union, where directives aim to reduce single-use plastics and mandate higher recycled content in consumer goods. These requirements increase operational complexity and necessitate significant R&D investments for reformulation and packaging redesign.

- While efforts are being made to transition to sustainable alternatives, the lack of global standardization in regulations and consumer resistance to changes in product performance (e.g., texture, strength, absorbency) may hinder rapid adoption of eco-friendly substitutes.

- Overcoming these restraints will require coordinated efforts across the value chain—including suppliers, manufacturers, and policymakers—to innovate, invest in sustainable technologies, and educate consumers on the importance of choosing greener hygiene solutions

Tissue and Hygiene Market Scope

The market is segmented on the basis of product type, distribution channel, and end user.

- By Product Type

On the basis of product type, the Tissue and Hygiene market is segmented into Tissue Products, Wipes Products, and Hygiene Products. The Tissue Products segment holds the largest market revenue share in 2025, attributed to its widespread use across residential, commercial, and institutional settings. Products such as toilet paper, paper towels, and facial tissues are considered essential commodities, driving consistent demand. The growth of e-commerce and increased hygiene awareness post-pandemic have further supported the expansion of this segment.

The Wipes Products segment is projected to register the fastest growth rate from 2025 to 2032, fueled by rising demand for convenient, portable, and multi-purpose cleaning and sanitizing solutions. Increased usage in baby care, cosmetics, and personal hygiene—especially in urban and travel scenarios—has led to greater product innovation and premiumization.

- By Distribution Channel

On the basis of distribution channel, the Tissue and Hygiene market is segmented into Direct and Indirect channels. The Indirect channel (including supermarkets, hypermarkets, pharmacies, and online retail) accounts for the largest share in 2025, due to the vast consumer reach, ease of accessibility, and strong promotional strategies. The rise of e-commerce platforms and home delivery services, especially during and after the pandemic, has significantly contributed to this segment’s dominance.

The Direct channel (including B2B sales, institutional supply contracts, and bulk purchases) is expected to witness steady growth, particularly in the healthcare and hospitality sectors. This channel offers cost efficiency, better supply chain control, and tailored product offerings to commercial clients, driving its adoption.

- By End-User

On the basis of end user, the Tissue and Hygiene market is segmented into Food and Beverage, Commercial, Hospitals and Home Care, and Others. The Hospitals and Home Care segment dominates the market in 2025, driven by heightened hygiene protocols, infection control requirements, and the increasing prevalence of chronic illnesses and elderly care needs. Demand for products like sanitizing wipes, incontinence solutions, and medical-grade tissues is particularly strong in this segment.

The Food and Beverage segment is expected to grow at a notable CAGR through 2032, as foodservice establishments increasingly prioritize hygiene compliance to meet health regulations and consumer expectations. Tissue products such as napkins and wipes are critical to operations, boosting segment demand.

Tissue and Hygiene Market Regional Analysis

- North America dominates the Tissue and Hygiene market with the largest revenue share of 38.5% in 2024, driven by rising awareness of hygiene and sanitation, as well as growing demand for premium and sustainable products.

- Consumers in the region highly value product innovation, including biodegradable tissues and chemical-free wipes, supported by strong retail and online distribution channels. High disposable incomes and stringent hygiene standards in healthcare and commercial sectors further propel demand.

U.S. Tissue and Hygiene Market Insight

The U.S. Tissue and Hygiene market captured the largest revenue share of 82% within North America in 2025, fueled by growing consumer focus on personal hygiene, cleanliness, and eco-friendly products. The pandemic has also led to sustained elevated demand for sanitizing wipes and disposable hygiene products across households and businesses. Moreover, aggressive marketing by leading brands and expanding e-commerce penetration continue to support market growth.

Europe Tissue and Hygiene Market Insight

Europe is projected to expand steadily during the forecast period, supported by strict environmental regulations, rising consumer consciousness on sustainable products, and innovations in hygiene product formulations. The region’s demand is also driven by growth in institutional hygiene, healthcare, and foodservice sectors. Consumers are increasingly favoring recycled and FSC-certified tissue products as well as flushable, biodegradable wipes.

U.K. Tissue and Hygiene Market Insight

The U.K. market is expected to grow at a notable CAGR, driven by rising hygiene awareness, urbanization, and consumer preference for premium and natural fiber-based products. Strong retail and online distribution frameworks further stimulate market penetration.

Germany Tissue and Hygiene Market Insight

Germany’s market growth is driven by environmentally conscious consumers, regulatory support for sustainable packaging, and the expansion of healthcare and hospitality industries demanding high-quality hygiene products. The focus on eco-friendly certifications and innovations in product texture and performance is increasing product adoption.

Asia-Pacific Tissue and Hygiene Market Insight

Asia-Pacific is poised to register the fastest growth, with a CAGR exceeding 24% in 2025, fueled by rapid urbanization, rising disposable incomes, and increasing hygiene awareness in developing countries such as China, India, and Southeast Asia. Government initiatives promoting public health, combined with growing e-commerce platforms and expanding retail chains, enhance product accessibility and affordability across the region.

Japan Tissue and Hygiene Market Insight

Japan’s market growth is supported by its aging population, strong focus on hygiene and cleanliness, and demand for premium, skin-friendly tissue products. Integration of hygiene products in public spaces and advanced packaging innovations also drive the market.

China Tissue and Hygiene Market Insight

China leads the Asia-Pacific region with the largest revenue share in 2025, propelled by an expanding middle class, increasing urbanization, and high acceptance of innovative hygiene products. Domestic manufacturers play a key role by offering affordable and varied tissue and wipe products. The rapid growth of the hospitality and healthcare sectors further accelerates demand.

Tissue and Hygiene Market Share

The Tissue and Hygiene industry is primarily led by well-established companies, including:

- Asia Pulp & Paper (Indonesia)

- Carmen Tissues S.A.E. (Egypt)

- Clearwater Paper Corporation (U.S.)

- Georgia-Pacific (U.S.)

- Hengan International Group Company Ltd. (China)

- Johnson & Johnson Services, Inc. (U.S.)

- KCWW [Kimberly-Clark Corporation] (U.S.)

- Kruger Inc. (Canada)

- Procter & Gamble (U.S.)

- Sofidel (Italy)

- Svenska Cellulosa Aktiebolaget SCA (Sweden)

- Unicharm Corporation (Japan)

- HOSPECO (U.S.)

- MPI Papers (Canada)

- WEPA Hygieneprodukte GmbH (Germany)

- Metsä Group (Finland)

- Asaleo Care Limited (Australia)

- KP Tissue Inc. (Canada)

- Essendant, Inc. (U.S.)

- Oji Holdings Corporation (Japan)

Latest Developments in Global Tissue and Hygiene Market

- In 2024, Hengan International Group, a prominent Chinese hygiene product manufacturer, introduced premium quality structured tissue products in the Chinese market. These products, featuring enhanced bulk, softness, and absorbency, were developed following the installation of Toscotec’s TADVISION® tissue machine at their Xiaogan mill. This advancement positions Hengan as a leader in high-quality tissue production in China

- In fiscal year 2024, Procter & Gamble (P&G) introduced the "Smooth-Tear" feature in its Charmin Ultra Soft bath tissue line. This innovation, resulting from five years of research, features scalloped-edge perforations designed to prevent uneven tearing, enhancing consumer satisfaction. The introduction of this feature contributed to a mid-single-digit growth in both value and volume sales for the U.S. bath tissue category

- In April 2024, Unicharm, a Japanese hygiene product manufacturer, launched the world's first "horizontally" recycled nappies. These nappies, made from recycled materials using novel sterilization, bleaching, and deodorizing technologies, address Japan's demographic shift towards an aging population. The product maintains hygiene and comfort levels akin to regular disposable nappies and is available for both adults and children, marking a significant innovation in sustainable hygiene products

- In January 2024, WEPA Professional, a leading European hygiene specialist, acquired Star Tissue UK, a prominent British hygiene paper provider. The newly acquired entity, operating under the name 'WEPA Professional UK,' aims to accelerate WEPA's growth in the UK's professional hygiene market, expanding its product offerings and market reach

- In April 2023, Asia Pulp & Paper (APP) Sinar Mas, a leading Indonesian pulp and paper company, partnered with TietoEVRY, a global technology services provider, to drive its digital transformation initiatives. This collaboration focuses on enhancing operational efficiency and sustainability through advanced digital solutions, aligning with APP's commitment to responsible business practices and innovation in the tissue and hygiene sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.