Global Transdermal Patches Market

Market Size in USD Billion

CAGR :

%

USD

7.84 Billion

USD

11.50 Billion

2024

2032

USD

7.84 Billion

USD

11.50 Billion

2024

2032

| 2025 –2032 | |

| USD 7.84 Billion | |

| USD 11.50 Billion | |

|

|

|

|

Transdermal Patches Market Size

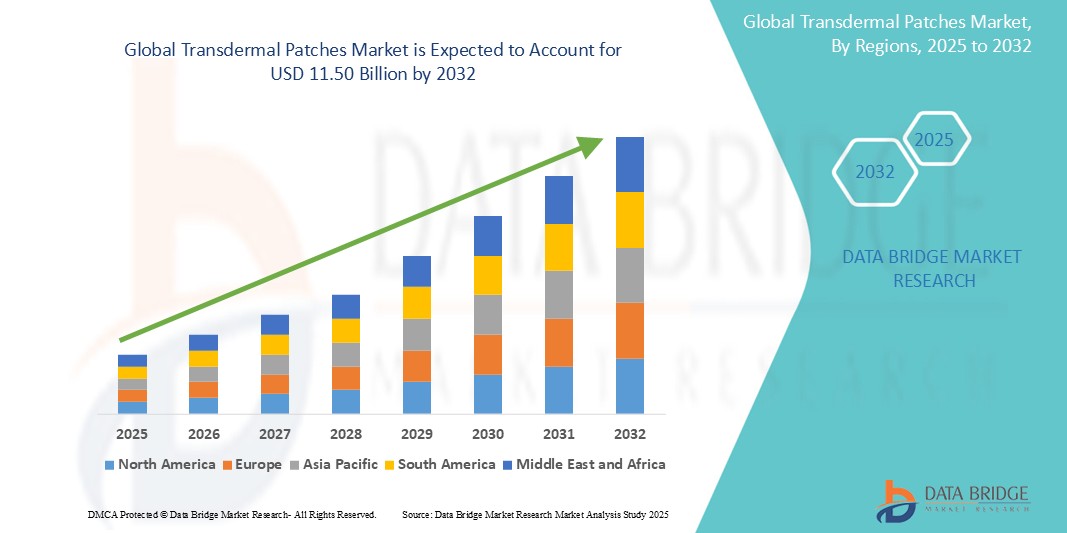

- The global transdermal patches market size was valued at USD 7.84 billion in 2024 and is expected to reach USD 11.50 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is largely fueled by the increasing launch of innovative drug delivery patches and expanded therapeutic indications

- Furthermore, the rising prevalence of chronic conditions such as hypertension, diabetes, and neurological disorders is driving the adoption of non-invasive drug delivery methods. In March 2024, Noven Pharmaceuticals received FDA approval for its Secuad (asenapine) transdermal system, a patch indicated for schizophrenia, which reflects the growing demand for patient-friendly psychiatric treatments and supports long-term market expansion

Transdermal Patches Market Analysis

- Transdermal patches, providing controlled and sustained drug delivery through the skin, are increasingly favored for their non-invasive administration, improved patient compliance, and ability to maintain steady plasma drug levels in chronic disease management

- The escalating demand for transdermal patches is primarily driven by the rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, pain management, and neurological disorders, along with advancements in patch technology including microneedle and iontophoresis-enabled systems

- North America dominates the transdermal patches market with the largest revenue share of approximately 38.5% in 2024, attributed to well-established healthcare infrastructure, high patient awareness, and strong pharmaceutical R&D investments. The U.S. leads in market adoption due to approvals of novel transdermal drug delivery systems and collaborations between biotech companies and medical device manufacturers

- Asia-Pacific is expected to be the fastest-growing region in the transdermal patches market during the forecast period, driven by increasing healthcare expenditure, expanding geriatric population, growing chronic disease burden, and improving regulatory frameworks supporting innovative drug delivery platforms in countries such as China and India

- The fentanyl transdermal patch segment is expected to dominate the transdermal patches market, holding approximately 45.3% market share in 2024This dominance is due to its extensive use in managing chronic and severe pain conditions such as cancer pain. Its effectiveness, coupled with advancements in controlled-release technology, supports steady market demand and ongoing product innovations

Report Scope and Transdermal Patches Market Segmentation

|

Attributes |

Transdermal Patches Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Transdermal Patches Market Trends

“Advancements in Controlled and Smart Drug Delivery Systems”

- A significant and accelerating trend in the global transdermal patches market is the incorporation of smart technologies such as wearable sensors, AI-enabled monitoring, and digital connectivity to enhance drug delivery precision, patient adherence, and real-time health data tracking

- For instance, MediPatch’s smart transdermal system integrates biosensors that monitor patient vitals and drug absorption rates, transmitting data to healthcare providers via mobile apps for personalized treatment adjustments. Similarly, Novogy’s AI-driven transdermal platform can adjust drug release rates based on patient feedback and physiological parameters

- AI integration enables predictive analytics that can optimize dosing schedules, reduce side effects, and provide alerts for patch replacement or adverse reactions. Additionally, some advanced patches incorporate microneedle arrays that enable painless, efficient drug delivery and can be combined with AI algorithms to tailor dosage in real-time

- The rise of connected health ecosystems allows patients and clinicians to manage therapy remotely and more effectively, improving chronic disease management and treatment outcomes. For instance, companies such as Sensio Labs are developing transdermal patches linked to smartphone apps that guide users through therapy adherence and symptom tracking.

- This trend toward intelligent, patient-centric transdermal systems is transforming expectations around drug delivery by emphasizing convenience, personalization, and continuous monitoring

- The demand for smart, digitally connected transdermal patches is growing rapidly across therapeutic areas such as pain management, diabetes, cardiovascular diseases, and hormone replacement therapy, driven by the increasing adoption of digital health technologies and remote patient monitoring solutions

Transdermal Patches Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases and Demand for Patient-Friendly Drug Delivery”

- The rising global prevalence of chronic diseases such as cardiovascular disorders, diabetes, neurological conditions, and cancer is a major driver boosting the demand for transdermal patches. These patches provide a non-invasive, effective, and convenient alternative to oral or injectable therapies, improving patient compliance and therapeutic outcomes

- For instance, In March 2024, Mylan Pharmaceuticals expanded its transdermal fentanyl patch portfolio to address chronic cancer pain management, emphasizing ease of use and steady drug release, thereby meeting growing patient needs worldwide

- In addition, technological advancements in transdermal drug delivery systems, including microneedle patches and iontophoresis-enabled systems, are enhancing drug absorption and efficacy, further fueling market growth

- Increasing healthcare awareness and the shift towards home-based and outpatient treatment settings are encouraging the adoption of transdermal patches that allow self-administration without the need for medical supervision

- The convenience of painless administration, reduced systemic side effects, and controlled drug release mechanisms are key factors driving patient preference, especially among elderly and pediatric populations

- Growing government support for innovative drug delivery technologies and favorable regulatory approvals for new transdermal formulations are also contributing significantly to market expansion

Restraint/Challenge

“Skin Irritation Issues and High Development Costs”

- Concerns regarding skin irritation and allergic reactions caused by adhesives or drug components in transdermal patches pose a significant challenge to broader market acceptance. Patients with sensitive skin or prolonged patch usage may experience dermatitis, limiting long-term adherence

- For instance, several reports of contact dermatitis related to opioid and hormone replacement transdermal patches have led some patients and healthcare providers to exercise caution in their use, impacting market growth in certain regions.

- Addressing these challenges requires advancements in biocompatible materials, hypoallergenic adhesives, and rigorous clinical testing to ensure patch safety and patient comfort. However, such innovations often involve high research and development costs, which can increase the overall price of the final product

- In addition, the complexity of developing transdermal formulations that achieve consistent drug delivery without causing skin issues increases the time and cost of product development, potentially delaying market entry

- While prices for some transdermal patches are gradually becoming more competitive, the relatively high costs compared to traditional oral medications or injectables can limit accessibility, particularly in emerging markets

- Overcoming these challenges through enhanced material science, patient education on correct patch usage, and investment in affordable production techniques will be crucial for sustained market growth

Transdermal Patches Market Scope

The market is segmented on the basis of product, type, application, technology, distribution channel, and end user.

By Product

On the basis of product, the market is segmented into single-layer drug-in-adhesive, multi-layer drug-in-adhesive, matrix, reservoir, vapor, and others. The single-layer drug-in-adhesive segment dominates the market with over 38% share in 2024, favored for its straightforward design and consistent drug release, making it widely adopted in pain management and hormone therapy applications.

The multi-layer drug-in-adhesive segment is projected to witness the fastest CAGR of 7.1% from 2024 to 2032, driven by its ability to deliver multiple drugs and controlled release, catering to complex therapeutic requirements.

By Type

On the basis of type, the market is categorized into fentanyl transdermal patch, nicotine transdermal patch, buprenorphine transdermal patch, clonidine transdermal patch, oxybutynin transdermal patch, and others. The fentanyl transdermal patch segment holds the largest market share, approximately 44% in 2024, owing to its extensive use in managing chronic pain conditions, especially cancer-related pain, supported by ongoing technological innovations in controlled drug release.

The nicotine transdermal patch segment is expected to grow at a CAGR of 6.2% during the forecast period, driven by increasing smoking cessation programs and government initiatives worldwide to reduce tobacco use.

By Application

On the basis of application, the market is segmented into cardiovascular disorder, central nervous system (CNS) disorders, pain management/relief, smoking reduction and cessation aid, overactive bladder, nicotine cessation, hormonal therapy/disorders, dermatology, and others. The pain management/relief segment commands the largest share at 41% in 2024, primarily due to the rising prevalence of chronic pain and the convenience of transdermal delivery for opioids and NSAIDs.

The smoking reduction and cessation aid segment is the fastest growing, with a CAGR of 6.5% through 2032, supported by growing public health awareness and demand for non-invasive therapies.

By Technology

On the basis of technology, the segments include electric current, mechanical arrays, thermal ablation, chemical enhancers, and others. Chemical enhancers dominate the technology segment with over 50% market share in 2024, owing to their proven effectiveness in increasing skin permeability and enhancing drug absorption in transdermal systems.

Thermal ablation technology is anticipated to register the fastest growth at a CAGR of 8.3% by 2032, driven by innovations enabling painless skin disruption to improve drug delivery efficiency.

By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Retail pharmacies hold the largest distribution channel share of 46% in 2024, due to their accessibility and strong presence in urban and rural areas for OTC and prescription patches.

The online pharmacies segment is growing rapidly at a CAGR of 9.0%, fueled by increasing e-commerce adoption and consumer preference for convenient, contactless purchase and home delivery.

By End User

On the basis of end user, the market includes home care settings, hospitals, and clinics. The home care settings segment dominates with a 52% market share in 2024, driven by the rise in chronic diseases and patient preference for self-administration of transdermal therapies.

The hospitals segment is projected to grow fastest at a CAGR of 6.8% during the forecast period, due to increasing use of transdermal patches in acute care and perioperative pain management.

Transdermal Patches Market Regional Analysis

- North America dominates the transdermal patches market with the largest revenue share of 38.5% in 2024, driven by advanced healthcare infrastructure, rising chronic disease prevalence, and strong adoption of innovative drug delivery systems

- Consumers and healthcare providers in the region prefer transdermal patches due to their non-invasive nature, improved patient compliance, and ongoing support from regulatory agencies encouraging novel therapies

- The presence of leading pharmaceutical companies investing in R&D and strategic partnerships to develop next-generation transdermal technologies further strengthens market growth in North America

U.S. Transdermal Patches Market Insight

The U.S. dominates the North American transdermal patches market with the largest revenue share of 81% in 2025, driven by advanced healthcare infrastructure, a high prevalence of chronic pain and cardiovascular diseases, and strong adoption of novel drug delivery systems. Increasing patient preference for non-invasive treatment options, along with rising awareness about benefits such as sustained drug release and improved compliance, is boosting demand for transdermal patches across home care and clinical settings. Moreover, substantial investments by pharmaceutical companies in R&D and technological advancements in controlled-release formulations are significantly contributing to the market’s growth in the U.S.

Europe Transdermal Patches Market Insight

The European transdermal patches market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing prevalence of chronic diseases, rising geriatric population, and growing healthcare expenditure. Stringent regulatory frameworks supporting innovative drug delivery technologies and increasing patient preference for non-invasive treatments further bolster market growth. Additionally, expanding use of transdermal patches in pain management, cardiovascular, and hormonal therapies across residential and clinical settings is fueling demand. The region is witnessing significant adoption in both developed and emerging European countries, supported by ongoing advancements in patch formulation and increasing awareness about their benefits.

U.K. Transdermal Patches Market Insight

The U.K. transdermal patches market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing incidence of chronic diseases, rising patient preference for non-invasive drug delivery methods, and supportive healthcare policies. Growing awareness about the advantages of transdermal therapy, such as improved compliance and reduced side effects, is fueling adoption. Additionally, the expanding pharmaceutical R&D landscape and strong distribution networks through retail and hospital pharmacies are contributing to steady market growth across both home care and clinical settings.

Germany Transdermal Patches Market Insight

The German transdermal patches market is expected to expand at a considerable CAGR during the forecast period, driven by a strong healthcare infrastructure, increasing prevalence of chronic conditions, and high patient awareness of innovative drug delivery systems. The country’s focus on advanced medical technologies and stringent regulatory standards fosters the development and adoption of transdermal therapies. Additionally, Germany’s aging population and rising demand for non-invasive, controlled-release medication options contribute significantly to market growth in both hospital and home care settings.

Asia-Pacific Transdermal Patches Market Insight

The Asia-Pacific transdermal patches market is projected to grow at the fastest CAGR during the forecast period, driven by rising healthcare expenditure, increasing prevalence of chronic diseases, and growing patient awareness across countries such as China, India, Japan, and Australia. Rapid urbanization, expanding pharmaceutical manufacturing capabilities, and supportive government policies for innovative drug delivery systems are further accelerating market adoption. Additionally, increasing access to healthcare facilities and the preference for non-invasive, convenient treatments boost demand in both hospital and home care settings.

Japan Transdermal Patches Market Insight

The Japan transdermal patches market is witnessing steady growth due to the country’s advanced healthcare infrastructure, increasing prevalence of chronic conditions, and a strong focus on patient-centric therapies. The aging population and rising demand for non-invasive, controlled drug delivery systems further drive adoption. Additionally, technological advancements and supportive regulatory frameworks encourage innovation in patch formulations, making Japan a key market for transdermal drug delivery in both hospital and home care setting.

China Transdermal Patches Market Insight

The China transdermal patches market holds a significant revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, increasing prevalence of chronic diseases, and expanding healthcare infrastructure. Rising consumer awareness about non-invasive drug delivery methods and government initiatives supporting innovative healthcare technologies further accelerate market growth. Additionally, strong domestic pharmaceutical manufacturing capabilities and growing demand from both hospital and home care settings contribute to China’s market prominence.

Transdermal Patches Market Share

The transdermal patches industry is primarily led by well-established companies, including:

- AdhexPharma (France)

- ProSolus, Inc (U.S.)

- tesa SE (Germany)

- Nitto Denko Corporation. (Japan)

- Noven Pharmaceuticals, Inc (U.S.)

- LTS Lohmann Therapie-Systeme AG (Germany)

- Medherant Limited (U.K.)

- Corium, LLC. (U.S.)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Antares Pharma (U.S.)

- Abbott. (U.S.)

- Mylan N.V. (U.S.)

- Acrux Limited (Australia)

- Sparsha Pharma International Pvt Ltd (India)

- Bliss GVS Pharma. (India)

- Johnson & Johnson Services, Inc. (U.S.)

- Informa Connect Limited (U.K.)

Latest Developments in Global Transdermal Patches Market

- In June 2024, Nicotine patches are widely used in nicotine replacement therapy (NRT) to help individuals quit smoking by reducing dependence on cigarettes. Studies indicate that using a nicotine patch can increase the chances of quitting successfully by 50% to 60%. The patch delivers a steady amount of nicotine through the skin, helping to manage withdrawal symptoms while avoiding the harmful effects of smoking. By triggering dopamine release, it mimics the brain’s response to smoking, making the transition easier

- In November 2023, the University of Warwick developed a testosterone patch for postmenopausal women, aiming to provide an effective and convenient treatment for menopause-related health issues. The patch, created by Warwick’s spin-out company Medherant, utilizes transdermal TEPI technology to deliver testosterone steadily, addressing symptoms such as low libido and hormonal imbalance. Currently undergoing clinical trials, the patch is expected to be the first approved transdermal testosterone treatment for women

- In July 2023, Industria Macchine Automatiche S.P.A. (IMA) acquired Phoenix Italia S.r.l., completing the purchase of 60% of Phoenix Italia and 100% of its subsidiary Phoenix Tech S.r.l., both based in Bareggio, Milano. Additionally, IMA acquired 70% of Mespic S.r.l. and 100% of its Illinois-based subsidiary, Mespic North America Corporation, from Holding FGLG S.r.l

- In April 2023, MIT researchers developed a wearable patch that enables painless drug delivery through the skin using ultrasonic waves. This technology creates tiny channels in the skin’s outer layer, allowing medications to pass through efficiently. The patch has potential applications for treating skin conditions and can be adapted for muscle relaxants, hormones, and other drugs. Designed for comfort and precision, it offers a needle-free alternative to traditional drug delivery methods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL TRANSDERMAL PATCHES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL TRANSDERMAL PATCHES MARKET: SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 APPLICATION POSITIONING GRID

2.2.5 COMPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 EPIDEMILOGY DATA

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL TRANSDERMAL PATCHES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.2.1 CLASS I

11.2.2 CLASS II

11.2.3 CLASS III

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL TRANSDERMAL PATCHES MARKET, BY TYPE

16.1 OVERVIEW

16.2 DRUG IN-ADHASIVE

16.2.1 BY LAYER

16.2.1.1. SINGLE-LAYER DRUG-IN-ADHESIVE

16.2.1.1.1. BY DESING

16.2.1.1.1.1 RECTANGULAR

16.2.1.1.1.2 CIRCULAR

16.2.1.1.1.3 SQUARE

16.2.1.1.1.4 OTHERS

16.2.1.1.2. BY SIZE

16.2.1.1.2.1 12.5 CM2

16.2.1.1.2.2 18.75 CM2- 25 CM2

16.2.1.1.2.3 ABOVE 37.5 CM2

16.2.1.1.3. BY DOSE

16.2.1.1.3.1 5 MICROGRAM -70 MICROGRAM

16.2.1.1.3.2 70 MICROGRAM-20 MILIGRAM

16.2.1.1.3.3 20 MILIGRAM-30 MILIGRAM

16.2.1.1.3.4 ABOVE 30 MILIGRAM

16.2.1.2. MULTI-LAYER DRUG-IN-ADHESIVE

16.2.1.2.1. BY DESING

16.2.1.2.1.1 RECTANGULAR

16.2.1.2.1.2 CIRCULAR

16.2.1.2.1.3 SQUARE

16.2.1.2.1.4 OTHERS

16.2.1.2.2. BY SIZE

16.2.1.2.2.1 12.5 CM2

16.2.1.2.2.2 18.75 CM2- 25 CM2

16.2.1.2.2.3 ABOVE 37.5 CM2

16.2.1.2.3. BY DOSE

16.2.1.2.3.1 5 MICROGRAM -70 MICROGRAM

16.2.1.2.3.2 70 MICROGRAM-20 MILIGRAM

16.2.1.2.3.3 20 MILIGRAM-30 MILIGRAM

16.2.1.2.3.4 ABOVE 30 MILIGRAM

16.3 MATRIX

16.3.1 BY DESING

16.3.1.1. RECTANGULAR

16.3.1.2. CIRCULAR

16.3.1.3. SQUARE

16.3.1.4. OTHERS

16.3.2 BY SIZE

16.3.2.1. 12.5 CM2

16.3.2.2. 18.75 CM2- 25 CM2

16.3.2.3. ABOVE 37.5 CM2

16.3.3 BY DOSE

16.3.3.1. 5 MICROGRAM -70 MICROGRAM

16.3.3.2. 70 MICROGRAM-20 MILIGRAM

16.3.3.3. 20 MILIGRAM-30 MILIGRAM

16.3.3.4. ABOVE 30 MILIGRAM

16.4 RESERVOIR

16.4.1 BY DESING

16.4.1.1. RECTANGULAR

16.4.1.2. CIRCULAR

16.4.1.3. SQUARE

16.4.1.4. OTHERS

16.4.2 BY SIZE

16.4.2.1. 12.5 CM2

16.4.2.2. 18.75 CM2- 25 CM2

16.4.2.3. ABOVE 37.5 CM2

16.4.3 BY DOSE

16.4.3.1. 5 MICROGRAM -70 MICROGRAM

16.4.3.2. 70 MICROGRAM-20 MILIGRAM

16.4.3.3. 20 MILIGRAM-30 MILIGRAM

16.4.3.4. ABOVE 30 MILIGRAM

16.5 VAPOR PATCH

16.5.1 BY DESING

16.5.1.1. RECTANGULAR

16.5.1.2. CIRCULAR

16.5.1.3. SQUARE

16.5.1.4. OTHERS

16.5.2 BY SIZE

16.5.2.1. 12.5 CM2

16.5.2.2. 18.75 CM2- 25 CM2

16.5.2.3. ABOVE 37.5 CM2

16.5.3 BY DOSE

16.5.3.1. 5 MICROGRAM -70 MICROGRAM

16.5.3.2. 70 MICROGRAM-20 MILIGRAM

16.5.3.3. 20 MILIGRAM-30 MILIGRAM

16.5.3.4. ABOVE 30 MILIGRAM

16.6 OTHERS

17 GLOBAL TRANSDERMAL PATCHES MARKET, BY DELIVERY TYPE

17.1 OVERVIEW

17.2 PASSIVE DELIVERY SYSTEM

17.2.1 MATRIX DELIVERY SYSTEM

17.2.2 RESERVOIR DELIVERY SYSTEM

17.3 ACTIVE DELIVERY SYSTEM

17.3.1 STRUCTURE-BASED DRUG DELIVERY SYSTEM

17.3.2 ELECTRICALLY-BASED DRUG DELIVERY SYSTEM

17.3.2.1. IONTOPHORESIS

17.3.2.2. ELECTROPORATION

17.3.2.3. SONOPHORESIS

17.3.3 OTHERS

18 GLOBAL TRANSDERMAL PATCHES MARKET, BY DRUG TYPE

18.1 OVERVIEW

18.2 BRANDED

18.2.1 NDA

18.2.2 505(B)(2)

18.2.3 TRANSDERM SCOP

18.2.4 CLIMARA PRO

18.2.5 DURAGESIC

18.2.6 DAYTRANA

18.2.7 NEUPRO

18.2.8 EMSAM

18.2.9 MINIVELLE

18.2.10 VIVELLE-DOT

18.2.11 OTHERS

18.3 GENERIC

18.4 OTC PHARMACEUTICALS

19 GLOBAL TRANSDERMAL PATCHES MARKET, BY DRUG

19.1 OVERVIEW

19.2 SCOPOLAMINE

19.3 NITROGLYCERIN

19.4 BUPRENORPHINE

19.5 CLONIDINE

19.6 ESTRADIOL

19.7 FENTANYL

19.8 NICOTINE

19.9 TESTOSTERONE

19.1 LIDOCAINE

19.11 OXYBUTYNIN

19.12 METHYLPHENIDATE

19.13 SELEGILINE

19.14 RIVASTIGMINE

19.15 ROTIGOTINE

19.16 COMBINATION DRUGS

19.17 OTHERS

20 GLOBAL TRANSDERMAL PATCHES MARKET, BY APPLICATION

20.1 OVERVIEW

20.2 PAIN MANAGEMENT

20.2.1 ACUTE POSTOPERATIVE PAIN

20.2.2 POST-HERPETIC NEURALGIA PAIN

20.2.3 CHRONIC PAIN

20.2.4 OTHERS

20.3 NEUROLOGICAL DISORDER

20.3.1 PARKINSON'S DISEASE

20.3.2 MAJOR DEPRESSIVE DISORDER

20.3.3 DEMENTIA

20.3.4 OTHERS

20.4 ENDOCRINOLOGICAL DISORDERS

20.4.1 TESTOSTERONE DEFICIENCY

20.4.2 MENOPAUSAL SYMPTOMS

20.4.3 OTHERS

20.5 CARDIOVASCULAR DISEASES

20.5.1 ANGINA PECTORIS

20.5.2 HYPERTENSION

20.5.3 OTHERS

20.6 ONCOLOGY

20.7 DERMATOLOGY

20.8 SMOKING CESSATION

20.9 HYPERTENSION

20.1 MOTION SICKNESS

20.11 OVERACTIVE BLADDER

20.12 HORMONAL THERAPY/ DISORDERS

20.13 OTHERS

21 GLOBAL TRANSDERMAL PATCHES MARKET, BY MODE OF PURCHASE

21.1 OVERVIEW

21.2 PRESCRIPTION

21.3 OVER THE COUNTER

22 GLOBAL TRANSDERMAL PATCHES MARKET, BY TECHNOLOGY

22.1 OVERVIEW

22.2 ELECTRIC CURRENT

22.3 MECHANICAL ARRAYS

22.4 THERMAL ABLATION

22.5 CHEMICAL ENHANCER

22.6 OTHERS

23 GLOBAL TRANSDERMAL PATCHES MARKET, BY AGE GROUP

23.1 OVERVIEW

23.2 PEDIATRICS

23.3 ADULT

23.4 GERIATRICS

24 GLOBAL TRANSDERMAL PATCHES MARKET, BY END USERS

24.1 OVERVIEW

24.2 HOSPITAL

24.3 CLINICS

24.4 HOME HEALTHCARE

24.5 OTHERS

25 GLOBAL TRANSDERMAL PATCHES MARKET, BY DISTRIBUTION CHANNEL

25.1 OVERVIEW

25.2 DIRECT TENDER

25.3 HOSPITALS PHARMACY

25.4 RETAIL PHARMACY

25.5 ONLINE PHARMACY

25.6 OTHERS

26 GLOBAL TRANSDERMAL PATCHES MARKET, BY GEOGRAPHY

26.1 GLOBAL TRANSDERMAL PATCHES MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

26.1.1 NORTH AMERICA

26.1.1.1. U.S.

26.1.1.2. CANADA

26.1.1.3. MEXICO

26.1.2 EUROPE

26.1.2.1. GERMANY

26.1.2.2. U.K.

26.1.2.3. FRANCE

26.1.2.4. ITALY

26.1.2.5. SPAIN

26.1.2.6. THE NETHERLANDS

26.1.2.7. SWITZERLAND

26.1.2.8. TURKEY

26.1.2.9. BELGIUM

26.1.2.10. RUSSIA

26.1.2.11. REST OF EUROPE

26.1.3 ASIA-PACIFIC

26.1.3.1. CHINA

26.1.3.2. JAPAN

26.1.3.3. SOUTH KOREA

26.1.3.4. INDIA

26.1.3.5. SINGAPORE

26.1.3.6. AUSTRALIA

26.1.3.7. MALAYSIA

26.1.3.8. PHILIPPINES

26.1.3.9. THAILAND

26.1.3.10. INDONESIA

26.1.3.11. REST OF ASIA-PACIFIC

26.1.4 SOUTH AMERICA

26.1.4.1. BRAZIL

26.1.4.2. ARGENTINA

26.1.4.3. REST OF SOUTH AMERICA

26.1.5 MIDDLE EAST AND AFRICA

26.1.5.1. SOUTH AFRICA

26.1.5.2. EGYPT

26.1.5.3. SAUDI ARABIA

26.1.5.4. U.A.E

26.1.5.5. ISRAEL

26.1.5.6. REST OF MIDDLE EAST AND AFRICA

26.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

27 GLOBAL TRANSDERMAL PATCHES MARKET, COMPANY LANDSCAPE

27.1 COMPANY SHARE ANALYSIS: GLOBAL

27.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

27.3 COMPANY SHARE ANALYSIS: EUROPE

27.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

27.5 MERGERS & ACQUISITIONS

27.6 NEW PRODUCT DEVELOPMENT & APPROVALS

27.7 EXPANSIONS

27.8 REGULATORY CHANGES

27.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

28 GLOBAL TRANSDERMAL PATCHES MARKET, SWOT AND DBMR ANALYSIS

29 GLOBAL TRANSDERMAL PATCHES MARKET, COMPANY PROFILE

29.1 POCONO PHARMACEUTICAL

29.1.1 COMPANY OVERVIEW

29.1.2 REVENUE ANALYSIS

29.1.3 GEOGRAPHIC PRESENCE

29.1.4 PRODUCT PORTFOLIO

29.1.5 RECENT DEVELOPEMENTS

29.2 HI TECH PRODUCTS

29.2.1 COMPANY OVERVIEW

29.2.2 REVENUE ANALYSIS

29.2.3 GEOGRAPHIC PRESENCE

29.2.4 PRODUCT PORTFOLIO

29.2.5 RECENT DEVELOPEMENTS

29.3 4P THERAPEUTICS (NUTRIBAND)

29.3.1 COMPANY OVERVIEW

29.3.2 REVENUE ANALYSIS

29.3.3 GEOGRAPHIC PRESENCE

29.3.4 PRODUCT PORTFOLIO

29.3.5 RECENT DEVELOPMENTS

29.4 TEIKOKU SEIYAKU CO., LTD.

29.4.1 COMPANY OVERVIEW

29.4.2 REVENUE ANALYSIS

29.4.3 GEOGRAPHIC PRESENCE

29.4.4 PRODUCT PORTFOLIO

29.4.5 RECENT DEVELOPEMENTS

29.5 JOHNSON & JOHNSON (PTY) LTD

29.5.1 COMPANY OVERVIEW

29.5.2 REVENUE ANALYSIS

29.5.3 GEOGRAPHIC PRESENCE

29.5.4 PRODUCT PORTFOLIO

29.5.5 RECENT DEVELOPEMENTS

29.6 PROSOLUS, INC.

29.6.1 COMPANY OVERVIEW

29.6.2 REVENUE ANALYSIS

29.6.3 GEOGRAPHIC PRESENCE

29.6.4 PRODUCT PORTFOLIO

29.6.5 RECENT DEVELOPEMENTS

29.7 LTS LOHMANN THERAPIE-SYSTEME AG

29.7.1 COMPANY OVERVIEW

29.7.2 REVENUE ANALYSIS

29.7.3 GEOGRAPHIC PRESENCE

29.7.4 PRODUCT PORTFOLIO

29.7.5 RECENT DEVELOPEMENTS

29.8 NOVEN PHARMACEUTICALS, INC. (HISAMITSU PHARMACEUTICAL CO., INC)

29.8.1 COMPANY OVERVIEW

29.8.2 REVENUE ANALYSIS

29.8.3 GEOGRAPHIC PRESENCE

29.8.4 PRODUCT PORTFOLIO

29.8.5 RECENT DEVELOPEMENTS

29.9 NITTO DENKO CORPORATION

29.9.1 COMPANY OVERVIEW

29.9.2 REVENUE ANALYSIS

29.9.3 GEOGRAPHIC PRESENCE

29.9.4 PRODUCT PORTFOLIO

29.9.5 RECENT DEVELOPEMENTS

29.1 CORIUM, LLC.

29.10.1 COMPANY OVERVIEW

29.10.2 REVENUE ANALYSIS

29.10.3 GEOGRAPHIC PRESENCE

29.10.4 PRODUCT PORTFOLIO

29.10.5 RECENT DEVELOPEMENTS

29.11 BAYER AG

29.11.1 COMPANY OVERVIEW

29.11.2 REVENUE ANALYSIS

29.11.3 GEOGRAPHIC PRESENCE

29.11.4 PRODUCT PORTFOLIO

29.11.5 RECENT DEVELOPEMENTS

29.12 MYLAN N.V (VIATRIS INC.)

29.12.1 COMPANY OVERVIEW

29.12.2 REVENUE ANALYSIS

29.12.3 GEOGRAPHIC PRESENCE

29.12.4 PRODUCT PORTFOLIO

29.12.5 RECENT DEVELOPEMENTS

29.13 ALZA CORPORATION (DISTRIBUTED BY- BOEHRINGER INGELHEIM PHARMACEUTICALS, INC. )

29.13.1 COMPANY OVERVIEW

29.13.2 REVENUE ANALYSIS

29.13.3 GEOGRAPHIC PRESENCE

29.13.4 PRODUCT PORTFOLIO

29.13.5 RECENT DEVELOPEMENTS

29.14 ENDO INTERNATIONAL PLC

29.14.1 COMPANY OVERVIEW

29.14.2 REVENUE ANALYSIS

29.14.3 GEOGRAPHIC PRESENCE

29.14.4 PRODUCT PORTFOLIO

29.14.5 RECENT DEVELOPEMENTS

29.15 AMNEAL PHARMACEUTICALS LLC

29.15.1 COMPANY OVERVIEW

29.15.2 REVENUE ANALYSIS

29.15.3 GEOGRAPHIC PRESENCE

29.15.4 PRODUCT PORTFOLIO

29.15.5 RECENT DEVELOPEMENTS

29.16 SPARSHA PHARMA INTERNATIONAL PVT LTD

29.16.1 COMPANY OVERVIEW

29.16.2 REVENUE ANALYSIS

29.16.3 GEOGRAPHIC PRESENCE

29.16.4 PRODUCT PORTFOLIO

29.16.5 RECENT DEVELOPEMENTS

29.17 BIOTTS INC.

29.17.1 COMPANY OVERVIEW

29.17.2 REVENUE ANALYSIS

29.17.3 GEOGRAPHIC PRESENCE

29.17.4 PRODUCT PORTFOLIO

29.17.5 RECENT DEVELOPEMENTS

29.18 BLISS GVS PHARMA LIMITED

29.18.1 COMPANY OVERVIEW

29.18.2 REVENUE ANALYSIS

29.18.3 GEOGRAPHIC PRESENCE

29.18.4 PRODUCT PORTFOLIO

29.18.5 RECENT DEVELOPEMENTS

29.19 ACRUX LIMITED

29.19.1 COMPANY OVERVIEW

29.19.2 REVENUE ANALYSIS

29.19.3 GEOGRAPHIC PRESENCE

29.19.4 PRODUCT PORTFOLIO

29.19.5 RECENT DEVELOPEMENTS

29.2 ADHEXPHARMA

29.20.1 COMPANY OVERVIEW

29.20.2 REVENUE ANALYSIS

29.20.3 GEOGRAPHIC PRESENCE

29.20.4 PRODUCT PORTFOLIO

29.20.5 RECENT DEVELOPEMENTS

29.21 TESA TAPES (INDIA) PRIVATE LIMITED

29.21.1 COMPANY OVERVIEW

29.21.2 REVENUE ANALYSIS

29.21.3 GEOGRAPHIC PRESENCE

29.21.4 PRODUCT PORTFOLIO

29.21.5 RECENT DEVELOPEMENTS

29.22 MEDHERANT LIMITED.

29.22.1 COMPANY OVERVIEW

29.22.2 REVENUE ANALYSIS

29.22.3 GEOGRAPHIC PRESENCE

29.22.4 PRODUCT PORTFOLIO

29.22.5 RECENT DEVELOPEMENTS

29.23 UCB, INC.

29.23.1 COMPANY OVERVIEW

29.23.2 REVENUE ANALYSIS

29.23.3 GEOGRAPHIC PRESENCE

29.23.4 PRODUCT PORTFOLIO

29.23.5 RECENT DEVELOPEMENTS

29.24 LAVIPHARM

29.24.1 COMPANY OVERVIEW

29.24.2 REVENUE ANALYSIS

29.24.3 GEOGRAPHIC PRESENCE

29.24.4 PRODUCT PORTFOLIO

29.24.5 RECENT DEVELOPEMENTS

29.25 LEAD CHEMICAL CO.,LTD.

29.25.1 COMPANY OVERVIEW

29.25.2 REVENUE ANALYSIS

29.25.3 GEOGRAPHIC PRESENCE

29.25.4 PRODUCT PORTFOLIO

29.25.5 RECENT DEVELOPEMENTS

29.26 LUYE LIFE SCIENCES GROUP

29.26.1 COMPANY OVERVIEW

29.26.2 REVENUE ANALYSIS

29.26.3 GEOGRAPHIC PRESENCE

29.26.4 PRODUCT PORTFOLIO

29.26.5 RECENT DEVELOPEMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

30 RELATED REPORTS

31 CONCLUSION

32 QUESTIONNAIRE

33 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.