Global Transportation And Logistics Carbon Management System Market

Market Size in USD Billion

CAGR :

%

USD

2.21 Billion

USD

3.29 Billion

2024

2032

USD

2.21 Billion

USD

3.29 Billion

2024

2032

| 2025 –2032 | |

| USD 2.21 Billion | |

| USD 3.29 Billion | |

|

|

|

|

What is the Global Transportation and Logistics Carbon Management System Market Size and Growth Rate?

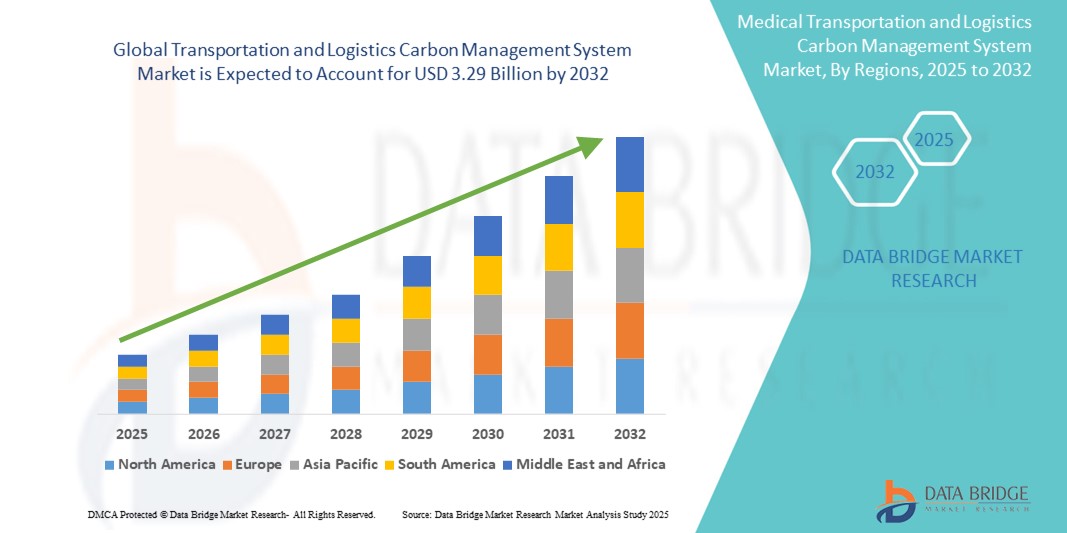

- The global transportation and logistics carbon management system market size was valued at USD 2.21 billion in 2024 and is expected to reach USD 3.29 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is primarily driven by the increasing regulatory pressure on logistics and transportation providers to reduce carbon emissions, coupled with the rising demand for real-time emissions monitoring and reporting technologies

- Moreover, the integration of advanced data analytics, AI, and IoT in carbon management platforms is enabling transportation companies to optimize routes, reduce fuel consumption, and meet sustainability goals, significantly boosting the adoption of these systems worldwide

What are the Major Takeaways of Transportation and Logistics Carbon Management System Market?

- Transportation and Logistics Carbon Management Systems, designed to measure, monitor, and reduce carbon emissions across supply chains, are becoming essential tools for companies aiming to meet global climate targets and enhance operational efficiency

- The rapid expansion of e-commerce, globalization of supply chains, and stricter environmental regulations are key factors accelerating demand for advanced carbon management solutions across the transportation and logistics sectors

- Companies are increasingly adopting integrated platforms that offer real-time tracking, emissions analytics, and automated reporting to improve sustainability performance, comply with regulations, and enhance corporate reputation in a carbon-conscious marketplace

- North America dominated the transportation and logistics carbon management system market with the largest revenue share of 42.5% in 2024, driven by increasing regulatory pressure for carbon emissions reporting and widespread adoption of digital sustainability tools across the logistics sector

- Asia-Pacific transportation and logistics carbon management system market is projected to grow at the fastest CAGR of 15.6% from 2025 to 2032, fueled by rapid urbanization, increasing regulatory focus on carbon reduction, and expanding digital infrastructure across countries such as China, Japan, and India

- The Solution segment dominated the market with the largest revenue share of 68.4% in 2024, driven by the increasing demand for comprehensive carbon tracking, reporting, and optimization platforms among transportation and logistics companies

Report Scope and Transportation and Logistics Carbon Management System Market Segmentation

|

Attributes |

Transportation and Logistics Carbon Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Transportation and Logistics Carbon Management System Market?

“AI-Driven Carbon Tracking and Predictive Analytics Integration”

- A significant and accelerating trend in the global transportation and logistics carbon management system market is the integration of artificial intelligence (AI) and predictive analytics to optimize carbon tracking, reporting, and emissions reduction strategies across logistics and transport operations. This integration is reshaping how organizations monitor and mitigate their carbon footprint

- For instance, platforms such as Persefoni and Accuvio leverage AI-powered tools to automate Scope 1, 2, and 3 emissions data collection and generate real-time insights for logistics firms, enhancing compliance with global carbon disclosure requirement

- AI integration enables systems to analyze complex transportation datasets, predict emissions hotspots, and suggest route optimizations or operational changes to reduce environmental impact. Companies can simulate "what-if" scenarios to forecast the carbon implications of different logistics strategies before implementation

- Moreover, carbon management platforms are increasingly offering integration with broader enterprise systems such as SAP or Salesforce, enabling centralized control of sustainability data alongside financial and operational metrics, thus fostering a unified environmental management ecosystem

- This trend is fundamentally transforming carbon management from a compliance-driven task to a strategic, data-informed process within transportation and logistics operations. Companies such as Engie and Microsoft are advancing AI-enabled carbon management tools to empower firms with proactive emissions reduction capabilities

- The demand for intelligent, predictive, and automated transportation and logistics carbon management systems is rapidly growing as global regulations tighten and corporations prioritize environmental, social, and governance (ESG) performance

What are the Key Drivers of Transportation and Logistics Carbon Management System Market?

- The increasing regulatory pressure for carbon disclosure and the global push toward achieving net-zero emissions targets are major drivers fueling the adoption of transportation and logistics carbon management systems

- For instance, in January 2024, the European Union enforced stricter Corporate Sustainability Reporting Directive (CSRD) requirements, compelling transport and logistics companies to enhance carbon accounting processes, driving demand for advanced carbon management platforms

- Rising stakeholder expectations, including investors and customers, are pushing organizations to demonstrate transparent emissions reporting and concrete climate action, making comprehensive carbon management solutions essential

- In addition, the surge in global e-commerce and supply chain complexities heightens the need for real-time, granular tracking of transport emissions, from freight shipments to last-mile delivery, further boosting market demand

- Companies seek transportation and logistics carbon management systems that ensure compliance and offer competitive advantages through optimized route planning, cost savings, and enhanced brand reputation for sustainability leadership

Which Factor is challenging the Growth of the Transportation and Logistics Carbon Management System Market?

- Data accuracy and standardization remain significant challenges, as emissions tracking across complex, multi-modal supply chains often involves disparate systems, incomplete datasets, and varying calculation methodologies

- For instance, transport providers operating across different regions face difficulties harmonizing carbon data, especially when collaborating with subcontractors or smaller fleets lacking digital infrastructure

- Overcoming this challenge requires robust data verification mechanisms, standardized carbon accounting frameworks, and greater collaboration across the transport value chain to ensure consistent emissions reporting

- Furthermore, the high implementation costs of comprehensive carbon management platforms, especially AI-driven solutions, can deter adoption among small and medium-sized logistics providers with limited budgets

- Although scalable, subscription-based models are emerging, affordability and ease of integration remain critical for broader market penetration. Companies such as Locus Technologies and EnergyCap are focusing on flexible, user-friendly solutions to address this barrier

- Bridging these gaps through technological innovation, industry-wide standards, and affordable offerings will be essential for unlocking the full potential of the transportation and logistics carbon management system market in supporting global decarbonization efforts

How is the Transportation and Logistics Carbon Management System Market Segmented?

The market is segmented on the basis of component and deployment.

- By Component

On the basis of component, the transportation and logistics carbon management system market is segmented into Solution and Services. The Solution segment dominated the market with the largest revenue share of 68.4% in 2024, driven by the increasing demand for comprehensive carbon tracking, reporting, and optimization platforms among transportation and logistics companies. These solutions enable organizations to measure, analyze, and reduce emissions across supply chains, aligning with global decarbonization goals and regulatory requirements.

The Services segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising need for consulting, system integration, and ongoing support services. As businesses adopt carbon management systems, expert services are essential to ensure seamless implementation, customization, and regulatory compliance, especially for organizations with complex logistics operations.

- By Deployment

On the basis of deployment, the transportation and logistics carbon management system market is segmented into Cloud and On-premises. The Cloud segment accounted for the largest market revenue share of 74.1% in 2024, attributed to the growing preference for scalable, flexible, and cost-efficient carbon management platforms. Cloud-based solutions offer real-time access to emissions data, seamless updates, and easy integration with other enterprise systems, making them ideal for logistics providers operating across multiple regions.

The On-premises segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the demand from organizations with strict data privacy requirements or operations in regions with limited internet infrastructure. On-premises deployment offers greater control over sensitive data and system configurations, making it a preferred choice for certain government, defense, or highly regulated logistics operations.

Which Region Holds the Largest Share of the Transportation and Logistics Carbon Management System Market?

- North America dominated the transportation and logistics carbon management system market with the largest revenue share of 42.5% in 2024, driven by increasing regulatory pressure for carbon emissions reporting and widespread adoption of digital sustainability tools across the logistics sector

- The region benefits from advanced technological infrastructure, significant investment in carbon reduction initiatives, and strong emphasis on ESG (Environmental, Social, and Governance) performance among corporations

- The presence of key players such as Microsoft, EnergyCap, and Persefoni, along with growing government mandates around carbon disclosure, further propels market growth. Logistics providers in North America are increasingly leveraging carbon management platforms to gain operational insights, reduce environmental impact, and ensure regulatory compliance

U.S. Transportation and Logistics Carbon Management System Market Insight

U.S. transportation and logistics carbon management system market captured the largest revenue share in North America in 2024, fueled by stringent climate policies, advanced digital ecosystems, and the growing corporate focus on transparent carbon reporting. Major companies are adopting AI-powered carbon management platforms to meet compliance requirements such as the U.S. Securities and Exchange Commission (SEC) climate disclosure rules. The rise in sustainable logistics, combined with increased demand for Scope 3 emissions visibility, is driving rapid market adoption across transportation and logistics enterprises.

Europe Transportation and Logistics Carbon Management System Market Insight

Europe transportation and logistics carbon management system market is projected to grow at a robust CAGR during the forecast period, driven by ambitious decarbonization targets, regulatory frameworks such as the European Green Deal, and increasing demand for sustainable supply chain solutions. Logistics providers across Europe are adopting carbon management systems to track emissions, optimize routes, and comply with mandatory reporting requirements, particularly in high-emission sectors. The integration of carbon management with broader digital supply chain solutions is further accelerating market expansion across residential, commercial, and industrial logistics operations.

U.K. Transportation and Logistics Carbon Management System Market Insight

U.K. transportation and logistics carbon management system market is anticipated to witness significant growth during the forecast period, supported by national climate policies, strong regulatory enforcement, and growing corporate demand for transparent emissions tracking. The U.K.'s push towards net-zero targets and increasing emphasis on ESG reporting among logistics providers are encouraging widespread adoption of carbon management platforms. Moreover, integration with IoT-based fleet management and data-driven sustainability solutions is fueling market expansion in the country.

Germany Transportation and Logistics Carbon Management System Market Insight

Germany transportation and logistics carbon management system market is expected to expand steadily during the forecast period, driven by a strong focus on industrial decarbonization, advanced technological infrastructure, and corporate sustainability commitments. German logistics companies are increasingly adopting carbon management systems to align with strict environmental standards, reduce operational emissions, and enhance competitiveness in global supply chains. The market is further supported by government initiatives promoting digital transformation and sustainable transportation practices.

Which Region is the Fastest Growing in the Transportation and Logistics Carbon Management System Market?

Asia-Pacific transportation and logistics carbon management system market is projected to grow at the fastest CAGR of 15.6% from 2025 to 2032, fueled by rapid urbanization, increasing regulatory focus on carbon reduction, and expanding digital infrastructure across countries such as China, Japan, and India. The region is experiencing significant investment in smart logistics, digital sustainability solutions, and carbon management platforms, particularly as governments prioritize climate action and smart city development. Rising awareness among corporations regarding emissions tracking and the availability of affordable, scalable carbon management solutions are key factors driving market growth.

Japan Transportation and Logistics Carbon Management System Market Insight

Japan transportation and logistics carbon management system market is gaining traction due to the country’s advanced technology landscape, strong focus on sustainability, and increasing adoption of AI-driven logistics solutions. Japanese logistics providers are implementing carbon management platforms to meet environmental targets, enhance operational efficiency, and integrate with broader smart city and smart mobility initiatives. The country's emphasis on innovation and energy efficiency further contributes to market expansion.

China Transportation and Logistics Carbon Management System Market Insight

China transportation and logistics carbon management system market held the largest revenue share within Asia-Pacific in 2024, driven by its vast logistics network, rapid adoption of smart technologies, and strong government initiatives promoting emissions reduction and smart city development. China's growing emphasis on green logistics, domestic production of affordable carbon management solutions, and increasing demand for digital sustainability platforms in transport and warehousing are key factors fueling market growth. The push for carbon neutrality by 2060 further accelerates adoption across industries.

Which are the Top Companies in Transportation and Logistics Carbon Management System Market?

The transportation and logistics carbon management system industry is primarily led by well-established companies, including:

- Accuvio (Ireland)

- Carbon Footprint (U.K.)

- Dakota Software (U.S.)

- Envirosoft (Canada)

- Engie (France)

- EnergyCap (U.S.)

- Enablon (France)

- Enviance (U.S.)

- Isometrix (South Africa)

- Intelex (Canada)

- IBM (U.S.)

- Locus Technologies (U.S.)

- Microsoft (U.S.)

- NativeEnergy (U.S.)

- Persefoni (U.S.)

- Schneider Electric (France)

- SAP (Germany)

- Salesforce (U.S.)

What are the Recent Developments in Global Transportation and Logistics Carbon Management System Market?

- In March 2025, Dakota Integrated Solutions Ltd. secured a contract with Flowervision Bristol to deploy their enhanced eTrakLogic solution across Flowervision’s fleet of delivery vehicles, following their recent strategic partnership with Optimize, a company specializing in fleet decarbonization and operational optimization. This initiative is expected to significantly support Flowervision’s carbon reduction and operational efficiency efforts

- In June 2024, IBM launched its AI-driven Maximo Emissions Management platform to support businesses in asset-intensive sectors, including transportation, energy, and industrials, with tracking and managing both continuous and fugitive emissions. This innovation strengthens IBM’s portfolio, helping organizations meet evolving sustainability and regulatory demands

- In December 2023, ENGIE and SANEF, both members of the European Clean Transport Network (ECTN Alliance), jointly commenced a proof-of-concept project for a low-carbon, long-distance road freight network covering over 900 kilometers from Avignon to Lille in France. This project aims to validate ECTN’s framework for reducing emissions in long-haul transport, marking a significant milestone for sustainable logistics

- In February 2023, Makersite, a leading provider of supply chain carbon management software, collaborated with Enablon to enhance their net-zero offerings by incorporating Scope 3 emissions management. This partnership enables Enablon to provide a more comprehensive carbon management platform, aligning with global decarbonization trends

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.