Global Treatment Resistant Depression Market

Market Size in USD Billion

CAGR :

%

USD

1.27 Billion

USD

1.72 Billion

2024

2032

USD

1.27 Billion

USD

1.72 Billion

2024

2032

| 2025 –2032 | |

| USD 1.27 Billion | |

| USD 1.72 Billion | |

|

|

|

|

Treatment-Resistant Depression Market Size

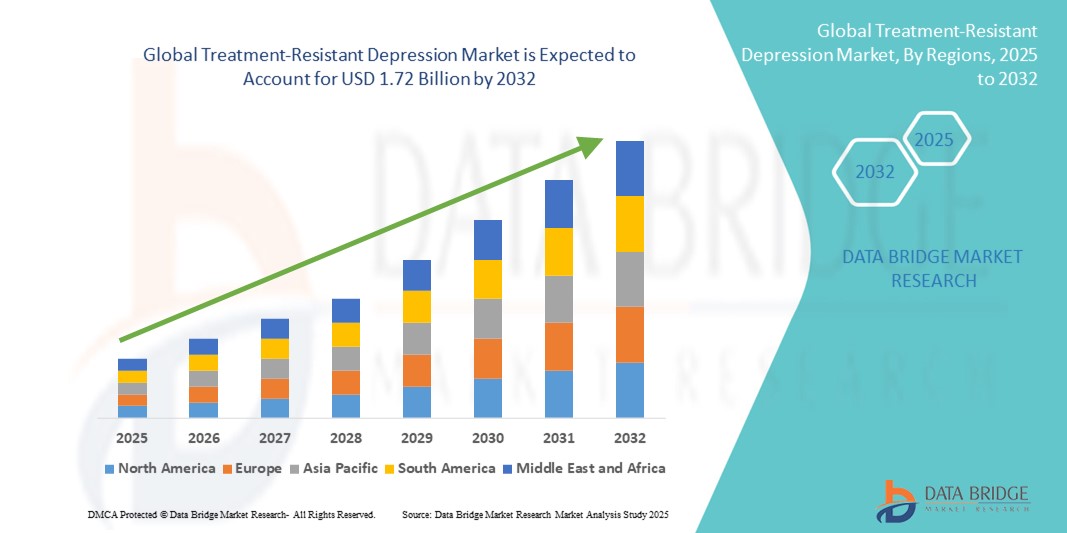

- The global treatment-resistant depression market size was valued at USD 1.27 billion in 2024 and is expected to reach USD 1.72 billion by 2032, at a CAGR of 3.90% during the forecast period

- The market growth is largely driven by the rising prevalence of major depressive disorders and the limited efficacy of conventional antidepressants in a significant subset of patients, necessitating alternative treatment options.

- Furthermore, advancements in neuromodulation therapies, novel pharmacological approaches such as ketamine-based treatments and psychedelics, and increased awareness among healthcare providers are shaping TRD as a critical focus area in mental health. These converging factors are accelerating innovation and adoption, thereby significantly boosting the industry's growth

Treatment-Resistant Depression Market Analysis

- Treatment-resistant depression, involving patients unresponsive to at least two lines of antidepressant therapy, is emerging as a critical focus in the mental health sector, with growing integration of novel pharmacological and neuromodulation-based approaches across care settings

- The escalating demand in the TRD market is primarily fueled by the global rise in depression prevalence, the limitations of conventional antidepressants, and increased healthcare awareness, leading to a surge in the adoption of advanced therapies such as esketamine, psychedelics, and transcranial magnetic stimulation (TMS)

- North America dominated the treatment-resistant depression market with the largest revenue share of 47.1% in 2024, attributed to strong mental health infrastructure, active drug approvals, and early adoption of novel treatments, particularly in the U.S., where esketamine-based therapies and outpatient TMS clinics are increasingly utilized

- Asia-Pacific is expected to be the fastest growing region in the treatment-resistant depression market during the forecast period due to increasing mental health awareness, expanding healthcare access, and rising investments in psychiatric services across emerging economies

- Selective Serotonin Reuptake Inhibitors (SSRIs) segment dominated the treatment-resistant depression market with a market share of 34.7% in 2024, driven by their continued use as baseline therapies, especially in combination treatments or as part of treatment augmentation strategies

Report Scope and Treatment-Resistant Depression Market Segmentation

|

Attributes |

Treatment-Resistant Depression Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Treatment-Resistant Depression Market Trends

Innovation in Novel Therapeutics and Neurostimulation Techniques

- A significant and accelerating trend in the global treatment-resistant depression market is the rapid evolution of novel therapeutics and non-invasive neurostimulation techniques, offering new hope for patients unresponsive to traditional antidepressants. These advances are transforming the therapeutic landscape by targeting new pathways and offering faster, more effective symptom relief

- For instance, the FDA approval of Spravato (esketamine nasal spray) marked a breakthrough, offering a fast-acting treatment option for TRD. Similarly, the development of psychedelic-assisted therapies using psilocybin and MDMA by companies such as COMPASS Pathways and MAPS is gaining momentum in clinical trials

- In parallel, non-invasive neuromodulation techniques such as transcranial magnetic stimulation (TMS) and transcranial direct current stimulation (tDCS) are witnessing increased adoption due to their ability to modulate brain activity without systemic side effects. BrainsWay’s Deep TMS, for example, has received regulatory clearance for use in TRD, offering high efficacy rates

- These innovations provide treatment options that go beyond serotonin-targeting mechanisms, often with faster onset and fewer systemic side effects, reshaping expectations for depression care

- The growing acceptance and clinical validation of these therapies have prompted major healthcare providers and mental health startups to invest in integrated service models, enabling broader access to cutting-edge treatments in both inpatient and outpatient settings

- As patients and clinicians increasingly seek alternatives to conventional antidepressants, the demand for innovative, multi-modal treatment approaches is surging across both developed and emerging healthcare markets

Treatment-Resistant Depression Market Dynamics

Driver

Rising Mental Health Burden and Unmet Clinical Need

- The growing global burden of major depressive disorder, with a substantial proportion of patients failing to respond to at least two lines of antidepressant therapy, is a major driver of the treatment-resistant depression market

- For instance, clinical studies estimate that up to 30% of depression patients exhibit resistance to traditional treatments, creating a strong demand for new and more effective options

- Government initiatives and advocacy for improved mental healthcare access, particularly in North America and Europe, are accelerating investment into TRD-focused research and treatment centers

- The availability of targeted therapies such as esketamine, alongside neuromodulation procedures and psychedelic-assisted therapy in clinical settings, is enabling more personalized treatment regimens, enhancing patient outcomes and fueling market growth

- In addition, increased awareness around mental health and reduced stigma are encouraging more individuals to seek specialized care, expanding the pool of diagnosed and treated patients globally

Restraint/Challenge

High Treatment Costs and Regulatory Hurdles

- Despite significant advancements, the high cost of TRD treatments remains a key barrier to widespread adoption. Advanced options such as esketamine nasal spray, TMS, and ketamine infusions are often expensive and not consistently covered by insurance providers

- For instance, Spravato therapy can cost thousands of dollars per month, limiting access in underinsured populations. Similarly, repeated TMS sessions, while effective, can be cost-prohibitive without comprehensive health coverage

- Regulatory complexities surrounding the approval and clinical deployment of novel therapies, especially psychedelic-based treatments, further delay patient access and complicate commercialization efforts

- Stringent clinical trial requirements, ethical concerns, and controlled substance regulations continue to pose significant hurdles to pharmaceutical companies and healthcare providers aiming to enter this space

- Addressing these challenges through pricing reforms, insurance reimbursement strategies, and clearer regulatory pathways will be essential to unlock the full potential of the TRD market and reach underserved populations

Treatment-Resistant Depression Market Scope

The market is segmented on the basis of drug class, route of administration, end-users, and distribution channel.

- By Drug Class

On the basis of drug class, the treatment-resistant depression market is segmented into Selective Serotonin Reuptake Inhibitors (SSRIs), Monoamine Oxidase Inhibitors (MAOIs), Tricyclic Antidepressants (TCAs), psychedelics, and others. The SSRIs segment dominated the market with the largest revenue share of 34.7% in 2024, owing to their widespread use as first-line treatments and continued relevance in augmentation strategies. SSRIs remain a foundational therapy in TRD management due to their safety profile, familiarity among prescribers, and ease of combination with emerging agents such as esketamine or antipsychotics.

The psychedelics segment is anticipated to witness the fastest growth rate of 22.8% from 2025 to 2032, driven by ongoing clinical trials and expanding regulatory acceptance. Substances such as psilocybin and MDMA are demonstrating strong therapeutic potential for severe depression, particularly in patients unresponsive to conventional therapies. The growing investment by biotech firms and mental health startups is accelerating the commercialization of psychedelic-based therapies.

- By Route of Administration

On the basis of route of administration, the treatment-resistant depression market is segmented into oral, parenteral, and others. The oral segment held the largest market share at 61.5% in 2024, supported by high patient compliance, widespread availability of oral antidepressants, and ease of administration in outpatient settings. Oral SSRIs, TCAs, and adjunctive agents remain standard practice, especially in primary care and home-based treatment protocols.

The parenteral segment is expected to grow at the fastest rate during the forecast period, propelled by the increasing use of intranasal esketamine and intravenous ketamine infusions. These therapies offer rapid relief for severe TRD cases and are typically administered in controlled clinical settings.

- By End-Users

On the basis of end-users, the treatment-resistant depression market is segmented into hospitals, homecare, specialty clinics, and others. The hospitals segment dominated the market with a revenue share of 45.8% in 2024, attributed to the administration of advanced therapies such as TMS, ECT, and esketamine, which require medical supervision and safety monitoring. Hospitals also benefit from integrated mental health infrastructure and multidisciplinary teams for managing complex TRD cases.

Specialty clinics are projected to be the fastest-growing end-user segment, driven by rising outpatient demand for innovative therapies such as Deep TMS and ketamine infusions. These clinics often offer focused, high-quality care for depression, attracting patients seeking alternatives beyond standard psychiatric treatment.

- By Distribution Channel

On the basis of distribution channel, the treatment-resistant depression market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment held the largest share at 38.7% in 2024, supported by the centralized dispensing of controlled medications such as esketamine and the need for regulated supply in clinical environments. Hospital pharmacies play a key role in the administration and compliance of TRD-specific therapies.

The online pharmacy segment is anticipated to witness the fastest CAGR during the forecast period, fueled by increasing digitalization, telepsychiatry services, and patient preference for home delivery of antidepressants. The convenience of digital prescriptions and expanded access to mental health care are supporting the segment’s rapid growth.

Treatment-Resistant Depression Market Regional Analysis

- North America dominated the treatment-resistant depression market with the largest revenue share of 47.1% in 2024, attributed to strong mental health infrastructure, active drug approvals, and early adoption of novel treatments, particularly in the U.S., where esketamine-based therapies and outpatient TMS clinics are increasingly utilized

- Patients and providers in the region highly value fast-acting, evidence-based solutions that address the limitations of traditional antidepressants, prompting significant investments in new treatment modalities and integrated mental health services

- This widespread adoption is further supported by favorable reimbursement policies, robust clinical research activity, and the presence of leading biopharmaceutical companies and mental health providers, establishing North America as a leader in TRD innovation and access.

The U.S. Treatment-Resistant Depression Market Insight

The U.S. treatment-resistant depression market captured the largest revenue share of 79% in 2024 within North America, driven by a high prevalence of major depressive disorders and a strong focus on mental healthcare innovation. The country’s widespread access to psychiatric services, rapid adoption of novel therapies such as esketamine and Deep TMS, and supportive FDA regulatory approvals are fueling market growth. In addition, robust insurance coverage for advanced treatments and increasing awareness campaigns around mental health are encouraging patients to seek specialized interventions for treatment-resistant cases.

Europe Treatment-Resistant Depression Market Insight

The Europe treatment-resistant depression market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising mental health challenges and increasing government initiatives to improve psychiatric care access. The growing acceptance of neuromodulation therapies and the advancement of clinical trials for psychedelic-assisted treatments are fostering the adoption of new approaches. Europe’s strong clinical research network and emphasis on evidence-based mental health interventions contribute to the region’s market growth across hospitals and outpatient care settings.

U.K. Treatment-Resistant Depression Market Insight

The U.K. treatment-resistant depression market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness of mental health, supportive NHS initiatives, and growing demand for alternative treatment methods. The expansion of specialist clinics offering therapies such as TMS and ketamine infusions, along with increasing clinical validation of psychedelic-based treatments, is supporting growth. In addition, public acceptance and de-stigmatization of mental health treatments are driving patients to seek care beyond traditional antidepressants.

Germany Treatment-Resistant Depression Market Insight

The Germany treatment-resistant depression market is expected to expand at a considerable CAGR during the forecast period, supported by the country’s advanced healthcare infrastructure and strong focus on medical innovation. The German market is witnessing increased adoption of neuromodulation technologies and esketamine therapies in clinical settings. With a growing elderly population and emphasis on mental wellness, the demand for effective, fast-acting treatment alternatives is rising. Germany’s support for mental health research and integration of digital health solutions further accelerates market expansion.

Asia-Pacific Treatment-Resistant Depression Market Insight

The Asia-Pacific treatment-resistant depression market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rising mental health awareness, increasing urban stress, and expanding access to psychiatric care in countries such as China, Japan, and India. Government support for mental healthcare reforms and the introduction of digital mental health platforms are enabling broader diagnosis and treatment reach. The growing availability of cost-effective TRD therapies and interest in neuromodulation techniques are also contributing to rapid regional growth.

Japan Treatment-Resistant Depression Market Insight

The Japan treatment-resistant depression market is gaining momentum due to the country’s aging population, high rates of depression, and focus on advanced therapeutic solutions. Japanese healthcare providers are increasingly offering TMS and pharmacological alternatives for TRD, responding to a growing demand for less invasive and faster-acting treatments. The country’s emphasis on technology and personalized healthcare supports the integration of digital mental health monitoring, contributing to improved patient engagement and care continuity.

India Treatment-Resistant Depression Market Insight

The India treatment-resistant depression market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, increased stress-related disorders, and rising mental health awareness. India's expanding psychiatric care infrastructure, growing middle class, and increased use of telemedicine platforms are driving market penetration. Government-led mental health initiatives and the entry of cost-effective ketamine therapy clinics in urban areas are further accelerating access to TRD treatments across diverse population segments.

Treatment-Resistant Depression Market Share

The Treatment-Resistant Depression industry is primarily led by well-established companies, including:

- Pfizer Inc (U.S.)

- Viatris Inc. (U.S.)

- Novartis AG (Switzerland)

- Hikma Pharmaceuticals plc (U.K.)

- Aurobindo Pharma (India)

- AbbVie Inc. (U.S.)

- Melinta Therapeutics, Inc (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- GSK plc. (U.K.)

- Bayer AG (Germany)

- Lupin (India)

- Perrigo Company plc (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Amneal Pharmaceuticals LLC. (U.S.)

- Aurobindo Pharma (India)

- Zydus Group (India)

- Teva Pharmaceutical Industries Ltd (Israel)

- Endo Pharmaceuticals plc (Ireland)

- Currax Pharmaceuticals LLC (U.S.)

What are the Recent Developments in Global Treatment-Resistant Depression Market?

- In November 2022, Compass Pathways published the phase-2b results for COMP360 (psilocybin) in the New England Journal of Medicine, reporting clinically meaningful reductions in depressive symptoms and informing the design of its pivotal phase-3 programme for TRD

- In August 2022, Axsome Therapeutics’ Auvelity (dextromethorphan-bupropion) — a rapid-acting oral NMDA-modulating antidepressant — received U.S. FDA approval for major depressive disorder, marking a new oral, fast-acting option that reshaped expectations for rapidly acting pharmacotherapies relevant to TRD management

- In March 2024, Neuronetics’ NeuroStar Advanced Therapy received FDA clearance as an adjunct (first-line add-on) treatment for adolescent depression (ages 15–21), expanding the approved remit of TMS-based neuromodulation technologies that are increasingly used for patients with treatment-resistant illness

- In July 2024, Johnson & Johnson (Janssen) submitted an sNDA to the U.S. FDA to expand SPRAVATO (esketamine nasal spray) use to include monotherapy for adults with TRD — a regulatory move backed by Phase-4 monotherapy data aiming to simplify clinical use of this fast-acting option

- In December 2023, Sage Therapeutics and Biogen’s zuranolone (Zurzuvae) received U.S. FDA approval as the first oral, short-course therapy for postpartum depression, demonstrating renewed regulatory appetite for novel neuroactive agents and accelerating interest in next-generation GABAergic and neurosteroid approaches relevant to broader TRD research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.