Global Truck Rental Market

Market Size in USD Billion

CAGR :

%

USD

1.40 Billion

USD

2.10 Billion

2024

2032

USD

1.40 Billion

USD

2.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 2.10 Billion | |

|

|

|

|

Truck rental Market Size

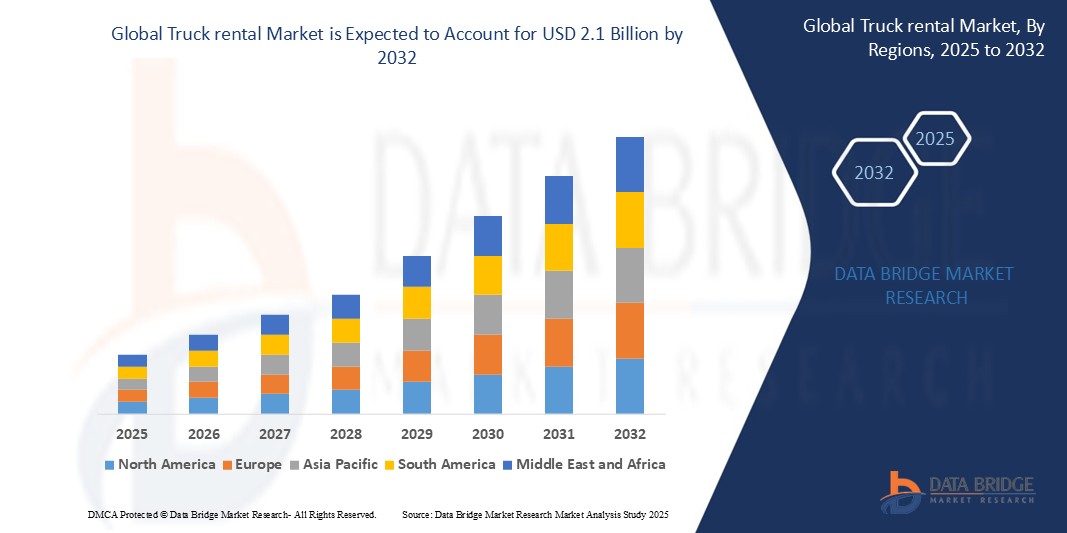

- The global truck rental market size was valued at USD 1.4 billion in 2024 and is expected to reach USD 2.1 billion by 2032, at a CAGR of 5.20% during the forecast period

- This growth is driven by factors such as the rising demand for transportation services, increasing e-commerce activities, and the expansion of logistics and supply chain networks.

Truck rental Market Analysis

- The truck rental market is experiencing steady growth due to the increasing demand for transportation solutions across various industries. Businesses are opting for truck rentals to reduce ownership costs and improve operational flexibility

- The market is also benefiting from the rise of e-commerce and online retail, leading to a surge in logistics and delivery needs. As these sectors expand, the demand for rental trucks to manage inventory and transportation efficiently continues to grow

- Asia-Pacific is expected to dominate the truck rental market due to rapid urbanization, industrial growth, and the booming e-commerce sector, which drive the demand for efficient, flexible transportation solutions across the region

- North America is expected to be the fastest-growing region in the truck rental market during the forecast period due to the increasing demand for last-mile delivery services, the rise of e-commerce, and the widespread adoption of digital rental platforms in the logistics sector

- The light duty segment is expected to dominate the truck rental market with the largest share of 70.1% in 2025 due to its versatility and widespread use across various industries. Light-duty trucks are commonly used for smaller deliveries, local transportation, and short-haul operations, making them an attractive option for businesses needing flexible and cost-effective solutions.

Report Scope and Truck rental Market Segmentation

|

Attributes |

Truck rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Truck rental Market Trends

“Rise of Electric and Eco-Friendly Trucks”

- There is a growing trend toward electric and eco-friendly trucks within the rental market, driven by the increasing demand for sustainable transportation solutions

- Companies are increasingly opting for electric truck rentals to reduce their carbon footprint and comply with tightening environmental regulations

- Some rental companies are integrating electric trucks into their fleets, offering businesses eco-friendly alternatives to traditional diesel-powered vehicles

- For instance, a major truck rental company introduced electric trucks to cater to businesses aiming to lower emissions

- The push for eco-friendly solutions is also backed by the expanding charging infrastructure, making it more feasible to rent electric trucks for long-distance transportation

- As governments offer incentives and tax benefits for using electric vehicles, truck rental companies are seeing more businesses opting for greener choices

- For instance, logistics firm that chose electric rental trucks to benefit from government rebates and environmental incentives

Truck rental Market Dynamics

Driver

“Increasing Demand for Flexible Transportation Solutions”

- The rising demand for flexible and cost-effective transportation solutions is driving the growth of the truck rental market, particularly among small and medium-sized enterprises. Renting trucks allows businesses to avoid high upfront costs and ongoing maintenance expenses

- Businesses can scale their operations based on fluctuating demand, eliminating the need for a long-term financial commitment to fleet ownership

- For instance, retail businesses can rent additional trucks during peak seasons, such as Black Friday, to handle the increased volume of deliveries

- The need for just-in-time delivery models in industries such as retail and e-commerce has increased reliance on outsourced transportation solutions. Truck rentals provide businesses with the flexibility to manage this demand without owning a large fleet

- Truck rental services offer businesses a variety of vehicle types, allowing them to choose the right truck based on their transportation needs

- For instance, an e-commerce company might rent a smaller truck for local deliveries but a larger one for long-haul shipments

- The customization and operational efficiency that truck rental services provide help businesses optimize costs, making them an attractive option for companies without the need for a dedicated fleet. This has been particularly beneficial for startups and SMEs, which do not have the capital to invest in fleet ownership

Opportunity

“Expansion of E-commerce and Last-Mile Delivery”

- The rapid growth of e-commerce has created significant opportunities for the truck rental market, as businesses require efficient last-mile delivery solutions to meet the surge in online shopping

- With the increasing demand for timely and reliable delivery, truck rental services provide a flexible solution for scaling transportation fleets according to seasonal or fluctuating needs, reducing the financial burden of fleet ownership

- Truck rental companies offer a variety of trucks suited for different types of deliveries, from small parcels to large bulk shipments, enabling e-commerce businesses to customize their fleet based on delivery requirements

- This flexibility helps businesses efficiently meet growing consumer demands without the need to manage their own fleet, allowing them to focus on core operations

- For instance, Amazon partners with third-party logistics firms to rent trucks for last-mile deliveries

- As the demand for faster deliveries continues to rise, truck rental services have a sustained opportunity to expand their presence in the logistics and e-commerce sectors, supporting businesses in managing their delivery logistics more effectively

Restraint/Challenge

“High Maintenance and Operational Costs”

- One of the key challenges in the truck rental market is the high maintenance and operational costs associated with maintaining a fleet of vehicles, which can place a significant financial burden on rental companies.

- Unexpected breakdowns or repairs can lead to downtime, negatively impacting service availability and customer satisfaction, making it difficult to meet customer expectations.

- These maintenance costs are often passed on to customers through higher rental rates, which could make truck rentals less attractive, especially for small and medium-sized businesses that prioritize cost-efficiency.

- Truck rental companies must also comply with stringent safety and environmental regulations, which require regular fleet updates and costly modifications to meet emission standards

- For instance, many regions require rental trucks to meet stricter emission guidelines, forcing rental companies to upgrade their older vehicles.

- The combination of high maintenance costs and regulatory compliance presents a challenge for rental companies, affecting their ability to maintain competitive pricing while ensuring efficient operations and customer satisfaction.

Truck rental Market Scope

The market is segmented on the basis of truck, lease, duration, propulsion, service provider, truck capacity, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Truck |

|

|

By Lease |

|

|

By Duration |

|

|

By Propulsion |

|

|

By Service Provider |

|

|

By Truck Capacity |

|

|

By End User |

|

In 2025, the light duty is projected to dominate the market with a largest share in truck segment

The light duty segment is expected to dominate the truck rental market with the largest share of 70.1% in 2025 due to its versatility and widespread use across various industries. Light-duty trucks are commonly used for smaller deliveries, local transportation, and short-haul operations, making them an attractive option for businesses needing flexible and cost-effective solutions.

The short term is expected to account for the largest share during the forecast period in duration market

In 2025, the short-term segment is expected to dominate the market with the largest market share due to its rising demand for flexible, cost-effective transportation solutions, driven by e-commerce growth and urban logistics needs.

Truck rental Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Truck rental Market”

- Asia Pacific is the dominating region in the truck rental market, holding the largest market share of 45% and is projected to maintain its lead in the coming years

- This dominance is supported by the region’s large logistics and manufacturing base, especially in countries such as China and India

- Rapid urbanization and industrial growth are key drivers in the region, creating high demand for efficient freight and delivery transport

- This trend is particularly strong in Southeast Asia and South Asia due to expanding infrastructure and trade

- The rise of small and medium-sized enterprises (SMEs) in logistics is fuelling short-term rental needs in urban centers

“North America is Projected to Register the Highest CAGR in the Truck rental Market”

- North America is the fastest-growing region in the truck rental market, with rapid expansion

- North America is expected to contribute 39% of the global truck rental market’s total growth

- This surge is largely driven by rising logistics activity and the shift to on-demand transport solutions

- Growth in e-commerce and last-mile delivery services is increasing demand for flexible, short-term truck rentals

- Businesses are adapting to peak-season delivery needs without investing in long-term fleet ownership

- Strong presence of key market players such as Ryder System, Penske, and U-Haul is enhancing market scalability

Truck rental Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Enterprise Holdings, Inc. (U.S.)

- The Hertz Corporation (U.S.)

- Penske (U.S.)

- Ryder System, Inc. (U.S.)

- Avis Rent A Car System, LLC (U.S.)

- NationaLease (U.S.)

- Daimler Truck AG (Germany)

- United Rentals, Inc. (U.S.)

- Bush Truck Leasing (U.S.)

- Kenworth Sales Company (U.S.)

Latest Developments in Global Truck rental Market

- In February 2024, Flexter.com (Canada) and Green Motion (UK) announced a strategic partnership to enhance the global short-term truck rental reservation process. This collaboration integrates Green Motion's extensive fleet—including compact vans to heavy-duty trucks—into Flexter's platform, providing real-time availability and transparent pricing. The partnership aims to improve accessibility and convenience for customers seeking eco-friendly, short-term truck rental solutions worldwide. By offering a diverse range of vehicles and a seamless booking experience, this alliance is poised to transform the short-term truck rental industry, benefiting both businesses and individual customers

- In July 2024, NHR Group (New Zealand) and Hertz (U.S.) announced a strategic partnership to enhance truck and van rental services across New Zealand. As the major franchise operator for Hertz and Thrifty commercial rentals in the country, NHR Group will operate five co-branded locations in Manukau, Pukekohe, Albany, Waikato, and Christchurch, with plans to expand into Queenstown. This collaboration aims to provide a comprehensive range of vehicles—including trucks, vans, buses, and passenger cars—through both companies' networks. By combining NHR Group's local expertise with Hertz's global brand recognition, the partnership seeks to meet the growing demand in sectors such as logistics, civil works, government, and the film industry, thereby strengthening the commercial vehicle rental market in New Zealand

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.