Global Ultra High Barrier Films Market

Market Size in USD Billion

CAGR :

%

USD

3.73 Billion

USD

5.30 Billion

2024

2032

USD

3.73 Billion

USD

5.30 Billion

2024

2032

| 2025 –2032 | |

| USD 3.73 Billion | |

| USD 5.30 Billion | |

|

|

|

|

Ultra-high Barrier Films Market Size

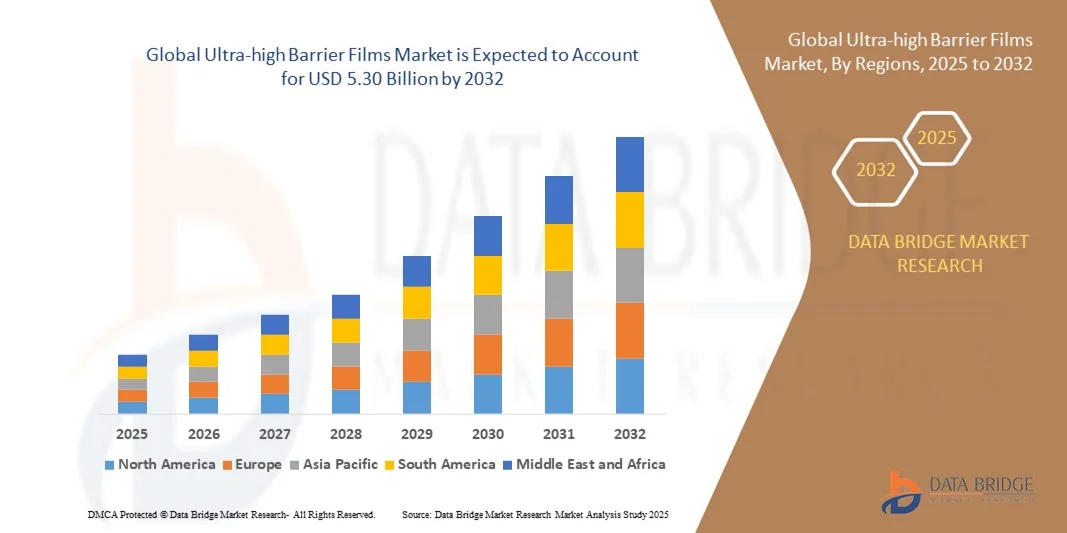

- The global ultra-high barrier films market size was valued at USD 3.73 billion in 2024 and is expected to reach USD 5.30 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance packaging solutions that enhance product shelf life, maintain freshness, and ensure safety across food, pharmaceutical, and electronic applications

- Furthermore, rising regulatory requirements, growing consumer awareness regarding food safety and sustainability, and the shift toward recyclable and eco-friendly packaging solutions are driving the adoption of ultra-high barrier films, significantly boosting market growth

Ultra-high Barrier Films Market Analysis

- Ultra-high barrier films, offering superior protection against oxygen, moisture, and light, are increasingly critical for maintaining product quality and extending shelf life in food, pharmaceutical, and electronic device packaging

- The escalating demand for these films is primarily driven by the need for advanced barrier properties, sustainable and recyclable packaging materials, and innovations in multilayer and coated film technologies that meet industry-specific regulatory and performance standards

- North America dominated the ultra-high barrier films market with a share of 42% in 2024, due to growing demand for high-quality food and pharmaceutical packaging and increasing adoption of advanced packaging technologies

- Asia-Pacific is expected to be the fastest growing region in the ultra-high barrier films market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing consumption of packaged foods, beverages, and pharmaceuticals

- Plastic segment dominated the market with a market share of 48.5% in 2024, due to its cost-effectiveness, flexibility, and ease of processing for various packaging applications. Plastic films are widely preferred in food and pharmaceutical packaging due to their lightweight nature, durability, and compatibility with high-speed production lines. Their adaptability to multilayer structures also enhances barrier properties, enabling extended shelf life for sensitive products. The segment benefits from ongoing innovations in polymer blends that improve oxygen and moisture resistance while maintaining transparency and printability

Report Scope and Ultra-high Barrier Films Market Segmentation

|

Attributes |

Ultra-high Barrier Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ultra-high Barrier Films Market Trends

Growing Adoption of Sustainable and Recyclable Packaging Solutions

- The ultra-high barrier films market is witnessing increasing adoption of sustainable and recyclable packaging solutions as industries respond to consumer demand and regulatory mandates emphasizing environmental responsibility. Manufacturers are proactively shifting from traditional multilayer plastic structures toward more eco-friendly materials that maintain superior barrier properties while enabling recyclability and reduced carbon emissions

- For instance, Amcor plc has introduced high-barrier recyclable packaging film solutions under its AmLite range, which combine metal-free barrier layers with recyclability compliant with global packaging regulations. This innovation underscores the growing trend toward flexible packaging formats that balance functionality, sustainability, and circular economy goals across the food and pharmaceutical industries

- Sustainable ultra-high barrier films are gaining traction across packaging applications such as snacks, coffee, medical devices, and perishable goods, where protection against moisture, oxygen, and light is critical. The transition to materials based on mono-polymer and bio-based compositions is reducing dependence on complex non-recyclable laminates while preserving product integrity

- In addition, advancements in nanocoating and plasma-deposition techniques are enabling manufacturers to achieve high oxygen and moisture barrier performance with thinner film structures. These technologies minimize material consumption and also improve recyclability and reduce transportation costs due to lighter weight packaging formats

- The collaboration between resin suppliers, converters, and brand owners is fostering innovation in barrier film design to meet both performance and sustainability targets. Integrating renewable resources and clean production processes has become essential for manufacturers aligning with environmental, social, and governance (ESG) frameworks globally

- As sustainability transitions from a differentiator to an industry standard, the adoption of recyclable and circular-ready ultra-high barrier films is expected to intensify. Ongoing R&D investments are paving the way for materials that deliver advanced protection, efficiency, and compliance, positioning sustainable barrier films as a cornerstone of future packaging technologies

Ultra-high Barrier Films Market Dynamics

Driver

Rising Demand for Product Protection and Extended Shelf Life

- The growing need for advanced packaging that ensures product safety, freshness, and shelf-life extension is a key driver for the ultra-high barrier films market. These films provide exceptional resistance against gases, moisture, and odor permeation, making them vital in industries such as food, pharmaceuticals, and electronics where product stability is crucial

- For instance, Mitsubishi Chemical Group Corporation has developed ultra-high barrier films using advanced multilayer coatings designed to enhance moisture and oxygen resistance in high-value food and healthcare applications. The company’s focus on technological precision demonstrates the market’s ongoing demand for superior protection films to reduce spoilage and maintain quality throughout distribution

- Ultra-high barrier films help preserve the flavor, texture, and efficacy of perishable and sensitive products, reducing dependency on preservatives and enabling longer storage cycles. This supports both manufacturers’ sustainability objectives and consumer expectations for product safety and freshness without compromising environmental performance

- As market competition intensifies, brands are prioritizing packaging differentiation that combines strong functional properties with visual appeal. The ability of ultra-high barrier films to maintain transparency and printability while providing maximum protection is strengthening their position in global packaging innovation

- The continued focus on maintaining product integrity and minimizing waste is expected to sustain robust growth for ultra-high barrier films. Their role as critical enablers of extended shelf life and reduced spoilage loss makes them indispensable across industries seeking reliability and environmental compliance in packaging solutions

Restraint/Challenge

High Cost and Complexity of Multilayer Films

- The high production cost and technical complexity associated with manufacturing multilayer ultra-high barrier films pose a major challenge to their broad-scale adoption. Achieving precise layer configurations and material compatibility often involves specialized co-extrusion, coating, and lamination technologies, which increase operational expenses and production time

- For instance, Uflex Ltd. and Toppan Printing Co., Ltd. have acknowledged the rising costs of raw materials and advanced processing equipment required for multilayer barrier film production. These financial and technical challenges make cost optimization a critical consideration for packaging producers, especially in competitive segments such as food and consumer goods

- Material selection and interlayer adhesion present significant hurdles, as variations in resin chemistry and thickness can lead to performance inconsistencies and recycling limitations. Balancing the integration of multiple functional layers with the need for recyclability adds further design and cost challenges for film manufacturers

- In addition, the capital-intensive nature of barrier film machinery and maintenance requirements limits accessibility for small and medium-sized converters. This results in slower market penetration and higher dependency on large-scale producers capable of achieving economies of scale

- Addressing these cost and complexity barriers will depend on continued innovation in film engineering and material science. Simplifying multilayer structures through mono-material designs, enhancing co-extrusion efficiency, and adopting solvent-free lamination technologies are expected to gradually reduce overall production costs and support wider use of ultra-high barrier films globally

Ultra-high Barrier Films Market Scope

The market is segmented on the basis of material type, packaging format, end user, and barrier material.

- By Material Type

On the basis of material type, the ultra-high barrier films market is segmented into plastic, aluminium oxide, and others. The plastic segment dominated the market with the largest market revenue share of 48.5% in 2024, driven by its cost-effectiveness, flexibility, and ease of processing for various packaging applications. Plastic films are widely preferred in food and pharmaceutical packaging due to their lightweight nature, durability, and compatibility with high-speed production lines. Their adaptability to multilayer structures also enhances barrier properties, enabling extended shelf life for sensitive products. The segment benefits from ongoing innovations in polymer blends that improve oxygen and moisture resistance while maintaining transparency and printability.

The aluminium oxide segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its superior barrier performance against oxygen, moisture, and UV light. Aluminium oxide coatings are increasingly adopted in high-end food, pharmaceutical, and electronic packaging applications, where product integrity and shelf life are critical. Rising consumer demand for high-quality packaged goods and regulatory emphasis on food safety drive the adoption of aluminium oxide films. In addition, their ability to provide rigid barrier performance in lightweight formats supports sustainability goals by reducing packaging material usage.

- By Packaging Format

On the basis of packaging format, the market is segmented into bags, pouches, tray lidding films, forming webs, wrapping films, and blister pack base webs. The pouches segment dominated the market with the largest revenue share in 2024, owing to their convenience, portability, and enhanced barrier properties suitable for food and pharmaceutical products. Pouches allow for flexible designs, resealable options, and easy printing, making them highly attractive for consumer-centric applications. They are increasingly preferred for ready-to-eat foods, snacks, and liquid products, where maintaining freshness and preventing contamination are priorities.

The tray lidding films segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand in retail-ready food packaging and frozen food applications. Tray lidding films provide excellent barrier protection while maintaining product visibility, allowing brands to enhance shelf appeal. Their compatibility with automated packaging lines and the ability to form hermetic seals for perishable goods further support market growth. Rising consumer preference for convenience foods and ready-to-cook meal solutions accelerates adoption in this segment.

- By End User

On the basis of end user, the ultra-high barrier films market is segmented into food, beverages, pharmaceuticals, electronic devices, medical devices, agriculture, chemicals, and others. The food segment dominated the market with the largest market revenue share in 2024, fueled by the increasing need to extend shelf life, preserve freshness, and prevent contamination of perishable products. Food manufacturers prioritize ultra-high barrier films for processed foods, snacks, and frozen goods, leveraging their superior oxygen and moisture resistance. The growing trend of packaged convenience foods and the rise in e-commerce food deliveries further bolster demand in this segment.

The pharmaceutical segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by stringent regulatory requirements for drug packaging and the need to maintain product integrity during transportation and storage. Ultra-high barrier films protect sensitive drugs and biologics from moisture, oxygen, and light exposure, ensuring efficacy and safety. The rising adoption of blister packs, sachets, and pouches for oral solid and liquid pharmaceuticals also supports growth. In addition, the expansion of the healthcare sector in emerging markets contributes to increasing demand.

- By Barrier Material

On the basis of barrier material, the market is segmented into ethylene vinyl alcohol (EVOH), polyvinylidene chloride (PVDC), polyamide (PA), polyethylene naphthalate (PEN), microfibrillated cellulose, aluminium, aluminium oxide, and silicon oxide. The ethylene vinyl alcohol (EVOH) segment dominated the market with the largest revenue share in 2024, driven by its excellent oxygen barrier properties, transparency, and compatibility with multilayer packaging structures. EVOH films are widely used in food and pharmaceutical packaging where protection against spoilage and extended shelf life are critical. Their ability to maintain barrier performance even under varying humidity conditions makes them highly reliable and cost-effective.

The aluminium oxide segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption in high-value applications requiring superior gas, moisture, and light barrier protection. Aluminium oxide coatings provide long-term stability, making them ideal for pharmaceuticals, electronics, and medical device packaging. Advancements in coating technologies that allow thin, uniform layers without compromising film flexibility further drive growth. Rising awareness of product preservation and quality assurance supports rapid expansion in this segment.

Ultra-high Barrier Films Market Regional Analysis

- North America dominated the ultra-high barrier films market with the largest revenue share of 42% in 2024, driven by growing demand for high-quality food and pharmaceutical packaging and increasing adoption of advanced packaging technologies

- Manufacturers and end-users in the region prioritize packaging solutions that enhance product shelf life, maintain freshness, and ensure regulatory compliance

- The presence of well-established packaging companies, high consumer awareness regarding food safety, and robust industrial infrastructure further strengthen market adoption. The demand for sustainable and efficient packaging solutions also supports the continued growth of ultra-high barrier films in North America

U.S. Ultra-high Barrier Films Market Insight

The U.S. ultra-high barrier films market captured the largest revenue share in North America in 2024, fueled by the widespread use of packaged foods, beverages, and pharmaceuticals. Rising consumer focus on product quality, convenience, and safety is driving demand for films with superior oxygen and moisture barriers. The adoption of multilayer and coated films in food and pharmaceutical packaging, combined with advancements in flexible packaging technologies, is further propelling market expansion. In addition, strong investments in automated packaging lines and increasing e-commerce penetration contribute to the growth of ultra-high barrier films in the country.

Europe Ultra-high Barrier Films Market Insight

The Europe ultra-high barrier films market is projected to expand at a notable CAGR throughout the forecast period, driven by stringent food and pharmaceutical safety regulations and increasing demand for longer shelf life packaging. Urbanization and rising consumer awareness regarding food safety and product quality are encouraging manufacturers to adopt high-performance barrier films. The region is witnessing strong growth in both flexible and rigid packaging formats across food, beverage, and pharmaceutical segments. Sustainable and recyclable packaging solutions are also becoming key factors driving market adoption in Europe.

U.K. Ultra-high Barrier Films Market Insight

The U.K. ultra-high barrier films market is expected to grow steadily during the forecast period, supported by rising demand for convenience foods, pharmaceuticals, and premium beverages. Concerns regarding product safety, quality preservation, and extended shelf life are encouraging manufacturers to integrate ultra-high barrier films into packaging solutions. Growth is further fueled by increasing adoption of flexible and multilayer packaging formats and the expansion of e-commerce food and pharmaceutical deliveries.

Germany Ultra-high Barrier Films Market Insight

The Germany ultra-high barrier films market is anticipated to expand at a significant CAGR during the forecast period, driven by advanced packaging infrastructure, strong industrial base, and regulatory focus on food and pharmaceutical safety. The adoption of innovative multilayer and coated films is increasing across packaged food, beverages, and pharmaceutical products. Germany’s emphasis on sustainability and recycling in packaging further promotes the use of high-performance barrier films.

Asia-Pacific Ultra-high Barrier Films Market Insight

The Asia-Pacific ultra-high barrier films market is poised to grow at the fastest CAGR during 2025–2032, fueled by rapid urbanization, rising disposable incomes, and increasing consumption of packaged foods, beverages, and pharmaceuticals. Government initiatives promoting food safety, digitalization, and modernization of the packaging industry are accelerating market adoption. The region is also a major hub for film production and end-use manufacturing, enhancing accessibility and affordability of ultra-high barrier films for both domestic and export markets.

Japan Ultra-high Barrier Films Market Insight

The Japan market is gaining momentum due to high consumer awareness regarding food safety and product quality. Rising demand for convenience foods, pharmaceuticals, and ready-to-eat meals drives adoption of films with superior barrier properties. Integration of innovative packaging technologies, such as multilayer and coated films, supports product preservation and safety across residential and commercial sectors.

China Ultra-high Barrier Films Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing packaged food and pharmaceutical consumption, and expansion of e-commerce channels. The availability of cost-effective, high-performance films, coupled with strong domestic manufacturing capabilities, is further accelerating market growth. Government emphasis on food safety and quality standards, alongside rising middle-class demand for premium packaged goods, supports the widespread adoption of ultra-high barrier films.

Ultra-high Barrier Films Market Share

The ultra-high barrier films industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- Bemis Manufacturing Company (U.S.)

- Berry Global Inc. (U.S.)

- Sealed Air (U.S.)

- Sonoco Products Company (U.S.)

- DS Smith (U.K.)

- 3M (U.S.)

- Mitsubishi Chemical Advanced Materials (Japan)

- Innovia Films (U.K.)

- TOPPAN INC. (Japan)

- Daibochi Berhad (Malaysia)

- Klöckner Pentaplast (Germany)

- OIKE & Co., Ltd. (Japan)

- Mondi (Austria)

- DuPont (U.S.)

- Avery Dennison Corporation (U.S.)

- Honeywell International Inc. (U.S.)

- Celplast Metallized Products (India)

- Cosmo Films Ltd. (India)

- UFlex Limited (India)

- WINPAK LTD. (Canada)

Latest Developments in Global Ultra-high Barrier Films Market

- In August 2025, Mondi Group expanded its portfolio with FunctionalBarrier Paper Ultimate, a high-performance, paper-based barrier solution designed to meet even the most demanding packaging requirements. This innovation provides excellent protection against oxygen, moisture, and grease, making it suitable for food, pharmaceutical, and other sensitive applications. By offering a recyclable alternative to traditional multi-layer plastic and aluminum laminates, the launch directly addresses the growing demand for sustainable packaging solutions. It also supports manufacturers’ efforts to meet regulatory and environmental standards while maintaining product integrity, driving wider adoption of eco-friendly high-barrier materials

- In April 2024, Smart Planet Technologies introduced HyperBarrier, a ternary nanocomposite coating for paper-based flexible packaging. HyperBarrier delivers a 20-fold improvement in oxygen barrier performance and a 15-fold enhancement in moisture barrier compared to conventional polyethylene coatings. This allows paper packaging to replace multi-layer plastics without compromising barrier performance, facilitating recyclability and sustainability. The development is particularly impactful in the food and pharmaceutical sectors, where product freshness and safety are critical, positioning the company as a leader in high-performance eco-conscious packaging

- In March 2024, Jindal Films launched a polypropylene mono-material barrier solution for horizontal form-fill-seal packaging lines. This high-barrier film provides excellent gloss, stable slip, scuff resistance, and alcohol resistance, making it ideal for baked goods, snacks, and other food products. By offering a single-material alternative to traditional multi-material laminates, the innovation enhances recyclability while maintaining performance, aligning with the packaging industry’s shift toward sustainable and circular solutions. This development also allows manufacturers to streamline production and reduce material complexity without compromising product protection

- In October 2023, Solvay introduced Diofan Ultra736, a polyvinylidene chloride (PVDC) coating with ultra-high water vapor barrier performance for pharmaceutical blister films. As an aqueous dispersion, it complies with direct pharmaceutical contact regulations and enables the production of thinner films, reducing carbon footprint and material usage. The launch provides an eco-friendlier solution for sensitive pharmaceutical products, ensuring extended shelf life and product safety while supporting manufacturers’ sustainability goals. The innovation also strengthens Solvay’s position in the specialty barrier coatings market

- In April 2023, Toyo Seikan Group Holdings launched Ultra Moisture Barrier Film under its MiraNeo® brand for electronic devices. This film offers the world’s highest level of moisture barrier performance combined with high durability, making it suitable for sensitive electronics packaging. By significantly enhancing product protection, the development helps manufacturers reduce device failure due to moisture exposure and gain a competitive edge in high-value markets. It also responds to the increasing demand for advanced packaging materials that combine high performance with reliability, particularly in the rapidly growing electronics and medical device sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ultra High Barrier Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ultra High Barrier Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ultra High Barrier Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.