Global Ultrasound Bone Densitometer Market

Market Size in USD Million

CAGR :

%

USD

211.59 Million

USD

277.12 Million

2025

2033

USD

211.59 Million

USD

277.12 Million

2025

2033

| 2026 –2033 | |

| USD 211.59 Million | |

| USD 277.12 Million | |

|

|

|

|

Ultrasound Bone Densitometer Market Size

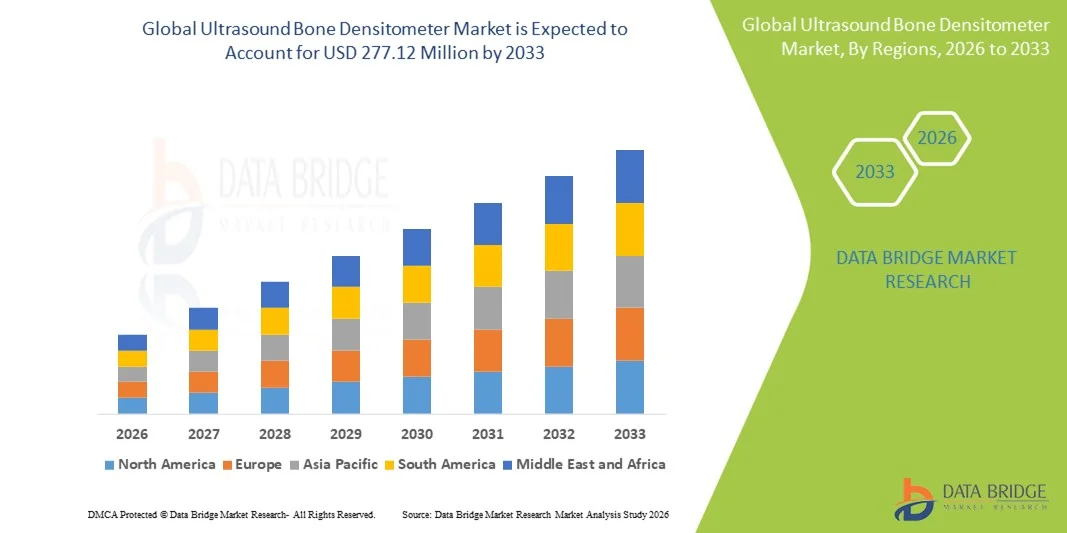

- The global ultrasound bone densitometer market size was valued at USD 211.59 million in 2025 and is expected to reach USD 277.12 million by 2033, at a CAGR of 3.43% during the forecast period

- The market growth is largely fueled by rising awareness of osteoporosis and other bone‑related conditions, increasing demand for non‑invasive and radiation‑free diagnostic tools, and technological advancements in portable and high‑resolution ultrasound devices

- Furthermore, the growing geriatric population and expanding healthcare infrastructure worldwide are driving adoption of ultrasound bone densitometers across clinical and diagnostic settings, as these solutions offer accessible, user‑friendly, and cost‑effective bone health assessment establishing them as preferred tools in modern preventive healthcare

Ultrasound Bone Densitometer Market Analysis

- Ultrasound bone densitometers, providing non-invasive and radiation-free assessment of bone density, are increasingly important tools in modern diagnostics for osteoporosis and other bone-related disorders, widely used across hospitals, diagnostic centers, and research institutes due to their portability, ease of use, and real-time results

- The growing demand for ultrasound bone densitometers is primarily driven by increasing awareness of bone health, rising incidence of osteoporosis and fractures, and preference for safe, cost-effective, and point-of-care diagnostic solutions over conventional imaging methods

- North America dominated the ultrasound bone densitometer market with the largest revenue share of 38.5% in 2025, attributed to early adoption of advanced diagnostic technologies, high healthcare spending, and a strong presence of key industry players, with the U.S. seeing significant uptake in hospitals and diagnostic centers

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period due to increasing geriatric population, growing healthcare infrastructure, and rising awareness of bone-related diseases among urban populations

- Central Scan segment dominated the market with a market share of 44.2% in 2025, owing to their accuracy in assessing core skeletal sites such as the hip and spine

Report Scope and Ultrasound Bone Densitometer Market Segmentation

|

Attributes |

Ultrasound Bone Densitometer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ultrasound Bone Densitometer Market Trends

Advancements in AI-Enabled Diagnostic and Predictive Features

- A significant and accelerating trend in the global ultrasound bone densitometer market is the integration of artificial intelligence (AI) and predictive analytics, which enhances accuracy in fracture risk assessment and early osteoporosis detection

- For instance, devices such as the Achilles Insight Densitometer now use AI algorithms to analyze bone quality and predict fracture probability, enabling clinicians to tailor preventive care plans

- AI integration allows bone densitometers to learn patient-specific bone density patterns over time, flagging abnormal changes for early intervention. Some devices also provide real-time alerts to clinicians if rapid bone loss is detected

- The seamless integration of ultrasound densitometers with hospital management and electronic health record systems facilitates centralized monitoring of patient bone health, allowing clinicians to track, compare, and analyze results across multiple visits and locations

- Manufacturers are increasingly developing portable and wireless devices, enabling bedside and remote screenings, which expand usage in outpatient clinics and community health programs

- This trend towards AI-driven, predictive, and connected diagnostic tools is transforming clinical expectations for non-invasive bone health assessments. Consequently, companies such as Hologic are developing densitometers with AI-assisted fracture risk scoring and cloud-based patient management

- The demand for AI-enhanced ultrasound bone densitometers is growing rapidly across hospitals, diagnostic centers, and research institutes, as clinicians increasingly prioritize precision, speed, and personalized patient care

- Integration with telemedicine platforms is emerging, allowing clinicians to perform remote bone health consultations and continuous monitoring for patients in underserved areas

Ultrasound Bone Densitometer Market Dynamics

Driver

Increasing Prevalence of Osteoporosis and Awareness of Bone Health

- The rising incidence of osteoporosis and fractures globally, coupled with growing awareness of preventive bone care, is a major driver of ultrasound bone densitometer adoption

- For instance, in March 2025, GE Healthcare launched an awareness program highlighting early osteoporosis detection using portable ultrasound densitometers in clinical and community settings

- As healthcare providers and patients seek early detection and non-invasive monitoring solutions, ultrasound densitometers offer an effective alternative to conventional DXA scans, providing quick results and reduced radiation exposure

- Furthermore, the rising preference for outpatient diagnostics and preventive healthcare programs is driving demand in hospitals, diagnostic centers, and research institutes

- The convenience of portable and easy-to-use devices, along with increasing government and insurance initiatives promoting bone health screening, is propelling adoption, particularly among aging populations and high-risk patient groups

- Expansion of preventive healthcare initiatives and bone health awareness campaigns in emerging regions is creating new adoption opportunities for portable and affordable densitometers

- Collaborations between manufacturers and academic/research institutes to develop advanced applications for bone quality assessment are further stimulating market growth

- Rising integration of bone densitometry in corporate wellness programs and community health checks is increasing routine screenings and early detection rates

Restraint/Challenge

High Device Cost and Limited Awareness in Emerging Markets

- The relatively high initial cost of advanced ultrasound bone densitometers poses a challenge for adoption, particularly in price-sensitive regions and smaller clinics

- For instance, some high-end models with AI-assisted features can cost several times more than basic units, limiting penetration in developing countries and rural healthcare settings

- In addition, limited awareness among healthcare providers and patients regarding the benefits of non-invasive bone density screening hampers market growth. Training and education programs are often required to encourage routine screening adoption

- While portable devices are increasing accessibility, the perception that advanced features are “premium” can discourage smaller diagnostic centers from investing. Manufacturers such as Hologic and GE are focusing on cost-effective, compact units to address this barrier

- Overcoming these challenges through price reduction strategies, government health initiatives, and educational campaigns on bone health will be essential for sustained market expansion, especially in emerging markets

- Limited reimbursement policies in certain countries for ultrasound-based bone density tests can restrict adoption and reduce market penetration

- Technical skill requirements and the need for trained operators to interpret results accurately remain barriers in small clinics and community healthcare centers

- Variability in device accuracy and calibration standards across regions can affect clinician trust and slow adoption, making regulatory harmonization a critical need for market growth

Ultrasound Bone Densitometer Market Scope

The market is segmented on the basis of application and end-user.

- By Application

On the basis of application, the ultrasound bone densitometer market is segmented into central scan and peripheral scan. The Central Scan segment dominated the market with the largest revenue share of 44.2% in 2025, driven by its ability to accurately assess core skeletal sites such as the hip and spine, which are critical for diagnosing osteoporosis and predicting fracture risk. Central scan devices are widely preferred in hospitals and diagnostic centers for their high precision, reproducibility, and compliance with clinical guidelines for bone density measurement. Healthcare providers often rely on central scan results to make key decisions regarding treatment plans, including pharmacological interventions and lifestyle recommendations. The segment benefits from technological advancements, such as AI-assisted fracture risk prediction, which improves clinical outcomes. High patient volumes in urban hospitals and tertiary care centers also contribute to the demand for central scan devices. Moreover, central scan densitometers are increasingly integrated with hospital information systems, allowing seamless patient monitoring and longitudinal tracking of bone health.

The Peripheral Scan segment is anticipated to witness the fastest growth rate of 9.8% CAGR from 2026 to 2033, fueled by the rising adoption of portable and low-cost devices for bone health assessment in outpatient clinics, community health programs, and remote areas. Peripheral scan devices allow quick screening of peripheral skeletal sites, such as the heel, wrist, or finger, making them highly convenient for preventive screening campaigns. Their non-invasive, radiation-free design appeals to elderly populations and high-risk individuals seeking routine monitoring. The increasing focus on early detection of osteoporosis in emerging markets is boosting peripheral scan adoption. Moreover, technological improvements in measurement accuracy and integration with mobile applications are expanding their usability. Healthcare providers are using peripheral devices for mass screening programs, employee wellness initiatives, and school health checks, driving the segment’s strong growth trajectory.

- By End-User

On the basis of end-user, the ultrasound bone densitometer market is segmented into hospitals, clinics, diagnostic centres, academic & research institutes, and others. The Hospitals segment dominated the market with a revenue share of 46.7% in 2025, due to their high patient volume and capacity to adopt advanced diagnostic technologies. Hospitals prefer ultrasound densitometers for both inpatient and outpatient services, providing comprehensive bone health assessments alongside routine check-ups. Centralized hospital settings benefit from devices that integrate with electronic health records, allowing clinicians to monitor patient trends over time. Hospitals also prioritize devices with AI-assisted predictive analytics to improve fracture risk assessment and treatment planning. The ability to conduct quick and accurate screenings in high-throughput settings enhances operational efficiency and patient care. Furthermore, government and private hospital initiatives promoting preventive healthcare programs drive the demand for ultrasound densitometers in these facilities.

The Diagnostic Centres segment is expected to witness the fastest CAGR of 10.2% from 2026 to 2033, driven by increasing demand for outpatient and preventive screening services. Diagnostic centers are rapidly adopting portable and cost-effective ultrasound densitometers to serve patients seeking quick, non-invasive bone health assessments without hospital admission. The rising awareness of osteoporosis and early detection benefits encourages patients to visit diagnostic centers for routine screenings. Integration with cloud-based systems allows these centers to provide results remotely and maintain patient records efficiently. Moreover, collaborations with corporate wellness programs and community health initiatives are expanding diagnostic center adoption. The convenience, affordability, and flexibility of diagnostic centers compared to traditional hospital settings are the primary factors fueling the rapid growth of this end-user segment.

Ultrasound Bone Densitometer Market Regional Analysis

- North America dominated the ultrasound bone densitometer market with the largest revenue share of 38.5% in 2025, attributed to early adoption of advanced diagnostic technologies, high healthcare spending, and a strong presence of key industry players, with the U.S. seeing significant uptake in hospitals and diagnostic centers

- Healthcare providers and patients in the region prioritize non-invasive, radiation-free, and accurate bone health assessment solutions, making ultrasound densitometers widely adopted in hospitals, diagnostic centers, and research institutes

- This widespread adoption is further supported by strong healthcare spending, availability of trained professionals, and integration of AI-assisted and predictive diagnostic technologies, establishing ultrasound bone densitometers as a preferred tool for bone density measurement and fracture risk assessment across clinical and preventive healthcare programs

U.S. Ultrasound Bone Densitometer Market Insight

The U.S. ultrasound bone densitometer market captured the largest revenue share of 82% in 2025 within North America, fueled by increasing awareness of osteoporosis, preventive healthcare programs, and widespread adoption of advanced diagnostic devices. Healthcare providers are prioritizing non-invasive, radiation-free solutions for bone density assessment in hospitals and diagnostic centers. The growing trend of outpatient and preventive health check-ups, coupled with integration of AI-assisted predictive analytics, further drives the market. In addition, rising patient demand for personalized fracture risk assessment and routine monitoring supports adoption. Strong healthcare infrastructure and availability of trained professionals enable rapid deployment of these devices across urban and suburban areas. Furthermore, integration with electronic health records and telemedicine platforms enhances monitoring and patient management, boosting market growth.

Europe Ultrasound Bone Densitometer Market Insight

The Europe ultrasound bone densitometer market is projected to expand at a substantial CAGR during the forecast period, driven by increasing incidence of osteoporosis, aging populations, and rising awareness of preventive healthcare. Strict clinical guidelines for bone health screening and increasing adoption in hospitals, diagnostic centers, and research institutes support market growth. Government health initiatives promoting early osteoporosis detection and preventive care further accelerate adoption. Urbanization and improved healthcare infrastructure enable easy access to diagnostic services. European healthcare providers increasingly prefer non-invasive, portable densitometers for community screenings and routine patient monitoring. Moreover, integration with hospital information systems and AI-assisted fracture prediction is gaining traction, particularly in Western Europe.

U.K. Ultrasound Bone Densitometer Market Insight

The U.K. ultrasound bone densitometer market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of osteoporosis, preventive healthcare initiatives, and the rising preference for non-invasive diagnostic tools. Healthcare providers and clinics are adopting ultrasound densitometers for both routine screenings and research applications. The growing geriatric population and rising incidence of bone fractures encourage adoption in hospitals and community health programs. Integration with electronic health records and patient management systems further improves clinical workflow and data tracking. In addition, government programs promoting early detection and preventive care enhance adoption rates across public and private healthcare facilities.

Germany Ultrasound Bone Densitometer Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of bone health, increasing osteoporosis prevalence, and well-developed healthcare infrastructure. German hospitals and diagnostic centers increasingly adopt portable and AI-assisted densitometers for accurate and efficient patient monitoring. Emphasis on innovation and preventive care encourages integration with electronic health records and telemedicine platforms. Rising preference for non-invasive diagnostic methods and patient-friendly devices supports adoption. The availability of advanced features such as fracture risk prediction further attracts hospitals and research institutes. Moreover, Germany’s emphasis on quality and precision aligns with the high accuracy standards of central and peripheral scan devices.

Asia-Pacific Ultrasound Bone Densitometer Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 10.5% during 2026–2033, driven by increasing geriatric population, urbanization, and rising prevalence of osteoporosis in countries such as China, India, and Japan. The region is witnessing growing awareness of preventive healthcare and bone health screening. Government initiatives promoting community health programs and telemedicine are expanding access to portable ultrasound densitometers. Technological advancements and local manufacturing of affordable devices enhance accessibility for hospitals, clinics, and diagnostic centers. In addition, increasing disposable incomes and adoption of modern diagnostic tools support rapid market growth across residential, commercial, and research applications.

Japan Ultrasound Bone Densitometer Market Insight

The Japan market is gaining momentum due to a high-tech healthcare culture, rapid urbanization, and increasing preventive health focus. Hospitals and clinics are adopting ultrasound densitometers for routine screenings, research studies, and long-term patient monitoring. Integration with AI-assisted predictive analytics and hospital information systems enhances clinical efficiency. The aging population drives demand for non-invasive, easy-to-use, and accurate bone health assessment tools. Rising awareness of osteoporosis and preventive care further encourages adoption. Moreover, Japan’s focus on technological advancement and innovation in healthcare devices supports continued growth in the market.

India Ultrasound Bone Densitometer Market Insight

The India market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, growing geriatric population, and increasing awareness of preventive healthcare. Hospitals, clinics, and diagnostic centers are increasingly adopting affordable ultrasound bone densitometers for routine screenings. Government initiatives promoting bone health and preventive care are expanding access to diagnostic services in urban and semi-urban areas. The availability of portable and low-cost devices, along with collaborations with local manufacturers, is driving adoption. Rising disposable incomes and technological adoption in healthcare further support growth. In addition, awareness campaigns and community screening programs are increasing patient reach, making India a key market in the region.

Ultrasound Bone Densitometer Market Share

The Ultrasound Bone Densitometer industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Hologic, Inc. (U.S.)

- BeamMed Inc. (U.S.)

- DMS Group (France)

- OsteoSys Corp. (South Korea)

- Swissray International Inc. (Taiwan)

- Scanflex Healthcare AB (Sweden)

- Medilink Medonica Co. Ltd (South Korea)

- CyberLogic (U.S.)

- Aarna Systems And Wellness Pvt. Ltd. (India)

- Echolight S.p.A (Italy)

- BMTech Co. Ltd (South Korea)

- Trivitron Healthcare (India)

- Xuzhou Pinyuan Electronic Technology (China)

- Demetech AB (Sweden)

- Eurotec Medical Systems S.r.l (Italy)

- CompuMed Inc. (U.S.)

- Shenzhen Aikerui Electric Co. Ltd (China)

- Osteometer Meditech (Finland)

What are the Recent Developments in Global Ultrasound Bone Densitometer Market?

- In October 2025, Echolight announced it will demonstrate its radiation‑free ultrasound bone density scanning technology (REMS) at the RSNA 2025 Congress, showcasing advanced capabilities to assess bone mineral density and microarchitecture without X‑rays, expanding clinical adoption of ultrasound densitometry

- In November 2024, Echolight signed a multi‑year reseller agreement with Siemens Healthineers, enabling Siemens to market Echolight’s REMS‑based bone densitometry devices (including EchoStation models) as part of its Women’s Health portfolio, increasing global access to ultrasound bone densitometry solutions

- In October 2024, NASA used Echolight’s REMS technology in a human bedrest study to monitor bone density changes without radiation exposure, highlighting the application of ultrasound bone densitometry in research and extreme clinical conditions beyond standard medical settings

- In August 2023, Biomedix and BeamMed announced a strategic partnership to expand access to portable bone density assessment solutions, including the MiniOmni scanner, facilitating broader deployment of ultrasound densitometry in clinical and value‑based care settings

- In April 2023, Echolight joined the International Osteoporosis Foundation (IOF) Committee of Corporate Advisors, indicating increased engagement with global bone health initiatives and the promotion of ultrasound‑based bone assessment technologies within clinical and preventive healthcare communities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.