Global Uterine Cancer Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

10.53 Billion

USD

23.75 Billion

2024

2032

USD

10.53 Billion

USD

23.75 Billion

2024

2032

| 2025 –2032 | |

| USD 10.53 Billion | |

| USD 23.75 Billion | |

|

|

|

|

Uterine Cancer Diagnostics Market Size

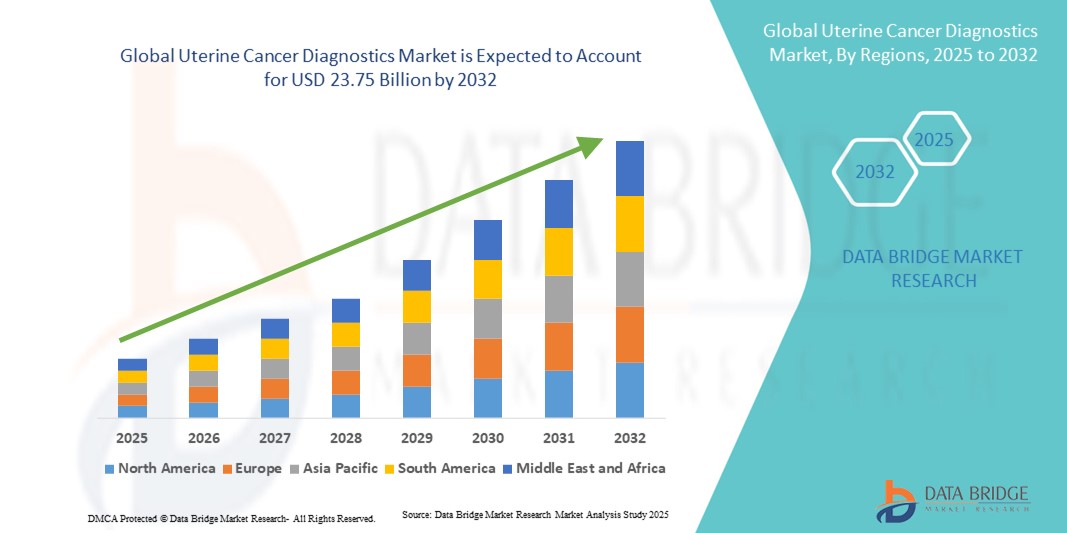

- The global uterine cancer diagnostics market size was valued at USD 10.53 billion in 2024 and is expected to reach USD 23.75 billion by 2032, at a CAGR of 10.7% during the forecast period

- The market growth is primarily driven by the rising prevalence of uterine cancer worldwide and the growing emphasis on early disease detection, supported by advancements in molecular diagnostics, imaging technologies, and biomarker-based testing

- In addition, increasing awareness initiatives, healthcare spending, and demand for accurate, non-invasive, and personalized diagnostic solutions are positioning uterine cancer diagnostics as a critical segment within oncology care. These combined factors are accelerating adoption rates, thereby significantly fueling the industry’s expansion

Uterine Cancer Diagnostics Market Analysis

- Uterine cancer diagnostics, covering imaging technologies, biopsy procedures, and molecular assays, are becoming increasingly critical for early detection, staging, and monitoring, as they directly contribute to improved treatment outcomes and survival rates in oncology care

- The rising demand for uterine cancer diagnostics is primarily fueled by the increasing prevalence of uterine cancer worldwide, growing awareness of women’s health, and advancements in non-invasive, biomarker-driven, and imaging-based diagnostic methods that enable accurate and timely results

- North America dominated the uterine cancer diagnostics market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and strong awareness programs, with the U.S. leading due to its wide access to genomic and molecular testing solutions

- Asia-Pacific is expected to be the fastest growing region in the uterine cancer diagnostics market during the forecast period, driven by rapid healthcare modernization, rising disposable incomes, and government-led cancer awareness initiatives across emerging economies

- The Endometrial Cancer segment dominated the uterine cancer diagnostics market with a market share of 81.7% in 2024, owing to its significantly higher prevalence compared to uterine sarcoma, making it the primary focus of diagnostic services and technological advancements

Report Scope and Uterine Cancer Diagnostics Market Segmentation

|

Attributes |

Uterine Cancer Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Uterine Cancer Diagnostics Market Trends

Growing Shift Toward Non-Invasive and Biomarker-Based Diagnostics

- A significant and accelerating trend in the global uterine cancer diagnostics market is the increasing adoption of non-invasive methods and biomarker-based testing, enabling earlier detection and more personalized treatment pathways

- For instance, liquid biopsy technologies are being developed to detect circulating tumor DNA, providing a less invasive alternative to traditional biopsy while offering real-time disease monitoring. Similarly, advanced imaging systems such as high-resolution MRI and 3D ultrasound are gaining traction for accurate staging and diagnosis

- Integration of molecular diagnostics and genomic profiling in uterine cancer testing is enhancing diagnostic precision, allowing physicians to identify specific mutations that can guide targeted therapies and improve patient outcomes. Furthermore, digital pathology platforms with AI capabilities are streamlining workflows and improving accuracy in histopathological analysis

- The adoption of these advanced diagnostic technologies supports a shift towards precision oncology, where patient-specific genetic and molecular data drive clinical decisions. Through integrated approaches, clinicians can combine imaging, pathology, and molecular results for a comprehensive assessment of the disease

- This trend toward minimally invasive, precise, and technologically advanced diagnostic systems is fundamentally reshaping expectations in cancer care. Consequently, companies such as Roche Diagnostics are investing in next-generation sequencing and biomarker discovery programs to expand diagnostic options and strengthen their market presence

- The demand for accurate, early-stage, and patient-friendly diagnostic solutions is growing rapidly across both developed and emerging healthcare markets, as patients and providers increasingly prioritize early detection and personalized treatment strategies

Uterine Cancer Diagnostics Market Dynamics

Driver

Rising Prevalence of Uterine Cancer and Demand for Early Detection

- The increasing global burden of uterine cancer, coupled with the urgent need for early detection to improve survival outcomes, is a major driver for the growing adoption of advanced diagnostic solutions

- For instance, in March 2024, the National Cancer Institute highlighted uterine cancer as one of the fastest-rising malignancies among women, prompting the expansion of screening and diagnostic initiatives worldwide. Such data-backed initiatives are expected to accelerate market growth during the forecast period

- As awareness about the importance of timely cancer detection rises, diagnostic solutions such as imaging, molecular assays, and biopsy testing are being increasingly utilized to identify cancer at earlier, more treatable stages

- Furthermore, rising investments in healthcare infrastructure and the integration of advanced technologies in oncology centers are making uterine cancer diagnostics more accessible, particularly in regions with increasing healthcare spending

- The demand for non-invasive testing methods, rapid diagnostic turnaround, and patient-centric diagnostic services is driving both clinical adoption and patient preference, strengthening market growth. The growing use of AI-enabled diagnostics and digital tools further enhances this momentum

Restraint/Challenge

High Cost of Advanced Diagnostics and Accessibility Barriers

- The relatively high cost of advanced diagnostic modalities, such as genomic testing, molecular assays, and digital pathology platforms, presents a significant challenge to widespread adoption, particularly in low- and middle-income countries

- For instance, advanced genomic sequencing panels for uterine cancer can cost several hundred to thousands of dollars, creating financial barriers for patients and healthcare systems with limited reimbursement support

- Limited access to specialized diagnostic infrastructure in rural and underserved regions further restricts early detection, leading to delayed diagnosis and poorer patient outcomes. This disparity highlights a key challenge in global market penetration

- In addition, strict regulatory frameworks and varying approval timelines across countries can slow down the commercialization and adoption of innovative diagnostic technologies, particularly biomarker-based and AI-driven solutions

- While ongoing initiatives aim to reduce costs through technological innovation and broader insurance coverage, affordability and accessibility remain pressing hurdles for large-scale adoption. Price-sensitive markets may continue to rely on conventional diagnostic methods, limiting advanced technology uptake

- Overcoming these challenges through strategic partnerships, government-backed screening programs, and cost-optimized diagnostic solutions will be vital for ensuring equitable access and sustained market growth

Uterine Cancer Diagnostics Market Scope

The market is segmented on the basis of diagnostic type, type, age group, end user, and distribution channel.

- By Diagnostic Type

On the basis of diagnostic type, the uterine cancer diagnostics market is segmented into instrument based and procedure based. The instrument based segment dominated the market with the largest revenue share of 57.8% in 2024, owing to the strong adoption of imaging technologies such as MRI, CT scans, and ultrasound, along with molecular diagnostic instruments that deliver precise and early detection. The reliability and widespread availability of these instruments across hospitals and diagnostic centers make them the preferred choice for clinicians. Rising innovation in digital imaging and AI-assisted diagnostic systems is further strengthening the adoption of instrument-based methods. These solutions are often integrated into oncology care pathways, ensuring efficiency and accuracy in staging and monitoring. As healthcare providers focus on advanced diagnostic technologies, instrument-based diagnostics will continue to maintain their leading position in the market.

The procedure based segment is anticipated to witness the fastest growth rate of 9.4% from 2025 to 2032, driven by increasing reliance on biopsy, hysteroscopy, and dilation & curettage procedures for definitive diagnosis. These procedures remain the gold standard for confirming uterine malignancies and are essential for histopathological evaluation. Advancements in minimally invasive procedures, supported by improved imaging guidance, are making diagnostic interventions safer and more effective. The growing demand for accurate tissue sampling to complement molecular testing is also boosting procedure-based diagnostics. In addition, rising awareness about regular screening and early detection is encouraging more women to undergo preventive diagnostic procedures. This growing clinical acceptance will drive accelerated adoption in the forecast period.

- By Type

On the basis of type, the uterine cancer diagnostics market is segmented into endometrial cancer and uterine sarcoma. The endometrial cancer segment dominated the market with the largest revenue share of 81.7% in 2024, as it represents the most common form of uterine cancer globally. Its high prevalence rate makes it the primary focus for diagnostic tests, screening initiatives, and healthcare awareness campaigns. Continuous advancements in imaging, biomarker discovery, and genetic profiling are further supporting endometrial cancer diagnostics. Widespread screening practices and targeted awareness efforts in both developed and developing regions ensure strong demand for diagnostic services in this segment. With a large patient pool and growing incidence, endometrial cancer remains the most significant driver of market revenues.

The uterine sarcoma segment is projected to witness the fastest growth at a CAGR of 8.7% from 2025 to 2032, despite its relatively smaller share. This rare but aggressive cancer type is gaining attention as awareness grows among clinicians and patients regarding its early detection challenges. Recent advancements in molecular diagnostics, coupled with increased research into sarcoma-specific biomarkers, are improving detection rates. Healthcare providers are emphasizing the importance of advanced diagnostic tools to distinguish sarcomas from more common uterine conditions. Pharmaceutical companies and diagnostic developers are also expanding R&D efforts around rare cancer diagnostics, which is fueling innovation in this space. As precision oncology gains traction, uterine sarcoma diagnostics are expected to see accelerated adoption.

- By Age Group

On the basis of age group, the uterine cancer diagnostics market is segmented into <30, 31–40, 41–50, 51–60, and >60. The >60 years segment dominated the market with the largest revenue share of 46.5% in 2024, as uterine cancer incidence increases significantly with age, particularly among postmenopausal women. This age group is at the highest risk, driving consistent demand for diagnostic tests across hospitals and specialty clinics. Regular screening programs and higher awareness levels among older women contribute to the strong uptake of diagnostic services. Healthcare providers often prioritize comprehensive diagnostic evaluations in this group due to elevated risk factors such as obesity, hormone imbalance, and comorbidities. Furthermore, advanced imaging and biopsy procedures are frequently performed in this segment, strengthening its dominance in the market.

The 41–50 years segment is projected to witness the fastest growth at a CAGR of 9.1% from 2025 to 2032, driven by the rising incidence of uterine cancer among premenopausal and perimenopausal women. Increasing lifestyle-related risk factors, combined with greater awareness and proactive screening behaviors, are fueling diagnostic demand in this group. Women in this age range are more such asly to seek preventive health checkups, where uterine cancer testing is often included. The availability of non-invasive and less time-consuming diagnostic solutions is also making testing more accessible and appealing to this age group. As healthcare policies emphasize early detection, the 41–50 segment will emerge as the fastest-growing contributor to diagnostic adoption.

- By End User

On the basis of end user, the uterine cancer diagnostics market is segmented into hospitals, diagnostic centers, cancer research centers, ambulatory surgical centers, specialized clinics, and others. The hospitals segment dominated the market with the largest revenue share of 49.7% in 2024, supported by their comprehensive access to advanced imaging technologies, pathology labs, and molecular diagnostic services. Hospitals are typically the first point of diagnosis for most uterine cancer patients, consolidating their role as the primary diagnostic providers. Multidisciplinary cancer care teams within hospitals also ensure integrated diagnostic pathways, further driving their dominance. Hospitals benefit from large patient inflows, advanced infrastructure, and established collaborations with diagnostic equipment manufacturers. This combination of clinical expertise and resource availability makes hospitals the strongest contributors to the market.

The diagnostic centers segment is projected to witness the fastest growth at a CAGR of 10.3% from 2025 to 2032, as specialized centers increasingly focus on offering dedicated oncology diagnostics with shorter turnaround times. These facilities are gaining popularity due to their cost efficiency and ability to provide highly accurate imaging and molecular tests. Rising awareness about preventive screenings is also driving more patients to seek direct diagnostic services from these centers. Advancements in digital pathology and telemedicine integration are enabling diagnostic centers to expand reach and accessibility, particularly in urban areas. Their ability to provide specialized, faster, and patient-friendly diagnostic services is fueling rapid growth compared to traditional hospital setups.

- By Distribution Channel

On the basis of distribution channel, the uterine cancer diagnostics market is segmented into direct tender, third-party distributors, and others. The direct tender segment dominated the market with the largest revenue share of 52.4% in 2024, as hospitals and large diagnostic networks prefer direct procurement for cost efficiency and bulk purchasing. This channel allows healthcare providers to negotiate directly with manufacturers, ensuring favorable pricing and access to advanced diagnostic equipment. Direct tender systems are widely used in government hospitals and large private networks, particularly in developed countries. The reliability, accountability, and volume-based procurement advantages make direct tender the dominant channel in uterine cancer diagnostics.

The third-party distributors segment is projected to witness the fastest growth at a CAGR of 8.9% from 2025 to 2032, driven by their expanding role in reaching smaller healthcare facilities and emerging markets. In many developing regions, distributors bridge the gap between manufacturers and local providers by offering affordable equipment and consumables. Their networks also help accelerate product penetration into rural and semi-urban areas where direct tendering may not be feasible. Flexible payment models, after-sales support, and localized services make distributors an attractive channel for smaller diagnostic players. As healthcare access expands globally, third-party distributors will play an increasingly important role in market growth.

Uterine Cancer Diagnostics Market Regional Analysis

- North America dominated the uterine cancer diagnostics market with the largest revenue share of 39.2% in 2024, supported by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and strong awareness programs, with the U.S. leading due to its wide access to genomic and molecular testing solutions

- Patients and providers in the region place high value on early detection, personalized care, and the availability of innovative diagnostic solutions such as molecular assays, genomic profiling, and high-resolution imaging systems

- This widespread adoption is further supported by strong awareness initiatives, higher healthcare spending, and favorable reimbursement frameworks, positioning North America as the leading hub for uterine cancer diagnostics and comprehensive oncology care

U.S. Uterine Cancer Diagnostics Market Insight

The U.S. uterine cancer diagnostics market captured the largest revenue share of 82% in 2024 within North America, driven by the high prevalence of endometrial cancer and the strong adoption of advanced molecular and imaging technologies. Patients are increasingly prioritizing early detection through genomic testing, biomarker-based assays, and high-resolution imaging. The presence of leading diagnostic companies, combined with favorable reimbursement policies and robust investment in oncology research, further propels market growth. Moreover, widespread screening programs and integration of precision oncology tools are significantly contributing to the expansion of uterine cancer diagnostics in the U.S.

Europe Uterine Cancer Diagnostics Market Insight

The Europe uterine cancer diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, primarily fueled by supportive government cancer screening initiatives and growing awareness among women regarding preventive healthcare. Rising adoption of advanced diagnostic tools such as liquid biopsy and MRI scans is fostering market penetration. European patients are drawn to early detection solutions that offer accuracy and minimal invasiveness. The region is experiencing strong growth across both public and private healthcare facilities, with diagnostic technologies being integrated into national cancer control programs.

U.K. Uterine Cancer Diagnostics Market Insight

The U.K. uterine cancer diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by national cancer awareness campaigns and the NHS’s focus on improving early diagnosis rates. Rising concerns about increasing incidence of uterine cancer are encouraging women to seek preventive screening and molecular diagnostics. The U.K.’s robust healthcare infrastructure, alongside partnerships between research institutions and diagnostic companies, is expected to accelerate market adoption. In addition, advancements in AI-powered diagnostic imaging and digital pathology are enhancing diagnostic accuracy across the country.

Germany Uterine Cancer Diagnostics Market Insight

The Germany uterine cancer diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing healthcare expenditure and the country’s emphasis on precision medicine. Germany’s strong diagnostic infrastructure, coupled with its focus on innovation and personalized oncology, promotes adoption of genomic assays and molecular testing. The integration of advanced diagnostic modalities into routine cancer care is becoming increasingly prevalent, supported by public funding and collaborations with biotech firms. German patients also show a strong preference for non-invasive and privacy-focused diagnostic solutions.

Asia-Pacific Uterine Cancer Diagnostics Market Insight

The Asia-Pacific uterine cancer diagnostics market is poised to grow at the fastest CAGR of 10.8% from 2025 to 2032, driven by rising incidence rates, rapid healthcare modernization, and expanding access to diagnostic services in countries such as China, Japan, and India. The region’s growing focus on women’s health and preventive screening, supported by government-led cancer awareness initiatives, is driving adoption. Furthermore, as APAC emerges as a hub for clinical research and diagnostic innovation, affordability and accessibility of testing services are improving. These factors are expanding the reach of uterine cancer diagnostics across both urban and semi-urban populations.

Japan Uterine Cancer Diagnostics Market Insight

The Japan uterine cancer diagnostics market is gaining momentum due to the country’s aging population, advanced healthcare infrastructure, and demand for precise oncology care. Japanese healthcare providers place a strong emphasis on early detection, with molecular diagnostics, imaging, and AI-enhanced pathology driving adoption. The integration of uterine cancer diagnostics with other advanced screening programs is fueling growth. Moreover, Japan’s culture of technological innovation and high per-capita healthcare spending is such asly to spur demand for cutting-edge, accurate, and minimally invasive diagnostic solutions across hospitals and research centers.

India Uterine Cancer Diagnostics Market Insight

The India uterine cancer diagnostics market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its large and expanding patient base, rapid urbanization, and growing healthcare investments. India stands as one of the fastest-developing markets for oncology diagnostics, with uterine cancer detection gaining significant attention in both public and private sectors. Government initiatives to promote cancer awareness and early detection, along with increasing availability of affordable molecular and imaging diagnostics, are driving adoption. Domestic manufacturers and collaborations with international diagnostic firms are further propelling growth in India.

Uterine Cancer Diagnostics Market Share

The uterine cancer diagnostics industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Hologic, Inc. (U.S.)

- Abbott (U.S.)

- Siemens Healthineers AG (Germany)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Illumina, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Bio-Techne (U.S.)

- QIAGEN (Netherlands)

- Sysmex Corporation (Japan)

- Leica Biosystems (U.S.)

- NanoString Technologies, Inc. (U.S.)

- OncoCyte Corporation (U.S.)

- Exact Sciences Corporation (U.S.)

- Guardant Health. (U.S.)

What are the Recent Developments in Global Uterine Cancer Diagnostics Market?

- In July 2025, Gnosis launched EdenDx, the first U.S. commercially available, non-invasive liquid-based cytology test for early-stage endometrial cancer detection. The test identifies hypermethylation of genes CDO1 and CELF4 from an endocervical sample, offering a painless alternative to biopsy with results delivered within three to seven days

- In March 2025, Sola Diagnostics and UCL introduced the WID-easy Test in the UK a minimally invasive swab-based screening for endometrial cancer that’s as accurate as ultrasound and reduces false positives by 87%, potentially sparing women from invasive diagnostics

- In August 2024, the U.S. FDA approved three immunotherapies durvalumab (Imfinzi), pembrolizumab (Keytruda), and dostarlimab (Jemperli) in combination with chemotherapy as new options for treating advanced endometrial cancer, expanding the treatment landscape for patients with mismatch repair–deficient (dMMR) tumors

- In March 2024, researchers published a study in eBioMedicine demonstrating a breakthrough non-invasive diagnostic approach for endometrial cancer by identifying proteomic biomarkers in blood plasma and cervicovaginal fluid using machine learning techniques

- In December 2023, Owkin (an AI-powered biotech company) entered a strategic collaboration with MSD (Merck & Co.) to develop and commercialize AI-powered digital pathology diagnostics, initially targeting the EU market. The partnership aims to create pre-screening tools enhancing the identification of MSI-H status across several cancer types including endometrial cancer to better inform immunotherapy treatment decisions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.