Global Influenza Drug Market

Market Size in USD Billion

CAGR :

%

USD

981.68 Billion

USD

1,168.36 Billion

2024

2032

USD

981.68 Billion

USD

1,168.36 Billion

2024

2032

| 2025 –2032 | |

| USD 981.68 Billion | |

| USD 1,168.36 Billion | |

|

|

|

|

Influenza Drug Market Size

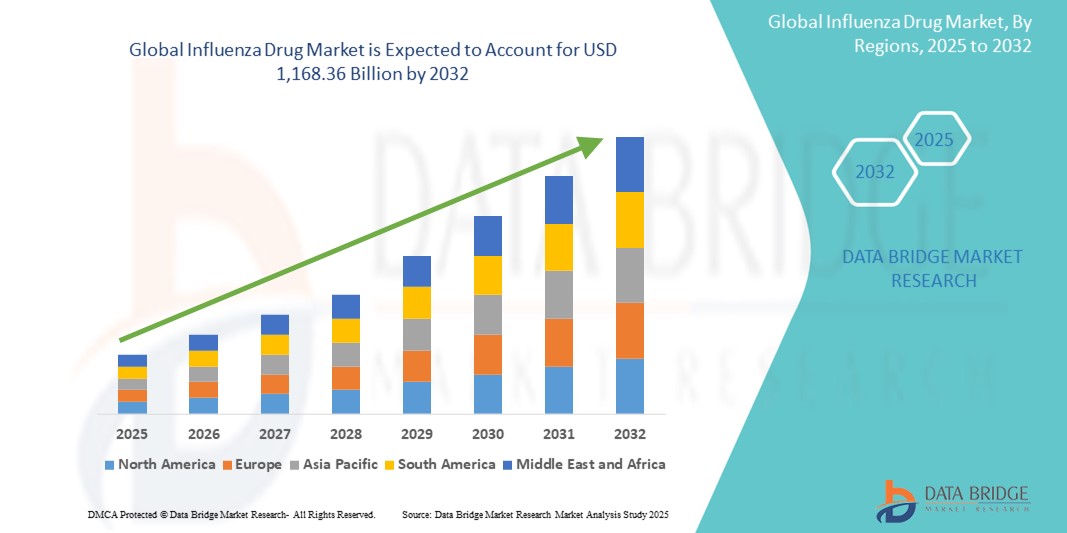

- The global influenza drug market size was valued at USD 981.68 billion in 2024 and is expected to reach USD 1,168.36 billion by 2032, at a CAGR of 2.20% during the forecast period

- The market growth is largely fueled by the growing incidence of seasonal flu and other contagious respiratory illnesses, along with an increasing patient population at risk of developing flu-related complications

- Furthermore, rising investments in research and development activities by pharmaceutical companies and research institutions to develop advanced and improved medications, including novel antiviral drugs and recombinant vaccines, are accelerating the uptake of influenza drug solutions, thereby significantly boosting the industry's growth

Influenza Drug Market Analysis

- The global influenza drug market encompasses a range of antiviral medications and vaccines designed to prevent, treat, and alleviate the symptoms of influenza infections, which pose a significant public health challenge due to their recurrent and seasonal nature, constant viral mutations, and potential for pandemics

- The escalating demand for influenza drugs is primarily fueled by the consistent global prevalence of influenza infections, increasing awareness about the benefits of vaccination, and continuous advancements in pharmaceutical research leading to more effective antiviral therapies and next-generation vaccines

- North America dominates the influenza drug market with the largest revenue share of 60.5% in 2024, characterized by robust healthcare infrastructure, high vaccination coverage rates, and the presence of major pharmaceutical companies. The U.S. experiences strong market growth driven by extensive public health campaigns, government initiatives for pandemic preparedness, and ongoing R&D in novel influenza treatments and vaccines

- Asia-Pacific is expected to be the fastest growing region in the influenza drug market during the forecast period due to increasing awareness about influenza, rising healthcare expenditure, growing urbanization, and a large patient pool susceptible to infections in densely populated countries

- Influenza A segment dominates the influenza drug market with a market share of 47.78% in 2024, driven by its higher mutation rate, wider host range, significant pandemic potential, and increased severity of illness, necessitating more complex vaccination strategies and frequent updates to treatments

Report Scope and Influenza Drug Market Segmentation

|

Attributes |

Influenza Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Influenza Drug Market Trends

“Rising Adoption of Telemedicine and Digital Health Tools”

- A significant and accelerating trend in the global influenza drug market is the increasing integration of telemedicine and digital health tools for influenza management, diagnosis, and prescription. This fusion of technologies is significantly enhancing accessibility to healthcare services, especially for flu patients

- For instance, virtual consultations allow individuals with flu-like symptoms to connect with healthcare professionals from the comfort of their homes, reducing the risk of viral transmission in clinics and hospitals. Telemedicine platforms can facilitate rapid diagnosis based on symptom assessment and guide patients on appropriate self-care or prescription of antiviral medications such as oseltamivir or baloxavir. Approximately 33% of health systems integrate influenza treatment into telemedicine services, enhancing accessibility in rural regions

- Digital health tools, including mobile apps and wearable devices, enable continuous monitoring of physiological parameters that can indicate the onset or progression of influenza. Some smart thermometers, such as those from KINSA, can track aggregate temperature data to identify potential flu hotspots. These technologies can provide early alerts, prompting individuals to seek medical advice sooner, which is crucial for the efficacy of antiviral treatments

- The seamless integration of digital health tools with healthcare systems also supports broader public health surveillance efforts. Data from wearable devices can contribute to real-time influenza surveillance, helping health authorities track outbreaks and allocate resources more effectively. This enhanced surveillance can inform targeted vaccination campaigns and timely distribution of antiviral drugs

- This trend towards more accessible, proactive, and data-driven influenza management is fundamentally reshaping patient engagement and healthcare delivery. Consequently, pharmaceutical companies and healthcare providers are exploring partnerships and developing platforms that leverage these digital capabilities to improve patient outcomes and medication adherence

- The demand for influenza drugs is indirectly boosted by these trends, as telemedicine makes it easier for patients to receive timely prescriptions, and digital monitoring can lead to earlier diagnosis and intervention, maximizing the effectiveness of available treatments

Influenza Drug Market Dynamics

Driver

“Growing Need Due to Consistent Global Prevalence of Influenza and Public Health Initiatives”

- The increasing and consistent global prevalence of seasonal influenza epidemics, coupled with the ongoing threat of pandemic strains and robust public health initiatives, is a significant driver for the heightened demand for influenza drugs and vaccines

- For instance, governments worldwide, including the U.S. and those in Europe and Asia, continually launch extensive vaccination campaigns and invest in national immunization programs to mitigate the impact of annual flu seasons and prepare for potential pandemics. These initiatives, along with increased surveillance and rapid diagnostic advancements, lead to a greater push for vaccination and early treatment with antiviral drugs

- As awareness among the general population and healthcare providers grows regarding the severity of influenza and its potential complications, there's a heightened demand for both preventive and therapeutic solutions. This is particularly true for high-risk populations such as the elderly, young children, and individuals with underlying health conditions

- Furthermore, continuous research and development efforts by pharmaceutical companies to create more effective and broader-spectrum antiviral drugs, as well as next-generation vaccines, are expanding the available treatment landscape and improving the efficacy of existing interventions, thereby propelling market growth

- The necessity for updated vaccine formulations each year due to the constantly evolving nature of influenza viruses ensures a sustained and recurring demand for novel products. This continuous cycle of development, production, and distribution is a key factor propelling the influenza drug market in both developed and emerging economies

Restraint/Challenge

“Challenges of Viral Mutability and Drug Resistance, and High Development Costs”

- A significant challenge to the global influenza drug market is the inherent mutability of influenza viruses, which constantly undergo antigenic drift and shift. This rapid evolution can render existing vaccines less effective and lead to the emergence of antiviral drug resistance, posing a continuous threat to public health

- For instance, the frequent need to update vaccine strains annually necessitates a continuous cycle of research, development, and production, which is both time-consuming and costly. Furthermore, the emergence of drug-resistant strains, such as those resistant to older antivirals such as amantadine or, more recently, some H1N1 viruses showing resistance to oseltamivir (Tamiflu), limits treatment options and complicates clinical management

- Addressing these biological challenges requires significant and sustained investment in R&D for novel antiviral agents with new mechanisms of action and broader-spectrum activity, as well as universal influenza vaccines that can offer long-lasting protection against multiple strains. However, vaccine and drug development is an exceptionally lengthy and expensive process, often taking 10-15 years and costing hundreds of millions to over a billion USD, with a high failure rate

- In addition, logistical challenges, particularly maintaining the "cold chain" for vaccine distribution from manufacturing sites to remote areas, can lead to wastage and reduced efficacy. Factors such as inadequate infrastructure, human error, and power outages in lower-income countries pose significant barriers

- The high initial cost of developing and bringing new influenza drugs and vaccines to market, combined with stringent regulatory approval processes, creates significant hurdles for manufacturers. This often translates to higher prices for advanced treatments, potentially limiting access in price-sensitive markets or for underinsured populations

- Overcoming these challenges through international collaborations, increased public and private funding for R&D, streamlined regulatory pathways, and investment in robust global distribution infrastructures will be vital for sustained market growth and effective pandemic preparedness

Influenza Drug Market Scope

The market is segmented on the basis of type, treatment, route of administration, age, end user, and distribution channel.

- By Type

On the basis of type, the influenza drug market is segmented into influenza A, influenza B, and influenza C. The influenza A segment dominates the market with a market share of 47.78% in 2024, driven by its higher mutation rate, wider host range, significant pandemic potential, and increased severity of illness, necessitating more complex vaccination strategies to control outbreaks. The consistent threat of Influenza A strains such as H1N1 and H3N2 ensures a sustained demand for related drugs and vaccines

Influenza B is expected to witness highest CAGR in market due to its inclusion in quadrivalent vaccines, which offer broader protection against both A and B strains. The increasing awareness of Influenza B's role in seasonal epidemics and the growing emphasis on comprehensive flu prevention strategies are driving demand for more effective vaccines that cover these strains, particularly in vulnerable populations

- By Treatment

On the basis of treatment, the influenza drug market is segmented into vaccines and drugs. The vaccines segment dominates the market with a market share of 87.23% in 2024, due to its pivotal role in preventing illness, reducing transmission, and addressing public health concerns associated with seasonal outbreaks and potential pandemics. Continuous advancements in vaccine technology, including the development of quadrivalent vaccines offering broader protection, further solidify their market leadership

The drugs segment, including antivirals such as oseltamivir and baloxavir, plays a crucial role in treating established infections, with baloxavir marboxil (Xofluza) noted as the fastest-growing drug type due to its single-dose administration and efficacy

- By Route of Administration

On the basis of route of administration, the influenza drug market is segmented into oral, intramuscular, intradermal, intranasal, and intravenous. The oral segment is expected to dominate the market with a market share of 45.04% in 2024, primarily driven by its convenience, ease of self-administration, and widespread accessibility for patients in both outpatient and home care settings. Oral antiviral medications are often the first line of treatment for influenza

The intranasal segment is expected to be the fastest-growing route of administration during the forecast period. This is attributed to its non-invasive, needle-free administration, which improves patient compliance, especially in pediatric populations, and its ability to induce both systemic and mucosal immunity

- By Age

On the basis of age, the influenza drug market is segmented into pediatrics and adults. The adult segment is the largest in the influenza market, with a 66.7% share in 2024, propelled by elevated vaccination rates among seniors and individuals with chronic illnesses, who are at higher risk of severe flu complications

The pediatrics segment is poised to grow at a notable CAGR, as young children, particularly those under 5 years, are at higher risk of severe influenza complications, accelerating the market scope for child-friendly formulations and vaccination efforts.

- By End Use

On the basis of end user, the influenza drug market is segmented into hospitals, and home care. The hospitals segment dominates the global influenza drug market with a market share of 72.62% in 2024, largely due to their role in managing severe influenza cases requiring intensive monitoring, intravenous antivirals, and critical care for high-risk patients. Hospitals also serve as key points for vaccination drives

The home care segment is expected to witness the fastest compound annual growth rate (CAGR) from 2025 to 2032 in the global influenza drug market, driven by the increasing preference for at-home treatment options, advancements in telemedicine, and the growing adoption of home healthcare services. These factors enable patients to manage influenza symptoms effectively within the comfort of their homes, reducing the need for hospitalization and minimizing exposure to healthcare facilities.

- By Distribution Channel

On the basis of distribution channel, the global influenza drug market is segmented into direct tenders and retail sales. The direct tenders segment is projected to dominate the global influenza drug market with the largest market share of 56.34% in 2024, primarily driven by large-scale procurement of vaccines and antiviral drugs by governments and public health organizations for national immunization programs and strategic stockpiling. This channel ensures bulk purchasing and efficient distribution for mass vaccination campaigns.

The retail sales segment is also a dominant channel, acting as key access points for both vaccines and over-the-counter and prescription treatments for the general public, and is expected to see significant growth, particularly through online pharmacies due to convenience and accessibility.

Influenza Drug Market Regional Analysis

- North America dominates the influenza drug market with the largest revenue share of 60.5% in 2024, driven by robust healthcare infrastructure, high vaccination coverage rates, and the presence of major pharmaceutical companies

- Consumers in the region highly prioritize preventive healthcare and readily access vaccines and antiviral treatments

- This widespread adoption is further supported by favorable reimbursement policies, a technologically advanced population, and the growing emphasis on public health initiatives, establishing influenza drugs as a crucial component of seasonal disease management

U.S. Influenza Drug Market Insight

The U.S. influenza drug market captured the largest revenue share of 56.2% in 2024 within North America, reflecting the nation's advanced healthcare system and proactive public health strategies. The U.S. is a major driver of the influenza market due to its substantial burden of seasonal flu, robust vaccination programs, and continuous investment in R&D for new treatments and vaccines. Consumers increasingly prioritize preventive measures and readily access influenza medications. The strong integration of public health recommendations, widespread availability of both vaccines and antiviral drugs, and a significant patient population contribute to the sustained demand.

Europe Influenza Drug Market Insight

The Europe influenza drug market is projected to expand at a CAGR of 2.5% throughout the forecast period, primarily driven by established government initiatives for influenza vaccination and treatment, stringent public health guidelines, and a high incidence of seasonal flu. The region's focus on preventive healthcare, coupled with advanced healthcare infrastructure and increasing awareness about flu complications, is fostering the adoption of influenza drugs. European countries are experiencing consistent demand for both vaccines and antiviral therapies in response to annual outbreaks.

U.K. Influenza Drug Market Insight

The U.K. influenza drug market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by robust government vaccination programs, an increasing focus on public health, and a desire for enhanced protection against seasonal flu. The U.K.'s well-established healthcare system and strong recommendations for annual flu shots are encouraging high uptake of both vaccines and antiviral treatments among the population. The country's commitment to public health initiatives further stimulates market growth.

Germany Influenza Drug Market Insight

The Germany influenza drug market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of public health security, a strong emphasis on preventive medicine, and demand for technologically advanced solutions. Germany's well-developed healthcare infrastructure, combined with its focus on high vaccination rates and efficient disease management, promotes the adoption of influenza drugs, particularly in both general practice and hospital settings. The integration of advanced diagnostics and a preference for evidence-based treatments align with local consumer and medical expectations.

Asia-Pacific Influenza Drug Market Insight

The Asia-Pacific influenza drug market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and technological advancements in healthcare in countries such as China, Japan, and India. The region's large and growing population is highly susceptible to influenza outbreaks, leading to increasing awareness and demand for effective treatments and vaccines. Furthermore, as APAC expands its healthcare infrastructure and government initiatives promote broader access to essential medicines, the affordability and accessibility of influenza drugs are expanding to a wider consumer base

Japan Influenza Drug Market Insight

The Japan influenza drug market is gaining momentum for antiviral drugs, due to the country’s high incidence of seasonal flu, rapid urbanization, and strong demand for effective treatment options. The Japanese market places a significant emphasis on public health and vaccine coverage, and the adoption of influenza drugs is driven by the increasing awareness of complications, especially in its aging population. The integration of advanced antiviral medications and continuous R&D efforts are fueling growth, as Japan prioritizes reducing the burden of influenza.

India Influenza Drug Market Insight

The India influenza drug market accounted for a significant market share within Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and increasing access to healthcare. India is a large market with a high burden of infectious diseases, and influenza drugs are becoming increasingly important in both public health programs and private healthcare. The push towards improving healthcare infrastructure and the availability of both domestically manufactured and imported influenza drugs are key factors propelling the market in India, with a projected CAGR of 2.6%.

Influenza Drug Market Share

The influenza drug industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- AstraZeneca (U. K.)

- BioNTech SE (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Cipla (India)

- COCRYSTAL PHARMA, INC. (U.S.)

- CSL (U.K.)

- Daiichi Sankyo Company, Limited (Japan)

- Dr. Reddy's Laboratories Ltd. (India)

- F. Hoffmann-La Roche AG (Switzerland)

- Gilead Sciences, Inc. (U.S.)

- GSK plc. (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Moderna, Inc. (U.S.)

- Novartis AG (Switzerland)

- Novavax (U.S.)

- Osivax (France)

- Sanofi S.A. (France)

Latest Developments in Global Influenza Drug Market

- In September 2024, AstraZeneca's FluMist Approved for Self-Administration in the US. This marks a significant advancement as it's the first flu vaccine that doesn't require administration by a healthcare provider, enhancing accessibility and convenience for individuals seeking influenza prevention. FluMist was approved by the US FDA for self-administration by adults up to 49 years of age or administered by a parent/caregiver to individuals 2-17 years of age

- In August 2024, Scientists from Harvard Medical School developed a nasal spray called the Pathogen Capture and Neutralizing Spray (PCANS), or Profi. This spray claims to protect against flu, colds, and COVID-19 with over 99.99% effectiveness by forming a barrier in the nasal cavity that captures and neutralizes viruses and bacteria

- In May 2024, Sanofi and Novavax announced a co-exclusive licensing agreement to co-commercialize Novavax's current stand-alone adjuvanted COVID-19 vaccine worldwide and develop a novel influenza-COVID-19 vaccine combination. This partnership aims to accelerate the development of combined vaccines, offering enhanced convenience and protection for patients.

- In April 2023, Sinovac Biotech Co., Ltd. announced the recent commissioning of its new influenza vaccine manufacturing facility in Beijing. This expansion increases global production capacity for influenza vaccines, contributing to broader availability and supply

- In March 2023, The FDA's Vaccines and Related Biological Products Advisory Committee (VRBPAC) convened to determine the vaccine's composition for the U.S. 2023-2024 influenza season. This annual process is crucial for ensuring that the vaccines are effective against the circulating strains of influenza viruses.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.