Global Viral Vector And Vaccine Market

Market Size in USD Million

CAGR :

%

USD

513.43 Million

USD

2,016.62 Million

2022

2030

USD

513.43 Million

USD

2,016.62 Million

2022

2030

| 2023 –2030 | |

| USD 513.43 Million | |

| USD 2,016.62 Million | |

|

|

|

|

Viral Vector and Vaccine Market Analysis and Size

The introduction of novel therapies based on vectors, such as gene therapy and cell therapy, has sparked great interest in the medical community in recent decades. Therapies involving genetic modification, such as the introduction of therapeutic DNA/gene into a patient's body or cell, have demonstrated great promise in the treatment of cancer, Alzheimer's disease, Parkinson's disease, and rheumatoid arthritis, among other disorders.

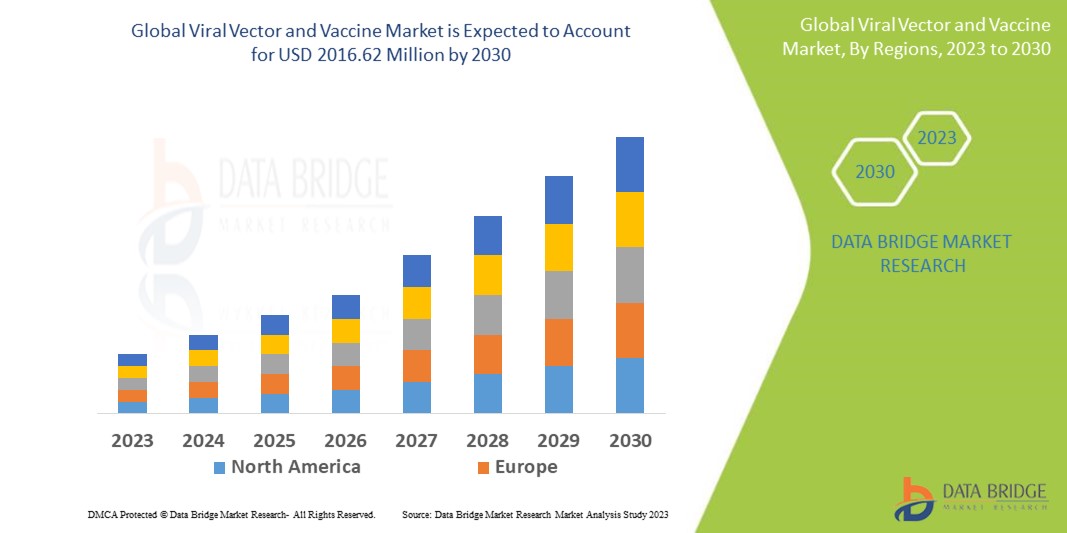

Data Bridge Market Research analyses that the viral vector and vaccine market which is USD 513.43 million in 2022, is expected to reach USD 2016.62 million by 2030, at a CAGR of 18.65% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Viral Vector and Vaccine Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Adenovirus, Retrovirus, Plasmid DNA, AAV, Lentivirus, Others), Workflow Upstream Processing, Downstream Processing, Application (Antisense and RNAi, Gene Therapy, Cell Therapy, Vaccinology), Disease (Cancer, Genetic Disorders, Infectious Diseases, Others), End Use (Pharmaceutical and Biopharmaceutical Companies, Research Institutes) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Novasep (France), MerckKGaA (Germany), Charles River Laboratories (U.K.), uniQure N.V. (Netherlands), Waisman Biomanufacturing (U.S.), Creative-Biogene (U.S.), Aldevron (U.S.), Addgene (U.S.), Oxford Biomedica (U.K.), Thermo Fisher Scientific Inc (U.S.), Fujifilm Corporation (Japan), Spark Therapeutics Inc. (U.S.), ABL Inc. (U.S.), Boehringer Ingelheim International GmbH. (Germany), Brammer Bio (U.S.), General Electric (U.S.), Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

A vector is a type of gene delivery device used to introduce a transgene into a cell where it can be replicated and/or expressed. The vector is a DNA molecule that contains a transgene insert as well as a longer sequence that acts as the vector's pillar. The vector's basic functions in conveying genetic information to another cell are the isolation, multiplication, or expression of the insert in the target cell.

Viral Vector and Vaccine Market Dynamics

Drivers

- Rising prevalence of cancer and genetic disorders

Lung cancer is the leading cause of cancer death, according to the World Health Organization, followed by breast cancer and colorectal cancer. One of the primary drivers of the global viral vector and vaccine market is the increasing prevalence of cancer, genetic illnesses, and infectious diseases, which is increasing demand for vector-based gene treatments, cell therapies, and vaccines.

- Rapid uptake of viral and plasmid vectors for the development of innovative therapies

Novel medicines are being developed at a rapid pace using viral and non-viral vectors. These vectors can deliver a gene to a specific cell or tissue in vivo. Adeno-associated virus, lentivirus, and retrovirus are examples of viral vectors used in clinical and preclinical trials to evaluate gene and cell therapy products and vaccines.

Opportunities

- Rising prevalence of diseases

The increasing prevalence of diseases such as heart disease, cancer, HIV, and haemophilia has necessitated the development of viral vector-based therapeutics, with technological advancements in viral vector manufacturing driving market growth. In addition, the increasing use of viral vectors in the biopharmaceutical industry, as well as the need for more cost-effective treatments, are driving market demand. However, the underdeveloped medical industry in some areas, as well as increased government activities in the healthcare R&D sector, will provide profitable opportunities in the coming years.

Restraints/Challenges

- High cost

The lack of skilled professionals and high cost are factors restraining market growth. The main disadvantages of viral vector vaccines are that they have a more complex manufacturing process, they risk genomic integration, host-induced neutralising antibodies to the carrier virus can develop, and/or it may not be possible to use the same technology for repeated vaccinations.

This viral vector and vaccine market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the viral vector and vaccine market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on Viral Vector and Vaccine Market

Due to the devastating COVID-19 pandemic, vaccine development against SARS-CoV-2 has been intense, encompassing all conceivable options for providing the global community with safe and effective vaccine candidates in the shortest timeframe possible. Viral vectors, particularly adenovirus-based vectors, have been crucial. Vaccines based on viral vectors such as vaccinia, measles, rhabdoviruses, influenza viruses, and lentiviruses have also been developed. Self-amplifying RNA viral vectors delivered by lipid nanoparticles were used to create COVID-19 vaccines. Several adenovirus-based vaccine candidates elicited strong immune responses in inoculated animals, and mice and primates were shielded from challenges. Furthermore, adenovirus-based vaccination candidates have gone through phase I, II, and III clinical trials. The simian adenovirus-based ChAdOx1 vector expressing the SARS-CoV-2 S spike protein was recently approved for use in clinical trials in the UK.

Recent Development

- In 2019, The US Food and Drug Administration approved Zolgensma (onasemnogene abeparvovec-xioi), an adeno-associated virus vector-based gene therapy for the treatment of pinal muscular atrophy (SMA) in infants under the age of two.

Global Viral Vector and Vaccine Market Scope

The viral vector and vaccine market is segmented on the basis of type, workflow, application, disease and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Adenovirus

- Fowlpox Virus

- Attenuated Yellow Fever

- Vaccinia Virus Vectors

- Others

Workflow

- Upstream Processing

- Downstream Processing

Application

- Antisense and RNAi

- Gene Therapy

- Cell Therapy

- Vaccinology

Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

End-User

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Viral Vector and Vaccine Market Regional Analysis/Insights

The viral vector and vaccine market is analyzed and market size insights and trends are provided by country, type, workflow, application, disease and end-user as referenced above.

The countries covered in the viral vector and vaccine market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

North America is anticipated to dominate the market share due to increasing infectious disease patients.

Asia-Pacific is expected to be fastest growing region in forecast period due to clinical transformation and industrialization of gene therapy manufacturing.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The viral vector and vaccine market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for viral vector and vaccine market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the viral vector and vaccine market. The data is available for historic period 2011-2021.

Competitive Landscape and Viral Vector and Vaccine Market Share Analysis

The viral vector and vaccine market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to viral vector and vaccine market.

Some of the major players operating in the viral vector and vaccine market are:

- Novasep (France)

- MerckKGaA (Germany)

- Charles River Laboratories (U.K.)

- uniQure N.V. (Netherlands)

- Waisman Biomanufacturing (U.S.)

- Creative-Biogene (U.S.)

- Aldevron (U.S.)

- Addgene (U.S.)

- Oxford Biomedica (U.K.)

- Thermo Fisher Scientific Inc (U.S.)

- Fujifilm Corporation (Japan)

- Spark Therapeutics Inc. (U.S.)

- ABL Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Brammer Bio (U.S.)

- Creative Biogene

- General Electric (U.S.)

- Pfizer Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL VIRAL VECTOR AND VACCINE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL VIRAL VECTOR AND VACCINE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY MODELING

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL VIRAL VECTOR AND VACCINE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 EPIDEMIOLOGY

7 INDUSTRY INSIGHTS

8 REGULATORY SCENARIO

9 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY TYPE

9.1 OVERVIEW

9.2 ADENOVIRUS

9.3 RETROVIRUS

9.4 VACCINE VIRUS

9.5 ADENO-ASSOCIATED VIRUS (AAV)

9.6 LENTIVIRUS

9.7 HERPES SIMPLEX VIRUSES

9.8 ALPHAVIRUSES

9.9 OTHERS

10 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY EXPRESSION SYSTEM

10.1 OVERVIEW

10.2 TRANSIENT

10.3 STABLE

11 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY WORKFLOW

11.1 OVERVIEW

11.2 UPSTREAM PROCESSING

11.2.1 VECTOR AMPLIFICATION

11.2.2 VECTOR RECOVERY

11.3 DOWNSTREAM PROCESSING

11.3.1 PURIFICATION

11.3.2 FILLS FINISH

12 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 ANTISENSE & RNAI

12.3 GENE THERAPY

12.4 CELL THERAPY

12.5 VACCINOLOGY

12.6 OTHER

13 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY DISEASE

13.1 OVERVIEW

13.2 CANCER

13.3 GENETIC DISORDERS

13.3.1 THALASSEMIA

13.3.2 CYSTIC FIBROSIS

13.3.3 TAY-SACHS DISEASE

13.3.4 SICKLE CELL ANEMIA

13.3.5 OTHERS

13.4 INFECTIOUS DISEASES

13.4.1 MEASLES VIRUS

13.4.2 VESICULAR STOMATITIS VIRUS

13.4.3 NOVEL ADENOVIRUSES

13.4.4 CYTOMEGALOVIRUS

13.4.5 OTHERS

13.5 OTHERS

14 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY END USER

14.1 OVERVIEW

14.2 PHARMACEUTICAL COMPANIES

14.2.1 SMALL SIZE ENTERPRISE

14.2.2 MEDIUM SIZE ENTERPRISE

14.2.3 LARGE SIZE ENTERPRISE

14.3 BIOPHARMACEUTICAL COMPANIES

14.3.1 SMALL SIZE ENTERPRISE

14.3.2 MEDIUM SIZE ENTERPRISE

14.3.3 LARGE SIZE ENTERPRISE

14.4 CONTRACT RESEARCH ORGANISATION (CRO)

14.4.1 SMALL SIZE ENTERPRISE

14.4.2 MEDIUM SIZE ENTERPRISE

14.4.3 LARGE SIZE ENTERPRISE

14.5 ACADEMIC & RESEARCH INSTITUTES

14.6 OTHER

15 GLOBAL VIRAL VECTOR AND VACCINE MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL VIRAL VECTOR AND VACCINE MARKET, BY GEOGRAPHY

16.1 GLOBAL VIRAL VECTOR AND VACCINE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. U.K.

16.1.2.3. ITALY

16.1.2.4. FRANCE

16.1.2.5. SPAIN

16.1.2.6. RUSSIA

16.1.2.7. SWITZERLAND

16.1.2.8. TURKEY

16.1.2.9. BELGIUM

16.1.2.10. NETHERLANDS

16.1.2.11. DENMARK

16.1.2.12. SWEDEN

16.1.2.13. POLAND

16.1.2.14. NORWAY

16.1.2.15. FINLAND

16.1.2.16. REST OF EUROPE

16.1.3 ASIA-PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. SINGAPORE

16.1.3.6. THAILAND

16.1.3.7. INDONESIA

16.1.3.8. MALAYSIA

16.1.3.9. PHILIPPINES

16.1.3.10. AUSTRALIA

16.1.3.11. NEW ZEALAND

16.1.3.12. VIETNAM

16.1.3.13. TAIWAN

16.1.3.14. REST OF ASIA-PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. EGYPT

16.1.5.3. BAHRAIN

16.1.5.4. UNITED ARAB EMIRATES

16.1.5.5. KUWAIT

16.1.5.6. OMAN

16.1.5.7. QATAR

16.1.5.8. SAUDI ARABIA

16.1.5.9. REST OF MEA

16.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL VIRAL VECTOR AND VACCINE MARKET, SWOT AND DBMR ANALYSIS

18 GLOBAL VIRAL VECTOR AND VACCINE MARKET, COMPANY PROFILE

18.1 NOVASEP

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 MERCKKGAA

18.2.1 COMPANY OVERVIEW

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 SARTORIUS AG

18.3.1 COMPANY OVERVIEW

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 SIRION-BIOTECH GMBH

18.4.1 COMPANY OVERVIEW

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 MAXCYTE

18.5.1 COMPANY OVERVIEW

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 CREATIVE BIOLABS

18.6.1 COMPANY OVERVIEW

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 UNIQURE N.V.

18.7.1 COMPANY OVERVIEW

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENTS

18.8 WAISMAN BIOMANUFACTURING

18.8.1 COMPANY OVERVIEW

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 CREATIVE-BIOGENE

18.9.1 COMPANY OVERVIEW

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 ALDEVRON

18.10.1 COMPANY OVERVIEW

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 ADDGENE

18.11.1 COMPANY OVERVIEW

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 OXFORD BIOMEDICA

18.12.1 COMPANY OVERVIEW

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 THERMO FISHER SCIENTIFIC INC

18.13.1 COMPANY OVERVIEW

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 PROBIOGEN AG

18.14.1 COMPANY OVERVIEW

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 IOSBIO

18.15.1 COMPANY OVERVIEW

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 IDT BIOLOGIKA

18.16.1 COMPANY OVERVIEW

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 REITHERA SRL

18.17.1 COMPANY OVERVIEW

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 CHARLES RIVER LABORATORIES

18.18.1 COMPANY OVERVIEW

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 FUJIFILM DIOSYNTH BIOTECHNOLOGIES

18.19.1 COMPANY OVERVIEW

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 SPARK THERAPEUTICS INC.

18.20.1 COMPANY OVERVIEW

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 ABL INC.

18.21.1 COMPANY OVERVIEW

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

18.22.1 COMPANY OVERVIEW

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 GENERAL ELECTRIC

18.23.1 COMPANY OVERVIEW

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 PFIZER INC.

18.24.1 COMPANY OVERVIEW

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 LONZA

18.25.1 COMPANY OVERVIEW

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

18.26 KANEKA CORPORATION

18.26.1 COMPANY OVERVIEW

18.26.2 REVENUE ANALYSIS

18.26.3 GEOGRAPHIC PRESENCE

18.26.4 PRODUCT PORTFOLIO

18.26.5 RECENT DEVELOPMENTS

18.27 REGENXBIO

18.27.1 COMPANY OVERVIEW

18.27.2 REVENUE ANALYSIS

18.27.3 GEOGRAPHIC PRESENCE

18.27.4 PRODUCT PORTFOLIO

18.27.5 RECENT DEVELOPMENTS

18.28 FINVECTOR

18.28.1 COMPANY OVERVIEW

18.28.2 REVENUE ANALYSIS

18.28.3 GEOGRAPHIC PRESENCE

18.28.4 PRODUCT PORTFOLIO

18.28.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 CONCLUSION

21 QUESTIONNAIRE

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.