Global Wind Turbine Gearbox Market

Market Size in USD Billion

CAGR :

%

USD

20.36 Billion

USD

40.86 Billion

2024

2032

USD

20.36 Billion

USD

40.86 Billion

2024

2032

| 2025 –2032 | |

| USD 20.36 Billion | |

| USD 40.86 Billion | |

|

|

|

|

Wind Turbine Gearbox Market Size

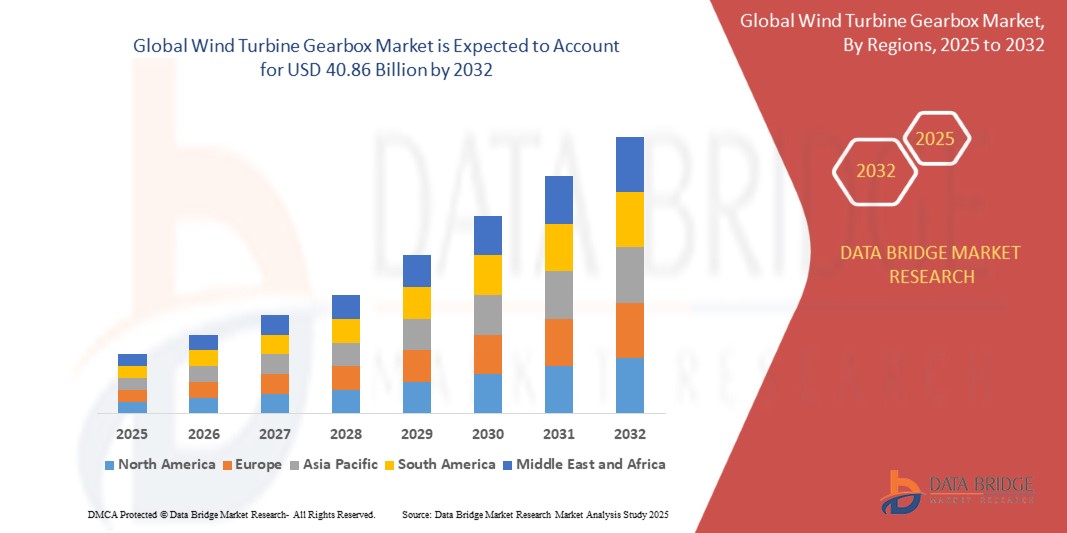

- The global wind turbine gearbox market size was valued at USD 20.36 billion in 2024 and is expected to reach USD 40.86 billion by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is largely fueled by the increasing global adoption of renewable energy and technological advancements in wind turbine design, leading to higher efficiency and reliability in both onshore and offshore wind power projects

- Furthermore, rising investments in large-scale wind energy infrastructure and the growing focus on reducing carbon emissions are driving demand for advanced wind turbine gearboxes. These converging factors are accelerating the deployment of high-capacity turbines, thereby significantly boosting the industry's growth

Wind Turbine Gearbox Market Analysis

- Wind turbine gearboxes are mechanical systems that transfer energy from the turbine rotor to the generator, optimizing torque and rotational speed to maximize electricity generation. These systems are critical for both onshore and offshore turbines, ensuring performance, longevity, and operational reliability

- The escalating demand for wind turbine gearboxes is primarily fueled by the global transition to renewable energy, increasing deployment of high-capacity wind turbines, and the need for efficient, durable, and low-maintenance gearbox solutions in modern wind farms

- Asia-Pacific dominated the wind turbine gearbox market with a share of 49.5% in 2024, due to rapid expansion of renewable energy capacity, strong government incentives for wind power adoption, and an increasing focus on sustainable energy generation

- North America is expected to be the fastest growing region in the wind turbine gearbox market during the forecast period due to rising demand for renewable energy, expansion of offshore and onshore wind projects, and increasing deployment of high-capacity turbines

- Onshore wind power segment dominated the market with a market share of 62.5% in 2024, due to extensive global deployment of onshore wind farms due to lower installation and maintenance costs compared to offshore setups. Onshore turbines also benefit from established supply chains, easier grid connectivity, and favorable regulatory support in key markets, making them the preferred choice for both utility and independent power producers. The growing focus on renewable energy adoption and government incentives for onshore projects further reinforce the dominance of this segment

Report Scope and Wind Turbine Gearbox Market Segmentation

|

Attributes |

Wind Turbine Gearbox Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wind Turbine Gearbox Market Trends

Rising Offshore Wind Projects

- The global wind turbine gearbox market is witnessing accelerated demand with the expansion of offshore wind projects. These installations require high-capacity, durable gearboxes capable of handling extreme marine conditions, supporting efficiency and long-term renewable energy targets

- For instance, Siemens Gamesa has developed advanced gearboxes optimized for offshore turbines deployed in Europe and Asia. These models are designed to withstand high loads while ensuring performance stability in offshore environments with heavy wind exposure

- Increasing turbine sizes are directly influencing gearbox designs. Larger offshore turbines require multi-megawatt capacity gearboxes with greater torque-handling capabilities, prompting investments in next-generation gear transmission systems to ensure reliability in renewable energy generation projects

- In addition, partnerships between governments and private developers for offshore wind farms are reinforcing gearbox demand. Long-term energy transition strategies are favoring high-performance gearbox adoption for both coastal and deep-sea renewable energy infrastructure investments

- Digitalization trends are shaping gearbox innovation as smart monitoring systems gain adoption. Predictive analytics and IoT-based condition monitoring provide insights that prevent unexpected downtime and optimize operational efficiency, particularly in costly offshore maintenance scenarios

- The move toward green hydrogen production is also linked to offshore wind expansion. Gearboxes powering offshore wind farms indirectly support hydrogen value chains by enabling reliable renewable electricity generation for electrolyzer operations worldwide

Wind Turbine Gearbox Market Dynamics

Driver

Growing Investments in Renewable Energy

- Rising global investments in renewable energy are strongly boosting wind turbine gearbox demand. Nations seeking to reduce carbon emissions and meet net-zero commitments are expanding wind power capacity, generating higher requirement for high-performance gear systems

- For instance, Vestas has secured large-scale projects involving advanced gearbox turbines across Europe and Asia. These initiatives reflect consistent industry investments that strengthen renewable electricity supply chains and secure future growth for gearbox manufacturers

- The growing adoption of offshore and onshore projects is supporting long-term demand. Wind turbine gearboxes are crucial for transmission efficiency, effectively converting rotational speeds into energy production aligned with global renewable energy frameworks

- In addition, multilateral financing institutions are backing public-private renewable projects with capital inflows. This global funding push is catalyzing infrastructure growth, with gearboxes at the core of turbine installations that enhance energy generation capacities

- The expansion of green financing mechanisms by governments and private banks is reinforcing industry growth. Subsidies and low-interest loans for clean power projects are strengthening investor confidence and accelerating gearbox adoption across strategic energy markets

Restraint/Challenge

High Gearbox Maintenance Costs

- The wind turbine gearbox market faces considerable challenges due to high maintenance costs. Offshore turbines, in particular, require frequent inspections and component replacements, raising operating expenses and affecting the overall return on investment for developers

- For instance, General Electric reported gearbox maintenance as one of the costliest aspects in offshore wind projects. These expenses have become a limiting factor for project profitability, despite strong demand for renewable electricity generation globally

- Gearbox failures can lead to significant downtime, causing energy production losses. Replacement or refurbishment often requires specialized cranes and vessels, especially offshore, turning repair into an expensive bottleneck within large-scale wind energy projects

- In addition, limited availability of skilled service providers capable of performing complex gearbox maintenance adds further barriers. This talent gap increases costs and delays, hampering operational efficiency for developers managing multi-site wind portfolios

- The trend toward direct-drive turbines, which eliminate gearboxes, is emerging as a competitive challenge. While costly to manufacture, these alternatives reduce maintenance needs, posing risks to long-term gearbox demand in future project developments

Wind Turbine Gearbox Market Scope

The market is segmented on the basis of application, gearbox type, turbine capacity, and end use.

• By Application

On the basis of application, the wind turbine gearbox market is segmented into onshore wind power and offshore wind power. The onshore wind power segment dominated the largest market revenue share of 62.5% in 2024, driven by extensive global deployment of onshore wind farms due to lower installation and maintenance costs compared to offshore setups. Onshore turbines also benefit from established supply chains, easier grid connectivity, and favorable regulatory support in key markets, making them the preferred choice for both utility and independent power producers. The growing focus on renewable energy adoption and government incentives for onshore projects further reinforce the dominance of this segment.

The offshore wind power segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising investments in large-scale offshore wind projects, particularly in Europe and Asia-Pacific. Offshore turbines offer higher wind speeds, leading to greater energy generation efficiency, and advancements in floating turbine technology are expanding deployment options in deeper waters. Increasing collaboration between energy developers and governments to meet net-zero targets is also driving rapid adoption of offshore wind turbines globally.

• By Gearbox Type

On the basis of gearbox type, the market is segmented into planetary, helical, and hybrid gearboxes. The planetary gearbox segment held the largest market revenue share in 2024, attributed to its high torque density, compact design, and reliability under high-stress operating conditions. Planetary gearboxes are widely adopted in both onshore and offshore turbines for their proven performance, ease of integration with existing turbine designs, and low maintenance requirements, making them the most preferred choice for large-scale wind energy projects.

The hybrid gearbox segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the increasing demand for innovative solutions that combine the efficiency of planetary gearboxes with the flexibility of helical designs. Hybrid gearboxes enhance performance in high-capacity turbines above 3 MW, reduce mechanical losses, and support longer operational lifespans, which is crucial for offshore applications. Growing investments in R&D for hybrid designs and increasing adoption in next-generation turbines are key factors contributing to its rapid growth.

• By Turbine Capacity

On the basis of turbine capacity, the market is segmented into below 1.5 MW, 1.5–3 MW, and above 3 MW. The 1.5–3 MW segment dominated the market in 2024, supported by its widespread adoption in utility-scale onshore projects that balance cost, energy output, and infrastructure compatibility. Turbines in this range offer optimal efficiency for both small and medium wind farms while providing proven reliability and easier logistics for installation and maintenance.

The above 3 MW segment is projected to witness the fastest growth from 2025 to 2032, fueled by the expansion of offshore wind projects and growing demand for higher-capacity turbines to meet global renewable energy targets. Larger turbines capture stronger and more consistent wind resources, significantly improving energy yield per unit, and are increasingly favored in new offshore and large-scale onshore developments. Technological advancements in gearbox design and materials further enable the scalability of turbines beyond 3 MW, driving rapid adoption in high-capacity projects.

• By End Use

On the basis of end use, the wind turbine gearbox market is segmented into power generation, industrial, and commercial. The power generation segment held the largest market revenue share in 2024, driven by the global shift toward renewable energy and increasing reliance on wind farms to meet electricity demand. Governments and private utilities prioritize high-performance gearboxes to ensure efficiency, reliability, and minimal downtime, making this segment the dominant end-user category.

The commercial segment is expected to witness the fastest growth from 2025 to 2032, supported by the rising adoption of wind turbines in corporate campuses, industrial parks, and smaller commercial facilities aiming for sustainable energy solutions. Advances in compact and modular gearbox designs allow easier integration with distributed energy systems, while companies increasingly focus on ESG compliance and carbon footprint reduction, boosting demand for commercial-scale wind turbine installations.

Wind Turbine Gearbox Market Regional Analysis

- Asia-Pacific dominated the wind turbine gearbox market with the largest revenue share of 49.5% in 2024, driven by rapid expansion of renewable energy capacity, strong government incentives for wind power adoption, and an increasing focus on sustainable energy generation

- The region’s cost-effective manufacturing infrastructure, rising investments in turbine production, and growing exports of wind energy equipment are accelerating market expansion

- Availability of skilled labor, favorable regulatory policies, and rapid industrialization across developing economies are contributing to increased adoption of high-capacity wind turbines and advanced gearbox technologies

China Wind Turbine Gearbox Market Insight

China held the largest share in the Asia-Pacific wind turbine gearbox market in 2024, owing to its position as the world’s leading producer of wind turbines and components. Strong government support for renewable energy projects, extensive domestic manufacturing capabilities, and aggressive offshore and onshore wind farm development are driving growth. Investments in R&D for advanced gearbox technology and the country’s large-scale wind energy projects further bolster demand.

India Wind Turbine Gearbox Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by an expanding onshore wind capacity, rising focus on green energy initiatives, and increasing adoption of large-scale industrial turbines. Government programs such as accelerated renewable energy development, coupled with foreign investments in turbine manufacturing and installation, are strengthening market demand. In addition, growing emphasis on domestic manufacturing and local component sourcing supports rapid market expansion.

Europe Wind Turbine Gearbox Market Insight

The Europe wind turbine gearbox market is expanding steadily, supported by strong investments in offshore wind projects, stringent environmental regulations, and high adoption of high-capacity turbines. The region emphasizes sustainability, efficiency, and advanced gearbox technology, particularly for offshore wind farms. Growing focus on reducing carbon emissions and advancing renewable energy infrastructure is further enhancing market growth.

Germany Wind Turbine Gearbox Market Insight

Germany’s market is driven by its leadership in renewable energy adoption, mature wind turbine manufacturing ecosystem, and commitment to offshore wind expansion. Strong R&D networks and collaboration between turbine manufacturers and research institutions are fostering continuous innovation in gearbox design. Demand is particularly strong for large-capacity turbines deployed in offshore and industrial wind farms.

U.K. Wind Turbine Gearbox Market Insight

The U.K. market is supported by a mature offshore wind sector, government initiatives for carbon neutrality, and growing investments in high-performance wind turbines. Increasing adoption of hybrid and planetary gearboxes for large offshore projects, along with enhanced local manufacturing capabilities, is sustaining market growth. Collaboration between academic research centers and turbine manufacturers is further driving technological advancements.

North America Wind Turbine Gearbox Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for renewable energy, expansion of offshore and onshore wind projects, and increasing deployment of high-capacity turbines. Government incentives, technological advancements in turbine gearboxes, and growing investment in domestic turbine manufacturing are boosting market adoption.

U.S. Wind Turbine Gearbox Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive wind power capacity, advanced R&D infrastructure, and strategic investments in both onshore and offshore turbines. Increasing focus on high-efficiency gearboxes, domestic manufacturing, and deployment of large-capacity turbines supports continued market leadership. Presence of key turbine and gearbox manufacturers further consolidates the U.S.’s dominant position in the region.

Wind Turbine Gearbox Market Share

The wind turbine gearbox industry is primarily led by well-established companies, including:

- Siemens Gamesa Renewable Energy SA (Spain)

- General Electric Renewable Energy (France)

- Robert Bosch (Germany)

- Vestas (Denmark)

- Moventas Gear Oy (Finland)

- Ishibashi Manufacturing Co. Ltd. (Japan)

- Voith GmbH & Co. KGaA (Germany)

- Winergy Group (U.S.)

- Dana Brevini SpA (Italy)

- ZF Friedrichshafen AG (Germany)

- ME Production A/S (Denmark)

- Renk AG (Germany)

Latest Developments in Global Wind Turbine Gearbox Market

- In March 2024, the Indian state-owned Solar Energy Corporation of India (SECI) announced plans to issue a tender for offshore wind project development with a cumulative capacity of 1,000 MW. This initiative is expected to significantly boost the Indian wind turbine gearbox market, as large-scale offshore projects will drive demand for high-capacity gearboxes and associated turbine components. The tender reflects the government’s commitment to expanding renewable energy infrastructure, which is likely to attract both domestic and international turbine and gearbox manufacturers

- In December 2023, the European Technology & Innovation Platform on wind energy launched its new Tactical R&I Agenda for 2025–2027, calling for USD 1.96 billion in public investment to strengthen the European wind energy supply chain. This funding initiative is expected to accelerate innovation and development of advanced wind turbine gearboxes, including hybrid and high-capacity designs, enhancing market growth across Europe. Investments in resilient and sustainable turbine components are likely to encourage adoption of next-generation gearbox technologies in both onshore and offshore wind projects

- In November 2023, the Odisha government received investment proposals totaling USD 60 million from various investors for wind energy projects with a combined capacity of 575 MW. This development is expected to stimulate regional demand for wind turbine gearboxes, as new installations require reliable, high-performance gear systems. The government’s support for such investments further strengthens the market outlook in India, creating opportunities for gearbox manufacturers and service providers

- In May 2021, Vestas and Iberdrola signed a contract to supply 50 units of the V174-9.5 MW offshore wind turbines for the Baltic Eagle project off the island of Rugen, including a service and maintenance agreement for the turbines. This collaboration demonstrates the growing market need for specialized high-capacity turbine gearboxes and associated maintenance services in offshore projects. It underscores the importance of long-term gearbox reliability and service solutions in sustaining market growth

- In May 2020, Mammoet was awarded a contract for maintenance of the Whitla Wind 1 Project in Southern Alberta, Canada, following a full gearbox failure in one of the turbines. The project involved heavy lifting and transport of the gearbox for replacement and maintenance. This incident highlights the critical role of reliable gearbox design, installation, and service in minimizing operational downtime, emphasizing the aftermarket and maintenance segment as a significant driver of the wind turbine gearbox market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.