Global Winter Wear Market

Market Size in USD Billion

CAGR :

%

USD

3.55 Billion

USD

5.62 Billion

2024

2032

USD

3.55 Billion

USD

5.62 Billion

2024

2032

| 2025 –2032 | |

| USD 3.55 Billion | |

| USD 5.62 Billion | |

|

|

|

|

Winter Wear Market Size

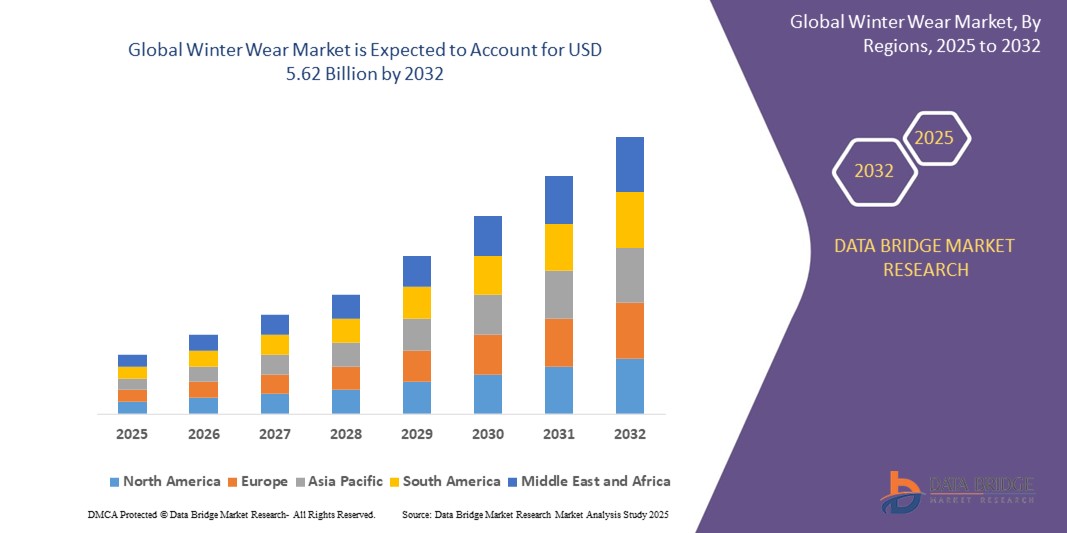

- The global winter wear market size was valued at USD 3.55 billion in 2024 and is expected to reach USD 5.62 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fueled by the increasing demand for functional and stylish outerwear, driven by rising fashion consciousness, especially in urban populations across North America, Europe, and Asia-Pacific

- Furthermore, growing awareness of cold-weather health protection and the availability of high-performance winter clothing through e-commerce platforms is accelerating the adoption of premium winter apparel, thereby significantly boosting the industry’s growth

Winter Wear Market Analysis

- Winter wear, encompassing jackets, coats, sweaters, and thermal clothing, plays a critical role in protecting individuals from cold climates while also serving as a fashion statement, making it a vital segment of the global apparel industry.

- The escalating demand for winter wear is primarily fueled by longer and harsher winter seasons in several regions, rising fashion consciousness, and increasing consumer inclination toward high-performance insulated clothing that combines warmth with style.

- Europe dominates the winter wear market with the largest revenue share of 34.7% in 2025, supported by seasonal demand across Northern and Western Europe, strong purchasing power, and the presence of well-established fashion and outdoor brands, with countries such as Germany, the UK, and France driving consistent growth in premium and sustainable winter apparel.

- Asia-Pacific is expected to be the fastest-growing region in the winter wear market during the forecast period due to rising disposable incomes, rapid urbanization, colder weather in emerging markets, and increased penetration of online fashion retail across countries such as China, India, and South Korea.

- The jackets segment is expected to dominate the winter wear market with a market share of 41.6% in 2025, driven by their widespread use in both casual and professional settings, technological innovations in insulation materials, and a growing emphasis on combining warmth with lightweight, water-resistant fabrics.

Report Scope and Winter Wear Market Segmentation

|

Attributes |

Winter Wear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Winter Wear Market Trends

“Innovation in Sustainable and Smart Performance Fabrics”

- A significant and accelerating trend in the global winter wear market is the increasing innovation in sustainable, lightweight, and smart performance fabrics that provide superior insulation, breathability, and moisture control while meeting consumer demands for environmentally responsible fashion.

- For instance, brands such as Patagonia and The North Face have introduced winter jackets made with recycled polyester, plant-based insulation (e.g., PrimaLoft® Bio™), and water-repellent finishes that are PFC-free, responding to the growing global focus on sustainability in apparel production.

- In addition, smart textiles are beginning to enter the winter wear segment, with products such as Therm-ic’s heated jackets and Ralph Lauren’s Olympic Parade Jacket, which featured battery-powered, adjustable heating zones. These innovations allow wearers to regulate their body temperature in real time, enhancing comfort in extreme climates.

- The integration of wearable tech features such as temperature regulation, weather adaptability, and Bluetooth connectivity is emerging as a next-generation trend in premium winter wear collections. For instance, Ororo and Volt Resistance are launching battery-powered heated clothing lines designed for winter sports, daily commuting, and occupational safety.

- Fashion-forward consumers are also influencing a shift toward multi-functional winter wear that blends style, performance, and eco-conscious materials, with demand surging for convertible jackets, urban athleisure-inspired designs, and items that transition from outdoors to indoors

- As consumer awareness rises regarding both environmental impact and climate adaptability, companies across Europe, North America, and Asia-Pacific are investing in R&D to develop next-gen thermal wear that balances comfort, environmental responsibility, and high-performance functionality, setting new expectations across both mass and premium market segments

Winter Wear Market Dynamics

Driver

“Growing Demand Driven by Cold Climate Exposure and Fashion-Conscious Consumers”

- The increasing frequency and intensity of cold weather across various global regions, combined with rising fashion consciousness and lifestyle shifts, are key drivers propelling demand in the winter wear market

- For instance, in January 2024, Uniqlo expanded its HEATTECH line of winter wear to new markets in Europe and Southeast Asia, featuring thermal insulation powered by proprietary fabric technology that traps body heat while maintaining a lightweight feel—reflecting growing consumer demand for functional yet stylish cold-weather apparel

- As consumers seek greater protection from extreme temperatures, especially in colder geographies such as North America, Europe, and East Asia, premium insulated clothing that provides warmth without compromising on style or comfort is becoming an essential wardrobe category

- Furthermore, the rise of athleisure and outdoor recreation trends, particularly post-pandemic, is driving increased consumption of multi-functional winter garments suitable for both urban and outdoor environments. This has encouraged brands to develop winter wear that bridges technical performance and everyday wearability

- The growing influence of e-commerce and seasonal fashion trends, paired with influencer marketing and social media, has also led to rapid adoption of trendy winter wear, especially among Gen Z and millennial demographics. Retailers are now offering broader seasonal collections, including thermal wear, puffer jackets, and wool coats tailored to specific age groups, climates, and fashion preferences

- As consumers increasingly prioritize warmth, comfort, and aesthetics, and as leading brands invest in innovative fabric technologies and global market expansion, the winter wear market is poised to experience consistent growth across both developed and emerging economies

Restraint/Challenge

“Seasonal Dependency and High Production Costs of Advanced Materials”

- One of the major challenges facing the global winter wear market is its strong seasonal dependency, which leads to fluctuating demand patterns and inventory management issues for retailers and manufacturers. This seasonal nature often results in overstocking or understocking, impacting profitability, particularly in regions with mild winters or unpredictable climate conditions.

- For instance, during milder-than-expected winters in Europe in Q4 2023, several apparel retailers—including H&M and Zara—reported excess winter stock, leading to heavier-than-usual discounting and inventory write-downs. Such seasonal volatility makes it difficult to forecast demand accurately and can discourage investment in winter-specific product lines.

- In addition, the high production costs associated with advanced thermal and sustainable materials, such as organic wool, recycled synthetics, or smart textiles, can pose a barrier for price-sensitive consumers and reduce market penetration in developing economies. Brands seeking to offer cutting-edge, eco-friendly, or tech-integrated winter garments often face higher R&D and manufacturing costs, which may result in premium pricing that is not accessible to all consumer segments.

- While brands such as Patagonia and Columbia Sportswear have successfully built a market for sustainable winter wear, their products remain out of reach for many consumers in Asia, Latin America, and Africa due to cost. This pricing gap between standard and advanced-performance winter apparel limits broader adoption.

- Addressing these challenges will require innovations in cost-effective sustainable materials, diversification of product lines for milder climates, and agile supply chain models that can respond to changing seasonal trends and climate variability. Educating consumers on the long-term value and environmental impact of premium winter wear could also help expand market access despite the higher upfront cost

Winter Wear Market Scope

The market is segmented on the basis of product, consumer group, fabric, technology, end user, and distribution channel.

- By Product

On the basis of product, the winter wear market is segmented into sweaters and cardigans; jackets, coats, and blazers; scarves, shawls, wraps, stoles, and mufflers; sweatshirts, hoodies, and pullovers; thermals; gloves; and accessories. The jackets, coats, and blazers segment dominates the largest market revenue share in 2025, driven by their essential role in providing warmth and protection during cold seasons and their widespread use across various age groups and regions. The variety in styles, from casual to formal, further bolsters demand in both urban and rural areas.

The sweaters and cardigans segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising fashion consciousness and the increasing trend of layering among consumers. Their versatility, comfort, and availability in diverse fabrics and designs contribute to their growing popularity among all consumer groups.

• By Consumer Group

On the basis of consumer group, the winter wear market is segmented into men, women, and kids. The women’s segment accounted for the largest market revenue share in 2024, driven by the expanding variety of winter wear options targeted toward women, increased purchasing power, and growing fashion trends emphasizing seasonal apparel.

The kids segment is expected to witness the fastest CAGR from 2025 to 2032, due to rising awareness among parents about thermal comfort and protection for children in colder climates, alongside growing urbanization and disposable income.

• By Fabric

On the basis of fabric, the winter wear market is segmented into natural and man-made. The natural fabric segment held the largest market revenue share in 2025, attributed to the preference for wool, cotton, and other natural fibers that offer superior warmth, breathability, and comfort. Consumers also favor natural fabrics for their eco-friendliness and biodegradability.

The man-made fabric segment is expected to witness the fastest CAGR from 2025 to 2032, driven by advancements in synthetic fiber technology, cost-effectiveness, and enhanced performance features such as water resistance, quick drying, and durability. These attributes make man-made fabrics particularly popular in activewear and performance-oriented winter clothing.

Winter Wear Market Regional Analysis

- Europe dominates the winter wear market with the largest revenue share of 34.7% in 2024, driven by the region’s long and harsh winter seasons, high consumer awareness of thermal comfort, and strong demand for premium and sustainable winter apparel

- Consumers in the region highly value the blend of fashion and functionality, prioritizing high-quality fabrics, insulation technologies, and eco-friendly materials in their winter wear purchases

- This widespread adoption is further supported by high disposable incomes, a mature retail infrastructure, and growing interest in outdoor activities and sports during winter, establishing winter wear as an essential category for men, women, and kids across Europe

U.K. Winter Wear Market Insight

The U.K. winter wear market captured the largest revenue share of 81% within Europe in 2025, fueled by the increasing demand for fashionable yet functional cold-weather apparel. Consumers are prioritizing thermal comfort combined with style, driving the uptake of premium coats, jackets, and layered clothing. The growing interest in sustainable and eco-friendly fabrics, alongside strong e-commerce and retail infrastructure, further propels the winter wear industry. Moreover, the rising trend of outdoor activities and seasonal tourism is significantly contributing to market expansion.

Germany Winter Wear Market Insight

The German winter wear market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by harsh winter conditions and heightened consumer focus on performance and durability. The increase in urbanization, coupled with a strong preference for innovative insulation technologies and sustainable materials, is fostering demand. German consumers are drawn to high-quality thermal wear that combines functionality with modern aesthetics. The region is witnessing growth across men’s, women’s, and kids’ apparel segments, particularly in jackets, thermals, and accessories.

North America Winter Wear Market Insight

The North America winter wear market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by cold climate zones, increasing disposable incomes, and rising fashion consciousness. In addition, growing health awareness about protection from cold-related illnesses encourages consumers to invest in quality winter apparel. The region’s adoption of advanced fabric technologies, such as moisture-wicking and thermal insulation, along with the rise of online retailing and branded products, is expected to continue to stimulate market growth.

U.S. Winter Wear Market Insight

The U.S. winter wear market is expected to expand at a considerable CAGR during the forecast period, fueled by the demand for versatile and premium winter apparel. The country’s diverse climate conditions create strong demand for a wide range of products, from heavy coats to lightweight thermals. The emphasis on activewear and athleisure trends further promotes the adoption of sweatshirts, hoodies, and performance fabrics. The growing influence of online platforms and brand collaborations is also driving consumer engagement and market expansion.

Asia-Pacific Winter Wear Market Insight

The Asia-Pacific winter wear market is poised to grow at the fastest CAGR of over 24% in 2025, driven by increasing urbanization, rising disposable incomes, and changing lifestyles in countries such as China, Japan, India, and South Korea. The region’s expanding middle class and growing awareness about health and comfort during winter seasons are boosting demand. Furthermore, government initiatives promoting domestic textile manufacturing and innovation in fabric technology support the market’s growth. Increasing participation in winter sports and outdoor activities also fuels demand for specialized winter apparel.

Japan Winter Wear Market Insight

The Japan winter wear market is gaining momentum due to the country’s changing climate patterns and consumers’ strong preference for high-quality, functional apparel. The Japanese market emphasizes compact, lightweight thermal wear and multifunctional garments that suit urban lifestyles. The integration of technology in fabric manufacturing, such as heat-retaining and breathable materials, is fueling growth. Moreover, Japan’s aging population is likely to spur demand for easy-to-wear and comfortable winter clothing suitable for older adults.

China Winter Wear Market Insight

The China winter wear market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to rapid urbanization, the expanding middle class, and increasing fashion consciousness. China stands as one of the largest apparel markets globally, with winter wear gaining popularity not only in northern cold regions but increasingly in milder areas due to growing awareness of health and comfort. The push towards smart textiles, along with the availability of affordable and diverse winter wear options from domestic manufacturers, are key factors propelling market growth in China.

Winter Wear Market Share

The winter wear industry is primarily led by well-established companies, including:

- Burberry Group Plc (U.K.)

- Capri Holdings Limited (U.S.)

- CHANEL (U.K.)

- Dolce and Gabbana Srl (Italy)

- Double R Bags (India)

- Giorgio Armani Spa (Italy)

- Hermes International S.A. (France)

- Kering (France)

- LVMH (France)

- Mulberry (U.K.)

- PRADA Group (Italy)

- P.V.H. Corp. (U.S.)

- Ralph Lauren (U.S.)

- Samsonite IP Holdings S.à r.l. (Hong Kong)

- Tapestry Inc. (U.S.)

Latest Developments in Global Winter Wear Market

- In November 2024, Zara unveiled its SRPLS collection for Autumn/Winter, featuring a fusion of utilitarian-inspired designs with contemporary style. The collection emphasizes oversized silhouettes, practical details, and a muted color palette, ensuring both comfort and versatility for modern consumers. Key pieces include oversized jackets and cargo pants, catering to the rising demand for streetwear aesthetics while maintaining a refined, fashion-forward appeal

- In April 2024, The Estée Lauder Companies unveiled groundbreaking research from its premier hair care brands, AVEDA and Bumble and bumble, in collaboration with the University of Bradford. Presented at the 13th World Congress for Hair Research, the findings explored ingredient potency, environmental effects on hair fibers, scalp health, and reducing hair color damage. These advancements aim to meet evolving industry expectations and set new standards in personal and professional hair care. The research underscores a commitment to innovation and sustainability in hair science

- In December 2023, The North Face introduced a new line of eco-friendly insulated jackets, combining warmth, weather protection, and sustainability. These jackets feature recycled materials and innovative insulation technologies, reducing environmental impact while maintaining high-performance standards. Designed for outdoor enthusiasts, the collection emphasizes durability and comfort in cold conditions. The North Face continues to advance its commitment to sustainability through responsible sourcing and production practices

- On November 15, 2022, Gap Inc. announced its partnership with Amazon Fashion in the U.S. and Canada, expanding its reach to a broader customer base. Through this collaboration, Gap offers a curated selection of modern essentials for the entire family, including hoodies, t-shirts, denim, socks, underwear, and sleepwear. The launch also features babyGap-branded nursery furniture and baby gear, such as strollers, bassinets, and cribs. This initiative aims to enhance accessibility and convenience for shoppers through Amazon’s platform

- On October 12, 2022, Peak Performance expanded its flagship store in Beijing, China, strengthening its presence in the region. The store, located in the Sanlitun district, blends high-tech design with the brand’s Scandinavian outdoor heritage, offering premium ski and outdoor apparel. To enhance engagement, Peak Performance launched on WeChat, China’s largest social platform, and introduced two specialty shop-in-shops in Beijing and Shanghai. These initiatives aim to build stronger connections with Chinese consumers through digital and physical channels

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.