Japan Lemon Fruit And Derived Functional Ingredients Market

Market Size in USD Million

CAGR :

%

USD

204.65 Million

USD

253.84 Million

2024

2032

USD

204.65 Million

USD

253.84 Million

2024

2032

| 2025 –2032 | |

| USD 204.65 Million | |

| USD 253.84 Million | |

|

|

|

|

Lemon Fruit and Derived Functional Ingredients Market Size

- The Japan Lemon fruit and derived functional ingredient market was valued at USD 204.65 million in 2024 and is expected to reach USD 253.84 million by 2032, at a CAGR of 2.8%, during the forecast period

- This growth is driven by factors such as demand for natural and functional ingredients is rising in Japan’s beauty and skincare sector

Lemon Fruit and Derived Functional Ingredients Market Analysis

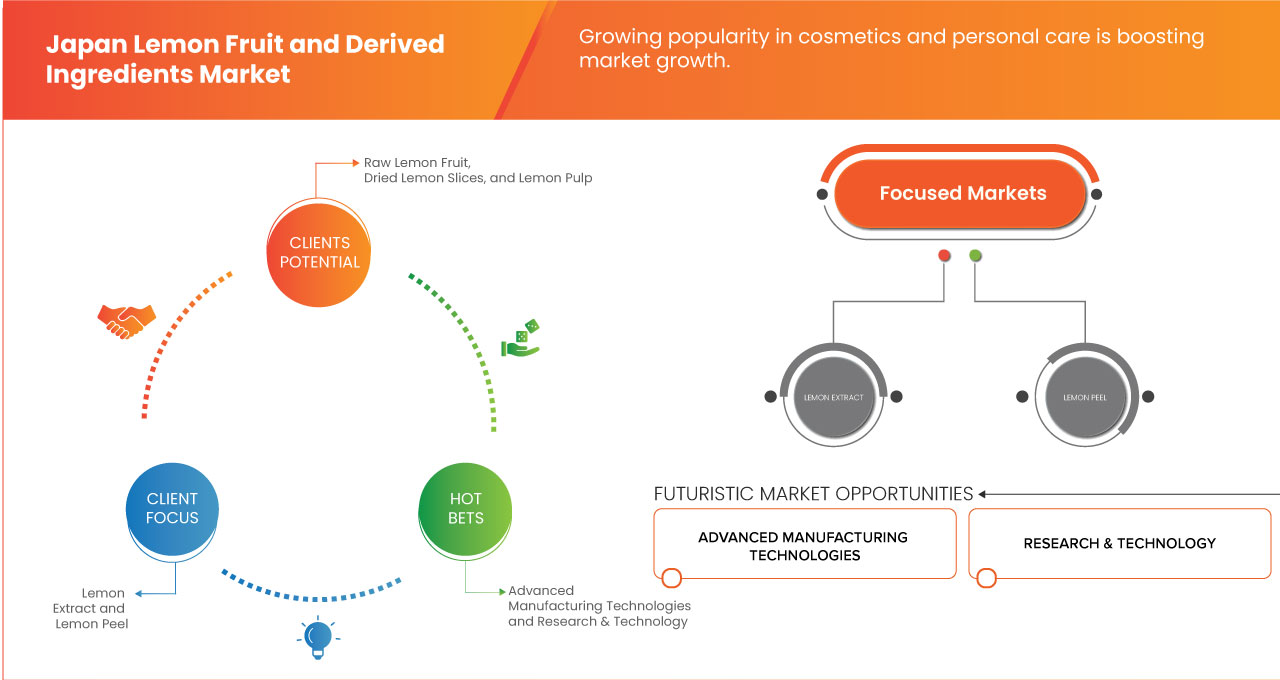

- Growing popularity in cosmetics and personal care, expansion of the food and beverage industry, and rising health and wellness trends are the major driver

- Some of the major restraints that may negatively impact the market growth are limited shelf life and stability and changing consumer preferences

- Lemon extract segment is expected to dominate the market with a market share of 43.26% due to natural and functional ingredients is rising in Japan’s beauty and skincare sector

- Citric Acid segment is expected to dominate the market with a market share of 31.94% due to natural and functional ingredients is rising in Japan’s beauty and skincare sector

Report Scope and Lemon fruit and derived Functional Ingredients Market Segmentation

|

Attributes |

Lemon fruit and derived Functional Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Japan |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Lemon Fruit and Derived Functional Ingredients Market Trends

“Growing Popularity in Cosmetics and Personal Care”

- The demand for natural and functional ingredients is rising in Japan’s beauty and skincare sector, driving increased usage of lemon-derived components

- Lemon is widely recognized for its high vitamin C content, antioxidant properties, and astringent characteristics, making it a popular choice in formulations aimed at skin brightening, acne treatment, and anti-aging

- Japanese skincare culture places a strong emphasis on clarity, tone, and softness, and lemon-based extracts and oils align well with these ideals

- Lemon essential oils and lemon peel extracts are increasingly used in facial cleansers, toners, moisturizers, and hair care products, owing to their refreshing scent and skin-rejuvenating properties. The shift toward organic and plant-based personal care products in Japan is further fueling demand for naturally sourced ingredients like lemon

- Additionally, cosmetic companies are leveraging lemon's antimicrobial and anti-inflammatory attributes in formulations for sensitive skin and scalp care

- For instance, In August 2024, the Japanese skincare brand Kose Corporation introduced a new line of anti-aging creams featuring lemon essential oil and citrus bioflavonoids. These lemon-derived compounds are recognized for their antioxidant properties and ability to protect skin from environmental stressors. The new product line positions itself in the premium segment, responding to consumers' preference for natural, effective skincare ingredients

- The increasing integration of lemon-based ingredients in mainstream and boutique cosmetics—combined with Japan’s cultural affinity for naturally radiant skin—continues to strengthen the role of lemon fruit derivatives in the personal care industry.

Lemon Fruit and Derived Functional Ingredients Market Dynamics

Driver

“Expansion of the Food and Beverage Industry”

- With increasing consumer demand for innovative, functional, and health-oriented food products, manufacturers are increasingly incorporating natural ingredients like lemon for their flavor, aroma, and health benefits

- Lemon juice, lemon oil, lemon zest, and citric acid are widely used in beverages, baked goods, confectionery, sauces, and ready-to-eat meals

- The trend toward premiumization and artisanal food products, coupled with the rising popularity of clean-label and plant-based foods, is pushing manufacturers to opt for natural flavoring and preservative options—further boosting the use of lemon-derived ingredients

- Moreover, the growth of health-focused beverages such as detox drinks, lemon-flavored sparkling waters, and fortified juices is significantly contributing to demand

For instance,

- In March 2024, Japan's leading beverage company, Suntory Holdings, introduced a new line of low-calorie, lemon-infused sparkling drinks aimed at health-conscious consumers. This product development leverages the natural tang of lemon to offer a refreshing and calorie-conscious alternative to sugary sodas

- The launch is indicative of the growing preference for beverages that are not only flavorful but also align with consumer desires for healthier options. As consumers increasingly prioritize wellness, the demand for lemon-based beverages is expected to continue to rise

- In February 2024, an article published in Martner Japan highlighted Sapporo Breweries launched a line of craft chu-hi (shochu highball) with authentic lemon juice and pulp to cater to Japan’s expanding premium alcoholic beverage segment. The chu-hi variants emphasize natural flavor, supporting the trend of using real citrus in adult beverages

- As a result of the Japan Lemon fruit and derived Functional Ingredient Market is benefitting from consumers increasingly seek healthier, natural, and functional food options, lemon’s versatility in enhancing flavor, providing nutritional benefits, and acting as a natural preservative is becoming more valued.

Opportunity

“Growth in Organic and Natural Products”

- With rising awareness of food safety, environmental sustainability, and health consciousness, Japanese consumers are more actively seeking products that are clean-label, additive-free, and made from naturally sourced ingredients

- This shift is especially visible among urban millennials, young families, and the aging population, who are all gravitating toward minimally processed foods and natural wellness boosters. As a result, there is a growing market for organic lemons and lemon-derived ingredients such as organic lemon juice, zest, powder, and essential oils.

- Organic lemon products are also aligning with Japan’s increasing emphasis on eco-labeling and ethical sourcing, further enhancing their appeal in the retail and foodservice sectors. Supermarkets, convenience stores, and e-commerce platforms are expanding their natural and organic product ranges to cater to this trend

- Lemon-based products with organic certification can command a premium price and enjoy higher brand loyalty, particularly when coupled with other clean-label claims such as “no preservatives,” “non-GMO,” or “100% fruit-derived”

- For food and beverage manufacturers, this trend provides an opportunity to innovate with lemon-infused functional drinks, snacks, teas, and condiments that meet Japan’s evolving demand for wellness-oriented and environmentally conscious offerings

For instance,

- In September 2021, a study published by SGS Société Générale de Surveillance SA stated that the International Food Information Council (IFIC) released a study showing that nearly two-thirds of adult consumers reported ingredient lists significantly influenced their food and beverage purchases

- The research revealed a strong preference for clean-label products made from simple, natural ingredients, as consumers increasingly avoided artificial additives and “chemical-sounding” substances in favor of foods perceived to promote long-term health and wellness

- The surge in demand for organic and natural products in Japan offers a strong growth pathway for lemon-based ingredients

- As consumers prioritize clean-label and sustainably sourced products, organic lemon-derived offerings can stand out in a competitive market by delivering both health benefits and ethical value

Restraint/Challenge

““Limited Shelf Life and Stability”

- Lemon and its derived ingredients—such as lemon juice, zest, essential oils, and powders—are highly perishable and prone to degradation due to their natural composition. Factors such as exposure to light, air, heat, and moisture can cause oxidation, microbial growth, and a reduction in nutritional value or aroma

- In the context of the Japanese market, where product quality, safety, and freshness are paramount, the limited shelf life of lemon-based ingredients poses a significant restraint, particularly for manufacturers and retailers aiming to offer clean-label and preservative-free products

- Additionally, maintaining the stability of lemon-derived compounds like vitamin C and essential oils in processed foods, beverages, and cosmetic formulations is a technical challenge. These ingredients often require specialized storage, cold-chain logistics, or advanced packaging solutions to prevent spoilage and ensure efficacy.

- For smaller businesses or organic producers, this adds to operational costs and limits large-scale commercialization. This is particularly impactful in Japan, where the consumer preference for naturally sourced, additive-free products is strong, yet shelf-life expectations are high

For instance,

- In September 2023, MDPI published an article stating that lemon juice stored at ambient temperatures rapidly loses vitamin C and antioxidant properties within weeks, highlighting the challenges for clean-label juice products in Japan’s retail sector

- The inherent instability and short shelf life of lemon-derived ingredients limit their broader application in Japan’s quality-sensitive and innovation-driven market. Without adequate preservation strategies, manufacturers risk product spoilage, diminished health benefits, and increased costs, making this a critical restraint for market scalability

Lemon Fruit and Derived Functional Ingredients Market Scope

The market is segmented on the basis of type, functional ingredient, category, form, extraction technique, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Functional Ingredient |

|

|

By Category |

|

|

By Form

|

|

|

By Extraction Technique |

|

|

By Application

|

|

|

By Distribution Channel |

|

In 2025, the lemon extract is projected to dominate the market with a largest share in type segment

The lemon extract segment is expected to dominate the lemon fruit and derived ingredients market with the largest share of 43.41% in 2025 due to increasing popularity of vitamin C-rich lemon products, such as juices and supplements, contributed to the market’s expansion.

The conventional is expected to account for the largest share during the forecast period in category market

In 2025, the conventional segment is expected to dominate the market with the largest market share of 92.18% due to its widespread availability, lower production costs, and established supply chains. Conventional lemon products are typically more affordable, making them the preferred choice for large-scale food and beverage manufacturers. Additionally, conventional lemon products meet the high demand for ingredients in various industries, including food processing, beverages, and cosmetics, where cost-effectiveness is a critical factor.

Lemon Fruit and Derived Functional Ingredient Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Japan presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ingredion (U.S.)

- ADM (U.S.)

- Kerry Group plc. (Ireland)

- Kobata Foods Co., Ltd. (Japan)

- Takasago International Corporation (Japan)

- International Flavors & Fragrances Inc. (U.S.)

- Döhler GmbH (Germany)

- Givaudan (Switzerland)

- dsm-firmenich (Netherlands/Switzerland)

- SÜDZUCKER AG (Germany)

- SHONAN FLAVORS, INC. (Japan)

- Citromax Group (U.S./Argentina)

- Symrise (Germany)

- Vedam Organic (India)

- Botanic Healthcare (India)

- Lemonconcentrate S.L.U (Spain)

- pureoilsindia (India)

- Matha Exports International (India)

- Arora Aromatics Private Limited (India)

Latest Developments in Japan Lemon fruit and derived Functional Ingredient Market

- In November 2020, MassChallenge Switzerland has partnered with Südzucker Group to boost innovation in sustainable food and agriculture. This collaboration will connect startups with Südzucker’s industry expertise, accelerating solutions for a more sustainable future. The partnership highlights both organizations' commitment to supporting impactful technologies through MassChallenge’s global, zero-equity accelerator program

- In October 2024, Privi holds a 51% stake in the joint venture with Givaudan, who retains 49%. The new Mahad facility will produce a range of value-added fragrance products, with activities ramping up over the next two to three years. Both companies highlight their commitment to innovation and sustainable growth in the industry

- In January 2025, Döhler GmbH inaugurated its new R&D Innovation Center in Princeton, New Jersey, marking a major milestone in its North American expansion. The state-of-the-art facility, spanning over 50,000 square feet, is set to enhance the company’s research and development capabilities while fostering innovation and collaboration in the food and beverage industry

- In March 2025, Döhler GmbH expanded its North American operations with the acquisition of Premier Juices. This strategic move strengthens Döhler’s portfolio of natural fruit-based products and enhances its capabilities across the food, beverage, and life science industries, reinforcing its position as a leader in natural ingredients and integrated solutions

- In December 2024, Citromax Flavors recently launched its “Pure Origins” campaign to commemorate its 60th anniversary. This initiative introduces a new line of sustainable flavor solutions, emphasizing eco-friendly farming practices and innovative processing technologies. The campaign aims to deliver responsibly sourced, high-quality ingredients to the global food and beverage industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT SCENARIO

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 COMPETITIVE RIVALRY

4.3 PRICING ANALYSIS

4.4 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

4.5 VALUE CHAIN ANALYSIS

4.6 BRAND OUTLOOK

4.7 CLIMATE CHANGE SCENARIO IN JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET

4.8 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.8.1 PRODUCT ORIGIN AND SAFETY ASSURANCE

4.8.2 PRICE SENSITIVITY AND VALUE PERCEPTION

4.8.3 AVAILABILITY AND SEASONAL CONSISTENCY

4.8.4 HEALTH AND WELLNESS TRENDS

4.9 GLOBAL LEMON FRUIT AND DERIVED INGREDIENTS MARKET OVERVIEW

4.1 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.10.1 PRODUCT DIVERSIFICATION AND FUNCTIONAL INNOVATION

4.10.2 STRATEGIC PARTNERSHIPS AND CONTRACT FARMING

4.10.3 GEOGRAPHIC EXPANSION AND E-COMMERCE OPTIMIZATION

4.10.4 SUSTAINABLE AND ETHICAL BRANDING INITIATIVES

4.11 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET –JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET

4.11.1 IMPACT ON PRICE

4.11.2 IMPACT ON SUPPLY CHAIN

4.11.3 IMPACT ON SHIPMENT

4.11.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.12 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.12.1 RISING DEMAND FOR FUNCTIONAL AND IMMUNITY-BOOSTING PRODUCTS

4.12.2 CLEAN LABEL AND NATURAL INGREDIENT MOVEMENT

4.12.3 INCREASING FOCUS ON SUSTAINABILITY AND CIRCULAR ECONOMY

4.12.4 DIGITALIZATION AND DIRECT-TO-CONSUMER ENGAGEMENT

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED EXTRACTION AND COLD-PRESS TECHNOLOGIES

4.13.2 SMART AGRICULTURE AND IOT INTEGRATION

4.13.3 BLOCKCHAIN-BASED TRACEABILITY SYSTEMS

4.13.4 AUTOMATION AND ROBOTICS IN PROCESSING FACILITIES

4.14 RAW MATERIAL SOURCING ANALYSIS

4.14.1 DOMESTIC PRODUCTION LANDSCAPE

4.14.2 IMPORT DEPENDENCE AND KEY SUPPLIER COUNTRIES

4.14.3 QUALITY ASSURANCE AND SAFETY COMPLIANCE

4.14.4 LOGISTICS, COLD CHAIN, AND HANDLING INFRASTRUCTURE

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL SOURCING AND AVAILABILITY

4.15.2 MANUFACTURING AND PROCESSING

4.15.3 DISTRIBUTION CHANNELS

4.15.4 REGULATORY COMPLIANCE AND STANDARDS

4.15.5 MARKET DEMAND AND CONSUMER TRENDS

4.15.6 CHALLENGES AND RISKS

4.16 TARIFFS AND THEIR IMPACT ON THE MARKET

4.16.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.16.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.16.3 VENDOR SELECTION CRITERIA DYNAMICS

4.16.4 IMPACT ON SUPPLY CHAIN

4.16.4.1 RAW MATERIAL PROCUREMENT

4.16.4.2 MANUFACTURING AND VALUE ADDITION

4.16.4.3 LOGISTICS AND DISTRIBUTION

4.16.4.4 PRICE PITCHING AND POSITION OF MARKET

4.16.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.16.5.1 SUPPLY CHAIN REALIGNMENT

4.16.5.2 LOCAL PROCESSING INITIATIVES

4.16.6 REGULATORY INCLINATION

4.16.6.1 FTA-DRIVEN TARIFF RELIEF

4.16.6.2 INDUSTRIAL INCENTIVES

4.17 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: TOC & TOB MANUFACTURERS – MARKET TRENDS AND INSIGHTS

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING POPULARITY IN COSMETICS AND PERSONAL CARE

6.1.2 EXPANSION OF THE FOOD AND BEVERAGE INDUSTRY

6.1.3 RISING HEALTH AND WELLNESS TRENDS

6.2 RESTRAINTS

6.2.1 LIMITED SHELF LIFE AND STABILITY

6.2.2 CHANGING CONSUMER PREFERENCES

6.3 OPPORTUNITIES

6.3.1 GROWTH IN ORGANIC AND NATURAL PRODUCTS

6.3.2 EXPANDING APPLICATIONS OF LEMON AND ITS DERIVATIVES IN AROMATHERAPY AND HOLISTIC HEALTH

6.4 CHALLENGES

6.4.1 CONSTRAINTS ARISING FROM CONTAMINATION AND PROCESSING LIMITATIONS

6.4.2 COMPETITION FROM SYNTHETIC ALTERNATIVES

7 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE

7.1 OVERVIEW

7.2 LEMON EXTRACT

7.3 LEMON PEEL

7.4 RAW LEMON FRUIT

7.5 DRIED LEMON SLICES

7.6 LEMON PULP

8 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FUNCTIONAL INGREDIENT

8.1 OVERVIEW

8.2 CITRIC ACID

8.3 ABSORBIC ACID

8.4 CITRUS BIOFLAONOIDS/POLYPHENOLS

8.5 PECTIN

8.6 LIMONENE

8.7 POTASSIUM

8.8 OTHERS

9 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 ORGANIC

10 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FORM

10.1 OVERVIEW

10.2 LIQUID

10.3 DRY

11 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY EXTRACTION TECHNIQUE

11.1 OVERVIEW

11.2 STEAM DISTILLATION

11.3 COLD PRESS EXTRACTION

11.4 SOLVENT EXTRACTION

11.5 OTHERS

12 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FOOD AND BEVERAGES

12.3 COSMETICS AND PERSONAL CARE

12.4 PHARMACEUTICALS

12.5 HOUSEHOLD CARE PRODUCTS

12.6 OTHERS

13 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 INDIRECT SALES

13.3 DIRECT SALES

14 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: JAPAN

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 INGREDION

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ADM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 KERRY GROUP PLC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 KOBATA FOODS CO. LTD

16.4.1 COMPANY SNAPSHOT

16.4.2 PRODUCT PORTFOLIO

16.4.3 RECENT DEVELOPMENT

16.5 INTERNATIONAL FLAVORS & FRAGRANCES INC

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT/BRAND PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 ARORA AROMATICS PVT. LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 BOTANIC HEALTHCARE.

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT/NEWS

16.8 CITROMAX

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 DÖHLER GMBH

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT/NEWS

16.1 DSM-FIRMENICH

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT/BRAND PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 GIVAUDAN

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 LEMONCONCENTRATE S.L.U

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 MATHA EXPORTS INTERNATIONAL

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 PUREOILSINDIA

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 SHONAN FLAVORS, INC.

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 SÜDZUCKER AG

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENT

16.17 SYMRISE

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT/BRAND PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 TAKASAGO INTERNATIONAL CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 PRODUCTION CAPACITY FOR TOP MANUFACTURERS

TABLE 2 COMPARATIVE BRAND ANALYSIS

TABLE 3 REGULATORY COVERAGE

TABLE 4 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 6 JAPAN LEMON EXTRACT IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 8 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (TONS)

TABLE 9 JAPAN CITRUS BIOFLAONOIDS/POLYPHENOLS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 11 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY CATEGORY, 2018-2032 (TONS)

TABLE 12 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 13 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FORM, 2018-2032 (TONS)

TABLE 14 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY EXTRACTION TECHNIQUE, 2018-2032 (USD THOUSAND)

TABLE 15 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY EXTRACTION TECHNIQUE, 2018-2032 (TONS)

TABLE 16 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY APPLICATION, 2018-2032 (TONS)

TABLE 18 JAPAN FOOD AND BEVERAGES IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 JAPAN BEVERAGES IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 JAPAN NON-ALCOHOLIC BEVERAGES IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 21 JAPAN HEALTH DRINKS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 JAPAN ALCOHOLIC BEVERAGES IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 23 JAPAN FOOD AND BEVERAGES IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 24 JAPAN COSMETICS AND PERSONAL CARE IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 25 JAPAN FACIAL CARE PRODUCTS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 JAPAN HAIR CARE PRODUCTS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 JAPAN COSMETICS AND PERSONAL CARE IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 28 JAPAN PHARMACEUTICALS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 29 JAPAN GASTROINTESTINAL HEALTH IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 JAPAN METABOLIC DISORDERS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 JAPAN PHARMACEUTICALS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY PRODUCT FORM, 2018-2032 (USD THOUSAND)

TABLE 32 JAPAN PHARMACEUTICALS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 33 JAPAN HOUSEHOLD CARE PRODUCTS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 JAPAN HOUSEHOLD CARE PRODUCTS IN LEMON FRUIT AND DERIVED INGREDIENT MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 35 JAPAN OTHERS IN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FUNCTIONAL INGREDIENT, 2018-2032 (USD THOUSAND)

TABLE 36 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 37 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (TONS)

TABLE 38 JAPAN INDIRECT SALES IN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 39 JAPAN OFFLINE IN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 JAPAN ONLINE IN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET

FIGURE 2 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: MULTIVARIATE MODELLING

FIGURE 7 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: SEGMENTATION

FIGURE 12 SEVEN SEGMENTS COMPRISE THE JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING POPULARITY IN COSMETICS AND PERSONAL CARE IS EXPECTED TO DRIVE THE JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE LEMON EXTRACT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET IN 2025 AND 2032

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/ KG)

FIGURE 19 VALUE CHAIN OF JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET

FIGURE 20 DROC ANALYSIS

FIGURE 21 JAPAN LEMON FRUIT AND DERIVED INGREDIENT MARKET: BY TYPE, 2024

FIGURE 22 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FUNCTIONAL INGREDIENT, 2024

FIGURE 23 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY CATEGORY, 2024

FIGURE 24 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY FORM, 2024

FIGURE 25 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY EXTRACTION TECHNIQUE, 2024

FIGURE 26 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY APPLICATION, 2024

FIGURE 27 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 JAPAN LEMON FRUIT AND DERIVED INGREDIENTS MARKET: COMPANY SHARE 2024 (%)

Japan Lemon Fruit And Derived Functional Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Japan Lemon Fruit And Derived Functional Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Japan Lemon Fruit And Derived Functional Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.