Mexico Digital Animation Market

Market Size in USD Billion

CAGR :

%

USD

9.78 Billion

USD

16.45 Billion

2024

2032

USD

9.78 Billion

USD

16.45 Billion

2024

2032

| 2025 –2032 | |

| USD 9.78 Billion | |

| USD 16.45 Billion | |

|

|

|

|

Digital Animation Market Size

- The Mexico digital animation market size was valued at USD 9.776 billion in 2024 and is expected to reach USD 16.45 billion by 2032, at a CAGR of 6.8% during the forecast period

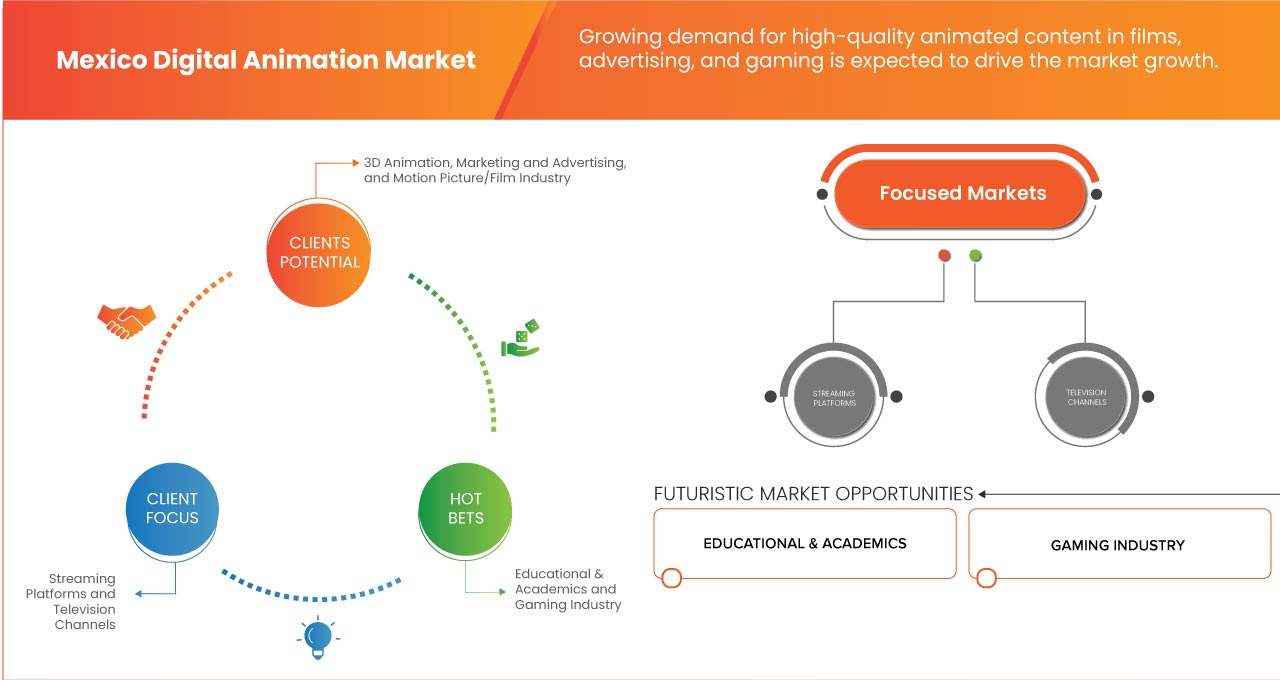

- The market growth is largely fueled by the growing demand for high-quality animated content in films, advertising, and gaming is fueling significant investment and production activity in Mexico

- Furthermore, mexican animation studios are responding by upgrading their capabilities and adopting cutting-edge technologies to meet the evolving expectations of clients in entertainment, marketing, and interactive media, fueling steady market growth

Digital Animation Market Analysis

- The Mexico digital animation market refers to the industry involved in the creation, production, and distribution of animated content using digital technologies within Mexico

- This market encompasses a wide range of applications, including entertainment (film, television, and streaming content), advertising, education, gaming, and virtual experiences

- Mexico City is expected to dominate the Mexico digital animation market with 30.12% market share in 2025 due to its concentration of major animation studios, skilled talent pool, and access to advanced digital infrastructure

- State of Mexico is emerging as the fastest-growing province in the Mexico digital animation market due to its strategic proximity to Mexico City, which facilitates access to major studios, talent, and infrastructure

- 3D animation segment is expected to dominate the Mexico digital animation market with a market share of 25.43% in 2025, its widespread application in film, advertising, gaming, and virtual production. It offers greater visual realism, flexibility, and scalability compared to traditional formats, making it the preferred choice for studios aiming to meet global production standards

Report Scope and Digital Animation Market Segmentation

|

Attributes |

Digital Animation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Mexico

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Digital Animation Market Trends

“Rising Adoption of Real-Time Rendering and Virtual Production”

- A prominent and accelerating trend in the Mexico digital animation market is the growing adoption of real-time rendering and virtual production technologies, particularly among studios targeting global content delivery and immersive storytelling formats

- For instance, platforms like Unreal Engine and Unity are increasingly being used not only in gaming but also in animated film and series production. Mexican studios are leveraging these tools to create interactive story environments and produce high-quality visuals in real-time, significantly reducing post-production timelines

- Virtual production techniques, such as LED wall-based filming and virtual camera systems, allow animators and directors to visualize and modify scenes instantly during live shoots. This is especially beneficial for hybrid projects involving both live-action and animated components, where real-time visualization improves creative accuracy and production speed

- As global demand for animated content surges driven by OTT platforms, gaming, and branded entertainment the pressure to deliver high-volume, high quality animation quickly is pushing Mexican studios to adopt real-time and virtual production pipelines

- This shift toward real-time rendering and virtual production is reshaping the animation landscape in Mexico, positioning local studios to innovate more rapidly, attract international clients, and expand their presence in the digital content market

Digital Animation Market Dynamics

Driver

Growing Demand for High-Quality Animated Content in Films, Advertising, and Gaming

- As audiences increasingly seek visually engaging and immersive experiences, both local and international media producers are turning to advanced animation to enhance storytelling and brand messaging

- The rise of streaming platforms, mobile gaming, and digital advertising has further intensified the need for compelling animated visuals

- For instance, in February 2025, as per Vitrina, Mexico's animation industry is gaining global momentum, driven by acclaimed films and the rise of prominent studios such as Televisa, TV Azteca, and Blim TV. With a rich cultural backdrop and an expanding talent pool, the country is becoming a vital hub for high-quality animated content. These studios are increasingly venturing into animation for advertising and gaming, boosting demand and investment in the sector and positioning Mexico as a competitive player in the digital animation market

- Mexican animation studios are responding by upgrading their capabilities and adopting cutting-edge technologies to meet the evolving expectations of clients in entertainment, marketing, and interactive media, fueling steady market growth

Restraint/Challenge

High Production Costs and Limited Access to Advanced Animation Technology

- High production costs and limited access to advanced animation technology act as significant restraints on the growth of the market. Many small and mid-sized studios face financial barriers when investing in the latest animation software, hardware, and production infrastructure, which are essential to meet international quality standards

- The high upfront and maintenance costs associated with these tools can limit the creative and technical capabilities of local creators

- Furthermore, the uneven availability of cutting-edge technology across regions creates disparities in production efficiency and output quality

- These challenges make it difficult for domestic studios to scale operations and compete globally, thereby hindering the overall development of the market

- For instance, in May 2025, according to Yum Digital, the cost of producing animated videos in 2025 ranges from free amateur tools to professional studio productions costing between USD 8,000 and USD 25,000 per minute, depending on complexity and quality

- Despite more affordable options from freelancers and mid-tier studios, the high production costs and limited access to advanced animation technology remain key restraints for the market, restricting smaller studios and emerging talent from fully competing and growing in the global animation space

Digital Animation Market Scope

The market is segmented on the basis of type, deployment mode, marketing channels, application, vertical, end consumers, and animation and media production services type.

- By Type

On the basis of type, the Mexico digital animation market is segmented into 3D animation, 2D animation, motion capture/motion graphics, animation with live action, typography animation, whiteboard animation, rotoscoping, traditional/ handmade/cell animation, stop motion/frame by frame, cutout animation, claymation, and others. The 3D animation segment is expected to dominate the Mexico digital animation market with 25.43% market share in 2025 due to its widespread application in film, advertising, gaming, and virtual production. It offers greater visual realism, flexibility, and scalability compared to traditional formats, making it the preferred choice for studios aiming to meet global production standards.

The 2D animation segment is anticipated to witness the significant growth rate of 7.1% from 2025 to 2032, due to its compatibility with modern rendering tools, VR/AR integration, and international outsourcing demands further solidify its leading position in the market.

- By Deployment Mode

On the basis of deployment mode, the Mexico digital animation market is segmented into cloud based and on-premise. The cloud-based segment is expected to dominate the Mexico digital animation market in 2025 due to its ability to provide scalable infrastructure, remote accessibility, and cost-effective resource allocation for animation studios.

The on-premise segment is expected to witness the significant CAGR from 2025 to 2032, driven by its supports real-time collaboration, faster rendering workflows, and seamless integration with global production pipelines. These advantages are essential for meeting tight deadlines, reducing overhead costs, and enabling small and midsized studios to compete in international markets.

- By Marketing Channels

On the basis of marketing channels, the Mexico digital animation market is segmented into OTT, advertisements, ticket sales, broadcast/satellite rights, comic/manga, and others. The OTT segment is expected to dominate the Mexico digital animation market in 2025 due to its direct to consumer delivery model, growing subscriber base, and increasing demand for on demand animated content.

The advertisements is expected to witness the significant CAGR from 2025 to 2032, favored for its flexibility, content personalization, and rising investment by major OTT providers in original animation further reinforce its leadership in the marketing channel segment.

- By Application

On the basis of application, the Mexico digital animation market is segmented into entertainment, marketing and advertising, gaming, architecture and engineering design, simulations, data visualization, modern arts, and others. The entertainment segment accounted for the largest market revenue share in 2025, driven by the due to its key role in producing animated films, TV shows, and streaming content. Strong investment and high audience demand make it the leading application driving the industry’s growth.

The marketing and advertising segment is expected to witness the significant CAGR from 2025 to 2032, driven by segment’s capacity to generate high audience engagement and revenue makes it the most influential application area within the industry.

- By Vertical

On the basis of vertical, the Mexico digital animation market is segmented into motion picture / film industry, gaming industry, education & academics, healthcare & pharmaceuticals industry, mass consumption, automotive industry, retail & e-commerce industry, real estate sector, government & defence, and others. The motion picture/film industry segment accounted for the largest market revenue share in 2025, due to its extensive use of high quality animation for storytelling, visual effects, and immersive experiences.

The Gaming Industry segment is expected to witness the significant CAGR from 2025 to 2032, driven by strong demand from both domestic and international productions, along with significant investment in cutting edge animation technologies, positions this segment as the primary driver of market growth.

- By End Consumers

On the basis of end consumers, the Mexico digital animation market is segmented into streaming platforms, television channels, advertising agencies, and others. The streaming platforms segment accounted for the largest market revenue share in 2025, driven by its widespread adoption, on demand content access, and personalized viewing experiences.

The television channels segment is expected to witness the significant CAGR from 2025 to 2032, driven by It offers greater convenience and variety compared to traditional television channels and advertising agencies, making it the preferred choice for end consumers seeking animated content.

Digital Animation Market Regional Analysis

- Mexico City is expected to dominate the Mexico digital animation market 30.12% market share in 2025 due to its concentration of major animation studios, skilled talent pool, and access to advanced digital infrastructure

- As the country’s creative and economic hub, it attracts international investment, hosts key industry events, and fosters collaboration between academia, tech firms, and media producers. These factors position Mexico City as the leading province for innovation and production in the animation sector

State of Mexico Digital Animation Market Insight

The State of Mexico is emerging as the fastest-growing province in the Mexico digital animation market with 7.1% CAGR due to its strategic proximity, which facilitates access to major studios, talent, and infrastructure.

The province is experiencing a surge in digital innovation, supported by local government initiatives and educational institutions that are fostering a skilled workforce. In addition, the expansion of streaming platforms and increased demand for localized content are driving investment in animation production within the state, positioning it as a burgeoning hub for digital animation growth.

Digital Animation Market Share

The digital animation market is primarily led by well-established companies, including:

- Epic Games, Inc. (U.S.)

- Universal Studios (U.S.)

- SEGA (Japan)

- Anima Estudios S.A.P.I. de C.V. (Mexico)

- Visualma (Mexico)

- VIDENS (Mexico)

- Casa Anafre | Animation Studio (Mexico)

- Intermedia Digital Studio (Mexico)

- Estudio Haini (Mexico)

- wearehobby (Mexico)

- Chaman Animation Studio (Mexico)

- Morita Creative Studios (Mexico)

- Cinema Fantasma (Mexico)

- EXODO ANIMATION STUDIOS (Mexico)

- Cluster Studio (Mexico)

- Boxel Studio (Mexico)

- Clik Clak Studio (Mexico)

- Sony Pictures Animation Inc. (U.S.)

- Huevocartoon (Mexico)

- Disney Enterprises, Inc. (U.S.)

Latest Developments in Digital Animation Market

- In April 2025, Epic Games acquired Loci, a leader in AI for 3D content tagging and recognition. Loci’s technology enabled automatic, large scale tagging and similarity detection for 3D assets, improving search, discovery, and IP protection. Epic planned to integrate this across Fab and Unreal Editor for Fortnite. The move enhanced Epic’s AI capabilities, streamlined creator workflows, and strengthened its 3D content ecosystem

- In October 2024, Epic Games partnered with Qualcomm Technologies to integrate Unreal Engine into the Snapdragon Cockpit Platform for the first time. This pre integrated solution gave automakers exclusive access to advance in cabin visualization tools. The collaboration enabled high quality, customizable user interfaces and faster development. Epic Games expanded Unreal Engine's reach into automotive tech, boosting its real-time 3D application across industries

- In March 2025, Boxel Studio partnered with Wonder Dynamics to integrate their AI-powered markerless motion capture technology into the production of Superman & Lois. This collaboration allowed Boxel to streamline their animation pipeline, reducing turnaround times from weeks to days while maintaining high-quality results. The partnership combined Boxel’s creative expertise with Wonder Dynamics’ cutting-edge machine learning tools, enabling more efficient workflows and greater flexibility in animating complex digital characters. Together, they demonstrated how innovation and teamwork can transform visual effects production under challenging industry conditions

- In July 2023, Cluster Studio upgraded its Baselight TWO systems to boost efficiency and support its expansion into the entertainment market. The Mexico-based post-production studio enhanced its services with end to end solutions including DI, color grading, VFX, and editing. The upgrade tripled storage capacity and streamlined 4K/HDR workflows. This investment strengthened Cluster’s position in Latin America and enabled collaboration with major platforms like Netflix and Amazon

- In December 2023, Epic Games launched three new experiences in Fortnite: LEGO Fortnite, Rocket Racing, and Fortnite Festival. LEGO Fortnite, developed with The LEGO Group, offered a survival crafting adventure; Rocket Racing, built by Psyonix, introduced arcade racing; and Fortnite Festival, from Harmonix, brought music gameplay. These launches expanded Fortnite’s ecosystem, attracting diverse audiences and boosting engagement across gaming, racing, and music communities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MEXICO DIGITAL ANIMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END CONSUMERS COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PENETRATION AND GROWTH PROSPECT MAPPING

4.3 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES

4.4 DIGITAL ANIMATION TRENDS

4.5 MARKET ACCESS REQUIREMENTS FOR ANIMATION MARKET

4.5.1 MARKET REGULATIONS NEEDED FOR DIGITAL ANIMATION MARKET

4.5.2 DEMAND ANALYSIS OF ANIMATION MARKET

4.6 CONSUMER BEHAVIOR

4.6.1 BUYING PATTERN

4.6.2 USES ANALYSIS

4.7 IMPORTANT PLAYERS IN THE DIGITAL ANIMATION ECOSYSTEM IN MEXICO

4.7.1 CONCLUSION

4.8 PRICING ANALYSIS

4.9 PRODUCTION AND SERVICE COSTS IN THE DIGITAL ANIMATION INDUSTRY (COSTS PER MAN-HOUR)

4.9.1 OVERVIEW

4.1 TECHNICAL AND QUALITY REQUIREMENTS DEMANDED BY THE MEXICAN MARKET

4.11 OPPORTUNITIES FOR PARTNERSHIPS WITH MEXICAN INSTITUTIONS IN THE MEXICO DIGITAL ANIMATION MARKET

4.12 KEY STUDIOS AND COMPANIES IN DIGITAL ANIMATION

4.13 COMPANIES IN MEXICO (PRODUCTION COMPANIES, ADVERTISING AGENCIES, AMONG OTHERS) THAT USE OR CONTRACT SERVICES FROM

4.14 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.15 TECHNOLOGY ANALYSIS

4.16 CHALLENGES

4.16.1 INADEQUATE ACCESS TO DOMESTIC FUNDING AND FINANCIAL SUPPORT

4.16.2 LACK OF GLOBAL PRESENCE AND RECOGNITION

4.16.3 INDUSTRY FRAGMENTATION AND WEAK COLLABORATIVE NETWORKS

4.16.4 CULTURAL AND LANGUAGE BARRIERS TO INTERNATIONAL SUCCESS

4.17 INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

4.17.1 CUSTOMER BASE

4.18 FUNDING DETAILS—INVESTOR DETAILS, REASON OF INVESTMENT FROM INVESTOR

5 REGULATORY STANDARDS

5.1 MEXICO DIGITAL ANIMATION MARKET – REGULATORY STANDARDS OVERVIEW

6 TARIFFS & IMPACT ON THE MEXICO DIGITAL ANIMATION MARKET

6.1 OVERVIEW

6.2 TARIFF STRUCTURES

6.2.1 GLOBAL VS. REGIONAL TARIFF STRUCTURES

6.2.2 MEXICO: ICT TARIFF POLICIES

6.3 EMERGING MARKETS: CHALLENGES IN TARIFF IMPLEMENTATION

6.4 IMPACT OF COSTS ON DIGITAL COMPONENTS

6.5 MARKET DISRUPTIONS

6.6 UNCERTAINTY AND INVESTMENT

6.7 IMPACT ON INNOVATION

6.8 COMPETITION AND MARKET DYNAMICS

6.9 EFFECT ON SMALL AND MEDIUM ENTERPRISES (SMES)

6.1 DEPLOYMENT OF DIGITAL COMPONENTS

6.11 STRATEGIC RESPONSES AND INDUSTRY OUTLOOK

6.12 ADVOCACY FOR POLICY ADJUSTMENTS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR HIGH-QUALITY ANIMATED CONTENT IN FILMS, ADVERTISING, AND GAMING

7.1.2 RISING INVESTMENTS IN DIGITAL MEDIA AND ENTERTAINMENT INDUSTRIES

7.1.3 EXPANSION OF STREAMING PLATFORMS INCREASING THE NEED FOR ORIGINAL ANIMATED CONTENT

7.1.4 TECHNOLOGICAL ADVANCEMENTS IN ANIMATION SOFTWARE AND TOOLS

7.2 RESTRAINTS

7.2.1 HIGH PRODUCTION COSTS AND LIMITED ACCESS TO ADVANCED ANIMATION TECHNOLOGY

7.2.2 REGULATORY AND BUREAUCRATIC HURDLES FOR MEDIA AND ENTERTAINMENT BUSINESSES

7.3 OPPORTUNITIES

7.3.1 RISING DEMAND FOR EDUCATIONAL AND E-LEARNING CONTENT USING ANIMATED FORMATS

7.3.2 INCREASING COLLABORATION BETWEEN INTERNATIONAL STUDIOS AND LOCAL MEXICAN ANIMATION HOUSES

7.3.3 GROWING POPULARITY OF LATIN AMERICAN STORYTELLING AND CULTURAL REPRESENTATION IN GLOBAL CONTENT

7.4 CHALLENGES

7.4.1 SHORTAGE OF SKILLED PROFESSIONALS AND SPECIALIZED TRAINING PROGRAMS

7.4.2 INTELLECTUAL PROPERTY PROTECTION AND PIRACY CONCERNS

8 MEXICO DIGITAL ANIMATION MARKET, BY TYPE

8.1 OVERVIEW

8.2 3D ANIMATION

8.2.1 CGI

8.2.2 MODELING AND SCULPTING

8.2.3 VIRTUAL REALITY

8.2.4 OTHERS

8.3 2D ANIMATION

8.4 MOTION CAPTURE/MOTION GRAPHICS

8.5 ANIMATION WITH LIVE ACTION

8.6 TYPOGRAPHY ANIMATION

8.7 WHITEBOARD ANIMATION

8.8 ROTOSCOPING

8.8.1 DIGITAL

8.8.2 VECTOR

8.8.3 OTHERS

8.9 TRADITIONAL/HANDMADE/CELL ANIMATION

8.1 STOP MOTION/FRAME BY FRAME

8.11 CUTOUT ANIMATION

8.12 CLAYMATION

8.12.1 SILICON

8.12.2 CLAY

8.12.3 GO MOTION

8.12.4 OTHER

8.13 OTHERS

9 MEXICO DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE

9.1 OVERVIEW

9.2 CLOUD BASED

9.3 ON PREMISE

10 MEXICO DIGITAL ANIMATION MARKET, MARKETING CHANNELS

10.1 OVERVIEW

10.2 OTT

10.3 ADVERTISEMENTS

10.4 TICKET SALES

10.5 BROADCAST/SATELLITE RIGHTS

10.6 COMIC/MANGA

10.7 OTHERS

11 MEXICO DIGITAL ANIMATION MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ENTERTAINMENT

11.3 MARKETING AND ADVERTISING

11.4 GAMING

11.5 ARCHITECTURE AND ENGINEERING DESIGN

11.6 SIMULATIONS

11.7 DATA VISUALIZATION

11.8 MODERN ARTS

11.9 OTHERS

12 MEXICO DIGITAL ANIMATION MARKET, BY VERTICAL

12.1 OVERVIEW

12.2 MOTION PICTURE/FILM INDUSTRY

12.2.1 MOTION CAPTURE/MOTION GRAPHICS

12.2.2 2D ANIMATION

12.2.3 3D ANIMATION

12.2.4 TYPOGRAPHY ANIMATION

12.2.5 ROTOSCOPING

12.2.6 STOP MOTION/CUTOUT ANIMATION

12.2.7 CLAYMATION

12.2.8 WHITEBOARD ANIMATION

12.2.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.2.10 OTHERS

12.3 GAMING INDUSTRY

12.3.1 3D ANIMATION

12.3.2 2D ANIMATION

12.3.3 MOTION CAPTURE/MOTION GRAPHICS

12.3.4 TYPOGRAPHY ANIMATION

12.3.5 WHITEBOARD ANIMATION

12.3.6 ROTOSCOPING

12.3.7 STOP MOTION/CUTOUT ANIMATION

12.3.8 CLAYMATION

12.3.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.3.10 OTHERS

12.4 EDUCATION & ACADEMICS

12.4.1 2D ANIMATION

12.4.2 WHITEBOARD ANIMATION

12.4.3 3D ANIMATION

12.4.4 MOTION CAPTURE/MOTION GRAPHICS

12.4.5 TYPOGRAPHY ANIMATION

12.4.6 ROTOSCOPING

12.4.7 STOP MOTION/CUTOUT ANIMATION

12.4.8 CLAYMATION

12.4.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.4.10 OTHERS

12.5 HEALTHCARE & PHARMACEUTICALS INDUSTRY

12.5.1 2D ANIMATION

12.5.2 WHITEBOARD ANIMATION

12.5.3 3D ANIMATION

12.5.4 MOTION CAPTURE/MOTION GRAPHICS

12.5.5 TYPOGRAPHY ANIMATION

12.5.6 ROTOSCOPING

12.5.7 STOP MOTION/CUTOUT ANIMATION

12.5.8 CLAYMATION

12.5.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.5.10 OTHERS

12.6 MASS CONSUMPTION

12.6.1 2D ANIMATION

12.6.2 MOTION CAPTURE/MOTION GRAPHICS

12.6.3 TYPOGRAPHY ANIMATION

12.6.4 ROTOSCOPING

12.6.5 STOP MOTION/CUTOUT ANIMATION

12.6.6 CLAYMATION

12.6.7 3D ANIMATION

12.6.8 WHITEBOARD ANIMATION

12.6.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.6.10 OTHERS

12.7 AUTOMOTIVE INDUSTRY

12.7.1 2D ANIMATION

12.7.2 MOTION CAPTURE/MOTION GRAPHICS

12.7.3 TYPOGRAPHY ANIMATION

12.7.4 WHITEBOARD ANIMATION

12.7.5 3D ANIMATION

12.7.6 ROTOSCOPING

12.7.7 STOP MOTION/CUTOUT ANIMATION

12.7.8 CLAYMATION

12.7.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.7.10 OTHERS

12.8 RETAIL & E-COMMERCE INDUSTRY

12.8.1 2D ANIMATION

12.8.2 3D ANIMATION

12.8.3 MOTION CAPTURE/MOTION GRAPHICS

12.8.4 TYPOGRAPHY ANIMATION

12.8.5 WHITEBOARD ANIMATION

12.8.6 ROTOSCOPING

12.8.7 STOP MOTION/CUTOUT ANIMATION

12.8.8 CLAYMATION

12.8.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.8.10 OTHERS

12.9 REAL ESTATE SECTOR

12.9.1 3D ANIMATION

12.9.2 2D ANIMATION

12.9.3 MOTION CAPTURE/MOTION GRAPHICS

12.9.4 TYPOGRAPHY ANIMATION

12.9.5 WHITEBOARD ANIMATION

12.9.6 ROTOSCOPING

12.9.7 STOP MOTION/CUTOUT ANIMATION

12.9.8 CLAYMATION

12.9.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.9.10 OTHERS

12.1 GOVERNMENT & DEFENSE

12.10.1 2D ANIMATION

12.10.2 MOTION CAPTURE/MOTION GRAPHICS

12.10.3 TYPOGRAPHY ANIMATION

12.10.4 WHITEBOARD ANIMATION

12.10.5 3D ANIMATION

12.10.6 ROTOSCOPING

12.10.7 STOP MOTION/CUTOUT ANIMATION

12.10.8 CLAYMATION

12.10.9 TRADITIONAL/HANDMADE/CELL ANIMATION

12.10.10 OTHERS

12.11 OTHERS

13 MEXICO DIGITAL ANIMATION MARKET, END CONSUMERS

13.1 OVERVIEW

13.2 STREAMING PLATFORMS

13.3 TELEVISION CHANNELS

13.4 ADVERTISING AGENCIES

13.5 OTHERS

14 MEXICO DIGITAL ANIMATION MARKET, ANIMATION AND MEDIA PRODUCTION SERVICES TYPE

14.1 OVERVIEW

14.2 2D AND 3D ANIMATION SERVICES

14.2.1 2D & 3D ANIMATION VIDEOS

14.2.1.1 SERIES

14.2.1.2 FILMS

14.2.1.3 SHORT FILMS

14.2.1.4 MUSIC VIDEOS

14.2.2 2D & 3D ANIMATION ADVERTISING

14.2.3 PRODUCT MODELING SERVICES

14.2.4 CHARACTER DESIGN

14.2.5 VIRTUAL REALITY (VR)/AUGMENTED REALITY (AR)

14.2.6 OTHERS

14.3 POST-PRODUCTION AND VISUAL EFFECTS (VFX)

14.4 PRE-PRODUCTION AND CONCEPT DEVELOPMENT

14.4.1 STORYBOARDS AND ANIMATICS

14.4.2 CONCEPT DESIGN AND SCRIPT VISUALIZATION

14.4.3 E-LEARNING VIDEO CONCEPTS AND STRUCTURE

14.5 VIDEO PRODUCTION AND DIGITAL MEDIA

14.5.1 VIDEO PRODUCTION AND DIGITAL MEDIA

14.5.1.1 ADS

14.5.1.2 BRANDING

14.5.1.3 EDUCATIONAL CONTENT

14.5.1.4 OTHERS

14.5.2 DIGITAL MARKETING CONTENT CREATION

14.5.3 PACKAGING DESIGN

14.5.4 OTHERS

14.6 AUDIO PRODUCTION AND SOUND DESIGN

14.6.1 AUDIO POST-PRODUCTION (MIXING & MASTERING)

14.6.2 DUBBING OF FILMS

14.6.3 MUSIC PRODUCTION AND SOUND DESIGN

14.6.4 OTHERS

14.7 OTHERS

15 MEXICO DIGITAL ANIMATION MARKET COUNTRY

15.1 MEXICO

15.1.1 MEXICO CITY

15.1.2 STATE OF MEXICO

15.1.3 NUEVO LEÓN

15.1.4 JALISCO

15.1.5 VERACRUZ

15.1.6 GUANAJUATO

15.1.7 BAJA CALIFORNIA

15.1.8 SONORA

15.1.9 CHIHUAHUA

15.1.10 REST OF MEXICO

16 MEXICO DIGITAL ANIMATION MARKET

16.1 COMPANY SHARE ANALYSIS: MEXICO

17 SWOT ANALYSIS

18 COMPANY PROFILES

18.1 EPIC GAMES, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 SERVICE PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.1.4 MARKETING CHANNEL BENCHMARKING

18.2 UNIVERSAL STUDIOS

18.2.1 COMPANY SNAPSHOT

18.2.2 SERVICE PORTFOLIO

18.2.3 RECENT DEVELOPMENT

18.2.4 MARKETING CHANNEL BENCHMARKING

18.3 SEGA

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 SERVICE PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.3.5 MARKETING CHANNEL BENCHMARKING

18.4 ANIMA ESTUDIOS S.A.P.I. DE C.V

18.4.1 COMPANY SNAPSHOT

18.4.2 SERVICE PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.4.4 MARKETING CHANNEL BENCHMARKING

18.5 VISUALMA

18.5.1 COMPANY SNAPSHOT

18.5.2 SERVICE PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.5.4 MARKETING CHANNEL BENCHMARKING

18.6 BOXEL STUDIO

18.6.1 COMPANY SNAPSHOT

18.6.2 SERVICE PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.6.4 MARKETING CHANNEL BENCHMARKING

18.7 CASA ANAFRE | ANIMATION STUDIO

18.7.1 COMPANY SNAPSHOT

18.7.2 SERVICE PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.7.4 MARKETING CHANNEL BENCHMARKING

18.8 CHAMAN ANIMATION STUDIO

18.8.1 COMPANY SNAPSHOT

18.8.2 SERVICE PORTFOLIO

18.8.3 RECENT DEVELOPMENT/NEWS

18.8.4 MARKETING CHANNEL BENCHMARKING

18.9 CINEMA FANTASMA

18.9.1 COMPANY SNAPSHOT

18.9.2 SERVICE PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.9.4 MARKETING CHANNEL BENCHMARKING

18.1 CLIK CLAK STUDIO

18.10.1 COMPANY SNAPSHOT

18.10.2 SERVICE PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.10.4 MARKETING CHANNEL BENCHMARKING

18.11 CLUSTER STUDIO

18.11.1 COMPANY SNAPSHOT

18.11.2 SERVICE PORTFOLIO

18.11.3 RECENT DEVELOPMENT

18.11.4 MARKETING CHANNEL BENCHMARKING

18.12 DISNEY ENTERPRISES, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 SERVICE PORTFOLIO

18.12.3 RECENT NEWS

18.12.4 MARKETING CHANNEL BENCHMARKING

18.13 ESTUDIO HAINI

18.13.1 COMPANY SNAPSHOT

18.13.2 SERVICE PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.13.4 MARKETING CHANNEL BENCHMARKING

18.14 EXODO ANIMATION STUDIOS

18.14.1 COMPANY SNAPSHOT

18.14.2 SERVICE PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.14.4 MARKETING CHANNEL BENCHMARKING

18.15 HUEVOCARTOON

18.15.1 COMPANY SNAPSHOT

18.15.2 SERVICE PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.15.4 MARKETING CHANNEL BENCHMARKING

18.16 INTERMEDIA DIGITAL STUDIO

18.16.1 COMPANY SNAPSHOT

18.16.2 SERVICE PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.16.4 MARKETING CHANNEL BENCHMARKING

18.17 MORITA CREATIVE STUDIO

18.17.1 COMPANY SNAPSHOT

18.17.2 SERVICE PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 MARKETING CHANNEL BENCHMARKING

18.18 SONY PICTURES ANIMATION INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 SERVICE PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.18.4 MARKETING CHANNEL BENCHMARKING

18.19 VIDENS

18.19.1 COMPANY SNAPSHOT

18.19.2 SERVICE PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.19.4 MARKETING CHANNEL BENCHMARKING

18.2 WEAREHOBBY

18.20.1 COMPANY SNAPSHOT

18.20.2 SERVICE PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.20.4 MARKETING CHANNEL BENCHMARKING

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 NEW BUSINESS AND EMERGING BUSINESS REVENUE OPPORTUNITIES

TABLE 2 MARKET REGULATIONS NEEDED FOR DIGITAL ANIMATION MARKET

TABLE 3 SUPPLIER ANALYSIS

TABLE 4 KEY USE CASES ANALYSIS IN MEXICO

TABLE 5 THE FOLLOWING TABLE SUMMARIZES THE KEY INFORMATION ABOUT IMPORTANT PLAYERS IN THE DIGITAL ANIMATION ECOSYSTEM IN MEXICO:

TABLE 6 PRICING PER MINUTE BY ANIMATION TYPE

TABLE 7 PRICING AND ESTIMATED COST PER MAN-HOUR BY ANIMATION TYPE

TABLE 8 KEY STUDIOS AND COMPANIES IN DIGITAL ANIMATION

TABLE 9 COMPANIES IN MEXICO (PRODUCTION COMPANIES, ADVERTISING AGENCIES, AMONG OTHERS) THAT USE OR CONTRACT SERVICES FROM

TABLE 10 TECHNOLOGY MATRIX

TABLE 11 SERVICE PLATFORM MATRIX

TABLE 12 COMPANY COMPARATIVE ANALYSIS

TABLE 13 COMPANY SERVICE PLATFORM MATRIX

TABLE 14 USE CASES & ANALYSIS OF KEY COMPANIES IN THE MEXICO DIGITAL ANIMATION MARKET

TABLE 15 FUNDING & INVESTOR OVERVIEW

TABLE 16 REGULATORY STANDARDS TABLE

TABLE 17 PRODUCTION PRICE COMPARISON OF COMPANIES

TABLE 18 MEXICO DIGITAL ANIMATION MARKET: BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 MEXICO 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 22 MEXICO DIGITAL ANIMATION MARKET: BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 23 MEXICO DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 24 MEXICO DIGITAL ANIMATION MARKET: BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 MEXICO DIGITAL ANIMATION MARKET: BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 26 MEXICO MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 MEXICO GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MEXICO EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 MEXICO HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MEXICO MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 MEXICO AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MEXICO RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 33 MEXICO REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MEXICO GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 MEXICO DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 36 MEXICO DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 MEXICO 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 MEXICO 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 MEXICO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO DIGITAL ANIMATION MARKET, BY PROVINCES, 2018-2032 (USD THOUSAND)

TABLE 44 MEXICO CITY DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO CITY 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO CITY ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO CITY CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO CITY DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO CITY DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 50 MEXICO CITY DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 MEXICO CITY DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 52 MEXICO CITY MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 MEXICO CITY GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MEXICO CITY EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 MEXICO CITY HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO CITY MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 MEXICO CITY AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO CITY RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO CITY REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO CITY GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO CITY DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO CITY DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 MEXICO CITY 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 MEXICO CITY 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 MEXICO CITY PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 MEXICO CITY VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 MEXICO CITY VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 MEXICO CITY AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 STATE OF MEXICO 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 STATE OF MEXICO ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 STATE OF MEXICO CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 74 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 75 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 77 STATE OF MEXICO MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 STATE OF MEXICO GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 STATE OF MEXICO EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 STATE OF MEXICO HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 STATE OF MEXICO MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 STATE OF MEXICO AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 STATE OF MEXICO RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 STATE OF MEXICO REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 STATE OF MEXICO GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 87 STATE OF MEXICO DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 STATE OF MEXICO 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 STATE OF MEXICO 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 STATE OF MEXICO PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 STATE OF MEXICO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 STATE OF MEXICO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 STATE OF MEXICO AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 NUEVO LEÓN 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 NUEVO LEÓN ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 NUEVO LEÓN CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 99 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 100 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 101 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 102 NUEVO LEÓN MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 NUEVO LEÓN GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 NUEVO LEÓN EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 NUEVO LEÓN HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 NUEVO LEÓN MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 NUEVO LEÓN AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 NUEVO LEÓN RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 NUEVO LEÓN REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NUEVO LEÓN GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 112 NUEVO LEÓN DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 NUEVO LEÓN 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NUEVO LEÓN 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 NUEVO LEÓN PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 NUEVO LEÓN VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NUEVO LEÓN VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NUEVO LEÓN AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 JALISCO DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 JALISCO 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 JALISCO ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 JALISCO CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 JALISCO DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 124 JALISCO DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 125 JALISCO DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 126 JALISCO DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 127 JALISCO MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 JALISCO GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 JALISCO EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 JALISCO HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 JALISCO MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 JALISCO AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 JALISCO RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 JALISCO REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 JALISCO GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 JALISCO DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 137 JALISCO DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 JALISCO 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 JALISCO 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 JALISCO PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 JALISCO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 JALISCO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 JALISCO AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 VERACRUZ DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 VERACRUZ 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 VERACRUZ ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 VERACRUZ CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 VERACRUZ DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 149 VERACRUZ DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 150 VERACRUZ DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 VERACRUZ DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 152 VERACRUZ MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 VERACRUZ GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 VERACRUZ EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 VERACRUZ HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 VERACRUZ MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 VERACRUZ AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 VERACRUZ RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 VERACRUZ REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 VERACRUZ GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 VERACRUZ DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 162 VERACRUZ DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 VERACRUZ 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 VERACRUZ 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 VERACRUZ PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 VERACRUZ VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 VERACRUZ VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 VERACRUZ AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 GUANAJUATO DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 GUANAJUATO 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 GUANAJUATO ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 GUANAJUATO CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 GUANAJUATO DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 174 GUANAJUATO DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 175 GUANAJUATO DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 176 GUANAJUATO DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 177 GUANAJUATO MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 GUANAJUATO GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 GUANAJUATO EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 GUANAJUATO HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 GUANAJUATO MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 GUANAJUATO AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 GUANAJUATO RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 GUANAJUATO REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 GUANAJUATO GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 GUANAJUATO DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 187 GUANAJUATO DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 GUANAJUATO 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 GUANAJUATO 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 GUANAJUATO PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 GUANAJUATO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 GUANAJUATO VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 GUANAJUATO AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 BAJA CALIFORNIA 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 BAJA CALIFORNIA ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 BAJA CALIFORNIA CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 199 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 200 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 201 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 202 BAJA CALIFORNIA MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 BAJA CALIFORNIA GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 BAJA CALIFORNIA EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 BAJA CALIFORNIA HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 BAJA CALIFORNIA MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 BAJA CALIFORNIA AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 BAJA CALIFORNIA RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 BAJA CALIFORNIA REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 210 BAJA CALIFORNIA GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 211 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 212 BAJA CALIFORNIA DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 BAJA CALIFORNIA 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 BAJA CALIFORNIA 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 BAJA CALIFORNIA PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 BAJA CALIFORNIA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 BAJA CALIFORNIA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 BAJA CALIFORNIA AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 SONORA DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 SONORA 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 SONORA ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 SONORA CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 SONORA DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 224 SONORA DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 225 SONORA DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 226 SONORA DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 227 SONORA MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 SONORA GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 SONORA EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 SONORA HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 SONORA MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 SONORA AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 SONORA RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 SONORA REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 SONORA GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 236 SONORA DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 237 SONORA DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 238 SONORA 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 239 SONORA 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 SONORA PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 SONORA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 SONORA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 SONORA AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 CHIHUAHUA DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 CHIHUAHUA 3D ANIMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 CHIHUAHUA ROTOSCOPING IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 CHIHUAHUA CLAYMATION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 CHIHUAHUA DIGITAL ANIMATION MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 249 CHIHUAHUA DIGITAL ANIMATION MARKET, BY MARKETING CHANNELS, 2018-2032 (USD THOUSAND)

TABLE 250 CHIHUAHUA DIGITAL ANIMATION MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 251 CHIHUAHUA DIGITAL ANIMATION MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 252 CHIHUAHUA MOTION PICTURE/FILM INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 CHIHUAHUA GAMING INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 CHIHUAHUA EDUCATION & ACADEMICS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 CHIHUAHUA HEALTHCARE & PHARMACEUTICALS INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 CHIHUAHUA MASS CONSUMPTION IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 CHIHUAHUA AUTOMOTIVE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 CHIHUAHUA RETAIL & E-COMMERCE INDUSTRY IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 CHIHUAHUA REAL ESTATE SECTOR IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 CHIHUAHUA GOVERNMENT & DEFENSE IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 CHIHUAHUA DIGITAL ANIMATION MARKET, BY END CONSUMERS, 2018-2032 (USD THOUSAND)

TABLE 262 CHIHUAHUA DIGITAL ANIMATION MARKET, BY ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2018-2032 (USD THOUSAND)

TABLE 263 CHIHUAHUA 2D AND 3D ANIMATION SERVICES IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 CHIHUAHUA 2D & 3D ANIMATION VIDEOS IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 CHIHUAHUA PRE-PRODUCTION AND CONCEPT DEVELOPMENT IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 266 CHIHUAHUA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 CHIHUAHUA VIDEO PRODUCTION AND DIGITAL MEDIA IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 CHIHUAHUA AUDIO PRODUCTION AND SOUND DESIGN IN DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 REST OF MEXICO DIGITAL ANIMATION MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO DIGITAL ANIMATION MARKET: SEGMENTATION

FIGURE 2 MEXICO DIGITAL ANIMATION MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO DIGITAL ANIMATION MARKET: DROC ANALYSIS

FIGURE 4 MEXICO DIGITAL ANIMATION MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 MEXICO DIGITAL ANIMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO DIGITAL ANIMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MEXICO DIGITAL ANIMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MEXICO DIGITAL ANIMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MEXICO DIGITAL ANIMATION MARKET: MULTIVARIATE MODELING

FIGURE 10 MEXICO DIGITAL ANIMATION MARKET: TYPE TIMELINE CURVE

FIGURE 11 MEXICO DIGITAL ANIMATION MARKET: END CONSUMERS COVERAGE GRID

FIGURE 12 MEXICO DIGITAL ANIMATION MARKET: SEGMENTATION

FIGURE 13 TWELVE SEGMENTS COMPRISE THE MEXICO DIGITAL ANIMATION MARKET, BY TYPE (2024)

FIGURE 14 MEXICO DIGITAL ANIMATION MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING DEMAND FOR HIGH-QUALITY ANIMATED CONTENT IN FILMS, ADVERTISING, AND GAMING IS EXPECTED TO DRIVE THE MEXICO DIGITAL ANIMATION MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 3D ANIMATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO DIGITAL ANIMATION MARKET IN 2025 & 2032

FIGURE 18 MARKET DEMAND SHARE BY ORIGINAL AND STREAMING PLATFORM, DEMAND SHARE 2021

FIGURE 19 GLOBAL EXPORTS OF CREATIVE GOODS AND SERVICES IN 2018-2020

FIGURE 20 WORLD CREATIVE SERVICES EXPORTS BY SERVICES CATEGORY, 2018-2022

FIGURE 21 DROC ANALYSIS

FIGURE 22 MEXICO DIGITAL ANIMATION MARKET: BY TYPE, 2024

FIGURE 23 MEXICO DIGITAL ANIMATION MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 24 MEXICO DIGITAL ANIMATION MARKET: MARKETING CHANNELS, 2024

FIGURE 25 MEXICO DIGITAL ANIMATION MARKET: BY APPLICATION, 2024

FIGURE 26 MEXICO DIGITAL ANIMATION MARKET: BY VERTICAL, 2024

FIGURE 27 MEXICO DIGITAL ANIMATION MARKET: END CONSUMERS, 2024

FIGURE 28 MEXICO DIGITAL ANIMATION MARKET: ANIMATION AND MEDIA PRODUCTION SERVICES TYPE, 2024

FIGURE 29 MEXICO DIGITAL ANIMATION MARKET, SNAPSHOT 2024

FIGURE 30 MEXICO DIGITAL ANIMATION MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.