Middle East And Africa Dairy Alternative Market

Market Size in USD Million

CAGR :

%

USD

837.50 Million

USD

2,207.90 Million

2024

2032

USD

837.50 Million

USD

2,207.90 Million

2024

2032

| 2025 –2032 | |

| USD 837.50 Million | |

| USD 2,207.90 Million | |

|

|

|

|

Middle East and Africa Dairy Alternative Market Size

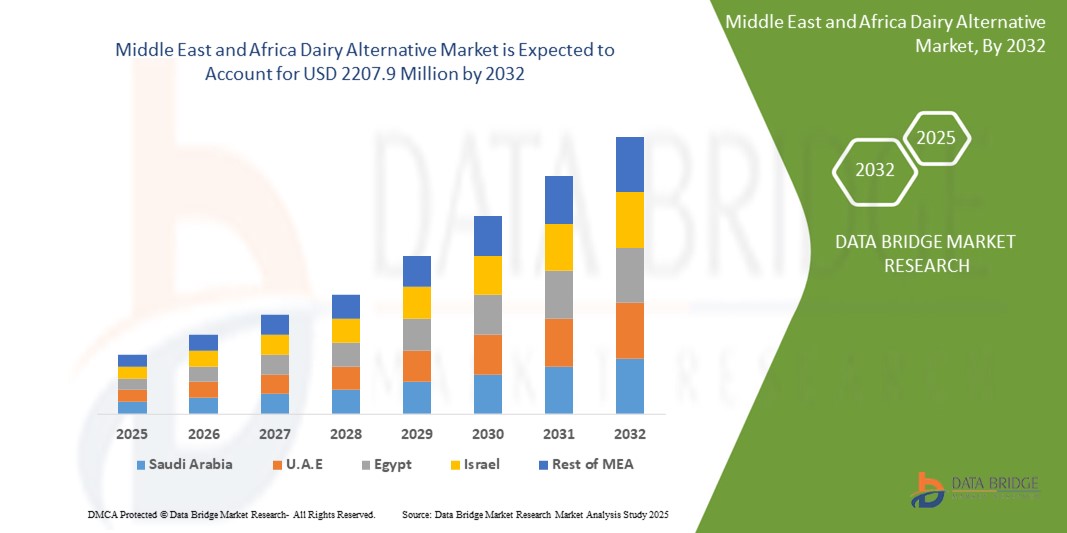

- The Middle East and Africa Dairy Alternative Market size was valued at USD 837.5 million in 2024 and is expected to reach USD 2,207.9 million by 2032, at a CAGR of 12.9% during the forecast period

- The market growth is largely fueled by the rapid demand for dairy alternative products in the region, driven by increasing awareness of lactose intolerance and dairy allergies, alongside a growing adoption of vegan and plant-based diets

- Furthermore, evolving lifestyles, increasing environmental concerns, and a rising focus on health and wellness are establishing dairy alternatives as a preferred choice for consumers seeking nutritious and sustainable options. These converging factors are accelerating the uptake of dairy alternative solutions, thereby significantly boosting the industry's growth

Middle East and Africa Dairy Alternative Market Analysis

- Dairy alternatives, encompassing plant-based substitutes for traditional milk, cheese, yogurt, and other dairy products, are increasingly vital components of modern diets in both residential and commercial settings due to their enhanced health benefits, suitability for lactose intolerance, and alignment with growing ethical and environmental concerns

- The escalating demand for dairy alternatives is primarily fueled by the widespread recognition of lactose intolerance and dairy allergies among consumers, a rising adoption of vegan and plant-based diets, and a growing preference for products that offer health benefits such as lower cholesterol and fat content

- South Africa is a prominent market within the Middle East and Africa, characterized by increasing consumer awareness regarding product benefits and rising demand for plant-derived products. The market in the region is experiencing substantial growth, driven by innovations from both established food companies and startups focusing on diversified product offerings and improved taste and texture

- The Middle East and Africa is expected to be one of the fastest-growing regions in the dairy alternative market during the forecast period due to increasing urbanization, rising disposable incomes, and a growing focus on health and wellness

- The Soy Milk segment dominates the Middle East and Africa dairy alternative market with a significant market share in 2024, driven by its established availability, high protein content, and long-standing use as a dairy substitute, particularly favored by lactose-intolerant and vegan consumers in the region

Report Scope and Middle East and Africa Dairy Alternative Market Segmentation

|

Attributes |

Ophthalmic Operational Microscope Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Middle East and Africa Dairy Alternative Market Trends

"Product Diversification and Fortification for Enhanced Nutritional Profiles"

- A significant and accelerating trend in the Middle East and Africa dairy alternative market is the deepening focus on product diversification and the fortification of existing offerings to enhance nutritional profiles and cater to a wider range of consumer preferences. This evolution is driven by consumer demand for healthier options and a desire for plant-based products that can effectively replace the nutritional value of traditional dairy

- For instance, brands are increasingly introducing a variety of dairy alternative types beyond traditional soy milk, such as almond milk, oat milk, coconut milk, and rice milk, each offering distinct taste profiles and nutritional benefits. Similarly, manufacturers are fortifying these products with essential vitamins and minerals like calcium and Vitamin D, to ensure they align with health-conscious consumer expectations and provide comprehensive nutritional support

- Innovation in flavors and textures is also a key aspect of this trend. Companies are developing new and exciting flavors to appeal to diverse palates in the region, while also working to achieve textures that closely mimic traditional dairy products, thereby improving consumer acceptance and satisfaction. This helps overcome the "taste and texture" challenge that some consumers initially associate with dairy alternatives

- The seamless integration of these diversified and fortified products into daily diets is further facilitated by their increasing availability across various retail channels, including supermarkets, hypermarkets, and online platforms. This broad accessibility, coupled with continuous product innovation, ensures that consumers can easily find dairy alternatives that meet their specific dietary needs and preferences

- This trend towards more nutritious, diverse, and accessible dairy alternative products is fundamentally reshaping consumer perceptions of plant-based options. Consequently, companies are actively investing in R&D to introduce novel formulations, focusing on aspects like gut health, protein content, and reduced sugar to align with evolving health trends

- The demand for dairy alternatives that offer enhanced nutritional value and a wider variety of choices is growing rapidly across the Middle East and Africa, as consumers increasingly prioritize health, wellness, and sustainable dietary options

Middle East and Africa Dairy Alternative Market Dynamics

Drivers

"Increasing Health Consciousness and Dietary Preferences"

- The increasing prevalence of health-conscious consumers and evolving dietary preferences, such as the growing adoption of plant-based and vegan diets, is a significant driver for the heightened demand for dairy alternatives in the Middle East and Africa

- For instance, in May 2024, a leading regional supermarket chain in the UAE expanded its dedicated "Plant-Based & Wellness" aisle, significantly increasing its offering of dairy-free milks, yogurts, and cheeses, reflecting a direct response to consumer demand for healthier options. Such strategies by key retailers and food manufacturers are expected to drive the dairy alternative industry growth in the forecast period

- As consumers become more aware of the health benefits associated with dairy-free products, such as reduced lactose intake, lower cholesterol, and fewer allergens, they are increasingly seeking alternatives to traditional dairy

- Furthermore, the rising popularity of various diets, including veganism, vegetarianism, and flexitarians, is making dairy alternatives an integral component of daily nutrition. These products offer seamless integration into existing culinary practices and provide suitable options for individuals with lactose intolerance or dairy allergies

- The convenience of readily available plant-based milks for cereals, coffee, and cooking, coupled with the expanding variety of dairy-free yogurts, cheeses, and ice creams, are key factors propelling the adoption of dairy alternatives in both retail and foodservice sectors. The trend towards sustainable and ethically produced food options further contributes to market growth

Restraint/Challenge:

"Consumer Preference for Traditional Dairy and Perceived High Cost"

- Concerns surrounding the deeply ingrained consumer preference for traditional dairy products, coupled with the perceived high initial cost of some dairy alternative products, pose a significant challenge to broader market penetration in the Middle East and Africa

- For instance, cultural culinary traditions in many MEA countries heavily rely on dairy products like milk, yogurt, and cheese, making it difficult to shift consumer habits. High-profile reports on the taste or texture differences of early dairy alternatives have made some consumers hesitant to adopt these new products

- Addressing these challenges through continuous product innovation that improves taste, texture, and nutritional parity with traditional dairy is crucial for building consumer trust

- Companies are actively investing in R&D to develop more palatable and versatile dairy alternative products. Additionally, the relatively higher initial cost of some dairy alternative products compared to traditional dairy can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or for budget-conscious households. While basic soy and almond milks have become more affordable, premium products like oat milk or specific dairy-free cheeses often come with a higher price tag

- While prices are gradually decreasing due to economies of scale and increased competition, the perceived premium for plant-based alternatives can still hinder widespread adoption, especially for those who do not immediately see the need for these products

- Overcoming these challenges through enhanced product development, consumer education on health benefits and versatility, and the development of more affordable dairy alternative options will be vital for sustained market growth

Middle East and Africa Dairy Alternative Market Scope

The market is segmented on the basis of product type, type (formulation), application, nutritive, and distribution channel.

- By Product Type

On the basis of product type, the Middle East and Africa dairy alternative market is segmented into Soy Milk, Almond Milk, Coconut Milk, Cashew Milk, Oat Milk, and Rice Milk. The Soy Milk segment held the largest market revenue share in 2024, driven by its established presence, high protein content, and widespread acceptance as a dairy substitute, particularly favored by lactose-intolerant and vegan consumers. The Almond Milk segment is anticipated to witness the fastest growth rate from 2025 to 2030, fueled by its appealing taste, lower calorie count compared to some other alternatives, and increasing consumer awareness of its nutritional benefits.

- By Type (Formulation)

On the basis of type (formulation), the Middle East and Africa dairy alternative market is segmented into Plain & Sweetened, Flavored & Unsweetened, Flavored & Sweetened, and Plain & Unsweetened. While specific dominant and fastest-growing formulations for MEA in 2024 are not explicitly detailed in the provided search results, generally, Plain & Sweetened formulations often hold a significant share due to widespread consumer preference, and Flavored & Unsweetened are typically seeing rapid growth as consumers seek healthier options without added sugars but with appealing taste.

- By Application

On the basis of application, the Middle East and Africa dairy alternative market is segmented into Food and Beverages. The Beverages application segment, which includes various forms of plant-based milks, is expected to hold the largest market revenue share in 2024, driven by the direct consumption of these products as alternatives to traditional milk in drinks, coffee, and cereals. The Food application segment, which includes dairy-free yogurts, cheeses, and ice creams, is expected to witness the fastest CAGR from 2025 to 2033, fueled by increasing innovation and product diversification in these categories to meet the demand for plant-based versions of traditional dairy foods.

- By Nutritive

On the basis of nutritive properties, the Middle East and Africa dairy alternative market is segmented into Protein, Vitamins, and Carbohydrates. While specific market shares for these nutritive segments in MEA for 2024 are not explicitly provided in the search results, generally, Protein-fortified dairy alternatives are gaining significant traction due to the growing consumer focus on protein intake for health and fitness. The Vitamins (fortified) segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the efforts of manufacturers to ensure their dairy alternative products provide comparable or enhanced nutritional value to traditional dairy.

- By Distribution Channel:

On the basis of distribution channel, the Middle East and Africa dairy alternative market is segmented into Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others. The Supermarkets/Hypermarkets segment held the largest market revenue share in 2024, driven by their wide product assortments, competitive pricing, and accessibility to a broad consumer base. The Online Retail segment is expected to witness the fastest CAGR from 2025 to 2033, fueled by increasing internet penetration, the convenience of home delivery, and the growing trend of e-commerce for groceries and specialized food products in the region

Middle East and Africa Dairy Alternative Market Regional Analysis

- Middle East and Africa Dairy Alternative Market Insight

The Middle East and Africa dairy alternative market is experiencing significant growth, driven by increasing awareness regarding lactose intolerance, growing health consciousness, and a rising adoption of plant-based and vegan diets. The region's expanding urban population and evolving lifestyles contribute to a higher demand for convenient and nutritious dairy alternatives. Furthermore, increasing environmental concerns associated with traditional dairy farming are prompting consumers to shift towards more sustainable plant-based options

- South Africa Dairy Alternative Market Insight

The South Africa dairy alternative market is a key growth area within the MEA region, anticipated to expand at a significant CAGR. This growth is primarily fueled by a notable increase in veganism and flexitarianism, along with a high prevalence of lactose intolerance among the population (over 80% in many African countries, including South Africa). Consumers are increasingly prioritizing nutritional choices, leading to a strong demand for plant-based milks like soy and almond milk, which hold a majority share. The market is also benefiting from active promotion of vegan lifestyles through events and increased awareness of animal welfare

- UAE Dairy Alternative Market Insight

The UAE dairy alternative market is experiencing substantial growth, driven by a highly health-conscious consumer base, a significant expatriate population with diverse dietary preferences, and a strong trend towards plant-based and health-conscious food consumption. Product innovation, including new plant-based dairy alternatives like oat milk, almond milk, and soy-based yogurt, is a key driver. The government's encouragement of local, organic, and sustainable dairy production also indirectly supports the alternative market as part of broader health and food security initiatives. Consumers are increasingly valuing sustainability and naturality in their purchasing decisions

- Saudi Arabia Dairy Alternative Market Insight

The Saudi Arabia dairy alternative market is poised for considerable expansion, fueled by increasing health consciousness, dietary shifts, and religious/ethical consumer considerations. High rates of obesity, diabetes, and lactose intolerance are prompting consumers to seek healthier alternatives. Shariah compliance and halal certification are non-negotiable requirements for food products, and plant-based options naturally align with these expectations, attracting consumers seeking ethical and animal-free products. Government-led health campaigns and the availability of diverse plant-based options like almond, soy, and oat-based products are significantly contributing to market growth

- Rest of Middle East and Africa Dairy Alternative Market Insight

The "Rest of MEA" region is also contributing to the overall market growth, with countries like Algeria, Kenya, and Ghana showing increasing adoption of dairy alternatives. The driving factors mirror those in the leading countries: growing vegan populations, high rates of lactose intolerance, and increased awareness of nutritional choices. While specific data for every country is not always readily available, the overarching trends of health, sustainability, and dietary diversification are pervasive across the broader MEA landscape, leading to a projected increase in demand for dairy alternative products

The Major Market Leaders Operating in the Market Are:

- The WhiteWave Foods Company (U.S.)

- Kite Hill (U.S.)

- Oatly (Sweden)

- Blue Diamond Growers (U.S.)

- Earth’s Own Food Company Inc. (Canada)

- SunOpta (Canada)

- Pureharvest (Australia)

- Pacific Foods of Oregon, Inc. (U.S.)

- Sanitarium Health and Wellbeing Company (Australia)

- The Hain Celestial Group, Inc. (U.S.)

Latest Developments in the Middle East and Africa Dairy Alternative Market

- In January 2025, Oatly, a leading plant-based beverage brand, launched a new line of organic oat-based dairy alternatives across the Middle East and Africa. This range focuses on catering to the growing demand for clean-label, organic products, especially in markets such as the United Arab Emirates and Saudi Arabia, where consumers are increasingly conscious of their health and the environment

- In December 2024, Alpro, a subsidiary of Danone, unveiled an innovative protein-rich plant-based yogurt range in the South African market. This product line focuses on offering a nutritious alternative to traditional dairy-based yogurts, capitalizing on the rising demand for high-protein, plant-based products in the region

- In November 2024, Pureharvest (Australia) expanded its product distribution in Kenya and Nigeria, introducing its range of unsweetened almond milk and coconut milk options to local markets. This expansion is part of a larger strategy to increase the availability of dairy alternatives in Africa’s rapidly developing urban markets

- In October 2024, The Hain Celestial Group, launched a new almond-based milk in Saudi Arabia. The product is fortified with essential vitamins and minerals, positioning it as a functional beverage in the Middle East. This launch aligns with the increasing demand for both plant-based and fortified dairy alternatives in the region

- In September 2024, SunOpta expanded its dairy alternative offerings in the UAE with a new line of oat-based milk targeting the growing vegan and lactose-intolerant populations. The launch is part of SunOpta’s strategy to capitalize on the trend towards plant-based nutrition and the rising health consciousness among UAE consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Dairy Alternative Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Dairy Alternative Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Dairy Alternative Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.