Middle East And Africa Dandruff Treatment Market

Market Size in USD Billion

CAGR :

%

USD

9.57 Billion

USD

15.03 Billion

2024

2032

USD

9.57 Billion

USD

15.03 Billion

2024

2032

| 2025 –2032 | |

| USD 9.57 Billion | |

| USD 15.03 Billion | |

|

|

|

|

Middle East and Africa Dandruff Treatment Market Size

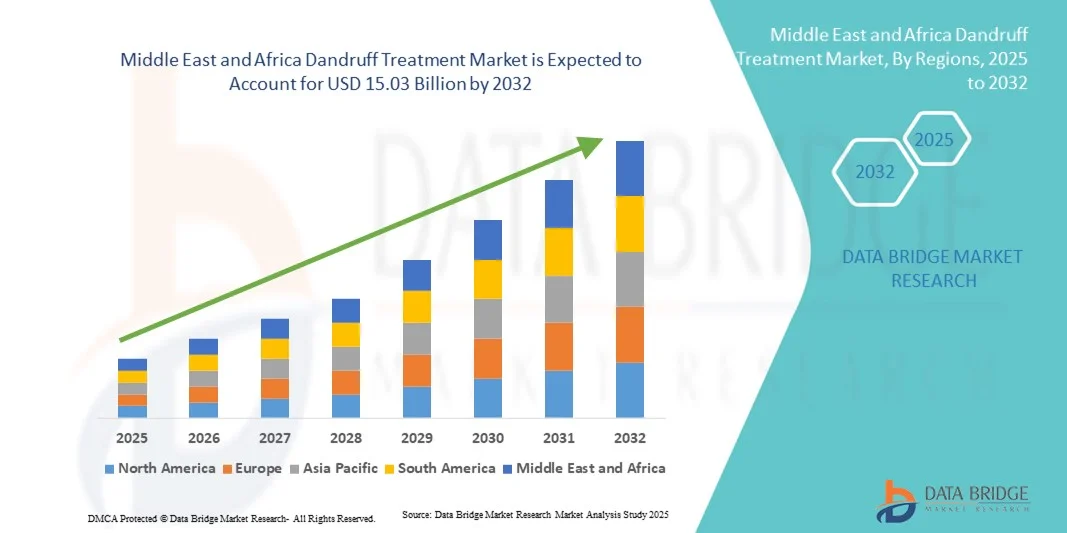

- The Middle East and Africa dandruff treatment market size was valued at USD 9.57 billion in 2024 and is expected to reach USD 15.03 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by increasing awareness of scalp health, rising prevalence of dandruff, and growing urbanization, which are driving higher adoption of both medicated and non-medicated dandruff treatment products

- Furthermore, rising consumer demand for safe, effective, and easy-to-use solutions for scalp care is establishing dandruff treatments as an essential personal care product in both residential and commercial settings. These converging factors are accelerating the uptake of dandruff treatment solutions, thereby significantly boosting the industry's growth

Middle East and Africa Dandruff Treatment Market Analysis

- Dandruff treatment products, offering solutions for flaky scalp and related scalp conditions, are increasingly vital components of personal care and grooming routines in both residential and commercial settings due to their effectiveness, ease of use, and integration into daily hair care practices

- The escalating demand for dandruff treatment products is primarily fueled by increasing awareness of scalp health, rising prevalence of dandruff, and a growing preference for convenient over-the-counter (OTC) and prescription solutions

- South Africa dominated the Middle East and Africa dandruff treatment market with the largest revenue share of 32.9% in 2024, characterized by high consumer awareness, growing adoption of hair care products, and a strong presence of key industry players

- Saudi Arabia is expected to be the fastest-growing country in the Middle East and Africa dandruff treatment market during the forecast period due to increasing urbanization, rising personal care spending, and a growing emphasis on appearance and hygiene

- Fungal dandruff segment dominated the Middle East and Africa dandruff treatment market with a market share of 38.5% in 2024, driven by its high prevalence, widespread consumer recognition, and the availability of effective treatment options in both OTC and prescription forms

Report Scope and Middle East and Africa Dandruff Treatment Market Segmentation

|

Attributes |

Middle East and Africa Dandruff Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Dandruff Treatment Market Trends

Rising Adoption of Herbal and Medicated Treatments

- A significant and accelerating trend in the MEA dandruff treatment market is the growing adoption of herbal, natural, and medicated shampoos and solutions, which offer effective relief while aligning with consumer preference for safer, chemical-free products

- For instance, a popular herbal anti-dandruff shampoo in UAE combines neem and tea tree oil to reduce scalp flakiness while being gentle on the skin, gaining traction among health-conscious consumers

- Medicated treatments with active antifungal ingredients such as ketoconazole and zinc pyrithione are increasingly integrated into daily hair care routines, providing both therapeutic effects and preventive scalp care

- The availability of products in multiple formats, such as shampoos, conditioners, and leave-on treatments, enhances convenience and supports adherence to scalp care regimens

- This trend toward natural, medicated, and multi-functional products is redefining consumer expectations for effective, safe, and easy-to-use dandruff treatments

- The demand for solutions that combine efficacy with holistic hair care benefits is growing rapidly across both adult and pediatric populations, as consumers increasingly prioritize scalp health alongside hair aesthetics

Middle East and Africa Dandruff Treatment Market Dynamics

Driver

Increasing Awareness of Scalp Health and Rising Urbanization

- The increasing prevalence of dandruff and scalp-related disorders, combined with growing consumer awareness of personal grooming and hygiene, is a significant driver for the heightened demand for dandruff treatment products

- For instance, in April 2024, a dermatology clinic in South Africa reported higher consultations for dandruff and related scalp issues, prompting expansion of treatment offerings and driving market uptake

- As consumers become more aware of the causes and consequences of untreated dandruff, the preference for effective OTC and prescription products has grown substantially

- Furthermore, rising urbanization, higher disposable incomes, and exposure to global beauty standards are motivating individuals in Saudi Arabia, UAE, and Egypt to adopt both herbal and medicated treatments

- Convenience of ready-to-use shampoos, conditioners, and leave-on treatments, along with easy availability through pharmacies and online stores, is further propelling adoption across adult and pediatric demographics

- The trend toward preventive scalp care and increasing popularity of dermatologically tested formulations is making dandruff treatments an essential component of personal care routines in both residential and professional settings

Restraint/Challenge

Product Sensitivity and Regulatory Compliance Hurdles

- Concerns regarding scalp sensitivity, allergic reactions, and improper use of active ingredients pose a significant challenge to broader market penetration, particularly for medicated and antifungal formulations

- For instance, some users in South Africa and UAE reported mild irritation after prolonged use of zinc pyrithione-based shampoos, making consumers hesitant to adopt certain products without professional guidance

- Addressing these sensitivity issues through safer formulations, clear usage instructions, and dermatologist endorsements is crucial for building consumer trust and encouraging repeat purchases

- In addition, stringent regulatory requirements in countries such as Saudi Arabia and UAE for product approvals, labeling, and claims can slow market entry for new brands, particularly smaller players

- While prices of herbal and OTC medicated treatments are gradually becoming more competitive, the perception of higher costs for effective or branded solutions can hinder adoption among price-sensitive consumers

- Overcoming these challenges through consumer education on safe usage, development of hypoallergenic formulations, and compliance with regional regulations will be vital for sustained market growth

Middle East and Africa Dandruff Treatment Market Scope

The market is segmented on the basis of type, mode of prescription, product, drug type, age group, gender, end user, and distribution type.

- By Type

On the basis of type, the MEA dandruff treatment market is segmented into fungal dandruff, dry skin-related dandruff, oily scalp-related dandruff, and disease-related dandruff. The Fungal Dandruff segment dominated the market with the largest market revenue share of 38.5% in 2024, driven by the high prevalence of Malassezia-related scalp infections and the widespread consumer awareness regarding effective antifungal treatments. Consumers often prefer targeted shampoos and conditioners containing active antifungal agents such as ketoconazole or zinc pyrithione. The segment’s dominance is further supported by its extensive availability across pharmacies, supermarkets, and online stores. Fungal dandruff treatments are recommended both in OTC and prescription formats, enhancing accessibility and encouraging repeat purchases. In addition, the segment benefits from ongoing innovations in formulation, including gentle daily-use shampoos and combination medicated-herbal products. Strong marketing campaigns by leading brands in South Africa, Saudi Arabia, and UAE have also contributed to higher adoption of fungal dandruff solutions.

The Dry Skin-Related Dandruff segment is anticipated to witness the fastest growth rate of 6.2% CAGR from 2025 to 2032, fueled by rising urbanization, climate-induced dry scalp conditions, and increased consumer awareness about moisturizing and scalp hydration. Dry scalp treatments often include specialized conditioners, leave-on lotions, and herbal oils that are gentle yet effective, catering to a growing base of sensitive scalp users. The segment’s growth is further supported by the expansion of dermatology clinics and online sales channels providing convenient access. Awareness campaigns emphasizing preventive scalp care and educational content about the link between dryness and dandruff are accelerating adoption in countries such as UAE, Egypt, and Saudi Arabia. Moreover, increased spending on premium personal care products is encouraging consumers to try advanced formulations targeting dry scalp conditions.

- By Mode of Prescription

On the basis of mode of prescription, the dandruff treatment market is segmented into OTC and Prescription. The OTC segment dominated the market in 2024 with a revenue share of 62%, driven by easy accessibility, cost-effectiveness, and widespread availability of medicated and herbal anti-dandruff solutions in pharmacies, supermarkets, and online stores. Consumers often prefer OTC products for convenience, daily use, and the ability to self-manage mild to moderate dandruff without consulting a dermatologist. OTC solutions are widely marketed and promoted through social media and e-commerce platforms, increasing awareness and boosting demand. Brands offering OTC formulations often provide additional hair care benefits, such as moisturizing or anti-hair fall properties, further driving preference. The dominance of OTC products is also supported by their versatility across age groups, including adults and pediatric users.

The Prescription segment is expected to witness the fastest growth rate of 7% CAGR from 2025 to 2032, driven by the increasing prevalence of severe or persistent dandruff cases requiring medical supervision. Prescription treatments often include stronger antifungal agents or combination therapies prescribed by dermatologists, ensuring higher efficacy for resistant dandruff types. Growth in this segment is fueled by the expansion of dermatology centers, specialty clinics, and online consultation platforms in South Africa, Saudi Arabia, and UAE. Increased awareness about professional scalp care and rising healthcare expenditure further support adoption. The prescription route also provides opportunities for branded products to gain market loyalty through physician endorsements.

- By Product

On the basis of product, the dandruff treatment market is segmented into non-medicated and medicated. The Medicated segment dominated the market with a revenue share of 55% in 2024, driven by its proven effectiveness in treating fungal dandruff and other scalp conditions. Medicated products often contain clinically validated antifungal agents, providing rapid relief and preventive benefits, which encourages repeat purchases. The segment also benefits from strong presence in pharmacies and e-commerce channels, making it easily accessible to both adults and pediatrics. Consumer trust in efficacy, combined with product innovations such as combined medicated-herbal formulations, further strengthens market dominance. Medicated treatments are recommended by dermatologists and widely promoted, ensuring higher brand recognition.

The Non-Medicated segment is expected to witness the fastest CAGR of 6.5% from 2025 to 2032, fueled by rising consumer preference for herbal, natural, and chemical-free alternatives. Non-medicated products are perceived as safer, gentler on sensitive scalps, and suitable for daily use. Growth in this segment is supported by the rising popularity of natural ingredients such as tea tree oil, aloe vera, and neem. Online retail expansion and health-conscious consumer trends across Saudi Arabia, UAE, and South Africa are also accelerating adoption. Marketing initiatives highlighting holistic hair care and preventive scalp health are boosting awareness and preference.

- By Drug Type

On the basis of drug type, the dandruff treatment market is segmented into branded and generics. The Branded segment dominated the market with a revenue share of 60% in 2024, driven by strong consumer trust, brand recognition, and perceived higher efficacy of branded antifungal and herbal dandruff treatments. Branded products often undergo extensive dermatological testing, offering guaranteed quality and better marketing support through pharmacies and online platforms. The segment’s dominance is also supported by continuous product innovation, packaging improvements, and targeted marketing campaigns in countries such as South Africa, UAE, and Saudi Arabia. Consumers are willing to pay a premium for branded products, believing in faster relief and safety. Dermatologists and specialty clinics frequently recommend branded formulations, further boosting adoption.

The Generics segment is expected to witness the fastest growth rate of 7% CAGR from 2025 to 2032, fueled by cost-sensitive consumers and increasing insurance or reimbursement coverage in some markets. Generics provide similar antifungal efficacy at a lower price, attracting both urban and semi-urban populations. Growth is supported by expanding retail and online pharmacy channels across Saudi Arabia, Egypt, and South Africa. Rising awareness about the equivalence of generics and branded products among consumers is accelerating adoption. Market entry by multiple local manufacturers offering generics at competitive prices also contributes to rapid growth.

- By Age Group

On the basis of age group, the dandruff treatment market is segmented into adults, pediatrics, and neonates. The Adults segment dominated the market with a revenue share of 65% in 2024, driven by higher prevalence of dandruff among adults and increasing focus on personal grooming, hygiene, and appearance. Adult consumers often seek both medicated and herbal treatments, providing strong market demand. The dominance is further supported by higher disposable incomes and awareness campaigns targeting adult populations in UAE, Saudi Arabia, and South Africa. Adults prefer convenient formulations such as daily-use shampoos, conditioners, and leave-on treatments. Marketing strategies by leading brands focusing on scalp health and hair aesthetics also reinforce adoption.

The Pediatrics segment is expected to witness the fastest CAGR of 6.8% from 2025 to 2032, fueled by increasing parental awareness about scalp care for children and the rising availability of mild, gentle, and safe formulations. Pediatric products are designed to minimize irritation and are often enriched with natural or hypoallergenic ingredients. Online pharmacies and pediatric dermatology clinics are increasingly facilitating access to these products. Awareness campaigns emphasizing early intervention for scalp health and dandruff prevention are supporting adoption in Saudi Arabia, UAE, and Egypt.

- By Gender

On the basis of gender, the dandruff treatment market is segmented into male and female. The Male segment dominated the market with a revenue share of 58% in 2024, driven by higher exposure to stress, environmental factors, and oily scalp conditions contributing to dandruff prevalence among men. Male consumers often prefer medicated solutions that are quick-acting and easy to integrate into daily routines. Strong marketing campaigns targeting men’s grooming products, including shampoos and conditioners for dandruff, further support dominance. Availability across retail stores, supermarkets, and online channels enhances accessibility. Male-focused formulations are increasingly combining anti-dandruff benefits with hair strengthening or anti-hair fall properties.

The Female segment is expected to witness the fastest CAGR of 6.5% from 2025 to 2032, fueled by increasing focus on hair aesthetics, cosmetic appeal, and scalp health. Female consumers are more such asly to adopt herbal and medicated products with added benefits such as shine, volume, or color protection. Growth is supported by targeted marketing campaigns, e-commerce penetration, and rising awareness about preventive scalp care in Saudi Arabia, UAE, and Egypt. Social media and influencer promotions also accelerate adoption in urban female populations.

- By End User

On the basis of end user, the dandruff treatment market is segmented into homecare, dermatology centers, specialty clinics, and others. The Homecare segment dominated the market with a revenue share of 70% in 2024, driven by the convenience of at-home treatment using OTC shampoos, conditioners, and leave-on solutions. Consumers prefer homecare products due to ease of use, cost-effectiveness, and accessibility from pharmacies, supermarkets, and online stores. Awareness about preventive scalp care and daily hair hygiene further supports homecare adoption. Brands continue to launch user-friendly products for home use, including herbal and medicated formulations.

The Dermatology Centers segment is expected to witness the fastest CAGR of 7.2% from 2025 to 2032, fueled by rising cases of severe dandruff and scalp-related conditions requiring professional supervision. Dermatology centers provide prescription products and specialized treatments that are often unavailable through general retail. Growth is supported by increasing number of clinics in urban areas of Saudi Arabia, UAE, and South Africa. Awareness campaigns emphasizing the importance of professional consultation for persistent dandruff accelerate adoption. The segment also benefits from partnerships with branded product manufacturers offering exclusive formulations for clinical use.

- By Distribution Type

On the basis of distribution type, the dandruff treatment market is segmented into supermarkets/hypermarkets, convenience stores, pharmacies, retail stores, online stores, and others. The Pharmacies segment dominated the market with a revenue share of 50% in 2024, driven by trust in pharmacist recommendations, availability of both OTC and prescription products, and widespread accessibility in urban and semi-urban regions. Pharmacies often provide a range of medicated and herbal anti-dandruff treatments, encouraging repeat purchases. Promotions and discounts in pharmacies also attract consumers. Leading brands continue to prioritize pharmacy distribution due to high consumer confidence and professional endorsement.

The Online Stores segment is expected to witness the fastest CAGR of 8% from 2025 to 2032, fueled by increasing internet penetration, rising e-commerce adoption, and consumer preference for convenient doorstep delivery. Online platforms provide access to a wider range of products, including premium and niche herbal treatments not always available in physical stores. Growth is particularly strong in Saudi Arabia, UAE, and South Africa. Digital marketing campaigns and influencer promotions on e-commerce platforms further accelerate adoption. Subscription services and bundle offers also support sustained growth in the online segment.

Middle East and Africa Dandruff Treatment Market Regional Analysis

- South Africa dominated the MEA dandruff treatment market with the largest revenue share of 32.9% in 2024, characterized by high consumer awareness, growing adoption of hair care products, and a strong presence of key industry players

- Consumers in the region highly value effective, easy-to-use, and safe solutions for scalp care, including OTC and prescription treatments that cater to both adults and pediatrics

- This widespread adoption is further supported by rising disposable incomes, urbanization, and increasing focus on personal grooming and hygiene, establishing dandruff treatments as an essential part of homecare and professional scalp care routines

The South Africa Dandruff Treatment Market Insight

The South Africa dandruff treatment market captured the largest revenue share of 32.9% in 2024 within the MEA region, driven by high consumer awareness of scalp health and widespread availability of both medicated and herbal products. Consumers are increasingly prioritizing effective treatments for fungal and dry scalp conditions, seeking solutions that provide rapid relief while being safe for daily use. The growing trend of at-home scalp care, coupled with strong demand for OTC shampoos and conditioners, further propels the market. Moreover, expanding dermatology clinics and online retail platforms are significantly contributing to product accessibility and market expansion.

Saudi Arabia Dandruff Treatment Market Insight

The Saudi Arabia dandruff treatment market is projected to expand at a substantial CAGR during the forecast period, primarily driven by rising urbanization, increasing disposable incomes, and a growing focus on personal grooming. Consumers are attracted to both herbal and medicated anti-dandruff solutions that combine efficacy with added hair care benefits. The market is witnessing significant growth across residential and professional care applications, with products being incorporated into daily routines as preventive and therapeutic scalp care. Online and pharmacy distribution channels are further facilitating adoption.

UAE Dandruff Treatment Market Insight

The UAE dandruff treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of personal grooming and the desire for safe, effective, and easy-to-use scalp care solutions. Increasing awareness of fungal and dry scalp conditions encourages both homecare and dermatology-based usage. In addition, the UAE’s well-developed retail and e-commerce infrastructure supports strong penetration of herbal and medicated treatments, further stimulating market growth.

Egypt Dandruff Treatment Market Insight

The Egypt dandruff treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by rising consumer knowledge about scalp health, increasing disposable income, and the adoption of daily hair care routines. Both adults and pediatric populations are actively seeking medicated and natural treatments for dandruff, boosting overall demand. The integration of educational campaigns and product promotions through pharmacies, online stores, and specialty clinics is enhancing market penetration. Consumers are showing a growing preference for dermatologically tested solutions to manage persistent scalp conditions.

Middle East and Africa Dandruff Treatment Market Share

The Middle East and Africa dandruff treatment industry is primarily led by well-established companies, including:

- Unilever (U.K.)

- Procter & Gamble (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- L'Oréal. (France)

- Henkel AG & Co. KGaA (Germany)

- BEIERSDORF (Germany)

- Amgen Inc. (U.S.)

- AbbVie Inc. (U.S.)

- GSK plc (U.K.)

- Sanofi (France)

- Bayer AG (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- AstraZeneca (U.K.)

- Eucerin (Germany)

- Head & Shoulders (U.S.)

What are the Recent Developments in Middle East and Africa Dandruff Treatment Market?

- In June 2025, a study published in ResearchGate focused on the formulation and evaluation of herbal shampoos for dandruff treatment. The research emphasized the benefits of herbal ingredients in treating dandruff, indicating a shift towards natural remedies in the Middle East and Africa's haircare market

- In July 2024, Minimalist expanded its haircare portfolio by launching an Anti-Dandruff Shampoo in India, which is also available in the Middle East and Africa markets. The shampoo is formulated to eliminate flakes, scaling, and itching associated with dandruff, offering visible relief and restoring balance to the scalp. The product is now available on the brand's official website and leading e-commerce platforms

- In March 2024, Pilgrim introduced its Australian Tea Tree Anti-Dandruff Shampoo in the Middle East and Africa. This product is clinically proven to achieve 100% dandruff reduction when used as part of a complete anti-dandruff regimen. The shampoo combines the benefits of tea tree oil with a gentle formula, catering to consumers seeking effective yet mild solutions for dandruff control

- In July 2023, Unilever's Clear brand rebranded itself from an anti-dandruff shampoo to a comprehensive scalp care expert. This strategic move involved launching products such as Clear Men Scalp Pro Anti Hair Fall and Clear Scalpceuticals Hair Fall Resist lines, which are clinically proven to reduce hair fall within 30 days. These products were first launched in China in August 2022 and have since been introduced to other markets, including the Middle East and Africa

- In March 2023, Unilever introduced a tailored haircare line in Ethiopia, addressing local hair needs with affordable shampoos and conditioners. This initiative aimed to enhance scalp health and combat dandruff among Ethiopian consumers, reflecting a growing trend of localized product offerings in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.