Global Herbal Shampoo Market

Market Size in USD Billion

CAGR :

%

USD

3.82 Billion

USD

6.01 Billion

2024

2032

USD

3.82 Billion

USD

6.01 Billion

2024

2032

| 2025 –2032 | |

| USD 3.82 Billion | |

| USD 6.01 Billion | |

|

|

|

|

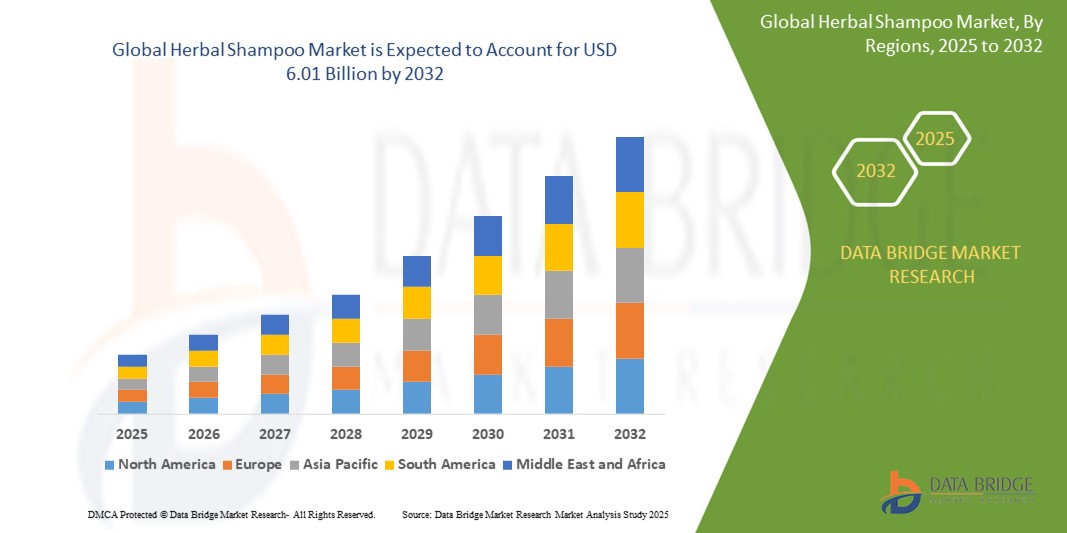

What is the Global Herbal Shampoo Market Size and Growth Rate?

- The global herbal shampoo market size was valued at USD 3.82 billion in 2024 and is expected to reach USD 6.01 billion by 2032, at a CAGR of 5.80% during the forecast period

- This growth is largely driven by increasing consumer preference for natural and chemical-free hair care products, along with a rising awareness about scalp health and eco-friendly formulations

- In addition, the market is benefiting from expanding urban populations, growing online retail penetration, and shifting lifestyle trends toward sustainable personal care solutions, all of which are accelerating product adoption across global markets

What are the Major Takeaways of Herbal Shampoo Market?

- Herbal Shampoos, enriched with plant-based ingredients and free from harsh chemicals, are gaining traction as consumers seek gentle, safe, and effective alternatives to conventional hair care products

- The surge in demand is primarily driven by growing concerns over hair damage, allergies to synthetic ingredients, and the increasing popularity of Ayurvedic and organic beauty regimes

- Moreover, the market is witnessing innovation in herbal formulations, packaging, and product variety, enhancing consumer engagement and further propelling global growth

- Asia-Pacific dominated the herbal shampoo market with the largest revenue share of 38.7% in 2024, driven by widespread preference for natural and plant-based personal care products, increasing urbanization, and rising consumer awareness of the harmful effects of synthetic shampoos

- North America herbal shampoo market is projected to grow at the fastest CAGR of 6.8% from 2025 to 2032, driven by heightened awareness of clean beauty, increasing preference for plant-based products, and rising incidence of scalp allergies caused by chemical shampoos

- The liquid segment dominated the herbal shampoo market with the largest revenue share of 64.3% in 2024, driven by its wide consumer acceptance, ease of application, and availability across all retail channels

Report Scope and Herbal Shampoo Market Segmentation

|

Attributes |

Herbal Shampoo Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Herbal Shampoo Market?

“Rising Demand for Clean Beauty and Plant-Based Formulation”

- A major trend shaping the global herbal shampoo market is the increasing consumer shift towards clean beauty products, particularly those with natural, organic, and plant-derived ingredients. Consumers are becoming more ingredient-conscious, preferring shampoos free from sulfates, parabens, silicones, and artificial fragrances

- For instance, brands such as Khadi Natural and WOW Skin Science have launched herbal shampoo lines that feature Ayurvedic formulations, focusing on neem, amla, bhringraj, and tea tree oil catering to rising demand for scalp-friendly, holistic products

- The surge in demand is driven by heightened awareness about scalp health, allergies to harsh chemicals, and the environmental impact of synthetic compounds. Consumers are opting for products that are vegan, cruelty-free, and sustainably packaged, aligning with the growing wellness movement

- In addition, the popularity of DIY natural hair care routines on social platforms is inspiring a new wave of consumers to explore herbal solutions for issues such as dandruff, hair fall, and thinning hair

- This growing preference for transparency, authenticity, and sustainability is compelling brands to innovate with botanical ingredients, which is redefining marketing strategies and product development in the shampoo industry

- As the clean beauty movement gains traction globally, the demand for herbal shampoos is expected to expand steadily across both emerging and developed markets, positioning it as a key growth segment in the broader haircare industry

What are the Key Drivers of Herbal Shampoo Market?

- The market is driven by increased consumer awareness of the harmful effects of synthetic chemicals in conventional shampoos, prompting a switch to herbal and plant-based alternatives for long-term scalp and hair health

- For instance, in March 2024, The Himalaya Drug Company expanded its herbal personal care portfolio by launching new anti-dandruff and anti-hair fall shampoo variants based on Ayurvedic formulations, reinforcing consumer trust in traditional herbal solutions

- Rising incidences of scalp sensitivity, hair loss, and allergic reactions have led consumers to seek milder, toxin-free formulations, with herbal shampoos offering the promise of safe, gentle cleansing enriched with natural oils and extracts

- Moreover, the influence of Ayurveda and traditional medicine systems, especially in Asia-Pacific, has elevated the credibility of herbal shampoos among diverse demographics, from millennials to aging populations

- The rapid expansion of e-commerce platforms and digital marketing has significantly enhanced product visibility and accessibility, enabling niche herbal shampoo brands to reach global audiences with minimal overhead costs

- Overall, the growing demand for eco-friendly, health-conscious, and sustainably produced personal care products is reinforcing the upward trajectory of the Herbal Shampoo market

Which Factor is challenging the Growth of the Herbal Shampoo Market?

- One of the major challenges for the herbal shampoo market is consumer skepticism regarding product efficacy compared to chemical-based shampoos. Many users are uncertain whether herbal formulas can effectively address specific hair issues such as deep cleansing, hair fall, or dandruff without synthetic additives

- For instance, despite increasing sales, several reviews on mass-market platforms indicate mixed consumer experiences regarding the lather quality and cleansing power of herbal shampoos compared to traditional products

- Another barrier is inconsistent product standardization, as the herbal shampoo segment lacks strict regulatory definitions in many countries. This creates a fragmented market with varying ingredient quality and claims, reducing consumer trust

- In addition, the higher price point of premium herbal shampoos, driven by natural ingredient sourcing and sustainable packaging, may deter price-sensitive buyers in cost-conscious markets. Budget herbal shampoos often compromise on concentration or quality to meet pricing goals, affecting consumer satisfaction and brand loyalty

- Overcoming these obstacles will require brands to focus on clinical efficacy validation, clear labeling, and affordable innovation, along with educating consumers about the long-term benefits of herbal formulations

- As awareness and scientific support for plant-based products grow, these challenges are expected to gradually decline, enabling broader market adoption and long-term category growth

How is the Herbal Shampoo Market Segmented?

The market is segmented on the basis of form, gender, and distribution channel.

• By Form

On the basis of form, the herbal shampoo market is segmented into liquid, bars, and powders. The liquid segment dominated the Herbal Shampoo market with the largest revenue share of 64.3% in 2024, driven by its wide consumer acceptance, ease of application, and availability across all retail channels. Liquid herbal shampoos are typically enriched with essential oils and herbal extracts, offering convenience in usage and effectiveness in hair cleansing, which appeals to a broad demographic.

The bars segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for sustainable, plastic-free packaging and travel-friendly products. Herbal shampoo bars are increasingly preferred by environmentally conscious consumers due to their lower carbon footprint and concentrated formulations, which also make them long-lasting and economical.

• By Gender

On the basis of gender, the herbal shampoo market is segmented into women and men. The women segment held the largest market share of 68.1% in 2024, driven by higher haircare expenditure, a strong inclination towards natural and organic products, and a wide variety of products targeting specific female hair issues such as hair fall, dandruff, and damage repair.

The men segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing awareness of personal grooming and the increasing availability of gender-specific herbal shampoo products designed to address issues such as scalp irritation, thinning hair, and dryness. Marketing campaigns targeting the male demographic and the expansion of herbal product lines for men are further accelerating this trend.

• By Distribution Channel

On the basis of distribution channel, the herbal shampoo market is segmented into supermarkets and hypermarkets, specialty stores, online, and others. The supermarket and hypermarket segment held the largest revenue share of 39.6% in 2024, due to the high footfall in physical retail outlets, immediate product availability, and strong in-store promotions. Consumers prefer these outlets for the ability to physically examine products and compare multiple brands.

The online segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing penetration of e-commerce platforms, convenience of home delivery, availability of a broader product range, and rising digital literacy among consumers. The growth of influencer marketing and direct-to-consumer strategies on platforms such as Amazon, Flipkart, and brand-owned websites is also propelling this segment forward.

Which Region Holds the Largest Share of the Herbal Shampoo Market?

- Asia-Pacific dominated the herbal shampoo market with the largest revenue share of 38.7% in 2024, driven by widespread preference for natural and plant-based personal care products, increasing urbanization, and rising consumer awareness of the harmful effects of synthetic shampoos

- The region benefits from a strong cultural inclination toward herbal remedies, with ingredients such as shikakai, neem, aloe vera, and amla being highly preferred in countries such as India, China, and Thailand

- Growing disposable incomes and a booming e-commerce landscape are further supporting product accessibility and variety, fueling regional market expansion across both rural and urban populations.=

India Herbal Shampoo Market Insight

India captured the largest revenue share in Asia-Pacific in 2024, supported by the deep-rooted tradition of Ayurvedic haircare and growing health consciousness among consumers. With an expanding middle-class population, demand for chemical-free, paraben-free, and sulfate-free shampoos is increasing. Local brands such as Patanjali, Himalaya, and Khadi Naturals dominate the domestic market, while international brands are gaining traction by introducing India-specific herbal variants to meet regional preferences.

China Herbal Shampoo Market Insight

The China herbal shampoo market is expanding steadily due to increasing demand for natural cosmetics, government encouragement for organic personal care, and a strong digital commerce ecosystem. Consumers are increasingly drawn toward ingredients such as ginseng, tea tree, and green tea extract. As Chinese consumers become more label-conscious, demand for herbal and clean-label formulations continues to rise, with both domestic and global brands strengthening their digital retail presence.

Japan Herbal Shampoo Market Insight

The Japan market is witnessing notable growth, backed by a growing aging population and rising awareness around scalp care. Herbal Shampoos that offer anti-hair fall, anti-dandruff, and gentle cleansing benefits are becoming particularly popular. Japanese consumers prefer minimalist yet effective formulas, often with botanical extracts such as camellia, sakura, and rice bran. Premium positioning and functional benefits are key growth drivers in the Japanese market.

Which Region is the Fastest Growing in the Herbal Shampoo Market?

North America herbal shampoo market is projected to grow at the fastest CAGR of 6.8% from 2025 to 2032, driven by heightened awareness of clean beauty, increasing preference for plant-based products, and rising incidence of scalp allergies caused by chemical shampoos. The region’s growing vegan population, coupled with eco-conscious consumer behavior, is accelerating demand for sulfate-free, cruelty-free, and organic herbal shampoos. Prominent brands such as Avalon Organics, SheaMoisture, and John Masters Organics are leading innovation with plant-powered formulations, supported by expanding shelf space in retail chains and online platforms.

U.S. Herbal Shampoo Market Insight

The U.S. accounted for the largest revenue share in North America, attributed to increased consumer spending on premium haircare and the growing popularity of eco-friendly packaging and clean labels. The market is supported by product innovation focusing on botanical blends, essential oils, and allergen-free formulations. Influencer-led marketing and clean beauty trends continue to drive product penetration across diverse age groups and hair types.

Canada Herbal Shampoo Market Insight

The Canada market is witnessing growth due to a strong shift towards organic and sustainable products. Canadian consumers are seeking transparent labeling and are inclined toward brands that use locally sourced herbs and follow ethical production practices. With strong retail distribution and supportive government policies on natural product certification, the Herbal Shampoo market in Canada is gaining momentum across both urban and suburban areas.

Which are the Top Companies in Herbal Shampoo Market?

The herbal shampoo industry is primarily led by well-established companies, including:

- Unilever (U.K.)

- Dabur (India)

- Henkel AG & Co. KGaA (Germany)

- Procter & Gamble (U.S.)

- Church & Dwight Co., Inc. (U.S.)

- KCWW – Kimberly-Clark Worldwide, Inc. (U.S.)

- Kao Corporation (Japan)

- Beiersdorf AG (Germany)

- Shiseido Company Limited (Japan)

- L'Oréal S.A. (France)

- Johnson & Johnson Private Limited (U.S.)

- Amway Corp (U.S.)

- The Detox Market (U.S.)

- Bo International (India)

- Syoss (Germany)

- Kérastase (France)

- Natura&Co (Brazil)

- Coty Inc. (U.S.)

- Wella International Operations Switzerland Sàrl. (Switzerland)

What are the Recent Developments in Global Herbal Shampoo Market?

- In April 2024, Kao unveiled a new hair care brand named Melt, curated to deliver “beauty care for relaxing moments.” The Melt Moisture Shampoo and Moisture Treatment incorporate a hybrid repair formula that addresses both the inner and outer layers of the hair, while enriching the user’s self-care routine through engaging sensory elements such as sound, bubbles, texture, and fragrance. This launch highlights Kao’s focus on holistic beauty experiences and premium hair nourishment

- In February 2024, Herbal Essences introduced its "Pure Plants of Aloe and Camellia Oil" collection, which includes 11 newly formulated shampoos and conditioners. Crafted with a minimum of 96% natural-origin ingredients such as aloe and camellia oil, the products are certified by the Royal Botanic Gardens, Kew, and are free from parabens and sulfates. The packaging redesign uses 25% less plastic and features tactile elements to support visually impaired users. This move reinforces Herbal Essences’ commitment to natural beauty and inclusive, sustainable packaging

- In June 2022, Procter & Gamble (P&G) launched its first high-performing solid shampoo and conditioner bars across its European haircare lines, including Herbal Essences. Packaged in recyclable, FSC-certified paper boxes, these bars serve as eco-conscious alternatives designed to last as long as two 250ml liquid shampoo bottles. With ergonomic shapes and integrated cotton ropes for easy shower storage, the bars align with P&G Beauty’s sustainability goal of reducing virgin plastic usage by 50% by 2025. This initiative underscores P&G’s long-term dedication to plastic reduction and environmental responsibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.