Middle East And Africa Digital Payment Market

Market Size in USD Billion

CAGR :

%

USD

19,652.35 Billion

USD

72,381.27 Billion

2022

2030

USD

19,652.35 Billion

USD

72,381.27 Billion

2022

2030

| 2023 –2030 | |

| USD 19,652.35 Billion | |

| USD 72,381.27 Billion | |

|

|

|

Middle East and Africa Digital Payment Market Analysis and Size

The digital payment market is changing considerably according to consumer behaviour. A few trends influencing the digital payment market are the instant payments, digital commerce, cashless economy, mobile banking, and the increasing influence of regulatory authorities. Also, the growing adoption of mobile wallets due to the significant growth in the usage of real-time payments is likely to enhance the market growth during the forecast period.

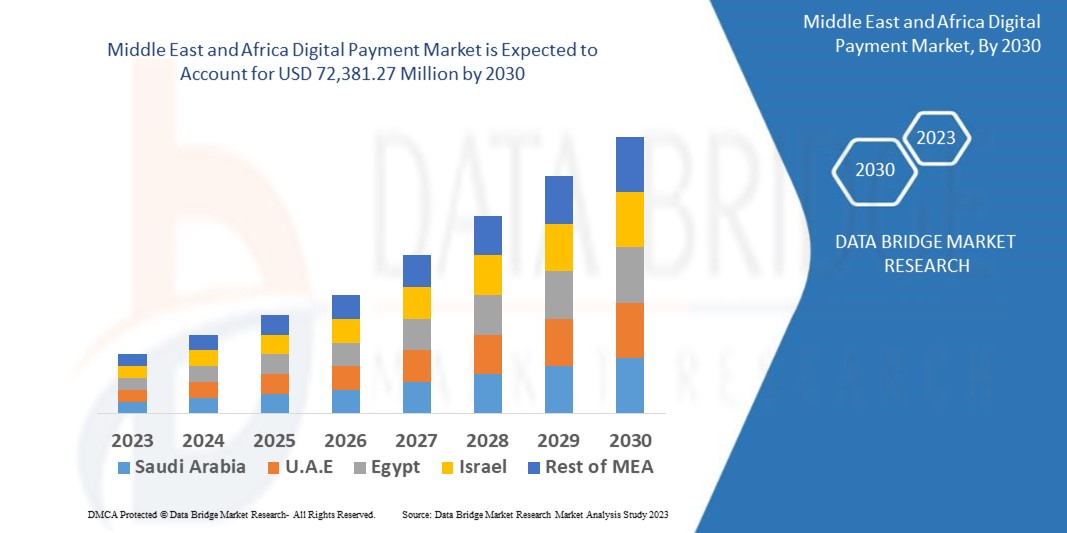

Data Bridge Market Research analyses that the digital payment market is expected to reach USD 72,381.27 million by 2030, which is USD 19,652.35 million in 2022, at a CAGR of 17.70% during the forecast period. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Middle East and Africa Digital Payment Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Offering (Solutions, Services), Deployment Model (On Premises, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Mode of Payment (Payment Cards, Point of Sale, Unified Payments Interface (UPI) Service, Mobile Payment, Online Payment), Mode of Usage (Mobile Application, Desktop/Web Browser), Technology (Application Programming Interface (API), Data Analytics and Machine Learning, Digital Ledger Technology (DLT), Artificial Intelligence and Internet of Things, Biometric Authentication), Use Case (Person (P/C), Merchant/ Business, Government), End User (Commercial, Consumer) |

|

Countries Covered |

Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

ACI Worldwide (U.S.), PayPal, Inc. (U.S.), Novatti Group Limited (Australia), Global Payments Inc. (U.S.), Visa (U.S.), Stripe, Inc. (Ireland), Google, LLC (U.S.), Finastra (U.K.), SAMSUNG (South Korea), Amazon Web Services, Inc. (U.S.), Financial Software & Systems Pvt. Ltd. (U.S.), Aurus Inc. (U.S.), Adyen (Netherlands), Apple Inc. (U.S.), Fiserv, Inc. (U.S.), WEX Inc. (U.S.), wirecard (U.S.), Mastercard (U.S.) among many others |

|

Market Opportunities |

|

Market Definition

Digital payments are payments done via online or digital modes, with no exchange of cash being involved. Digital payment sometimes also called electronic payment is the transfer of money from one account to another payment account by using digital devices such as a computer, mobile phone. In digital payments, payee and payer both use digital modes to receive and send money. It is also called electronic payment (e-payment).

Middle East and Africa Digital Payment Market

Drivers

- Surging integration of advanced features in payment system

Various efforts taken by the digital payment companies to integrate artificial intelligence features in their payment system which are anticipated to drive the market growth. For instance, Mastercard which is a financial service provider and AI-powered payments company has announced the integration of Mastercard Cross-Border Services into Previse’s Instant Pay platform in October 2021. This collaboration will help them to pay their suppliers immediately.

- Increasing efforts by e-commerce companies to deploy their point-of-sale systems

E-commerce industries are making several efforts to use their point-of-sale systems to develop their offerings in the field of digital payment. For instance, retail giants, such as Amazon and Shopify, are developing point-of-sale systems which will capable of handling both in-store and online transactions. These developments are encouraging banks to increase their digital payment services to maintain their position in the market. Therefore, growing efforts by e-commerce companies to deploy their point-of-sale systems is likely to propel the market growth.

Opportunities

- Increasing adoption of open banking API

Growing adoption of open banking API for payments is likely to create lucrative opportunities for the market growth during the forecast period. Open banking has the potential to provide relevant and customized product and service options which most banking apps fail to do. Open banking API will integrate, simplify, and provide a hassle-free experience to the customer during payment. It also provides flexibility and can be tailored business's preferences and needs. These factors increase the adoption of adoption of open banking API and boost the market growth.

- Rising industry-level initiatives to digitize the payment process

Increasing industry-level initiatives to support digital payments might include launching alternative payment-processing platforms and introducing tiered MDRs based on sales volumes. The digital payments is one of the major factor for the growth of the country's economy. It can aid to increase the economic growth and productivity, increase tax revenue, improve transparency and open up new economic opportunities for end-users. The industry-level initiatives which will further likely to generate lucrative opportunities the market growth.

Restraints

- Increasing hesitance and fear among people

Increasing hesitance and fear among people in underdeveloped areas of Middle East and Africa in regards to the security and safety in digital payments such as fraudulent payment apps, reverse engineering and tampering and many more will hamper the growth of the market.

- Increasing chances of cyber-attacks by adoption of technologies

Cyber-attack is the major hurdle in digital payments which is expected to hamper the growth of the market. Cyber-attacks are one of the major issues the payments sector which has been facing for over a decade. The adoption of technologies related to digital payments market is also growing the cyber security risks such as cyber theft. This is also the major factor which hinders the market growth.

This digital payment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the digital payment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Recent Developments

- In 2022, Verizon Business announced their partnership with First National Bank of Omaha (FNBO) and Mastercard to launch a credit card. The main goal of this launch to bring value to small business owners. The Verizon Business Mastercard is available to companies with an online account. It will include reward points on every purchase from credit card.

- In 2022, Visa partnered with Fundbox which is a working capital platform. With this partnership, they will convert its operation into digital payment solutions for small enterprises. The first phase of this complete process is to launch Fundbox Flex Visa Debit Card, allotted by Pathward N.A.

- In 2022, Visa completed its acquisition process with Tink that allows merchants, fintech and financial institutions, to make financial services and products. Tink collaborated with over 3,400 banks and millions of bank customers across Europe.

- In 2022, The Bank of America Corporation collaborated with Banked Ltd. to introduce Pay by Bank which is the online payment solution to allow customers of e-commerce sectors to pay directly from their bank account. As per the company, this strategy is a part of its repeated series of technology investments.

Middle East and Africa Digital Payment Market Scope

The digital payment market is segmented on the basis of offering, deployment model, organization size, mode of payment, mode of usage, technology, use case, end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security & Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Consulting

- Implementation

- Support and Maintenance

- Managed Services

Deployment Model

- On Premises

- Cloud

Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Mode of Payment

- Payment Cards

- Debit Card

- Credit Card

- Pre-Paid Card

- Point of Sale

- Unified Payments Interface (UPI) Service

- Mobile Payment

- Online Payment

Mode of Usage

- Mobile Application

- Desktop/Web Browser

Technology

- Application Programming Interface (API)

- Data Analytics and Machine Learning

- Digital Ledger Technology (DLT)

- Artificial Intelligence and Internet of Things

- Biometric Authentication

Use Case

- Person (P/C)

- Merchant/ Business

- Government

End User

- Commercial

- Consumer

Digital Payment Market Regional Analysis/Insights

The digital payment market is analyzed and market size insights and trends are provided by country, offering, deployment model, organization size, mode of payment, mode of usage, technology, use case, end user as referenced above.

The countries covered in the digital payment market report are Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Israel dominates the digital payment market owing to the augmented government initiatives taken to increase the digitalization in this region. Furthermore, growing number unmanned stores is creating the demand for the digital payment solutions which will further boost the market growth.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Digital Payment Market Share Analysis

The digital payment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to digital payment market.

Some of the major players operating in the digital payment market are:

- ACI Worldwide (U.S.)

- PayPal, Inc. (U.S.)

- Novatti Group Limited (Australia)

- Global Payments Inc. (U.S.)

- Visa (U.S.)

- Stripe, Inc. (Ireland)

- Google, LLC (U.S.)

- Finastra. (U.K.)

- SAMSUNG (South Korea)

- Amazon Web Services, Inc. (U.S.)

- Financial Software & Systems Pvt. Ltd. (U.S.)

- Aurus Inc. (U.S.)

- Adyen (Netherlands)

- Apple Inc. (U.S.)

- Fiserv, Inc. (U.S.)

- WEX Inc. (U.S.)

- wirecard (U.S.)

- Mastercard. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.