유럽 디지털 결제 시장은 다양한 전자 결제 수단과 서비스를 아우르는 역동적이고 빠르게 발전하는 분야입니다. 온라인 결제 플랫폼, 모바일 지갑, 비접촉식 결제 , 그리고 전통적인 카드 기반 거래가 포함됩니다. 유럽 전역에서 디지털 결제 솔루션 도입이 증가함에 따라 이 시장은 최근 몇 년간 상당한 성장을 이루었습니다. 유럽 소비자와 기업들이 디지털 결제 옵션을 점점 더 적극적으로 수용함에 따라 이 시장은 매우 경쟁적이고 혁신적입니다. 디지털화와 핀테크 발전이 결제 환경을 변화시키면서 이 시장은 앞으로도 지속적인 성장세를 보일 것으로 예상됩니다.

전체 보고서는 https://www.databridgemarketresearch.com/reports/europe-digital-payment-market 에서 확인하세요.

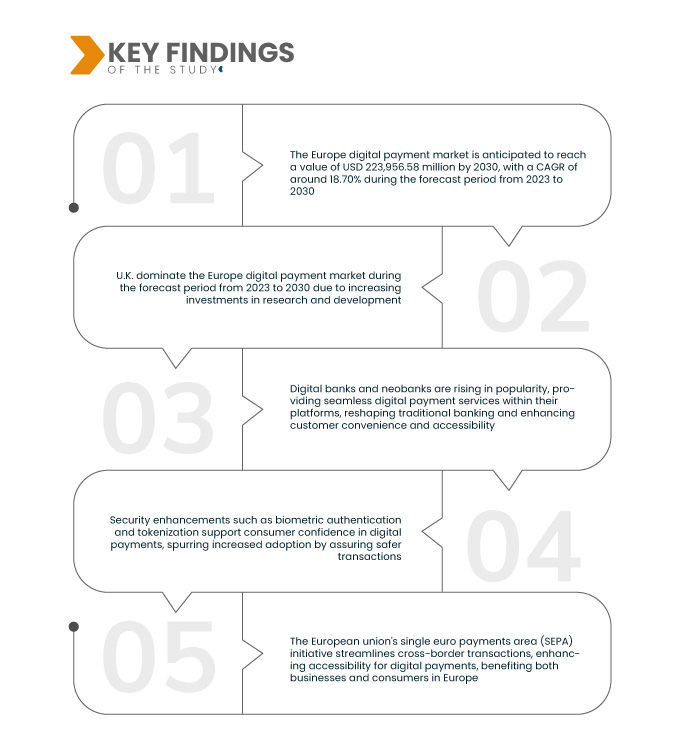

데이터 브리지 마켓 리서치(Data Bridge Market Research)는 유럽 디지털 결제 시장이 2023년부터 2030년까지 연평균 성장률(CAGR) 18.70%로 성장할 것으로 예상되며, 2022년 568억 2,744만 달러에서 2030년에는 2,239억 5,658만 달러에 이를 것으로 전망했습니다. 많은 유럽 국가들이 무현금 사회를 적극적으로 지지하며 일상 거래에서 디지털 결제의 광범위한 도입을 촉구하고 있습니다. 이러한 이니셔티브는 편의성 향상, 비용 절감, 금융 포용성 증진을 목표로 하며, 역내에서 안전하고 효율적인 전자 결제 방식을 발전시키는 것을 목표로 합니다.

연구의 주요 결과

전자상거래 확대로 시장 성장률 견인될 전망

전자상거래 부문의 확장은 유럽 디지털 결제 솔루션의 성장을 촉진하는 중요한 촉매제입니다. 온라인 쇼핑과 전자상거래 플랫폼의 확산은 디지털 결제 수단에 대한 수요를 크게 증가시켰습니다. 이러한 추세는 소비자의 온라인 구매 방식을 간소화하고 편리하고 안전한 결제 경험을 제공합니다. 결과적으로 디지털 결제 시스템은 유럽 전역에서 전자상거래의 성장과 접근성을 촉진하는 데 중추적인 역할을 합니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2023년부터 2030년까지

|

기준 연도

|

2022

|

역사적인 해

|

2021 (2015-2020년으로 맞춤 설정 가능)

|

양적 단위

|

매출(백만 달러), 볼륨(단위), 가격(달러)

|

다루는 세그먼트

|

제공 항목(솔루션 및 서비스), 배포 모델(온프레미스, 클라우드), 조직 규모(대기업, 중소기업(SME)), 결제 방식(결제 카드, 판매 시점, 통합 결제 인터페이스(UPI) 서비스, 모바일 결제, 온라인 결제), 사용 방식(모바일 애플리케이션, 데스크톱/웹 브라우저), 기술(애플리케이션 프로그래밍 인터페이스(API), 데이터 분석 및 머신 러닝, 디지털 원장 기술(DLT), 인공 지능 및 사물 인터넷, 생체 인증), 사용 사례(개인(P/C), 가맹점/기업, 정부), 최종 사용자(상업, 소비자)

|

포함 국가

|

독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 나머지 지역.

|

시장 참여자 포함

|

ACI Worldwide(미국), PayPal, Inc.(미국), Novatti Group Limited(호주), Global Payments Inc.(미국), Visa(미국), Stripe, Inc.(아일랜드), Google, LLC(미국), Finastra(영국), SAMSUNG(한국), Amazon Web Services, Inc.(미국), Financial Software & Systems Pvt. Ltd.(미국), Aurus Inc.(미국), Adyen(네덜란드), Apple Inc.(미국), Fiserv, Inc.(미국), WEX Inc.(미국), wirecard(미국), Mastercard(미국) 등이 있습니다.

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research 팀이 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 시장 부문, 지리적 범위, 시장 참여자, 시장 시나리오와 같은 시장 통찰력 외에도 심층적인 전문가 분석, 수입/수출 분석, 가격 분석, 생산 소비 분석, 유봉 분석이 포함되어 있습니다.

|

세그먼트 분석:

유럽 디지털 결제 시장은 제공 서비스, 배포 모델, 조직 규모, 결제 방식, 사용 방식, 기술, 사용 사례 및 최종 사용자를 기준으로 세분화됩니다.

- 유럽 디지털 결제 시장은 제공 항목을 기준으로 솔루션과 서비스로 구분됩니다.

- 배포 모델을 기준으로 유럽 디지털 결제 시장은 온프레미스와 클라우드로 구분됩니다.

- 유럽 디지털 결제 시장은 조직 규모에 따라 대기업, 중소기업(SME)으로 구분됩니다.

- 결제 방식을 기준으로 유럽 디지털 결제 시장은 결제 카드, 판매 시점 결제, 통합 결제 인터페이스(UPI) 서비스, 모바일 결제, 온라인 결제로 구분됩니다.

- 사용 방식을 기준으로 유럽 디지털 결제 시장은 모바일 애플리케이션, 데스크톱/웹 브라우저로 구분됩니다.

- 유럽 디지털 결제 시장은 기술을 기반으로 애플리케이션 프로그래밍 인터페이스(API), 데이터 분석 및 머신 러닝, 디지털 원장 기술(DLT), 인공 지능 및 사물 인터넷, 생체 인증으로 구분됩니다.

- 유럽 디지털 결제 시장은 사용 사례를 기준으로 개인(P/C), 상인/기업, 정부로 구분됩니다.

- 최종 사용자를 기준으로 유럽 디지털 결제 시장은 상업 및 소비자용으로 구분됩니다.

주요 플레이어

Data Bridge Market Research에서는 유럽 디지털 결제 시장의 주요 기업으로 ACI Worldwide(미국), PayPal, Inc.(미국), Novatti Group Limited(호주), Global Payments Inc.(미국), Visa(미국), Stripe, Inc.(아일랜드), Google, LLC(미국), Finastra(영국), SAMSUNG(한국)을 꼽았습니다.

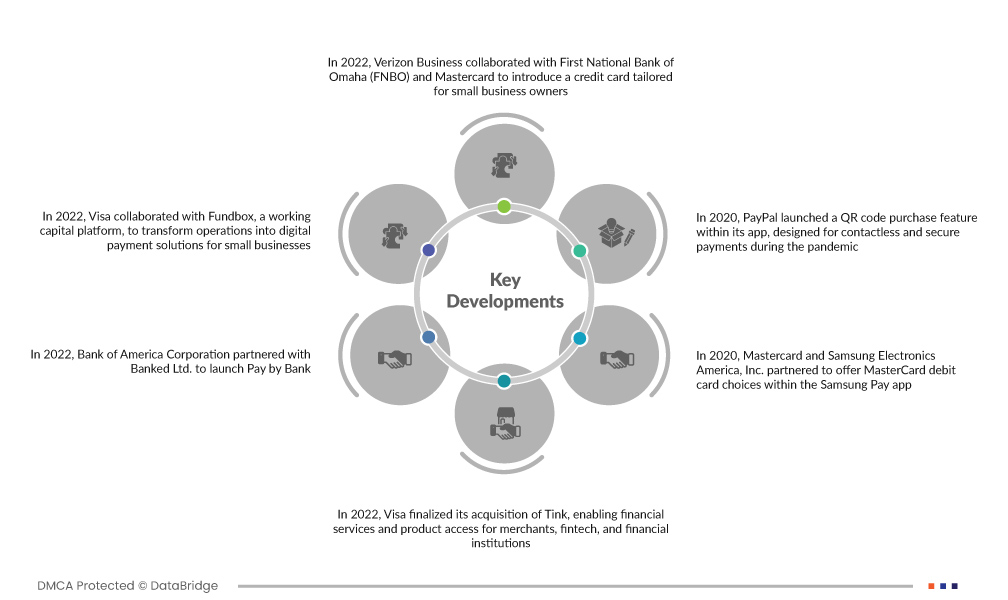

시장 개발

- 2022년, Verizon Business는 First National Bank of Omaha(FNBO) 및 Mastercard와 협력하여 소규모 사업주를 위한 맞춤형 신용카드를 출시했습니다. 온라인 계좌 소유자가 이용할 수 있는 Verizon Business Mastercard는 모든 구매에 대해 리워드를 제공합니다.

- 2022년, 비자는 운영 자금 플랫폼인 펀드박스(Fundbox)와 협력하여 중소기업을 위한 디지털 결제 솔루션으로 운영 방식을 전환했습니다. 첫 번째 단계는 Pathward NA에서 발행한 펀드박스 플렉스 비자 직불카드를 도입하는 것이었습니다.

- 2022년, 뱅크 오브 아메리카(Bank of America Corporation)는 Banked Ltd.와 파트너십을 맺고 전자상거래 고객이 은행 계좌에서 직접 결제할 수 있는 온라인 결제 솔루션인 Pay by Bank를 출시했습니다. 이번 조치는 회사의 지속적인 기술 투자 계획의 일환입니다.

- 2022년, 비자는 팅크(Tink) 인수를 완료하여 가맹점, 핀테크, 금융 기관의 금융 서비스와 상품 접근성을 확대했습니다. 팅크는 3,400개 이상의 은행과 수백만 명의 유럽 은행 고객과 파트너십을 맺었습니다.

- 2020년, 페이팔은 팬데믹 기간 동안 비접촉식 보안 결제를 위해 앱 내에 QR 코드 구매 기능을 도입했습니다. 이 혁신은 회사의 가시성과 시장 입지를 강화할 것으로 예상됩니다.

- 2020년 Mastercard와 Samsung Electronics America, Inc.는 힘을 합쳐 Samsung Pay 앱 내에서 MasterCard 직불 카드 옵션을 제공함으로써 고객 도달 범위를 확대하고 앱을 통한 편리한 직불 카드 결제를 가능하게 했습니다.

지역 분석

지리적으로 유럽 디지털 지불 시장 보고서에서 다루는 국가는 독일, 프랑스, 영국, 네덜란드, 스위스, 벨기에, 러시아, 이탈리아, 스페인, 터키, 유럽의 나머지 지역입니다.

Data Bridge Market Research 분석에 따르면:

영국은 2023-2030년 예측 기간 동안 유럽 디지털 결제 시장 에서 지배적인 지역입니다 .

영국은 연구 개발에 대한 막대한 투자와 첨단 기술 육성을 통해 디지털 결제 시장을 선도하고 있습니다. 이 지역의 디지털 인프라, 온라인 플랫폼, 그리고 인터넷 접근성은 시장 확장에 기여합니다. 이러한 요소들은 시너지 효과를 발휘하여 혁신과 편의성을 촉진하고 있으며, 영국은 디지털 결제 분야에서 선도적인 역할을 수행하고 있습니다.

유럽 디지털 결제 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/europe-digital-payment-market