Middle East And Africa Green Bio Polyols Market

Market Size in USD Million

CAGR :

%

USD

43.40 Million

USD

71.14 Million

2024

2032

USD

43.40 Million

USD

71.14 Million

2024

2032

| 2025 –2032 | |

| USD 43.40 Million | |

| USD 71.14 Million | |

|

|

|

Green and Bio Polyols Market Analysis

Crop Green and Bio Polyols Market has an increasing demand for rigid and flexible polyurethane in various applications like sports and athletic footwear, as consumers are increasingly seek eco-friendly alternatives that minimize environmental impact while ensuring sustainable practices and less environmental effect, thereby driving market growth globally.

Green and Bio Polyols Market Size

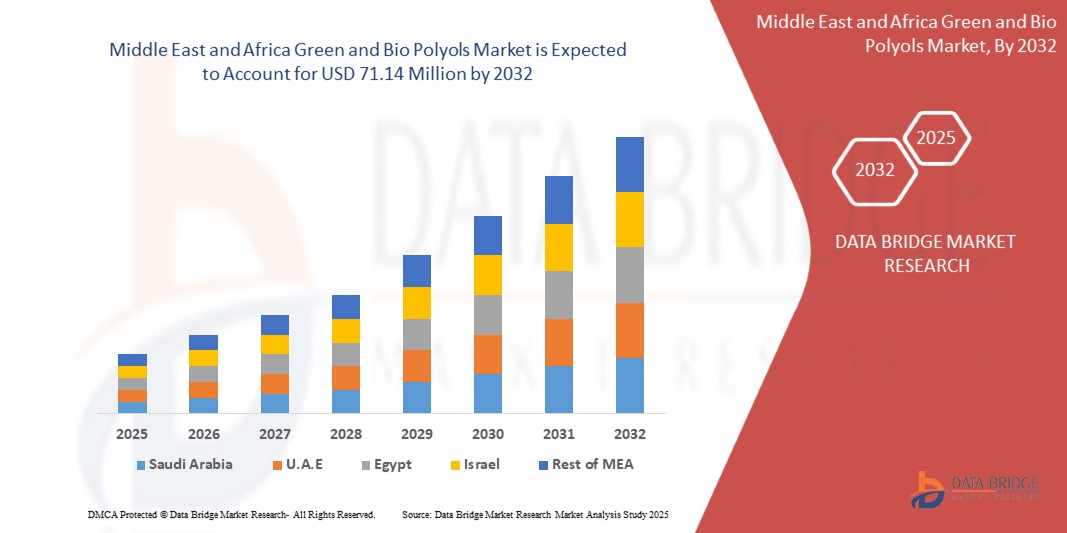

Middle East and Africa green and bio polyols market is expected to reach USD 71.14 million by 2032 from USD 43.40 million in 2024, growing with a substantial CAGR of 6.5% in the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Green and Bio Polyols Market Trends

“Rising Awareness of Sustainable Materials ”

The growing Middle East and Africa emphasis on sustainability is significantly influencing the demand for green and bio-based polyols, reshaping the market landscape. With increased awareness of the environmental consequences of fossil fuel-derived products, consumers and industries alike are shifting toward sustainable materials. This paradigm shift has catalyzed innovation and adoption of green and bio polyols, which are derived from renewable resources like plant-based oils and recycled materials.

Key industries such as construction, automotive, and packaging are embracing these eco-friendly polyols to align with stricter regulatory frameworks and evolving consumer preferences. Governments across regions are introducing incentives and mandates to curb carbon footprints, which further propels the demand for bio-based alternatives. In the automotive industry, rising consumer preference for vehicles with reduced environmental impact is driving the adoption of bio-polyurethane foams, which are widely used in seating, interiors, and insulation. Similarly, the construction sector is leveraging green polyols for energy-efficient insulation materials, meeting the growing demand for green building certifications such as LEED.

Moreover, multinational corporations are increasingly integrating sustainability into their branding strategies, opting for eco-friendly raw materials to enhance their market reputation. This shift not only addresses corporate social responsibility (CSR) goals but also positions these companies as innovators in an eco-conscious marketplace. In addition to it, heightened consumer awareness, driven by education campaigns and media coverage, has transformed sustainability from a niche concern into a mainstream market driver. This rising consciousness is reshaping buying patterns across sectors, creating robust demand for sustainable solutions like green and bio polyols.

Report Scope and Market Segmentation

|

Attributes |

Green and Bio Polyols Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Saudi Arabia, U.A.E., Egypt, South Africa, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Cargill, Incorporated (U.S.), BASF SE (Germany), , Stepan Company (U.S.), and Wanhua (China) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Green and Bio Polyols Market Definition

Green and bio polyols are environmentally friendly alternatives to conventional polyols used in the production of polyurethane foams, coatings, adhesives, and elastomers. These polyols are derived from renewable resources such as vegetable oils (e.g., soy, castor, or palm oil), natural sugars, or another biomass. They help reduce reliance on petroleum-based feedstock and contribute to lower greenhouse gas emissions during production. Green polyols emphasize sustainable production methods with minimal environmental impact, whereas bio polyols specifically highlight their biological or renewable origin. Both types retain comparable chemical and physical properties to traditional polyols, making them suitable for diverse industrial applications. Additionally, they support circular economy principles, with some being recyclable or biodegradable. The use of green and bio polyols aligns with growing Middle East and Africa demands for sustainable materials in sectors like automotive, construction, and packaging, as industries transition toward eco-friendly manufacturing solutions.

Green and Bio Polyols Market Dynamics

Drivers

- Increasing Demand for Rigid and Flexible Polyurethane in Various Applications Like Sports and Athletic Footwear

The growing demand for rigid and flexible polyurethane in diverse applications, particularly in sports and athletic footwear, is a key driver accelerating the growth of the Middle East and Africa green and bio polyols market. As industries increasingly prioritize sustainability, the adoption of bio-based polyols for polyurethane production is gaining momentum, especially in high-demand sectors such as footwear. In the sports and athletic footwear industry, polyurethane plays a crucial role due to its lightweight, durable, and versatile properties. Rigid polyurethanes are widely used for structural components, while flexible variants are integral in cushioning and midsole applications. With rising consumer preference for eco-friendly products, footwear manufacturers are shifting toward bio-based polyurethanes to meet market demands and align with sustainability goals. Leading sportswear brands like Adidas, Nike, and Puma are at the forefront of this transformation. For instance, Adidas’ Futurecraft. Footprint sneakers incorporate bio-based polyurethane derived from renewable materials, reflecting the brand's commitment to reducing its environmental impact. Similarly, Nike is integrating bio-polyols in its product lines to create performance footwear that balances sustainability and functionality. The market for bio-polyols is further propelled by increasing awareness among consumers regarding the environmental impact of conventional polyurethane. As customers demand greener alternatives, companies are leveraging bio-based polyols to differentiate their products and strengthen their market positioning. Additionally, the rise of athleisure as a lifestyle trend is expanding the application scope of polyurethane, driving higher production volumes of bio-based variants. The ability of green and bio polyols to reduce greenhouse gas emissions and reliance on fossil fuels aligns seamlessly with Middle East and Africa environmental targets, attracting investments from industry players. For Instance, Allbirds utilizes bio-based polyurethane derived from sugarcane in its footwear. The company’s SweetFoam innovation has become a benchmark in the industry for sustainable midsole production, further driving demand for green polyols

- Circular Economy Focuses on Maximizing Resource Efficiency by Minimizing Waste and Promoting the Reuse

The concept of a circular economy is rapidly gaining traction across industries, and its focus on maximizing resource efficiency by minimizing waste and promoting the reuse of materials is becoming a key driver of the Middle East and Africa green and bio polyols market. This economic model encourages manufacturers to adopt sustainable practices, such as using renewable resources, reducing energy consumption, and recycling materials, which aligns seamlessly with the growing demand for environmentally friendly solutions in the production of polyurethane products. In a circular economy, the emphasis is on reducing the reliance on virgin, petroleum-based resources and instead utilizing bio-based alternatives, such as green and bio polyols. These renewable polyols are derived from plant-based feedstocks or waste materials, contributing to a reduction in greenhouse gas emissions and supporting sustainable production processes. This shift is particularly important in industries such as automotive, construction, and consumer goods, where the use of traditional, non-renewable materials is being increasingly scrutinized. Leading companies are embracing circular economy principles by incorporating bio-based polyols into their product offerings. For example, BASF’s PolyTHF products, used in various applications, are now produced with a focus on sustainability and renewable feedstocks, contributing to a circular economy. Likewise, Covestro’s commitment to circularity is evident in its development of polyurethanes based on recycled CO2 and bio-based polyols, reducing reliance on fossil fuels and promoting a more sustainable supply chain

Opportunities

- Increased Construction Activities, Particularly in Emerging Economies

Regulatory push for eco-friendly products is creating a significant opportunity for the Middle East and Africa Green and Bio Polyols Market. As governments worldwide implement stricter environmental regulations and sustainability targets, there is a growing demand for products made from renewable and biodegradable materials. Bio-based polyols, which are used in the production of sustainable foams, coatings, and adhesives, align with these regulatory requirements, offering an alternative to petroleum-based products. This shift is further supported by green building certifications and energy-efficient standards, encouraging manufacturers to adopt eco-friendly materials in their products. Consequently, these regulatory trends drive the market for green and bio polyols, fostering innovation and expansion in various industries, including construction, automotive, and packaging. he regulatory push for eco-friendly products will create substantial opportunities for the Middle East and Africa green and bio polyols market by encouraging the transition to more sustainable, renewable alternatives. As governments implement stricter environmental regulations and set ambitious sustainability goals, companies will be driven to adopt bio-based and circular solutions to meet these requirements. This regulatory shift will foster innovation, improve the availability of sustainable polyols, and align with the growing consumer preference for environmentally conscious products.

- Regulatory Push for Eco-Friendly Products

Regulatory push for eco-friendly products is creating a significant opportunity for the global Green and Bio Polyols Market. As governments worldwide implement stricter environmental regulations and sustainability targets, there is a growing demand for products made from renewable and biodegradable materials. Bio-based polyols, which are used in the production of sustainable foams, coatings, and adhesives, align with these regulatory requirements, offering an alternative to petroleum-based products. This shift is further supported by green building certifications and energy-efficient standards, encouraging manufacturers to adopt eco-friendly materials in their products. Consequently, these regulatory trends drive the market for green and bio polyols, fostering innovation and expansion in various industries, including construction, automotive, and packaging. In conclusion, the regulatory push for eco-friendly products will create substantial opportunities for the global green and bio polyols market by encouraging the transition to more sustainable, renewable alternatives. As governments implement stricter environmental regulations and set ambitious sustainability goals, companies will be driven to adopt bio-based and circular solutions to meet these requirements. This regulatory shift will foster innovation, improve the availability of sustainable polyols, and align with the growing consumer preference for environmentally conscious products.

Restraints/Challenges

- Stringent regulations regarding use of Green and Bio Polyols

The high production cost associated with bio-based polyols remains a critical restraint for their widespread adoption in the Middle East and Africa market. Unlike conventional polyols, which benefit from mature, cost-efficient manufacturing processes and established supply chains, bio-based polyols rely on renewable raw materials such as plant oils, agricultural waste, or other biomass. These feedstocks often involve complex extraction, refining, and processing steps that significantly increase production costs. One of the primary drivers of these elevated costs is the dependency on advanced technologies and infrastructure to convert bio-based feedstocks into high-quality polyols. These technologies, including enzymatic processing or fermentation, require substantial capital investments and operational expenditures. Additionally, economies of scale are yet to be achieved in the bio-based polyol segment, further exacerbating the cost disparity with petroleum-based alternatives. The variability and limited availability of feedstocks also contribute to high costs. Factors such as fluctuating agricultural yields, seasonal constraints, and competition from other industries using the same biomass resources can drive up raw material prices. For instance, soybean or castor oil, commonly used in bio-polyol production, often face pricing pressures due to demand from the food and biofuel sectors. These cost factors make bio-based polyols less attractive for price-sensitive industries, such as packaging, automotive, and consumer goods. Companies may hesitate to transition from conventional polyols, particularly in markets where sustainability certifications do not provide significant competitive advantage or consumer willingness to pay a premium is limited.

- Stringent Regulation for Polyols (Polyurethane) Production

Stringent regulations for polyols (polyurethane) production present significant challenges for the Middle East and Africa Green and Bio Polyols Market by increasing compliance costs and operational complexities. Regulations such as the NESHAP in the U.S., REACH in Europe, and various national laws around the world require companies to invest in advanced technologies to reduce emissions, ensure chemical safety, and meet environmental standards. These regulations often demand extensive testing, documentation, and adjustments in manufacturing processes, which can slow production, increase operational costs, and create barriers to market entry, particularly for companies transitioning to sustainable and bio-based production methods. For instance

United States

National Emission Standards for Hazardous Air Pollutants (NESHAP) Rules for new and existing plant facilities to reduce hazardous air pollutant emissions by ~70%, leading to higher compliance costs and potential operational delays.

Europe

REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) Comprehensive regulations requiring safety testing and documentation for chemicals, impacting the production process and increasing R&D costs for compliance.

India

Environmental Protection Act, 1986 Regulations to control pollution and ensure safe manufacturing practices, necessitating adherence to environmental safety protocols, which may increase production costs.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Middle East and Africa Green and Bio Polyols Market Scope

The market is segmented on the basis of type and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Polyether Polyols

- Polyester Polyols

Application

- Foam

- Coatings

- Adhesives

- Sealants

- Elastomers

- Others

Middle East and Africa Green and Bio Polyols Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market are Saudi Arabia, U.A.E., Egypt, South Africa, Israel, and Rest of Middle East and Africa.

Saudi Arabia is dominating the MEA (Middle East and Africa) green and bio polyols market due to its strong industrial base, significant investments in sustainable technologies, and growing focus on reducing environmental impact. The country has a well-established chemical and petrochemical sector, which supports the production of green and bio-based polyols.

Saudi Arabia is expected to be the fastest-growing country in the MEA green and bio polyols market due to increasing demand for environmentally friendly materials across various industries such as automotive, construction, and packaging. The country's commitment to Vision 2030, which aims to develop a more sustainable and diversified economy, is driving the adoption of green technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Green and Bio Polyols Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Green and Bio Polyols Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- Stepan Company (U.S.)

- Wanhua (China)

Latest Developments in Green and Bio Polyols Market

- In November 2024, Krishna Enterprise and Alberdingk Boley announced their collaboration in water-based acrylic dispersions for the Indian market. Since 1985, Krishna Enterprise has provided innovative solutions in coatings, and Gaurang Goradia visited Alberdingk in October to sign the partnership agreement

- In October 2024, Cargill has been awarded the INDI 4.0 2024 Smart Factory award by Indonesia’s Ministry of Industry for successfully implementing Industry 4.0 technologies at its cocoa processing facility in Gresik. This recognition highlights Cargill’s commitment to advanced manufacturing practices, including automation, real-time data monitoring, and energy management, aimed at enhancing efficiency and sustainability

- In July 2023, Stepan received the World Finance Sustainability Award 2023, recognizing their commitment to sustainability and eco-friendly practices. The award highlights Stepan's efforts in creating innovative, environmentally responsible solutions across industries, reinforcing their leadership in sustainable business practices

- In June 2024, Aurorium, a specialty ingredients manufacturer, announced the launch of Haelium Pharmaceutical Solutions, reflecting its long-term commitment to healthcare. Built on decades of innovation, the Haelium product line established Aurorium as a Middle East and Africa leader in pharmaceutical ingredients, embodying a unique approach to excellence

- In June 2024, BASF has expanded its portfolio by introducing biomass-balanced (BMB) ecoflex, a certified compostable biopolymer for the packaging industry. This ecoflexF Blend C1200 BMB uses renewable feedstock from organic waste, reducing fossil resource consumption and offering a 60% lower carbon footprint

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.1.7 CONCLUSION

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 THREAT OF SUBSTITUTES

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 BARGAINING POWER OF BUYERS

4.2.5 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICE INDEX

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT'S ROLE

4.7.4 ANALYST RECOMMENDATIONS

4.8 PRODUCTION CAPACITY OVERVIEW

4.8.1 CURRENT PRODUCTION CAPACITY

4.8.2 REGIONAL DISTRIBUTION OF PRODUCTION CAPACITY

4.8.3 TECHNOLOGICAL ADVANCEMENTS AND INNOVATION

4.8.4 CAPACITY EXPANSION AND FUTURE PROJECTIONS

4.9 RAW MATERIAL COVERAGE

4.9.1 PLANT OILS

4.9.1.1 Castor Oil

4.9.1.2 Soybean Oil

4.9.1.3 Palm Oil

4.9.2 AGRICULTURAL RESIDUES AND WASTE BIOMASS

4.9.2.1 Corn Stover

4.9.2.2 Wheat Straw and Rice Husk

4.9.3 SUGAR-BASED FEEDSTOCKS

4.9.3.1 Sugar Alcohols

4.9.4 ALGAE AND OTHER NOVEL SOURCES

4.9.4.1 Algae

4.9.5 WASTE OILS AND BY-PRODUCTS

4.9.5.1 Used Cooking Oils

4.9.6 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.2.1 Transportation Costs

4.10.2.2 Storage and Inventory Management

4.10.2.3 Middle East And Africa Supply Chain Disruptions

4.10.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.10.3.1 Raw Material Sourcing and Transportation

4.10.3.2 Sustainability in Logistics

4.10.3.3 Middle East And Africa Distribution and Supply Chain Coordination

4.10.3.4 Technological Integration

4.10.4 CONCLUSION

4.11 TECHNOLOGY ADVANCEMENTS BY MANUFACTURERS

4.11.1 FEEDSTOCK INNOVATION AND RAW MATERIAL OPTIMIZATION

4.11.1.1 Advanced Catalysis and Green Chemistry

4.11.1.2 Feedstock Diversification

4.11.2 ADVANCED PRODUCTION TECHNIQUES

4.11.2.1 Biocatalysis and Enzymatic Processes

4.11.2.2 Green Solvents and Solvent-free Processes

4.11.2.3 Continuous and Flow Chemistry

4.11.3 PROCESS INTEGRATION AND ENERGY EFFICIENCY

4.11.3.1 Heat Integration and Energy Recovery

4.11.3.2 Process Intensification

4.11.4 PERFORMANCE AND PRODUCT INNOVATION

4.11.4.1 Tailored Bio Polyols for Specific Applications

4.11.4.2 Enhanced Durability and Stability

4.11.5 CIRCULAR ECONOMY AND WASTE REDUCTION

4.11.5.1 Recycling of Bio-Based Polyols

4.11.5.2 Zero-Waste Manufacturing

4.11.6 CONCLUSION

5 REGULATION COVERAGE

5.1 ENVIRONMENTAL REGULATIONS AND STANDARDS

5.1.1 CARBON FOOTPRINT AND GREENHOUSE GAS EMISSIONS

5.1.2 SUSTAINABILITY AND BIODEGRADABILITY

5.1.3 REACH AND CHEMICAL SAFETY REGULATIONS

5.2 FEEDSTOCK SOURCING AND AGRICULTURAL REGULATIONS

5.2.1 SUSTAINABLE SOURCING OF RAW MATERIALS

5.2.2 AGRI-ENVIRONMENTAL REGULATIONS

5.2.3 TRACEABILITY AND CERTIFICATION

5.3 PRODUCT SAFETY AND REGULATORY COMPLIANCE

5.3.1 SAFETY AND TOXICITY REGULATIONS

5.3.2 FLAMMABILITY STANDARDS

5.4 CIRCULAR ECONOMY AND WASTE MANAGEMENT REGULATIONS

5.4.1 EXTENDED PRODUCER RESPONSIBILITY (EPR)

5.4.2 PLASTIC WASTE AND PACKAGING REGULATIONS

5.5 REGIONAL REGULATIONS AND STANDARDS

5.6 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING AWARENESS OF SUSTAINABLE MATERIALS

6.1.2 INCREASING DEMAND FOR RIGID AND FLEXIBLE POLYURETHANE IN VARIOUS APPLICATIONS LIKE SPORTS AND ATHLETIC FOOTWEAR

6.1.3 CIRCULAR ECONOMY FOCUSES ON MAXIMIZING RESOURCE EFFICIENCY BY MINIMIZING WASTE AND PROMOTING THE REUSE

6.2 RESTRAINTS

6.2.1 PERFORMANCE LIMITATIONS COMPARED TO CONVENTIONAL POLYOLS

6.2.2 HIGH PRODUCTION COST FOR BIO BASED POLYOLS

6.3 OPPORTUNITIES

6.3.1 INCREASED CONSTRUCTION ACTIVITIES, PARTICULARLY IN EMERGING ECONOMIES

6.3.2 REGULATORY PUSH FOR ECO-FRIENDLY PRODUCTS

6.3.3 TECHNOLOGICAL ADVANCEMENTS IN PRODUCTION

6.4 CHALLENGE

6.4.1 STRINGENT REGULATION FOR POLYOLS (POLYURETHANE) PRODUCTION

7 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE

7.1 OVERVIEW

7.2 POLYETHER POLYOLS

7.3 POLYESTER POLYOLS

8 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 FOAM

8.3 COATINGS

8.4 ADHESIVES

8.5 SEALANTS

8.6 ELASTOMERS

8.7 OTHERS

9 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY REGION

9.1 MIDDLE EAST AND AFRICA

9.1.1 SAUDI ARABIA

9.1.2 U.A.E.

9.1.3 EGYPT

9.1.4 SOUTH AFRICA

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CARGILL, INCORPORATED

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 BASF

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 EMERY OLEOCHEMICALS

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 STEPAN COMPANY

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 POLYLABS TM.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 ALBERDINGK BOLEY GMBH

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 AURORIUM

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENT

12.8 BIOBASED TECHNOLOGIES

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 WANHUA

12.9.1 COMPANY SNAPSHOT

12.9.2 REVENUE ANALYSIS

12.9.3 PRODUCT PORTFOLIO

12.9.4 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 COUNTRY WISE REGULATION FOR PRODUCTION OF POLYOLS (POLYURETHANE)

TABLE 2 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 4 MIDDLE EAST AND AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA FOAM IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY COUNTRY, 2018-2032 (KILO TONS)

TABLE 12 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 14 MIDDLE EAST AND AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 20 SAUDI ARABIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 SAUDI ARABIA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 22 SAUDI ARABIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 23 SAUDI ARABIA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 24 SAUDI ARABIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 25 SAUDI ARABIA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 26 SAUDI ARABIA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 27 SAUDI ARABIA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 28 U.A.E. GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 U.A.E. GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 30 U.A.E. POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 31 U.A.E. POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 32 U.A.E. POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 33 U.A.E. POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 U.A.E. GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 U.A.E. FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 36 EGYPT GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 EGYPT GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 38 EGYPT POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 39 EGYPT POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 40 EGYPT POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 41 EGYPT POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 42 EGYPT GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 EGYPT FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 44 SOUTH AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 SOUTH AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 46 SOUTH AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 47 SOUTH AFRICA POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 48 SOUTH AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 49 SOUTH AFRICA POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 50 SOUTH AFRICA GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 51 SOUTH AFRICA FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 52 ISRAEL GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 ISRAEL GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

TABLE 54 ISRAEL POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 55 ISRAEL POLYETHER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 56 ISRAEL POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 57 ISRAEL POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 58 ISRAEL GREEN AND BIO POLYOLS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 59 ISRAEL FOAM IN POLYESTER POLYOLS IN GREEN AND BIO POLYOLS MARKET, BY SEGMENT, 2018-2032 (USD THOUSAND)

TABLE 60 REST OF MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 REST OF MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYPE, 2018-2032 (KILO TONS)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET

FIGURE 2 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: APPLICATION COVERAGE GRID

FIGURE 11 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: SEGMENTATION

FIGURE 12 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, BY TYP, 2024

FIGURE 13 EXECUTIVE SUMMARY OF MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET

FIGURE 14 STRATEGIC DECISIONS

FIGURE 15 RISING AWARENESS OF SUSTAINABLE MATERIALS IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE POLYETHER POLYOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET IN 2025 AND 2032

FIGURE 17 PESTEL ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET, 2023-2032, AVERAGE SELLING PRICE (USD/TON)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET

FIGURE 24 TOTAL LENGTH OF NATIONAL HIGHWAY IN (KM) (2014-2023) OF INDIA

FIGURE 25 NUMBER OF AIRPORTS (2014-2024) IN INDIA

FIGURE 26 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: BY TYPE, 2024

FIGURE 27 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: BY APPLICATION, 2024

FIGURE 28 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: SNAPSHOT (2024)

FIGURE 29 MIDDLE EAST AND AFRICA GREEN AND BIO POLYOLS MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Green Bio Polyols Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Green Bio Polyols Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Green Bio Polyols Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.