Middle East And Africa Minimally Invasive Surgery Market

Market Size in USD Billion

CAGR :

%

USD

1.76 Billion

USD

2.70 Billion

2025

2033

USD

1.76 Billion

USD

2.70 Billion

2025

2033

| 2026 –2033 | |

| USD 1.76 Billion | |

| USD 2.70 Billion | |

|

|

|

|

Middle East and Africa Minimally Invasive Surgery Market Size

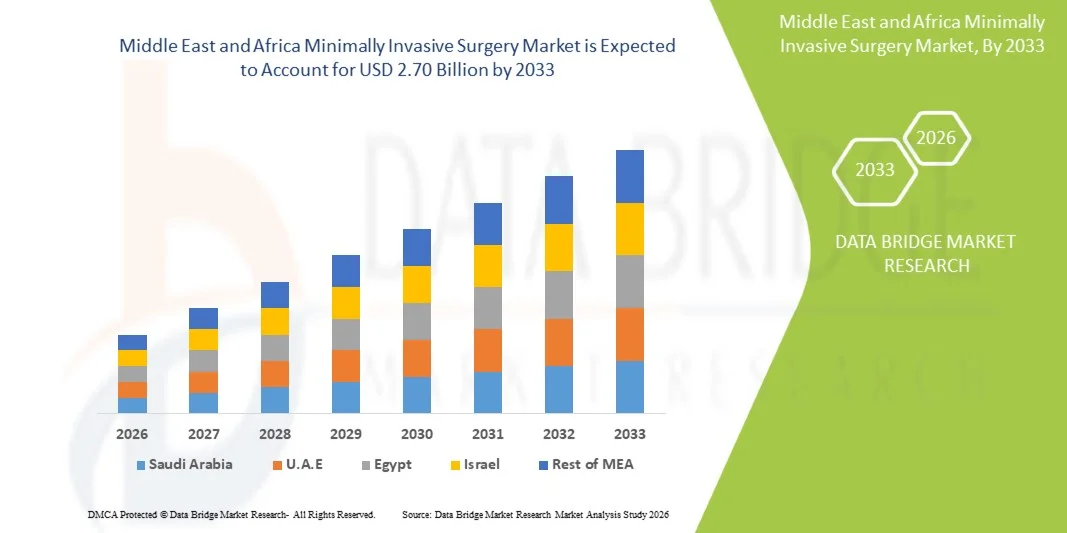

- The Middle East and Africa minimally invasive surgery market size was valued at USD 1.76 billion in 2025 and is expected to reach USD 2.70 billion by 2033, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by the increasing prevalence of chronic diseases, rising surgical volumes, and the growing adoption of advanced surgical technologies that enable reduced trauma, shorter hospital stays, and faster patient recovery

- Furthermore, improving healthcare infrastructure, rising investments in modern surgical equipment, and increasing preference for cost-effective and precision-based procedures among healthcare providers are positioning minimally invasive surgery as a preferred treatment approach across the region. These factors collectively are accelerating market adoption and significantly contributing to overall market growth

Middle East and Africa Minimally Invasive Surgery Market Analysis

- Minimally invasive surgery (MIS), encompassing procedures performed through small incisions using advanced imaging and specialized instruments, is becoming an essential component of modern surgical care across the Middle East and Africa due to its benefits of reduced postoperative pain, shorter hospital stays, and faster patient recovery

- The rising demand for minimally invasive surgery is primarily driven by the increasing prevalence of chronic and lifestyle-related diseases, growing awareness of advanced treatment options, and a strong preference among patients and clinicians for procedures associated with lower complication risks

- Saudi Arabia dominated the Middle East and Africa minimally invasive surgery market with a revenue share of 37.5% in 2025, supported by high healthcare spending, advanced hospital infrastructure, and strong government initiatives to modernize surgical care, with significant adoption of MIS techniques across general surgery, orthopedics, and gynecology

- South Africa is expected to be the fastest growing country during the forecast period driven by expanding private healthcare facilities, increasing surgical procedure volumes, and rising investments in advanced medical technologies

- The laparoscopy surgery segment dominated the minimally invasive surgery market in 2025 with a market share of 46.4%, driven by its widespread clinical acceptance, broad applicability across multiple surgical specialties, and proven effectiveness in improving clinical outcomes while reducing overall treatment costs

Report Scope and Middle East and Africa Minimally Invasive Surgery Market Segmentation

|

Attributes |

Middle East and Africa Minimally Invasive Surgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Minimally Invasive Surgery Market Trends

“Rising Adoption of Robotic-Assisted and AI-Enabled Procedures”

- A significant and accelerating trend in the Middle East and Africa minimally invasive surgery market is the increasing integration of robotic-assisted systems and AI-enabled surgical planning tools, enhancing precision, reducing complications, and improving patient outcomes

- For instance, the da Vinci Xi Surgical System is being increasingly adopted in Saudi Arabia for complex urological and gynecological procedures, allowing surgeons to perform delicate operations through smaller incisions with enhanced accuracy

- AI-enabled imaging and predictive analytics are being used to assist surgeons in preoperative planning, real-time decision-making, and post-operative assessment, improving overall procedural efficiency and patient safety

- The combination of robotics and AI in minimally invasive procedures enables surgeons to perform complex surgeries with shorter recovery times, lower blood loss, and reduced risk of infection, particularly in high-volume hospitals and specialized surgical centers

- This trend is reshaping patient expectations and hospital investment strategies, encouraging healthcare providers to upgrade surgical infrastructure and adopt technologically advanced MIS systems

- The demand for robotic-assisted and AI-integrated minimally invasive procedures is growing rapidly across both public and private hospitals, as patients and surgeons increasingly prioritize precision, efficiency, and minimally traumatic interventions

- Growing collaborations between device manufacturers and hospitals for customized MIS solutions are promoting adoption of procedure-specific instruments and surgical kits, further enhancing efficiency and patient outcomes

Middle East and Africa Minimally Invasive Surgery Market Dynamics

Driver

“Increasing Prevalence of Chronic Diseases and Advanced Surgical Infrastructure”

- The rising incidence of chronic and lifestyle-related diseases, such as obesity, cardiovascular disorders, and gastrointestinal conditions, is driving demand for minimally invasive surgery procedures across the Middle East and Africa

- For instance, in 2025, King Faisal Specialist Hospital & Research Centre in Saudi Arabia reported a surge in laparoscopic bariatric and gastrointestinal surgeries, reflecting growing patient preference for less invasive procedures

- Advanced hospital infrastructure, rising healthcare expenditure, and government initiatives to modernize surgical care are supporting the adoption of MIS procedures in countries such as Saudi Arabia, UAE, and South Africa

- Patients and surgeons increasingly prefer minimally invasive approaches due to reduced postoperative pain, shorter hospital stays, faster recovery, and lower risk of complications compared to traditional open surgeries

- Furthermore, the growing awareness of MIS benefits, coupled with increasing surgical volumes in high-demand specialties such as orthopedics, gynecology, and urology, is bolstering market growth across both private and public healthcare segments

- These converging factors are making minimally invasive surgery an essential component of modern surgical care, driving investments and encouraging broader adoption in the region

- Rising medical tourism in the UAE, Saudi Arabia, and Egypt is creating additional demand for advanced minimally invasive procedures, attracting international patients seeking high-quality surgical care

- Increasing government funding for healthcare innovation and hospital modernization programs is facilitating the introduction of advanced MIS technologies and expanding access in both urban and semi-urban areas

Restraint/Challenge

“High Equipment Costs and Limited Skilled Workforce”

- The high capital investment required for robotic-assisted systems, advanced imaging devices, and MIS equipment presents a major challenge for hospitals and clinics, particularly in developing Middle East and Africa countries

- For instance, the upfront cost of da Vinci surgical systems and AI-enabled MIS tools limits adoption to well-funded hospitals and specialized centers, leaving smaller hospitals dependent on conventional laparoscopic instruments

- In addition, the limited availability of skilled surgeons and trained support staff in advanced MIS techniques hinders rapid expansion, particularly in African countries with developing healthcare infrastructure

- High maintenance costs, consumable requirements, and ongoing software updates add further financial pressure, making procurement decisions more complex for hospital administrators

- While government initiatives and medical training programs are gradually addressing workforce gaps, the shortage of experienced MIS surgeons continues to restrict market penetration and growth in less-developed regions

- Overcoming these challenges through affordable technology solutions, surgeon training programs, and strategic hospital partnerships is crucial for sustaining market expansion and adoption of minimally invasive procedures

- Inconsistent reimbursement policies and limited insurance coverage for advanced MIS procedures in some countries pose financial barriers for hospitals and patients, slowing adoption rates

- Regulatory approval processes and compliance requirements for novel MIS devices can be lengthy and complex, delaying product launches and hindering timely market entry

Middle East and Africa Minimally Invasive Surgery Market Scope

The market is segmented on the basis of product type, application, technology, and end users

- By Product Type

On the basis of product type, the Middle East and Africa minimally invasive surgery market is segmented into surgical devices, monitoring & visualization systems, laparoscopy devices, endosurgical equipment, and electrosurgical equipment. The surgical devices segment dominated the market with the largest market revenue share of 39.8% in 2025, driven by the high demand for advanced instruments used in laparoscopic, robotic-assisted, and general MIS procedures. Hospitals and surgical centers prioritize surgical devices for their direct role in improving procedural precision and reducing patient recovery time. The segment benefits from continuous innovation in ergonomics, instrumentation, and minimally invasive access solutions. Surgeons prefer these devices due to their reliability and compatibility with multiple MIS procedures. Moreover, ongoing adoption of robotic-assisted and AI-integrated systems further fuels demand for surgical devices. The presence of established manufacturers offering procedure-specific surgical kits also reinforces this segment’s dominance.

The laparoscopy devices segment is anticipated to witness the fastest growth rate of 22.1% from 2026 to 2033, driven by increasing laparoscopic procedures in gastrointestinal, bariatric, and gynecological surgeries. Laparoscopy devices offer enhanced visualization and reduced trauma, which are highly preferred by both patients and surgeons. Rising awareness of minimally invasive benefits and expanding hospital infrastructure in Saudi Arabia, UAE, and South Africa contribute to rapid adoption. The segment’s growth is also supported by rising medical tourism in the Middle East for bariatric and gastrointestinal surgeries. Continuous technological advancements, including high-definition imaging and improved instrument flexibility, are further accelerating growth.

- By Application

On the basis of application, the market is segmented into gastrointestinal surgery, gynecology surgery, urology surgery, cosmetic surgery, thoracic surgery, vascular surgery, orthopedic & spine surgery, bariatric surgery, breast surgery, cardiac surgery, adrenalectomy surgery, anti-reflux surgery, cancer surgery, cholecystectomy surgery, colectomy surgery, colon & rectal surgery, ear, nose & throat surgery, and obesity surgery. The gastrointestinal surgery segment dominated the market with a revenue share of 28.7% in 2025, driven by the high prevalence of gastrointestinal disorders and rising adoption of laparoscopic and endoscopic procedures. Hospitals and specialized surgical centers in Saudi Arabia and UAE increasingly prefer minimally invasive techniques to reduce hospital stays, minimize complications, and improve recovery. Endoscopic devices, advanced laparoscopic instruments, and AI-assisted imaging are widely used in gastrointestinal procedures. The growth is reinforced by increasing patient awareness of less invasive treatments and government initiatives to improve healthcare infrastructure. The popularity of bariatric surgery and colorectal procedures also strengthens the segment’s leadership.

The bariatric surgery segment is expected to witness the fastest growth rate of 24.3% from 2026 to 2033, fueled by the rising incidence of obesity and metabolic disorders in the Middle East. Hospitals and clinics in Saudi Arabia, UAE, and Egypt are increasingly adopting laparoscopic and robotic-assisted bariatric procedures due to their minimally invasive nature. The segment benefits from growing medical tourism, advanced surgical equipment availability, and rising insurance coverage for obesity treatments. Surgeons prefer minimally invasive bariatric techniques for reduced postoperative complications, faster recovery, and improved patient satisfaction.

- By Technology

On the basis of technology, the market is segmented into transcatheter surgery, laparoscopy surgery, non-visual imaging, and medical robotics. The laparoscopy surgery segment dominated the market with 46.4% share in 2025, due to its widespread clinical adoption, versatility across multiple specialties, and proven effectiveness in improving outcomes. Laparoscopic procedures are preferred for gastrointestinal, gynecological, and bariatric surgeries because they reduce recovery time and hospital costs. Hospitals across Saudi Arabia, UAE, and South Africa are investing heavily in laparoscopic equipment and training. Continuous advancements, including high-definition cameras and ergonomic instruments, reinforce the segment’s strong position. Surgeons value laparoscopy for precision, reliability, and compatibility with robotic-assisted enhancements. Patient preference for minimally invasive procedures further supports segment growth.

The medical robotics segment is expected to witness the fastest growth rate of 25.6% from 2026 to 2033, driven by rising adoption of robotic-assisted MIS procedures in complex surgeries. Countries such as Saudi Arabia and UAE are investing in robotic systems for urology, gynecology, and bariatric procedures. Robotics enhance surgical precision, reduce complication rates, and improve recovery outcomes, attracting both hospitals and patients. Training programs for robotic surgery and government incentives are also promoting growth. The segment benefits from technological innovation, such as AI-assisted robotic guidance and telesurgery capabilities, expanding its applicability across multiple specialties.

- By End Users

On the basis of end users, the market is segmented into hospital surgical departments, outpatient surgery patients, group practices, and individual surgeons. The hospital surgical department segment dominated the market with 52.4% share in 2025, supported by high procedure volumes, availability of advanced MIS equipment, and strong investment in surgical infrastructure. Hospitals in Saudi Arabia, UAE, and South Africa serve as the primary adopters due to access to funding, trained staff, and advanced operating facilities. Surgical departments prefer minimally invasive techniques to improve efficiency, patient outcomes, and reduce hospital stays. High patient demand for advanced procedures and growing medical tourism further strengthen this segment. Hospitals also drive innovation by collaborating with device manufacturers for procedure-specific solutions.

The outpatient surgery patients segment is expected to witness the fastest growth rate of 23.8% from 2026 to 2033, fueled by rising preference for same-day surgeries, reduced hospital stays, and minimally invasive approaches. Outpatient clinics are increasingly offering laparoscopic, endoscopic, and robotic-assisted procedures due to lower costs and faster recovery times. Patient awareness of minimally invasive benefits and growing insurance coverage are driving adoption. Expansion of ambulatory surgical centers in urban areas of Saudi Arabia and UAE further accelerates growth. The segment’s convenience and cost-effectiveness make it increasingly popular among patients seeking quick recovery with minimal disruption to daily life.

Middle East and Africa Minimally Invasive Surgery Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa minimally invasive surgery market with a revenue share of 37.5% in 2025, supported by high healthcare spending, advanced hospital infrastructure, and strong government initiatives to modernize surgical care, with significant adoption of MIS techniques across general surgery, orthopedics, and gynecology

- Patients and healthcare providers in the country increasingly prefer minimally invasive techniques due to reduced postoperative pain, shorter hospital stays, faster recovery, and improved surgical outcomes, making MIS a standard choice across specialties such as gastrointestinal, bariatric, and gynecology surgeries

- The strong presence of private hospitals, specialized surgical centers, and government-backed initiatives to modernize healthcare infrastructure further supports widespread adoption of advanced MIS technologies in Saudi Arabia

The Saudi Arabia Minimally Invasive Surgery Market Insight

The Saudi Arabia minimally invasive surgery market captured the largest revenue share of 37.5% in 2025 within the Middle East and Africa, fueled by the country’s high healthcare expenditure, advanced hospital infrastructure, and adoption of robotic-assisted and laparoscopic procedures. Patients increasingly prefer minimally invasive techniques for faster recovery, reduced complications, and shorter hospital stays. The presence of well-established private hospitals and specialized surgical centers supports high procedure volumes. Moreover, government initiatives to modernize healthcare infrastructure and promote advanced surgical technologies are significantly contributing to market expansion. Saudi Arabia’s medical tourism sector also attracts international patients seeking bariatric, gastrointestinal, and urological surgeries.

United Arab Emirates Minimally Invasive Surgery Market Insight

The UAE minimally invasive surgery market is projected to expand at a substantial CAGR throughout the forecast period, driven by rising patient awareness, growing medical tourism, and a focus on high-quality, technologically advanced surgical care. Hospitals in Dubai and Abu Dhabi are increasingly integrating robotic-assisted and laparoscopic systems to offer precise and efficient procedures. The demand for outpatient and day surgeries, along with government investment in healthcare infrastructure, supports adoption. UAE patients and surgeons prioritize minimally invasive techniques for faster recovery and reduced hospital costs. The integration of advanced imaging and visualization systems further accelerates the adoption of MIS across multiple surgical specialties.

Egypt Minimally Invasive Surgery Market Insight

The Egypt minimally invasive surgery market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness of MIS benefits, improving hospital infrastructure, and increasing accessibility to laparoscopic and endoscopic procedures. Patients are increasingly opting for MIS due to lower complication rates and shorter recovery times compared to traditional surgeries. Urban hospitals are investing in advanced MIS equipment and training for surgeons. Moreover, government initiatives to enhance surgical care standards and expand healthcare access are promoting adoption. Egypt’s growing population and expanding private healthcare sector further support market growth.

South Africa Minimally Invasive Surgery Market Insight

The South Africa minimally invasive surgery market is expected to expand at a considerable CAGR during the forecast period, driven by growing adoption of laparoscopic and robotic-assisted procedures in private and public hospitals. The country has witnessed rising procedure volumes in orthopedic, gastrointestinal, and gynecological surgeries. Patient preference for minimally invasive techniques, combined with increasing medical tourism, is boosting market demand. Hospitals are investing in modern MIS infrastructure, including high-definition imaging and advanced surgical devices. Training programs for surgeons in advanced MIS techniques further strengthen adoption. South Africa’s efforts to improve healthcare quality and efficiency support sustained growth.

Middle East and Africa Minimally Invasive Surgery Market Share

The Middle East and Africa Minimally Invasive Surgery industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Boston Scientific Corporation (U.S.)

- Olympus Corporation (Japan)

- Karl Storz SE & Co. KG (Germany)

- CONMED Corporation (U.S.)

- FUJIFILM Corporation (Japan)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Abbott (U.S.)

- B. Braun SE (Germany)

- Zimmer Biomet (U.S.)

- Arthrex, Inc. (U.S.)

- Cook (U.S.)

- Richard Wolf GmbH (Germany)

- Accuray Incorporated (U.S.)

- Globus Medical, Inc. (U.S.)

- Intuitive Surgical, Inc. (U.S.)

- Smith+Nephew (U.K.)

What are the Recent Developments in Middle East and Africa Minimally Invasive Surgery Market?

- In October 2025, King Faisal Specialist Hospital & Research Centre (KFSHRC) in Saudi Arabia performed the world’s first robotic intracranial tumor resection, showcasing groundbreaking neurosurgical capability and expansion of minimally invasive robotic surgery into highly complex procedures

- In September 2025, American Hospital Dubai became the first in the Middle East, Africa, and Eastern Europe to pioneer single‑port robotic surgery using the Da Vinci SP system, enabling complex procedures through a single incision and delivering less post‑operative pain, minimal scarring, and faster patient recovery compared to multi‑port approaches, underscoring rapid adoption of advanced robotic MIS in the region

- In June 2025, Yas Clinic – Khalifa City launched an advanced AI‑powered robotic spine surgery programme deploying intelligent navigation systems to significantly enhance precision and patient recovery in complex spinal procedures, representing a leap forward in minimally invasive surgical technology adoption in the UAE

- In June 2025, Cleveland Clinic Abu Dhabi performed the UAE’s first robotic cytoreductive surgery with hyperthermic intraperitoneal chemotherapy (HIPEC) to treat a rare appendiceal tumor using minimally invasive robotics, marking a major advancement in cancer care and reinforcing Abu Dhabi as a global hub for innovative surgical procedures

- In November 2024, Mediclinic City Hospital in the UAE carried out its 1,500th robotic surgery procedure, marking a major milestone in minimally invasive surgical care as the hospital’s da Vinci Xi HD robotic surgery program continues to expand high‑precision procedures with reduced recovery times, lower complication rates, and broader availability for patients across multiple surgical specialties

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.