Middle East and Africa Organic Solar Cell (OPV) Market Analysis and Size

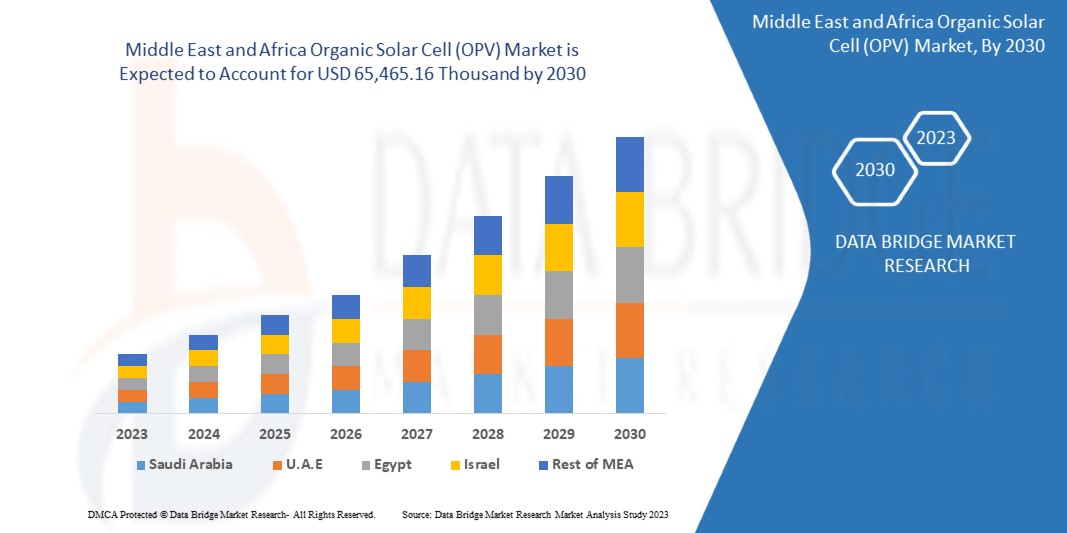

The Middle East and Africa organic solar cell (OPV) market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 10.1% in the forecast period of 2023 to 2030 and is expected to reach USD 65,465.16 thousand by 2030. The major factor driving the growth of the Organic solar cell (OPV) market is the rising popularity of Organic solar cell (OPV) products among the organic solar cell, and growing awareness regarding the properties of the organic solar cell (OPV) products.

Organic solar cells (OSCs), which are categorized as third-generation solar cells using organic polymer material as the light-absorbing layer, are one of the newest photovoltaic (PV) technologies. Organic photovoltaic (OPV) solar cells seek to offer a low-energy-production and Earth-abundant photovoltaic (PV) solution.

The Middle East and Africa organic solar cell (OPV) market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Type (Bilayer Membrane Heterojunction, Schottky Type, and Others), Material (Polymer, and Small Molecules), Application (BIPV & Architecture, Consumer Electronics, Wearable Devices, Automotive, Military & Device, and Others), Physical Size (More Than 140*100 Mm Square, and Less Than 140*100 Mm Square), End User (Commercial, Industrial, Residential, and Others) |

|

Countries Covered |

South Africa, Egypt, Saudi Arabia, U.A.E, Israel, and the Rest of the Middle East and Africa. |

|

Market Players Covered |

Eni S.p.A, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc, MORESCO Corporation, NanoFlex Power Corporation, and Flask, among others |

Market Definition

Organic solar cells or organic photovoltaics refer to multilayer photovoltaic devices made with organic compounds, converting solar energy into electricity. An organic solar cell is manufactured using carbon-based material and organic electronics instead of silicon as a semiconductor. Organic cells may also be referred to as plastic solar cells or polymer solar cells; compared to crystalline silicon solar cells, organic solar cells are made from compounds that can be dissolved in ink and printed onto plastics. This gives the organic solar cells the attribute of flexibility, lightweight and easy incorporation in places or structures, among others.

Organic solar cell technology is still developing. The power conversion efficiency of the organic solar cell does not match the efficiencies achieved by inorganic silicon solar cells. But the OPVs showcase a wide range of potential applications, and it might not be long before they become the commonly used technology. OPVs are easy to manufacture compared to inorganic solar cells and cheap to produce, and physically versatile. The working principle of organic solar cells is just like that of monocrystalline and polycrystalline silicon solar cells. They generate electricity through the photovoltaic effect in three simple steps, such as:

- Electrons are knocked loose from the semiconducting polymer material when light is absorbed

- The flow of the loose electrons constitutes an electric current

- The current is captured and transferred to wires

The OPV’s versatility can be attributed to the diversity of organic materials designed and synthesized for the absorber, acceptor, and interfaces. Organic solar cells find applications in automotive, rooftop panels, building-integrated photovoltaics (BIPV), consumer electronics, and others.

Middle East and Africa Organic Solar Cell (OPV) Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Increasing awareness towards the use of renewable energy for power generation

The continuous growth in the population, and the increasing flourishment in the industrial sector, coupled with growth in infrastructure development, which is leading to a significant increase in the demand for electricity Middle East and Africa. Countries are investing heavily in power-generating resources by installing new power plants to meet the energy demand for unhindered development. This has led to increased pollution and environmental hazards. As the focus is shifting towards climate conservation, there is an increase in the adoption of renewable energy sources for power generation and harnessing solar energy for electricity is one of the leading technology Middle East and Africa.

- Surge in demand for building integrated photovoltaic products (BIPV)

Building integrated photovoltaics (BIPV) refers to materials that are utilized for building to replace the conventional building materials in the roofs, skylights, and facades, among others. With BIPV, the buildings have an outer layer of the structure that also generates electricity for on-site use or export to the grid. The BIPV applications are often for commercial and industrial buildings. The use of OPVs has significant advantages over silicon solar cells as they result in cost reduction. They are lightweight, flexible and visibly transparent. This has resulted in growth in the adoption of organic photovoltaics as material in BIPV applications.

Organic photovoltaics are thin-filed and flexible and can be integrated into the sides of buildings, replacing conventional glass windows; this offers a large available area for solar energy absorption. OPC skylights are integrated using ultra-thin organic solar cells, which allow daylight to penetrate while simultaneously generating electricity.

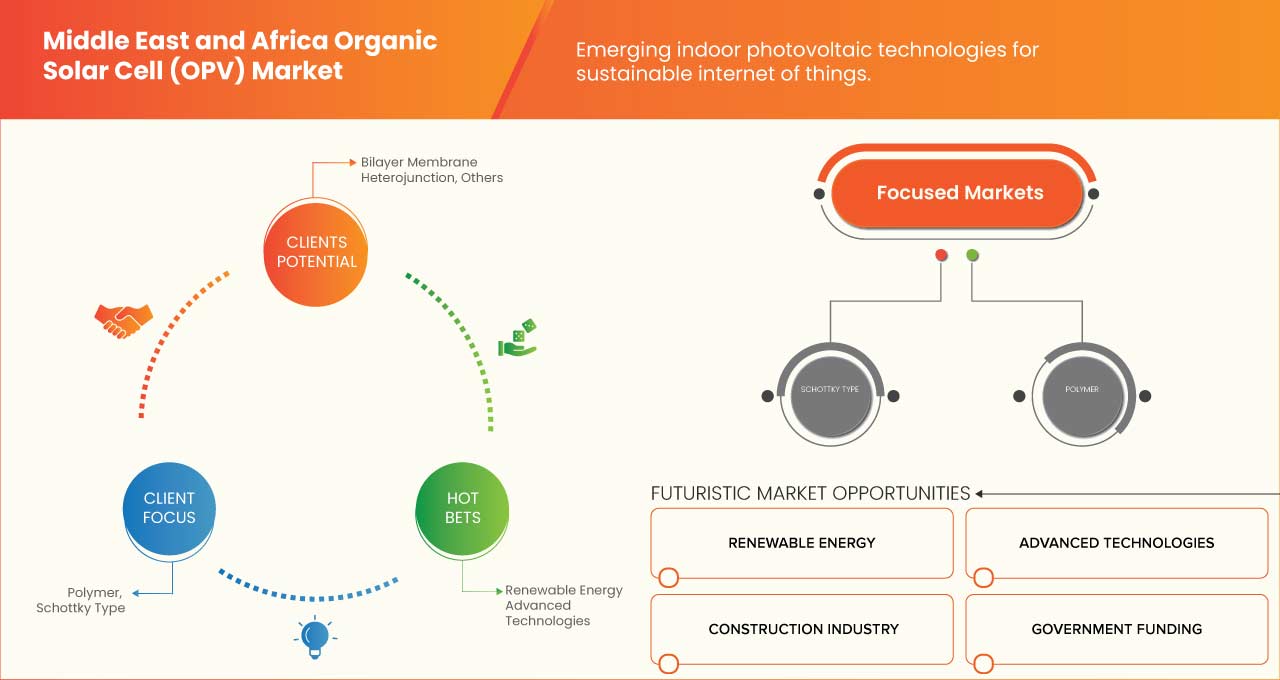

Opportunities

- Increasing applications in DIY projects and gadgets

Recent years have witnessed extensive research in the development of organic solar cells for increasing efficiency and making organic solar cells more flexible and thin. The results achieved are commendable. The researchers are able to achieve a power conversion efficiency (PCE) in excess of 10%. The recent developments have led to the advancement in flexible nature, mechanical bending stability and good conformability. This has led to applications of organic solar cells in applications such as power generation in wearable electronics and small projects.

There is an increasing demand in the market for portable and wearable future electronic devices, such as smartwatches or biometric sensors, which employ lightweight, flexible and efficient power generation resources. This has opened up exciting opportunities for organic solar cells as next-generation power supply resources due to their desirable properties. As a result, many research activities to further develop organic solar cells to increase their PCE and flexibility are undertaken Middle East and Africa.

- Increasing government focus on climate change

Middle East and Africa warming driven by human-induced emission of greenhouse gases and shifts and changes in weather patterns owing to the constants altered ecosystem is resulting in accelerated climate changes in every region Middle East and Africa. It is not slowing down and has an immense impact on human well-being and poverty around the globe. According to The World Bank, climate change may push up to 132 million people towards poverty. There is a movement throughout the world, and the major governments are realizing and acting toward adopting and combating measures to avoid further harm to the world's ecosystem.

Restraints/Challenges

- Higher setup cost of OPV systems

There has been a strong focus on accelerating the adoption of solar electric systems, such as organic photovoltaic systems, for developing building integrated photovoltaic systems. But despite these efforts, the inculcation of BIPV (building integrated photovoltaic) design with the building design is less as compared to the buildings with rack-mounted organic solar cell systems. This adds to the increased cost of integration of design pre-implementation. This proves to be a significant restraining factor to the market.

Though the adoption of renewable energy is encouraged and is thus increasing with increasing focus on climate change, solar adopters are seen to be skewed in most regions of the globe. This skewness is attributed to the income of the people.

- Low-efficiency rates of organic solar cells

The power conversion efficiency in a solar cell refers to the fraction of light energy the cell is able to convert to electricity. There is a growing opportunity for the adoption of organic solar cells as they provide flexibility and can conform to any surface, such as the roof of a car or on the outside of wearable electronics. The major challenge which has impeded the technology’s commercialization is the relatively low power conversion efficiency as compared to the efficiency provided by the inorganic silicon solar cells.

Recent Development

- In January 2023, Novaled GmbH was announced that they won the award of "Corporate Health Excellence Award" in 2022. This will help the company to be recognized better among the competitors.

Middle East and Africa Organic Solar Cell (OPV) Market Scope

The Middle East and Africa organic solar cell (OPV) market is categorized based on type, material, application, physical size, and end user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Bilayer Membrane Heterojunction

- Schottky Type

- Others

On the basis of type, the Middle East and Africa organic solar cell (OPV) market is classified into three segments Bilayer Membrane Heterojunction, Schottky Type, and others.

Material

- Polymer

- Small Molecules

On the basis of material, the Middle East and Africa organic solar cell (OPV) market is classified into two segments Polymer and Small Molecules.

Application

- BIPV & Architecture

- Consumer Electronics

- Wearable Devices

- Automotive

- Military & Device

- Others

On the basis of application, the Middle East and Africa organic solar cell (OPV) market is classified into six segments bipv & architecture, consumer electronics, wearable devices, automotive, military & device, and others.

Physical Size

- More Than 140*100 MM Square

- Less Than 140*100 MM Square

On the basis of physical size, the Middle East and Africa organic solar cell (OPV) market is classified into two segments more than 140*100 MM square and less than 140*100 MM square.

End User

- Commercial

- Industrial

- Residential

- Others

On the basis of end user, the Middle East and Africa organic solar cell (OPV) market is classified into four segments commercial, industrial, residential, and others.

Middle East and Africa Organic Solar Cell (OPV) Market Regional Analysis/Insights

The Middle East and Africa organic solar cell (OPV) market is segmented on the basis of type, material, application, physical size and end user.

The countries in the Middle East and Africa organic solar cell (OPV) market are South Africa, Egypt, Saudi Arabia, U.A.E, Israel, and the Rest of the Middle East and Africa. United Arab Emirates is dominating the Middle East and Africa organic solar cell (OPV) market in terms of market share and market revenue due to the rising popularity of organic solar cell (OPV) among commercial and residential sectors in this region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Organic Solar Cell (OPV) Market Share Analysis

The Middle East and Africa organic solar cell (OPV) market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Middle East and Africa organic solar cell (OPV) market.

Some of the prominent participants operating in the Middle East and Africa organic solar cell (OPV) market are Eni S.p.A, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation, and Flask, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION

5.1.2 SURGE IN DEMAND FOR BUILDING INTEGRATED PHOTOVOLTAIC PRODUCTS (BIPV)

5.1.3 GOVERNMENT INITIATIVES AND TAX BENEFITS FOR THE APPLICATION OF ALTERNATE ENERGY RESOURCE

5.1.4 ADVANTAGES OF OPVS OVER SILICON SOLAR CELLS AND SIMPLICITY IN THE MANUFACTURING PROCESS

5.1.5 INCREASING SOLAR ADOPTION IN RESIDENTIAL AREAS

5.2 RESTRAINTS

5.2.1 HIGHER SETUP COST OF OPV SYSTEMS

5.2.2 CUSTOM TARIFFS OVER SOLAR PANELS AND SOLAR CELLS BY MULTIPLE GOVERNMENTS

5.3 OPPORTUNITIES

5.3.1 INCREASING APPLICATIONS IN DIY PROJECTS AND GADGETS

5.3.2 INCREASING GOVERNMENT FOCUS ON CLIMATE CHANGE

5.3.3 INCREASING FOCUS ON THE DEVELOPMENT OF TANDEM ORGANIC CELLS

5.3.4 EMERGING INDOOR PHOTOVOLTAIC TECHNOLOGIES FOR SUSTAINABLE INTERNET OF THINGS

5.4 CHALLENGES

5.4.1 LOW-EFFICIENCY RATES OF ORGANIC SOLAR CELLS

5.4.2 STABILITY PROBLEMS IN ORGANIC SOLAR CELL

6 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 BILAYER MEMBRANE HETEROJUNCTION

6.3 SCHOTTKY TYPE

6.4 OTHERS

7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYMER

7.3 SMALL MOLECULES

8 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIPV & ARCHITECTURE

8.3 CONSUMER ELECTRONICS

8.4 WEARABLE DEVICES

8.5 AUTOMOTIVE

8.6 MILITARY & DEVICE

8.7 OTHERS

9 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE

9.1 OVERVIEW

9.2 MORE THAN 140*100 MM SQUARE

9.3 LESS THAN 140*100 MM SQUARE

10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 COMMERCIAL, BY COMMERCIAL TYPE

10.2.1.1 PUBLIC INSTITUTIONS

10.2.1.2 GOVERNMENT AGENCIES

10.2.1.3 RESEARCH INSTITUTIONS

10.2.1.4 OTHERS

10.2.2 COMMERCIAL, BY TYPE

10.2.2.1 BILAYER MEMBRANE HETEROJUNCTION

10.2.2.2 SCHOTTKY TYPE

10.2.2.3 OTHERS

10.3 INDUSTRIAL

10.3.1 INDUSTRIAL, BY TYPE

10.3.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.3.1.2 SCHOTTKY TYPE

10.3.1.3 OTHERS

10.4 RESIDENTIAL

10.4.1 RESIDENTIAL, BY TYPE

10.4.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.4.1.2 SCHOTTKY TYPE

10.4.1.3 OTHERS

10.5 OTHERS

11 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 U.A.E

11.1.2 SAUDI ARABIA

11.1.3 SOUTH AFRICA

11.1.4 ISRAEL

11.1.5 EGYPT

11.1.6 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12.2 BUSINESS ACQUISITION & EXPANSION

12.3 COLLABORATION & PARTNERSHIP

12.4 ACQUISITION

12.5 AGREEMENT & CERTIFICATION

12.6 RECOGNITION & PRODUCT LAUNCH

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ENI SPA (2022)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 TOSHIBA CORPORATION (2022)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ARMOR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 TOKYO CHEMICAL INDUSTRY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MERCK KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BORUN NEW MATERIAL TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EPISHINE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FLASK

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HELIATEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LUMTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MORESCO CORPORATION (2022)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 NANOFLEX POWER CORPORATION (2022)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NINGBO POLYCROWN SOLAR TECH CO, LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NOVALED GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHIFENG TECHNOLOGY CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOLARIS CHEM INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SOLARMER ORGANIC OPTOELECTRONICS TECHNOLOGY (BEIJING) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SUNEW

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA ON PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA BILAYER MEMBRANE HETEROJUNCTION IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION , 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA SCHOTTKY TYPE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA POLYMER IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SMALL MOLECULES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA BIPV & ARCHITECTURE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA CONSUMER ELECTRONICS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA WEARABLE DEVICES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA AUTOMOTIVE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA MILITARY & DEVICE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE , 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA MORE THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA LESS THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 43 U.A.E ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 44 U.A.E COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.A.E COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.A.E INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 U.A.E RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 SAUDI ARABIA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 53 SAUDI ARABIA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 SAUDI ARABIA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 SAUDI ARABIA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 SAUDI ARABIA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 SOUTH AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 62 SOUTH AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 SOUTH AFRICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 SOUTH AFRICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 SOUTH AFRICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 69 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 70 ISRAEL ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 71 ISRAEL COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 ISRAEL COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 ISRAEL INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 ISRAEL RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 77 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 78 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 79 EGYPT ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 80 EGYPT COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 EGYPT COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 EGYPT INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 EGYPT RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 REST OF MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL MARKET

FIGURE 2 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET: SEGMENTATION

FIGURE 14 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET IN THE FORECAST PERIOD

FIGURE 15 2 WHEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET

FIGURE 17 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2022

FIGURE 18 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2022

FIGURE 19 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2022

FIGURE 20 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2022

FIGURE 21 MIDDLE EAST & AFRICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2022

FIGURE 22 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY SNAPSHOT (2022)

FIGURE 23 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022)

FIGURE 24 MIDDLE EAST AND AFRICA SOLAR CELL (OPV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 MIDDLE EAST AND AFRICA ORGANIC SOLAR CELL (OPV) MARKET: BY TYPE (2023-2030)

FIGURE 27 MIDDLE EAST & AFRICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.