Middle East And Africa Orthopedic Implants Including Dental Implants Market

Market Size in USD Million

CAGR :

%

USD

991.14 Million

USD

2,350.80 Million

2024

2032

USD

991.14 Million

USD

2,350.80 Million

2024

2032

| 2025 –2032 | |

| USD 991.14 Million | |

| USD 2,350.80 Million | |

|

|

|

|

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Size

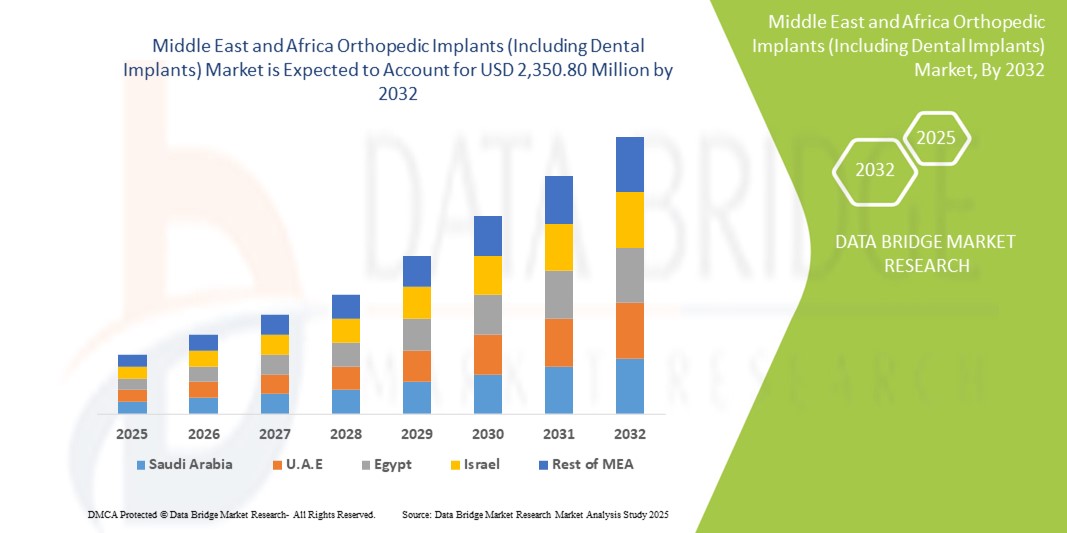

- The Middle East and Africa orthopedic implants (including dental implants) market size was valued at USD 991.14 million in 2024 and is expected to reach USD 2,350.80 million by 2032, at a CAGR of 11.4% during the forecast period

- The market growth is largely fueled by the increasing prevalence of orthopedic conditions such as osteoarthritis, fractures, and sports injuries, along with rising awareness about musculoskeletal health, an aging population, and lifestyle changes leading to obesity and sedentary habits

- Furthermore, government initiatives, increased healthcare expenditure, and investments in specialized orthopedic and dental centers, along with the adoption of advanced technologies such as 3D-printed implants, robotic-assisted surgeries, and minimally invasive procedures, are establishing orthopedic and dental implants as preferred solutions for improved patient outcomes. These converging factors are accelerating the uptake of orthopedic and dental implants, thereby significantly boosting the industry's growth

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Analysis

- Orthopedic and dental implants, including joint replacements, spinal implants, and dental prosthetics, are becoming increasingly critical components of modern healthcare infrastructure in both hospitals and specialized clinics due to their effectiveness in restoring mobility, functionality, and oral health

- The rising demand for orthopedic and dental implants is primarily driven by the growing prevalence of musculoskeletal disorders, fractures, osteoarthritis, and dental conditions, coupled with an aging population, increasing obesity rates, and greater awareness of advanced treatment options

- Saudi Arabia dominated the MEA orthopedic and dental implants market with the largest revenue share of 32.5% in 2024, characterized by advanced healthcare infrastructure, higher healthcare spending, and a strong presence of key industry players. Investments in specialized orthopedic and dental centers, along with the introduction of minimally invasive and robotic-assisted surgeries, are accelerating adoption

- Egypt is expected to be the fastest-growing country in the MEA orthopedic and dental implants market during the forecast period, due to expanding healthcare facilities, government initiatives to improve surgical outcomes, and increasing awareness of modern orthopedic and dental treatment options

- Reconstructive Joint Replacements segment dominated the orthopedic segment with a market share of 38.5% in 2024, driven by their established effectiveness in restoring mobility, reducing pain, and improving the quality of life for patients with chronic joint disorders

Report Scope and Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Segmentation

|

Attributes |

Middle East and Africa Orthopedic Implants (Including Dental Implants) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Trends

Advancement Through Robotic and Minimally Invasive Surgeries

- A key and accelerating trend in the MEA orthopedic and dental implants market is the adoption of robotic-assisted and minimally invasive surgical techniques. This integration is significantly improving surgical precision, reducing recovery time, and enhancing patient outcomes

- For instance, Mazor X Stealth Edition is utilized in spinal implant surgeries in Saudi Arabia, allowing surgeons to plan and execute procedures with high accuracy, while reducing post-operative complications and hospitalization periods

- Robotic and minimally invasive approaches in orthopedic surgeries facilitate smaller incisions, reduced blood loss, and faster rehabilitation. Similarly, in dental implants, guided surgery using digital imaging ensures precise placement of titanium and zirconia implants

- The combination of advanced surgical robots and digital planning tools allows hospitals and clinics to standardize procedures, improve success rates, and deliver predictable patient results, elevating overall confidence in orthopedic and dental treatments

- This trend toward more precise, technology-driven, and patient-friendly procedures is reshaping expectations in the MEA market. Consequently, companies such as Medtronic and DePuy Synthes are developing robot-assisted and minimally invasive implant solutions for joint replacement and spinal surgeries

- The demand for orthopedic and dental implants that support robotic and minimally invasive procedures is growing rapidly across hospitals and specialized clinics, as healthcare providers seek to enhance procedural outcomes and patient satisfaction

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Dynamics

Driver

Rising Demand Due to Increasing Orthopedic and Dental Disorders

- The growing prevalence of musculoskeletal disorders, fractures, osteoarthritis, and dental conditions, combined with an aging population and increasing obesity rates, is a major driver for the heightened demand for orthopedic and dental implants

- For instance, in 2024, the Saudi Ministry of Health reported a rise in joint replacement procedures due to osteoarthritis, prompting hospitals to expand orthopedic implant offerings

- Patients increasingly prefer advanced implants such as joint replacements, spinal fixation devices, and dental prosthetics, which improve mobility, reduce pain, and restore oral function, providing a compelling alternative to conventional treatments

- Furthermore, increasing awareness about corrective procedures, insurance coverage for implants, and greater access to modern healthcare facilities are making orthopedic and dental implants a preferred treatment option across the MEA region

- Hospitals and clinics are investing in surgical infrastructure, training programs, and post-operative care services, enhancing procedural adoption and accelerating market growth in both orthopedic and dental implant segments

Restraint/Challenge

High Cost and Limited Awareness in Emerging Markets

- The relatively high cost of advanced orthopedic and dental implants compared to conventional treatments poses a challenge to market penetration, particularly in price-sensitive countries such as Egypt and Nigeria

- For instance, imported titanium joint replacement implants are often priced beyond the reach of many patients in emerging MEA markets, limiting widespread adoption despite clinical effectiveness

- Additionally, lack of awareness regarding advanced treatment options and limited availability of specialized surgical expertise can delay patient adoption and slow market expansion

- Hospitals and clinics must address these challenges through patient education, training programs for surgeons, and collaborations with manufacturers to provide cost-effective implant solutions without compromising quality

- Overcoming these barriers through affordability initiatives, awareness campaigns, and infrastructure development will be crucial to sustaining the growth of orthopedic and dental implants across the MEA region

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Scope

The market is segmented on the basis of product type, biomaterial, procedures, fixation type, end user, and distribution channel.

- By Product Type

On the basis of product type, the orthopedic implants (including dental implants) market is segmented into reconstructive joint replacements, spinal implants, motion preservation/non-fusion devices, dental implants, trauma implants, orthobiologics, and others. The reconstructive joint replacements segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the high prevalence of osteoarthritis and joint degeneration in the MEA region. Hospitals and specialized orthopedic centers prioritize joint replacement implants due to their proven efficacy in restoring mobility and improving patients’ quality of life. The segment benefits from increasing awareness among patients and physicians about advanced joint replacement procedures, supported by government healthcare initiatives. Technological advancements such as computer-assisted and robotic-assisted surgeries further enhance the adoption of reconstructive joint implants. High-income countries like Saudi Arabia and UAE have robust infrastructure and disposable income, facilitating access to these advanced procedures. The growing geriatric population in the region also sustains long-term demand for joint replacement solutions.

The dental implants segment is anticipated to witness the fastest growth rate of 8.5% CAGR from 2025 to 2032, fueled by rising demand for permanent tooth replacement and cosmetic dentistry procedures. Increasing awareness of oral health and availability of advanced titanium and zirconia implant options are key growth drivers. Investments in dental care infrastructure in Egypt, UAE, and Saudi Arabia further support adoption. Cosmetic dentistry trends and aesthetic preferences are expanding the patient base, while minimally invasive guided implant procedures improve procedural success and patient satisfaction. The segment also benefits from increasing disposable incomes and a growing middle-class population in the region. Rising popularity of private dental clinics contributes to the fast adoption of dental implants across MEA.

- By Biomaterial

On the basis of biomaterial, the orthopedic implants (including dental implants) market is segmented into metallic, ceramic, polymeric, natural, and others. The metallic biomaterials segment dominated the market with the largest share in 2024 due to the widespread use of titanium and cobalt-chromium alloys in joint and spinal implants. Hospitals and implant manufacturers in Saudi Arabia and UAE prefer metallic implants due to their high strength, corrosion resistance, and long-term biocompatibility. Metallic implants are especially suitable for load-bearing applications in orthopedic procedures. Surgeon familiarity and well-established supply chains in the MEA region further support adoption. The segment also benefits from proven clinical outcomes and high patient satisfaction rates. Demand for metallic biomaterials remains high due to their versatility across multiple orthopedic and dental applications.

The ceramic biomaterials segment is expected to witness the fastest growth during forecast period, due to increasing use in dental implants and joint resurfacing procedures. Ceramics offer high wear resistance, biocompatibility, and reduced risk of allergic reactions. Advanced ceramic coatings improve implant longevity and performance. Growing patient preference for aesthetics and biocompatibility drives adoption in dental applications. The segment is further supported by investments in advanced dental and orthopedic clinics. Countries like Egypt and UAE are witnessing increased acceptance of ceramic implants among younger and middle-aged patients.

- By Procedures

On the basis of procedures, the orthopedic implants (including dental implants) market is segmented into open surgery, minimally invasive surgery (MIS), and others. The open surgery segment dominated in 2024 due to its suitability for complex joint and spinal reconstructions. Hospitals with established orthopedic departments rely on open surgeries for high-risk or revision procedures. Open surgery ensures precise implant placement and predictable outcomes, particularly for trauma and degenerative cases. The segment is favored in Saudi Arabia and UAE, where advanced surgical infrastructure supports high-volume procedures. Open surgeries remain standard for many orthopedic and dental interventions. Surgeons continue to trust open approaches for complex or multi-level procedures.

The minimally invasive surgery (MIS) segment is expected to witness the fastest growth during forecast period, due to rising patient demand for shorter recovery periods and lower complication rates. Robotic-assisted and guided MIS procedures are increasingly adopted in urban centers across the MEA region. MIS allows for smaller incisions, reduced blood loss, and faster rehabilitation. Hospitals and clinics invest in MIS training and infrastructure, accelerating adoption. The segment also benefits from rising awareness of outpatient procedures and cosmetic dentistry. MIS procedures enhance patient satisfaction and increase the success rate of implants.

- By Fixation Type

On the basis of fixation type, the orthopedic implants (including dental implants) market is segmented into cement, cementless, and hybrid orthopedic implants. The cementless orthopedic implants segment dominated the market due to better long-term stability and osseointegration properties, particularly in hip and knee replacements. Cementless implants are preferred in younger patients and highly active populations. Countries like Saudi Arabia and UAE have a high adoption rate due to advanced surgical expertise. Surgeons favor cementless designs for predictable performance and reduced revision rates. Hospitals stock cementless implants widely to meet demand for primary and revision procedures. Patient satisfaction and clinical outcomes further strengthen segment dominance.

The hybrid implants segment is expected to witness the fastest growth during forecast period, as it combines cemented and cementless components to optimize outcomes for complex cases. Hybrid implants are versatile for patient-specific anatomical and physiological conditions. Adoption is growing due to technological improvements and surgeon familiarity. Countries with expanding orthopedic infrastructure, such as Egypt and UAE, are rapidly implementing hybrid solutions. The segment benefits from increasing awareness of personalized surgical options. Hybrid implants address both short-term fixation needs and long-term durability, driving demand.

- By End User

On the basis of end user, the orthopedic implants (including dental implants) market is segmented into hospitals, clinics, ambulatory surgical centers, home care settings, academic and research institutes, and others. Hospitals dominated the market with the largest revenue share in 2024, handling most orthopedic and dental implant procedures. Hospitals have access to advanced surgical infrastructure and high-volume patient populations. Countries like Saudi Arabia, UAE, and Egypt contribute majorly to this dominance due to strong healthcare investment. Hospitals also offer comprehensive post-operative care and follow-ups, improving outcomes. Institutional support and insurance coverage encourage implant adoption in hospital settings.

The clinics segment is expected to witness the fastest growth during forecast period, due to increasing availability of specialized outpatient orthopedic and dental services. Clinics provide minimally invasive procedures, cosmetic dental implants, and personalized care. Patients prefer clinics for convenience and shorter recovery times. Investment in specialized equipment accelerates growth in urban centers. The segment benefits from private sector expansion and increasing patient awareness. Clinics are also key drivers for adoption in countries like Egypt and UAE where outpatient care is expanding rapidly.

- By Distribution Channel

On the basis of distribution channel, the orthopedic implants (including dental implants) market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market in 2024, as large hospitals and government healthcare systems procure implants through tenders to ensure cost-efficiency and consistent supply. Direct tender is particularly significant in Saudi Arabia and UAE, where government-funded hospitals dominate. This channel ensures regulatory compliance and bulk procurement efficiency. Hospitals also benefit from long-term contracts with suppliers. High adoption of standardized implants supports market stability. Tender processes allow governments to negotiate pricing for advanced implant solutions.

The retail sales segment is expected to witness the fastest growth during forecast period, due to increasing private sector investments and the expansion of orthopedic and dental clinics. Patients are increasingly purchasing implants through consultation with surgeons or private providers. Retail channels improve accessibility in emerging North African markets. Clinics and smaller hospitals prefer retail purchases for flexibility in inventory. The segment also benefits from rising awareness and willingness to pay for advanced procedures. Retail distribution is becoming a key growth driver for the MEA market.

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Regional Analysis

- Saudi Arabia dominated the MEA orthopedic and dental implants market with the largest revenue share of 32.5% in 2024, characterized by advanced healthcare infrastructure, higher healthcare spending, and a strong presence of key industry players. Investments in specialized orthopedic and dental centers, along with the introduction of minimally invasive and robotic-assisted surgeries, are accelerating adoption

- Patients and healthcare providers in Saudi Arabia highly value the availability of advanced joint replacement, spinal, and dental implant solutions, along with minimally invasive and robotic-assisted procedures that improve surgical outcomes and reduce recovery times

- This widespread adoption is further supported by government initiatives to enhance healthcare services, investments in specialized orthopedic and dental centers, and high disposable incomes among patients, establishing implants as the preferred solution for musculoskeletal and dental treatments in hospitals and private clinics

The Saudi Arabia Orthopedic Implants Market Insight

The Saudi Arabia orthopedic and dental implants market captured the largest revenue share of 32.5% in 2024 within the MEA region, driven by advanced healthcare infrastructure and rising investments in specialized orthopedic and dental centers. Patients increasingly prioritize joint replacement, spinal implants, and dental prosthetics to restore mobility, reduce pain, and improve quality of life. The growing adoption of minimally invasive and robotic-assisted surgeries, along with state-of-the-art surgical facilities, further propels market growth. High disposable incomes and robust insurance coverage contribute to increased accessibility of advanced implants. Moreover, government initiatives promoting healthcare modernization and orthopedic awareness are significantly enhancing adoption. Hospitals and private clinics remain key contributors, offering both primary and revision implant procedures.

Egypt Orthopedic Implants Market Insight

The Egypt orthopedic and dental implants market is emerging as the fastest-growing country within the MEA region, driven by expanding healthcare infrastructure and rising awareness of musculoskeletal and dental health. Increasing investments in both public and private hospitals are improving access to joint replacement, spinal, and dental implants. Patients show growing preference for minimally invasive and guided implant procedures due to shorter recovery times and reduced complications. The expanding middle class and rising disposable incomes support the adoption of advanced implants. Moreover, government programs promoting elective surgeries and orthopedic care are encouraging market growth. Clinics and outpatient facilities are playing a significant role in increasing accessibility.

UAE Orthopedic Implants Market Insight

The UAE orthopedic and dental implants market is witnessing substantial growth, fueled by high adoption of advanced implant technologies and well-developed healthcare infrastructure. Hospitals and specialty clinics increasingly offer joint, spinal, trauma, and dental implants with robotic-assisted and computer-guided procedures. Patients value improved surgical outcomes, faster recovery, and high-quality care, driving demand. Investments in private healthcare and collaborations with global implant manufacturers further accelerate growth. Moreover, a technologically inclined population and medical tourism contribute to market expansion. The UAE is becoming a regional hub for advanced orthopedic and dental procedures.

South Africa Orthopedic Implants Market Insight

The South Africa market is expected to grow steadily due to increasing prevalence of musculoskeletal disorders, fractures, and dental conditions. Hospitals and clinics are expanding orthopedic and dental services to meet rising patient demand. Awareness campaigns and government initiatives are enhancing access to joint replacements, spinal implants, and dental prosthetics. Private healthcare providers are investing in minimally invasive and guided surgical procedures. Patients increasingly seek implants that offer long-term durability and improved quality of life. Furthermore, urban centers are witnessing adoption of technologically advanced implant solutions, driving growth.

Middle East and Africa Orthopedic Implants (Including Dental Implants) Market Share

The Middle East and Africa Orthopedic Implants (Including Dental Implants) industry is primarily led by well-established companies, including:

- MEGA’GEN IMPLANT CO.,LTD. (South Korea)

- Medical Systems & Devices International (Israel)

- OrthoCare Surgical (U.S.)

- Institut Straumann AG (Switzerland)

- Stryker (U.S.)

- Nobel Biocare Services AG (Switzerland)

- SIGN Fracture Care International (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- DePuy Synthes (U.S.)

- Smith & Nephew (U.K.)

- CONMED Corporation (U.S.)

- Orthofix Medical Inc. (U.S.)

- NuVasive (U.S.)

- Medacta International (Switzerland)

- Xenco Medical (U.S.)

- Bioventus (U.S.)

- Auxein Medical (India)

What are the Recent Developments in Middle East and Africa Orthopedic Implants (Including Dental Implants) Market?

- In July 2025, ZimVie, a dental implants manufacturer, announced its acquisition by private equity firm Archimed for USD 730 million, valuing ZimVie at USD 19 per share. This deal is expected to close by the end of 2025, potentially impacting the dental implant market in the MEA region

- In May 2025, Egypt's Ministry of Health partnered with Zimmer Biomet to introduce advanced orthopedic implants and prosthetic technologies into government-run healthcare facilities. This collaboration aims to elevate the quality of care for patients with orthopedic conditions, ensuring treatments meet international standards. The initiative is expected to improve outcomes for patients suffering from joint problems and limb loss

- In November 2024, Auxein launched a range of innovative advanced orthopedic and arthroscopy products at MEDICA 2024. The new product line includes AV-Wiselock Plates, Osteochondral Transfer System, Reusable Suture Passer, Ligament Augmentation Repair Instrument Set, Auxilock Silicon Cannula, Auxilock Rigid Threaded Cannula, Bioabsorbable Interference Screw, Bioabsorbable Anchors, and GFS Ultimate Button with Brace/Tape System, among others

- In October 2024, Swiss dental implants maker Straumann reported an 11.4% increase in organic revenue in the EMEA region, which includes the Middle East and Africa. This growth was driven by strong demand in implantology, particularly in markets like India and Malaysia

- In September 2024, MIS Implants Technologies launched new dental implant products at the MIS Global Conference 2024 held in Palma de Mallorca, Spain. The conference attracted over 1,500 participants and showcased cutting-edge scientific programs in the field of dental implants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.